Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hillshire Brands Co | d591198d8k.htm |

Barclays Back to School Conference

September 3, 2013

Sean Connolly, President & CEO

Maria Henry, EVP & CFO

Exhibit 99 |

Forward-Looking

Statements We caution you that our remarks this morning contain forward-looking

statements about HSH’s future operations, financial performance, business conditions

and our outlook for FY14 and future fiscal years. These forward-looking

statements are based on currently available competitive, financial and economic data, as

well as management’s views and assumptions regarding future events. Such

forward-looking statements are inherently uncertain, and investors must recognize

that actual results may differ materially from those expressed or implied in these

statements. Consequently, we caution you not to place undue reliance on

forward-looking statements. We have provided additional information in our most

recent Form 10-K that we encourage you to review concerning factors that could cause

actual results to differ materially from those expressed or implied by our

forward-looking statements. This presentation includes certain non-GAAP financial

measures intended to supplement, not

substitute

for,

comparable

GAAP

measures.

Reconciliations

of

non-GAAP

financial

measures

to

GAAP

financial

measures

are

provided

in

the

Appendix

at

the

end

of

the

presentation. Investors are urged to consider carefully the comparable GAAP measures

and the reconciliations to those measures provided in the Appendix or on our website at

www.hillshirebrands.com.

1 |

What We Want You to

Take Away From Today We have a terrific portfolio of leading, iconic brands

We compete in attractive categories

We expect to grow through disciplined investments in

brand building and innovation

We will fuel our growth through rigorous cost

management

We will pursue targeted M&A opportunities to further

accelerate our growth

We have the potential to deliver significant

shareholder returns

2 |

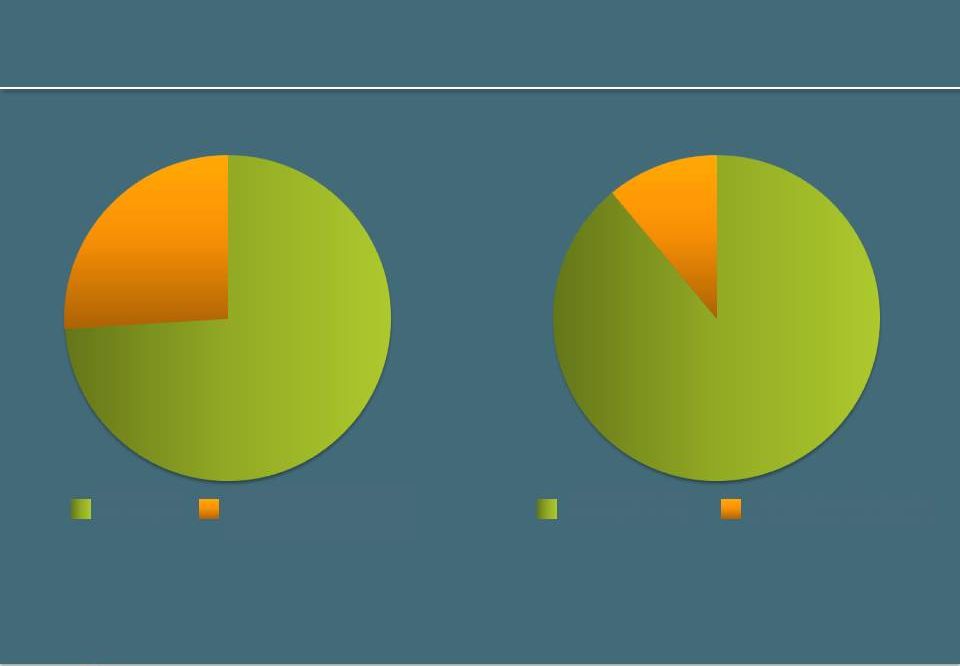

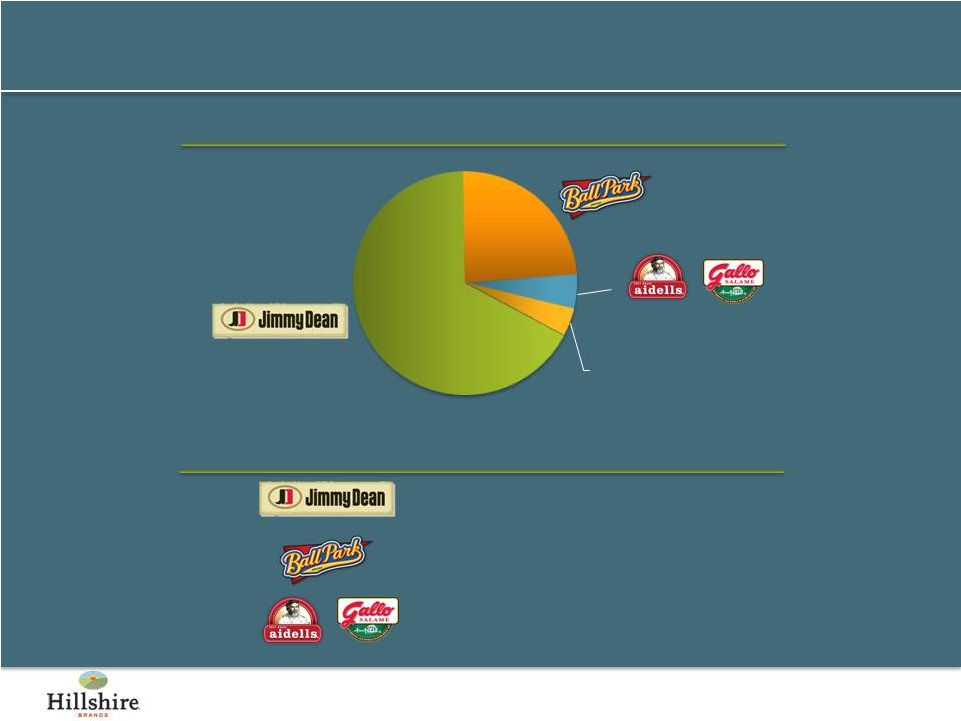

$4B Revenue North

American, Focused Food Company

3

Source: Company Financial Statement information

74%

26%

Retail

Foodservice

89%

11%

Branded

Unbranded |

Strong Brand

Portfolio; Two $1B Brands 4 |

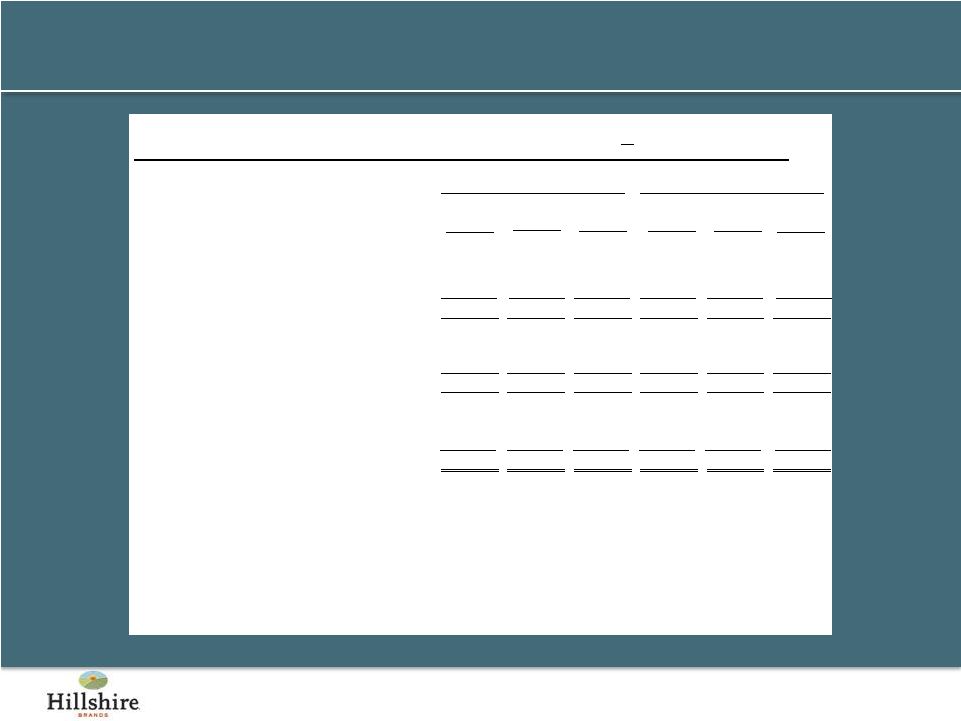

Leading Share

Positions in Core Categories 5

Source: Symphony IRI Group, Total US Multi-Outlet, 52 weeks ending 7/21/13

Brand

Brand

Category

Category

HSH Share

HSH Share

Position

Position

Relative Market

Relative Market

Share

Share

Breakfast Sausage

#1

2.9x

Frozen Protein Breakfast

#1

8.1x

Lunchmeat

#3

0.3x

Smoked Sausage

#1

2.8x

Hot Dogs

#1

1.1x

Corn Dogs

#1

1.5x

Super Premium Sausage

#1

1.8x

Specialty Lunchmeat

#3

0.3x |

Compete in Large

Categories With Multiple Areas for Growth

6

Source: Symphony IRI Group, National Consumer Panel, Total US–All Outlets, 52 weeks

ending 6/16/13 and Total US Multi-Outlet, 52 weeks ending 7/21/13

Size of

Category

$5.1B

$2.8B

$1.8B

$1.8B

$1.5B

Volume

Growth

+0.2%

(1.2)%

+0.7%

+5.0%

+10.5%

78%

78%

60%

61%

38%

30%

30%

29%

28%

22%

Lunchmeat

Hot Dogs

Smoked

Sausage

Breakfast

Sausage

Frozen Protein

Breakfast

Category HH Penetration

Brand HH Penetration |

Core Categories Have

Limited Private Label Penetration

7

Source: Symphony IRI Group, Total US Multi-Outlet, 52 Weeks Ending 8/11/2013

Category

Category

Private Label Dollar Share

Private Label Dollar Share

Frozen Protein Breakfast

6%

Hot Dogs

4%

Corn Dogs

4%

Smoked/Cooked Sausage

5%

Cocktail Links

5%

Breakfast Sausage

11%

Mainstream Lunchmeat

17%

Total Industry

12% |

Four Strategies to

Deliver Long-Term Value Creation

8

Extend Into Adjacencies

Strengthen the Core

Acquire On-Trend Brands

Fuel Growth Through Efficiency |

Brand Building and

Innovation Key to Growth Agenda

9

Brand Building

Innovation

Brand positioning

World-class advertising

Category management

Upgrade existing

quality and packaging

New line extensions

Adjacent innovations |

Increasing

Investment in MAP Behind Our Core Brands

10

3.5%

4.4%

5%

Historic Average

FY13

FY15E

MAP Spending as % of Sales |

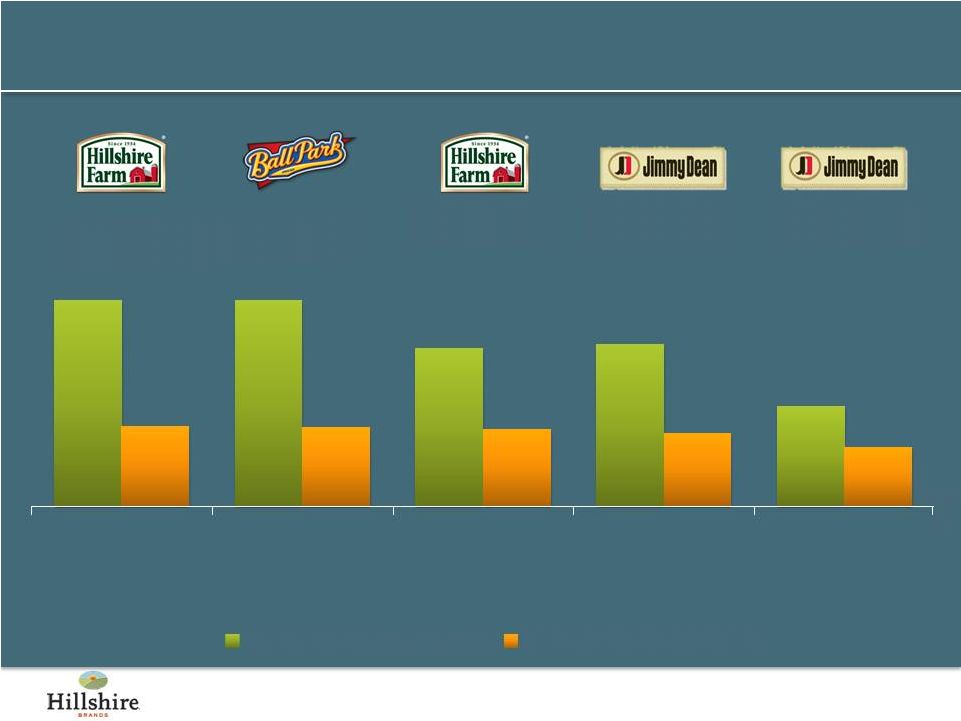

FY13 YoY Percent

Change in Sales Where We Increase MAP Support We See

Good Growth

11

FY13 MAP Increase Allocation

High single digits

Low single digits

High single digits

Other |

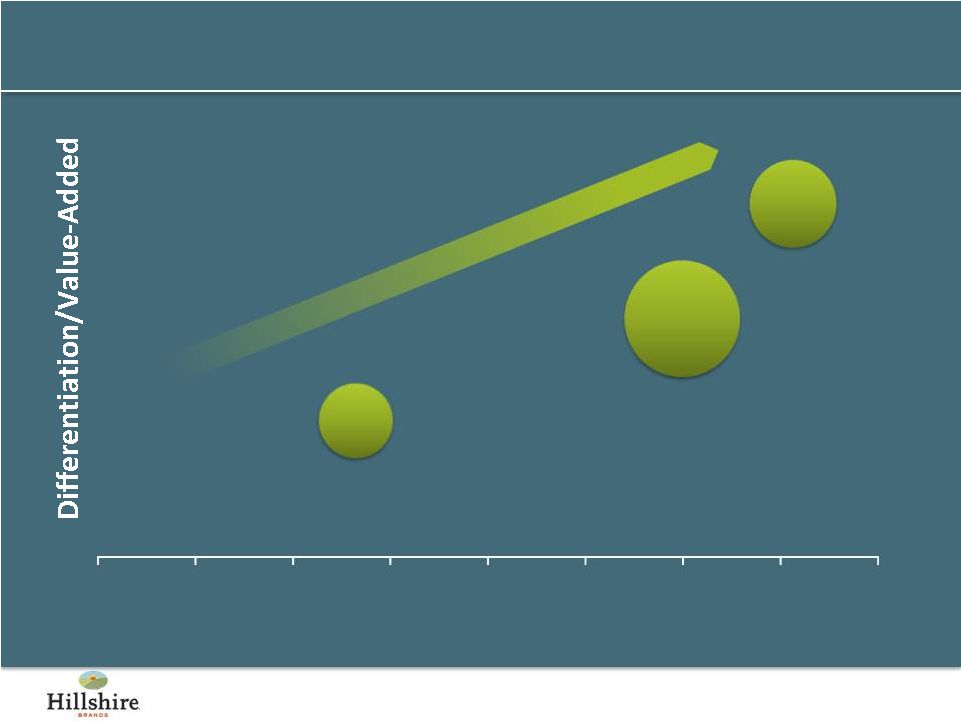

Innovation Focused on

Differentiated, Value-Added Products

12

Source: Company Financial Statement information

0%

5%

10%

15%

20%

25%

30%

35%

40%

Gross Margin

Commodity

Unbranded

Branded

Meal

Components

Branded

Ready

Meals

$0.5B

$2.6B

$0.8B |

Over $300MM in

Revenue From Products Introduced Within the Last Three Years

13 |

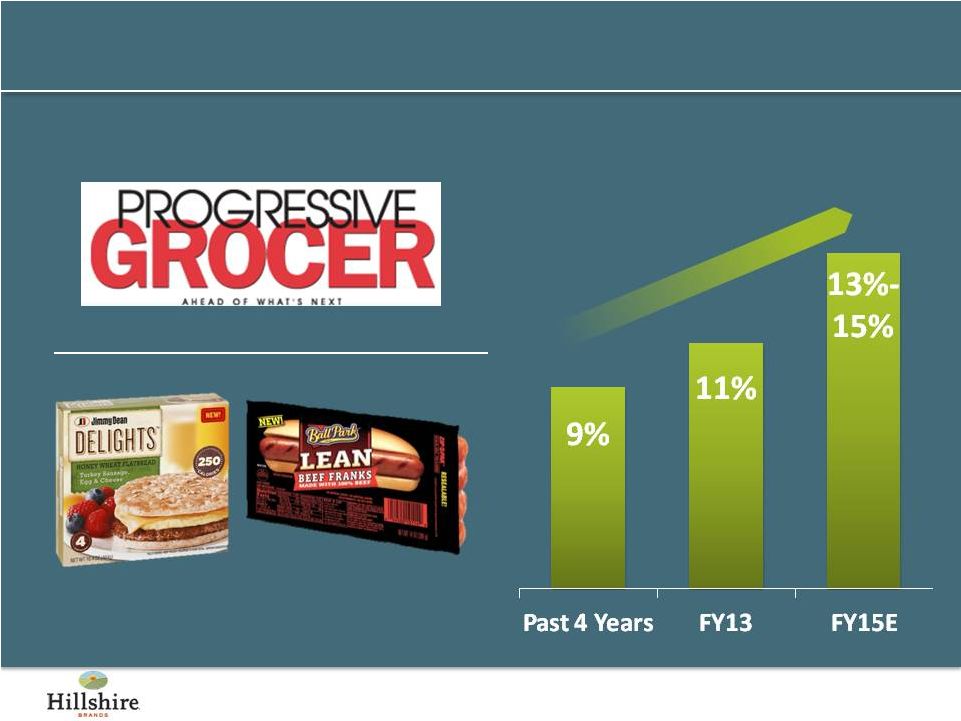

Well on Our Way to

Achieve Our Innovation Goals 14

*Percent

annual

revenue

from

past

three

years’

rolling

innovations,

Retail

segment

only

2013 Editors' Top New Picks

Revenue From New

Innovations* |

Overall, Good

Progress in First Year… More Work to Do

15

Source: Symphony IRI Group, Total US Multi-Outlet, 52 weeks ending July 1, 2012 and June

30, 2013 Percent Change in Total Consumption Volume

FY12

FY12

FY13

FY13

Hillshire Farm

(5.9)%

(1.9)%

Jimmy Dean

+1.3%

+7.3%

Ball Park

(4.7)%

+5.0%

State Fair

(1.5)%

(2.4)%

Gallo

(5.7)%

+9.0%

Aidells

+22.3%

+13.9%

Sara Lee Sweet Goods

(8.8)%

(6.6)%

Sara Lee Deli

(17.2)%

(7.0)% |

What’s

Next… Continue Working the Plan

16

Grow Core Brands

Rigorous Cost Management

Acquire New, On-Trend Brands |

We Will Activate

Our Core Brands Behind Broadened Brand Positionings

17

“Farm House

Quality Meats”

“Hearty

Comfort Food”

“Better Guy

Food for Better

Guy Times”

“Smart and

Sensible

Family Choices”

“Authentic

Ingredients,

Exceptional Tastes”

“Artisanal

Italian Meats” |

Jimmy Dean

Expanding Hispanic Reach 18 |

Robust Innovation

Slate Planned for FY14 19

First Half FY14

Second Half FY14

Ramp up distribution for

FY13 innovations

New line extensions in

Jimmy Dean, Aidells,

Sara Lee and Foodservice

Build presence in value

channel

Represents bulk of FY14

innovation activity

Introduce new products

and platforms under

Ball Park and Hillshire Farm

brands

More details to come

First Half Innovations |

M&A Will

Complement Organic Growth 20

Value-added categories

Strong brands

Complementary / additive

capabilities

Scale with suppliers and customers

Top-line growth

EPS contribution

Attractive financial returns

Alignment

with

Strategic

Vision

Shareholder

Value

Creation |

M&A Will

Leverage Strong Infrastructure 21

Capabilities

Assets

Consumer insights

Frozen / Breakfast /

Meals expertise

Category captaincies in

key product areas

Robust R&D and

innovation focus

History of success

integrating acquired

businesses

Efficient supply chain

and production

Fully-integrated SAP

enterprise system

Extensive distribution

infrastructure

Powerful brand

equities with proven

ability to penetrate

new segments |

Golden Island

Acquisition Provides Initial Entry to the Attractive Meat Snacking Market

Source: Symphony IRI Group, Total U.S. FDMx data, ending CY 2011

$59B

$59B

2.6% CAGR

2.6% CAGR

$0.9B

$0.9B

+5% CAGR

+5% CAGR

Meat-Centric

Snacks

Total Snacking Market

22 |

What is Golden

Island? Manufactures and sells

all natural pork and

beef jerky

Among top ten jerky

brands

Differentiated

technology to make a

more tender jerky

23 |

Remain Committed to

Achieving Our Mid-Term Targets

24

Net Sales Growth

MAP % of Total

Revenue

Operating Margin

4-5%

5%

10% |

Maria Henry, EVP

& CFO 25 |

Total Hillshire

Brands Income Statement 26

“Adjusted”

terms are non-GAAP financial measures. See our reconciliation to the most directly

comparable GAAP measure in our press release dated August 8, 2013 and at the end of

this presentation. Continuing Operations

($ millions, excluding significant items)

FY12

FY13

YoY

Adjusted Net Sales

$3,903

$3,920

+0.4%

Adjusted Op Income

323

363

+12.5%

Adjusted Op Margin

8.3%

9.3%

+100 bps

Adjusted Diluted EPS

$1.45

$1.72

+18.6% |

Cost Management

Programs Progressing On track for $145MM of efficiencies

•

Achieved $40MM cost savings goal in FY13

•

Plans in place to execute remaining $105MM

Efficiency programs will also strengthen core

capabilities for sustainable growth and profitability

Company culture embracing efficiency mindset

27 |

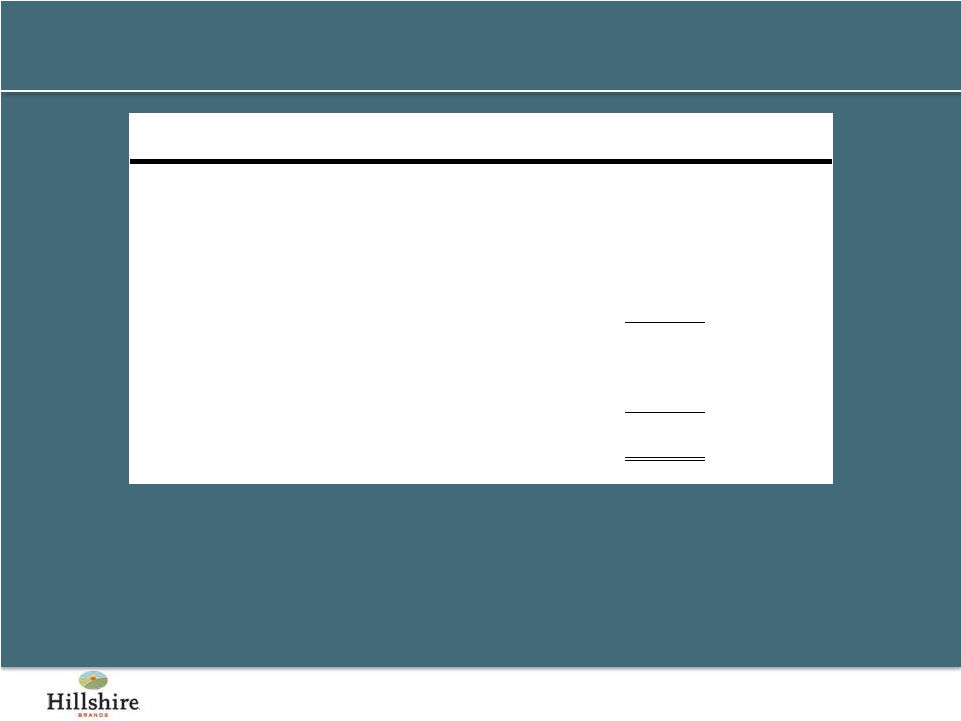

Strong Balance

Sheet 28

“Adjusted”

terms are non-GAAP financial measures. See our reconciliation to the most directly

comparable GAAP measure in our press release dated August 8, 2013 and at the end of

this presentation. ($ millions, excluding significant items)

FY13

Adjusted Cash Flow

$ 312

Adjusted EBITDA

$ 509

Cash

$ 400

Debt

$ 951

Net Debt

$ 551 |

Capital Allocation

Strategy Continue to invest in the business

Increased dividend 40% to $0.70 per share

annual rate

Targeting $200 million in share repurchases over the

next two years

Committed to M&A as a value creation lever

No plans to significantly reduce debt at this time

29 |

FY14 Outlook

30

Perspective

Facing near-term inflation, lapping one-time benefits

Continue disciplined investment in brand building

Defend market positions where necessary

Sales increase slightly

Adjusted diluted EPS flat to down mid-single digits

Guidance |

Summary

We have a terrific portfolio of leading, iconic brands

We compete in attractive categories

We expect to grow through disciplined investments in

brand building and innovation

We will fuel our growth through rigorous cost

management

We will pursue targeted M&A opportunities to further

accelerate our growth

We have the potential to deliver significant

shareholder returns

31 |

Q&A

32 |

Appendix

33 |

(1) Represents

a non-GAAP financial measure. See detailed explanation of these and other

non-GAAP measures in the release dated August 8, 2013.

34

EPS Reconciliation—Reported to Adjusted

Twelve Months ended June 29, 2013

Twelve Months Ended June 30, 2012

As

Reported

Impact of

Significant

Items

Adjusted

(1)

As

Reported

Impact of

Significant

Items

Adjusted

(1)

Continuing operations:

Income (loss) from continuing operations before

income taxes

$

256

$

(66)

$

322

$

(35)

$

(294)

$

259

Income tax expense (benefit)

72

(38)

110

(15)

(101)

86

Income (loss) from continuing operations

184

(28)

212

(20)

(193)

173

Discontinued operations:

Income from discontinued operations, net of tax

15

4

11

463

62

401

Gain on sale of discontinued operations, net of tax

53

53

—

405

405

—

Net income from discontinued operations

68

57

11

868

467

401

Net income

252

29

223

848

274

574

Less: Income from noncontrolling interests, net of tax

Discontinued operations

—

—

—

3

3

Net income attributable to Hillshire Brands

$

252

$

29

$

223

$

845

$

274

$

571

Amounts attributable to Hillshire Brands:

Net (loss) income from continuing operations

$

184

$

(28)

$

212

$

(20)

$

(193)

$

173

Net income from discontinued operations

68

57

11

865

467

398

Earnings per share of common stock:

Diluted

Income (loss) from continuing operations

$

1.49

$

(0.23)

$

1.72

$

(0.16)

$

(1.61)

$

1.45

Net income

$

2.04

$

0.23

$

1.81

$

7.13

$

2.36

$

4.77

Effective tax rate—continuing operations

28.1%

34.2%

44.2%

33.1%

Twelve

Months

ended

June

29,

2013

and

June

30,

2012

(in

millions,

except

per

share

data

unaudited)

— |

35

(1) Represents a non-GAAP financial measure. See detailed explanation of these and other

non-GAAP measures in the release dated August 8, 2013.

Operating Income Reconciliation—Reported to Adjusted

Twelve Months ended June 29, 2013

As

Reported

Impact of

Significant

Items

Dispositions

Adjusted

(1)

Net Sales

$

3,920

$

—

$

—

$

3,920

Cost of Sales

2,758

11

—

2,747

Gross Profit

1,162

(11)

—

1,173

MAP Expense

174

—

—

174

SG&A (excluding MAP)

681

45

—

636

Net charges for exit activities, asset and business dispositions

9

9

—

—

Impairment charges

1

1

—

—

Operating income

$

297

$

(66)

$

—

$

363

Twelve Months Ended June 30, 2012

As

Reported

Impact of

Significant

Items

Dispositions

Adjusted

(1)

Net Sales

$

3,958

$

—

$

55

$

3,903

Cost of Sales

2,857

28

40

2,789

Gross Profit

1,101

(28)

15

1,114

MAP Expense

135

—

—

135

SG&A (excluding MAP)

795

132

7

656

Net charges for exit activities, asset and business dispositions

81

81

—

—

Impairment charges

14

14

—

—

Operating income

$

76

$

(255

)

$

8

$

323

Twelve

Months

ended

June

29,

2013

and

June

30,

2012

(in

millions,

except

per

share

data

unaudited) |

36

(1) Represents the change in cash, excluding the impact of significant items. See the

press release dated August 8, 2013 for a detailed definition of significant

items. Cash Flow Reconciliation - Reported to Adjusted

Twelve Months ended June 29, 2013 (in millions, except per share data - unaudited)

As

Reported

Restructuring

Swap

Settlement /

Other

Adjusted (1)

Cash Flow

$165

$102

$45

$312 |

37

(1) EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization and is

a non-GAAP number

EBITDA

Reconciliation

-

Reported

to

Adjusted

Twelve

Months

ended

June

29,

2013

(in

millions,

except

per

share

data

-

unaudited)

Reported Net Income

252

Income

tax

expense

-

continuing

operations

72

Income

tax

benefit

-

discontinued

operations

(8)

Income

tax

expense

-

gain

on

sale

of

discontinued

operations

15

Interest (net)

41

Depreciation & Amortization

166

EBITDA (1)

538

Significant Items, excluding accelerated depreciation (pre-tax)

(29)

Adjusted EBITDA (1)

509 |