Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATHEON INC | d592277d8k.htm |

| EX-99.1 - EX-99.1 - PATHEON INC | d592277dex991.htm |

Patheon

Fiscal 2013 Third Quarter Results

September 5, 2013

Exhibit 99.2 |

1

Forward-looking statements

This

presentation

contains

forward-looking

statements

or

information

which

reflect

our

expectations

regarding

possible

events,

conditions,

our

future

growth,

results

of

operations,

performance,

and

business

prospects

and

opportunities.

All

statements,

other

than

statements

of

historical

fact,

are forward-

looking

statements.

Forward-looking

statements

necessarily

involve

significant

known

and

unknown

risks,

assumptions

and

uncertainties

that

may

cause

our

actual

results

in

future

periods

to

differ

materially

from

those

expressed

or

implied

by

such

forward-looking

statements,

including

risks

related

to

acquisitions

and

divestitures,

our

operational

excellence

initiatives

and

transformation

activities,

our

exposure

to

complex

production

issues,

our

substantial

financial

leverage,

international

operations,

competition,

government

regulations,

customer

demand,

potential

environmental,

health

and

safety

liabilities,

existence

of

a

majority

shareholder,

and

product

liability

claims.

For

additional

information

regarding

risks

and

uncertainties

that

could

affect

our

business

and

our

financial

results,

please

see

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

October

31,

2012

and

our

subsequent

filings

with

the

U.S.

Securities

and

Exchange

Commission

and

the

Canadian

Securities

Administrators.

Accordingly,

you

are

cautioned

not

to

place

undue

reliance

on

forward-looking

statements.

These

forward-looking

statements

are

made

as

of

the

date

hereof,

and

except

as

required

by

law,

we

assume

no

obligation

to

update

or

revise

them

to

reflect

new

events

or

circumstances.

Use of Non-GAAP Financial Measures

Commencing

in

fiscal

2013,

we

revised

our

calculation

of

Adjusted

EBITDA

to

exclude

stock-based

compensation

expense,

consulting

costs

related

to

our

operational

initiatives,

purchase

accounting

adjustments,

and

acquisition-related

litigation

expenses.

We

believe

that

excluding

these

items

from

Adjusted

EBITDA

better

reflects

our

underlying

performance.

Based

on

the

revisions

to

the

definition

of

Adjusted

EBITDA,

we

have

recast

the

presentation

of

Adjusted

EBITDA

for

the

three

and

nine

months

periods

ended

July

31,

2012

to

be

consistent

with

the

current

period

presentation.

Our

Adjusted

EBITDA

is

now

income

(loss)

from

continuing

operations

before

repositioning

expenses,

interest

expense,

foreign

exchange

losses

reclassified

from

other

comprehensive

income

(loss),

refinancing

expenses,

acquisition

and

integration

costs

(including

certain

product

returns

and

inventory

write-offs

recorded

in

gross

profit),

gains

and

losses

on

sale

of

capital

assets,

income

taxes,

asset

impairment

charges,

depreciation

and

amortization,

stock-based

compensation

expense,

consulting

costs

related

to

our

operational

initiatives,

purchase

accounting

adjustments,

acquisition-related

litigation

expenses

and

other

income

and

expenses.

Adjusted

EBITDA

margin

is

Adjusted

EBITDA

as

a

percentage

of

revenues.

Since

Adjusted

EBITDA

is

a

non-GAAP

measure

that

does

not

have

a

standardized

meaning,

it

may

not

be

comparable

to

similar

measures

presented

by

other

issuers.

Readers

are

cautioned

that

Adjusted

EBITDA

should

not

be

construed

as

an

alternative

to

net

income

(loss)

determined

in

accordance

with

U.S.

GAAP

as

an

indicator

of

performance.

Adjusted

EBITDA

is

used

by

management

as

an

internal

measure

of

profitability.

We

have

included

Adjusted

EBITDA

because

we

believe

that

this

measure

is

used

by

certain

investors

to

assess

our

financial

performance

before

non-cash

charges

and

certain

costs

that

we

do

not

believe

are

reflective

of

our

underlying

business.

A

reconciliation

of

Adjusted

EBITDA

to

the

closest

U.S.

GAAP

measure

is

included

with

the

financial

statements

in

this

press

release. |

2

•

Revenues increased by 30.4% from prior year

•

Gross profit improved by $15.6 million or 28.1% compared to the

same period last year

•

Adjusted EBITDA increase of $4.6 million from prior year

•

Banner integration complete and yielding benefits

•

On track to achieve more than $1 billion in revenue in fiscal year 2013

Fiscal 2013 third quarter highlights |

3

Strengthen

core operations

Sell business

differently

Enter logical

adjacencies

Drive industry

consolidation

•

Delivered $42M in

Adjusted EBITDA

savings in 2012 and on

track to deliver above

$30M in 2013

•

Right First Time and On

Time Delivery metrics

continue to improve

across our facilities

•

Talent upgrades across

several facilities

•

Executive sponsor

program for key

accounts driving right

level of dialogue

•

New project proposals

continue to grow across

many customers

•

Banner integration

complete and yielding

attractive results

•

Additional technology

and/or company

opportunities being

explored linked to

differentiated model

•

High degree of consolidation activity

underway across CDMO industry

•

Customer market research indicates

that building an integrated offering at

scale is an attractive proposition

Strategy |

4

Key accomplishments

CMO

Revenue increased by 35.4% compared to the

same quarter last year, including Banner

Factory performance, improved customer matrix,

Right First Time, On Time Delivery

PDS

Strong revenue of $37.9 million

7.1% year-over-year growth

Ongoing results from operating

excellence and top line growth

Product Updates

FDA approval of Calcitriol

Positive results from Entericare

(fish oil) clinical trial

First-to-file PIV ANDA for

Diclofenac |

5

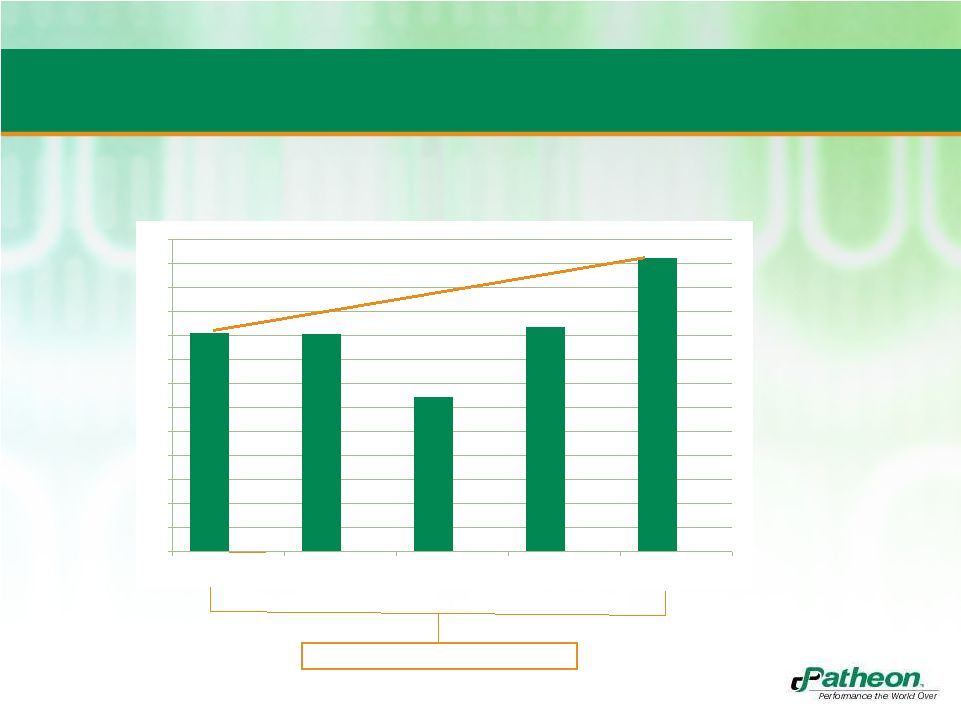

203.7

210.0

213.5

253.9

265.7

100

120

140

160

180

200

220

240

260

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

Revenues increased by $62.0

million from prior year

Banner represented $66.4

million of the increase

Revenues

(U.S. $ in millions)

30.4% yr-yr revenue growth |

6

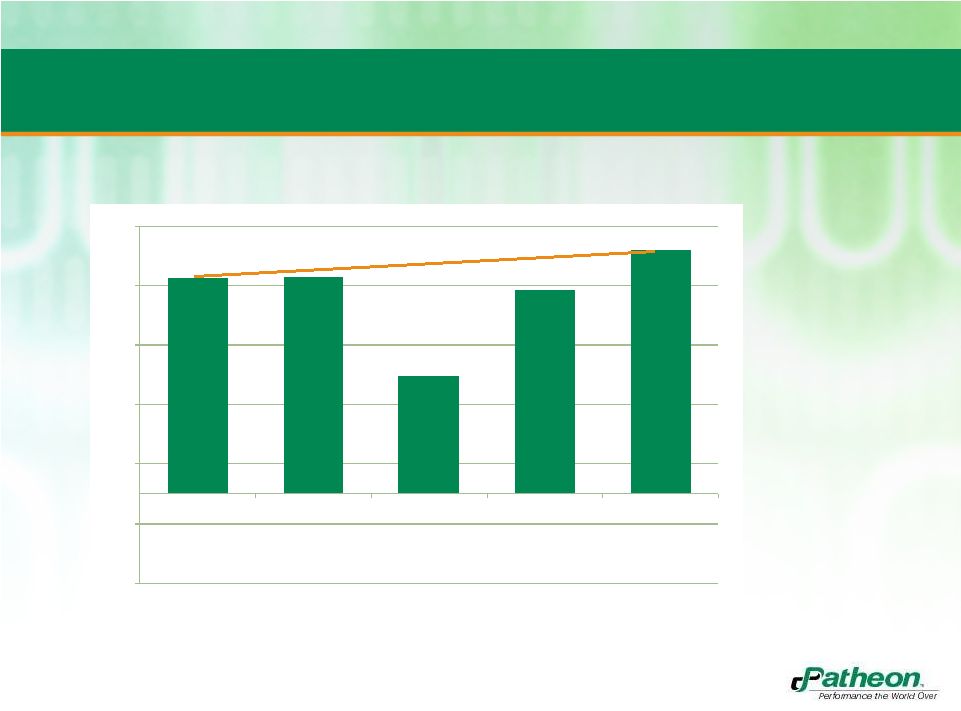

55.5

55.4

42.4

57.0

71.1

10

15

20

25

30

35

40

45

50

55

60

65

70

75

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

Gross profit increased by $15.6

million from prior year

Gross Profit

(U.S. $ in millions)

28.1% yr-yr gross profit growth |

7

Adjusted EBITDA increase of $4.6 million from prior year

36.4

36.5

19.8

34.4

41.0

-15

-5

5

15

25

35

45

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

Adjusted EBITDA

(U.S. $ in millions) |

8

Summary financial results

Three months ended July 31,

Statement of Operations

2013

2012

Change

(in millions of U.S. dollars)

$

$

$

Revenues

265.7

203.7

62.0

Gross Profit

71.1

55.5

15.6

Selling, general and administrative expenses

44.8

29.9

14.9

Operating income

16.6

25.5

(8.9)

Income from continuing operations

4.3

15.5

(11.2)

Adjusted EBITDA

41.0

36.4

4.6

Balance Sheets

Q3 2013

Q4 2012

Cash and cash equivalents

40.9

39.4

Inventories

144.3

82.3

Intangible assets

70.6

-

Goodwill

45.3

3.5

Deferred tax liabilities (LT & ST)

57.7

23.0

Total debt (LT & ST)

610.4

313.1

Undrawn lines of credit

63.4

64.4 |

9

•

Provide industry leading customer experience

–

Right First Time

–

On Time Delivery

•

Exceed industry growth rates

•

Continue to improve financial results

–

Margin expansion

–

Free cash flow

–

Enhance shareholder value

2013 priorities |

10

Thank you |

11

Appendix

ADJUSTED EBITDA BRIDGE

Three months ended July 31,

Nine months ended July 31,

2013

2012

2013

2012

$

$

$

$

Total Adjusted EBITDA

41.0

36.4

95.2

51.0

Depreciation and amortization

(12.4)

(9.3)

(35.6)

(30.8)

Repositioning expenses

(4.5)

(0.1)

(11.0)

(6.9)

Acquisition and integration costs

(1.2)

—

(15.4)

—

Interest expense, net

(12.6)

(6.8)

(35.0)

(19.8)

Impairment charge

(1.2)

—

(11.3)

(57.9)

Gain on sale of capital assets

—

—

1.6

—

(Provision for) benefit from income taxes

(0.9)

(3.3)

5.5

(3.6)

Refinancing expenses

—

—

(29.2)

—

Operational initiatives related consulting costs

(0.4)

(1.0)

(2.3)

(13.3)

Acquisition-related litigation expenses

(4.0)

—

(4.0)

—

Stock-based compensation expense

(0.7)

(0.7)

(2.4)

(2.5)

Purchase accounting adjustments

—

—

(5.0)

—

Other

1.2

0.3

2.0

0.5

Income (loss) from continuing operations

4.3

15.5

(46.9)

(83.3) |