Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - PROSPERITY BANCSHARES INC | d593977dex992.htm |

| 8-K - FORM 8-K - PROSPERITY BANCSHARES INC | d593977d8k.htm |

Merger with F&M Bancorporation Inc.

August 29, 2013

Exhibit 99.1 |

2

“Safe Harbor”

Statement

“Safe Harbor”

Statement

under the Private Securities Litigation Reform Act of 1995

Statements contained in this presentation which are not

historical facts and which pertain to future operating results

of Prosperity Bancshares

®

and its subsidiaries constitute

“forward-looking statements”

within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements involve significant risks and

uncertainties. Actual results may differ materially from the

results discussed in these forward-looking statements. Factors

that might cause such a difference include, but are not limited

to, those discussed in the company’s periodic filings with the

SEC. Copies of the SEC filings for Prosperity Bancshares

®

may be downloaded from the Internet at no charge from

www.prosperitybankusa.com. |

3

Strategic Rationale

Strategic Rationale

•

Expands Prosperity’s presence to the economically attractive Tulsa

market: •

Bolsters commercial lending efforts:

•

Adds the well-established F&M Private Bank

•

Accretive to earnings per share:

•

Prosperity will remain well-capitalized

•

Combined

company

will

surpass

$20

billion

in

total

assets

(1)

(1)

Based on 6/30/13 financial data; pro forma for pending acquisition of

FVNB Corp. –

F&M is currently the 2nd largest bank in Tulsa (by deposits)

–

Combined

franchise

would

be

the

7th

largest

bank

in

Oklahoma

(by

deposits)

–

Adds significant C&I lending focus, including expertise in energy

lending –

Commercial clients in both Oklahoma and Texas

–

Complementary

to

existing

Prosperity

trust

and

wealth

management

businesses

–

Consistent with recently announced acquisition of FVNB Corp.

–

F&M’s 2013 year-to-date efficiency ratio was

76.4% –

Estimated

cost

savings

of

25%

-

30% |

4

Continued Oklahoma Expansion

Continued Oklahoma Expansion

Source: SNL Financial

* Branch count excludes duplicative drive-thru locations

PB* (219)

FVNB* (34)

FMBC (13) |

5

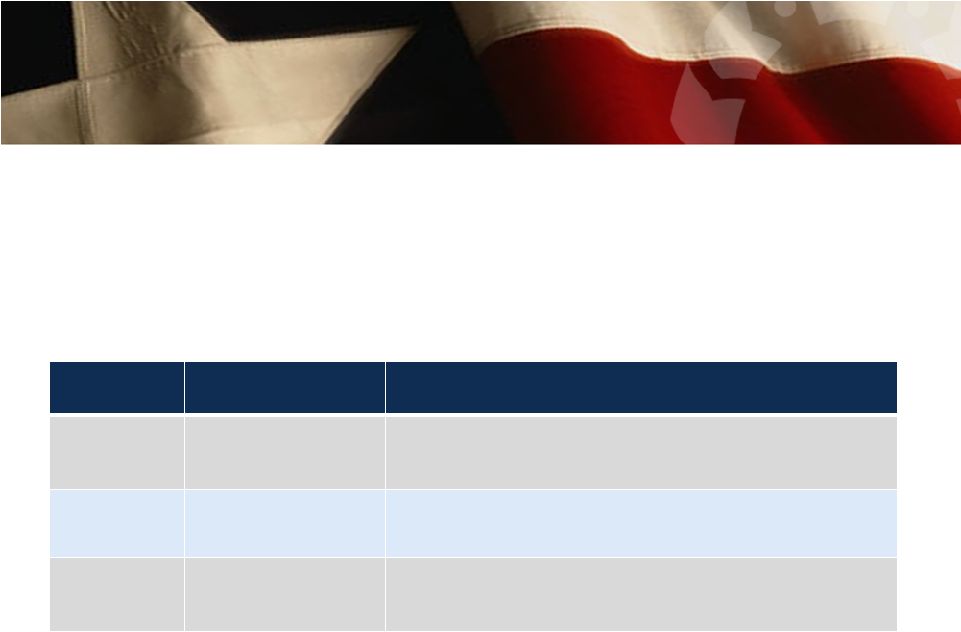

Enhances Oklahoma Market Share

Enhances Oklahoma Market Share

(1)

(2)

Source: SNL Financial

Note: Deposit data as of 6/30/12

Rank

Institution (ST)

Number

of

Branches

Deposits in

Market

($mm)

Market

Share

(%)

1

BOK Financial Corp. (OK)

82

10,313

13.9

2

BancFirst Corp. (OK)

100

5,120

6.9

3

Midland Financial Co. (OK)

55

5,007

6.7

4

Arvest Bank Group Inc. (AR)

101

4,096

5.5

5

JPMorgan Chase & Co. (NY)

33

3,638

4.9

6

Bank of America Corp. (NC)

33

3,202

4.3

Pro Forma

19

2,889

3.9

7

F & M Bancorp. Inc. (OK)

10

1,811

2.4

8

RCB Holding Co. (OK)

30

1,615

2.2

9

Durant Bancorp Inc. (OK)

24

1,546

2.1

10

Southwest Bancorp Inc. (OK)

13

1,381

1.9

11

International Bancshares Corp. (TX)

52

1,313

1.8

12

Prosperity Bancshares Inc. (TX)

9

1,078

1.5

13

Olney Bancshares of Texas Inc. (TX)

19

972

1.3

14

Spirit BankCorp Inc. (OK)

14

879

1.2

15

Ironhorse Financial Group Inc. (OK)

22

877

1.2

Top 15

597

42,848

57.7

Total

1,391

74,258

100.0

Oklahoma Deposit Market Share |

6

Growing Markets of Operation

Growing Markets of Operation

(1)

(2)

Tulsa

Dallas

•

With

a

population

of

over

one

million

in

the

Tulsa

MSA,

it

ranks

as

the

2nd

largest

city,

and

most

densely

populated county

in Oklahoma

•

Diversified economy inclusive of Energy, Finance, Aviation,

Telecommunications and Technology •

Tulsa Port of Catoosa and Tulsa International Airport are home to

extensive industrial parks •

Consistently rated among the best cities in the country to do business

with by Forbes magazine •

Tulsa manufacturing accounts for 60% of Oklahoma’s exports and GDP

growth ranks in the top third nationally •

The Dallas/Ft. Worth MSA is the largest MSA in the state of Texas and

the 4th largest in the United States •

The metropolitan area is a major economic hub for the North Texas

region, is the home to 19 Fortune 500 companies and has the

third busiest airport in the world •

2011 GDP of nearly $400 billion, with a population of 6.5 million and

growing •

Home to AT&T, American Airlines, Texas Instruments and Lockheed

Martin, Dallas/Ft. Worth represents one of the most attractive

economies in the United States |

7

Source: F&M internal documents

•

Founded in 1946, F&M Bank

is the 4th largest bank

headquartered in Oklahoma

•

Operates 13 total locations in

the Tulsa (10) and Dallas (3)

areas

•

Consistent balance sheet

growth through the cycle

•

Markets of operation are both

economically and

demographically attractive

Financial Highlights:

F&M Bancorporation Inc.

Financial Highlights:

F&M Bancorporation Inc.

Year ended,

Year to Date

Dollars in Thousands

12/31/2010

12/31/2011

12/31/2012

6/30/2013

Balance

Sheet

Total Assets

1,560,876

2,021,290

2,309,714

2,436,656

Net Loans (Including HFS)

1,122,138

1,473,187

1,859,216

1,876,423

Securities

45,488

31,882

69,034

112,364

Deposits

1,409,602

1,798,170

2,073,762

2,208,371

Borrowings

57,390

49,497

57,386

45,340

Total Equity (Including Minority Interest)

93,884

156,919

161,535

169,766

Tangible Common Equity

91,470

118,697

123,313

131,544

Balance

Sheet

Ratios

Loans / Deposits (%)

80.5

83.0

90.9

86.0

TCE / TA (%)

5.9

5.9

5.3

5.4

Leverage Ratio (%)

8.4

10.1

9.3

9.1

Tier 1 Capital Ratio (%)

9.9

12.0

10.0

10.2

Total Capital Ratio (%)

11.5

13.2

11.3

11.3

Income

Statement

Net Interest Income

49,892

59,219

78,946

42,284

Provision Expense

7,781

29,954

10,939

350

Noninterest Income (Including Securities Gains)

16,358

10,695

15,280

6,791

Noninterest Expense

49,576

55,747

62,769

37,514

Gain / Loss on Securities

358

(63)

376

0

Pre-tax Income

8,893

(15,787)

20,518

11,211

Net Income Available to Common Shareholders

5,704

(8,131)

12,179

6,869

Profitability

Ratios

ROAA (%)

0.46

(0.41)

0.61

0.60

ROAE (%)

7.20

(6.34)

8.39

8.45

Net Interest Margin (%)

3.58

3.54

3.96

3.78

Efficiency Ratio (%)

75.2

79.7

66.9

76.4

Fee Income / Operating Revenue (%)

24.3

15.4

15.9

13.8

Per

Share

Information

Weighted Average Common Shares Outstanding

2,094

2,455

3,337

3,348

Tangible Book Value per Share ($)

43.68

34.94

33.90

34.69

Dividends ($)

1.00

1.20

2.50

0.26

Earnings Per Share ($)

2.72

(3.31)

3.65

1.84 |

8

Pro Forma Loan Composition

Pro Forma Loan Composition

Source: SNL Financial; data as of or for the quarter ended

6/30/13 Note: Pro forma loan composition excludes purchase

accounting adjustments Loan composition per GAAP and regulatory

filings Prosperity Bancshares, Inc.

Pro Forma

Yield on Loans: 5.89%

Loans / Deposits: 49.4%

Yield on Loans: 5.25%

Loans / Deposits: 76.7%

Yield on Loans: 5.61%

Loans / Deposits: 57.6%

FVNB Corp.

F&M Bancorporation Inc.

Yield on Loans: 5.01%

Loans / Deposits: 86.0%

Residential

R.E.

23.5%

Commercial

R.E.

42.5%

Construction

11.3%

Commercial

& Industrial

17.6%

Consumer &

Other

5.2%

Residential

R.E.

22.2%

Commercial

R.E.

37.0%

Construction

11.8%

Commercial

& Industrial

24.7%

Consumer &

Other

4.3%

Residential

R.E., 10.9%

Commercial

R.E., 21.9%

Construction

6.1%

Commercial

& Industrial,

57.5%

Consumer &

Other, 3.5%

Residential

R.E., 20.8%

Commercial

R.E., 37.5%

Construction,

10.3%

Commercial

& Industrial,

26.6%

Consumer &

Other, 4.7%

Loan Portfolio ($000)

Amount

%

Residential R.E.

1,452,268

23.5%

Commercial R.E.

2,621,209

42.5%

Construction

694,585

11.3%

Commercial & Industrial

1,084,233

17.6%

Consumer & Other

320,188

5.2%

Total Loans & Leases

$6,172,483

100%

Loan Portfolio ($000)

Amount

%

Residential R.E.

366,066

22.2%

Commercial R.E.

609,124

37.0%

Construction

194,510

11.8%

Commercial & Industrial

407,073

24.7%

Consumer & Other

71,499

4.3%

Total Loans & Leases

$1,648,272

100.0%

Loan Portfolio ($000)

Amount

%

Residential R.E.

207,400

10.9%

Commercial R.E.

417,060

21.9%

Construction

116,309

6.1%

Commercial & Industrial

1,092,694

57.5%

Consumer & Other

66,672

3.5%

Total Loans & Leases

$1,900,135

100.0%

Loan Portfolio ($000)

Amount

%

Residential R.E.

$2,025,734

20.8%

Commercial R.E.

$3,647,393

37.5%

Construction

$1,005,404

10.3%

Commercial & Industrial

$2,584,000

26.6%

Consumer & Other

$458,359

4.7%

Total Loans & Leases

$9,720,890

100.0% |

9

Pro Forma Deposit Composition

Pro Forma Deposit Composition

Cost of Deposits: 0.30%

Cost of Deposits: 0.32%

Cost of Deposits: 0.32%

Cost of Deposits: 0.42%

Deposit Portfolio ($000)

Amount

%

Demand Deposits

3,016,205

24.1%

NOW & Other

2,750,305

22.0%

MMDA & Savings

4,240,094

33.9%

Retail Time Deposits

1,133,753

9.1%

Jumbo Time Deposits

1,368,293

10.9%

Total Deposits

$12,508,650

100%

Deposit Portfolio ($000)

Amount

%

Demand Deposits

543,526

25.3%

NOW & Other

557,891

25.9%

MMDA & Savings

617,807

28.7%

Retail Time Deposits

214,234

10.0%

Jumbo Time Deposits

216,421

10.1%

Total Deposits

$2,149,879

100.0%

Deposit Portfolio ($000)

Amount

%

Demand Deposits

623,374

28.2%

NOW & Other

162,491

7.4%

MMDA & Savings

623,468

28.2%

Retail Time Deposits

148,587

6.7%

Jumbo Time Deposits

650,451

29.5%

Total Deposits

$2,208,371

100.0%

Deposit Portfolio ($000)

Amount

%

Demand Deposits

$4,183,105

24.8%

NOW & Other

$3,470,687

20.6%

MMDA & Savings

$5,481,369

32.5%

Retail Time Deposits

$1,496,574

8.9%

Jumbo Time Deposits

$2,235,165

13.3%

Total Deposits

$16,866,900

100.0%

Prosperity

Bancshares,

Inc.

Pro Forma

FVNB Corp.

F&M Bancorporation Inc.

Demand

Deposits,

24.1%

NOW &

Other,

22.0%

MMDA &

Savings,

33.9%

Retail Time

Deposits,

9.1%

Jumbo Time

Deposits,

10.9%

Demand

Deposits,

25.3%

NOW &

Other,

25.9%

MMDA &

Savings,

28.7%

Retail Time

Deposits,

10.0%

Jumbo Time

Deposits,

10.1%

Demand

Deposits,

28.2%

NOW &

Other, 7.4%

MMDA &

Savings,

28.2%

Retail Time

Deposits,

6.7%

Jumbo Time

Deposits,

29.5%

Demand

Deposits,

24.8%

NOW &

Other,

20.6%

MMDA &

Savings,

32.5%

Retail Time

Deposits,

8.9%

Jumbo Time

Deposits,

13.3%

Source: SNL Financial; data as of or for the quarter ended 6/30/13 Note: Pro forma deposit composition excludes

purchase accounting adjustments Deposit

composition per GAAP and regulatory filings |

10

Transaction Terms

Transaction Terms

Merger Partner:

F&M Bancorporation Inc. (OTC: FMBC)

Aggregate Deal Value:

$243.9 million

(1)

Consideration Structure:

3,298,246 shares of Prosperity and $47.0 million of cash

Consideration Mix:

81% stock / 19% cash

(1)

Termination Fee:

$10.0 million plus expenses incurred by Prosperity up to

$750,000 Required Approvals:

Customary regulatory approval; F&M shareholder approval

Due Diligence:

Completed

Anticipated Closing:

First quarter of 2014

(1)

Based on a per share price of Prosperity Bancshares, Inc. common stock

of $59.69, which represents the closing price as of 8/28/13 |

11

Transaction Summary

Transaction Summary

Aggregate Deal Value ($mm)

(1)

$243.9

Transaction

Multiples

LTM Earnings ($15.3mm)

16.0x

Book Value ($131.5mm)

1.85x

Tangible Book Value ($131.5mm)

1.85x

Most Recent Quarter Annualized Earnings ($13.7mm)

17.8x

Core Deposit Premium ($1,558mm)

(2)

7.2%

Source: SNL Financial

F&M’s financials are as of and for the period ended 6/30/13

(1)

Based on a per share price of Prosperity Bancshares, Inc. common stock

of $59.69, which represents the closing price as of 8/28/13 (2) Equal to aggregate deal value

less F&M’s tangible common equity as a percentage of core deposits; core deposits defined as total deposits less jumbo time deposits (greater than $100,000) |

12

Management Retention

Management Retention

Prosperity has placed a very high value on the existing F&M

leadership team and has extended numerous individual employment

agreements to members of the production staff, including existing loan officers and

several managers and supervisory personnel.

In addition, the executive leaders listed below will join Prosperity in

the following capacity: F&M

Member

Current Role

Prosperity Bank Position

Anthony Davis

Chairman and CEO

Chairman –

Tulsa Area / Turtle Creek Banking Center

Eric Davis

President

Vice Chairman –

Tulsa Area / Turtle Creek Banking Center

Jeff Pickryl

President of F&M Bank

President –

Tulsa Area / Turtle Creek Banking Center

|

13

Financial Impact

Financial Impact

Source: SNL Financial

Note: Includes impact of the redemption of FVNB’s $18.0 million

SBLF preferred and F&M’s $38.2 million SBLF preferred

(1)

Pro Forma includes both the pending merger with FVNB Corp. and the

proposed merger with F&M Bancorporation Inc.; estimated closing for the FVNB Corp. merger is the 4th quarter of 2013;

estimated closing for the F&M merger is the 1st quarter of

2014 Includes estimated purchase accounting adjustments

Assumes no asset growth from 6/30/13 through 3/31/14

PB

Prosperity Bancshares, Inc.

FVNB Corp.

F&M Bancorporation Inc.

Pro Forma

(1)

Financial Impact

6/30/13

6/30/13

6/30/13

3/31/14

Balance Sheet ($mm)

Total Assets

$16,270.7

$2,417.1

$2,436.7

$21,272.4

Gross Loans

6,172.5

1,648.3

1,900.1

9,671.0

Total Deposits

12,508.7

2,149.9

2,208.4

16,866.9

Tangible Common Equity

967.8

151.6

131.5

1,214.7

Capital (%)

TCE / TA (%)

6.50%

6.40%

5.40%

6.23%

Leverage Ratio (%)

7.07%

8.72%

9.13%

7.09%

Tier 1 Capital Ratio (%)

14.15%

12.58%

10.15%

12.34%

Total Capital Ratio (%)

14.91%

13.83%

11.28%

12.85% |

|