Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CYS Investments, Inc. | d595550d8k.htm |

Investment

Outlook - September 2013

Kevin E. Grant, CFA

Chief Executive Officer

Exhibit 99.1

Barclays Global Financial Services Conference

September 10, 2013 |

Forward Looking

Statements 2

This presentation contains forward-looking statements, within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, that are based on management’s beliefs and assumptions, current expectations, estimates and

projections. Such statements, including information relating to the Company’s

expectations for future distributions and market conditions, are not considered

historical facts and are considered forward-looking information under the federal securities laws. This information may contain words such

as “believes,” “plans,” “expects,” “intends,”

“estimates” or similar expressions.

This information is not a guarantee of the Company’s future performance and is subject to

risks, uncertainties and other important factors that could cause the Company’s

actual performance or achievements to differ materially from those expressed or implied by this forward-looking information and

include, without limitation, changes in the Company’s distribution policy, changes in the

Company’s ability to pay distributions, changes in the market value and yield of

our assets, changes in interest rates and the yield curve, net interest margin, return on equity, availability and terms of financing and

hedging and various other risks and uncertainties related to our business and the economy,

some of which are described in our filings with the SEC. Given these

uncertainties, you should not rely on forward-looking information. The Company undertakes no obligations to update any forward-looking

information, whether as a result of new information, future events or

otherwise. |

CYS Overview

Focus on Cost

Efficiency

Target Assets

Agency Residential Mortgage Backed Securities

A Real Estate Investment Trust Formed in January 2006

Ample Financing

Sources

Financing lines with 37

lenders

Swap agreements with 18 counterparties

Dividend Policy

Self managed: highly scalable

Senior

Management

Kevin Grant, CEO, President, Chairman

Frances Spark, CFO

Company intends to distribute all or substantially all of its REIT

taxable income

3 |

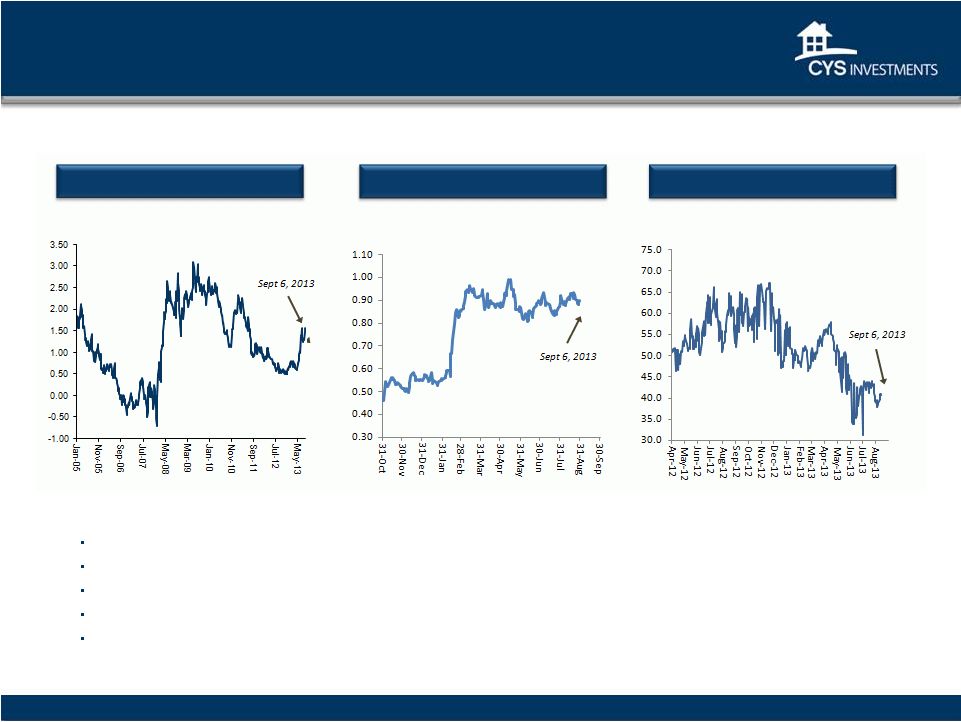

Investment

Environment: 15 Year -

Hedged vs. Unhedged

15 Year Hedged

(i)

15 Year Unhedged

(ii)

Borrow Short

Invest Long

Sept 6, 2013

15 Year Fixed Hedged with Swaps, April 2009 –

September 2013

0.00

1.00

2.00

3.00

4.00

5.00

Source: Bloomberg.

Note: Spreads calculated as: (i) 15 year CC Index = 50% 4 year

swap, and (ii) 15 year Current Coupon Index

4 |

Investment

Environment: 30 Year -

Hedged vs. Unhedged

30 Year Hedged

30 Year Unhedged

5

30 Year Fixed Hedged with Swaps, April 2009 –

September 2013

0.75

1.25

1.75

2.25

2.75

3.25

3.75

4.25

4.75

5.25

Borrow Short

Invest Long

Sept 6, 2013

Note: Spread calculated as: (i) 30 year CC Index - 90% 5 year swap Source: Bloomberg

|

Volatility in

the Cap/Floor Markets Hit a Low in Mid-March

30 Year MBS Cheapened Meaningfully Relative

to 15 Year MBS

Yield Curve

Creates positive carry

Very low cost of financing

Good ROE

Hedge flexibility very important

Fed still fighting deflation

30 Year MBS Priced for Operation Taper

Source: Bloomberg

6

April 2012 –

Sept 2013

January 2005 –

Sept 2013

5 Year Swap vs. 1 Month LIBOR

30 Yr MBS -

15 Yr MBS Spread

7 Yr Cap/Floor Implied Vol

October 2012 –

Sept 2013 |

7

Source: Board of Governors of the Federal Reserve

Actual Economic Performance:

Sluggish vs. Fed Projections |

8

Appropriate Timing

of Policy Firming

Ten Year Treasury

August 2011 –

September 2013,

and Implied Projection

•

Creates Significant Headwinds for the Economy

•

Housing Will Struggle

•

Corporate Interest Expense will rise

+25

-25

Appropriate Pace

of Policy Firming

Target Fed Funds Rate at Year End

Overview of FOMC Participants Assessments

of Appropriate Monetary Policy

Can the Economy Withstand

The Implied Path of 10 Year UST ?

•

Forward Rate Guidance is the Fed’s Most Impactful Tool

•

Appropriate Timing and Pace will drive the Yield Curve

%

Transition to a Normalized Yield Curve:

Will the Fed’s Forecast Pan Out?

Source: Federal Reserve June 2013 Forecast, Bloomberg, CYS

1

3

14

1

3.5

4.5

4

3

2.5

2

1.5

1

0.5

0 |

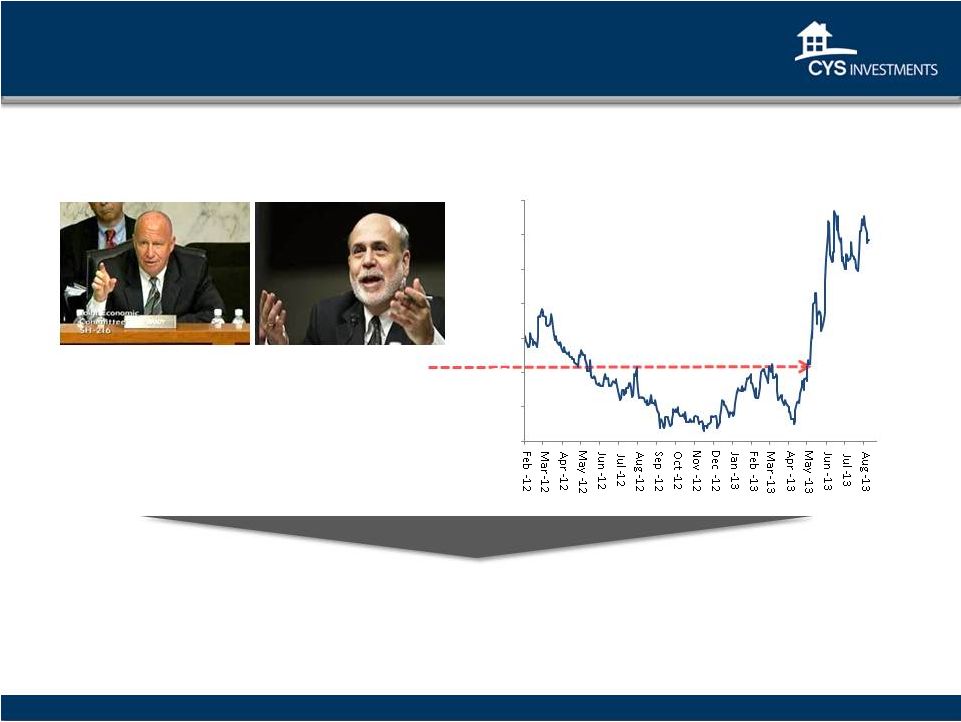

Operation Taper:

Confused Messaging or Intentional Market Test?

•

Refi Activity has Rapidly Dropped

-

Gain on sale windfall may be over

•

Purchase Activity slower to react

•

Origination Volume Will Decrease

Before the Joint Economic Committee, U.S. Congress

May 22, 2013

Primary Mortgage Rate

January 2012 -

Sept 2013

"If we see continued

improvement and we have

confidence that that's going to be

sustained then we could in the

next few meetings ... take a step

down in our pace of purchases."

•

Banks Will be Pushed to Government Bonds

-

Gov’t ROE’s now better than Credit ROE’s

•

Home Affordability Now Diminished

“What is the Fed’s exit strategy,

the steps you’ll undertake and

when do you anticipate

executing this? “

Source: Thomson Reuters, Bloomberg

JEC Chair Brady

Federal Reserve Chairman Bernanke

9

3.30

3.50

3.70

3.90

4.10

4.30

4.50

4.70 |

Fed Guidance

– Markets Expect a Change Soon

“…keep the target range for the federal funds

rate at 0 to 1/4 percent and anticipates that

exceptionally low levels for the federal funds

rate are likely to be warranted at least through

mid-2015.”

1

FOMC Meeting Minutes, September 2012 , Released October 4, 2012

“…

maintain its existing policy of reinvesting

principal payments from its holdings of agency

debt and agency mortgage-backed securities in

agency mortgage-backed securities..”

“…increase policy accommodation by

purchasing additional agency mortgage-

backed securities at a pace of $40 billion per

month.”

No Change

May Vary Pace Up/Down

No Change

10

Post Testimony

Testimony

Prior

to

May

22

1 |

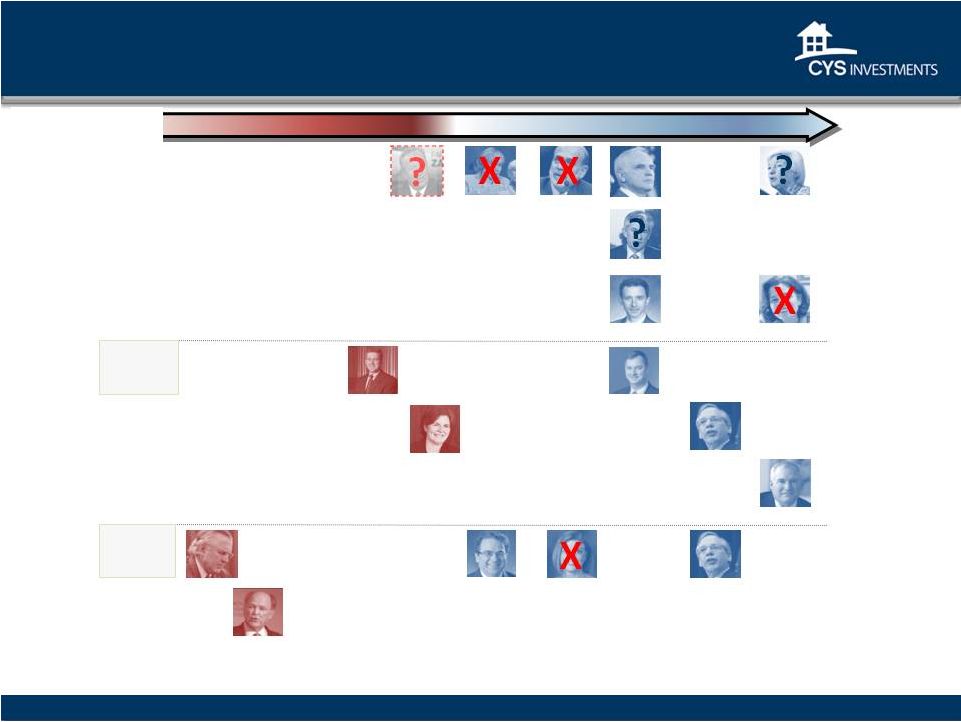

Fed Voters:

Imminent Turnover Creates Substantial Uncertainty

Duke

Yellen

Raskin

Powell

Stein

Pianalto

Evans

Bullard

George

Source: federalreserve.gov, Barclays, Macroeconomic Advisers, LLC, Bank of America

Merrill Lynch, Bloomberg, Wall Street Journal, Indiana University, Marketwatch, Thomson Reuters, Federal Reserve

Bank of Atlanta, Federal Reserve Bank of Chicago, Federal Reserve Bank of Cleveland, Maryland

Consumer Rights Coalition, Boston Globe, Businessweek, Newsweek, Washington Post, CNBC.

Fisher

Kocherlakota

Plosser

Hawkish

Dovish

Neutral

Bernanke

2013

Voters

2014

Voters

Summers

Tarullo

X = resigned, or term ending in 2014

? = role uncertain

11

Dudley

Rosengren

Dudley |

12

Yellen (Age 66)

Summers (Age 59)

Quantitative

Easing

Believes QE is effective, indeed powerful.

Source: Macroeconomic Advisers, Barclays

Balance Sheet

Expansion Policies

Must be considered in a cost-benefit framework.

Focused on financial stability risks, has concerns regarding

costs of further expanding the Fed’s balance sheet.

Must be considered in a cost-benefit framework.

Favors more aggressive asset purchase programs than Bernanke -

and than the FOMC -

undertook.

Forward

Guidance

Links financial stability risks to rates being very low for too

long

-

i.e.any

policy

that

keeps

rates

lower

for

longer.

Less

inclined to move to more-aggressive forward rate guidance.

Prefers more aggressive forward rate guidance than the FOMC.

Labor Force

Participation

Concerned about hysteresis, but believes that there is not

much evidence of an increase in structural unemployment.

Yellen likely more inclined to delay.

Concerned about hysteresis, but inclined to believe that

cyclical unemployment may have already become

structural unemployment.

If Summers believes that there could be less slack in the

economy (than Yellen), he may be more likely to raise rates

when the unemployment rate reaches 6½%.

Thesis Developing on a Larry Summers Fed:

Significant

Questions

about

FOMC

Approach

in

2014

-

2018

(-

2022?)

In the short term, Yellen and Summers are more alike than different, and both are constrained

by current FOMC and Chairman guidance - monetary policy will remain broadly

the same. Policy

differences will arise only if the economy evolves differently from FOMC expectations.

Skeptical, and more concerned about financial stability risks of a

very long period of low rates. More cautious about increasing

the pace of asset purchases, should the economy weaken. |

13

Summers’

Approval Process:

A

Prolonged,

Rocky

Path

Through

a

Liberal

Gauntlet

1

No Republican has expressed

support for any Obama nominee.

Many Republicans are critical of

Summers’

support

of

stimulus

spending programs and Dodd-Frank.

Democrats hold a two vote majority,

however, at least three democrats

are expected to oppose Summers.

Losing three Democrats will

preempt

Summers’

advancing

to

Senate confirmation vote without

Republican backing.

In July, over 1/3 of the Senate

Democratic caucus signed a letter

urging Obama to nominate Yellen.

Senate Banking Committee

N = 22

1

Wall Street Journal, Sept. 6, 2013

2

Huffington Post, Sept. 5, 2013

Committee Member

Status

Mike Crapo, ID (Rnkg Member)

No support expressed

Bob Corker TN

No support expressed

Tom Coburn, OK

No support expressed

Dean Heller, NV

No support expressed

Mike Johanns NE

No support expressed

Mark Kirk, IL

No support expressed

Jerry Moran, KS

No support expressed

Richard Shelby, AL

No support expressed

Patrick J. Toomey, PA

No support expressed

David Vitter, LA

No support expressed

Committee Member

Status

Tim Johnson, SD (Chairman)

Likely In Favor¹

Sherrod Brown OH

Likely Against¹

Kay Hagan, NC

Potentially Against²

Heidi Heitkamp, ND

Unknown

Joe Manchin III, WV

Unknown

Robert Menendez, NJ

Unknown

Jeff Merkley, KS

Likely Against¹

Jack Reed, RI

Unknown

Charles E. Schumer, NY

Unknown

Jon Tester, MT

Unknown

Mark R. Warner, IL

Unknown

Elizabeth Warren, MA

Likely Against¹

R: 10

D: 12 |

Central

Banks: Decidedly

More

Accommodative

-

Focus

on

Global

Deflation

Risk

14

Note: Raghuram Rajan succeeded Duvvuri Subbarao as the 23rd Governor of the Reserve Bank of

India on September 4, 2014. Draghi

EU

Hawkish

Dovish

Neutral

Draghi

EU

Bernanke

USA

Rajan

India

Kuroda

Japan

Canada

Poloz

Kuroda

Japan

Carney

UK

Xiaochuan

China

Xiaochuan

China

Australia

Stevens

Australia

Stevens

New Zealand

Wheeler

New Zealand

Wheeler

Tombini

Brazil

Tombini

Brazil |

Update: GSE

Reform •

Wind Down FNMA & FreddieMac over 5 Years

•

Existing Securities Become Explicit Full Faith &

Credit of US Treasury (like GNMAs)

U.S. Senators Bob Corker, R-Tenn., Mark Warner, D-Va., Mike Johanns, R-Neb., Jon

Tester, D-Mont., Dean Heller, R-Nev., Heidi Heitkamp, D-N.D., Jerry Moran, R-Kan., and

Kay Hagan, D-N.C., all members of the Senate Banking, Housing and Urban Affairs

Committee •

Creates Federal Mortgage Insurance Corp. (FMIC)

•

Credit Support comes in the form of Insurance

•

Managed by a Government Technocrat

•

No Portfolio Business

•

Obama supports principal ideas in this bill.

•

Bipartisan support on the Senate Banking

Committee

FNMAs and Freddie Macs converge on GNMA Prices

Committee Hearings and markup this Fall,

potential for 2014 adoption

•

Simpler, fungible securities

•

TBA market intact

•

New “Insurance Tranches”

traded by Institutional Investors

Impact

Corker Warner Provisions

15 |

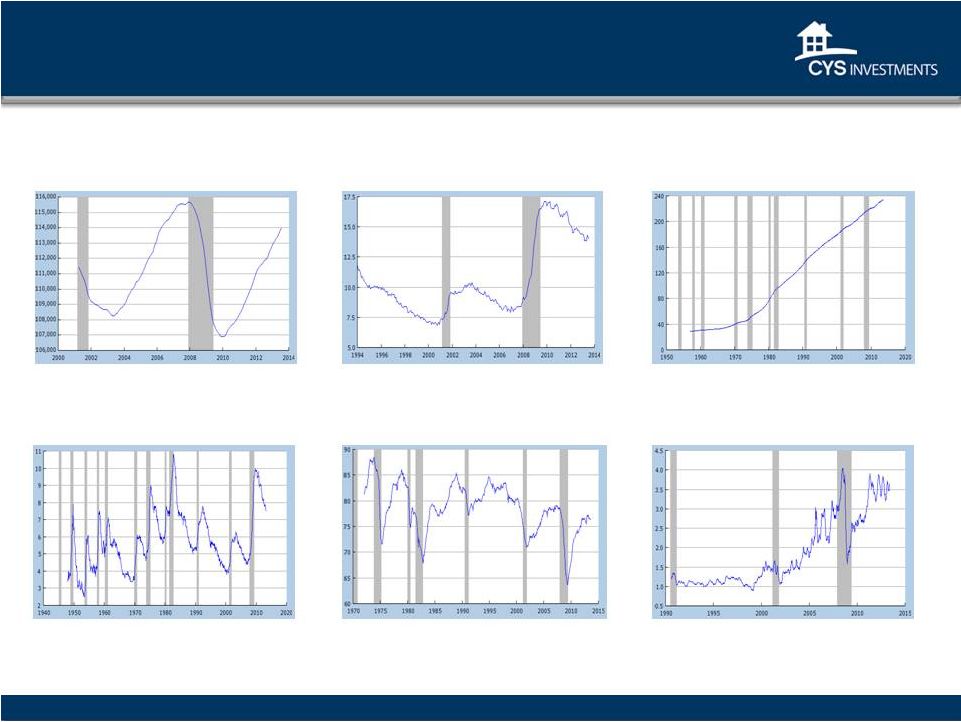

Economic

Recovery Below Normal Pace U.S. Regular Conventional Gas Price

$ per gal

Updated 9/3/2013

Capacity Utilization: Manufacturing

%

Updated 8/15/2013

Civilian Unemployment Rate

%

Updated 9/6/2013

CPI-U All Items, Core

% Change

-

Year

to

Year

Updated 8/15/2013

Total Nonfarm Private Payroll Employment

Updated 9/5/2013

Total Unemployed + All Marginally Attached + Total

Employed Part Time for Economic Reasons (U6)

Updated 9/6/13

Source: S&P, Federal Reserve Bank of St. Louis, Fiserv, and Macromarkets LLC / Haver

Analytics, BLS, Challenger, Gray & Christmas, US Dept. of Energy, NYMEX

16 |

Mortgage Market

Shrinkage Likely to Continue 17

Residential Mortgage Debt Decline Driven By:

1.

2.

3.

4.

5.

6.

7.

8.

Mortgage Debt

Outstanding

2007 -2013

Source: FRB, Freddie Mac

Single Family

Mortgage Origination Volume

1992 –

2013E

1992

1997

2002

2007

2012

2.0T

1.9T

Refinance Originations

Home Purchase Originations

1,000

0

2,000

3,000

4,000

Mortgage Debt Outstanding

Growth Rate

0.00%

0.50%

1.00%

9.75

10.00

10.25

10.50

10.75

11.00

11.25

11.50

1.50%

2.00%

3.50%

4.00%

4.50%

0.50%

2.00%

1.50%

1.00%

9.50

8.75

9.00

9.25

Home prices now reset lower

Delevering Consumers/Homeowners

Psychology of lower leverage

Low volume of new and existing home sales

All-cash home purchase transactions, and higher downpayments

Scheduled principal payments

High percentage of cash-in refi’s versus cash-out refi’s.

QM Rules Restrictive |

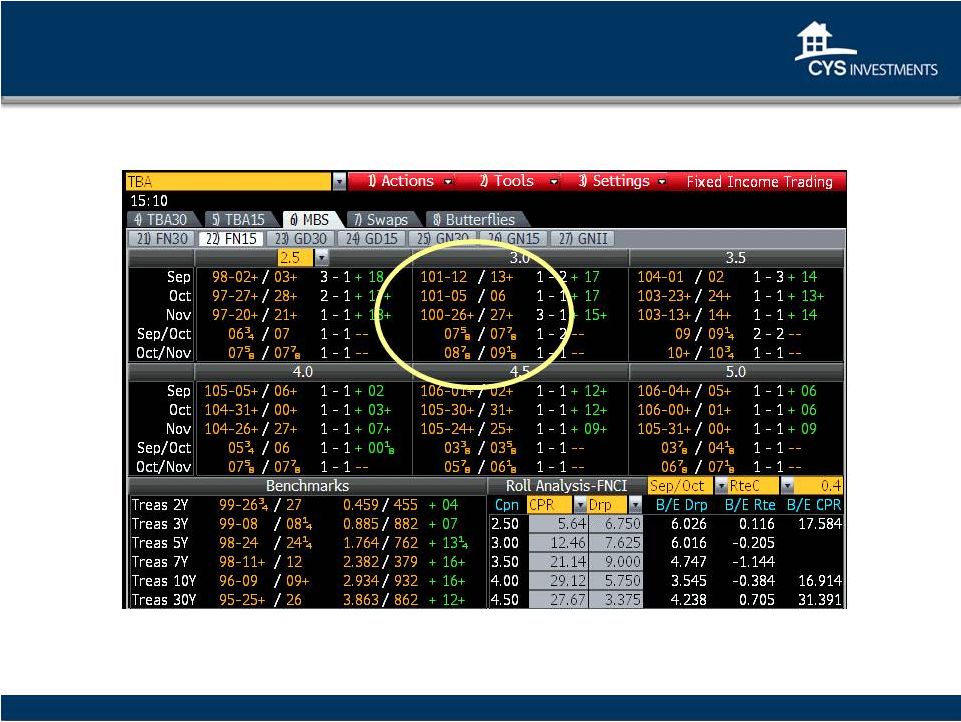

Economics of

Forward Purchase Source: Bloomberg, 9/6/13

18 |

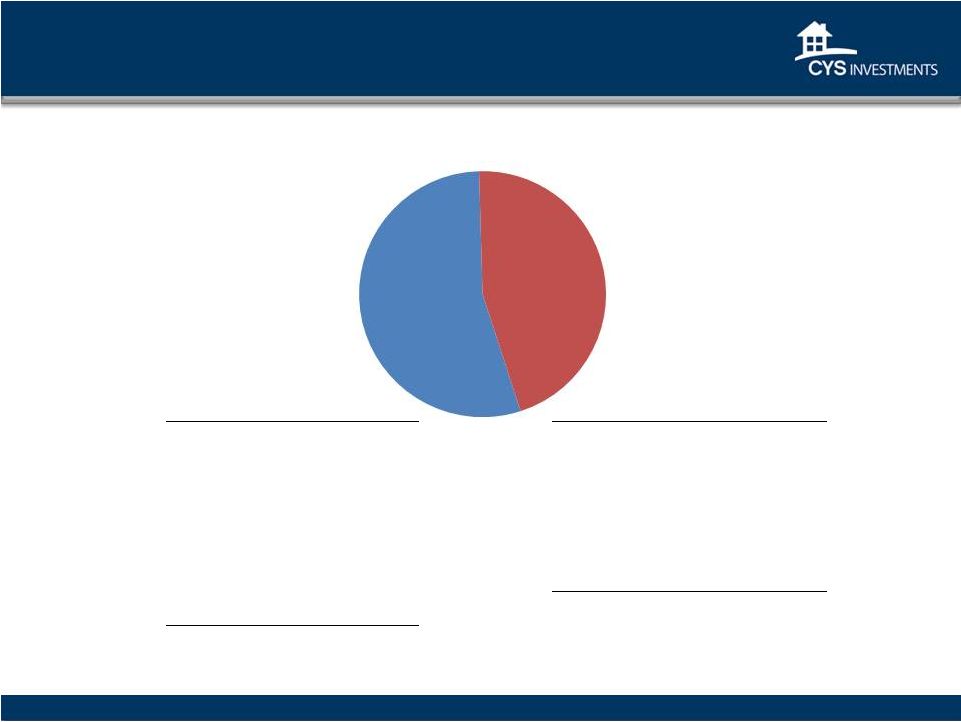

19

Portfolio Composition and Dividends

1

As of 6/30/13

Total Agency RMBS: $17,211 million

CYS Common Stock Dividends

September

2009

–

June

2013

CYS Agency RMBS Portfolio

Hybrid ARMs:

15%

15 Year Fixed:

34%

30 Year Fixed:

45%

20 Year

Fixed:

6%

1

Note: the December 2012 dividend was composed of $0.40 quarterly cash dividend, and $0.52

special cash dividend.

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

$1.00 |

20

Portfolio Characteristics

CYS Agency RMBS Portfolio Characteristics*

* As of 6/30/13

Par Value

Fair Value

Weighted Average

Asset Type

(in thousands)

Cost/Par

Fair

Value/Par

MTR

(1)

Coupon

CPR

(2)

15 Year Fixed Rate

$5,582,309

$5,773,741

$104.51

$103.43

N/A

3.17%

15.2%

20 Year Fixed Rate

1,028,057

1,044,339

104.91

101.58

N/A

3.15%

7.6%

30 Year Fixed Rate

7,683,260

7,837,908

104.30

102.01

N/A

3.59%

7.8%

Hybrid ARMs

2,511,218

2,555,271

103.74

101.75

74.8

2.59%

17.4%

Total/Weighted

Average

$16,804,844

$17,211,259

$104.32

$ 102.42

3.27%

13.5%

(2) CPR, or “Constant Prepayment Rate,” is a method of expressing the prepayment

rate for a mortgage pool that assumes that a constant fraction of the remaining principal is prepaid each month or

year. Specifically, the constant prepayment rate is an annualized version of the prior three

month prepayment rate. Securities with no prepayment history are excluded from this calculation.

(1) MTR, or “Months to Reset” is the number of months remaining before the fixed

rate on a hybrid ARM becomes a variable rate. At the end of the fixed period, the variable rate will be determined

by the margin and the pre-specified caps of the ARM. After the fixed period, 100% of the

hybrid ARMS in the portfolio reset annually. |

21

(1)

Drop income is a component of our net income accounted for as net gain from investments on

our statement of operations and therefore excluded from our Core Earnings. (2)

Core earnings is defined as net income (loss) available to common shares excluding net gain

(loss) on investments, net realized gain (loss) on termination of swap and cap contracts

and unrealized appreciation (depreciation) on swap and cap contracts.

Financial Information

Three Months Ended

Income Statement Data

(in

000's)

6/30/2013

3/31/2013

Total investment income

$ 81,551

$ 73,101

Interest expense

14,047

15,031

Operating expenses

5,671

5,553

Total expenses

19,718

20,584

Net investment income

61,833

52,517

Net gain (loss) from investments

(656,295)

(78,811)

Net gain (loss) from swap and cap contracts

196,176

10,091

Net income

(loss)

(398,286)

(16,203)

Dividend on preferred shares

(3,995)

(1,453)

Net income (loss) available to common shares

($402,281)

($17,656)

Net income (loss) per common share (diluted)

($2.32)

($0.10)

Drop income per common share (diluted)

$0.19

$0.15

Core Earnings per common share (diluted)

$0.18

$0.17

Distributions per common share

$0.34

$0.32

Non-GAAP Measure/Reconciliation

(in

000's)

NET INCOME (LOSS) AVAILABLE TO COMMON SHARES

(402,281)

(17,656)

Net (gain) loss from investments

656,295

78,811

Net (gain) loss from termination of swap and cap contracts

(7,329)

(8,630)

Net unrealized (appreciation) depreciation on swap and cap contracts

(215,546)

(23,417)

Core Earnings

$31,139

$29,108

(2)

(1) |

22

(1)

The average settled Agency RMBS is calculated by averaging the month end cost basis of settled

Agency RMBS during the period. (2)

The average total Agency RMBS is calculated by averaging the month end cost basis of Agency

RMBS during the period. (3)

The average repurchase agreements are calculated by averaging the month end repurchase

agreements balance during the period. (4)

The average Agency RMBS liabilities are calculated by averaging the month end repurchase

agreements balance plus average unsettled Agency RMBS during the period. (5)

The

average

net

assets

are

calculated

by

averagingthe

month

end

net

assets during the period.

(6)

The average common shares outstanding are calculated by averaging the daily common shares

outstanding during the period. (7)

The

leverageratio

is

calculated

by

dividing

(i)

the

Company's

repurchase

agreements

balance

plus

payable

for

securities

purchased

minus

receivable

for

securities

sold

by

(ii)

net

asset.

(8)

The average yield on settled Agency RMBS for the period is calculated by dividing interest

income from Agency RMBS by average settled Agency RMBS. (9)

The average yield on total Agency RMBS including drop income for

the period is calculated by dividing interest income from Agency RMBS

plus

drop

income

by

average

totalAgency

RMBS.

(10)

The

average

cost

of

funds

and

hedge

for

the

period

is

calculated

by

dividing

total

interest

expense,

including

net

swap

and

cap

interest

income

(expense),

by

average

repurchase

agreements.

(11)

The

adjusted

average

cost

of

funds

and

hedge

for

the

period

is

calculated

by

dividingtotal

interest

expense,

including

net

swap

and

cap

interestincome

(expense),

by

average

Agency

RMBS

liabilities.

(12)

The interest rate spread net of hedge for the period is calculated by subtracting average cost

of funds and hedge from average yield on Agency RMBS. (13)

The

interest

rate

spread

net

of

hedge

including

drop

income

for

the

period

is

calculated

by

subtracting

adjusted

average

cost

of

funds

and

hedge

from

average

total

yield

on

Agency

RMBS

including

drop

income

assets.

(14)

The operating expense ratio for the period is calculated by dividing operating expenses by

average net assets. *All percentages are annualized.

Three Months Ended

Key Balance Sheet Metrics

June 30, 2013

March 31, 2013

Average settled Agency RMBS

(1)

$15,974,500

$16,066,672

Average total Agency RMBS

(2)

$19,944,791

$20,200,479

Average repurchase agreements

(3)

$13,871,404

$14,107,740

Average Agency RMBS liabilities

(4)

$17,841,695

$18,241,547

Average net assets

(5)

$2,321,128

$2,357,333

Average common shares outstanding

(6)

174,145

174,864

Leverage ratio (at period end)

(7)

7.5:1

7.8:1

Key Performance Metrics*

Average yield on settled Agency RMBS

(8)

2.03%

1.80%

Average yield on total Agency RMBS including drop income

(9)

2.27%

1.97%

Average cost of funds and hedge

(10)

1.17%

1.05%

Adjusted average cost of funds and hedge

(11)

0.91%

0.81%

Interest rate spread net of hedge

(12)

0.86%

0.75%

Interest rate spread net of hedge including drop income

(13)

1.36%

1.16%

Operating expense ratio

(14)

0.98%

0.94%

Financial Information |

History of

Transparent and Consistent Financial Reporting CYS uses Financial Reporting for

Investment Companies CYS Financial Reporting

–

Transparent and Best in Class

Schedule of investments

NAVs have reflected mark-to-market accounting since inception

Realized and unrealized losses taken through income statement

in period incurred

No OCI account on balance sheet

23 |

Barclays

Global Financial Services Conference September 10, 2013

Investment Outlook -

September 2013

Kevin E. Grant, CFA

Chief Executive Officer |