Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraft Foods Group, Inc. | d591409d8k.htm |

Kraft Foods

Group Barclays Back-to-School Conference

September 4, 2013

Exhibit 99.1 |

Tony Vernon

Chief Executive Officer |

3

Kraft Foods Group, Inc.

Forward-Looking Statements

This

presentation

contains

a

number

of

forward-looking

statements.

The

words

“plan,”

“build,”

“make,”

“improve,”

“invest,”

“focus,”

“will,”

“execute,”

“target”

and

similar

expressions

are

intended

to

identify

the

forward-looking

statements.

Examples

of

forward-looking

statements

include,

but

are

not

limited

to,

statements

regarding

Kraft’s

growth,

progress,

plans,

supply

chain,

productivity,

working

capital,

building

blocks

to

deliver

potential

and

long-term

targets.

These

forward-looking

statements

are

not

guarantees

of

future

performance

and

are

subject

to

a

number

of

risks

and

uncertainties,

many

of

which

are

beyond

Kraft’s

control.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

indicated

in

the

forward-looking

statements

include,

but

are

not

limited

to,

increased

competition;

continued

consumer

weakness

and

weakness

in

economic

conditions;

Kraft’s

ability

to

differentiate

its

products

from

retailer

and

economy

brands;

Kraft’s

ability

to

maintain

its

reputation

and

brand

image;

continued

volatility

and

increases

in

commodity

and

other

input

costs;

pricing

actions;

increased

costs

of

sales;

regulatory

or

legal

changes,

restrictions

or

actions;

unanticipated

expenses

and

business

disruptions;

product

recalls

and

product

liability

claims;

unexpected

safety

or

manufacturing

issues;

Kraft’s

indebtedness

and

its

ability

to

pay

its

indebtedness;

Kraft’s

inability

to

protect

its

intellectual

property

rights;

tax

law

changes;

Kraft’s

ability

to

achieve

the

benefits

it

expects

to

achieve

from

the

spin-off

and

to

do

so

in

a

timely

and

cost-effective

manner;

and

its

lack

of

operating

history

as

an

independent,

publicly

traded

company.

For

additional

information

on

these

and

other

factors

that

could

affect

Kraft’s

forward-looking

statements,

see

Kraft’s

risk

factors,

as

they

may

be

amended

from

time

to

time,

set

forth

in

its

filings

with

the

Securities

and

Exchange

Commission,

including

its

Annual

Report

on

Form

10-K

for

the

year

ended

December

29,

2012.

Kraft

disclaims

and

does

not

undertake

any

obligation

to

update

or

revise

any

forward-looking

statement

in

this

presentation,

except

as

required

by

applicable

law

or

regulation. |

One year ago, we

introduced the new Kraft Foods Group |

5

Kraft Foods Group, Inc.

We laid out our four-part plan

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Redefine

Efficiency |

6

Kraft Foods Group, Inc.

We stated our mission

Make Kraft North American

Food & Beverage Company

THE

Innovator

THE

Strongest Portfolio

THE

Lowest Cost Producer |

7

Kraft Foods Group, Inc.

In February, we outlined our innovation journey

THE

Innovator |

8

Kraft Foods Group, Inc.

Today, we’ll chart our path on costs

THE

Lowest Cost Producer |

Bob Gorski

Executive Vice President, Integrated Supply Chain

9 |

10

Kraft Foods Group, Inc.

We manage a $15 billion value chain

~$15B

Plant

Conversion

Other

Manufacturing

Indirect

Transportation

&

Warehousing

Commodities

Ingredients

&

Packaging

Scrap

& Waste

Total

Value

Chain

$Billions

Cost of Goods Sold ~$12.5B |

11

Kraft Foods Group, Inc.

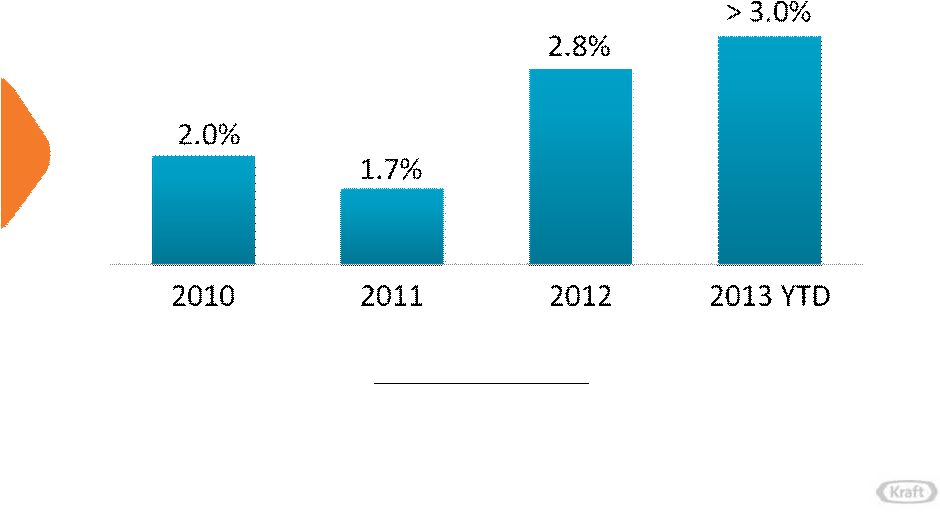

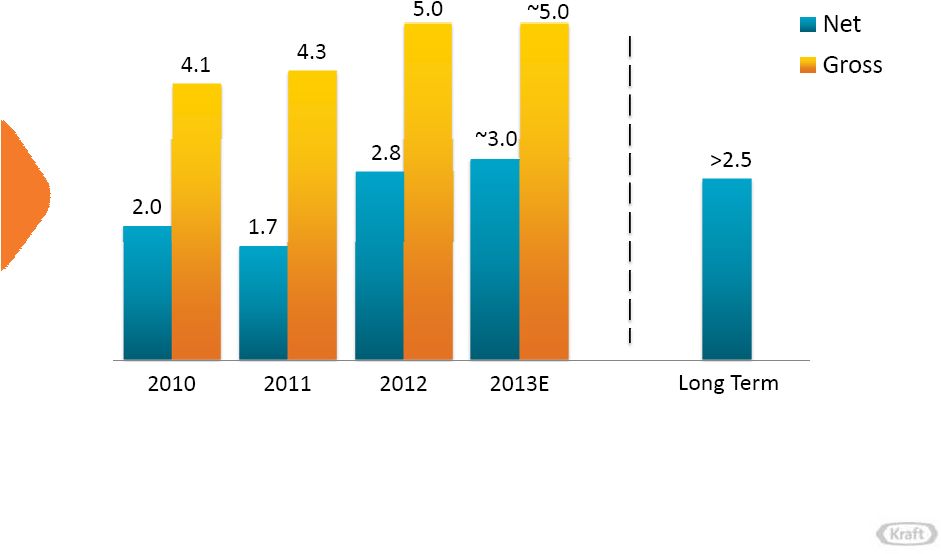

We’ve made great progress on productivity

*Net Productivity

Gross productivity less inflation, business investments and

changes in HQ overhead supporting COGS

Net Productivity* as a % of COGS |

12

Kraft Foods Group, Inc.

*

*

*

*

*

*

*

*

* |

13

Kraft Foods Group, Inc.

Building a simpler, more integrated supply chain

Today

Future State

Suppliers

> 7,000

< 1,000

Packaging Component

Specifications

~ 6,800

< 500 |

14

Kraft Foods Group, Inc.

Building a simpler, more integrated supply chain

Today

Future State

4

-rated Production Lines

14%

> 90%

Planned Maintenance

35%

> 80%

Production Breakdowns

every 4 minutes

> 240 minutes |

15

Kraft Foods Group, Inc.

Building a simpler, more integrated supply chain

Today

Future State

SKUs

~ 5,500

20% net

reduction

Direct Plant-to-Customer

Shipments

~ 30%

~ 60% |

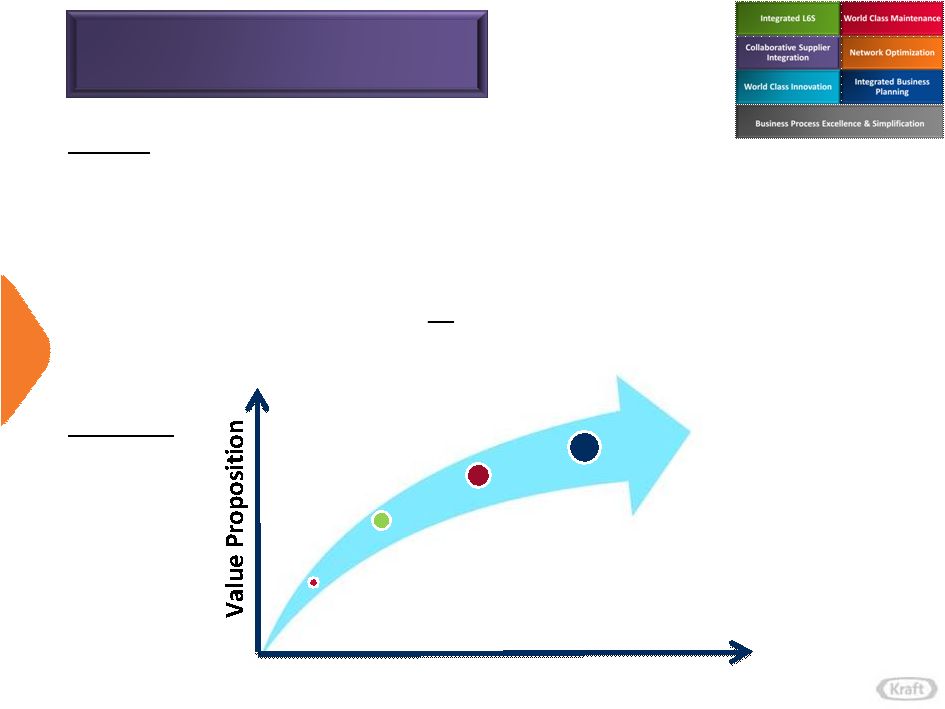

16

Kraft Foods Group, Inc.

Room to improve gross-to-net conversion

Productivity as a % of COGS

Gross-to-Net

Conversion

49%

40%

56%

~60%

70%-plus |

17

Kraft Foods Group, Inc.

Sizable opportunity to take out working capital

Cash Conversion Cycle

(days)

(1)

Reflects

2012

four-quarter

average

of

Receivables

Days

plus

Days

Inventory

on

Hand,

less

Accounts

Payable

Days

1 |

18

Kraft Foods Group, Inc.

*

*

*

*

*

*

*

**

* |

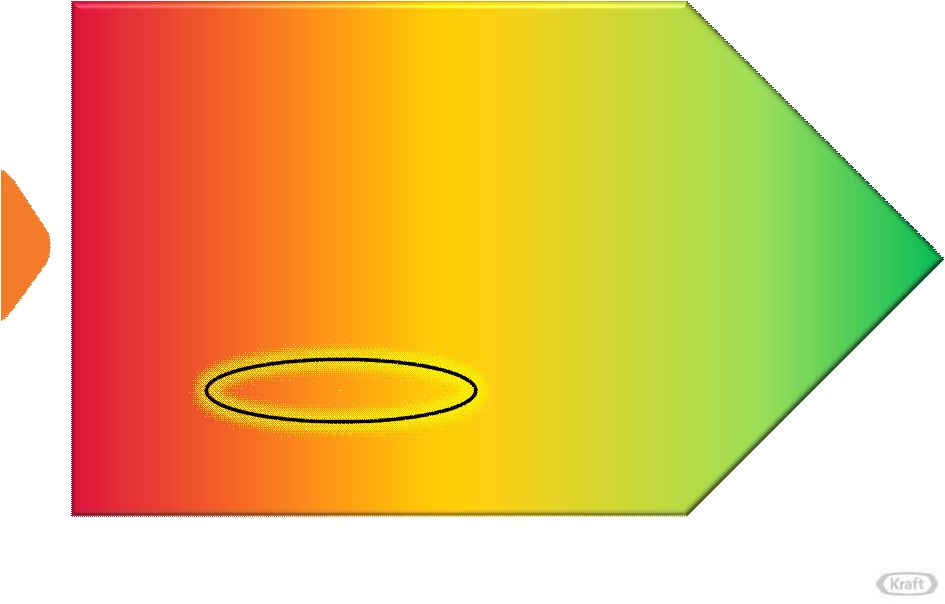

19

Kraft Foods Group, Inc.

Invest in people to close capability gaps

LOW

HIGH

Current State

INTEGRATED LEAN SIX SIGMA

MAINTENANCE

NETWORK

OPTIMIZATION

GROSS-TO-NET

PRODUCTIVITY

CONVERSION

END-TO-END

VALUE-CHAIN MAPPING

CASH CONVERSION CYCLE

QUALITY

SERVICE / SUPPLY CHAIN RELIABILITY

SAFETY

SIMPLIFICATION

ENGINEERING

BUSINESS PROCESSES / SYSTEMS

METRICS

DATA

COMMODITY MANAGEMENT /

PRICING NET OF COSTS |

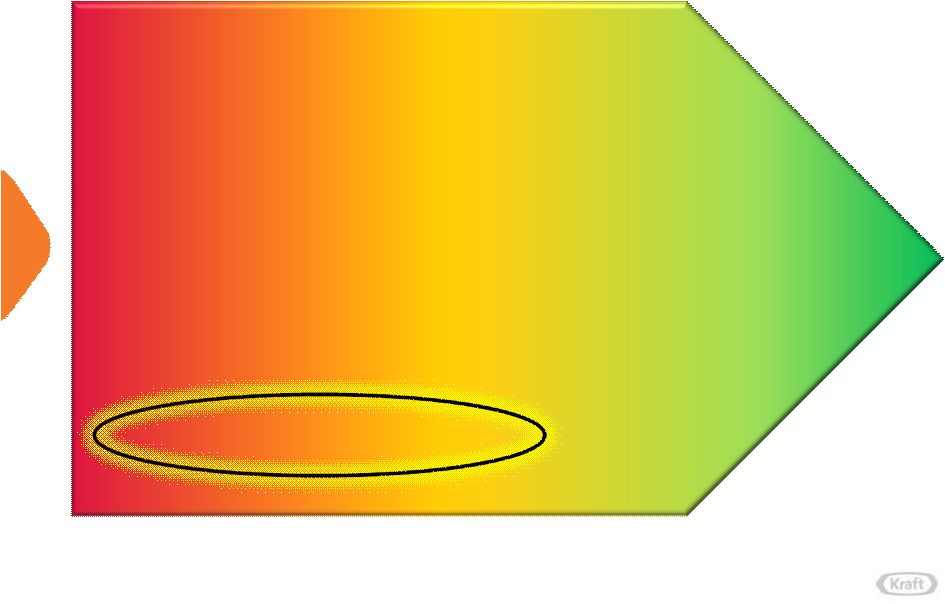

20

Kraft Foods Group, Inc.

Invest in people to close capability gaps

LOW

HIGH

Current State

INTEGRATED LEAN SIX SIGMA

MAINTENANCE

NETWORK

OPTIMIZATION

GROSS-TO-NET

PRODUCTIVITY

CONVERSION

END-TO-END

VALUE-CHAIN MAPPING

CASH CONVERSION CYCLE

QUALITY

SERVICE / SUPPLY CHAIN RELIABILITY

SIMPLIFICATION

ENGINEERING

BUSINESS PROCESSES / SYSTEMS

METRICS

DATA

COMMODITY MANAGEMENT /

PRICING NET OF COSTS

SAFETY |

21

Kraft Foods Group, Inc.

Invest in people to close capability gaps

LOW

HIGH

Current State

INTEGRATED LEAN SIX SIGMA

MAINTENANCE

NETWORK

OPTIMIZATION

GROSS-TO-NET

PRODUCTIVITY

CONVERSION

END-TO-END

VALUE-CHAIN MAPPING

CASH CONVERSION CYCLE

QUALITY

SERVICE / SUPPLY CHAIN RELIABILITY

SIMPLIFICATION

ENGINEERING

BUSINESS PROCESSES / SYSTEMS

METRICS

DATA

COMMODITY MANAGEMENT /

PRICING NET OF COSTS

SAFETY |

22

Kraft Foods Group, Inc.

Invest in people to close capability gaps

LOW

HIGH

Current State

INTEGRATED LEAN SIX SIGMA

MAINTENANCE

NETWORK

OPTIMIZATION

GROSS-TO-NET

PRODUCTIVITY

CONVERSION

END-TO-END

VALUE-CHAIN MAPPING

CASH CONVERSION CYCLE

QUALITY

SERVICE / SUPPLY CHAIN RELIABILITY

SAFETY

SIMPLIFICATION

ENGINEERING

BUSINESS PROCESSES / SYSTEMS

METRICS

DATA

COMMODITY MANAGEMENT /

PRICING NET OF COSTS |

23

Kraft Foods Group, Inc.

Seven building blocks will deliver our potential

Integrated L6S

World Class Maintenance

Network Optimization

Collaborative Supplier

Integration

World Class Innovation

Integrated Business

Planning

Business Process Excellence & Simplification |

24

Kraft Foods Group, Inc.

Focus

•

Extend Black Belt capabilities to customer service & logistics

•

Build “end-to-end”

capabilities and eliminate “intersection losses”

through value stream mapping and loss analysis

•

100% employee engagement via unique ownership of equipment,

work areas, systems

Benefit

•

Reduce costs, cash usage by driving defects to zero, unlocking

trapped costs

•

Enable revenue growth

Integrated L6S |

25

Kraft Foods Group, Inc.

Focus

•

Real-time equipment performance

•

Master preventative maintenance

•

Transform parts buying into Just-in-Time methodology and

drastically reduce suppliers

Benefit

•

Reduce costs and spare parts inventory

•

Enable growth via more predictable throughput

World Class Maintenance |

26

Kraft Foods Group, Inc.

Focus

•

Simplify, streamline, standardize engineering processes

•

Strategically allocate technical resources in best-for-Kraft

manner

•

Selectively develop, implement high tech/state-of-the-art

equipment platforms with step-change performance

Benefit

•

Lower delivered cost with greater speed to market

•

Enable network optimization

•

Improve free cash flow predictability, maintain capex at

2.5% of net revenue

World Class Innovation |

27

Kraft Foods Group, Inc.

Focus

•

Consolidate supplier base, form strategic partnerships

•

Reduce total cost of ownership

•

Tap supplier innovation product and process

Benefit

Productivity

Cash-Flow

Innovation

Growth

Relationship

Collaborative Supplier

Integration |

28

Kraft Foods Group, Inc.

Focus

•

Establish metrics to track network-wide lowest landed cost

•

Move to pull system with demand-driven front end

•

Optimize End-to-End network design

Benefit

•

Improve customer service levels

•

Reduce costs and total cost of ownership

•

Improve working capital, free cash flow through increased

velocities

Network Optimization |

29

Kraft Foods Group, Inc.

Focus

•

Establish integrated product, demand, supply review

processes across business units

•

Optimize sku’s within each product line

Benefit

•

Achieve world-class customer service levels and lower

inventory through increased forecast accuracy, on-time

delivery, improved case fill rates

•

Enable Business Process Excellence & Simplification

Integrated Business

Planning |

30

Kraft Foods Group, Inc.

Business Process Excellence

& Simplification

Focus

•

Define standard plant metrics and supply chain KPI’s

•

Optimize, integrate operational reporting

Benefit

•

Lower manufacturing, customer service and logistics costs

•

Drive long-term cash flow delivery

Order Management

Order Management

Manufacturing

Procurement

Procurement

Demand & Supply

Demand & Supply

Planning

Planning

SINGLE SAP PLATFORM

Financials

Financials |

Tim

McLevish Chief Financial Officer |

32

Kraft Foods Group, Inc.

Situation and discovery

Integrated

Business

Planning

Business Process

Excellence

SAP Refresh

Integrated Lean

Six Sigma

•

Fragmented systems designed for a

complex business model

•

Ownership and accountabilities of

processes not defined

•

Processes lacked uniformity;

complex; siloed; fragmented;

not

end-to-end

•

Key to any sustainable benefit

realization would require process

simplification, standardization,

streamlining |

33

Kraft Foods Group, Inc.

SAP utilization low, customization high

Customized

Where We Are

Where We Will Be

NOT in Use

Standard |

We put dollars in

Shareholders’ pockets…

not

growth rates, not margins

Inconsistent commitment

Revenue growth and OI margin

focus

No capital charges

Functional silos, metrics

and incentives

Data and reports

Key cultural priority

Balanced emphasis on both P&L

and Balance Sheet

ROIC focus from strategic to

operating decisions

End-to-end metrics

Decision tools that create bias

for action

From

To

To

34

Kraft Foods Group, Inc. |

35

Kraft Foods Group, Inc.

A sustainable long-term growth algorithm

Metric

Long-Term Target

(1)

Market defined as the North American Food & Beverage market

Organic Net Revenue

Operating Income

Dividends

Profitable growth at or above market growth

1

Consistent mid-single-digit growth

Consistent mid-single-digit growth

EPS

Consistent mid-to-high, single-digit growth

Free Cash Flow

Consistent mid-single-digit growth

ROIC

Consistent year-to-year improvement |

Tony

Vernon Chief Executive Officer |

Our

transformation is a marathon, not a sprint Way we

Way we

think

think

Way we

Way we

behave

behave

Way work

Way work

gets done

gets done

Way we use

Way we use

our enablers

our enablers

Way we run

our business

37

Kraft Foods Group, Inc. |

38

Kraft Foods Group, Inc.

Our Mission

Make Kraft North American

Food & Beverage Company

Best Investment in the Industry

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Superior

Dividend

Payout |

|