Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIAA FSB Holdings, Inc. | form8-kforeverbankconferen.htm |

EVERBANK FINANCIAL CORP BARCLAYS GLOBAL FINANCIAL SERVICES CONFERENCE September 2013

• Diversified financial services company headquartered in Jacksonville, FL with lending and deposit activities nationwide 2 EVERBANK OVERVIEW STRONG RETURNS (1) Unless otherwise noted, figures as of June 30, 2013. Market data as of September 9, 2013. A reconciliation of non-GAAP financial measures can be found in the appendix. CONSISTENT GROWTH LOW RISK Flexible business model Robust asset generation capabilities Scalable, low cost deposit platform Disciplined risk management Cohesive, long tenured management team BARCLAYS CONFERENCE PRESENTATION (1) Total Assets $18.4bn Total Deposits $13.7bn Total Equity $1.5bn 2Q13 Adjusted EPS $0.28 2Q13 GAAP EPS $0.35 Share Price $14.99 Market Cap $1.8bn

$ 1.0 $ 1.5 $ 1.7 $ 2.1 $ 3.1 $ 3.7 $ 4.2 $ 5.5 $ 7.0 $ 8.1 $ 12.0 $ 13.0 $ 18.2 $ 18.4 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2Q13 Assets Deposits 3 EVOLUTION AND GROWTH 2000 - 2003 Mortgage Lending and Servicing 2004 - 2007 Expansion of Deposit Strategy 2008 - 2012 Addition of Diversified Asset Generation 2013 - Optimization of Business Platforms BARCLAYS CONFERENCE PRESENTATION

4 EVERBANK’S NATIONWIDE PLATFORM BUSINESS LOCATIONS SPREAD ACROSS TOP METRO MARKETS Jacksonville, FL Denver, CO San Francisco, CA Los Angeles, CA San Diego, CA Scottsdale, AZ San Antonio, TX Austin, TX Houston, TX Dallas-Ft. Worth, TX Palm Beach / Miami, FL Orlando, FL Sarasota, FL Kansas City, KS Tulsa, OK Burlington, VT Boston, MA New York, NY Washington DC Metro Area Redmond, WA BARCLAYS CONFERENCE PRESENTATION Commercial Lending Retail Lending Chicago, IL Atlanta, GA Florida Financial Center

76% 24% 0, 0% Residential Commercial finance 73% 17% 7% 3% Residential Commercial + CRE Lease financing receivables Other 51% 40% 8% 1% Residential Commercial + CRE Lease financing receivables Other 5 DIVERSE BUSINESS MODEL RETAINED ASSET GENERATION LOANS AND LEASES HFI COMPOSITION 49% 15% 24% 12% Residential Commercial Commercial finance Warehouse finance 2Q11 - $0.4BN 2Q13 - $12.8BN BARCLAYS CONFERENCE PRESENTATION 2Q11 - $6.8 BN 2Q13 - $1.1BN

6 EVERBANK’S DIVERSIFIED BUSINESS PLATFORMS Residential Lending / Residential Servicing Commercial Real Estate Commercial Finance Deposits • Prime jumbo • Conforming • Servicing • Owner-occupied CRE and credit tenant leasing • Structured finance • Mortgage warehouse finance • Mid-sized business loans • Equipment leases and loans for healthcare, office, technology, etc. • Revolving credit to specialty finance companies • YieldPledge Checking, Money Market and CD • WorldCurrency • Metals Select • Foreign Currencies PRODUCTS DISTRIBUTION REACH • Nationwide • Nationwide • Nationwide • Nationwide • Retail • Consumer direct • Financial centers • Third party • Single tenant • Multi tenant • EverBank Commercial Finance • EverBank Lender Finance • Consumer direct • Financial centers • Financial intermediaries BARCLAYS CONFERENCE PRESENTATION

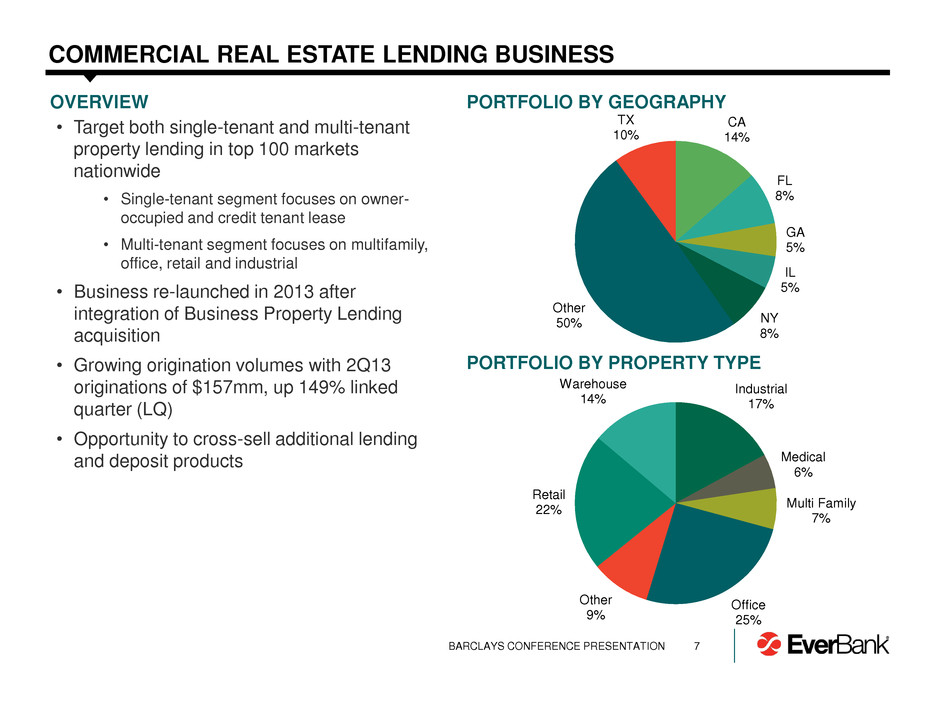

Industrial 17% Medical 6% Multi Family 7% Office 25% Other 9% Retail 22% Warehouse 14% • Target both single-tenant and multi-tenant property lending in top 100 markets nationwide • Single-tenant segment focuses on owner- occupied and credit tenant lease • Multi-tenant segment focuses on multifamily, office, retail and industrial • Business re-launched in 2013 after integration of Business Property Lending acquisition • Growing origination volumes with 2Q13 originations of $157mm, up 149% linked quarter (LQ) • Opportunity to cross-sell additional lending and deposit products 7 COMMERCIAL REAL ESTATE LENDING BUSINESS PORTFOLIO BY GEOGRAPHY PORTFOLIO BY PROPERTY TYPE OVERVIEW BARCLAYS CONFERENCE PRESENTATION CA 14% FL 8% GA 5% IL 5% NY 8% Other 50% TX 10%

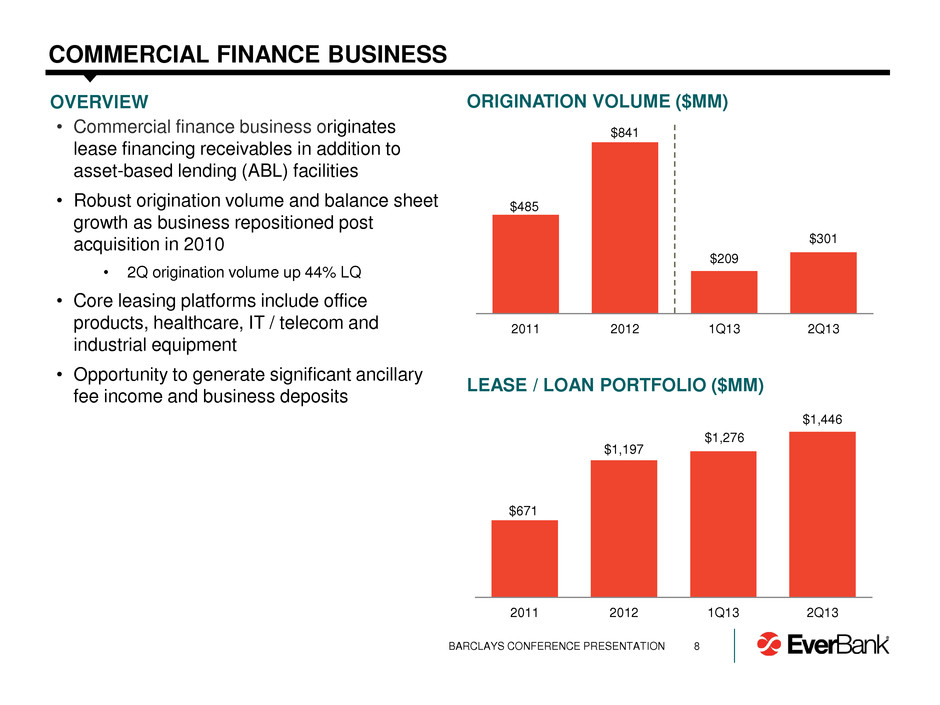

$671 $1,197 $1,276 $1,446 2011 2012 1Q13 2Q13 $485 $841 $209 $301 2011 2012 1Q13 2Q13 8 COMMERCIAL FINANCE BUSINESS • Commercial finance business originates lease financing receivables in addition to asset-based lending (ABL) facilities • Robust origination volume and balance sheet growth as business repositioned post acquisition in 2010 • 2Q origination volume up 44% LQ • Core leasing platforms include office products, healthcare, IT / telecom and industrial equipment • Opportunity to generate significant ancillary fee income and business deposits ORIGINATION VOLUME ($MM) LEASE / LOAN PORTFOLIO ($MM) OVERVIEW BARCLAYS CONFERENCE PRESENTATION

Consumer Direct 31% Third-Party 32% Retail 37% 9 RESIDENTIAL LENDING BUSINESS OVERVIEW • Originate residential loans through three channels: • Retail • Consumer direct call centers • Correspondent lender relationships • Retail expansion targets top 50 wealth markets nationwide with emphasis on purchase money transactions • Flexibility to generate prime jumbo hybrid ARM loans for bank portfolio or fixed-rate jumbo loans for capital markets execution based on product demand in the market • Jumbo volume of $1.0bn in 2Q, up 36% LQ • Increased productivity of newly added sales professionals expected to drive continued market share gains ORIGINATIONS BY CHANNEL BARCLAYS CONFERENCE PRESENTATION ORIGINATIONS BY PRODUCT TYPE Prime / Jumbo 32% Conventional 68%

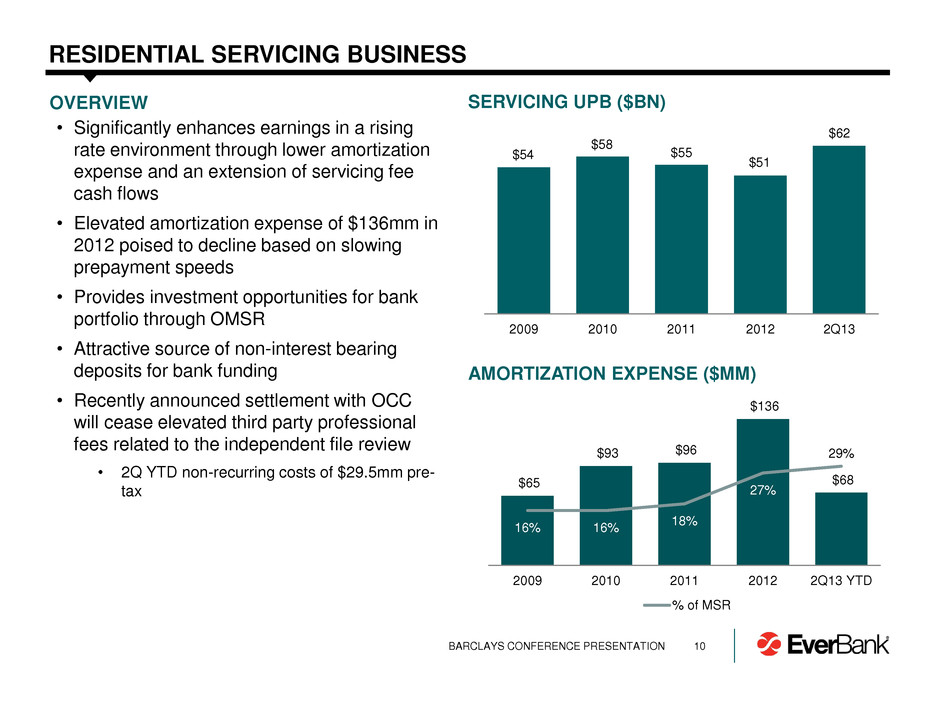

2009 2010 2011 2012 2Q13 10 RESIDENTIAL SERVICING BUSINESS OVERVIEW SERVICING UPB ($BN) • Significantly enhances earnings in a rising rate environment through lower amortization expense and an extension of servicing fee cash flows • Elevated amortization expense of $136mm in 2012 poised to decline based on slowing prepayment speeds • Provides investment opportunities for bank portfolio through OMSR • Attractive source of non-interest bearing deposits for bank funding • Recently announced settlement with OCC will cease elevated third party professional fees related to the independent file review • 2Q YTD non-recurring costs of $29.5mm pre- tax $54 $58 $55 $51 $62 BARCLAYS CONFERENCE PRESENTATION AMORTIZATION EXPENSE ($MM) $65 $93 $96 $136 $68 16% 16% 18% 27% 29% 2009 2010 2011 2012 2Q13 YTD % of MSR

OVERVIEW • Generate deposits through the following channels: • Direct (online) deposit gathering from consumers and small businesses • Financial advisors • Financial centers • Proven ability to tailor deposit growth to current and forecasted asset growth assumptions • Target vanguard customers who utilize “sticky” features such as direct deposit and online bill pay SCALABLE DEPOSIT PLATFORM 11 NATIONWIDE CLIENT REACH 2Q13 DEPOSIT COMPOSITION 9% 22% 8% 38% 23% Noninterest-bearing Interest Checking Global Market MMDA & Savings Time Deposits ATTRACTIVE NATIONWIDE CUSTOMER BASE • 127,624 households, 254,728 accounts • Average deposits per household: $85,614 • 50% household income > $75,000 • 40% household net worth > $250,000 BARCLAYS CONFERENCE PRESENTATION

$10,000 $20,000 $30,000 $40,000 $50,000 $60,000 2006 2007 2008 2009 2010 2011 2012 2Q13 Average Balance of Accounts Existing at Each Period 2006 2007 2008 2009 2010 2011 2012 12 VALUE PROPOSITION YIELDS ATTRACTIVE CUSTOMER BASE Vintage 97% 96% 93% 93% 2006 2007 2008 2009 Compound Annual Retention Rate (1) HIGH CUSTOMER DEPOSIT RETENTION LOYAL CUSTOMERS WITH GROWING BALANCES (1) Compound annual retention rate for balances of non-CD bank accounts existing at June 30, 2013, calculated from initial year end to June 30, 2013 (2) Average account balance for non-CD bank accounts existing at each point in time, shown from initial year end to June 30, 2013 BARCLAYS CONFERENCE PRESENTATION (2)

1.67% 2.36% 3.29% 3.87% 3.18% 1.83% 1.20% 0.97% 0.78% 0.76% 2.17% 4.02% 5.29% 5.02% 3.20% 1.57% 0.93% 0.86% 1.01% 0.75% 0.00 % 1.50% 3.00% 4.50% 6.00% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2Q13 EverBank interest cost of deposits Avg. one-year LIBOR 200 bps 13 DEPOSIT PRICING LAGS IN RISING RATE ENVIRONMENT (1) Calculated as annual deposit interest expense divided by average balance of deposits; includes non-interest bearing deposits; YTD (2) EverBank interest cost of deposits for year to date June 30, 2013; Average one-year LIBOR represents the average of December 31, 2012, March 31, 2013 and June 30, 2013 (1) (2) BARCLAYS CONFERENCE PRESENTATION

14 KEY HIGHLIGHTS – 2Q13 Note: A reconciliation of non-GAAP financial measures can be found in the appendix. SUMMARY BALANCE SHEET ($MM) SUMMARY INCOME STATEMENT ($MM) EARNINGS PER SHARE GROWTH DEPOSIT GROWTH IMPROVED CREDIT QUALITY STRONG ASSET GENERATION VOLUME Total Revenue 288$ Net Interest Income, net of Provision 141 Noninterest Income 147 Noninterest Expense 214 Net Income 46 Adjusted Net Income 37$ 2Q12 2Q13 %Δ Adjusted EPS $0.33 $0.28 (15)% GAAP EPS $0.09 $0.35 289% Deposits $10.8bn $13.7bn 27% Adjusted NPA / Total Assets 1.46% 0.92% (37)% NCOs / Avg. Loans HFI 0.34% 0.12% (65)% Asset Generation $2.7bn $3.8bn 41% BARCLAYS CONFERENCE PRESENTATION Cash and Cash Equivalents 490$ Investment Securities 1,615 Loans HFS 2,000 Loans and leases HFI, net 12,794 Total Assets 18,363 Total Deposits 1 ,670 Total Liabilities 16,813 Total Shareholders' Equity 1,549$

15 STRONG CREDIT PERFORMANCE ADJUSTED NON-PERFORMING ASSETS AS A PERCENTAGE OF TOTAL ASSETS(1) NET CHARGE-OFFS TO AVERAGE LOANS HELD FOR INVESTMENT 2.73% 2.11% 1.86% 1.08% 0.99% 0.92% 2009 2010 2011 2012 1Q13 2Q13 1.35% 1.46% 1.02% 0.31% 0.23% 0.12% 2009 2010 2011 2012 1Q13 2Q13 (1) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property accounted for under ASC 310-30 because we expect to fully collect the carrying value of such loans and foreclosed property. A reconciliation of non-GAAP financial measures can be found in the appendix. BARCLAYS CONFERENCE PRESENTATION

16 SOLID LONG TERM EARNINGS GROWTH ADJUSTED EARNINGS PER SHARE(1) $0.42 $0.53 $0.63 $0.74 $0.66 $0.41 $0.78 $1.28 $1.11 $1.27 $0.61 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2Q13 YTD (1) Represents adjusted diluted earnings per common share from continuing operations for 2007-2Q13; 2003-2006 represents GAAP basic earnings per common share from continuing operations Calculated using adjusted net income attributable to the Company from continuing operations for 2010-2Q13; No material items gave rise to material adjustments prior to the year ended December 31, 2010; 2012 adjusted EPS calculation includes $4.5mm and $1.1mm cash dividends paid to Series A and Series B Preferred shareholders in Q1 and Q2, respectively; a reconciliation of non-GAAP financial measures can be found in the appendix. BARCLAYS CONFERENCE PRESENTATION

17 BOOK VALUE GROWTH TANGIBLE COMMON EQUITY PER SHARE(1) $3.10 $3.60 $4.08 $4.81 $5.39 $6.96 $8.54 $10.65 $10.12 $10.30 $11.00 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2Q13 BARCLAYS CONFERENCE PRESENTATION (1) Represents tangible common equity per share including other comprehensive loss. A reconciliation of non-GAAP financial measures can be found in the appendix.

18 CONSISTENT EARNINGS THROUGH VARIETY OF CYCLES ADJUSTED RETURN ON AVERAGE EQUITY 14.3% 15.4% 16.3% 16.5% 13.1% 7.4% 11.5% 14.0% 10.7% 12.4% 11.3% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2Q13 YTD EverBank Banks $5-25bn in Assets BARCLAYS CONFERENCE PRESENTATION

APPENDIX

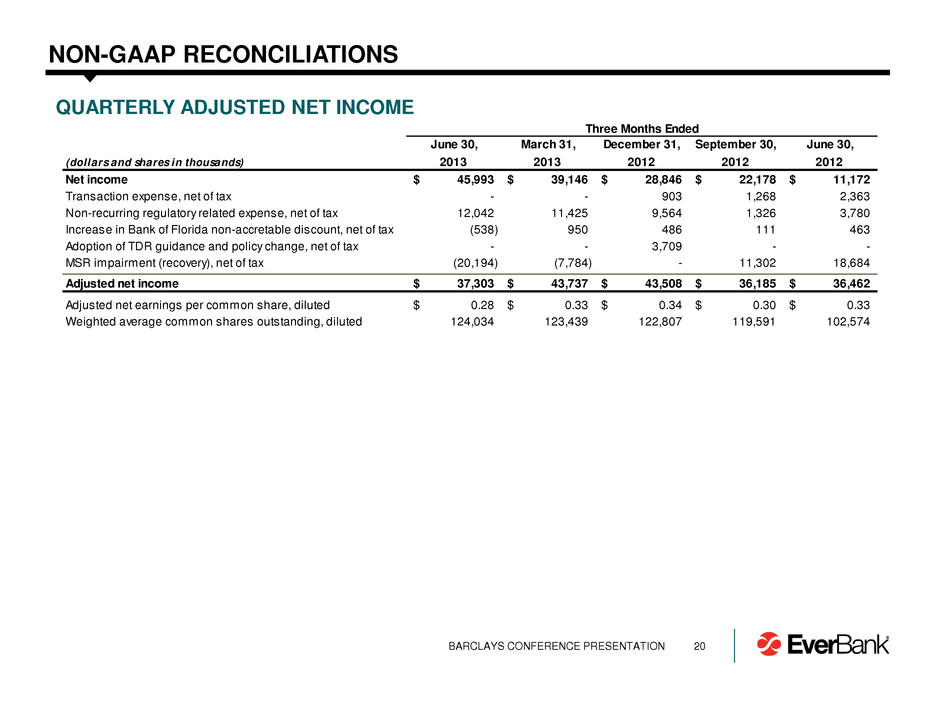

20 NON-GAAP RECONCILIATIONS QUARTERLY ADJUSTED NET INCOME Three Months Ended June 30, March 31, December 31, September 30, June 30, (dollars and shares in thousands) 2013 2013 2012 2012 2012 Net income 45,993$ 39,146$ 28,846$ 22,178$ 11,172$ Transaction expense, net of tax - - 903 1,268 2,363 on-recurring regulatory related expense, net of tax 12,042 11,425 9,564 1,326 3,780 Increase in Bank of Florida non-accretable discount, net of tax (538) 950 486 111 463 Adoption of TDR guidance and policy change, net of tax - - 3,709 - - MSR impairment (recovery), net of tax (20,194) (7,784) - 11,302 18,684 Adjusted net income 37,303$ 43,737$ 43,508$ 36,185$ 36,462$ Adjusted net earnings per common share, diluted 0.28$ 0.33$ 0.34$ 0.30$ 0.33$ Weighted average common shares outstanding, diluted 124,034 123,439 122,807 119,591 102,574 BARCLAYS CONFERENCE PRESENTATION

21 NON-GAAP RECONCILIATIONS YEARLY ADJUSTED NET INCOME(1) (1) No material items gave rise to adjustments prior to the year ended December 31, 2010. BARCLAYS CONFERENCE PRESENTATION (dollars and shares in thousands) 2012 2011 2010 GAAP net income from continuing operations $ 74,042 $ 52,729 $ 188,900 Bargain purchase gain on Tygris transaction, net of tax - - (68,056) Gain on sale of investment securities due to portfolio repositioning, net of tax - - (12,337) Gain on repuchase of trust preferred securities, net of tax - (2,910) (3,556) Transaction expense, net of tax 5,355 9,006 5,984 Non-recurring regulatory related expense, net of tax 17,733 7,825 - Loss on early extinguishment of acquired debt, net of tax - - 6,411 Decrease in fair value of Tygris indemnification asset, net of tax - 5,382 13,654 Increase in Bank of Florida non-accretable discount, net of tax 3,195 3,007 3,837 Impact of change in ALLL methodology, net of tax - 1,178 - Adoption of TDR guidance and policy change, net of tax 3,709 6,225 - MSR impairment, net of tax 39,375 24,462 - Tax expense (benefit) related to revaluation of Tygris NUBILS, net of tax - 691 (7,840) Adjusted net income 143,409$ 107,595$ 126,997$ Adjusted net earnings per common share, diluted 1.27$ 1.11$ 1.28$ Weighted average common shares outstanding, diluted 105,951 77,506 74,589

22 NON-GAAP RECONCILIATIONS NON-PERFORMING ASSETS (NPAs) (1) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property acquired in the Bank of Florida acquisition accounted for under ASC 310-30 because we expect to fully collect the carrying value of such loans and foreclosed property. BARCLAYS CONFERENCE PRESENTATION June 30, March 31, December 31, December 31, December 31, December 31, (dollars in thousands) 2013 2013 2012 2011 2010 2009 Total non-accrual loans and leases 132,078$ 141,468$ 156,629$ 193,478$ 213,838$ 194,951$ Accruing loans 90 days or more past due - - - 6,673 1,754 1,362 Total non-performing loans (NPL) 132,078 141,468 156,629 200,151 215,592 196,313 Other real estate owned (OREO) 36,528 39,576 40,492 42,664 37,450 24,087 Total non-performing assets (NPA) 168,606 181,044 197,121 242,815 253,042 220,400 Troubled debt restructurings (TDR) less than 90 days past due 82,236 88,888 90,094 92,628 70,173 95,482 Total NPA and TDR (1) 250,842$ 269,932$ 287,215$ 335,443$ 323,215$ 315,882$ Total NPA and TDR 250,842$ 269,932$ 287,215$ 335,443$ 323,215$ 315,882$ Government-insured 90 days or more past due still accruing 1,405,848 1,547,995 1,729,877 1,570,787 553,341 589,842 Loans accounted for under ASC 310-30: 90 days or more past due 54,054 67,630 79,984 149,743 195,425 - OREO 21,194 22,955 16,528 19,456 19,166 - Total regulatory NPA and TDR 1,731,938$ 1,908,512$ 2,113,604$ 2,075,429$ 1,091,147$ 905,724$ Adjusted credit quality ratios excluding government-insured loans and loans accounted for under ASC 310-30:(1) NPA to total assets 0.92% 0.99% 1.08% 1.86% 2.11% 2.73% Credit quality ratios including government-insured loans and loans accounted for under ASC 310-30: NPA to total assets 8.98% 9.94% 11.09% 15.20% 8.50% 10.05%

23 NON-GAAP RECONCILIATIONS ADJUSTED TANGIBLE COMMON EQUITY (dollars in millions) 2Q13 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 G AP shareholders equity $ 1,549 $ 1,451 $ 968 $ 1,013 $ 554 $ 411 $ 239 $ 213 $ 185 $ 165 $ 144 Less: Goodwill 47 47 10 10 0 0 2 0 0 0 0 Less: Other intangible assets 7 8 7 9 - 1 2 3 4 6 7 Tangible equity 1,496$ 1,396$ 950$ 994$ 554$ 410$ 235$ 209$ 180$ 159$ 137$ Less: Perpetual preferred stock 150 150 - - - - - - - - - Tangible common equity 1,346$ 1,246$ 950$ 994$ 554$ 410$ 235$ 209$ 180$ 159$ 137$ Less: Accumulated other comprehensive income (loss) (80) (87) (108) (5) 20 1 (2) 3 3 4 3 Adjusted tangible common equity 1,426$ 1,333$ 1,058$ 999$ 534$ 409$ 237$ 206$ 178$ 155$ 134$ BARCLAYS CONFERENCE PRESENTATION

24 DISCLAIMER THIS PRESENTATION HAS BEEN PREPARED BY EVERBANK FINANCIAL CORP ("EVERBANK" OR THE “COMPANY”) SOLELY FOR INFORMATIONAL PURPOSES BASED ON ITS OWN INFORMATION, AS WELL AS INFORMATION FROM PUBLIC SOURCES. THIS PRESENTATION HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF EVERBANK AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE RELEVANT. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF EVERBANK AND THE DATA SET FORTH IN THIS PRESENTATION AND OTHER INFORMATION PROVIDED BY OR ON BEHALF OF EVERBANK. EXCEPT AS OTHERWISE INDICATED, THIS PRESENTATION SPEAKS AS OF THE DATE HEREOF. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE WILL BE NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF. CERTAIN OF THE INFORMATION CONTAINED HEREIN MAY BE DERIVED FROM INFORMATION PROVIDED BY INDUSTRY SOURCES. EVERBANK BELIEVES THAT SUCH INFORMATION IS ACCURATE AND THAT THE SOURCES FROM WHICH IT HAS BEEN OBTAINED ARE RELIABLE. EVERBANK CANNOT GUARANTEE THE ACCURACY OF SUCH INFORMATION, HOWEVER, AND HAS NOT INDEPENDENTLY VERIFIED SUCH INFORMATION. THIS PRESENTATION MAY CONTAIN CERTAIN FORWARD-LOOKING STATEMENTS AS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, AND SUCH STATEMENTS ARE INTENDED TO BE COVERED BY THE SAFE HARBOR PROVIDED BY THE SAME. WORDS SUCH AS “OUTLOOK,” “BELIEVES,” “EXPECTS,” “POTENTIAL,” “CONTINUES,” “MAY,” “WILL,” “COULD,” “SHOULD,” “SEEKS,” “APPROXIMATELY,” “PREDICTS,” “INTENDS,” “PLANS,” “ESTIMATES,” “ANTICIPATES” OR THE NEGATIVE VERSION OF THOSE WORDS OR OTHER COMPARABLE WORDS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL FACTS, AND ARE BASED ON CURRENT EXPECTATIONS, ESTIMATES AND PROJECTIONS ABOUT THE COMPANY’S INDUSTRY, MANAGEMENT’S BELIEFS AND CERTAIN ASSUMPTIONS MADE BY MANAGEMENT, MANY OF WHICH, BY THEIR NATURE, ARE INHERENTLY UNCERTAIN AND BEYOND THE COMPANY’S CONTROL. ACCORDINGLY, YOU ARE CAUTIONED THAT ANY SUCH FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT. ALTHOUGH THE COMPANY BELIEVES THAT THE EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE AS OF THE DATE MADE, EXPECTATIONS MAY PROVE TO HAVE BEEN MATERIALLY DIFFERENT FROM THE RESULTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. UNLESS OTHERWISE REQUIRED BY LAW, EVERBANK ALSO DISCLAIMS ANY OBLIGATION TO UPDATE ITS VIEW OF ANY SUCH RISKS OR UNCERTAINTIES OR TO ANNOUNCE PUBLICLY THE RESULT OF ANY REVISIONS TO THE FORWARD-LOOKING STATEMENTS MADE IN THIS PRESENTATION. INTERESTED PARTIES SHOULD NOT PLACE UNDUE RELIANCE ON ANY FORWARD-LOOKING STATEMENT AND SHOULD CONSIDER THE UNCERTAINTIES AND RISKS DISCUSSED UNDER THE HEADINGS “RISK FACTORS” AND “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” IN EVERBANK’S ANNUAL REPORT ON FORM 10-K, QUARTERLY REPORTS ON FORM 10-Q AND IN OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. BARCLAYS CONFERENCE PRESENTATION