Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AgEagle Aerial Systems Inc. | v354675_8k.htm |

A Domestic Onshore Oil Company EnerJex Resources, Inc. (Stock Symbol: ENRJ) Euro Pacific Global Investment Conference –September 10, 2013

SUMMARY: The material presented is a presentation of general background information about EnerJex Resources, Inc. (“ENRJ”) as of the date of this document. This information is in summary form and does not purport to be complete. This document (and/or attachments to this document) is not intended to be relied upon as advice to existing or potential investors. FORWARD-LOOKING STATEMENTS: This document (including the financial projections and any subs equent questions and answers) contains statements that are forward -looking within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements are only predictions and are not guarantees of future performance. Investors are cautioned that any such for ward-looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environment of ENRJ that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward-looking statements. RESERVE AND RESOURCE DISCLOSURE: Securities and Exchange Commission (“SEC”) rules prohibit a publicly-reporting oil and gas company from including oil and gas resource estimates in its filings with the SEC, except proved, probable and possible reserves that meet the SEC’s definition of such terms. Estimates of non -proved and non-probable reserves included herein are not based on SEC definitions and guidelines and may not meet spe cific definitions of reserves or resource categories within the meaning of the SPE/SPEE/WPC Petroleum Resource Management System. NO REPRESENTATIONS: The information in this document (and/or attachments to this do cument) is current as of the date indicated. That information is not complete, and the performanc e projections included herein have not been audited. These presentation materials do not contain certain material informati on concerning ENRJ, including important disclosures and risk factors associated with making an investment in ENRJ, and are su bject to revision at any time. ENRJ does not undertake any obligated to inform you of any changes in circumstances that may affect, in the future, the accuracy of the information set forth herein. Although ENRJ believes that the expectations and assumpt ions reflected in this document and the forward -looking statements are reasonable based upon information currently available to ENRJ, and their respective principals, employees, agents and authorized representatives, none of ENRJ, or their respectiv e principals, employees, agents or authorized representatives makes any warranty or representation, whether express or implied, or assumes any legal liability for the accuracy, completeness or usefulness of any information disclosed. ENRJ nor any of its respective principals, employees, agents or authorized representatives accepts any responsibility or liability whatsoev er caused by any action taken in reliance upon this document and/or its attachments. Disclaimer / Forward Looking Statements 2

▪Company Overview ▪Company Transformation ▪Pending Merger

Company Overview Asset Overview Domestic Onshore 100% Oil -Eastern Kansas / South Texas Shallow Reservoirs Long Life / Multi-Pay Serendipity Low Risk >95% Historical Drilling Success Rate Enhanced Oil Recovery Pressure Maintenance / Secondary Recovery Attractive Economics ~50% IRR / ~5X ROI (Mississippian / Cherokee) Repeatable Hundreds of Unbooked Drilling Locations Identified Location of ENRJ AssetsPictures of ENRJ Oil Operations Corporate Profile Asset Profile Key Statistics (2012) Headquarters San Antonio, TX Gross Production ~500 BOPD Net Production 96,842 Bbl Stock Price $0.55 Proved Oil Reserves 2.9 MMbbl Revenue $8.5 Million Market Cap $37 Million % PDP 53% EBITDA $2.7 Million Net Debt $11 Million Proved PV-10 Value $61 Million Operating Expenses $32 / Bbl Insider Ownership 62% % PDP 57% Reserve Replacement 320% 4

ENRJ’s entire board of directors and management team were reconstituted at the end of 2010. ▪ New management has accomplished a tremendous amount in a short time period and executed on numerous key operating and financing objectives, setting the stage for an exciting future. Company Transformation Year-End 2010 Transformation: »Converted $2.7 million of debt into common equity at $0.80 per share. »Added a new focus area in South Texas and acquired additional assets in Eastern Kansas. »Raised $5 million through the issuance of common equity at $0.40per share. 2011 Milestones: »More than doubled exposure to Mississippian oil play in Kansas. »Raised $3.4 million through the issuance of common equity at $0.60 per share. »Repurchased 3.75 million shares of common stock at $0.40 per share. »Secured new $50 million senior credit facility. »Formed $5 million general partnership to develop certain oil assets in Kansas. »Sold $5.5 million of non-core assets. »Drilled 54 oil wells with a 100% success rate and 37 secondary recovery water injection wells. »Improved operating cost structure and significantly reduced unitoperating expenses. 2012 Milestones: »Announced successful production results from 3 high-impact oil wells in South Texas. »Unveiled Cherokee oil resource play in Kansas and increased acreage position 10-fold. »Repurchased 2 million shares of common stock at $0.53 per share. »Drilled 126 oil wells with a 98% success rate and 100 secondary recovery water injection wells. »Achieved record proved reserves, oil production, revenue, net income, EBITDA, and operating cash flow. 5 The transformation is complete! EnerJex is poised for rapid growth with ~$10 million of liquidity.

ENRJ recently announced an agreement to acquire privately held Black Raven Energy, Inc. ▪ Transaction based on a negotiated value of $0.70 per share of ENRJ common stock. ▪ Existing ENRJ shareholders expected to own ~67% of the combined company on a diluted basis. ▪ ENRJ expected to incur ~$15 million of additional debt to complete the acquisition. ▪ Transaction expected to close within 30 days. Black Raven assets provide an attractive entrance into the Denver-Julesburg (“DJ”) Basin. ▪ Large footprint of more than 75,000 net acres, including ~45,000net acres held by production. ▪ 100% working interest in ~19,000 acres representing the vast majority of Adena Field. ▪Adena is the 3 rd largest oil field in Colorado history, having produced 75 million barrels of oil. ▪Nearly all producing wells were suspended during the mid-1980’s when oil prices collapsed. ▪Current production of ~250 BOEPD (2/3 oil) from 8 J-Sand and 7 D-Sand wells at a depth of 5,500’. ▪135 existing wells of which 80 reactivations or recompletions have already been identified. ▪Most recent D-Sand recompletion achieved a stabilized production rate of ~30 BOPD. ▪New D-Sand waterflood initiated during 1Q 2013. ▪ 100% working interest in more than 55,000 acres targeting gas production from the Niobrara formation. ▪ 150 high-ranked drilling locations identified based on 114 miles of 2D and 165 square miles (105,000 net acres) of 3D seismic analysis, which has historically yielded success rates of approximately 90% in this play. ▪ Direct access to Cheyenne Hub market and immediate proximity to major pipelines. ▪ 6% overriding royalty interest in 200 wells that were drilled during the past few years. ▪ Exposure to emerging unconventional oil resource plays being pursued by numerous competitors. Pending Merger 6

▪Overview of Oil Portfolio ▪Summary of Oil Reserves ▪Kansas –Mississippian Project ▪Kansas –Cherokee Project ▪Overview of Enhanced Oil Recovery ▪Texas –El Toro Project ▪Key Metrics

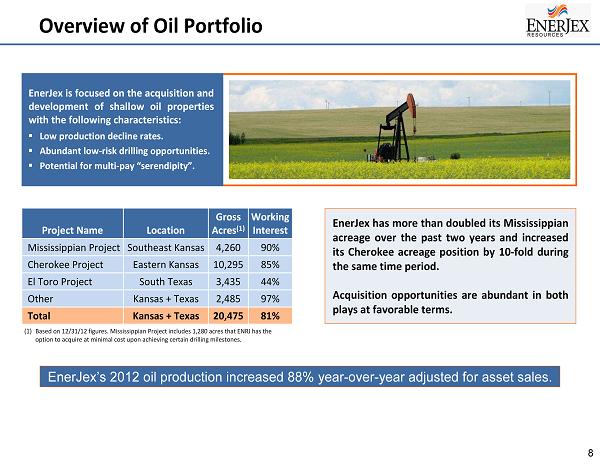

Overview of Oil Portfolio Project Name Location Gross Acres (1) Working Interest Mississippian Project Southeast Kansas 4,260 90% Cherokee Project Eastern Kansas 10,295 85% El Toro Project South Texas 3,435 44% Other Kansas + Texas 2,485 97% Total Kansas + Texas 20,475 81% (1) Based on 12/31/12 figures. Mississippian Project includes 1,280 acres that ENRJ has the option to acquire at minimal cost upon achieving certain drilling milestones. EnerJex is focused on the acquisition and development of shallow oil properties with the following characteristics: ▪ Low production decline rates. ▪ Abundant low-risk drilling opportunities. ▪ Potential for multi-pay “serendipity”. EnerJex’s 2012 oil production increased 88% year-over-year adjusted for asset sales. 8 EnerJex has more than doubled its Mississippian acreage over the past two years and increased its Cherokee acreage position by 10-fold during the same time period. Acquisition opportunities are abundant in both plays at favorable terms.

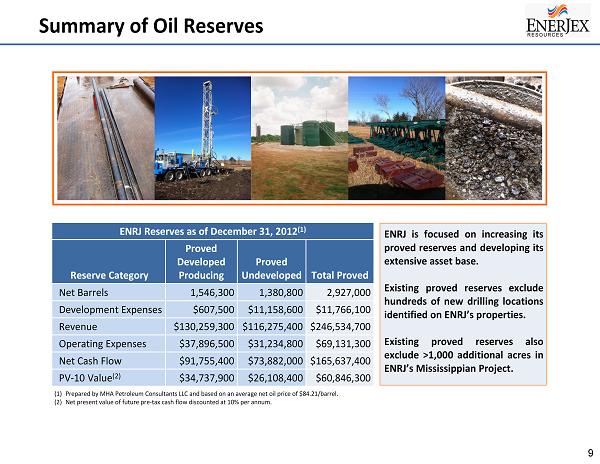

Summary of Oil Reserves ENRJ Reserves as of December 31, 2012 (1) Reserve Category Proved Developed Producing Proved Undeveloped Total Proved Net Barrels 1,546,300 1,380,800 2,927,000 Development Expenses $607,500 $11,158,600 $11,766,100 Revenue $130,259,300 $116,275,400 $246,534,700 Operating Expenses $37,896,500 $31,234,800 $69,131,300 Net Cash Flow $91,755,400 $73,882,000 $165,637,400 PV-10 Value (2) $34,737,900 $26,108,400 $60,846,300 (1) Prepared by MHA Petroleum Consultants LLC and based on an average net oil price of $84.21/barrel. (2) Net present value of future pre-tax cash flow discounted at 10% per annum. ENRJ is focused on increasing its proved reserves and developing its extensive asset base. Existing proved reserves exclude hundreds of new drilling locations identified on ENRJ’s properties. Existing proved reserves also exclude >1,000 additional acres in ENRJ’s Mississippian Project. 9

Kansas Oil & Gas Production EnerJex’s Mississippian Project is located in the Winterschied Field, which has produced approximately 15 million barrels of crude oil according to the Kansas Geological Survey. Production from this field averaged approximately 1,000 BOPD in 1970 and 400 BOPD in 2012. EnerJex has increased its production from this project by more than 150% from 75 to 200 BOPD since the beginning of 2011, and it is expected to continue growing for the foreseeable future. Mississippian Project 10 Woodson County Oil & Gas Fields

Mississippian Project Characteristics ▪Rural area with long production history ▪Shallow formation depth of 1,700 feet ▪10 acre producer well spacing ▪Five-spot water injection pattern ▪Finding & development costs < $10/Bbl ▪Operating expenses < $25/Bbl ▪Drilling and completion cost of $80,000 ▪Drilling success rate > 95% ▪Drilling time of 72 hours ▪Oil to market within days of completion ▪Low production decline rate ▪Multi-zone serendipity potential ▪WTI basis differential of $7/Bbl ▪Multiple oil purchaser options ▪Stable service and cost environment 11 More than 1 billion barrels of oil have been produced from the Mississippian formation in Kansas.

Franklin County Oil & Gas Fields Miami County Oil & Gas Fields Kansas Oil & Gas Production EnerJex’s Cherokee Project is located in the prolific Paola-Rantoul Field, which has produced nearly 30 million barrels of crude oil according to the Kansas Geological Survey. Production from this field exceeded 2,000 BOPD in the early 1980 ’s and averaged more than 900 BOPD in 2012. EnerJex has increased its production from this project by 10x from 25 to 250 BOPD since the beginning of 2011, and it is expected to continue growing for the foreseeable future. Cherokee Project 12

Cherokee Project Characteristics ▪Rural area with long production history ▪Shallow formation depth of 600-650 feet ▪4 acre producer well spacing ▪Five-spot water injection pattern ▪Finding & development costs < $10/Bbl ▪Operating expenses < $25/Bbl ▪Drilling and completion cost of $30,000 ▪Drilling success rate > 95% ▪Drilling time of 24 hours ▪Oil to market within days of completion ▪Low production decline rate ▪Multi-zone serendipity potential ▪WTI basis differential of $7/Bbl ▪Multiple oil purchaser options ▪Stable service and cost environment 13 Many discoveries were abandoned prior to development after oil prices collapsed in the mid-80’s.

Oil Production Well Primary Oil Production Secondary Oil Production Barrels Of Oil Per Day Time Elapsed Water Injection Well Cherokee Project: Incremental Oil Production From Initiating Water Injection At Inception Before Reservoir Pressure Is Depleted Mississippian Project: Incremental Oil Production From Initiating Water Injection After Primary Oil Recovery Has Depleted Reservoir Pressure Enhanced Oil Recovery ▪ Primary recovery results from natural reservoir pressure and typically recovers 10-25% of original oil in place. ▪ Water injection re-pressurizes the oil reservoir and pushes oil to producing wells, resulting in an additional 10-25% recovery of original oil in place. 14

El Toro Project El Toro Project Area Oil Fields (Frio & Atascosa Counties) Oil Fields Texas Oil & Gas Fields ▪ More than 100 million barrels of oil have been produced from the Olmos formation in the area surrounding the company’s El Toro Project. ▪ EnerJex has completed 12 Olmos oil wells in this project spanning 8 miles with consistent petro - physical results but varying production results. ▪ EnerJex believes its acreage was neglected due to low reservoir permeability and that horizontal drilling and fracture stimulation may justify widespread economic development. ▪ The first two vertical wells drilled by EnerJex produced ~100% more oil during the initial 12 months than the best well in the adjacent field which has produced 10 million barrels of oil. ▪ Service constraints and increased costs due to the Eagle Ford Shale frenzy have caused management to focus on Kansas projects in the near term. 15

Oil Revenue (Millions) Oil Production (Barrels) ENRJ management continues to execute on its business strategy toincrease per-share value by rapidly increasing oil production and reserves in an accretive manner for shareholders. Key Metrics Following Company Transformation Existing Properties (Excluding Asset Sales) Existing Properties (Excluding Asset Sales) 16 Proved PV-10 Value (Millions) Oil Reserves (Millions of Barrels)

▪Capitalization / Ownership Table ▪Key Executives ▪Senior Credit Facility ▪Corporate Objectives

Capitalization / Ownership Table The management team has significant ownership in ENRJ. ▪Alignment of interests with shareholders. ▪Strong financial background. ▪Deep understanding of value creation. Ownership Table –September 10, 2013 Description # Shares % Common Shares Outstanding Officers / Directors / >5% Shareholders (1) Montecito Venture Partners, LLC (Including Affiliates) 14,813,923 21.8% West Coast Opportunity Fund, LLC (Including Affiliates) 11,812,103 17.4% Newman Family Trust 5,000,000 7.4% Robert G. Watson Jr. (CEO) 4,000,000 5.9% Coal Creek Energy, LLC (Including Affiliates) 3,944,648 5.8% James G. Miller (Director) 2,173,871 3.2% Lance W. Helfert 201,999 0.3% R. Atticus Lowe 128,585 0.2% TOTAL Officers / Directors / >5% Shareholders 42,075,129 62.0% Public Float 25,761,400 38.0% Total Common Shares Outstanding 67,836,529 100.0% Series A Preferred Shares (2) 4,779,460 NA (1) Based on most recent SEC filings and knowledge of EnerJex Resources, Inc. (2) Series A Preferred Stock will convert into 4,779,460 common shares once cumulative distributions reach $4,779,460. Preferred distributions are paid quarterly from one-third of ENRJ’s adjusted operating cash flow. 18

Robert Watson Jr. (Chief Executive Officer) ▪ Co-founder and former CEO of Black Sable Energy, a private oil exploration and production company focused on South Texas that was subsequently sold to ENRJ. ▪ Former President of Centerra Energy Partners, a private oil and gas partnership focused on South Texas. ▪ Senior Associate at American Capital, Ltd. (NASDAQ: ACAS), a publicly traded middle-market private equity firm and global asset manager with $68 billion in assets under management. »Executed 7 transactions in excess of $150 million in invested capital, and actively participated in the daily management of 12 portfolio companies. ▪ Member of Investment Banking Team in the Energy Group at CIBC World Markets. ▪ Graduate of Southern Methodist University with a Bachelor of Arts degree in Finance. Douglas Wright (Chief Financial Officer) ▪ Former Corporate Controller and Chief Accounting Officer of Nations Petroleum Company, Ltd. »Privately held company grew production of its core U.S. asset from 300 BOPD to ~5,000 BOPD over a 5-year period before selling to Occidental Petroleum. »Built accounting staff and developed the company’s financial accounting and reporting procedures while arranging $250 million of mezzanine financing. ▪ Oversight of Financial Reporting for subsidiary of Noble Energy,Inc. (NYSE: NBL) from 2005 to 2006. ▪ Responsible for SEC reporting relating to its $3.4 billion acquisition of Patina Oil & Gas Corp. ▪ Served in managerial roles from 1986 to 1996 at Oryx Energy, which was acquired by Kerr McGee Corp. for $3.1 billion. ▪ Began career at Deloitte & Touche and served as a manager from 1977 to 1986. Key Executives 19

ENRJ has secured a $50 million credit facility with Texas Capital Bank. ▪$11.0 million drawn as of June 30, 2013 compared to $6.1 millionas of year-end 2010. ▪Access to capital increases as oil production and proved reserves increase. ▪Borrowing base increased by 60% from $12.15 million to $19.5 million in April 2013. ▪Current interest rate is 3.75%. ▪Hedges provide downside protection. Senior Credit Facility $50 Million Senior Secured Line of Credit -Working Capital -Drilling -Acquisitions Crude Oil Hedges Period Monthly Volume Price/Barrel Sep 13 –Dec 13 6,200 $83.6 Sep 13 –Dec 13 1,550 $90.0 -$94.5 Jan 14 –Dec 14 5,820 $82.6 Jan 15 –Dec 15 4,000 $82.0 20

Corporate Objectives ▪ Increase Kansas production to 1,000+ barrels of oil per day through development of existing drilling inventory. ▪ Significantly increase oil reserves attributed to existing properties. ▪ Continue exploring and developing Texas assets. ▪ Implement a proactive investor outreach campaign to increase company exposure and improve stock trading volume. ▪ List stock on NYSE MKT or NASDAQ. MANAGEMENT IS 100% FOCUSED ON CREATING PER-SHARE VALUE FOR STOCKHOLDERS 21

Corporate Website: www.enerjex.com Corporate Headquarters: 4040 Broadway Street, Suite 508 San Antonio, TX 78209 Chief Executive Officer: Robert Watson, Jr. (210) 451-5545 Investor Relations: Daniel Vernon (405) 230-1124 A Domestic Onshore Oil Company