Attached files

| file | filename |

|---|---|

| EX-3.1.2 - EXHIBIT 3.1.2 - USMetals, Inc. | ex3x1x2.htm |

| EX-14.1 - EXHIBIT 14.1 - USMetals, Inc. | ex14x1.htm |

| EX-5.1 - EXHIBIT 5.1 - USMetals, Inc. | ex5x1.htm |

| EX-3.2 - EXHIBIT 3.2 - USMetals, Inc. | ex3x2.htm |

| EX-23.1 - EXHIBIT 23.1 - USMetals, Inc. | ex23x1.htm |

| EX-10.1 - EXHIBIT 10.1 - USMetals, Inc. | ex10x1.htm |

| EX-3.1.3 - EXHIBIT 3.1.3 - USMetals, Inc. | ex3x1x3.htm |

| EX-3.1.1 - EXHIBIT 3.1.1 - USMetals, Inc. | ex3x1x1.htm |

SECURITIES AND EXCHANGE COMMISSION

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

USMetals, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of

Incorporation or organization)

|

1000

(Primary Standard Industrial

Classification Code Number)

|

88-0463279

(I.R.S. Employer Identification No.)

|

|

4535 W. Sahara Avenue, Suite 200

Las Vegas, NV 89102

(702) 933-4034

(Address and Telephone Number of Registrant’s Principal Executive Offices and Principal Place of Business)

|

CSS NEVADA

4535 W. Sahara Avenue, Suite 200

Las Vegas, NV 89102

(702) 933-4030

(Name, Address and Telephone Number of Agent for Service)

|

With a Copy to:

Dennis Brovarone

Attorney at Law

35 Pinyon Pine Road

Littleton, CO 80127

Telephone No.: (303) 589-1388

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities To Be Registered

|

Amount To

Be Registered

|

Offering Price

Per Share (1)

|

Aggregate

Offering Price

|

Amount of

Registration Fee

|

||||||||||||

|

Common stock (2)

|

74,714,452 | $ | 0.001 | $ | 74,715 | $ | 10.20 | |||||||||

|

|

(1) Based on Rule 457 under the Securities Act. The offering price is the par value of $0.001 of the shares to be issued.

|

|

(2) Represents shares held by the Selling Securities Holders, which include the shares to be issued to the USCorp stockholders in the spinoff and others. See “Prospectus Summary - The Offering,” “Plan of Distribution,” and “Selling Securities Holders.”

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion, September 4, 2013

USMetals, Inc.

74,714,452 Shares of Common Stock

This prospectus relates to the offering of up to 74,714,452 shares of the common stock of USMetals, Inc., a Nevada corporation to the stockholders of USCorp, a Nevada corporation, pursuant to a spinoff of the shares of the registrant held by USCorp, and the resale of 35,297,886shares by non-affiliated stockholders. Please refer to “Prospectus Summary - The Offering,” “Plan of Distribution,” and “Selling Securities Holders.”

We will not receive any proceeds as a result of the spinoff to the stockholders of USCorp or from the sale of the shares of our common stock by the Selling Securities Holders. We will bear all expenses in connection with the registration of all of the shares of our common stock covered by this prospectus. We are offering the shares to the stockholders of USCorp without the use of any placement agent. Our fees and expenses associated with this offering are estimated to be $30,000.

The Selling Securities Holders will be offering shares of our common stock. The Selling Securities Holders may sell all or a portion of these shares through registration under the Securities Act of 1933, as amended, from time to time in market transactions through any market on which our common stock is then traded, in negotiated transactions or otherwise, at a price of $0.001 per share for the duration of the offering pursuant to this prospectus. For additional information on the methods of sale, you should refer to the section in this prospectus entitled “Plan of Distribution.”

USCorp, and all of the Selling Securities Holders, and all of the intermediaries through whom the shares of the Selling Securities Holders may be sold are deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. We have agreed to indemnify the Selling Securities Holders against certain liabilities, including liabilities under the Securities Act. We will notify the Selling Securities Holders of their underwriting status and our agreement to indemnify them against certain liabilities, including liabilities under the Securities Act, pursuant to a letter in the form attached to this prospectus as Attachment A.

We are an emerging growth company as described in the Jumpstart Our Business Startups Act (the “JOBS Act”) which was signed into law on April 5, 2012. See “Prospectus Summary.”

The shares of our common stock are not currently listed for sale on any exchange, although we do plan to attempt to have our shares quoted for sale on the “Pink Sheets” or the OTC Bulletin Board after the effective date of this prospectus. However, there can be no assurance that we will be successful in having our shares quoted or traded on any public market.

THE SECURITIES OFFERED HEREBY INVOLVE A HIGH DEGREE OF RISK.

INVESTING IN OUR COMMON STOCK INVOLVES RISKS WHICH ARE DESCRIBED UNDER THE “RISK FACTORS,” SECTION OF THIS PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is ________________, 2013

The information in this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. No one may sell these securities nor may offers to buy be accepted until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer, solicitation or sale is not permitted.

Available Information

We have not previously been subject to the reporting requirements of the Securities and Exchange Commission. We have filed with the Commission a Registration Statement on Form S-1 under the Securities Act with respect to the shares offered hereby. This prospectus does not contain all of the information set forth in the Registration Statement and the Exhibits and Schedules thereto. For further information with respect to our Securities and to us you should review the Registration Statement and the Exhibits and Schedules thereto.

You can inspect the Registration Statement and the Exhibits and Schedules thereto filed with the Commission, without charge, in our files in the Commission’s public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20459. You can also obtain copies of these materials at prescribed rates. You can obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The Commission maintains a web site on the internet that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission at http://www.sec.gov

Reports To Security Holders

As a result of the Registration Statement we are subject to the reporting requirements of the Federal Securities Law, and are required to file periodic reports and other information with the SEC. We will furnish our security holders with annual reports containing audited financial statements certified by independent public accountants following the end of each fiscal year and quarterly reports containing unaudited financial information for the first three quarters of each fiscal year following the end of such fiscal quarter.

2

Table of Contents

|

Prospectus Summary

|

4

|

|

Risk Factors

|

10

|

|

Use of Proceeds

|

19

|

|

Capitalization and Determination of Offering Price

|

19

|

|

Dilution

|

20

|

|

Business

|

21

|

|

Description of Properties

|

25

|

|

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

|

36

|

|

Selling Securities Holders

|

41

|

|

Plan of Distribution

|

48

|

|

Security Ownership of Certain Beneficial Owners and Management

|

52

|

|

Directors, Executive Officers and Control Persons

|

53

|

|

Executive Compensation

|

56

|

|

Certain Relationships and Related Transactions

|

56

|

|

Legal Matters

|

57

|

|

Experts

|

57

|

|

Attachment A

|

Attachment A

|

| Financial Statements | F-1 |

3

Prospectus Summary

This summary highlights information described more fully elsewhere in this prospectus. You should read the entire prospectus carefully. In this prospectus, “USMetals,” “USMI”, the “Company,” “we,” “us” and “our” refer to USMetals, Inc., a Nevada corporation.

The Company

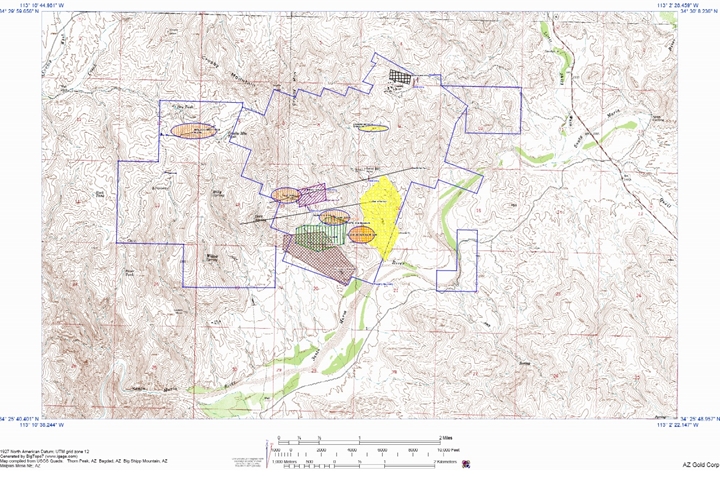

USMetals was incorporated in 2000 and since 2002 has been a wholly owned subsidiary of USCorp, Inc. USMetals is the holder of 276 unpatented mining claims known as the Twin Peaks Project through its wholly owned subsidiary, AGC Corp, an Arizona corporation (“AGCAZ”), the record holder of the claims. The Twin Peaks mining claims are located in West-Central Arizona, in the Eureka Mining District of Yavapai County, Arizona, approximately 42 miles west of Prescott, Arizona. In 2007 USCorp conducted a so called “feasibility study”, actually a scoping study, on the Twin Peaks Project that identified mineralized material on the property. During fiscal 2009 and 2009 USCorp completed Phase 1, Phase 2 and Phase 2.5 of a 3-phase drilling program. In 2012 USCorp completed Phase 3 of the 2008 and 2009 drilling program. The scoping study was performed and used in preparation for the exploration program and is not to determine the feasibility of profitable exploration. In May 2012, USCorp determined that spinning off USMetals as a separate company would be the best method of pursuing exploration and development of the Twin Peaks Project. The record date for the spinoff is July 1, 2013.

The Offering

This prospectus relates to the offering of up to 74,714,452 shares of the common stock of USMetals, Inc., a Nevada corporation, $0.001 par value per share, to the stockholders of USCorp, a Nevada corporation, pursuant to a spinoff of the shares of the registrant held by USCorp and the resale of 35,297,886 shares of our common stock by non-affiliated stockholders. Please refer to “Prospectus Summary - The Offering” “Selling Securities Holders” and “Plan of Distribution.”

We will not receive any proceeds as a result of the spinoff to the stockholders of USCorp, or from the sale of the shares of our common stock by the Selling Securities Holders. We will bear all expenses in connection with the registration of all of the shares of our common stock covered by this prospectus. We are offering the shares to the stockholders of USCorp without the use of any placement agent.

Our fees and expenses associated with this offering are estimated to be $30,000.

The Selling Securities Holders will be offering shares of our common stock. The Selling Securities Holders may sell all or a portion of these shares through registration under the Securities Act of 1933, as amended, from time to time in market transactions through any market on which our common stock is then traded, in negotiated transactions or otherwise, at a price of $0.001 per share for the duration of the offering pursuant to this prospectus. For additional information on the methods of sale, you should refer to the section in this prospectus entitled “Plan of Distribution.”

USCorp, all of the Selling Securities Holders, and all of the intermediaries through whom the shares of the Selling Securities Holders may be sold are deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. We have agreed to indemnify the Selling Securities Holders against certain liabilities, including liabilities under the Securities Act. We will notify the Selling Securities Holders of their underwriting status and our agreement to indemnify them against certain liabilities, including liabilities under the Securities Act, pursuant to a letter in the form attached to this prospectus as Attachment A.

The offering price per share of $0.001 is the par value of the shares to be issued in connection with the proposed spinoff. There will be no commissions paid in connection with the spinoff shares as described in this prospectus. Please refer to the “Plan of Distribution” section of this prospectus. The shares of our common stock are not currently listed for sale on any exchange, although we do plan to attempt to have our shares quoted for sale on the “Pink Sheets” or the OTC Bulletin Board after the effective date of this prospectus. However, there can be no assurance that we will be successful in having our shares quoted or traded on any public market.

4

The Spinoff

On May 30, 2012, USCorp, a Nevada corporation, determined to spinoff all of the shares of USMetals, Inc., a Nevada corporation, held by USCorp to the holders of USCorp common and preferred stock. USMetals has been a wholly-owned subsidiary of USCorp since 2002. USCorp will affect the spinoff by distributing on the effective date as a non-taxable distribution, the shares at the rate of one share of USMI common stock for every ten shares of USCorp Common Stock outstanding, and one share of USMI common stock for every ten shares of Common Stock underlying the eight to one conversion rights of the outstanding USCorp Series A Preferred Stock and the two for one conversion rights of the outstanding Series B Preferred Stock. The revised record date for the dividend is July 1, 2013 and the distribution date will be set as soon as the registration of our common stock under the Securities Act of 1933 is effective and our filing with the Financial Industry Regulatory Agency (FINRA) is complete. The purpose of the distribution is to establish USMetals as a separate company and facilitate the financing and development of its business independently of other properties of USCorp and its subsidiaries.

The following table illustrates the USCorp dividend distribution.

|

Type of USCorp Equity

|

Outstanding as of 7/1/2013

|

Right to Common Stock

|

Dividend @ 1 for 10

|

|||

|

A Preferred

|

25,600,000

|

204,800,000

|

20,480,000

|

|||

|

B Preferred

|

105,000

|

210,000

|

21,000

|

|||

|

Common

|

542,154,519

|

0

|

54,215,452

|

|||

|

Total

|

74,714,452

|

|||||

Inasmuch as USCorp will distribute 74,714,452 shares of our common stock to the to the USCorp stockholders, following the spinoff, USCorp will own no shares of USMetals, which means that USMetals will be a fully independent company, although there may not be any active market for our shares. No vote of USCorp stockholders was required in connection with the spinoff, however on May 30, 2012 a majority of the voting shares of the company voted in favor of the spinoff. USCorp has approximately 1,200 stockholders of record, including the shares held by Cede & Co. for the benefit of various unknown stockholders. The USCorp stockholders will not be required to pay any cash or other consideration for the shares of USMetals common stock distributed to them as a result of the spinoff or to surrender or exchange their shares of USCorp common stock to receive the distribution of USMetals common stock.

Reasons for the Spinoff

USMetals, Inc. believes that our separation from USCorp will provide the following benefits:

Improved positioning for each company to pursue distinct minerals exploration and development opportunities intended to facilitate capital formation and management expertise on distinct exploration and development projects.

More efficient allocation of capital, which will allow each company to develop an independent investment program without the constraints of a holding company, conglomerate structure.

Facilitate engaging separate management with the intention of focusing exclusively on the distinct exploration opportunities for stockholder value creation.

USCorp also considered a number of potentially negative factors in evaluating the spinoff, including:

The potential loss of synergies from operating as one company and potential increased costs;

5

Potential loss of joint purchasing power;

Potential disruptions to the businesses as a result of the spinoff;

Risks of being unable to achieve the benefits expected to be achieved by the spinoff;

The risk that the spinoff might not be completed;

The costs of the spinoff; and

The risk that the quoted price of a share of USCorp common stock after the spinoff plus the quoted price of a share of USMetals common stock distributed will, in the aggregate, be less than the quoted price of a share of USCorp common stock before the spinoff.

USCorp concluded that the potential long-term benefits of the spinoff outweighed these factors.

In view of the wide variety of factors considered in connection with the evaluation of the spinoff and the complexity of these matters, USCorp did not find it useful to, and did not attempt to, quantify, rank or otherwise assign relative weights to the factors considered.

At the present time, USMetals is a subsidiary of USCorp, with our corporate activities directed by the USCorp board of directors. Following the spinoff USMetals will be owned by the USCorp stockholders as of July 1, 2013, and not USCorp. Management of USCorp will continue as our management. However, we intend to bring on additional management personnel and expand our board of directors as conditions and finances warrant.

USMetals has no present plans to be acquired or to merge with another company nor does USMetals or USCorp have plans to enter into a change of control or similar transaction.

Current Operations of USCorp

USCorp will continue to be engaged in mineral exploration and development by virtue of its explorations operations through its wholly owned subsidiary Imperial Metals, Inc.

When and How the USMetals Shares Will be Distributed

The USMetals shares will be distributed by USMetals as of 5:00 p.m., New York, New York time, on the effective date of the registration statement of which this prospectus is a part (the “Distribution Date”) by causing the shares of USMetals common stock to be registered in accounts established in the ownership records of USMetals.

Registered Holders. If any USCorp stockholder owns shares in registered form, the USMetals shares distributed to him will be registered in his name, the USCorp common stockholder will become the record holder of that number of shares of USMetals common stock equal to 1 USMetals share for each 10 USCorp shares, with fractional shares rounded up to the next whole share. Registered Series A and Series B Preferred stockholders will receive a distribution of one share of USMI common stock for every ten shares of Common Stock underlying the eight to one conversion rights of the outstanding USCorp Series A Preferred Stock and the two for one conversion rights of the outstanding Series B Preferred Stock.

Street Name Holders. If any USCorp stockholder shares are held in a brokerage account or with a nominee, the distribution will be credited to the account of his brokerage firm or nominee. The USCorp stockholder’s broker/nominee will in turn credit his account for the USMetals shares that he is entitled to receive. This could take up to two weeks from the Distribution Date.

Fractional Shares. We will not deliver any fractional shares of USMetals common stock in connection with the spinoff. Instead, we will round up to nearest whole and deliver rounded up shares to each USCorp stockholder.

6

Book-Entry Registration. USMetals common stock will be issued in book-entry form through the Direct Registration System. USMetals’ transfer agent and registrar, Computershare, 350 Indiana Street, Suite 750, Golden CO 80401, telephone 1 303.262.0678, will hold each USCorp stockholder’s book-entry shares. If an USCorp stockholder wishes to receive a physical certificate after the Distribution Date, he should contact Computershare.

Distribution Statement. Following the Distribution Date, a distribution statement will be sent to each USCorp stockholder showing his ownership interest in USMetals common stock. We currently estimate that it will take up to 10 days from the Distribution Date to complete the mailings of distribution statements.

Dissenters’ Right of Appraisal

Nevada law does not provide for a right of a stockholder to dissent to the spinoff.

U.S. Federal Income Tax Consequences

We have not obtained any tax opinion with respect to the spinoff. Therefore, all USCorp stockholders should consult with their own tax advisers to determine whether or not the spinoff will be tax-free to our common stockholders for U.S. federal income tax purposes, specifically as to whether or not the USCorp common stockholders who receive our shares will recognize a gain or loss by reason of the receipt of shares of USMetals common stock as a result of the spinoff.

We are an Emerging Growth Company

Pursuant to Section 107 of the Jumpstart Our Business Startups Act (the “JOBS Act”) which was signed into law on April 5, 2012, we have elected to claim the exemption provided to emerging growth companies.

The JOBS Act provides an “IPO on ramp” for “emerging growth companies” (a newly created category of issuer under the Securities Act), which are issuers with annual gross revenues of less than $1 billion during the most recently completed fiscal year. Emerging growth companies may take advantage of the scaled disclosure requirements that already have been available to “smaller reporting companies” (defined by the Securities Act as companies having a public float of less than $75 million). The scaled disclosure includes a requirement to include only two, rather than three, years of audited financial statements in the issuer’s initial public offering (“IPO”) registration statement and, during the “IPO on ramp” period, the ability to omit the auditor’s attestation on internal control over financial reporting required by the Sarbanes-Oxley Act of 2002.

Also during the “IPO on ramp” period, emerging growth companies would not need to submit say-on-pay votes to their stockholders (including say-on-pay frequency or golden parachute votes) and would face more limited executive compensation disclosure requirements than larger companies.

Changes to the IPO process itself are likely the most significant aspects of the new emerging growth company regime. The JOBS Act allows an emerging growth company to submit its IPO registration statement on a confidential basis, with the result that any sensitive information contained in the registration statement would not be immediately publicly available. The ability for an emerging growth company to maintain confidentiality and avoid disclosing that it is contemplating an offering until it is ready to do so is significant.

However, the initial confidential submission and any subsequent amendments must be publicly filed at least 21 days before the issuer’s road show. In addition, the JOBS Act permits an emerging growth company to “test the waters” by communicating orally or in writing with qualified institutional buyers or other accredited investors to gauge interest in a contemplated securities offering, even if a registration statement has not yet been filed, and permits analysts to publish research reports about an emerging growth company that is going public even if the analyst’s firm is one of the underwriters in the issuer’s IPO.

These emerging growth company and “IPO on ramp” provisions can be taken advantage of not only by any issuers who go public in the future, but also by any issuer that has consummated an IPO since December 9, 2011. The “IPO on ramp” period ends upon the earliest of:

7

The last day of the fiscal year in which the issuer achieves annual gross revenues of at least $1 billion;

The last day of the fiscal year following the fifth anniversary of the issuer’s IPO;

The issuance of more than $1 billion in non-convertible debt during the previous three years; or

The issuer’s becoming a “large accelerated filer” (which generally is an issuer with at least $700 million in public float).

While the JOBS Act by no means overhauls the IPO process for emerging growth companies, it may help minimize the “time to market” and fill in a gap for companies wishing to undertake an IPO that now qualify as emerging growth companies but did not previously qualify as smaller reporting companies, and it reduces audit-related costs and lessens certain ongoing reporting requirements.

The JOBS Act also provides scaled disclosure requirements within registration statement, as follows:

Two years audited financials and two years selected financial data (in lieu of the former requirements for three years audited and five years selected financial data);

The emerging growth company’s management discussion and analysis only needs to cover years for which the company’s financials are provided; and

The SEC has indicated emerging growth companies currently in registration may amend to scale back disclosure; however, issuers may be required to add disclosure to explain changes.

With respect to executive compensation, emerging growth companies can follow the disclosure requirements for smaller reporting company (generally companies with public float of less than $75 million) under Regulation S-K. However, unless the SEC issues guidance to the contrary, an already existing issuer that is an emerging growth company but does not qualify as smaller reporting company will not get benefit of reduced executive compensation disclosure.

Under the JOBS Act, emerging growth companies need only provide the following with respect to executive compensation:

Top three executives (principal executive officer plus two other most highly compensated who earned more than $100,000 in the last fiscal year), rather than the top five;

One year of compensation disclosure required for a registration statement on Form S-1, the same as current rules (but going forward, only need two years instead of current three year requirement); and

May omit compensation disclosure and certain compensation tables.

Emerging growth companies have scaled disclosure after an initial public offering, as follows:

After an IPO, an issuer can take advantage of additional exemptions and reduced disclosure requirements as long as it qualifies as an emerging growth company, including:

Auditor attestation requirements of Section 404(b) of Sarbanes-Oxley Act of 2002;

Compensation disclosure and other executive compensation disclosure as noted above;

Disclosure required for the top three, rather than the top five named executive officers, as noted above;

Disclosure required for two, rather than three years, as noted above; and

Dodd-Frank compensation disclosure requirements (say on pay, say on pay frequency, say on golden parachute, pay for performance graph and chief executive officer pay ratio).

8

After ceasing to qualify as an emerging growth company:

The issuer must hold first say on pay vote not later than the end of one year period beginning on the date the issuer ceases to be an emerging growth company, or the end of the three year period beginning on the date the emerging growth company ceases to qualify as an emerging growth company, if issuer has been an emerging growth company for less than two years after its first registered sale of equity securities;

Extended phase-in for new or revised accounting standards. An emerging growth company will not need to comply with such standards until those standards also apply to private companies;

Emerging growth companies will also be permitted to use any longer phase-in periods for private companies for any new or revised accounting standards;

PCAOB rules, including, exempted from any rules mandating audit firm rotation and auditor discussion and analysis if such rules are adopted, and any new rules subject to SEC determination that such rules are “necessary or appropriate in the public interest” after considering investor protection and “whether the action will promote efficiency, competition and capital formation.”

Rules for research coverage for an emerging growth company have been changed to provide:

New safe harbor rules that provides that broker-dealer publication of research report about an emerging growth company will not constitute an offer, even if broker-dealer is part of syndicate;

FINRA research restrictions during post-offering period or prior to expiration of lockup under NASD Rule 2711(f) will not apply to post- IPO reports issued in connection with an emerging growth company; and

Research analysts may meet with accountants or members of an emerging growth company’s management before and after filing, including in presence of or in coordination with investment bankers.

The JOBS Act does not explicitly preempt existing rules and does not expressly address rulemaking by national securities exchanges thus, it is unclear if the exchanges are still permitted to maintain independent conflict of interest rules.

What continues to apply under the JOBS Act:

Antifraud provisions regarding analyst research;

Conflicts of interest rules between analysts and investment banking;

Analyst certification requirements; and

Restrictions on analyst conduct, compensation, supervision and related matters under NASD Rule 2711 and Global Research Analyst Settlement of 2003.

9

Risk Factors

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risks Relating to Our Business

Lack of Operating History and Earnings.

The Company has limited operating history and no revenues. The Company expects to incur further losses in the foreseeable future due to significant costs associated with its business development, and the business development of its subsidiaries, including costs associated with its acquisition of new mining claims and/or operations. There can be no assurance that the Company’s operations will ever generate sufficient revenues to fund its continuing operations, or that the Company will ever generate positive cash flow from its operations, or that the Company will attain or thereafter sustain profitability in any future period.

Dependence Upon Management; Possible Conflict of Interest.

The Company is totally dependent upon the personal efforts of its current management. Our officers and directors have duties and affiliations with other companies which may be a present a conflict of interest regarding decisions they make for USMetals. The loss of any officer or director of the Company could have a material adverse effect upon its business and future prospects. The Company does not presently have key-man life insurance upon the life of any of its officers or directors. None of our management are chemists, metallurgists, mining engineers or geologists and as such do not have the technical experience in exploring for, starting, and/or operating a mine. Upon adequate funding management intends to hire qualified and experienced personnel, including additional officers and directors, and mining specialists, professionals and consulting firms to advise management as needed; however there can be no assurance that management will be successful in raising the necessary funds, recruiting, hiring and retaining such qualified individuals. Such consultants have no fiduciary duty to the Company or its shareholders, and may not perform as expected. The success of the Company will, in significant part, depend upon the efforts and abilities of management, including such consultants as are or may be engaged in the future.

Risks Inherent In Exploration and Mining Operations.

Mineral exploration is highly speculative and capital intensive. Most exploration efforts are not successful, in that they do not result in the discovery of mineralization of sufficient quantity or quality to be profitably mined. The Company’s Mining Claims are also indirectly subject to all hazards and risks normally incidental to developing and operating mining properties. These risks include insufficient ore reserves, fluctuations in production costs that may make mining of reserves uneconomic; significant environmental and other regulatory restrictions; and the risks of injury to persons, property or the environment. In particular, the profitability of gold mining operations is directly related to the price of gold. The price of gold fluctuates widely and is affected by numerous factors that are beyond the control of any mining company. These factors include expectations with respect to the rate of inflation, the exchange rates of the dollar and other currencies, interest rates, global or regional political, economic or banking crises, and a number of other factors. If the price of gold should drop dramatically, the value of the Mining Claims could also drop dramatically, and the Company might then be unable to recover its investment in those interests or properties. Selection of a property for exploration or development; the determination to construct a mine and to place it into production, and the dedication of funds necessary to achieve such purposes, are decisions that must be made long before the first revenues from production will be received. Price fluctuations between the time that such decisions are made and the commencement of production can drastically affect the economics of a mine. The volatility of gold prices represents a substantial risk, generally, which no amount of planning or technical expertise can eliminate.

10

Uncertainty of Reserves and Mineralization Estimates.

There are numerous uncertainties inherent in estimating proven and probable reserves and mineralization, including many factors beyond the Company’s control. The estimation of reserves and mineralization is a subjective process and the accuracy of any such estimates is a function of the quality of available data and of engineering and geological interpretation and judgment. Results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may justify revision of such estimates. No assurances can be given that the volume and grade of reserves recovered and rates of production will not be less than anticipated. Assumptions about prices are subject to great uncertainty and gold prices have fluctuated widely in the past. Declines in the market price of gold or other precious metals also may render reserves or mineralization containing relatively lower grades of ore uneconomic to exploit. Changes in operating and capital costs and other factors including, but not limited to, short-term operating factors such as the need for sequential development of ore bodies and the processing of new or different ore grades, may materially and adversely affect reserves.

Environmental Risks.

Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Insurance against environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is not generally available to the Company (or to other companies within the gold industry) at a reasonable price. To the extent the Company becomes subject to environmental liabilities, the satisfaction of any such liabilities would reduce funds otherwise available and could have a material adverse effect on the Company. Laws and regulations intended to ensure the protection of the environment are constantly changing, and are generally becoming more restrictive.

Proposed Federal Legislation.

Beginning in the 1990s, the U.S. Congress adopted revisions of the General Mining Law of 1872, which governs the creation of mining claims and related activities on Federal public lands in the United States. Similarly, the U. S. Congress and the Clinton Administration eliminated the U.S. Bureau of Mines, which was the agency responsible for gathering and maintaining data on mines throughout the United States. Beyond changes to the existing laws, the Congress or the Obama Administration may propose or adopt new laws; any such revisions could also impair USMetals’ ability to develop, in the future, any mineral prospects that are located on unpatented mining claims on Federal lands.

Title to Properties.

The validity of unpatented mining claims, which constitute all of the Company’s property holdings, is often uncertain and such validity is always subject to contest. Unpatented mining claims are unique property interests and are generally considered subject to greater title risks than patented mining claims, or other real property interests that are owned in fee simple. The Company has not filed any patent applications for any of its properties that are located on Federal public lands in the United States, and, under changes to the General Mining Law, patents may not be available for such properties. Although management believes it has taken requisite action to acquire satisfactory title to its undeveloped properties, it does not intend to go to the expense to obtain title opinions until financing is secured to develop the property, with the attendant risk that title to some properties, particularly title to undeveloped properties, may be defective.

Competition.

There is aggressive competition within the minerals industry to discover and acquire properties considered to have commercial potential. The Company will compete for promising gold exploration projects with other entities, many of which have greater financial and other resources than the Company. In addition, the Company will compete with other firms in its efforts to obtain financing to explore and develop mineral properties.

The Company’s Financial Statements Contain a “Going Concern Qualification.”

The Company may not be able to operate as a going concern. The independent auditors’ report accompanying its financial statements contains an explanation that the Company’s financial statements have been prepared assuming that it will continue as a going concern. Note 1 to these financial statements indicates that the Company is in the exploration stage and needs additional funds to implement its plan of operations. This condition raises substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Uncertainty As To Management’s Ability To Control Costs And Expenses.

With respect to the Company’s exploration of its mining properties and the implementation of commercial operations, management cannot accurately project or give any assurance, with respect to its ability to control exploration and operating costs and/or expenses. Consequently, if management is not able to adequately control costs and expenses, such operations may not generate any profit or may result in operating losses.

11

No Dividends.

The Company has not paid any dividends nor, by reason of its present financial status and contemplated financial requirements, does it anticipate paying any dividends in the foreseeable future.

We do not have a traditional credit facility with a financial institution.

This absence may adversely impact our operations. We do not have a traditional credit facility with a financial institution, such as a working line of credit. The absence of a facility could adversely impact our operations, as it may constrain our ability to have the working capital for equipment purchases or other operational requirements. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our business development efforts. Without credit facilities, the Company could be forced to cease operations and investors in our securities could lose their entire investment.

The JOBS Act allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies.

Since, we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act, this election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

If we ever become a publicly quoted company, we may have difficulty in attracting and retaining management and outside independent members to our board of directors as a result of their concerns relating to their increased personal exposure to lawsuits and stockholder claims by virtue of holding these positions in a publicly quoted company.

The directors and management of publicly quoted corporations are increasingly concerned with the extent of their personal exposure to lawsuits and stockholder claims, as well as governmental and creditor claims which may be made against them, particularly in view of recent changes in securities laws imposing additional duties, obligations and liabilities on management and directors. Due to these perceived risks, directors and management are also becoming increasingly concerned with the availability of directors and officers’ liability insurance to pay on a timely basis the costs incurred in defending such claims. We currently do not carry limited directors and officers’ liability insurance. Directors and officers’ liability insurance has recently become much more expensive and difficult to obtain. If we are unable to continue or provide directors and officers’ liability insurance at affordable rates or at all, it may become increasingly more difficult to attract and retain qualified outside directors to serve on our board of directors.

We may lose potential independent board members and management candidates to other companies that have directors’ and officers’ liability insurance to insure them from liability or to companies that have revenues or have received greater funding to date which can offer more lucrative compensation packages. The fees of directors are also rising in response to their increased duties, obligations and liabilities as well as increased exposure to such risks. As a company with limited operating history and resources, we will have a more difficult time attracting and retaining management and outside independent directors than a more established company due to these enhanced duties, obligations and liabilities.

We may incur significant costs to ensure compliance with U.S. corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer’s liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

12

Risks Related to Our Common Stock

We will be subject to the “penny stock” rules which will adversely affect the liquidity of our common stock.

The Company’s stock is defined as a “penny stock” under Rule 3a51-1 adopted by the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended. In general, a “penny stock” includes securities of companies which are not listed on the principal stock exchanges or NASDAQ and have a bid price in the market of less than $5.00; and companies with net tangible assets of less than $2,000,000 ($5,000,000 if the issuer has been in continuous operation for less than three years), or which has recorded revenues of less than $6,000,000 in the last three years. “Penny stocks” are subject to rule 15g-9, which imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses, or individuals who are officers or directors of the issuer of the securities). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. Consequently, this rule may adversely affect the ability of broker-dealers to sell the Company’s stock, and therefore, may adversely affect the ability of the Company’s stockholders to sell stock in the public market.

Because directors and officers currently and for the foreseeable future will continue to control USMetals, it is not likely that you will be able to elect directors or have any say in the policies of USMetals.

Our shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring shareholder approval will be decided by majority vote. The directors and officers of USMetals beneficially own approximately 30.8% of our outstanding common stock. Due to such significant ownership position held by our insiders, new investors may not be able to effect a change in our business or management, and therefore, shareholders would have no recourse as a result of decisions made by management.

The sale of shares by our directors and officers may adversely affect the market price for our shares.

Sales of significant amounts of shares held by our officers and directors, or the prospect of these sales, could adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Since we intend to retain any earnings for development of our business for the foreseeable future, you will likely not receive any dividends for the foreseeable future.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

A significant number of our shares will be eligible for sale and their sale or potential sale may depress the market price of our common stock.

Sales of a significant number of shares of our common stock in the public market could harm the market price of our common stock. As additional shares of our common stock become available for resale in the public market, the supply of our common stock will increase, which could decrease its price. In addition some or all of the shares of common stock may be offered from time to time in the open market pursuant to Rule 144, and these sales may have a depressive effect on the market for our shares of common stock. Subject to certain restrictions, a person who has held restricted shares for a period of six months may sell common stock into the market.

13

We may, in the future, issue additional Common Shares which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 200,000,000 Shares of Common Stock. The future issuance of our authorized Common Shares, may result in substantial dilution in the percentage of our Common Shares held by our then existing stockholders. We may value any Common Shares issued in the future on an arbitrary basis. The issuance of Common Shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the Common Shares held by our investors, and might have an adverse effect on any trading market for our Common Shares.

Because of the early stage of exploration and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its exploration. We are seeking to commence operations in the highly competitive mining industry, and we have yet to operate our first planned mining operation. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date, and there is little likelihood that we will generate any revenues or realize any profits in the short to medium term. Any profitability in the future from our business will be dependent upon our successfully implementing our business plan, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to undertake our business operations.

The elimination of monetary liability against the Company’s directors, officers and employees under Nevada law and the existence of indemnification rights to the Company’s directors, officers and employees may result in substantial expenditures by the Company and may discourage lawsuits against the Company’s directors, officers and employees.

The Company’s certificate of incorporation contains a specific provision that eliminates the liability of directors for monetary damages to the Company and the Company’s stockholders; further, the Company is prepared to give such indemnification to its directors and officers to the extent provided by Nevada law. The Company may also have contractual indemnification obligations under its employment agreements with its executive officers. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which the Company may be unable to recoup. These provisions and resultant costs may also discourage the Company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties and may similarly discourage the filing of derivative litigation by the Company’s stockholders against the Company’s directors and officers even though such actions, if successful, might otherwise benefit the Company and its stockholders.

There is no market for our shares. If we become a publicly quoted company, our common stock will most likely be thinly quoted, so you may be unable to sell at or near bid prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

Our shares are not quoted or quoted on any securities market. If our shares become publicly traded or quoted for sale, our common stock will be sporadically or “thinly-quoted” on the “Pink Sheets,” and possibly on the Over-the-Counter Bulletin Board, meaning that the number of persons interested in purchasing our common stock at or near ask prices at any given time may be relatively small or nonexistent. This situation will be attributable to a number of factors, including the fact that we are a small company which will be relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable.

As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a mature issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. It is possible that a broader or more active public trading market for our common stock will not develop or be sustained, or that trading levels will not continue.

OTC Markets, informally known as the “Pink Sheets,” is an electronic quotation system operated by OTC Markets Group that displays quotes from broker-dealers for many over-the-counter securities. These securities tend to be inactively quoted stocks, including penny stocks and those with a narrow geographic interest. Market makers and other brokers can use OTC Markets to publish their bid and ask quotation prices. The term Pink Sheets is no longer in use formally.

14

The OTC Markets is not a stock exchange. To be quoted in the OTC Markets, companies do not need to fulfill any financial reporting requirements with the SEC. The companies quoted in the OTC Markets tend to be closely held, extremely small, thinly quoted, or bankrupt. Most do not meet the minimum U.S. listing requirements for trading on a stock exchange such as the New York Stock Exchange. Many of these companies do not file periodic reports or audited financial statements with the SEC, making it very difficult for investors to find reliable, unbiased information about those companies.

There are three reporting standards that OTCQX, OTCQB and OTC Pink companies can follow to provide disclosure to investors:

|

§

|

International Information Standard: Rule 12g3-2(b) under the Securities Exchange Act (“Rule 12g3-2(b)”) permits non-U.S. companies with securities listed primarily on a qualified non-U.S. exchange to make publicly available to U.S investors in English the same information that is made publicly available in their home countries as an alternative to SEC reporting. Companies following this standard may be on the OTC Pink marketplace, and if they elect to and are able to comply by additional disclosure and financial requirements, trade on OTC Markets Group’s best marketplace OTCQX

|

|

§

|

U.S. Reporting Standard: Companies are in compliance with their SEC reporting requirements or are current in their periodic reporting requirements to a U.S. banking or insurance regulator. Companies following this standard may be on the OTCQB marketplace, and if qualified by higher financial standards, the OTCQX marketplace

|

|

§

|

Alternative Reporting Standard: When SEC registration is not required, companies must generally still make information publicly available pursuant to Federal securities laws, including Rule 10b-5 under the Exchange Act and pursuant Rule 144(c)(2) under the Securities Act. OTC Markets Group offers the Alternative Reporting Standard for companies who choose to make material information publicly available to investors

OTCQX U.S companies not reporting to the SEC can follow the Alternative Reporting Standard. These companies submit information pursuant to the OTCQX U.S. Disclosure Guidelines and are subject to the eligibility requirements and terms of the OTCQX Rules for U.S. Companies. OTCQX companies provide current and potential investors with a set of "material" information to help investors make a sound investment decision. OTCQX company disclosure enables an investor to understand the company’s business operations and prospects

OTC Pink companies may publish disclosure in accordance with the OTC Pink Basic Disclosure Guidelines. These requirements are designed to give an investor the basic information a broker-dealer must maintain under Exchange Act Rule 15c2-11 in order to initiate a quote in a security on the OTCQX, OTCQB or OTC Pink marketplaces.

|

A Company's Obligations on the OTCQX, OTCQB and OTC Pink Marketplaces

|

§

|

Financial Reporting - Many companies are not subject to SEC registration requirements, and therefore, do not make regular filings of financial information and other corporate events with the SEC. Companies are not required to provide financial information to OTC Markets Group; however in order for investors to make informed trading decisions, many companies elect to provide disclosure. For a detailed explanation of SEC registration and reporting requirements and the exemptions available from those requirements.

|

15

|

§

|

Corporate Actions - SEC Rule 10b-17 requires all OTCQX, OTCQB and OTC Pink companies to provide timely notice to FINRA of certain corporate actions, including dividends, stock splits, reverse splits, name changes, mergers, acquisitions, dissolutions, bankruptcies or liquidations, at least 10 days prior to the record date. Companies who fail to report such corporate actions in the required time may be subject to fines up to $5,000. For more information, see FINRA's Notice to Member 10-38. For further details, contact FINRA’s Operations Department at 866-776-0800

|

The OTCBB is a quotation service for the Financial Industry Regulatory Authority (“FINRA”) market makers, and not an issuer listing service or securities market. The listing requirements that must be met by an OTCBB issuer are given below. There is no minimum bid price requirement.

OTCBB companies are not considered to be “listed.” There are, however, certain requirements an issuer must meet in order for its securities to be eligible for a market maker to enter a quotation on the OTCBB. In order for a security to be eligible for quotation by a market maker on the OTCBB, the security must be registered with the Securities and Exchange Commission or other federal regulatory authority that has proper jurisdiction and the issuer must be current in its required filings with such federal authority.

The stated listing requirements for the OTCBB are as follows:

Fully reporting with the Securities and Exchange Commission;

Not a blank check or inactive company;

Minimum of 40 stockholders of record holding at least 100 shares each (note: this number is informal and has been moving up);

Directors, officers, and stockholders will be scrutinized for previous involvements in other OTCBB companies, in particular, blank check companies; and

Must have a market maker submit a Rule 15c211 application to FINRA and agree to act as market maker for securities of company.

We may need to raise additional capital. If we are unable to raise necessary additional capital, our business may fail or our operating results and our stock price may be materially adversely affected.

Because we need to secure adequate funding, selling additional stock, either privately or publicly, would dilute the equity interests of our stockholders. If we borrow more money, we will have to pay interest and may also have to agree to restrictions that limit our operating flexibility. If we are unable to obtain adequate financing, we may have to curtail our operations and our business would fail.

Our issuance of additional common stock in exchange for services or to repay debt would dilute your proportionate ownership and voting rights and could have a negative impact on the market price of our common stock.

We may generally issue shares of common stock to pay for debt or services, without further approval by our stockholders based upon such factors as our board of directors may deem relevant at that time. It is likely that we will issue additional securities to pay for services and reduce debt in the future. It is possible that we will issue additional shares of common stock under circumstances we may deem appropriate at the time.

16

We have never paid or declared any dividends on our common stock.

We have never paid or declared any dividends on our common stock. Likewise, we do not anticipate paying, in the near future, dividends or distributions on our common stock or our common stock to be sold in this offering. Any future dividends will be declared at the discretion of our board of directors and will depend, among other things, on our earnings, our financial requirements for future operations and growth, and other facts as we may then deem appropriate.

Our directors have the right to authorize the issuance of shares of our preferred stock and additional shares of our common stock.

Our directors, within the limitations and restrictions contained in our articles of incorporation and without further action by our stockholders, has the authority to issue shares of preferred stock from time to time in one or more series and to fix the number of shares and the relative rights, conversion rights, voting rights, and terms of redemption, liquidation preferences and any other preferences, special rights and qualifications of any such series. We have no intention of issuing shares of preferred stock at the present time. Any issuance of shares of preferred stock could adversely affect the rights of holders of our common stock. Should we issue additional shares of our common stock at a later time, each investor’s ownership interest in our stock would be proportionally reduced. No investor will have any preemptive right to acquire additional shares of our common stock, or any of our other securities.

If our shares become publicly quoted and our shares are quoted on the Pink Sheets or the OTCBB, and we fail to remain current in our reporting requirements, we could be removed from the OTCBB, which would limit the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Companies whose shares are quoted for sale on the OTCBB and some whose shares are quoted for sale on the Pink Sheets must be reporting issuers under Section 12 of the Exchange Act, and must be current in their reports under Section 13 of the Exchange Act, in order to maintain price quotation privileges on the Pink Sheets and OTCBB. If our shares become publicly quoted and our shares are quoted for sale on the OTCBB, and we fail to remain current in our reporting requirements, we could be removed from the OTCBB. As a result, the market liquidity for our securities could be adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

If our shares become publicly quoted, the market price for our common stock will most likely be particularly volatile given our status as a relatively unknown company with a small and thinly quoted public float, limited operating history and lack of net revenues which could lead to wide fluctuations in our share price. The price at which you purchase our common stock may not be indicative of the price that will prevail in the trading market.

If our shares become publicly quoted, the market for our common stock will most likely be characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price would be attributable to a number of factors. First, as noted above, the shares of our common stock will likely be sporadically and/or thinly quoted. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our stockholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of shares of our common stock are sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price.

Secondly, we will most likely be a speculative or “risky” investment due to our dependence on an initial flow of corporate consulting assignments and their implementation producing positive results to attract new clients. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer.

17

As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a mature issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. It is possible that a broader or more active public trading market for our common stock will not develop or be sustained, or that current trading levels will continue.

Shares eligible for future sale by our current stockholders may adversely affect our stock price.

The sale of a significant number of shares of common stock at any particular time could be difficult to achieve at the market prices prevailing immediately before such shares are offered. In addition, sales of substantial amounts of common stock, including shares issued upon the exercise of outstanding options and warrants, under Securities and Exchange Commission Rule 144 or otherwise could adversely affect the prevailing market price of our common stock and could impair our ability to raise capital at that time through the sale of our securities.

Anti-takeover provisions may impede the acquisition of USMetals.

Certain provisions of the Nevada Revised Statutes have anti-takeover effects and may inhibit a non-negotiated merger or other business combination. These provisions are intended to encourage any person interested in acquiring USMetals to negotiate with, and to obtain the approval of, our directors, in connection with such a transaction. As a result, certain of these provisions may discourage a future acquisition of USMetals, including an acquisition in which the stockholders might otherwise receive a premium for their shares.

You may be unable to sell your common stock at or above your purchase price, which may result in substantial losses to you.

The following factors may add to the volatility in the price of our common stock: actual or anticipated variations in our quarterly or annual operating results; government regulations, announcements of significant acquisitions, strategic partnerships or joint ventures; our capital commitments; and additions or departures of our key personnel. Many of these factors are beyond our control and may decrease the market price of our common stock, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time, including as to whether our common stock will sustain the current market price, or as to what effect the sale of shares or the availability of common stock for sale at any time will have on the prevailing market price.

We may need to raise additional capital. If we are unable to raise necessary additional capital, our business may fail or our operating results and our stock price may be materially adversely affected.

We may need to secure adequate funding. If we are unable to obtain adequate funding, we may not be able to successfully develop and market our proposed products and our business will most likely fail. We do not have commitments for additional financing. To secure additional financing, we may need to borrow money or sell more securities, which may reduce the value of our outstanding securities. We may be unable to secure additional financing on favorable terms or at all.

Selling additional stock, either privately or publicly, would dilute the equity interests of our stockholders. If we borrow more money, we will have to pay interest and may also have to agree to restrictions that limit our operating flexibility. If we are unable to obtain adequate financing, we may have to curtail business operations, which would have a material negative effect on operating results and most likely result in a lower stock price.

If our shares become publicly quoted, an active trading market in our shares may not be sustained.

If our shares become publicly quoted, an active trading market in our shares may not be sustained. Factors such as those discussed in this “Risk Factors” section may have a significant impact upon the market price of the securities to be distributed by us. Many brokerage firms may not be willing to participate in transactions in a security if a low price develops in the trading of the security. Even if a purchaser finds a broker willing to effect a transaction in our securities, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of our securities as collateral for any loans.

18

The market for penny stocks has suffered in recent years from patterns of fraud and abuse.

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

Boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons;

Excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses.

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, if our shares become publicly quoted, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

Use Of Proceeds

We will not receive any proceeds from the sale of our common stock offered by this prospectus in the spinoff to the USCorp stockholders or from the sale of our common stock by the Selling Securities Holders. See “Selling Securities Holders” and “Plan of Distribution.”

Market Price Of And Dividends On

Our Common Equity And Related Stockholder Matters

As of the date of this prospectus, the shares of our common stock are not quoted for sale on any public market. Following the spinoff, we will have 74,714,452 shares of our common stock issued and outstanding, which will be held of record and beneficially owned by approximately 1,200 stockholders, including the shares held by Cede & Co. for the benefit of various unknown stockholders. As for our shares which we are to issue to the USCorp stockholders by means of this prospectus, and our shares which may be sold subject to the provisions of Rule 144 under the Securities Act, please see “Prospectus Summary - The Offering,” “Selling Securities Holders,” and “Shares Eligible for Future Sale.”

Dividends

We have not paid or declared any dividends on our common stock, nor do we anticipate paying any cash dividends or other distributions on our common stock in the foreseeable future. Any future dividends will be declared at the discretion of our board of directors and will depend, among other things, on our earnings, if any, our financial requirements for future operations and growth, and other facts as our board of directors may then deem appropriate.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans as of the date of this prospectus.

19

Capitalization

The following table sets forth our capitalization as of September 30, 2012 and June 30, 2013.

This information should be read in conjunction with our Management’s Discussion and Analysis or Plan of Operation and our consolidated financial statements and the related notes appearing elsewhere in this prospectus.

We had net losses of $1,067,183 for the year ended September 30, 2012 and $400,417 for the year ended September 30, 2011 included in the accumulated deficit in the table below. Our net loss for the nine months ended June 30, 2013 was $156,476.

|

Actual

09/30/12

|

After

Distribution

|

|||||||

|

Common stock, $0.001 par value per share; 200,000,000 shares authorized, 24,200,000 issued and outstanding as of 09/30/12 and 74,714,452 shares to be issued and outstanding after the distribution,

|

$ | 24,200 | $ | 75,163 | ||||

|

Additional paid-in capital

|

$ | 2,002,707 | $ | 1,926,907 | ||||

|

Accumulated deficit

|

$ | (1,913,156 | ) | $ | (2,069,632 | ) | ||

|

Total stockholders’ equity (deficit)

|

$ | 113,751 | $ | (42,725 | ) | |||

DILUTION

Prior to this offering, we have 100,000,000 shares of our common stock issued and outstanding, and 100% owned by our parent company, USCorp. However, based on the terms of the Spinoff, 74,714,452 of these shares are for the benefit of the USCorp stockholder base as of July 1, 2013. USCorp will return the excess shares to USMetals for cancellation and return to the treasury stock of the Company; USCorp with then own no shares following the spinoff on the effective date of the registration statement of which this prospectus is a part. Our tangible book as of June 30, 2013, was a negative ($2,725,369), which was cash of $2,391, property and equipment of $9,519 and real property of $155,605 less our liabilities of $2,892,884. This calculates out to a negative net tangible book value of ($0.04) per share (74,714,452 total shares).

20

Business