Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Altimmune, Inc. | v354612_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Altimmune, Inc. | v354612_ex99-1.htm |

Creating a Diversified Biologics Company Addressing Government and Commercial Markets

2 Safe Harbor Statement Except for the historical information presented herein, matters discussed may constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements . Statements that are not historical facts, including statements preceded by, followed by, or that include the words “will” ; "potential" ; "believe" ; "anticipate" ; "intend" ; "plan" ; "expect" ; "estimate" ; "could" ; "may" ; "should" ; or similar statements are forward - looking statements . Such statements include, but are not limited to those referring to the potential for the generation of value, ability to leverage funding sources, potential for revenue, and potential for growth . PharmAthene disclaims any intent or obligation to update these forward - looking statements . Risks and uncertainties include, among others, failure to obtain necessary shareholder approval for the proposed merger with Theraclone and the matters related thereto ; failure of either party to meet the conditions to closing of the transaction ; delays in completing the transaction and the risk that the transaction may not be completed at all ; failure to realize the anticipated benefits from the transaction or delay in realization thereof ; the businesses of PharmAthene and Theraclone may not be combined successfully, or such combination may take longer, be more difficult, time - consuming or costly to accomplish than expected ; operating costs and business disruption during the pendency of and following the transaction, including adverse effects on employee retention and on business relationships with third parties ; the combined company’s need for and ability to obtain additional financing ; risk associated with the reliability of the results of the studies relating to human safety and possible adverse effects resulting from the administration of the combined company's product candidates ; unexpected funding delays and/or reductions or elimination of U . S . government funding for one or more of the combined company's development programs ; the award of government contracts to competitors ; unforeseen safety issues ; unexpected determinations that these product candidates prove not to be effective and/or capable of being marketed as products ; as well as risks detailed from time to time in PharmAthene's Form 10 - K and quarterly reports on Form 10 - Q under the caption "Risk Factors" and in its other reports filed with the U . S . Securities and Exchange Commission (the "SEC") . In particular, there is significant uncertainty regarding the level and timing of sales of Arestvyr™ and when and whether it will be approved by the U . S . FDA and corresponding health agencies around the world . PharmAthene cannot predict with certainty if or when SIGA will begin recognizing profit on the sale thereof and there can be no assurance that any profits received by SIGA will be significant . In its May 2013 decision, the Delaware Supreme Court reversed the remedy ordered by the Court of Chancery and remanded the issue of a remedy back to the trial court for reconsideration in light of the Supreme Court’s opinion . As a result, there can be no assurance that the Chancery Court will issue a remedy that provides PharmAthene with a financial interest in Arestvyr™ and related products or any remedy . In addition, significant additional research work, non - clinical animal studies, clinical trials, and manufacturing development work remain to be done with respect to all of our product candidates . At this point there can be no assurance that any of these product candidates will be shown to be safe and effective and approved by regulatory authorities for use in humans . Copies of PharmAthene's public disclosure filings are available from its investor relations department and its website under the investor relations tab at http : //www . pharmathene . com .

3 Important Additional Information About the Merger This communication is being made in respect of the proposed merger involving Theraclone Sciences, Inc. (“Theraclone”) and PharmAthene. On August 1, 2013, PharmAthene filed with the SEC a current report on Form 8 - K, which includes the merger agreement and related documents. PharmAthene filed a registration statement on Form S - 4 with the SEC, which contains a preliminary proxy statement / prospectus / consent solicitation and other relevant materials, and plans to file with the SEC other documents regarding the proposed transaction. The final proxy statement/prospectus /consent solicitation will be sent to the stockholders of PharmAthene and Theraclone in connection with the stockholder votes on matters relating to the proposed transaction. The proxy statement/prospectus/consent solicitation contains information about PharmAthene, Theraclone, the proposed transaction, and related matters. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS/CONSENT SOLICITATION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY AS THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN OR WILL CONTAIN, AS THE CASE MAY BE, IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING A DECISION ABOUT THE MERGER AND RELATED MATTERS. In addition to receiving the proxy statement/prospectus/consent solicitation and proxy card by mail, stockholders will also be able to obtain the proxy statement/prospectus/consent solicitation, as well as other filings containing information about PharmAthene, without charge, from the SEC’s website ( http://www.sec.gov ) or, without charge, by contacting Stacey Jurchison at PharmAthene at (410) 269 - 2610.

4 No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction in connection with the merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in Solicitation PharmAthene and its executive officers and directors may be deemed to be participants in the solicitation of proxies from PharmAthene’s stockholders with respect to the matters relating to the proposed merger. Theraclone may also be deemed a participant in such solicitation. Information regarding PharmAthene’s executive officers and directors is available in Amendment No. 1 to PharmAthene’s proxy statement on Schedule 14A, filed with the SEC on May 9, 2013. Information regarding such executive officers and directors and regarding any interest that PharmAthene, Theraclone or any of the executive officers or directors of PharmAthene or Theraclone may have in the transaction will be set forth in the final proxy statement / prospectus / consent solicitation that PharmAthene will file in connection with the stockholder votes on matters relating to the proposed transaction. Stockholders will be able to obtain this information by reading the final proxy statement/prospectus/consent solicitation when it becomes available. Additional Important Information About the Merger

5 PharmAthene / Theraclone PharmAthene, Inc., (NYSE MKT: PIP) a leading biodefense company, and Theraclone Sciences, Inc., a monoclonal antibody discovery and development company, announced an intention to merge to form a commercially - focused biologics company with extensive vaccines and therapeutics expertise

6 Combined Company – Investment Opportunity Compelling transaction with complementary capabilities to realize synergies and accelerate value Premier biologics company with vaccine and antibody expertise and a focus on infectious diseases and oncology Four clinical programs and multiple partnered preclinical programs addressing high - value markets Robust discovery engine with validated mAb platform technology providing significant collaboration opportunities Significant revenue potential from SIGA smallpox antiviral, Arestvyr™

7 Biologics Company with Significant Growth Potential Non - dilutive funding to drive near - term growth Product development milestones and deals to drive long - term growth DEVELOP SIGNIFICANT COMMERCIAL PRODUCTS DEVELOP GOVERNMENT MARKETS LEVERAGE PROPRIETARY I - STAR™ PLATFORM • Flu Antibody (TCN - 032) • CMV Antibody (TCN - 202) • Pre - clinical pipeline • Pfizer partnered programs • Non - dilutive R&D partnerships • New drug candidates for commercial and government pipeline • Non - dilutive grants and contracts • SparVax® - Anthrax Vaccine • Valortim® - Anthrax Anti - toxin • Flu Antibody (TCN - 032) +

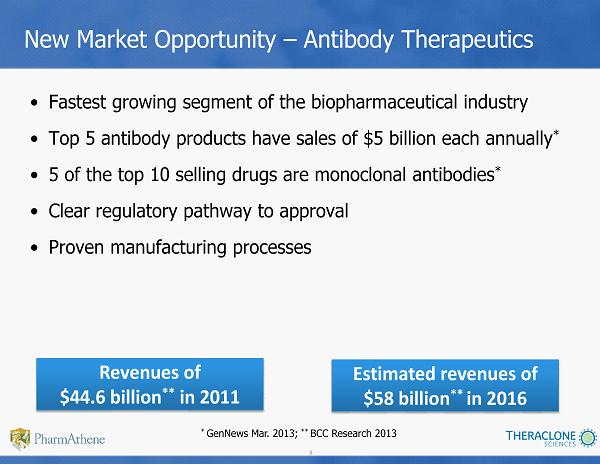

8 New Market Opportunity – Antibody Therapeutics • Fastest growing segment of the biopharmaceutical industry • Top 5 antibody products have sales of $5 billion each annually * • 5 of the top 10 selling drugs are monoclonal antibodies * • Clear regulatory pathway to approval • Proven manufacturing processes Estimated revenues of $58 billion ** in 2016 Revenues of $44.6 billion ** in 2011 * GenNews Mar. 2013; ** BCC Research 2013

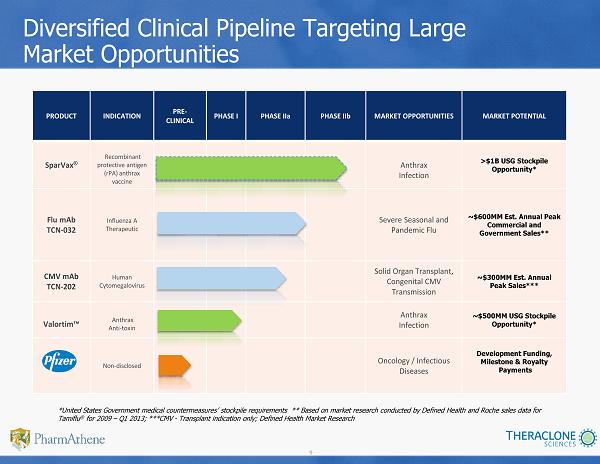

9 PRODUCT INDICATION PRE - CLINICAL PHASE I PHASE IIa PHASE IIb MARKET OPPORTUNITIES MARKET POTENTIAL SparVax ® Recombinant protective antigen (rPA) anthrax vaccine Anthrax Infection >$1B USG Stockpile Opportunity* Flu mAb TCN - 032 Influenza A Therapeutic Severe Seasonal and Pandemic Flu ~$ 600MM Est. Annual Peak Commercial and Government Sales** CMV mAb TCN - 202 Human Cytomegalovirus Solid Organ Transplant, Congenital CMV Transmission ~$300MM Est. Annual Peak Sales*** Valortim™ Anthrax Anti - toxin Anthrax Infection ~$500MM USG Stockpile Opportunity* Non - disclosed Oncology / Infectious Diseases Development Funding, Milestone & Royalty Payments Diversified Clinical Pipeline Targeting Large Market Opportunities *United States Government medical countermeasures’ stockpile requirements ** Based on market research conducted by Defined H eal th and Roche sales data for Tamiflu ® for 2009 – Q1 2013; ***CMV - Transplant indication only; Defined Health Market Research

10 I - STAR TM Validating Partnerships January 2011 I - STAR™ collaboration to discover antibodies against up to four undisclosed targets in the areas of infectious disease and cancer. Pfizer has Worldwide licensing rights. February 2008 IAVI collaboration to discover HIV - neutralizing antibodies March 2010 I - STAR collaboration to discover and develop broadly protective antibodies for the treatment of pandemic influenza and severe seasonal influenza. ZK has licensing rights in Japan ‘AIDS Researchers Isolate New Potent and Broadly Effective Antibodies Against HIV’

11 Flu Antibody: TCN - 032 • IgG mAb that binds to a novel, highly - conserved universal epitope – Influenza A (H1N1; H5N1; H7N9) • Annually, 200,000 U.S. patients are hospitalized; 36,000 die from serious influenza infections* • Government stockpile market offers significant upside potential • Phase 1 completed; favorable safety and pharmacokinetic profile • Phase 2a viral challenge study completed; data presented at ISIRV conference TCN - 032 Human Monoclonal Antibody Product Profile ~$600MM Estimated Annual Peak Commercial and Government Sales** * 2003 study by Centers for Disease Control published in the Journal of the American Medical Association ** Based on market research conducted by Defined Health and Roche sales data for Tamiflu® from 2009 – Q1 2013

12 TCN - 032: Phase 2a Human Viral Challenge Study • Demonstrated reductions in total clinical symptom scores and viral load • S afe and well - tolerated with no increase in adverse events compared to placebo , including lower respiratory tract symptoms • P harmacokinetics consistent with Phase 1 study – H alf - life ~16 days; no evidence of immunogenicity • Next steps: Clinical studies in natural infection including the target population of patients hospitalized with serious influenza infection Results are the first demonstration that a non - neutralizing antibody given parenterally may provide immediate immunity and therapeutic benefit in influenza A infection in humans with no apparent emergence of resistant virus

13 Cytomegalovirus (CMV) Antibody: TCN - 202 • Recognizes broadly conserved epitope on CMV • Neutralizes CMV viral infection in many cell types – Epithelia, endothelial, fibroblasts, etc. • ~1,000x more potent than plasma - derived CMV - IGIV (preclinical studies)* • Phase 1 completed; favorable safety, immunogenicity with PK properties consistent with human mAbs • Phase 2a commenced in solid organ (kidney) transplant patients TCN - 202 Human Monoclonal Antibody Product Profile Management of CMV disease is a significant unmet medical need *Theraclone study conducted by Dr. Wolf of Hadassah Univ. Hospital in Jerusalem

14 TCN - 202: Phase 1 Clinical Study • Well - tolerated in single doses of 1 - 50 mg/kg and multiple doses at 15 mg/kg x2 • AEs were mild to moderate – Most were unrelated to study drug • Pharmacokinetics – Dose proportional (Cmax and AUC) – Half - life ~14 days – Volume of distribution and clearance - consistent with IgG • Immunogenicity – None detected

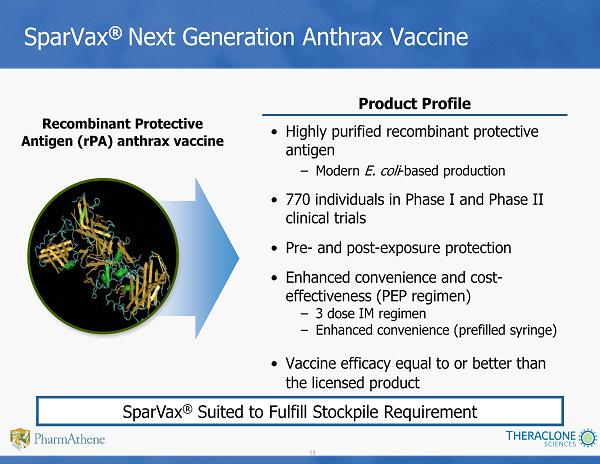

15 SparVax ® Next Generation Anthrax Vaccine • Highly purified recombinant p rotective antigen – Modern E. coli - based production • 770 individuals in Phase I and Phase II clinical trials • Pre - and post - exposure protection • Enhanced convenience and cost - effectiveness (PEP regimen) – 3 dose IM regimen – Enhanced convenience (prefilled syringe) • Vaccine efficacy equal to or better than the licensed product Recombinant Protective Antigen (rPA) anthrax vaccine Product Profile SparVax ® Suited to Fulfill Stockpile Requirement

16 Valortim ® Anthrax Anti - Toxin • Dept. of Homeland Security Material Threat Assessment: 200,000 treatments • HHS procurement program to fulfill requirement Fully human monoclonal antibody (mAb) • Novel mechanism of action similar to natural immune response • Effective Pre - and Post - exposure • Demonstrated significant protection after single dose in primates • Ability to neutralize free and cell - bound anthrax toxin • Potential sporicidal activity * * Cross, et. Al, 2009; University of Maryland, Poster: Keystone Symposia on Molecular and Cellular Biology Gov’t Requirement for Anthrax Anti - Toxin Product Profile

17 Nerve Agent Bioscavenger rBChE Nerve Agent Bioscavenger to Address Chemical Threats • Prevents physiological damage from chemical nerve agents • Robust advanced expression system (AES) technology platform • $5.7MM in DoD funding • Cell culture - based manufacturing • Scalable manufacturing process • Streamlined development and production with clear regulatory path Fully human recombinant bioscavenger Key Advantages

18 I - STAR ™ Generating Highly - Specific Human Antibodies for Significant Unmet Medical Needs Selected donor population convalescent/vaccinated subjects = protective Abs Superior B - cell activation Deep sequencing of all hit wells Rapid screen for binding and function IgG+ Memory B - cells “Archive of immunological history” >10,000 human mAb clones ID clones that neutralize/ bind target Obtain sequences for all mAbs Generate recombinant cell line Therapeutic bNAbs

19 Significant Near - Term Revenue Opportunity Arestvyr™ (SIGA Technologies) Oral Smallpox Antiviral Up to ~$2.8B* NOTE: The above is based solely on information from the following public sources: SIGA press releases and other public statem ent s, research analyst reports, SEC filings • $2.8B* U.S. market opportunity plus potential for international contracts • Product delivery to USG commenced (as of July 2013): • 590,000 treatment courses accepted by the United States government • SIGA has received and/or billed the United States Government over $140MM ** for the supply of Arestvyr™ • SIGA anticipates completing product delivery by the end of 2014 * Based on statements in “justification for other than full and open competition” notification initially issued by BARDA in Dec ember 2010 and supplemented in May 2011, and purchase of additional 12 million courses of therapy; ** Represents all milestone and procurement payments made to date

20 Significant Revenue Opportunity Arestvyr™ (SIGA Technologies) Oral Smallpox Antiviral • Breach of contract lawsuit filed by PharmAthene in December 2006 • Trial court awarded PharmAthene 50% of net profits on WW sales of Arestvyr™ for 10 years once SIGA retains the first $40MM in profit • Decision appealed in June 2011; Supreme Court upheld breach of contract ruling; remanded to Delaware Chancery Court for reconsideration of damages award and attorneys’ fees • U.S. market opportunity of $2.8B* plus potential upside for international contracts and U.S. government replenishment orders * Based on statements in “justification for other than full and open competition” notification initially issued by BARDA in Dec ember 2010 and supplemented in May 2011, and purchase of additional 12 million courses of therapy

21 Combined Company Executive Team Clifford J. Stocks Chief Executive Officer Calistoga Pharmaceuticals, Inc., ICOS Corporation Francesca Cook SVP, Policy and Government Affairs Guilford Pharmaceuticals Covance Health Econ., U.S. HHS Russ Hawkinson Chief Financial Officer Corixa Corporation Ernst & Young Jordan Karp SVP, General Counsel Constellation Energy MCI Comm., Guilford Pharmaceuticals Wayne Morges, Ph.D. SVP, Regulatory Affairs and Quality Baxter Vaccines Acambis, Merck Eleanor L. Ramos, M.D. Chief Medical Officer Zymogenetics Roche, Bristol - Myers Squibb Kristine Swiderek, Ph.D. Chief Scientific Officer Zymogenetics City of Hope

22 Combined Company Board of Directors Mitch Sayare, Ph.D. Chairman ImmunoGen XenoGen John M. Gill Tetralogic Pharmaceuticals 3D Pharma, SKB Steve Gillis, Ph.D. Immunex, Corixa, ARCH Venture Partners Wende Hutton Canaan Partners Mayfield Fund, GenPharma International Brian Markison King Pharmaceuticals Fougera (sold to Sandoz) Eric I. Richman PharmAthene, MedImmune HealthCare Ventures Derace Schaffer, M.D. The LAN Group Clifford J. Stocks Chief Executive Officer Calistoga Pharmaceuticals, Inc. ICOS Corporation Director To Be Named

23 Near - Term Valuation Catalysts Initiate CMV antibody Phase 2a study Q3 13 Present Flu Antibody Phase 2a results Q3 13 Present CMV Antibody Phase 1 results Q3 13 Secure additional USG SparVax ® funding Q4 13 Initiate SparVax ® Phase 2 clinical trial Q4 13 Event* Date *The Milestones listed above are targets established by PharmAthene and Theraclone. The achievement of these milestones are sub ject to specific events, many of which are not within the control of PharmAthene and Theraclone There can be no assurance that the events will occur withi n t he time frames indicated.

24 Key Terms of the Transaction Proposed Transaction: Tax - free, all stock transaction Pro Forma Ownership: Merger of Equals Next Steps: Proxy Statement / Prospectus / Consent Solicitation Stockholder meeting and vote Name: PharmAthene Public Market: NYSE MKT; symbol “PIP”

25 TCN - 032: Flu Antibody Phase 2a Viral Challenge Study

26 Viral Challenge Protocol: Study Design • Double - blind, placebo - controlled, randomized study • Population – Normal healthy subjects; males or females, age 18 - 45 years – Seronegative (HAI titer ≤ 10) to H3N2 challenge strain (A/Wisconsin/67/05) • Treatment: TCN - 032 40 mg/kg or placebo, given 24 hours after viral inoculation • Endpoints – Efficacy ▪ Clinical symptoms (Day 1 - 7) o Grade 2 or greater symptoms, or pyrexia (T>37.9 ° C) [main parameter for sample size estimation] o Total scores; URI/LRI/systemic scores; time to peak/resolution/duration of symptoms; nasal mucus weight o Viral resistance to TCN - 032 (genotypic/phenotypic analyses) ▪ Virology o Viral load by viral culture (TCID 50 ) [Day 1 - 7] and q PCR [Day 2 - 7] o Time to peak, time to resolution, duration of shedding ▪ Seroconversion, seroprotection (pre - challenge to Day 28) – Pharmacokinetics and anti - drug antibodies – Safety: adverse events, laboratory parameters, spirometry • Sample size: 64 subjects (32/treatment arm) – 90% power to detect a 60% reduction in the proportion of subjects with grade 2 or greater symptoms, assuming placebo rate of 50%, with one - sided alpha of 0.10

27 Clinical Symptoms Clinical Symptoms TCN - 032 n=24 Placebo n=24 % Difference p value (one - sided) Proportion of subjects with grade 2 symptoms or pyrexia 10/24=41.2% 13/24=54.2% 12.5% p=0.21 CMH test AUC (Day 1 - 7) median 25.5 39 35% p=0.0466* Wilcoxon

28 Median Time to Peak, Time to Resolution and Duration of Symptoms TCN - 032 n=24 Placebo n=24 p value (one - sided) Time to Peak Symptoms Day 3 Day 3 p=0.21 Wilcoxon Time to Resolution of Symptoms Day 6.5 Day 7.5 p=0.06 Wilcoxon Duration of Symptoms 4.5 days 6 days p=0.11 Wilcoxon

29 Viral Shedding and Viral Escape Analysis TCN - 032 AUC (log 10 TCID 50 /mL) Placebo AUC (log 10 TCID 50 /mL) Absolute Log Decrease p value (one - sided) PCR Day 2 - 7 Median=5.2 Median=7.4 2.2 p=0.09* Wilcoxon Viral escape genotypic analysis ▪ Sequence analysis (454 Next Generation) TCN - 032 epitope portion of M2e from subjects and parental challenge virus A/Wisconsin/67/2005 ▪ Results: samples from 17 placebo and all 13 TCN - 032 treated subjects that shed virus by TCID 50 show no change in epitope recognized by TCN - 032

30 Clinical Symptoms and Viral Shedding by PCR Clinical symptoms and viral shedding in both treatment arms follow similar patterns

31 Summary and Conclusions • In a human viral challenge model, TCN - 032 showed reductions in clinical symptoms and viral shedding • TCN - 032 was safe and tolerable, with no increase in adverse events compared to placebo , including lower respiratory tract symptoms • TCN - 032 pharmacokinetics were consistent with Phase 1 study ( half - life ~16 days ) with no evidence of immunogenicity R esults are the first demonstration that a non - neutralizing antibody given parenterally may provide immediate immunity and therapeutic benefit in influenza A infection in human with no apparent emergence of resistant virus • Next steps: clinical studies in natural infection including the target population of patients hospitalized with serious influenza infection

32 TCN - 202: CMV Antibody Phase 1 Study Results

33 TCN - 202: Background • TCN - 202 is a fully human mAb that targets the highly conserved antigenic domain (AD - 2) epitope in glycoprotein B (gB) of human cytomegalovirus (HCMV) gB plays important roles in viral entry and spread to adjacent cells • Antibodies against AD - 2 neutralize the infectivity of various CMV isolates in vitro suggesting that AD - 2 is an important target for development of protective anti - CMV responses • However, the AD - 2 epitope is poorly immunogenic as only 50% of CMV seropositive individuals develop anti - AD - 2 antibodies

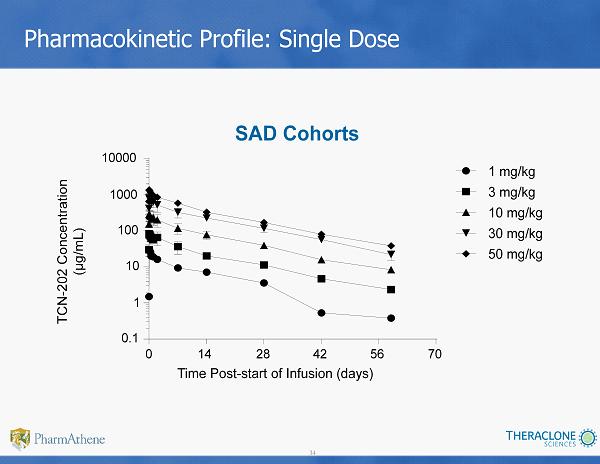

34 Pharmacokinetic Profile: Single Dose SAD Cohorts Time Post - start of Infusion (days) 0 14 28 42 56 70 0.1 1 10 100 1000 10000 1 mg/kg 3 mg/kg 10 mg/kg 30 mg/kg 50 mg/kg TCN - 202 Concentration (µg/mL)

35 15 mg/kg x 2 doses Time Post - start of 1 st Infusion (days) 0 14 28 42 56 70 84 10 100 1000 TCN - 202 Concentration (µg/mL) Pharmacokinetic Profile: Multiple Dose

36 Summary • TCN - 202 at single doses of 1 - 50 mg/kg and multi - dose at 15 mg/kg x2: well - tolerated • AEs were mild to moderate – Most were unrelated to study drug • Pharmacokinetics – Dose proportional (Cmax and AUC) – Half - life ~14 days – Volume of distribution and clearance - consistent with IgG • Immunogenicity – None detected