Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Western Refining Logistics, LP | d570955dex231.htm |

| EX-10.5 - EX-10.5 - Western Refining Logistics, LP | d570955dex105.htm |

| EX-10.7 - EX-10.7 - Western Refining Logistics, LP | d570955dex107.htm |

| EX-10.6 - EX-10.6 - Western Refining Logistics, LP | d570955dex106.htm |

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on September 4, 2013

Registration No. 333-190135

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

WESTERN REFINING LOGISTICS, LP

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 4610 | 46-3205923 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

123 W. Mills Avenue

El Paso, Texas 79901

(915) 534-1400

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Lowry Barfield

Senior Vice President—Legal, General Counsel and Secretary

123 W. Mills Avenue

El Paso, Texas 79901

(915) 534-1400

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| David P. Oelman Alan Beck Vinson & Elkins L.L.P. 1001 Fannin Street, Suite 2500 Houston, Texas 77002 (713) 758-2222 |

Joshua Davidson M. Breen Haire Baker Botts L.L.P. One Shell Plaza 910 Louisiana Street Houston, Texas 77002 (713) 229-1234 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus, dated September 4, 2013

PROSPECTUS

Common Units

Representing Limited Partner Interests

Western Refining Logistics, LP

This is the initial public offering of our common units representing limited partner interests. Prior to this offering, there has been no public market for our common units. We currently expect the initial public offering price to be between $ and $ per common unit. We intend to apply to list our common units on the New York Stock Exchange under the symbol “WNRL.” We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012.

Investing in our common units involves risks. Please read “Risk Factors” beginning on page 21.

These risks include the following:

| • | Our parent company, Western Refining, Inc., or Western, accounts for substantially all of our revenues. If Western changes its business strategy, is unable to satisfy its obligations under our commercial agreements for any reason or significantly reduces the volumes transported through our pipelines and gathering systems or handled at our terminals, our revenues would decline and our financial condition, results of operations, cash flows, and ability to make distributions to our unitholders would be adversely affected. |

| • | We may not have sufficient cash from operations following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our unitholders. |

| • | Western may suspend, reduce, or terminate its obligations under each of our commercial agreements and our services agreement in some circumstances, which would have a material adverse effect on our financial condition, results of operations, cash flows, and ability to make distributions to our unitholders. |

| • | Western will own a % limited partner interest in us and will control our general partner, which has sole responsibility for conducting our business and managing our operations. Our general partner and its affiliates, including Western, have conflicts of interest with us and limited duties to us and may favor their own interests to the detriment of our unitholders. |

| • | Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors. |

| • | Unitholders will experience immediate and substantial dilution of $ per common unit. |

| • | Our tax treatment depends on our status as a partnership for U.S. federal income tax purposes. If the Internal Revenue Service were to treat us as a corporation for federal income tax purposes, then our cash available for distribution to our unitholders would be substantially reduced. |

| • | Our unitholders will be required to pay taxes on their share of our income even if they do not receive any cash distributions from us. |

| Per Common Unit |

Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discount (1) |

$ | $ | ||

| Proceeds to Western Refining Logistics, LP (before expenses) |

$ | $ |

| (1) | Excludes a structuring fee equal to % of the gross proceeds of this offering payable to Merrill Lynch, Pierce, Fenner & Smith Incorporated and Barclays Capital Inc. Please read “Underwriting” for a description of all underwriting compensation payable in connection with this offering. |

The underwriters may also exercise their option to purchase up to an additional common units from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units to purchasers on or about , 2013 through the book-entry facilities of The Depository Trust Company.

Joint Book-Running Managers

| BofA Merrill Lynch | Barclays |

The date of this prospectus is , 2013

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

i

Table of Contents

Index to Financial Statements

| 92 | ||||

| 95 | ||||

| Factors Affecting the Comparability of Our Financial Results |

96 | |||

| 97 | ||||

| 98 | ||||

| 101 | ||||

| 104 | ||||

| 105 | ||||

| 106 | ||||

| 106 | ||||

| 106 | ||||

| 107 | ||||

| 107 | ||||

| 109 | ||||

| 110 | ||||

| 122 | ||||

| 131 | ||||

| 132 | ||||

| 133 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 135 | ||||

| 137 | ||||

| 142 | ||||

| 142 | ||||

| 142 | ||||

| 143 | ||||

| 143 | ||||

| Directors and Executive Officers of Western Refining Logistics GP, LLC |

144 | |||

| 145 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

151 | |||

| 153 | ||||

| Distributions and Payments to Our General Partner and its Affiliates |

153 | |||

| 154 | ||||

| 157 | ||||

| Procedures for Review, Approval and Ratification of Transactions with Related Persons |

165 | |||

| 166 | ||||

| 166 | ||||

| 171 | ||||

| 174 | ||||

| 174 | ||||

| 174 | ||||

| 174 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 177 | ||||

| 178 | ||||

| 178 |

ii

Table of Contents

Index to Financial Statements

| 179 | ||||

| 180 | ||||

| Merger, Consolidation, Conversion, Sale or Other Disposition of Assets |

180 | |||

| 182 | ||||

| 182 | ||||

| 183 | ||||

| 183 | ||||

| 184 | ||||

| Transfer of Subordinated Units and Incentive Distribution Rights |

184 | |||

| 184 | ||||

| 185 | ||||

| 185 | ||||

| 185 | ||||

| 186 | ||||

| 186 | ||||

| 187 | ||||

| 188 | ||||

| 188 | ||||

| 188 | ||||

| 189 | ||||

| 189 | ||||

| 190 | ||||

| 190 | ||||

| 190 | ||||

| 190 | ||||

| 191 | ||||

| 191 | ||||

| 192 | ||||

| 192 | ||||

| 194 | ||||

| 198 | ||||

| 199 | ||||

| 201 | ||||

| 201 | ||||

| 202 | ||||

| 203 | ||||

| INVESTMENT IN WESTERN REFINING LOGISTICS, LP BY EMPLOYEE BENEFIT PLANS |

205 | |||

| 207 | ||||

| 207 | ||||

| 208 | ||||

| 208 | ||||

| 208 | ||||

| 208 | ||||

| 209 | ||||

| 210 | ||||

| 210 | ||||

| 210 | ||||

| 210 | ||||

| 210 | ||||

| Notice to Prospective Investors in the European Economic Area |

211 | |||

| 212 | ||||

| 212 |

iii

Table of Contents

Index to Financial Statements

| 213 | ||||

| 213 | ||||

| 213 | ||||

| 214 | ||||

| 214 | ||||

| 214 | ||||

| 215 | ||||

| F-1 | ||||

| APPENDIX A—AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP OF WESTERN REFINING LOGISTICS, LP |

A-1 | |||

| B-1 |

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus and any free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Risk Factors” and “Forward-Looking Statements.”

Industry and Market Data

This prospectus includes industry data and forecasts that we obtained from industry publications and surveys, public filings, and internal company sources. These data sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Moreover, forecasted information is inherently uncertain and we can provide no assurance that forecasted information will materialize. Statements as to our market position and market estimates are based on independent industry publications, government publications, third-party forecasts, management’s estimates and assumptions about our markets, and our internal research. Certain market and industry data has been derived from a report commissioned by us and prepared by BENTEK Energy, LLC (“BENTEK”). While we are not aware of any misstatements regarding the market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Forward-Looking Statements” and “Risk Factors” in this prospectus.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks, and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks, and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, the trademarks, service marks, and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks, and trade names.

iv

Table of Contents

Index to Financial Statements

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the historical and pro forma financial statements and the notes to those financial statements, before investing in our common units. The information presented in this prospectus assumes, unless otherwise indicated, (1) an initial public offering price of $ per common unit (the mid-point of the price range set forth on the cover of this prospectus) and (2) that the underwriters’ option to purchase additional common units is not exercised. You should read “Risk Factors” for information about important risks that you should consider before buying our common units.

Unless the context otherwise requires, references in this prospectus to “Western Refining Logistics, LP,” “our partnership,” “we,” “our,” “us,” or like terms when used in a historical context, refer to Western Refining Logistics, LP Predecessor, our predecessor for accounting purposes, also referred to as “the Predecessor,” and when used in the present tense or prospectively, refer to Western Refining Logistics, LP and its subsidiaries. Unless the context otherwise requires, references in this prospectus to “Western” refer collectively to Western Refining, Inc. and its subsidiaries, other than Western Refining Logistics, LP, its subsidiaries and its general partner.

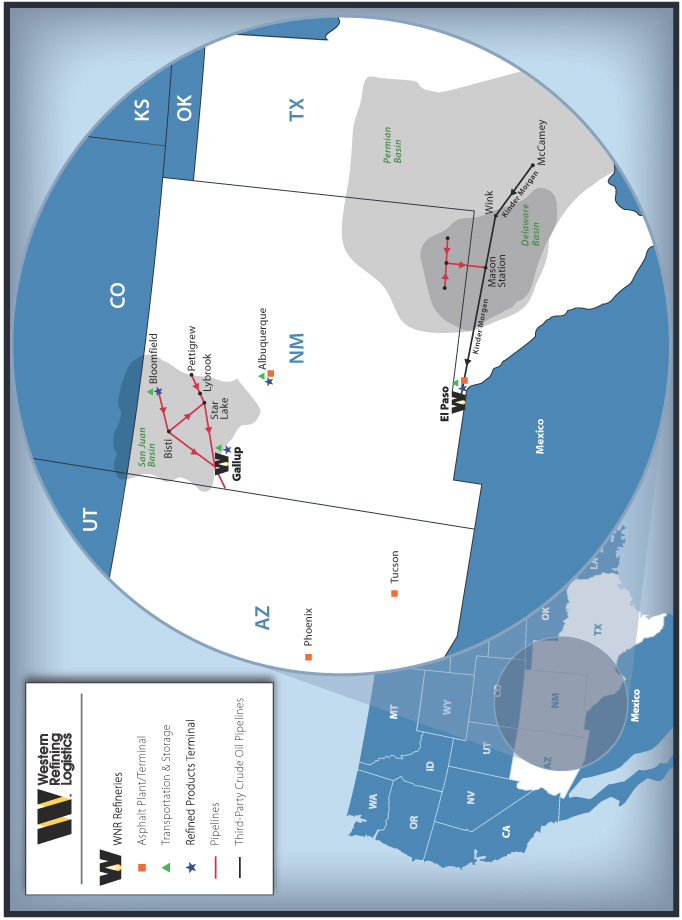

Western Refining Logistics, LP

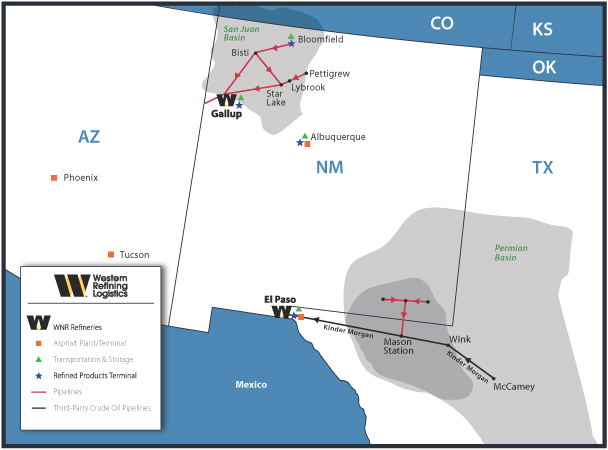

We are a fee-based, growth oriented Delaware limited partnership recently formed by Western to own, operate, develop, and acquire terminals, storage tanks, pipelines, and other logistics assets. Our initial assets consist of pipeline and gathering assets and terminalling, transportation, and storage assets in the Southwestern portion of the U.S., including approximately 300 miles of pipelines and approximately 7.9 million barrels of active storage capacity, as well as other assets. Most of our assets are integral to the operations of Western’s refineries located in El Paso, Texas, and near Gallup, New Mexico.

We generate revenue primarily by charging fees and tariffs for transporting crude oil and refined and other products through our terminals and pipelines and for providing storage at our storage tanks and terminals. We do not take ownership of the hydrocarbons or products (other than certain additives) that we handle or engage in the trading of any commodities. Accordingly, we generally do not have direct exposure to fluctuations in commodity prices. Initially, substantially all of our revenue will be derived from two 10-year, fee-based agreements with Western, supported by minimum volume commitments and inflation adjustments. We believe these contracts will generate stable and predictable cash flows. Please read “—Our Commercial Agreements with Western” below for a description of these agreements.

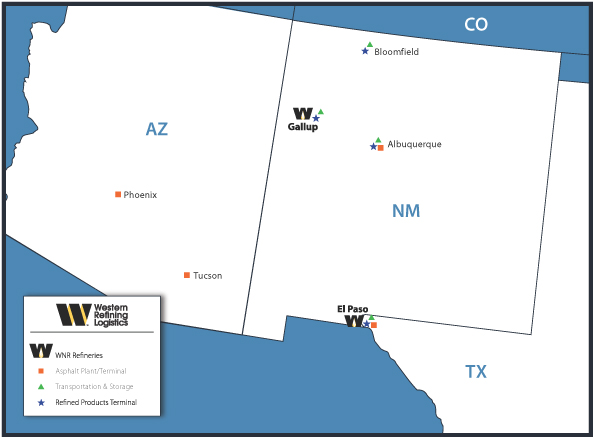

Our relationship with Western is one of our principal strengths. Western is a publicly traded (NYSE: WNR) independent crude oil refiner and marketer of refined and other products, and owns and operates two refineries, in El Paso, Texas and Gallup, New Mexico (referred to as Western’s “El Paso Refinery” and “Gallup Refinery,” respectively), with a total crude oil throughput capacity of 153,000 barrels per day (“bpd”). Western’s primary operating areas that we support encompass West Texas, Arizona, New Mexico, Utah, and Colorado. In addition to its refineries, Western also operates retail convenience stores in Arizona, Colorado, New Mexico, and Texas; a fleet of crude oil and refined product truck transports; and a wholesale petroleum products distributor that operates in Arizona, California, Colorado, Georgia, Nevada, New Mexico, Texas, Maryland, and Virginia. For the year ended December 31, 2012, Western reported net sales, operating income and net income of $9.5 billion, $711.9 million and $398.9 million, respectively. For the six months ended June 30, 2013, Western reported net sales, operating income and net income of $4.6 billion, $445.7 million and $233.0 million. As of June 30, 2013, Western reported total assets of $2.5 billion and total debt of $550.8 million.

1

Table of Contents

Index to Financial Statements

We intend to expand our business primarily by increasing utilization of our existing systems, acquiring additional logistics assets from Western and third parties and executing organic growth projects. The Permian Basin in general, and the Delaware Basin in particular, are experiencing significant crude oil production growth as a result of improved drilling and completion techniques. This production growth provides the El Paso Refinery with a local supply of high quality, cost-advantaged crude oil. Western has stated that it intends to increase its access to this production and grow its logistics business generally, and has formed us to be the primary growth vehicle for this business. Western will grant us a right of first offer on certain logistics assets that it will retain following the completion of this offering, as well as on additional assets that Western may acquire or construct in our existing areas of operation in the future. Please read “Business—Our Assets and Operations—Right of First Offer.” We do not have a current agreement or understanding with Western to purchase any assets covered by our rights of first offer.

Our initial assets consist of the following:

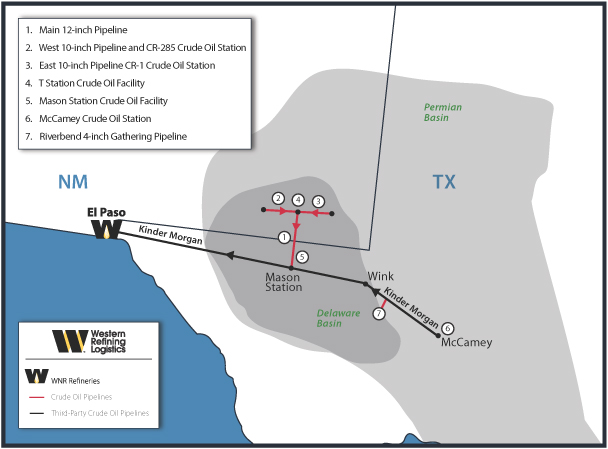

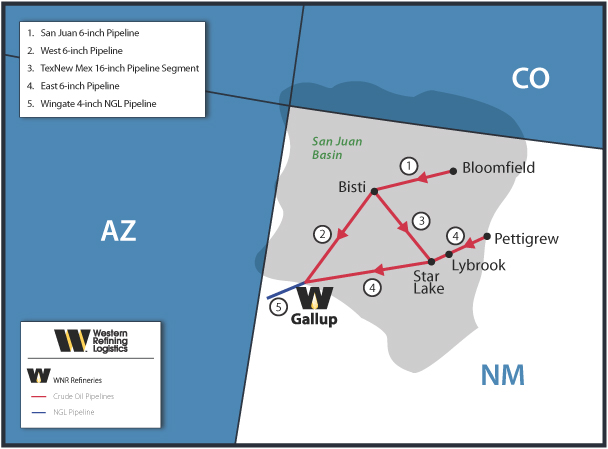

| • | Pipeline and Gathering Assets. Our pipeline and gathering assets consist of approximately 300 miles of crude oil pipelines and gathering systems and approximately 566,000 barrels of active crude oil storage located primarily in the Delaware Basin in the Permian Basin area of West Texas and southern New Mexico and in the Four Corners area in northwestern New Mexico. These assets serve as a key source of high quality, cost-advantaged crude oil for Western’s El Paso and Gallup Refineries. |

| • | Terminalling, Transportation, and Storage Assets. Our terminalling, transportation, and storage assets consist of terminals and storage assets located on site at each of Western’s El Paso and Gallup Refineries, and standalone refined products terminals located in Bloomfield and Albuquerque, New Mexico. These assets include approximately 6.9 million barrels of active shell storage capacity. These assets primarily receive, store, and distribute crude oil, feedstock, and refined products for Western’s refineries. We also provide fee-based asphalt terminalling and processing services at an asphalt plant and terminal in El Paso and asphalt terminalling services at three stand-alone asphalt terminals located in Albuquerque, New Mexico and Phoenix and Tucson, Arizona, which have a combined storage capacity of approximately 473,000 barrels. |

Business Objectives and Strategies

Our primary business objectives are to maintain stable cash flows and to increase our quarterly cash distribution per unit over time. We intend to accomplish these objectives by executing the following strategies:

| • | Generate Stable, Fee-Based Revenues. We are focused on generating stable and predictable cash flows by providing fee-based logistics services. Initially, substantially all of our revenue will be derived from two 10-year, fee-based agreements with Western, supported by minimum volume commitments and inflation adjustments. As we grow our business, we will seek to enter into similar contracts with third parties that generate stable and predictable cash flows, as well as increase volumes under our existing contracts with Western. Pursuant to our contracts with Western, we generally do not have exposure to variability in the prices of the hydrocarbons and other products we handle. |

| • | Increase Utilization and Pursue Attractive Organic Growth Opportunities. We expect to realize increased throughput on our existing systems due to projected crude oil production growth in the Delaware Basin and Four Corners area and the continued ramp-up of our new gathering system in |

2

Table of Contents

Index to Financial Statements

| the Delaware Basin. We also intend to evaluate organic growth opportunities to increase utilization of our existing assets by, for example, adding gathering lines to connect new production to our mainline gathering lines. Additionally, we intend to take other steps to accommodate growth in Western’s business as well as increased third-party activity in our existing areas of operations. |

| • | Grow Through Strategic Acquisitions. We plan to pursue accretive acquisitions of complementary assets from Western as well as third parties. In order to provide us with initial acquisition opportunities, Western will grant us a right of first offer to acquire certain logistics assets that it will retain following this offering, as well as additional assets that it may acquire or construct in our existing areas of operation in the future. We believe we complement Western’s acquisition strategy by providing a specialized vehicle for owning, operating and acquiring logistics assets. This allows us to either bid jointly with Western for assets with associated logistics or subsequently purchase logistics assets from Western pursuant to our right of first offer in the omnibus agreement. |

| • | Maintain Safe, Reliable, and Efficient Operations. We are committed to maintaining and improving the safety, reliability, environmental compliance, and efficiency of our operations. We believe these objectives are integral to maintaining stable cash flows and are critical to the success of our business. |

We believe we are well positioned to achieve our primary business objectives and execute our business strategies based on the following competitive strengths:

| • | Well-Positioned Assets in High-Growth Regions. Most of our assets are located in or near the Delaware Basin in the Permian Basin area of West Texas and southern New Mexico and in the Four Corners area in the San Juan and Paradox Basins in northwestern New Mexico. These shale-focused, crude oil producing basins are experiencing significant growth in production. According to BENTEK Energy, LLC (“BENTEK”), an energy market analytics company, Delaware Basin crude oil production was 450,000 bpd as of June 2013. BENTEK predicts that Delaware Basin crude oil production will increase by approximately 120,000 bpd over the next five years based on current drilling, and could increase by as much as an additional 300,000 bpd, for a total of 870,000 bpd, over this same period assuming increases in horizontal rig count, well count, and initial production (“IP”) rates. Western’s Gallup Refinery is currently sourcing approximately 25,000 bpd of crude oil primarily from the San Juan and Paradox Basins. Drilling activity in the area is increasing, and BENTEK predicts total production in the San Juan Basin alone could grow from approximately 7,700 bpd currently to between 20,000 bpd and 52,000 bpd over the next five years. This range is based on certain assumptions by BENTEK relating to horizontal rig count, well count, and IP rates. We believe crude oil production growth in these basins should increase utilization of our pipeline and gathering assets and create organic growth opportunities. |

| • | Relationship with Western. One of our principal strengths is our relationship with Western. We believe that Western will be incentivized to grow our business as a result of its significant economic interest in us, as well as its stated strategies of growing its logistics business and increasing its access to crude oil produced in its existing areas of operations. In particular, we expect to benefit from the following aspects of our relationship with Western: |

| • | Acquisition Opportunities. Western will grant us a right of first offer to acquire certain logistics assets that it will retain following this offering, as well as additional assets that it may acquire or construct in its existing areas of operation in the future; |

3

Table of Contents

Index to Financial Statements

| • | Strength and Stability of Western’s Refining Business. Western’s El Paso and Gallup Refineries have a combined crude oil throughput capacity of 153,000 bpd. Western’s refining margins are supported throughout the refining cycle by a combination of abundant and lower cost feedstocks and strong values for its refined products. Through access to multiple strategic product pipelines afforded by our assets, Western sells products into several areas in the southwestern United States where refined product margins have historically been higher than Gulf Coast benchmarks. In addition, Western’s integrated distribution network of wholesale and retail assets provides a ratable output for products produced at its refineries; |

| • | Integration of Assets with Western’s Refineries. Most of our assets are integral to the operations of Western’s refineries. The refineries are strategically located in West Texas and New Mexico, which gives Western access to a diverse slate of high quality, advantageously priced crude oils. Our assets provide the refineries with their primary access to this supply of crude oil, and many of our assets are located adjacent to these refineries; and |

| • | Access to Operational and Industry Expertise. We expect to benefit from Western’s extensive operational, commercial, and technical expertise, as well as its industry relationships, as we seek to optimize and expand our existing asset base. |

| • | Long-Term, Fee-Based Contracts. Initially, we will generate substantially all of our revenue under two 10-year, fee-based contracts with Western that will include minimum volume commitments and inflation adjustments. We believe these contracts will generate stable, predictable cash flows and mitigate substantially all of our direct exposure to commodity price fluctuations. For the twelve months ending September 30, 2014, Western’s aggregate annual minimum fees under these agreements are expected to total $118.3 million, or approximately 90% of our forecasted revenues of $130.8 million for such period. Please read “Our Cash Distribution Policy and Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve Months Ending September 30, 2014” for additional information regarding our forecasted revenues and related assumptions. |

| • | Experienced Management Team. Our management team is experienced in the operation of logistics assets and the execution of expansion and acquisition strategies. Our management team includes some of the most senior officers of Western, who average more than 20 years of experience in the energy industry. |

| • | Financial Flexibility. In connection with this offering, we expect to enter into a new $300 million revolving credit facility and will have no initial indebtedness at the closing of this offering. In addition, we expect to retain $50 million as cash-on-hand from the proceeds of this offering. We believe we will have the financial flexibility to execute our growth strategy through cash-on-hand, the available capacity under our revolving credit facility, and our ability to access the debt and equity capital markets. |

Over the last few years, the U.S. has experienced a significant increase in crude oil production, driven primarily by new technologies including multi-stage fracturing and horizontal drilling. According to BENTEK, U.S. and Canadian crude oil production has grown from approximately 8.7 million bpd in 2011 to approximately 11.0 million bpd as of June 2013. The Permian Basin is among those basins experiencing significant growth. For example, according to BENTEK, current crude oil production in the Delaware Basin area of the Permian Basin was 450,000 bpd as of June 2013. BENTEK predicts that Delaware Basin crude oil production will increase by

4

Table of Contents

Index to Financial Statements

approximately 120,000 bpd over the next five years based on current drilling, and could increase by as much as an additional 300,000 bpd, for a total of 870,000 bpd, over this same period assuming increases in horizontal rig count, well count, and IP rates. We believe there are a number of potential growth opportunities for infrastructure projects within the Permian Basin and Four Corners areas to facilitate the delivery of crude oil from the wellhead to Western’s refineries and potentially other third parties.

Our asset portfolio consists of pipeline and gathering assets and terminalling, transportation, and storage assets, which are primarily located in or near the Delaware and San Juan Basins, and provide Western’s El Paso and Gallup Refineries with their primary access to the crude oil production in these areas. The anticipated increase in production in these basins provides us two distinct ways to grow our revenues and cash flow:

| • | Increasing throughput on our existing systems. Our Delaware Basin system was placed into service in April 2013 and throughput on this system is increasing. In anticipation of increased crude oil production in the region and the addition of new gathering connections, mainline capacity of the system is designed to handle 100,000 bpd. In addition, there is approximately 38,000 bpd of truck unloading capacity at our Mason Station crude oil facility. Western’s forecasted throughput for the twelve months ending September 30, 2014 is 27,250 bpd on the mainline and 14,900 bpd at the Mason Station truck rack, representing approximately 27% and 39% of total capacity, respectively. Our Four Corners system also has available throughput capacity to accept increased production in the San Juan and Paradox Basins. |

| • | Organic growth projects to connect additional production to our system. We expect to construct or acquire from Western additional pipelines that connect to our existing gathering systems. These additional pipelines would generate revenue not only through fees charged for volumes transported on such pipelines, but also through increased throughput on our existing pipeline assets to which they connect. |

For purposes of our forecast included elsewhere in this prospectus, we have not budgeted for any expansion capital expenditures for the twelve months ending September 30, 2014. We expect to fund future growth capital expenditures primarily from a combination of cash-on-hand, borrowings under our revolving credit facility and the issuance of additional equity or debt securities. To the extent we issue additional units to fund future acquisitions or expansion capital expenditures, the payments of distributions on those additional units may increase the risk that we will be unable to maintain or increase our per unit distribution level.

Rights of First Offer

We believe that our relationship with Western should provide us with a number of potential future growth opportunities, including the opportunity to potentially acquire the following assets that Western will grant us a right of first offer to acquire for a period of 10 years after the closing of this offering:

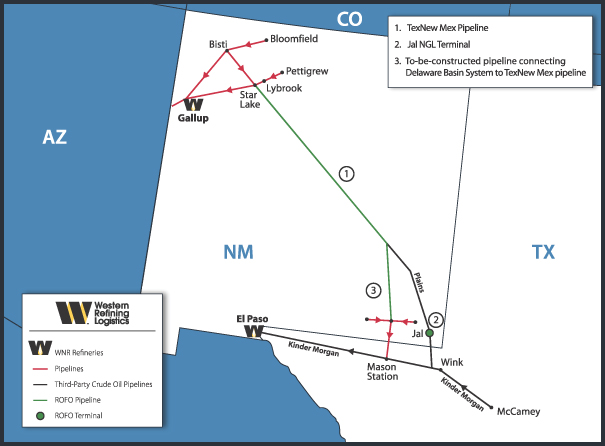

| • | TexNew Mex 16” Pipeline. At the closing of this offering, Western will contribute to us an approximately 43-mile segment of its TexNew Mex 16” Pipeline, and retain the remaining 299-mile segment that is currently not operating but is being evaluated for return to service. The retained segment extends from our crude oil station in Star Lake, New Mexico in the Four Corners area to near Maljamar, New Mexico in the Delaware Basin, and has hydraulic capacity to flow in a northerly or southerly direction. Western also anticipates the potential construction of crude oil gathering and storage tanks along this line should it be brought back into service. However, we currently do not expect Western to return this pipeline to service during the twelve months ending September 30, 2014. |

5

Table of Contents

Index to Financial Statements

| • | Jal NGL Terminal. Western’s Jal NGL Terminal, located in Lea County, New Mexico, receives, stores, and ships various light hydrocarbon products or natural gas liquids (“NGLs”) via truck, rail, and pipeline. On an annual average basis, Western uses approximately 25% of this terminal’s throughput capacity primarily to receive and store butanes in support of its El Paso Refinery. Primary storage at the Jal NGL Terminal consists of four large NGL storage caverns, with combined storage capacity of approximately 562,000 barrels, that are connected to the Enterprise Products Partners L.P. (“Enterprise”) MAPL system connecting NGL hubs at Conway, Kansas and Mt. Belvieu, Texas. Brine ponds are available on site to support product movement in and out of the storage caverns. The terminal also includes 17 storage tanks with a combined shell storage capacity of approximately 15,000 barrels, and loading and unloading capacity of up to 6,000 bpd, utilizing either a three-bay truck rack or a rail loading facility located on the Texas-New Mexico Railroad that has 16 loading spots. |

| • | Crude Oil Trucking and Refined Products Trucking. Western operates a fleet of approximately 190 crude oil and refined product truck transports. Twenty-nine crude truck transports in the Four Corners area gather approximately 9,100 bpd of crude oil, and Western anticipates growing its newly-created Delaware Basin fleet to approximately 40 truck transports by the end of 2013. In addition, Western has a fleet of 156 refined product truck transports that operate in Texas, New Mexico, Arizona, Colorado, Utah, and California. |

| • | Wholesale Fuel/Jobber/Lube Facilities. Western’s wholesale operations market and distribute approximately 73,900 bpd of Western’s refinery production. Western’s lubricant marketing, distribution and warehousing operations handle approximately one million gallons per month. Western’s wholesale operations distribute refined products and lubricants in Arizona, California, Colorado, Nevada, New Mexico, and Texas. |

In addition, Western will grant us a right of first offer to acquire additional logistics assets in the Permian Basin or the Four Corners area that it may construct or acquire in the future. Western currently anticipates constructing additional logistics assets that would be subject to our rights of first offer, if constructed. These assets, which may require significant capital to construct and place into service, include:

| • | Additional gathering lines connected to the Delaware Basin system and the Four Corners system. The Delaware Basin system mainline is designed to handle up to 100,000 bpd in anticipation of the expected growth of crude oil production in the surrounding area. Western is evaluating building gathering facilities to tie nearby production facilities to our mainlines. Western is also evaluating building additional gathering lines to connect producers in the Four Corners area to our Four Corners system. |

| • | Pipeline to connect Delaware Basin system and TexNew Mex 16” Pipeline. Western is in the initial engineering phase for the potential construction of an approximately 70-mile pipeline to connect the TexNew Mex 16” Pipeline near Maljamar with our Delaware Basin system. Western anticipates the potential construction of additional crude oil gathering systems, both pipeline and truck, and additional storage tank capacity along this pipeline, should it be completed. |

We refer to the assets listed above as our “right of first offer assets” and our rights related to them as our “rights of first offer.” Pursuant to an omnibus agreement, Western will be required to offer us the opportunity to acquire these assets in the future if it decides to sell them. We expect that Western would be the primary customer for these assets after any purchase of such assets by us. The consummation and timing of any acquisition of assets owned by Western will depend upon, among other things, Western’s willingness to offer the asset for sale and obtain any necessary consents, the determination that the asset is suitable for our business at that particular time, our ability to agree on a mutually acceptable price, our ability to negotiate an acceptable

6

Table of Contents

Index to Financial Statements

purchase agreement and services agreement with respect to the asset and our ability to obtain financing on acceptable terms. We do not have a current agreement or understanding with Western to purchase any assets covered by our rights of first offer.

As further discussed under “—Growth Opportunities”, for purposes of our forecast, we have not budgeted for any expansion capital expenditures for the twelve months ending September 30, 2014, and we expect to fund future growth capital expenditures primarily from a combination of cash-on-hand, borrowings under our revolving credit facility and the issuance of additional equity or debt securities. To the extent we issue additional units in connection with any acquisitions or expansion capital expenditures, the payments of distributions on those additional units may increase the risk that we will be unable to maintain or increase our per unit distribution level.

Following the completion of this offering, Western will continue to own and operate its refining and other assets and will retain a significant interest in us through its ownership of a % limited partner interest, as well as ownership of our general partner and, indirectly, all of our incentive distribution rights. Given Western’s significant ownership in us following this offering, as well as its stated strategies of growing its logistics business and increasing its access to crude oil produced in our existing areas of operations, we believe it will be in Western’s best interests for it to contribute additional assets to us over time and to facilitate organic growth opportunities and accretive acquisitions from third parties. However, Western is under no obligation to contribute or sell any assets to us or accept any offer for its assets that we may choose to make.

In addition to the commercial agreements we will enter into with Western upon the closing of this offering, we will also enter into an omnibus agreement and a services agreement with Western. Under the omnibus agreement, subject to certain exceptions, Western will grant us our rights of first offer. The omnibus agreement will also address our reimbursement to Western for the provision of various administrative services in support of our assets and Western’s indemnification of us for certain matters, including environmental, title and tax matters. Please read “Certain Relationships and Related Party Transactions—Agreements Governing the Transactions—Omnibus Agreement.”

While our relationship with Western and its subsidiaries is a significant strength, it is also a source of potential conflicts. Please read “Conflicts of Interest and Duties” and “Risk Factors.”

Our Commercial Agreements with Western

Initially, substantially all of our revenue will be derived from two 10-year, fee-based agreements with Western (one for pipeline and gathering services, and another for terminalling, transportation and storage services), supported by minimum volume commitments and inflation adjustments, that may be renewed for two five-year periods upon mutual agreement of us and Western. Under these agreements, we will provide various crude oil gathering, terminalling, and storage services to Western, and Western will commit to provide us with minimum monthly throughput volumes of crude oil and refined and other products, and to reserve storage capacity. For the twelve months ending September 30, 2014, Western’s aggregate annual minimum fees under these agreements are expected to total $118.3 million, or approximately 90% of our forecasted revenues of $130.8 million for such period. Please read “Our Cash Distribution Policy and Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve Months Ending September 30, 2014” for additional information regarding our forecasted revenues and related assumptions.

Our commercial agreements with Western were not the result of arm’s-length negotiations. For additional information about these commercial agreements, please read “Certain Relationships and Related Party Transactions—Our Commercial Agreements with Western.”

7

Table of Contents

Index to Financial Statements

Our Emerging Growth Company Status

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012. As long as a company is deemed an emerging growth company, it may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

| • | a requirement to present only two years of audited financial statements and related Management’s Discussion and Analysis included in an initial public offering registration statement; |

| • | an exemption to provide fewer than five years of selected financial data in an initial public offering registration statement; |

| • | an exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal controls over financial reporting; |

| • | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| • | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| • | no requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions until we are no longer an emerging growth company, which will occur on the earliest of (1) the last day of the fiscal year following the fifth anniversary of this offering, (2) the last day of the fiscal year in which we have more than $1.0 billion in annual revenues, (3) the date on which we have more than $700 million in market value of our common units held by non-affiliates or (4) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period.

We have elected to adopt the reduced disclosure requirements described above, except we have elected to opt out of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards (this election is irrevocable). As a result of these elections, the information that we provide in this prospectus may be different from the information you may receive from other public companies in which you hold equity interests.

An investment in our common units involves risks associated with our business, regulatory and legal matters, our limited partnership structure, and the tax characteristics of our common units. You should read carefully the risks under the caption “Risk Factors.”

8

Table of Contents

Index to Financial Statements

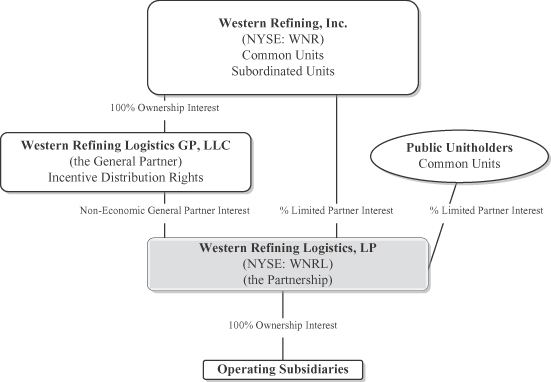

Formation Transactions and Partnership Structure

We are a Delaware limited partnership formed in July 2013 by Western to own, operate, develop, and acquire terminals, storage tanks, pipelines, and other logistics assets. In connection with this offering, Western will contribute certain assets and operations to us.

Additionally, at the closing of this offering, the following transactions will occur:

| • | we will issue a non-economic general partner interest in us, as well as all of our incentive distribution rights, to our general partner; |

| • | we will issue common units and subordinated units to Western, representing an aggregate % limited partner interest in us; |

| • | we will issue common units in this offering to the public, representing a % limited partner interest in us; |

| • | we will enter into a new $300 million revolving credit facility, with no borrowings under the facility at the closing of this offering; |

| • | we will enter into two 10-year commercial agreements with Western; |

| • | we will enter into an omnibus agreement with Western; and |

| • | we will enter into a services agreement with Western. |

We will use the net proceeds from this offering (including any net proceeds from the exercise of the underwriters’ option to purchase additional common units from us) as described in “Use of Proceeds.”

The diagram on the following page depicts a simplified version of our organization and ownership structure after giving effect to this offering and the related formation transactions.

Ownership of Western Refining Logistics, LP

After giving effect to the transactions described above, assuming the underwriters’ option to purchase additional common units from us is not exercised, all of our incentive distribution rights will be held by our general partner and our units will be held as follows:

| Public Common Units |

% | |||

| Common Units held by Western |

% | |||

| Subordinated Units held by Western |

% | |||

| Non-Economic General Partner Interest held by Western Refining Logistics GP, LLC |

— | |||

|

|

|

|||

| Total |

100 | % |

9

Table of Contents

Index to Financial Statements

The following simplified diagram depicts our organizational structure after giving effect to the transactions described above.

We are managed and operated by the board of directors and executive officers of Western Refining Logistics GP, LLC, our general partner. Western is the sole owner of our general partner and has the right to appoint the entire board of directors of our general partner, including the independent directors appointed in accordance with the listing standards of the New York Stock Exchange (“NYSE”). Unlike shareholders in a publicly traded corporation, our unitholders will not be entitled to elect our general partner or the board of directors of our general partner. Many of the executive officers and directors of our general partner also currently serve as executive officers of Western. For more information about the directors and executive officers of our general partner, please read “Management—Directors and Executive Officers of Western Refining Logistics GP, LLC.”

In order to maintain operational flexibility, our operations will be conducted through, and our operating assets will be owned by, various operating subsidiaries. However, neither we nor our subsidiaries will have any employees. Our general partner has the sole responsibility for providing the personnel necessary to conduct our operations, whether through directly hiring employees or by obtaining the services of personnel employed by Western or others. All of the personnel that will conduct our business immediately following the closing of this offering will be employed or contracted by our general partner and its affiliates, including Western, but we sometimes refer to these individuals in this prospectus as our employees because they provide services directly to us.

10

Table of Contents

Index to Financial Statements

Principal Executive Offices and Internet Address

Our principal executive offices are located at 123 W. Mills Avenue, El Paso, Texas 79901 and our telephone number is (915) 534-1400. Our website will be located at . We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (the “SEC”), available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

Summary of Conflicts of Interest and Duties

General. Under our partnership agreement, our general partner has a duty to manage us in a manner it believes to be in the best interests of our partnership. However, because our general partner is a wholly owned subsidiary of Western, the officers and directors of our general partner also have a duty to manage our general partner in a manner that is in the best interests of Western. Consequently, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and its affiliates, including Western, on the other hand.

Partnership Agreement Replacement of Fiduciary Duties. Our partnership agreement limits the liability and eliminates and replaces the fiduciary duties of our general partner to our unitholders, and also restricts the remedies available to our unitholders for actions that might otherwise constitute a breach of our general partner’s duties. By purchasing a common unit, each purchaser agrees to be bound by the terms of our partnership agreement. Each unitholder is also treated as having consented to various actions and potential conflicts of interest contemplated in the partnership agreement that might otherwise be considered a breach of fiduciary or other duties.

For a more detailed description of the conflicts of interest and duties of our general partner, please read “Conflicts of Interest and Duties.”

11

Table of Contents

Index to Financial Statements

| Common units offered to the public |

common units. |

| common units if the underwriters exercise their option to purchase an additional common units (the “option units”) in full. |

| Units outstanding after this offering |

common units and subordinated units, for a total of limited partner units, regardless of whether the underwriters exercise their option to purchase any of the option units, representing a 100% limited partner interest in us. Of this amount, common units will be issued to Western or a wholly owned subsidiary of Western at the closing of this offering and, assuming the underwriters do not exercise their option to purchase any of the option units, all such option units will be issued to Western, upon the expiration of the underwriters’ option exercise period. However, if the underwriters exercise their option to purchase any portion of the option units, we will (1) issue to the public the number of option units purchased by the underwriters pursuant to such exercise, and (2) issue to Western, upon the expiration of the option exercise period, all remaining option units. Any such option units issued to Western will be issued for no additional consideration. Accordingly, the exercise of the underwriters’ option will not affect the total number of common units outstanding or the amount of cash needed to pay the minimum quarterly distribution on all units. In addition, our general partner will own a non-economic general partner interest in us. |

| Use of proceeds |

We intend to use the estimated net proceeds of approximately $ million from this offering, based upon the assumed initial public offering price of $ per common unit (the midpoint of the price range set forth on the cover of this prospectus), after deducting underwriting discounts, structuring fees and offering expenses, as follows: |

| • | we will retain $50 million for general partnership purposes; and |

| • | we will distribute the balance of any net proceeds to Western in partial consideration of its contribution of assets to us in connection with this offering and to reimburse Western for certain capital expenditures incurred with respect to such assets. We will not be required to pay additional consideration for the contributed assets or reimburse additional pre-closing capital expenditures, except as described above. For more information about the book value of the assets to be contributed to us and distributions to Western from the net proceeds of this offering, please see “Dilution.” |

| If the underwriters exercise their option to purchase additional common units in full, the additional net proceeds to us would be |

12

Table of Contents

Index to Financial Statements

| approximately $ million. The net proceeds from any exercise by the underwriters of their option to purchase additional common units from us will be distributed to Western. |

| Cash distributions |

Upon completion of this offering, our partnership agreement will provide for a minimum quarterly distribution of $ per common unit and subordinated unit ($ per common unit and subordinated unit on an annualized basis) to the extent we have sufficient cash after establishment of reserves and payment of fees and expenses, including payments to our general partner and its affiliates. We refer to this cash as “available cash,” and it is defined in our partnership agreement included in this prospectus as Appendix A. Our ability to pay the minimum quarterly distribution is subject to various restrictions and other factors described in more detail under the caption “Our Cash Distribution Policy and Restrictions on Distributions.” |

| For the first quarter that we are publicly traded, we anticipate that we will pay investors in this offering a prorated distribution covering the period from the completion of this offering through , 2013, based on the actual length of that period. |

| Our partnership agreement requires us to distribute all of our available cash each quarter in the following manner: |

| • | first, to the holders of common units, until each common unit has received the minimum quarterly distribution of $ plus any arrearages from prior quarters; |

| • | second, to the holders of subordinated units, until each subordinated unit has received the minimum quarterly distribution of $ ; and |

| • | third, to all unitholders, pro rata, until each unit has received a distribution of $ . |

| If cash distributions to our unitholders exceed $ per unit in any quarter, our general partner, as the holder of our incentive distribution rights, will receive distributions according to the following percentage allocations: |

| Marginal Percentage Interest in Distributions | ||||

| Total Quarterly Distribution |

Unitholders |

General Partner (as | ||

| above $ up to $ |

85.0% | 15.0% | ||

| above $ up to $ |

75.0% | 25.0% | ||

| above $ |

50.0% | 50.0% | ||

| We refer to these distributions as “incentive distributions.” Please read “How We Make Distributions to Our Partners.” |

13

Table of Contents

Index to Financial Statements

| We believe, based on our financial forecast and related assumptions included in “Our Cash Distribution Policy and Restrictions on Distributions,” that we will have sufficient available cash to pay the minimum quarterly distribution of $ on all of our common units and subordinated units for each quarter in the twelve months ending September 30, 2014. However, we do not have a legal obligation to pay quarterly distributions at our minimum quarterly distribution rate or at any other rate, except as provided in our partnership agreement. If we do not generate sufficient cash from operations we may, but are not required to, borrow funds to pay the minimum quarterly distribution to our unitholders. There is no guarantee that we will distribute quarterly cash distributions to our unitholders in any quarter. Please read “Our Cash Distribution Policy and Restrictions on Distributions.” |

| If we had completed this offering and related transactions on July 1, 2012, our unaudited pro forma cash available for distribution for the twelve-month period ended June 30, 2013 would have been approximately $29.2 million. This amount would have been sufficient to pay the minimum quarterly distribution of $ per unit per quarter ($ per unit on an annualized basis) on all of our common units and a cash distribution of $ per unit per quarter ($ per unit on an annualized basis), or approximately % of the minimum quarterly distribution, on all of our subordinated units for such period. |

| If we had completed this offering and related transactions on January 1, 2012, our unaudited pro forma cash available for distribution for the year ended December 31, 2012 would have been approximately $34.2 million. This amount would have been sufficient to pay the minimum quarterly distribution of $ per unit per quarter ($ per unit on an annualized basis) on all of our common units and a cash distribution of $ per unit per quarter ($ per unit on an annualized basis), or approximately % of the minimum quarterly distribution, on all of our subordinated units for such period. |

| Subordinated units |

Western will initially own, directly or indirectly, all of our subordinated units. The principal difference between our common units and subordinated units is that in any quarter during the subordination period, holders of the subordinated units are not entitled to receive any distribution until the common units have received the minimum quarterly distribution plus any arrearages in the payment of the minimum quarterly distribution from prior quarters. Subordinated units will not accrue arrearages. |

| Conversion of subordinated units |

The subordination period will end on the first business day after we have earned and paid distributions of available cash of at least (1) $ (the minimum quarterly distribution on an annualized basis) on each outstanding common and subordinated unit for each of three consecutive, non-overlapping four-quarter periods ending on or after , 2016, or (2) $ (150% of the annualized minimum |

14

Table of Contents

Index to Financial Statements

| quarterly distribution) on each outstanding common and subordinated unit and the related distributions on the incentive distribution rights for any four-quarter period ending on or after , 2014, in each case provided there are no arrearages in the payment of the minimum quarterly distributions on our common units at that time. |

| The subordination period also will end upon the removal of our general partner other than for cause if no subordinated units or common units held by the holder(s) of subordinated units or their affiliates are voted in favor of that removal. |

| When the subordination period ends, all subordinated units will convert into common units on a one-for-one basis, and thereafter common units will no longer be entitled to arrearages. |

| Our general partner’s right to reset the target distribution levels |

Our general partner, as the initial holder of all of our incentive distribution rights, has the right, at any time when there are no subordinated units outstanding and it has received incentive distributions at the highest level to which it is entitled (50.0%) for each of the prior four consecutive whole fiscal quarters, to reset the initial target distribution levels at higher levels based on our cash distributions at the time of the exercise of the reset election. If our general partner transfers all or a portion of our incentive distribution rights in the future, then the holder or holders of a majority of our incentive distribution rights will be entitled to exercise this right. Following a reset election, the minimum quarterly distribution will be adjusted to equal the reset minimum quarterly distribution, and the target distribution levels will be reset to correspondingly higher levels based on the same percentage increases above the reset minimum quarterly distribution. |

| If our general partner elects to reset the target distribution levels, it will be entitled to receive a number of common units equal to the number of common units that would have entitled their holder to an aggregate quarterly cash distribution in the quarter prior to the reset election equal to the distribution to our general partner on the incentive distribution rights in the quarter prior to the reset election. Please read “How We Make Distributions to Our Partners—Our General Partner’s Right to Reset Incentive Distribution Levels.” |

| Issuance of additional units |

Our partnership agreement authorizes us to issue an unlimited number of additional units without the approval of our unitholders. Please read “Units Eligible for Future Sale” and “The Partnership Agreement—Issuance of Additional Interests.” |

| Limited voting rights |

Our general partner will manage and operate us. Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights on matters affecting our business. Our unitholders will have no right to elect our general partner or its directors on an annual |

15

Table of Contents

Index to Financial Statements

| or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 66 2/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon consummation of this offering, Western will own an aggregate of % of our outstanding voting units (or % of our outstanding voting units, if the underwriters exercise their option to purchase additional common units in full). This will give Western the ability to prevent the removal of our general partner. Please read “The Partnership Agreement—Voting Rights.” |

| Limited call right |

If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner will have the right, but not the obligation, to purchase all of the remaining common units at a price equal to the greater of (1) the average of the daily closing price of the common units over the 20 trading days preceding the date three days before notice of exercise of the call right is first mailed, and (2) the highest per-unit price paid by our general partner or any of its affiliates for common units during the 90-day period preceding the date such notice is first mailed. Please read “The Partnership Agreement—Limited Call Right.” Upon consummation of this offering, and assuming no exercise of the underwriters’ option to purchase additional common units, our general partner and its affiliates will own, directly or indirectly, % of our outstanding common units. At the end of the subordination period, assuming no additional issuances of units (other than upon the conversion of the subordinated units), our general partner and its affiliates will own % of our outstanding common units. |

| Estimated ratio of taxable income to distributions |

We estimate that if you own the common units you purchase in this offering through the record date for distributions for the period ending December 31, 2015, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be % or less of the cash distributed to you with respect to that period. For example, if you receive an annual distribution of $ per unit, we estimate that your average allocable federal taxable income per year will be no more than approximately $ per unit. Thereafter, the ratio of allocable taxable income to cash distributions to you could substantially increase. Please read “Material U.S. Federal Income Tax Consequences—Tax Consequences of Unit Ownership” for the basis of this estimate. |

| Material federal income tax consequences |

For a discussion of the material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read “Material U.S. Federal Income Tax Consequences.” |

16

Table of Contents

Index to Financial Statements

| Directed unit program |

At our request, the underwriters have reserved for sale up to % of the common units being offered by this prospectus for sale at the initial public offering price to the directors and executive officers of our general partner and Western, and certain other employees and consultants of Western and its affiliates. We do not know if these persons will choose to purchase all or any portion of these reserved common units, but any purchases they do make will reduce the number of common units available to the general public. Please read “Underwriting—Reserved Common Units.” |

| Exchange listing |

We intend to apply to list our common units on the NYSE under the symbol “WNRL.” |

17

Table of Contents

Index to Financial Statements

Summary Historical and Pro Forma Financial Data

The following table shows summary historical combined financial data of the Predecessor, and summary unaudited pro forma combined financial data of Western Refining Logistics, LP for the periods and as of the dates indicated. The summary historical combined financial statements of the Predecessor, as of and for the years ended December 31, 2012, and December 31, 2011, are derived from the audited combined financial statements of the Predecessor appearing elsewhere in this prospectus. The summary historical interim combined financial data of the Predecessor as of and for the six months ended June 30, 2013, and for the six months ended June 30, 2012, are derived from the unaudited interim combined financial statements of the Predecessor appearing elsewhere in this prospectus. The following table should be read together with, and is qualified in its entirety by reference to, the historical and unaudited pro forma combined financial statements and the accompanying notes included elsewhere in this prospectus. The table should also be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary unaudited pro forma combined financial statements presented in the following table as of and for the six months ended June 30, 2013, and for the year ended December 31, 2012, are derived from the unaudited pro forma combined financial statements included elsewhere in this prospectus. The unaudited pro forma combined balance sheet assumes the offering and the related transactions occurred as of June 30, 2013, and the unaudited pro forma combined statements of operations for the six months ended June 30, 2013 and the year ended December 31, 2012, assume the offering and the related transactions occurred as of January 1, 2012. These transactions include, and the unaudited pro forma combined financial statements give effect to, the following:

| • | Western’s contribution of certain of the Predecessor’s assets to us and the elimination of certain of the Predecessor’s assets that will not be contributed to us; |

| • | our entering into a new $300 million revolving credit facility, under which there will be no borrowings at the closing of this offering; |

| • | our entering into two 10-year commercial agreements with Western, and the recognition of crude oil gathering and transportation, terminalling and storage revenue under those agreements at rates that were not recognized on a historical basis by the Predecessor; |

| • | our entering into an omnibus agreement and services agreement with Western; |

| • | the completion of this offering, and our issuance of (i) our non-economic general partner interest and all of our incentive distribution rights to our general partner; (ii) common units and subordinated units, representing an aggregate % limited partner interest in us to Western and its subsidiaries; and (iii) common units, representing a % limited partner interest in us, to the public; and |

| • | the application of the net proceeds of this offering as described in “Use of Proceeds.” |

The unaudited pro forma combined financial statements do not include $3.5 million in estimated incremental general and administrative expenses that we expect to incur annually as a result of being a separate publicly traded partnership.

18

Table of Contents

Index to Financial Statements

| Western Refining Logistics, LP Predecessor |

Western Refining Logistics, LP |

|||||||||||||||||||||||

| Six months ended June 30, |

Year ended December 31, |

Six months ended June 30, |

Year ended December 31, |

|||||||||||||||||||||

| (in thousands, except per unit amounts) |

2013 | 2012 | 2012 | 2011 | 2013 | 2012 | ||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| Combined statements of income: |

||||||||||||||||||||||||

| Revenues (1): |

||||||||||||||||||||||||

| Affiliate |

$ | 1,919 | $ | 1,714 | $ | 3,167 | $ | 2,439 | $ | 50,482 | $ | 100,385 | ||||||||||||

| Third-party |

519 | 381 | 678 | 992 | 519 | 678 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenues |

2,438 | 2,095 | 3,845 | 3,431 | 51,001 | 101,063 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating costs and expenses: |

||||||||||||||||||||||||

| Operating and maintenance expenses |

34,072 | 26,606 | 58,667 | 53,766 | 28,754 | 51,347 | ||||||||||||||||||

| General and administrative expenses |

2,190 | 2,035 | 4,227 | 4,045 | 2,190 | 4,227 | ||||||||||||||||||

| Loss (gain) on disposal of assets |

— | 335 | 335 | (26,687 | ) | — | 335 | |||||||||||||||||

| Depreciation and amortization expense |

5,816 | 5,833 | 11,620 | 12,694 | 4,832 | 9,527 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating costs and expenses |

42,078 | 34,809 | 74,849 | 43,818 | 35,776 | 65,436 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income (loss) |

(39,640 | ) | (32,714 | ) | (71,004 | ) | (40,387 | ) | 15,225 | 35,627 | ||||||||||||||

| Other income (expense): |

||||||||||||||||||||||||

| Interest expense and other financing costs |

— | — | — | — | (742 | ) | (1,485 | ) | ||||||||||||||||

| Other, net |

6 | 4 | 12 | 14 | 6 | 12 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) before income taxes |

(39,634 | ) | (32,710 | ) | (70,992 | ) | (40,373 | ) | 14,489 | 34,154 | ||||||||||||||

| Provision for income taxes |

— | — | — | — | (203 | ) | (448 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | (39,634 | ) | $ | (32,710 | ) | $ | (70,992 | ) | $ | (40,373 | ) | $ | 14,286 | $ | 33,706 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) per limited partner unit (basic and diluted): |

||||||||||||||||||||||||

| Common units |

||||||||||||||||||||||||

| Subordinated units |

||||||||||||||||||||||||

| Combined balance sheets (at period end): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | — | $ | — | $ | — | $ | 50,000 | ||||||||||||||||

| Property, plant, and equipment, net |

164,783 | 134,596 | 120,015 | 137,443 | ||||||||||||||||||||

| Total assets |

165,254 | 135,331 | 120,384 | 189,243 | ||||||||||||||||||||

| Total liabilities |

2,963 | 5,558 | 2,450 | — | ||||||||||||||||||||

| Division equity |

162,291 | 129,773 | 117,934 | — | ||||||||||||||||||||

| Partners’ capital |

— | — | — | 250,000 | ||||||||||||||||||||

| Total liabilities, division equity, and partners’ capital |

165,254 | 135,331 | 120,384 | 189,243 | ||||||||||||||||||||

| Combined statements of cash flows: |

||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

(36,083 | ) | (26,974 | ) | (57,331 | ) | (53,603 | ) | ||||||||||||||||

| Investing activities |

(36,069 | ) | (6,258 | ) | (25,500 | ) | 36,069 | |||||||||||||||||

| Financing activities |

72,152 | 33,232 | 82,831 | 17,534 | ||||||||||||||||||||

| Other financial data: |

||||||||||||||||||||||||

| Capital Expenditures: |

||||||||||||||||||||||||

| Maintenance |

1,542 | 2,464 | 5,922 | 3,302 | 1,542 | 5,922 | ||||||||||||||||||

| Expansion |

34,462 | 4,037 | 20,839 | 656 | 34,462 | 20,839 | ||||||||||||||||||

| EBITDA (2) |

$ | (33,818 | ) | $ | (26,877 | ) | $ | (59,372 | ) | $ | (27,679 | ) | $ | 20,063 | $ | 45,166 | ||||||||

19

Table of Contents

Index to Financial Statements

| (1) | Our assets have historically been a part of the integrated operations of Western, and the Predecessor generally recognized only the costs and did not record revenue associated with the transportation, terminalling, or storage services provided to Western on an intercompany basis. Accordingly, the revenues in the Predecessor’s historical combined financial statements relate only to amounts received from third parties for these services and minimum amounts required to be recorded for Western for local tax purposes. Following the closing of this offering, our revenues will be generated by existing third-party contracts and from the commercial agreements that we will enter into with Western at the closing of this offering. Pro forma revenues reflect recognition of affiliate revenues generated by pipeline and gathering assets and terminalling, transportation and storage assets to be contributed to us at the closing of this offering that were not previously recorded in the historical financial records of the Predecessor. |

| (2) | We define EBITDA as net income (loss) before net interest expense, income taxes, and depreciation and amortization. For a reconciliation of EBITDA to our most directly comparable financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”), please read “Selected Historical and Pro Forma Financial Data—Non-GAAP Financial Measures.” |

20

Table of Contents

Index to Financial Statements

Limited partner interests are inherently different from capital stock of a corporation, although many of the business risks that we are subject to are similar to those that would be faced by a corporation engaged in similar businesses. You should carefully consider the following risk factors together with all of the other information included in this prospectus in evaluating an investment in our common units.

If any of the following risks were actually to occur, our business, financial condition, results of operations or cash flows could be materially adversely affected. In that case, we might not be able to pay the minimum quarterly distribution or any distributions at all on our common units, the trading price of our common units could decline and you could lose all or part of your investment.

Western accounts for substantially all of our revenues, and therefore we are subject to the business risks of Western. If Western changes its business strategy, is unable to satisfy its obligations under our commercial agreements for any reason or significantly reduces the volumes transported through our pipelines and gathering systems or handled at our terminals, our revenues would decline and our financial condition, results of operations, cash flows, and ability to make distributions to our unitholders would be adversely affected.