Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PNMAC Holdings, Inc. | a13-20456_18k.htm |

Exhibit 99.1

|

|

Barclays Global Financial Services Conference September 10, 2013 |

|

|

Forward Looking Statements 1 This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or from illustrative examples provided herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in federal, state and local laws and regulations applicable to the highly regulated industry in which we operate; lawsuits or governmental actions if we do not comply with the laws and regulations applicable to our businesses; the creation of the Consumer Financial Protection Bureau, or CFPB, and enforcement of its rules; changes in existing U.S. government-sponsored entities, their current roles or their guarantees or guidelines; changes to government mortgage modification programs; the licensing and operational requirements of states and other jurisdictions applicable to our businesses, to which our bank competitors are not subject; foreclosure delays and changes in foreclosure practices; certain banking regulations that may limit our business activities; changes in macroeconomic and U.S. residential real estate market conditions; difficulties in growing loan production volume; changes in prevailing interest rates; increases in loan delinquencies and defaults; our reliance on PennyMac Mortgage Investment Trust as a significant source of financing for, and revenue related to, our correspondent lending business; availability of required additional capital and liquidity to support business growth; our obligation to indemnify third-party purchasers or repurchase loans that we originate, acquire or assist in with fulfillment; our obligation to indemnify advised entities or investment funds to meet certain criteria or characteristics or under other circumstances; decreases in the historical returns on the assets that we select and manage for our clients, and our resulting management and incentive fees; regulation applicable to our investment management segment; conflicts of interest in allocating our services and investment opportunities among ourselves and our advised entities; the potential damage to our reputation and adverse impact to our business resulting from ongoing negative publicity; and our rapid growth. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only. |

|

|

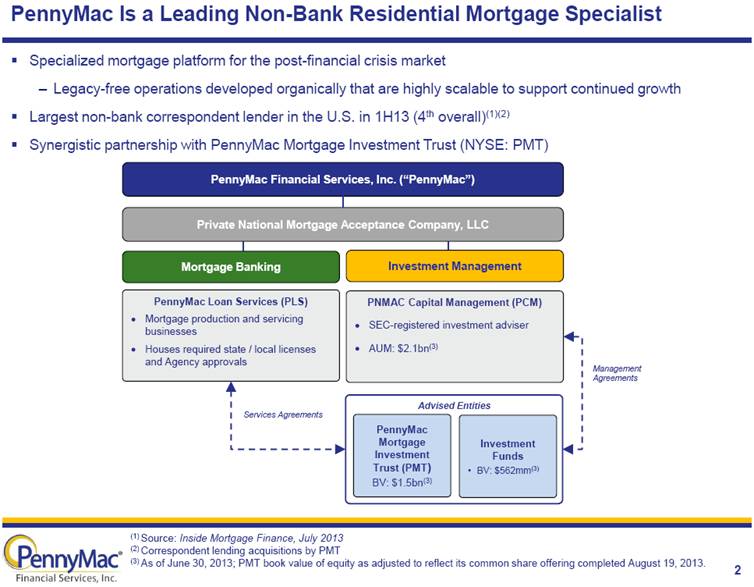

PennyMac Is a Leading Non-Bank Residential Mortgage Specialist 2 Management Agreements Services Agreements Mortgage Banking PennyMac Loan Services (PLS) Mortgage production and servicing businesses Houses required state / local licenses and Agency approvals PNMAC Capital Management (PCM) SEC-registered investment adviser AUM: $2.1bn(3) PennyMac Mortgage Investment Trust (PMT) BV: $1.5bn(3) Investment Funds BV: $562mm(3) Advised Entities Private National Mortgage Acceptance Company, LLC Investment Management PennyMac Financial Services, Inc. (“PennyMac”) Specialized mortgage platform for the post-financial crisis market Legacy-free operations developed organically that are highly scalable to support continued growth Largest non-bank correspondent lender in the U.S. in 1H13 (4th overall)(1)(2) Synergistic partnership with PennyMac Mortgage Investment Trust (NYSE: PMT) (1) Source: Inside Mortgage Finance, July 2013 (2) Correspondent lending acquisitions by PMT (3) As of June 30, 2013; PMT book value of equity as adjusted to reflect its common share offering completed August 19, 2013. |

|

|

Correspondent Lending Aggregates from approved third-party sellers, newly originated mortgage loans Revenue sources: Gain on mortgage loans for government-insured correspondent acquisitions Fulfillment fees from PMT’s conventional and jumbo loan correspondent acquisitions Loan origination fees and warehouse spread PFSI Has a Unique Business Model With Diverse Revenue Sources 3 Loan Production Loan Servicing Collect and remit payments and provide borrower services on existing loans Revenue sources: Servicing fees on owned MSRs Subservicing fees from Advised Entities Ancillary income Investment Management Serve as external manager to pools of capital investing in mortgage-related assets Revenue sources: Management fees from all Advised Entities Performance-based incentive fees from PMT Carried Interest from Investment Funds Retail Lending Originates conventional and government loans for purchase and refinance transactions Revenue sources: Gain on mortgage loans for retail originated mortgage loans Loan origination fees Warehouse spread Correspondent Lending Retail Lending Loan Servicing Investment Management |

|

|

Correspondent Lending Opportunity 4 Well-capitalized firm with many sources of financing Sophisticated capital markets expertise to hedge pipeline and interest rate risk Capabilities and scale to service loans and retain MSRs Approvals and established performance for Agencies and other investors Pooling and securitization capabilities Small and mid-sized mortgage banks across the U.S. Agencies and other investors Approximately 30% of the mortgage origination market, or >$500 billion in new originations, flowed through the correspondent channel in 2012 Correspondent share could increase as tightening retail margins motivate small / mid-sized lenders to sell more loans “servicing released” Correspondent market share is concentrated in a few leaders (Wells Fargo and Chase today) In 2011, Bank of America, Citi and Ally together had 34% market share, representing $150 billion in production volume All three of these institutions have since substantially reduced their presence or exited the market Source: Inside Mortgage Finance. Aggregator $ $ $ |

|

|

5 Bank (1) Source: Inside Mortgage Finance, July 2013: Total origination market estimates for the period. Bank and nonbank market share based on the 30 largest originators, which collectively represent over three quarters of origination volume in each period. Consumer direct lending has significant advantages over branch-based model Call centers result in an efficient concentration of personnel and expertise Business development driven by corporate-directed leads Centralized environment creates a controlled process and better ability to deploy technology improvements Refinance market has already shifted in favor of the consumer direct model – purchase-money market is next Barriers to establishing a national platform have only increased Capital and financing relationships require sophisticated capital markets expertise Increased regulatory requirements and resource demands for compliance and oversight Continued investments in technology, marketing, and infrastructure to be competitive Retail Lending Opportunity Nonbank Banks have dominated the market since the financial crisis, but they are retreating Increased capital requirements Regulatory scrutiny Focusing on serving only “core” banking customers 100% = $3.0T $1.0T Banks Growing Share of Origination Market(1) |

|

|

Origination Estimates(2) Rising Rates Present Challenges to Loan Production 6 (1) Source: Freddie Mac Primary Mortgage Market Survey, as of August 2013 (2) Source: Mortgage Bankers Association, Freddie Mac, Fannie Mae mortgage market forecasts, as of August 2013 Mortgage Rates(1) UPB (millions) % Rising mortgage rates have significantly slowed refinancing activity, resulting in a smaller mortgage origination market for the foreseeable future Volume decline from 1H13 to 2H13 is expected to be >30% Adjustable-rate and hybrid products have become more attractive relative to fixed-rate mortgages Continued pressures on gain on sale margins PFSI’s leadership has managed through many interest rate environments; remain focused on the controllable elements of the business Aligning headcount levels with market opportunity Focus on efficiency and expense management, balanced by continued investments in long-term growth 34% Average Decline 1H13 |

|

|

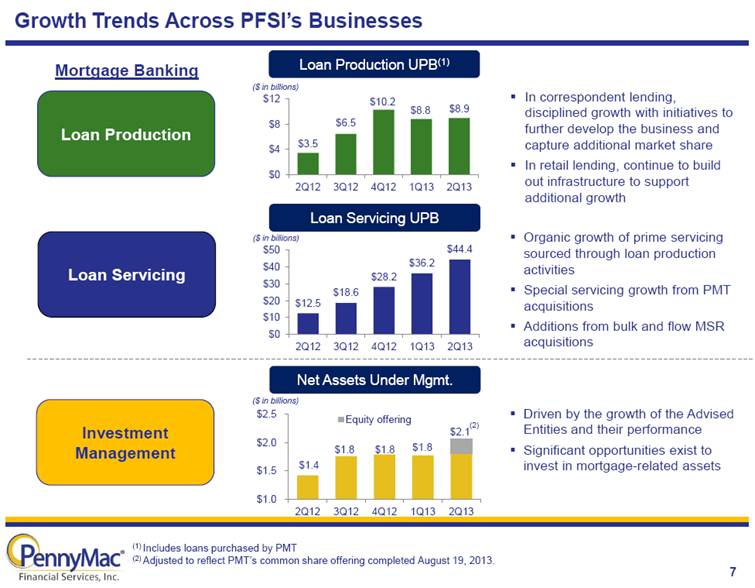

Growth Trends Across PFSI’s Businesses 7 Loan Production Loan Servicing Mortgage Banking Investment Management In correspondent lending, disciplined growth with initiatives to further develop the business and capture additional market share In retail lending, continue to build out infrastructure to support additional growth Organic growth of prime servicing sourced through loan production activities Special servicing growth from PMT acquisitions Additions from bulk and flow MSR acquisitions Driven by the growth of the Advised Entities and their performance Significant opportunities exist to invest in mortgage-related assets Loan Production UPB(1) Loan Servicing UPB Net Assets Under Mgmt. ($ in billions) ($ in billions) ($ in billions) (1) Includes loans purchased by PMT (2) Adjusted to reflect PMT’s common share offering completed August 19, 2013. (2) |

|

|

Long-Term Initiatives to Profitably Expand Share in Loan Production Continue to develop a complete platform to serve smaller originators Recognizing changing industry dynamics and growing importance of smaller / local mortgage banks Provide relevant products and a complete array of delivery methods for sellers Optimize the seller network Objective to make each seller relationship meaningful Adding new seller relationships prudently Expand our market presence – Northeast is a primary target Disciplined execution, pricing and risk management Correspondent Lending Retail Lending 8 Bring the efficiency of the consumer direct model to the purchase-money market Provide value to realtors and consumers through effective service, products and pricing Products, e.g., Approved Buyer Certification (ABC) program Technology initiatives, e.g., mobile application for progress updates Deliver superior service / process through specialized loan processors and underwriters Lead generation opportunities from: Leveraging the growing portfolio, including purchase-money opportunities from distressed loans Bulk MSR acquisitions Targeted marketing |

|

|

[LOGO] |