Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | d594319d8k.htm |

THIRD

QUARTER 2013 ASSOCIATED BANC-CORP

INVESTOR

PRESENTATION

Exhibit 99.1 |

FORWARD-LOOKING STATEMENTS

1

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are

forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This includes any statements regarding

management’s plans, objectives, or goals for future operations,

products or services, and forecasts of its revenues, earnings, or other measures of

performance.

Such forward-looking statements may be identified by the use of words such

as “believe”, “expect”, “anticipate”,

“plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or

similar expressions.

Forward-looking statements are based on current management

expectations and, by their nature, are subject to risks and uncertainties. Actual

results may differ

materially

from

those

contained

in

the

forward-looking

statements.

Factors

which

may

cause actual results to differ materially from those contained in such

forward-looking statements include those identified in the

company’s most recent Form 10-K and subsequent SEC filings.

Such factors are incorporated herein by reference. |

OUR

FOOTPRINT AND FRANCHISE •

Top 50, publicly traded,

U.S. bank holding

company

•

$24 billion in assets;

largest bank

headquartered in

Wisconsin

•

239 branches serving

approximately one

million customers

About Associated

ASBC

Deposits¹ ($

in billions)

ASBC

Branches¹

WI

$11.5

170

IL

$4.0

44

MN

$1.6

25

Total

$17.1

239

1

FDIC market share data 6/30/13

2 |

ATTRACTIVE MIDWEST MARKETS

3

•

Population:

Over 60 mm people live in our footprint (~ 20% of USA)

1

.

•

GDP Metrics:

$2.9 trillion in 2012 (18.4% of US GDP). 4% growth from

2011 is consistent with the national average.

2

•

Employment Data:

Five states in our footprint have lower unemployment

rates than the national average of 7.4%. Total jobs in footprint

grew 371

thousand YoY.

3

•

Manufacturing Concentrated:

Top 3 states (Indiana, Wisconsin, and

Iowa) for concentration of manufacturing jobs and two other states in the

top 10.

4

•

Manufacturing Growth:

Midwest Manufacturing output is up 6.9% CAGR

from 2011 vs. national index increase of 3.1% CAGR

5

.

•

Favorable Credit:

Five of the top ten cities with the best credit ratings are

in footprint.

6

1

US Census Bureau 2012 ; ²

US Department of Commerce;

3

U.S. BLS, State: Jul 2013 ;

4

March 2012 Brookings Paper ;

5

FRB Chicago Midwest Manufacturing Index, Jul 2013. Jul 2012, Jul 2011;

6

Experian State of Credit Survey 2012; |

ASSOCIATED AT ITS CORE

4

Community

bank values,

flexibility,

decision-

making,

attention to

relationships

and service

Big bank

products,

strength,

lending limits,

efficiency,

innovation,

depth of

expertise |

SECOND

QUARTER HIGHLIGHTS AND OUTLOOK 5

•

Net income of $47 mm

•

Average loans of $15.7 bn, up

2% QoQ

•

Net interest income of $160

mm, up 2% QoQ

•

CET1 ratio of 11.5%

•

Repurchased $30 mm of stock

•

ROCET1 of 9.9%, compared to

9.3% for Q2 2012

Second Quarter 2013 Highlights:

Outlook –

Growing the

Franchise & Creating Long-

Term Shareholder Value

•

Continued focus on organic

growth opportunities

•

Defending NIM compression in

low-rate environment

•

Strong focus on efficiency &

expense management

•

Disciplined focus on deploying

capital to drive long-term

shareholder value |

RESHAPING & REBUILDING THE LOAN

PORTFOLIO

1

6

1

Based on Average Balances, $ in Billions

Installment

Home Equity

Residential

Mortgage &

HE 1

st

Liens

Construction

CRE

Investor

Commercial

&

Business

Lending

$16.3

$14.6

$12.6

$14.0

$15.1

$15.7

•

Portfolio peaked at

$16.3 b in 4Q 2008

•

Goal: A balanced

portfolio between

Commercial & Business,

Commercial Real

Estate, and Retail

•

Reduced Construction

exposure by ~ 70% from

2008

•

Home Equity run off as

more consumers

refinance into fixed rate

mortgages

35%

33%

32%

33%

36%

37%

19%

19%

24%

31%

30%

29%

14%

18%

19%

18%

19%

19%

14%

11%

6%

4%

4%

5%

13%

13%

13%

10%

8%

7%

5%

6%

6%

4%

3%

3% |

LOAN

PORTFOLIO GROWTH AND COMPOSITION 7

Average Loans of $15.7 billion for Second Quarter 2013

2Q 2013 Average Net Loan Growth of $280 million

Loan Mix –

2Q 2013 (Average)

($ balances in millions)

Home Equity & Installment

Commercial Real Estate

Residential Mortgage

Power & Utilities

Oil & Gas

Mortgage Warehouse

General Commercial Loans

Average Quarterly Loans ($ in billions)

+2% QoQ

Peak Loans (4Q 2008) $16.3 billion |

BRANCH

STRATEGY 8

Refine

Footprint

•

Footprint Project –

60%

complete. Began in 2011.

Rationalize

Footprint

•

Consolidated 24% of

branches since 2007.

Reinvigorate

Model

Deposit Automation ATM

Transaction Express

Financial Outlet

Video Teller

Lower Cost Branch Concepts

•

Leverage technology solutions for service.

Deposits & Customer Funding

($ in billions)

Non-maturity deposits

Time Deposits

Retain

Relationships

•

Grow deposits |

New Features:

•

Associated SnapDeposit™

(Picture of Checks)

•

Popmoney (Person to

Person Transfers)

•

View/Pay eBills

•

New Alerts

•

Enhanced Security

ENHANCING MOBILE BANKING OFFERINGS

9

•

New iPad App

(Sept 2013)

•

Enhanced

Smartphone

Apps (Sept 2013) |

COMMITTED TO EFFICIENCY IMPROVEMENTS

10

Efficiency Ratio¹

Trend

1

–

Efficiency ratio

= Noninterest expense, excluding amortization of intangibles, divided by sum of

taxable equivalent net interest income plus noninterest income, excluding

investment securities gains, net, and asset gains, net. This is a non-GAAP

financial measure. Please refer to the appendix for a reconciliation of this and

other non-GAAP items. 2

–

Peer Average

= based on ASBC’s peer group and sourced from SNL.

64.5%

Peer Average²

Net Interest Income Trend

Noninterest Income Trend

Noninterest Expense Trend

Opportunity |

PURSUING EFFICIENCY GAINS

11

Project Pathway Benefits:

Customer

Relationship

Reporting &

Analytics

Workflow

Management

Time to

Market

Audit Trail

Data Quality

Automation

Compliance

Enforcement

Colleague

Engagement

Green Bay

Chicago

Real Estate Initiatives:

•

Actions to optimize our real estate

holdings and capacity

•

2013 –

Consolidated Corporate offices in

Green Bay (6 buildings) and Chicago (3

buildings)

Back Office Initiatives:

•

Implementing technology solutions in

labor intensive processes

•

2013 -

Commercial loan system with

end to end processing |

GROWING NET INTEREST INCOME WHILE

MARGIN COMPRESSES

12

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Net Interest Income & Net Interest Margin

($ in millions) |

CAPITAL MANAGEMENT PRIORITIES

13

Funding Organic

Growth

Paying a

Competitive

Dividend

Non-organic

Growth

Opportunities

Share Buybacks

and Redemptions

Priority

Highest

Lowest

2012

2013

•

Fund Loan Growth and other Capital Investments

•

Announced $125 mm

share repurchase program

(November 2012)

•

Repurchased $30 mm in

Q4 2012

•

Repurchased $90 mm YTD

•

Announced additional $120

mm share repurchase

program (July 2013)

•

Announced authorization to

repurchase $10 mm

preferred shares (July 2013)

•

Increased quarterly

dividend to $0.08/share in

Q4 2012 (60% increase

from $0.05/ share)

•

Paid $0.08 /share in Q1

and Q2

•

~

2% Dividend Yield

•

~ 30% Cash Payout on

EPS

•

Cost Take-out Provides Greater Value

•

Maintain Discipline in Pricing of any Transaction |

CAPITAL

DEPLOYMENT OPPORTUNITIES 14

Basel I ASBC

2Q = 11.5%

2Q = 11.0%

8% -

9.5%

Basel III ASBC

3

Basel III

2

Systematically Important Financial Institutions

1

Regional and Community Banks

= 7%

+1 -

2.5%

Organic Asset

Growth

Non Organic

Cash Acquisition

Repurchase /

Special Dividend

Capacity

3

In July 2013, the Federal Reserve and the OCC published final rules (the

“Basel III Capital Rules”) establishing a new comprehensive

capital framework for U.S. banking organizations. 11.0% is 2Q estimate of

Basel III capital ratio. Potential

Excess Capital

1.5 –

3%

Capital

Deployment

Options

2

1 |

2013

SECOND HALF OUTLOOK 15

Loan Trends

•

Quarterly loan growth of 1 –

2%.

•

Continued disciplined loan

pricing

Deposit Trends

Fee Income

Expenses

NIM

Growing the Franchise & Creating Long-Term Shareholder Value

Footprint

Credit

Capital

•

Continued disciplined deposit

pricing

•

Sustained focus on treasury

management solutions to drive

growth in commercial deposits

•

Continued compression over

the second half of the year

•

Modest improvement in core fee-

based revenues with lower net

mortgage banking revenues

•

Flat year-over-year

•

Reduced regulatory costs offset by

continued franchise investments

•

Continuing to invest in our

branches while optimizing our

network

•

Complete Green Bay and Chicago

corporate office consolidations

•

Modest improvement in credit

trends

•

Provision expense to increase

based on quarterly loan growth

•

Disciplined focus on

deploying capital to drive

long-term shareholder value

•

$26 million of 9.25% sub-debt

called for redemption in

October |

WHY

ASSOCIATED 16

•

Committed to Efficiency Ratio Improvement

•

Strong Capital Profile & Opportunities for

Capital Deployment

•

Leading Midwest Bank Operating in

Attractive Markets

•

Core Organic Growth Opportunity

•

Disciplined Loan and Deposit Pricing

•

Improving Credit Quality

•

Improving Earnings Profile

Net Income

Available to

Common

($ in millions)

Return on

Common Equity

Tier 1

Reasons to Invest

Net Income Available to Common & ROCET1¹

Management Team Focused on Creating

Long-Term Shareholder Value

1

–

Return on Common Equity Tier 1 (ROCET1)

= Management uses Tier 1 common equity, along with other

capital measures, to assess and monitor our capital position. This is a

non-GAAP financial measure. Please refer to the appendix for a

definition of this and other non-GAAP items. |

OUR

VISION 17

ASSOCIATED

will be the most

admired Midwestern financial

services company, distinguished by

sound, value-added financial

solutions with personal service for

our customers, built upon a strong

commitment to our colleagues and

the communities we serve, resulting

in exceptional value for our

shareholders. |

APPENDIX

18 |

IMPROVEMENT IN CREDIT QUALITY INDICATORS

($ IN MILLIONS)

19 |

INVESTMENT SECURITIES PORTFOLIO

20

Type

Mkt Value

(000’s)

%of Total

0% RWA

$ 468,264

9%

20% RWA

4,349,847

88%

50% RWA

25,585

1%

=>100% RWA

72,075

1%

Not subject to RW

10,046

1%

TOTAL

$4,925,817

100%

Risk –

Weighted Profile –

June 30, 2013

Investment Portfolio –

June 30, 2013

Credit Rating

($ in thousands)

Mkt Value

% of Total

Govt & Agency

$ 4,037,284

82.0%

AAA

68,692

1.4%

AA

559,555

11.4%

A

249,565

5.1%

BAA1, BAA2 &

BAA3

---

0.0%

BA1 & Lower

2,534

0.1%

Non-rated

8,186

0.2%

Total

$4,925,817

100.0%

Portfolio Composition Ratings –

June 30, 2013

Market Value Composition –

June 30, 2013

Type

Bk Value

(000’s)

Mkt Value

(000’s)

TEY

(%)

Duration

(Yrs)

Govt &

Agencies

$ 1,002

$ 1,004

0.30

1.13

MBS

2,536,056

2,533,037

2.74

3.84

CMOs

1,068,119

1,075,432

2.57

2.45

Agency CMBS

446,807

431,252

1.89

3.95

Municipals

777,482

801,731

5.23

4.84

Corporates

84,095

83,316

1.59

1.07

Other

18

45

---

---

TOTAL HTM &

AFS

$4,913,579

$4,925,817

3.01

3.65

Risk

–

weighted

profile

estimated

as

of

July

12,

2013

CMOs

22%

MBS

51%

Municipals

16%

Agency CMBS

9%

Corporates

2%

All Other

97% |

COMMERCIAL LOANS BY INDUSTRY

AS OF JUNE 30, 2013

21

CB&L Loans by Industry ¹

1

Based on NAICS codes

($6.0 billion)

CRE Loans by Industry

($3.8 billion) |

COMMERCIAL LOAN PORTFOLIOS BY

GEOGRAPHY

AS OF JUNE 30, 2013

22

Commercial & Business Loans by State

CRE Loans by State

($6.0 billion)

($3.8 billion)

1

Includes Missouri, Indiana, Ohio, Michigan, & Iowa

|

CONSUMER LOAN PORTFOLIOS BY

GEOGRAPHY

AS OF JUNE 30, 2013

23

Residential Mortgage Loans by State

Home Equity Loans by State

Approximately half of home equity

portfolio is in first-lien position

($3.5 billion)

($2.0 billion)

1

Includes Missouri, Indiana, Ohio, Michigan, & Iowa

|

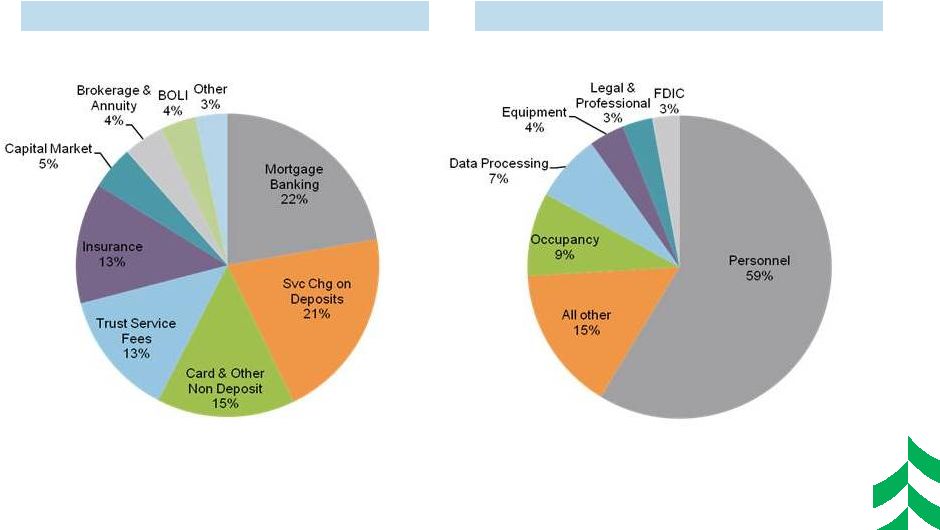

NON

INTEREST INCOME AND EXPENSE COMPOSITION

1

ST

HALF 2013

24

Noninterest Income by Category

Noninterest Expense by Category

($166 million)

($337 million) |

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

25

1H 2013

1H 2012

2Q 2013

1Q 2013

4Q 2012

3Q 2012

2Q 2012

Efficiency Ratio Reconciliation:

Efficiency ratio (1)

69.64%

72.57%

69.54%

69.74%

73.71%

72.81%

72.30%

Taxable equivalent adjustment

(1.43)

(1.62)

(1.39)

(1.46)

(1.57)

(1.61)

(1.62)

Asset gain (losses), net

0.12

(1.26)

(0.01)

0.24

(0.06)

(0.98)

(1.47)

Other intangible amortization

(0.42)

(0.44)

(0.41)

(0.42)

(0.43)

(0.43)

(0.44)

Efficiency ratio, fully taxable equivalent (1)

67.91%

69.25%

67.73%

68.10%

71.65%

69.79%

68.77%

(1)

Efficiency

ratio

is

defined

by

the

Federal

Reserve

guidance

as

noninterest

expense

divided

by

the

sum

of

net

interest

income

plus

noninterest

income,

excluding investment securities gains / losses, net. Efficiency

ratio, fully taxable equivalent, is noninterest expense, excluding other

intangible amortization, divided by the sum of taxable equivalent net

interest income plus noninterest income, excluding investment securities gains / losses, net

and asset gains / losses, net. This efficiency ratio is presented on a

taxable equivalent basis, which adjusts net interest income for the tax-favored status

of certain loans and investment securities. Management believes

this measure to be the preferred industry measurement of net interest income as it

enhances the comparability of net interest income arising from taxable and

tax-exempt sources and it excludes certain specific revenue items (such as

investment securities gains / losses, net and asset gains / losses, net).

Definition of Common Equity Tier 1:

Common

Equity

Tier

1

(CET1),

a

non-GAAP

financial

measure,

is

used

by

banking

regulators,

investors

and

analysts

to

assess

and

compare

the

quality

and composition of our capital with the capital of other financial services

companies. Management uses Tier 1 common equity, along with other capital

measures, to assess and monitor our capital position. Common Equity Tier 1 is Tier

1 capital excluding qualifying perpetual preferred stock and qualifying

trust preferred securities. |