Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DYCOM INDUSTRIES INC | ex991dadavidsonpressreleas.htm |

| 8-K - 8-K - DYCOM INDUSTRIES INC | dycomdadavidsonpressreleas.htm |

1 Trend Schedule - Selected Financial Information (Unaudited) Revenue Detail ($ in millions) Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 Organic Revenue-Non-GAAP(a) 315.8$ 267.4$ 296.1$ 315.8$ 1,195.1$ 323.3$ 276.7$ 314.5$ 339.6$ 1,254.0$ Organic Revenue Growth % - Non-GAAP 15.2% 19.2% 17.3% 9.0% 15.4% 2.4% 3.5% 6.2% 7.5% 4.9% Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 Legacy companies (b) (excluding storm restoration revenue) 315.8$ 267.4$ 296.1$ 315.8$ 1,195.1$ 323.3$ 276.7$ 314.5$ 339.6$ 1,254.0$ Businesses acquired in Q2-13 (b) - - - - - - 75.9 122.9 136.5 335.4 Businesses acquired in Q4-13 (b) - - - - - - - - 2.6 2.6 Storm restoration revenue 3.7 - - 2.3 6.0 - 16.7 - - 16.7 Total Revenue 319.6$ 267.4$ 296.1$ 318.0$ 1,201.1$ 323.3$ 369.3$ 437.4$ 478.6$ 1,608.6$ 2013 Top Five Customers Customer Revenue % of Total Revenue Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 AT&T Inc. 15.2% 13.5% 13.4% 12.7% 13.7% 13.5% 13.6% 17.4% 16.5% 15.5% CenturyLink, Inc. 13.3% 14.5% 13.0% 13.6% 13.6% 13.7% 14.7% 14.3% 15.5% 14.6% Comcast Corporation 12.9% 12.5% 12.5% 12.6% 12.6% 12.7% 11.0% 10.1% 10.2% 10.9% Verizon Communications Inc. 12.0% 9.9% 11.1% 12.2% 11.3% 10.2% 9.1% 8.9% 10.2% 9.6% Windstream Corporation 6.4% 7.9% 9.0% 10.1% 8.4% 9.4% 8.8% 8.3% 5.9% 7.9% All Other customers 40.1% 41.7% 41.0% 38.9% 40.4% 40.4% 42.9% 40.9% 41.6% 41.5% Total Revenue 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Customer Revenue ($ in thousands) Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 AT&T Inc. 48.7$ 36.1$ 39.8$ 40.3$ 164.8$ 43.7$ 50.1$ 75.9$ 79.1$ 248.8$ CenturyLink, Inc. 42.6 38.8 38.5 43.2 163.1 44.4 54.2 62.6 74.3 235.5 Comcast Corporation 41.3 33.4 37.1 40.0 151.7 41.2 40.8 44.3 48.9 175.2 Verizon Communications Inc. 38.3 26.4 32.7 38.8 136.2 33.0 33.5 39.1 49.0 154.6 Windstream Corporation 20.6 21.2 26.6 32.1 100.5 30.3 32.3 36.5 28.1 127.2 All Other customers 128.2 111.6 121.4 123.6 484.8 130.7 158.5 179.1 199.1 667.4 Total Revenue 319.6$ 267.4$ 296.1$ 318.0$ 1,201.1$ 323.3$ 369.3$ 437.4$ 478.6$ 1,608.6$ Notes: Amounts may not add due to rounding. These trend schedules present certain financial measures that are not presented according to generally accepted principles in the U.S. (“GAAP”). Certain of these measures are considered “Non-GAAP financial measures” under the regulations of the Securities and Exchange Commission ("SEC"). We believe that the presentation of certain Non-GAAP financial measures provides information that is useful to investors because it allows for a more direct comparison of our performance for the period with our performance in the comparable prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G schedules on pages 5-7. We caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. *For comparison purposes, revenues from Time Warner Cable Inc. and Insight Communications Company, Inc. have been combined for periods prior to their February 2012 merger. (b) Legacy company information excludes (i) the telecommunications infrastructure services subsidiaries acquired on December 3, 2012 from Quanta Services, Inc. (the “Q2-13 businesses acquired”) and (ii) Sage Telecommunications Corp of Colorado, LLC and certain assets of a tower construction and maintenance company acquired during Q4-13 (the “Q4-13 businesses acquired”). (a) Organic Revenue – Non-GAAP are revenues from businesses that are included for the full period in both the quarter presented and the comparable prior quarterly or yearly period, excluding storm restoration services, if any. Organic Revenue growth is calculated as the percentage increase in revenues over those of the comparable prior year period (fiscal quarter or fiscal year) for revenues from businesses that are included in both periods for the full fiscal period, excluding revenues, if any, from storm restoration services. As a result, revenues may be excluded in the calculation of yearly organic revenue growth that are not excluded from the calculation of quarterly organic revenue growth for quarters within that fiscal year. For example, for comparisons beginning with Q3-14, Organic Revenue – Non-GAAP will include revenues of businesses acquired in Q2-13 as the revenues from these businesses will be included in both quarters; however, the annual comparison of Organic Revenue – Non-GAAP for fiscal 2014 will exclude these revenues because they will not be included in the comparable fiscal 2013 period for the full period. See pages 5-7 for a reconciliation of GAAP to Non-GAAP financial measures. Exhibit 99.2

2 Trend Schedule - Selected Financial Information (Unaudited) Backlog ($ in millions at end of period) Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13(b) Q3-13 Q4-13 Backlog - Total (a) 1,441.4$ 1,818.6$ 1,743.8$ 1,565.1$ 1,375.6$ 2,019.3$ 2,002.9$ 2,196.9$ Backlog - Next 12 Months (included in Total Backlog) (a) 791.0$ 966.9$ 961.3$ 908.6$ 821.9$ 1,242.4$ 1,207.6$ 1,217.3$ Employees (at end of period) Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 Q4-13 Number of Employees 8,285 8,288 8,207 8,111 8,001 10,135 10,349 10,822 Estimated Future Amortization of Intangibles ($ in millions) Dycom Legacy Company (c) Q2-13 Business acquired Q4-13 Business acquired Total Estimated Quarterly Expense: Q1-14 1.6$ 3.4$ 0.1$ 5.2$ Q2-14 1.5$ 3.1$ 0.1$ 4.8$ Q3-14 1.5$ 2.5$ 0.1$ 4.1$ Q4-14 1.5$ 2.5$ 0.1$ 4.1$ Estimated Expense by Fiscal Year: FY 2014 6.1$ 11.5$ 0.5$ 18.2$ FY 2015 6.0$ 8.5$ 0.5$ 15.0$ FY 2016 5.6$ 8.2$ 0.5$ 14.3$ FY 2017 4.8$ 7.6$ 0.5$ 12.9$ FY 2018 4.7$ 5.5$ 0.5$ 10.7$ Thereafter 11.4$ 35.0$ 3.1$ 49.5$ Notes: Amounts may not add due to rounding. (c) Legacy company information excludes (i) the Q2-13 businesses acquired and (ii) the Q4-13 businesses acquired. This Trend Schedule includes certain forward-looking statements within the meaning of the 1995 Private Securities Litigation Reform Act. These statements are based on management's current expectations or beliefs, and are subject to uncertainty and changes in circumstances. Forward-looking statements are subject to risks and uncertainties that may cause actual results in the future to differ materially from the results projected or implied in any forward-looking statements contained in this Trend Schedule. Such risks and uncertainties include business and economic conditions and trends in the telecommunications industry affecting our customers, future financial and operating results, the future impact of any acquisitions or dispositions and the other risks affecting the operations of the Company. Information about these risks may be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. The Company is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward looking statements, whether as a result of new information, future events, or otherwise. (b) Total Q2-13 backlog included $462 million of backlog from the Q2-13 businesses acquired. (a) Our backlog consists of the uncompleted portion of services to be performed under job-specific contracts and the estimated value of future services that we expect to provide under master service agreements and other contracts. We include in our backlog the amount of services projected to be performed over the terms of the contracts based on our historical experience with customers and, more generally, our experience in procurements of this type. Backlog is considered a Non-GAAP financial measure as defined by SEC Regulation G; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others.

3 Trend Schedule - Selected Financial Information (Unaudited) Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 Adjusted EBITDA ($ in millions) Adjusted EBITDA (Non-GAAP) 40.4$ 24.7$ 29.9$ 40.5$ 135.5$ 40.4$ 37.2$ 44.0$ 58.1$ 179.8$ Adjusted EBITDA (Non-GAAP) - as a % of Revenue 12.6% 9.2% 10.1% 12.7% 11.3% 12.5% 10.1% 10.1% 12.1% 11.2% Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 Net Income-Non-GAAP and Earnings Per Share - Non-GAAP ($ in millions, except earnings per share) Net income - Non-GAAP 13.0$ 3.5$ 9.6$ 13.3$ 39.4$ 12.3$ 5.2$ 7.2$ 15.1$ 39.8$ Diluted earnings per common share - Non-GAAP 0.38$ 0.10$ 0.28$ 0.39$ 1.14$ 0.36$ 0.15$ 0.21$ 0.44$ 1.18$ Shares used in computing Diluted EPS (in millions): 34.2 34.6 34.7 34.4 34.5 33.7 33.5 33.8 34.1 33.8 Notes: The Company has defined Adjusted EBITDA (Non-GAAP) as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, acquisition related costs, write-off of deferred financing costs, charges for a wage and hour class action settlement, and stock-based compensation expense. See pages 5-7 for a reconciliation of GAAP to Non-GAAP financial measures. Amounts may not add due to rounding.

4 Trend Schedule - Selected Financial Information (Unaudited) Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 Q4-13 Liquidity ($ in millions) Cash and equivalents 51.3$ 86.2$ 66.7$ 52.6$ 54.7$ 22.6$ 18.2$ 18.6$ Debt: Capital lease obligations 0.2$ 0.2$ 0.1$ 0.1$ 0.1$ -$ -$ -$ Revolver - $275 Senior Credit Agreement - matures Dec. 2017 - - - - - 20.0 36.0 49.0 Term Loan - Senior Credit Agreement - amortizes through Dec. 2017 - - - - - 125.0 123.4 121.9 7.125% Senior Subordinated Notes, due Jan 2021 (including premium) 187.5$ 187.5$ 187.5$ 187.5$ 187.5$ 281.3$ 281.2$ 281.1$ Total Debt 187.7$ 187.7$ 187.6$ 187.6$ 187.6$ 426.3$ 440.6$ 452.0$ Letters of Credit outstanding 41.2$ 39.1$ 39.1$ 38.5$ 44.1$ 44.1$ 46.7$ 46.7$ Availability on Senior Credit Agreement 179.8$ 185.9$ 185.9$ 186.5$ 180.9$ 210.9$ 192.3$ 179.3$ Cash flow ($ in millions) Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 Net cash flow from operating activities 19.4$ 51.4$ (2.4)$ (3.3)$ 65.1$ 27.7$ 63.5$ 0.1$ 15.4$ 106.7$ Cap-ex, net of disposal proceeds (14.4)$ (20.1)$ (7.8)$ (10.6)$ (52.8)$ (10.5)$ (15.7)$ (15.1)$ (17.5)$ (58.8)$ Acquisition payments - - - - - - (314.8) (4.2) (11.3) (330.3) Other investing activity (restricted cash) 0.6 - - 0.4 0.9 - (0.0) - 0.1 0.1 Net cash flow from investing activities (13.9)$ (20.1)$ (7.8)$ (10.2)$ (51.9)$ (10.5)$ (330.5)$ (19.3)$ (28.8)$ (389.1)$ Net borrowings (repayments) on credit facility and capital lease obligations (0.1)$ (0.1)$ (0.0)$ (0.0)$ (0.2)$ (0.0)$ 238.8$ 14.4$ 11.4$ 264.6$ Debt issuance costs - - - - - - (6.4) (0.3) - (6.7) Share repurchases - - (10.9) (2.0) (13.0) (15.2) - - - (15.2) Option proceeds, net 0.9 3.1 1.3 1.2 6.5 0.2 2.7 0.6 1.7 5.3 Other financing activities 0.1 0.5 0.4 0.3 1.3 0.0 (0.3) 0.1 0.5 0.4 Net cash flow from financing activities 1.0$ 3.5$ (9.3)$ (0.6)$ (5.4)$ (15.1)$ 234.8$ 14.9$ 13.7$ 248.3$ Net cash flow from all activities 6.5$ 34.9$ (19.5)$ (14.1)$ 7.8$ 2.1$ (32.1)$ (4.3)$ 0.4$ (34.0)$ Amounts may not add due to rounding.

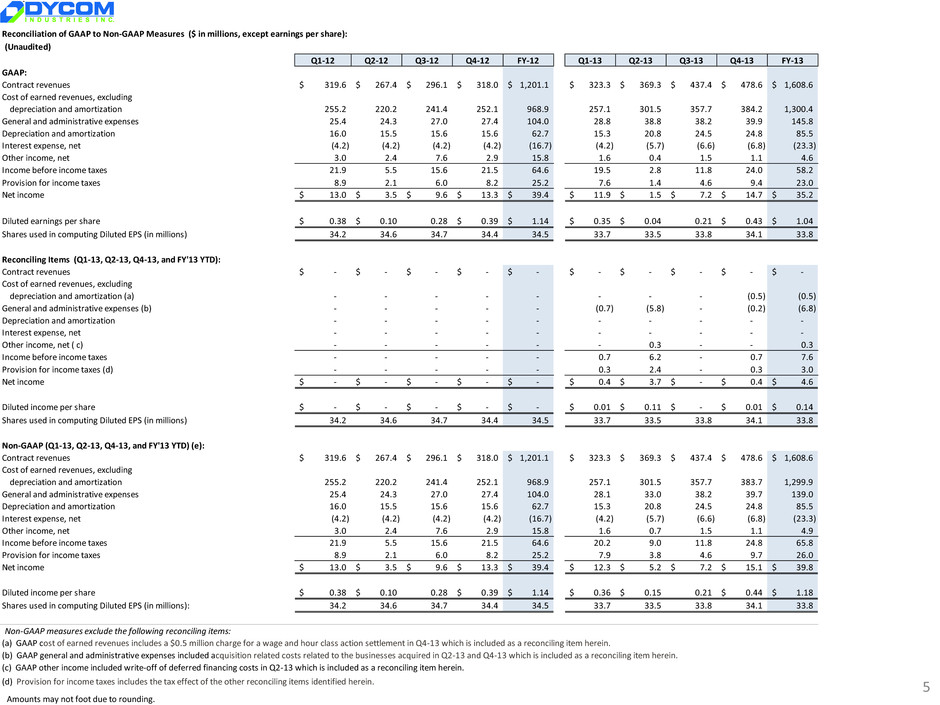

5 Reconciliation of GAAP to Non-GAAP Measures ($ in millions, except earnings per share): (Unaudited) Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 GAAP: Contract revenues 319.6$ 267.4$ 296.1$ 318.0$ 1,201.1$ 323.3$ 369.3$ 437.4$ 478.6$ 1,608.6$ Cost of earned revenues, excluding depreciation and amortization 255.2 220.2 241.4 252.1 968.9 257.1 301.5 357.7 384.2 1,300.4 General and administrative expenses 25.4 24.3 27.0 27.4 104.0 28.8 38.8 38.2 39.9 145.8 Depreciation and amortization 16.0 15.5 15.6 15.6 62.7 15.3 20.8 24.5 24.8 85.5 Interest expense, net (4.2) (4.2) (4.2) (4.2) (16.7) (4.2) (5.7) (6.6) (6.8) (23.3) Other income, net 3.0 2.4 7.6 2.9 15.8 1.6 0.4 1.5 1.1 4.6 Income before income taxes 21.9 5.5 15.6 21.5 64.6 19.5 2.8 11.8 24.0 58.2 Provision for income taxes 8.9 2.1 6.0 8.2 25.2 7.6 1.4 4.6 9.4 23.0 Net income 13.0$ 3.5$ 9.6$ 13.3$ 39.4$ 11.9$ 1.5$ 7.2$ 14.7$ 35.2$ Diluted earnings per share 0.38$ 0.10$ 0.28 0.39$ 1.14$ 0.35$ 0.04$ 0.21 0.43$ 1.04$ Shares used in computing Diluted EPS (in millions) 34.2 34.6 34.7 34.4 34.5 33.7 33.5 33.8 34.1 33.8 Reconciling Items (Q1-13, Q2-13, Q4-13, and FY'13 YTD): Contract revenues -$ -$ -$ -$ -$ -$ -$ -$ -$ -$ Cost of earned revenues, excluding depreciation and amortization (a) - - - - - - - - (0.5) (0.5) General and administrative expenses (b) - - - - - (0.7) (5.8) - (0.2) (6.8) Depreciation and amortization - - - - - - - - - - Interest expense, net - - - - - - - - - - Other income, net ( c) - - - - - - 0.3 - - 0.3 Income before income taxes - - - - - 0.7 6.2 - 0.7 7.6 Provision for income taxes (d) - - - - - 0.3 2.4 - 0.3 3.0 Net income -$ -$ -$ -$ -$ 0.4$ 3.7$ -$ 0.4$ 4.6$ Diluted income per share -$ -$ -$ -$ -$ 0.01$ 0.11$ -$ 0.01$ 0.14$ Shares used in computing Diluted EPS (in millions) 34.2 34.6 34.7 34.4 34.5 33.7 33.5 33.8 34.1 33.8 Non-GAAP (Q1-13, Q2-13, Q4-13, and FY'13 YTD) (e): Contract revenues 319.6$ 267.4$ 296.1$ 318.0$ 1,201.1$ 323.3$ 369.3$ 437.4$ 478.6$ 1,608.6$ Cost of earned revenues, excluding depreciation and amortization 255.2 220.2 241.4 252.1 968.9 257.1 301.5 357.7 383.7 1,299.9 General and administrative expenses 25.4 24.3 27.0 27.4 104.0 28.1 33.0 38.2 39.7 139.0 Depreciation and amortization 16.0 15.5 15.6 15.6 62.7 15.3 20.8 24.5 24.8 85.5 Interest expense, net (4.2) (4.2) (4.2) (4.2) (16.7) (4.2) (5.7) (6.6) (6.8) (23.3) Other income, net 3.0 2.4 7.6 2.9 15.8 1.6 0.7 1.5 1.1 4.9 Income before income taxes 21.9 5.5 15.6 21.5 64.6 20.2 9.0 11.8 24.8 65.8 Provision for income taxes 8.9 2.1 6.0 8.2 25.2 7.9 3.8 4.6 9.7 26.0 Net income 13.0$ 3.5$ 9.6$ 13.3$ 39.4$ 12.3$ 5.2$ 7.2$ 15.1$ 39.8$ Diluted income per share 0.38$ 0.10$ 0.28 0.39$ 1.14$ 0.36$ 0.15$ 0.21 0.44$ 1.18$ Shares used in computing Diluted EPS (in millions): 34.2 34.6 34.7 34.4 34.5 33.7 33.5 33.8 34.1 33.8 Non-GAAP measures exclude the following reconciling items: (a) GAAP cost of earned revenues includes a $0.5 million charge for a wage and hour class action settlement in Q4-13 which is included as a reconciling item herein. (b) GAAP general and administrative expenses included acquisition related costs related to the businesses acquired in Q2-13 and Q4-13 which is included as a reconciling item herein. (c) GAAP other income included write-off of deferred financing costs in Q2-13 which is included as a reconciling item herein. (d) Provision for income taxes includes the tax effect of the other reconciling items identified herein. Amounts may not foot due to rounding.

6 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) ($ in millions): Q1-12 Q2-12 Q3-12 Q4-12 FY-12 Q1-13 Q2-13 Q3-13 Q4-13 FY-13 Net income 13.0$ 3.5$ 9.6$ 13.3$ 39.4$ 11.9$ 1.5$ 7.2$ 14.7$ 35.2$ Interest expense, net 4.2 4.2 4.2 4.2 16.7 4.2 5.7 6.6 6.8 23.3 Provision for income taxes 8.9 2.1 6.0 8.2 25.2 7.6 1.4 4.6 9.4 23.0 Depreciation and amortization expense 16.0 15.5 15.6 15.6 62.7 15.3 20.8 24.5 24.8 85.5 Earnings Before Interest, Taxes, Depreciation & Amortization ("EBITDA") 42.0 25.3 35.4 41.3 144.0 39.0 29.4 43.0 55.6 167.0 Gain on sale of fixed assets (2.9) (2.2) (7.4) (2.9) (15.4) (1.6) (0.8) (1.5) (0.8) (4.7) Stock-based compensation expense 1.3 1.6 1.9 2.1 7.0 2.3 2.5 2.5 2.6 9.9 Charge for a wage and hour class action litigation settlement - - - - - - - - 0.5 0.5 Acquisition related costs - - - - - 0.7 5.8 - 0.2 6.8 Write-off of deferred financing costs - - - - - - 0.3 - - 0.3 Adjusted EBITDA (Non-GAAP) 40.4$ 24.7$ 29.9$ 40.5$ 135.5$ 40.4$ 37.2$ 44.0$ 58.1$ 179.8$ Note: Amounts may not foot due to rounding. The below table presents the Non-GAAP financial measure of Adjusted EBITDA for the indicated periods and a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure. Reconciliation of Net income to Adjusted EBITDA (Non-GAAP) The Company has defined Adjusted EBITDA (Non-GAAP) as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, acquisition related costs, write-off of deferred financing costs, charges for a wage and hour class action settlement, and stock-based compensation expense.

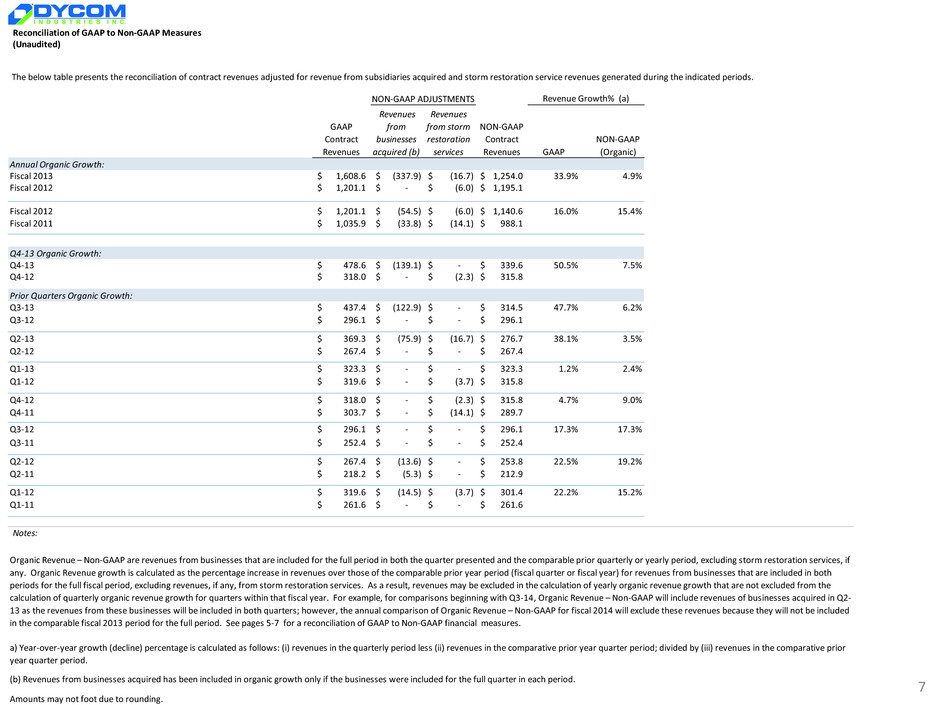

7 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) Revenues from businesses acquired (b) Revenues from storm restoration services GAAP NON-GAAP (Organic) Annual Organic Growth: Fiscal 2013 1,608.6$ (337.9)$ (16.7)$ 1,254.0$ 33.9% 4.9% Fiscal 2012 1,201.1$ -$ (6.0)$ 1,195.1$ Fiscal 2012 1,201.1$ (54.5)$ (6.0)$ 1,140.6$ 16.0% 15.4% Fiscal 2011 1,035.9$ (33.8)$ (14.1)$ 988.1$ Q4-13 Organic Growth: Q4-13 478.6$ (139.1)$ -$ 339.6$ 50.5% 7.5% Q4-12 318.0$ -$ (2.3)$ 315.8$ Prior Quarters Organic Growth: Q3-13 437.4$ (122.9)$ -$ 314.5$ 47.7% 6.2% Q3-12 296.1$ -$ -$ 296.1$ Q2-13 369.3$ (75.9)$ (16.7)$ 276.7$ 38.1% 3.5% Q2-12 267.4$ -$ -$ 267.4$ Q1-13 323.3$ -$ -$ 323.3$ 1.2% 2.4% Q1-12 319.6$ -$ (3.7)$ 315.8$ Q4-12 318.0$ -$ (2.3)$ 315.8$ 4.7% 9.0% Q4-11 303.7$ -$ (14.1)$ 289.7$ Q3-12 296.1$ -$ -$ 296.1$ 17.3% 17.3% Q3-11 252.4$ -$ -$ 252.4$ Q2-12 267.4$ (13.6)$ -$ 253.8$ 22.5% 19.2% Q2-11 218.2$ (5.3)$ -$ 212.9$ Q1-12 319.6$ (14.5)$ (3.7)$ 301.4$ 22.2% 15.2% Q1-11 261.6$ -$ -$ 261.6$ Notes: Amounts may not foot due to rounding. (b) Revenues from businesses acquired has been included in organic growth only if the businesses were included for the full quarter in each period. GAAP Contract Revenues NON-GAAP Contract Revenues NON-GAAP ADJUSTMENTS The below table presents the reconciliation of contract revenues adjusted for revenue from subsidiaries acquired and storm restoration service revenues generated during the indicated periods. Organic Revenue – Non-GAAP are revenues from businesses that are included for the full period in both the quarter presented and the comparable prior quarterly or yearly period, excluding storm restoration services, if any. Organic Revenue growth is calculated as the percentage increase in revenues over those of the comparable prior year period (fiscal quarter or fiscal year) for revenues from businesses that are included in both periods for the full fiscal period, excluding revenues, if any, from storm restoration services. As a result, revenues may be excluded in the calculation of yearly organic revenue growth that are not excluded from the calculation of quarterly organic revenue growth for quarters within that fiscal year. For example, for comparisons beginning with Q3-14, Organic Revenue – Non-GAAP will include revenues of businesses acquired in Q2- 13 as the revenues from these businesses will be included in both quarters; however, the annual comparison of Organic Revenue – Non-GAAP for fiscal 2014 will exclude these revenues because they will not be included in the comparable fiscal 2013 period for the full period. See pages 5-7 for a reconciliation of GAAP to Non-GAAP financial measures. a) Year-over-year growth (decline) percentage is calculated as follows: (i) revenues in the quarterly period less (ii) revenues in the comparative prior year quarter period; divided by (iii) revenues in the comparative prior year quarter period. Revenue Growth% (a)