Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EAGLE MATERIALS INC | d592309d8k.htm |

Low

Cost

Producer

Autumn 2013

Profitable Growth

•

Smart Investments

•

Up-Cycle Tailwinds

•

Favorable Secular Trends

•

Low-Cost Advantages

•

Healthy Balance Sheet

Exhibit 99.1 |

Forward Looking Statement

2

forward-looking statement to reflect future events or changes in the Company's

expectations. This presentation contains forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by

the context of the statement and generally arise when the Company is discussing its beliefs, estimates or

expectations. These statements are not historical facts or guarantees of future performance but

instead represent only the Company's belief at the time the statements were made regarding

future events which are subject to certain risks, uncertainties and other factors many of which

are outside the Company's control. Actual results and outcomes may differ materially from what is

expressed or forecast in such forward-looking statements. The principal risks and uncertainties

that may affect the Company’s actual performance include the following: the cyclical and

seasonal nature of the Company’s business; public infrastructure expenditures; adverse

weather conditions; the fact that our products are commodities and that prices for our products are subject to

material fluctuation due to market conditions and other factors beyond our control; availability of

raw materials; changes in energy costs including, without limitation, natural gas and oil;

changes in the cost and availability of transportation; unexpected operational difficulties;

inability to timely execute announced capacity expansions; difficulties and delays in the development of new business

lines; governmental regulation and changes in governmental and public policy (including, without

limitation, climate change regulation);possible outcomes of pending or future litigation or

arbitration proceedings; changes in economic conditions specific to any one or more of the

Company’s markets; competition; announced increases in capacity in the gypsum wallboard and cement

industries; changes in the demand for residential housing construction or commercial construction;

general economic conditions; and interest rates. For example, increases in interest

rates, decreases in demand for construction materials or increases in the cost of energy

(including, without limitation, natural gas and oil) could affect the revenues and operating earnings of our operations. In

addition, changes in national or regional economic conditions and levels of infrastructure and

construction spending could also adversely affect the Company's result of operations. With

respect to our acquisition of the Acquired Assets as described in this press release, factors,

risks and uncertainties that may cause actual events and developments to vary materially from those

anticipated in forward-looking statements include, but are not limited to, the risk that we may

not be able to integrate the Acquired Assets in an efficient and cost-effective manner with

our other assets and operations, the possible inability to realize synergies or other expected

benefits of the transaction, the possibility that we may incur significant costs relating to transition or integration

activities or repair and maintenance of the Acquired Assets, the discovery of undisclosed liabilities

associated with the business, the need to repay the indebtedness incurred to fund the

acquisition and the fact that increased debt may limit our ability to respond to any changes in

general economic and business conditions that occur after the acquisition. These and other factors are described in

the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013, and the

Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30,

2013. These reports are filed with the Securities and Exchange Commission. All

forward-looking statements made herein are made as of the date hereof, and the risk that actual

results will differ materially from expectations expressed herein will increase with the

passage of time. The Company undertakes no duty to update any

|

Eagle Materials Business Definition

Minerals-Based Commodity Products

Infrastructure

and

Related

Construction Materials

Residential

and Commercial

Construction Materials

Strategy Emphasis Now

Key Demand Drivers

Competitive Advantage

Innovation Focus

Asset Optimization

Cyclical Recovery

Cost Position

Profitable, High-Returning Growth

Secular and Cyclical Growth

Oil Well

Cement

Frac

Sand

Construction

Cement

Aggregates

and Concrete

Gypsum

Wallboard

Gypsum

Paperboard

Cost Position

Scarcity

3

Extension of Low Cost Producer Positions

Energy

Industry

Materials |

Eagle Materials Low Cost Producer Focus

Minerals-Based Commodity Products

Infrastructure

and

Related

Construction Materials

Residential

and Commercial

Construction Materials

Strategy Emphasis Now

Key Demand Drivers

Competitive Advantage

Innovation Focus

Oil Well

Cement

Frac

Sand

Construction

Cement

Aggregates

and Concrete

Gypsum

Wallboard

Gypsum

Paperboard

Cost Position

Scarcity

4

Extension of Low Cost Producer Positions

Asset Optimization

Cyclical Recovery

Cost Position

Energy

Industry

Materials

Profitable, High-Returning Growth

Secular and Cyclical Growth |

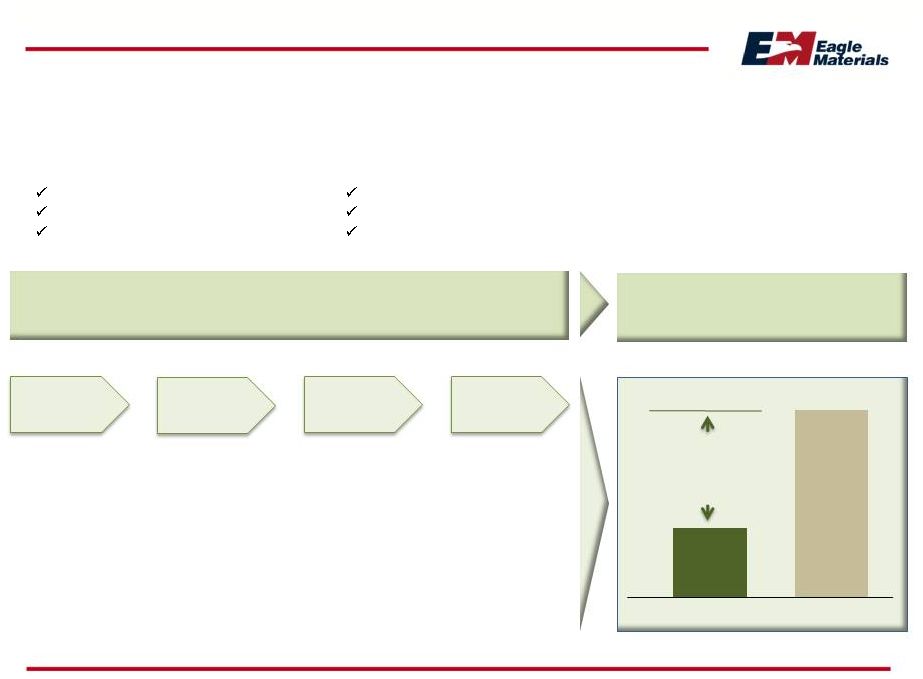

Multiple Sources of Cost Advantage

Lowest Cost Position is Important in a Commodity Industry

Operational Execution

Low-Cost Focused Innovation

Technology and Engineering

Eagle

Cost

Advantages

EXP

Industry

5

Sustained Innovation Focus on Cost

Reduction

Across Every Aspect of the Business System

Inputs

Waste

Overhead

•

Proximity of

raw materials

•

Unique

technologies

•

Material and

energy usage

•

Mining

innovations

•

Manufacturing

innovations

•

Logistics

innovations

•

Process

control

•

Product line

focus

•

Maintenance

disciplines

•

Simple

systems

•

Low staffing

requirements

•

No frills only

necessities

Processing

Process Management

Smart Design and Scale

Sustained Maintenance

Significant, Sustained and

Proven Cost Advantages |

Our

Low Cost Producer Strategy

Is Closely Aligned with Our Sustainability Objectives

Strategy Objective

Sustainability Result

Less

waste

Reduced cost

Responsible use of

resources

Less

energy

used

Reduced cost

Smaller

environmental footprint

Less mineral

resource used

Reduced cost

Greater

conservation

Less

water

used

Reduced cost

Lower energy

requirements

More recycled

resource use

Reduced cost

Beneficial use

of waste

streams 6 |

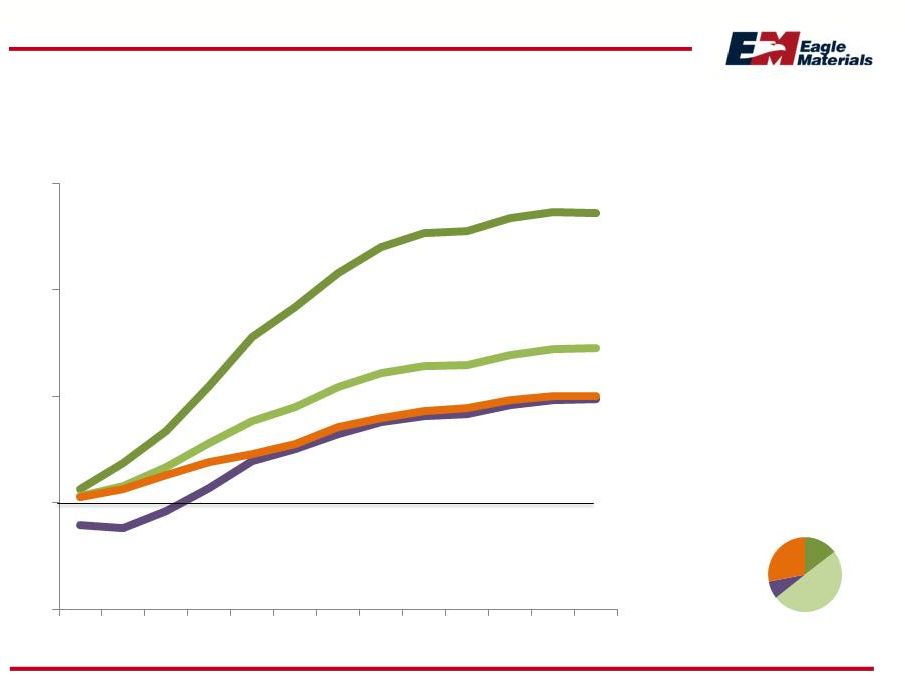

Shareholder

Value

Creation

Track

Record

-

TSR

Some Say “The Best Predictor of Grades is Grades”

1-Year

3-Year

Since

Inception

(April 15, 1994)

Source: Longnecker & Associates. All measures are as of

3/31/13 fiscal year end. Direct Peers: Martin Marietta, Texas Industries Inc., USG Corp., Vulcan Materials

Industry Peers: Martin Marietta, Texas Industries Inc., USG Corp., Vulcan

Materials, Titan Cement Co. S.A., CRH, Buzzi Unicem S.p.A., Holcim Ltd., HeidelbergCement

AG, Lafarge S.A., Cementos Bio-Bio S.A., Cementos Portland Valderrivas, Cemex

S.A.B. de C.V., Italcementi S.p.A., Cementos Argos S.A., Headwaters Incorporated

7

0%

100%

200%

0%

50%

100%

0%

1000%

2000%

Eagle Materials

Direct Peers

(median)

Industry Peers

(median) |

Eagle Materials Business Definition

Minerals-Based Commodity Products

Infrastructure and

Related

Construction

Materials Residential and

Commercial

Construction Materials

Strategy Emphasis Now

Key Demand Drivers

Competitive Advantage

Innovation Focus

Oil Well

Cement

Frac

Sand

Aggregates

and Concrete

Gypsum

Wallboard

Gypsum

Paperboard

8

Construction

Cement

Extension of Low Cost Producer Positions

Asset Optimization

Cyclical Recovery

Cost Position

Profitable, High-Returning Growth

Secular and Cyclical Growth

Cost Position

Scarcity

Energy

Industry

Materials |

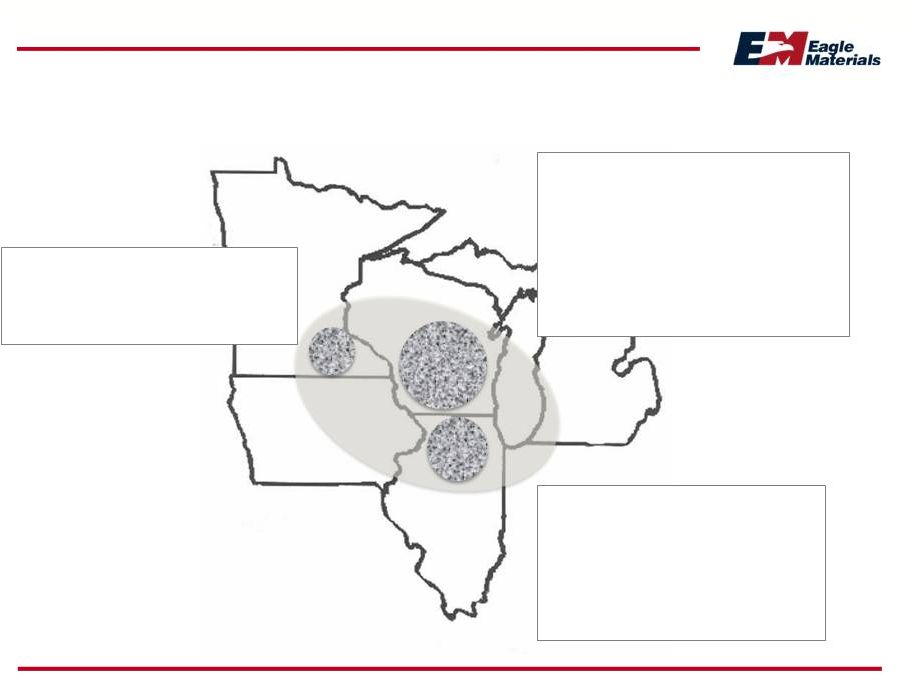

A

Central US Cement System New Cement Plants “Filled in a Missing Puzzle

Piece” •

Kansas City and

Tulsa cement plant

acquisitions (Nov.

30, 2012) link

east-to-west and

central-to-south

•

Heartland focus

also limits impact

of imports

Acquired Cement Terminals

Eagle Cement Terminals

Eagle Cement Plants

Acquired Cement Plants

9

Mountain

Cement

Nevada

Cement

Illinois

Cement

Kansas City, MO

Tula, OK

Texas

Lehigh

Cement

(50/50 JV)

Houston

Cement

Terminal |

System Scale

Recent Acquisitions Increased Cement Capacity by 60%

Texas Lehigh (50%)

700

Illinois Cement

1,100

Mountain Cement

700

Nevada Cement

550

Central Plains Kansas City

1,150

Central Plains Tulsa

700

Total

4,900

Cement Short Tons Capacity (000)

10 |

US

Cement Consumption Outlook Million Metric Tons

Source: Portland Cement Association

US Capacity

•

New capacity --

and capacity

expansion

--

is

constrained for

the foreseeable

future

•

Some existing

capacity may be

closed by 2015

due to NESHAP

compliance

•

Imports will be

required again

to meet demand

regardless

11

0

30

60

90

120

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Non-Residential

Governmental

Residential |

EPA

Regulatory Developments Final Rule Issued –

Extension Granted

On

February

12,

2013

the

EPA

published

the

final

rule

amending

•

National Emission Standards for Hazardous Air Pollutants

(NESHAP) for the Portland Cement Manufacturing Industry

•

New Source Performance Standards (NSPS) for Portland

Cement Plants

Existing Facilities

•

Compliance deadlines

September

New Facilities

•

Standards

continue

to

apply

to

all

sources

which

commenced construction or reconstruction after May 6, 2009

12

extended until

2015 |

EPA

Regulatory Developments Standards Tough to Meet, Will Chill New Capacity

Addition Pollutant

Existing Source

Standard

New Source

Standard

Particulate Matter

0.07 lb/ton clinker

0.02 lb/ton clinker

Mercury

55 lb/MM tons clinker

21 lb/MM tons clinker

Nitrogen Oxide

3.5 -10 lb/ton clinker

(varies)

1.5 lb/ton clinker

Sulfur Oxide

1.2-5.0 lb/ton clinker

(varies)

0.4 lb/ton clinker

Total Hydrocarbons

24 ppm

24 ppm

Hydrogen Chloride

3 ppm

3 ppm

Organic Air Pollutants

12 ppm

12 ppm

Standards for

new sources

are challenging

to meet

individually --

and as a set of

standards

compliance

may be not be

economically or

even

technologically

feasible

13 |

Concrete/Cement Value Proposition

In Relation to Asphalt, the Leading Substitute

•

Historically

•

Asphalt is used over 85% of the time in US highway and road construction, and this

has been the case over many decades

•

Life cycle costs have always favored concrete over asphalt

•

Now

initial costs per mile as well as life cycle costs favor concrete, driven by

escalation in asphalt bitumen input costs (oil driven)

•

The cost cross-over point favoring concrete over asphalt occurred in 2008 but

has been masked by the recession and long-standing historical

practices •

Concrete has, in fact, been gaining share over asphalt since 2008

•

Outlook

is for a further strengthening of the concrete/cement value proposition

•

More

rapid

share

gains

for

concrete

are

expected

as

the

cost

and

performance

advantages

of concrete increase, as cost benefits are broadly understood, and as use

adaptations occur 14

initial costs per construction mile have favored asphalt over concrete

|

Life Cycle Analysis Favors Concrete

Pavement Life Expectancy (Before Reconstruction is Required)

Asphalt

Average:

13.6 Years

Concrete

Average:

29.3 Years

Source: PCA Highway Report

15

0

5

10

15

20

25

1-

5

6-10

Years

11-15

Years

16-20

Years

21-30

Years

31-50

Years

Asphalt

Concrete

Years |

Asphalt Production Costs Linked to Oil/Bitumen

Asphalt Costs Diverging from Historical Relationship with Concrete

Ready Mix PPI

Dec 1984 =100

Asphalt PPI

Dec 1984 =100

Crude Oil

$/Barrel

Sources: US Department of Labor, International Monetary Fund

16

$0

$50

$100

$150

$200

$250

$300

0

100

200

300

Dec-84

Dec-90

Dec-96

Dec-02

Dec-08 |

Concrete Share Has, In Fact, Been Growing

Growth Since 2008 Has Been Masked by the Recession

Concrete Share of Highway Paving Volume

Source: PCA June 2012, Oman Data Systems

Long-Term Average 14.4%

17

13.3%

12.1%

15.5%

16.2%

17.5%

8%

13%

18%

2007

2008

2009

2010

2011 |

Outlook and Strategic Implications

A Game Changer for Cement and Asphalt

•

The

price

of

asphalt

is

expected

to

continue

to

diverge

from

the

price

of concrete as oil price inflation remains higher than the cost inflation

of the fuels used in producing cement (e.g., petcoke, shale gas)

•

High oil prices have also driven refineries to invest in cokers to extract more

high grade

products

from

crude

--

this

has

meant

less

production

of

bitumen

and

more

production

of

petcoke,

further

extending

the

gap

•

Petroleum coke is a low-value solid by-products of the oil refining

industry and this is

reflected

in

pricing

--

decisions

about

production

levels

tend

not

to

be

made

on

the markets for petroleum coke; it is a waste recovery by-product “priced

to move” rather than to store

•

Competition from concrete will limit asphalt’s ability to pass on costs

•

Well-positioned cement producers should enjoy increasing advantages

18 |

PCA

Projected Initial Bid Paving Costs Per Two Lane Road Mile -

Urban

Concrete

Asphalt

Parity achieved in Fiscal 2009

Bid

costs

do

not

consider

life-cycle

costs

–

which

further

favors

concrete

19

$200

$400

$600

$800

$1,000

$1,200

2003

2005

2007

2009

2011

2013

2015 |

Eagle Materials Business Definition

Minerals-Based Commodity Products

Strategy Emphasis Now

Key Demand Drivers

Competitive Advantage

Innovation Focus

Asset Optimization

Cyclical Recovery

Cost Position

Profitable, High-Returning Growth

Secular and Cyclical Growth

Extension of Low Cost Producer Positions

Cost Position

Scarcity

20

Infrastructure and

Related

Construction

Materials Residential and

Commercial

Construction Materials

Oil Well

Cement

Frac

Sand

Construction

Cement

Aggregates

and Concrete

Gypsum

Wallboard

Gypsum

Paperboard

Energy

Industry

Materials |

Close Relationship of End-Uses

Oil Well Cement and Now Frac Sand

Important elements

for unlocking energy

in the shale plays

•

Specialty oil well

cement

for casing

wells

•

Special purpose

frac sand

to keep

the fractures

“propped open”

21 |

Shifting the Cement Product Mix to Oil Well Cement

A Company Priority

22

•

Very few US cement producers have

the capability, know-how, permits or

customer relationships required to

effectively produce and market

specialty oil-well cement, especially

Class H, the grade used in the most

demanding casing applications

•

The alternative for oil services

companies is to apply additives to

more conventional grade cement to

achieve similar results –

this can be

more costly and less predictable

Eagle has been

the pre-eminent

US producer of oil

well cement for

decades

Strong value

proposition for

Eagle and a key

profit growth

opportunity |

Oil

Well Cement Strategic Directions A Mutually Reinforcing Growth Opportunity

with Frac Sand Eagle Plant

Current

Production

Proportion

Target

Production

Proportion

Key

Cement

Grades

Target

Shale

Plays

Texas

Lehigh

~ 50%

> 50%

Class H

Eagle Ford

Mature

capability

Mountain

~ 25%

> 25%

Class G

Niobrara

Mature

capability

Illinois

0%

> 25%

Class G

and H

Utica

Now

proven

Tulsa

4%

> 50%

Class C

and H

Miss. Lime,

Ardmore

Acquired,

now proven

Kansas

City

0%

> 25%

Class G

and H

Anadarko,

Bakken

Acquired,

feasible

23

Plant

Capability

Status |

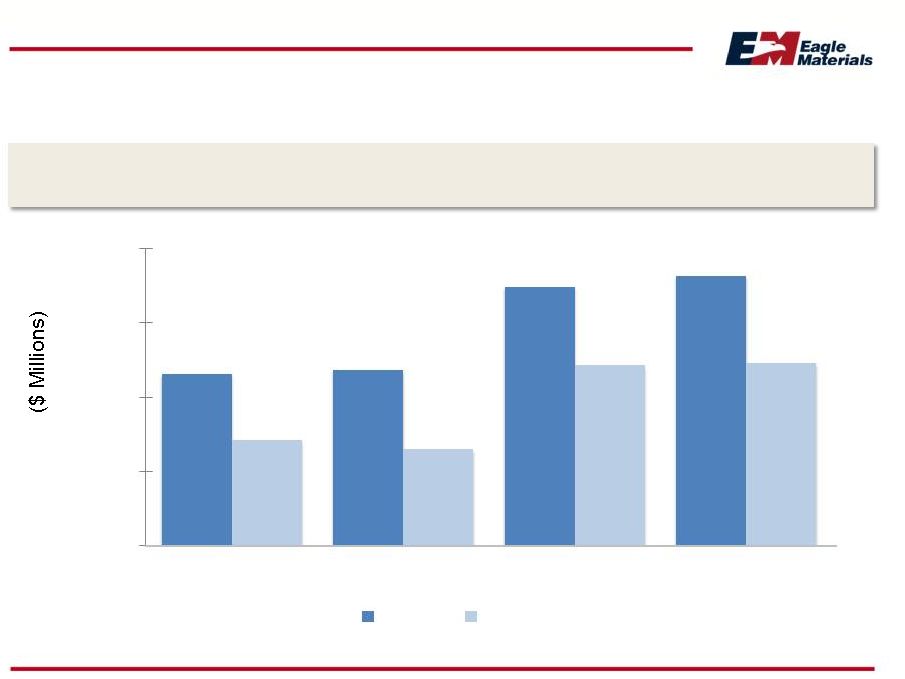

Increasing

drilling activity

should

continue to

drive growth in

cement

consumption

South Texas

represents

~15-20% of US

oil well cement

spend

Eagle Ford –

Cement Consumption Outlook

Continued Growth is Expected

24

2011

2012

2013

2014

2015

Estimated Annual Oil Well Cement Demand

and Outlook |

Eagle Materials Business Definition

Minerals-Based Commodity Products

Infrastructure and

Related

Construction

Materials Residential and

Commercial

Construction Materials

Strategy Emphasis Now

Key Demand Drivers

Competitive Advantage

Innovation Focus

Asset Optimization

Cyclical Recovery

Cost Position

Profitable, High-Returning Growth

Secular and Cyclical Growth

Extension of Low Cost Producer Positions

Oil Well

Cement

Frac

Sand

Construction

Cement

Aggregates

and Concrete

Gypsum

Wallboard

Gypsum

Paperboard

Cost Position

Scarcity

25

Energy

Industry

Materials |

Frac Sand is a Natural, Close Adjacency for Eagle

Key Growth Opportunity and a Top Eagle Priority

Frac sand entry leverages Eagle’s existing

•

Customer base (oil well cement)

•

Owned distribution infrastructure that we

have repurposed (Corpus Christi port

terminal, proximate to Eagle Ford)

•

Processing expertise (aggregates)

•

Advantaged access to scarce northern

white sand resource

•

Long-standing relationships (at Illinois

Cement) enabled acquisition of a 50-year

scale reserve deposit in Illinois

•

Northern white sand is the preferred

proppant in oily plays --

and increasingly so

•

Northern white sand deposits are not near

any shale plays, so logistics is a key

Opportunity to create a low-cost system

26 |

Northern Illinois

MN / WI

Small Universe of Areas in North America (and in the World)

Highest

Quality

Frac

Sand

Studies have shown geologic conditions creating these deposits are rare across the

globe. England deposits are played out, limited quality deposits in

Poland, Asia/Pacific and Arabia have lower crush strengths –

implies a relatively low sand import threat.

Geology

is

Destiny

–

Quality

Scarcity

Dark Red Represents the Outcroppings of Quartz Sand ~ 500 Million Years Old

27 |

Sandstone Formation Section View

Sandstone Closest to the Surface is Even Less Common

28 |

Key

Northern White Sand Sources Top Players Currently

Illinois (Top Quality)

~ 6 million tons capacity

1.

US Silica

2.

Unimin

3.

Fairmount

Wisconsin (Top Quality)

~ 10 million tons capacity

1.

Badger Mining

2.

Unimin

3.

Fairmount

4.

EOG Resources

Minnesota (Top Quality)

~ 4 million ton capacity

•

Unimin

29 |

Entrance to Eagle’s Illinois Mine

Northern White Frac Sand

Mine

Preparation

30

Processing

Construction |

Corpus Christi Site Repurposed, Now Operational

Third-Party Sand to Initialize Processing/Logistics Systems

31

Processing Construction |

Growth in US Rig Activity, Oil and Gas

Spears and Associates Forecasts

Forecast

Forecast

Forecast

•

The demands of the oily plays are a good fit with

our northern white sand

•

Horizontal drilling is the most frac sand intensive

32 |

Unconventional Oil/Liquids Land Rig Count Outlook

Key Shale Plays

~ 900

~ 875

Total

840 33

0

50

100

150

200

250

2012 Average

2013E Average

2014E Average |

Near-Term Oil and Gas Price Outlooks

Relatively Stable According to Spears Forecasts, July 2013

Forecast

Forecast

34 |

US

Liquids-Focused Threshold Economics Compelling After-Tax Rates of

Return at Expected Oil Prices Eagle Ford

Oil

Eagle Ford

Condensate

Mississippi

Lime

DJ

Niobrara

Granite

Wash

Bakken

Shale

Bakken

Parshall

10%

$53.31

$51.53

$48.45

$59.30

$43.16

$62.86

$44.13

15%

60.99

64.49

59.90

68.23

56.17

71.48

51.59

20%

67.51

75.74

70.05

75.86

67.21

78.92

58.06

25%

73.23

85.70

79.17

82.56

76.82

85.53

63.79

Source: Simmons and Company, June 2013

35 |

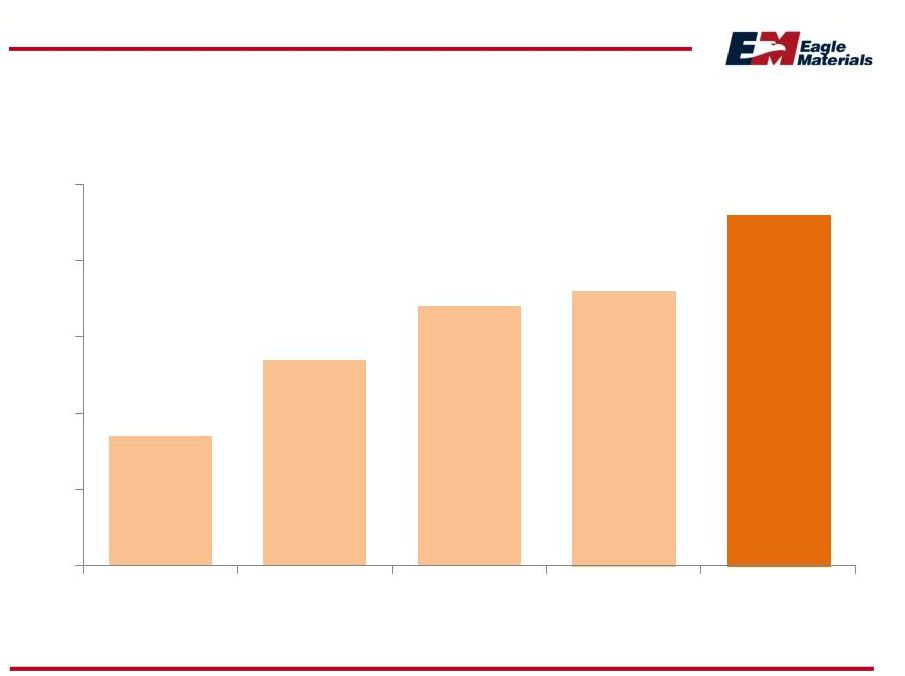

North American Proppant Annual Consumption

Annual million tons, estimated

36

17

27

34

36

46

0

10

20

30

40

50

2009

2010

2011

2012

2013 |

Estimated Available Supply and Demand

Million Tons

High Quality

White Sand

Inferior Sand

Types

2011 Tons

Industry

Capacity

2012 Tons

“Probable”

Year End Capacity

2013

Demand

Forecast

High

quality

northern

white

sand

is

increasingly

the

proppant

of

choice,

especially in oily plays. The industry is relying on lower quality but more

proximate sand types (as well as ceramics) to meet total demand.

37

0

10

20

30

40

50 |

Demand growth

over the next two

years is expected to

approximate our

newly installed

drying capacity at

Corpus Christi

Demand estimates

for 2013 range from

8 to 13 million tons

Eagle Ford –

Proppant Demand

Growth is Expected

38

2011

2012

2013

2014

2015

Annual

Proppant

Demand

Outlook |

Eagle Materials Business Definition

Minerals-Based Commodity Products

Infrastructure and

Related

Construction

Materials Residential and

Commercial

Construction Materials

Strategy Emphasis Now

Key Demand Drivers

Competitive Advantage

Innovation Focus

Asset Optimization

Cyclical Recovery

Cost Position

Profitable, High-Returning Growth

Secular and Cyclical Growth

Extension of Low Cost Producer Positions

Oil Well

Cement

Frac

Sand

Construction

Cement

Aggregates and

Concrete

Gypsum

Wallboard

Gypsum

Paperboard

Cost Position

Scarcity

39

Energy

Industry

Materials |

Eagle’s US Market and Production Locations

Wallboard

Paperboard

Gypsum, CO

700 MMSF

Albuquerque, NM

425 MMSF

Duke, OK

1,300 MMSF

Georgetown, SC

900 MMSF

Lawton, OK

350,000 tons

Bernalillo, NM

550 MMSF

Currently idled

Note: Design capacities here do not necessarily represent current operating rates

(“effective capacity”). 40

Total Wallboard

4,425 MMSF |

US

Demand for Gypsum Wallboard Closely Linked with Housing

41

0

5

10

15

20

25

30

35

40

0

200

400

600

800

1,000

1,200

New Home Sales (000)

BSF Gypsum Wallboard Shipments |

Single-Family Housing Starts Outlook

Moody’s economy.com, SAAR in Millions

2005

2007

2009

2011

2013

2006

2008

2010

2012

2014

2015

Harvard Joint Center for Housing Studies “conservative”

case:

16 million housing units needed 2010-20 (implies an average of

1.6 million/year --

household formations alone are 1.3 million)

Household Formations 2010-20

Gap

42

0.0

0.5

1.0

1.5

2.0 |

Latest

Regional

Recovery

Outlooks

--

Wallboard

Single Family Housing Starts, 2012Q4=1

2012 Relative

MSA Scale in

Starts

Source: Moody’s Economy.com, July 2013, Company analysis

Phoenix is expected to drive higher than

average growth ahead in this region

Areas like DFW and

Denver

have already been

on

the mend and

are

starting

from

“up the

curve” 43

0

1

2

3

4

2013Q1

2014Q1

2015Q1

2016Q1

Duke, OK

Eagle, CO

Albuquerque

Georgetown

(Charleston, SC, Columbia, SC, Wilmington,

NC, Raleigh, NC, Charlotte, NC, Atlanta,

Jacksonville, FL, Savannah, GA MSA’s)

(Albuquerque, NM, Santa Fe, NM, Phoenix,

AZ MSAs)

(DFW-Arlington, Oklahoma City, OK, Little

Rock, AR, Wichita Falls, TX, Wichita, KS MSA’s)

(Denver, Co, Boulder, Co, Cheyenne, WY, Salt

Lake, UT MSA’s) |

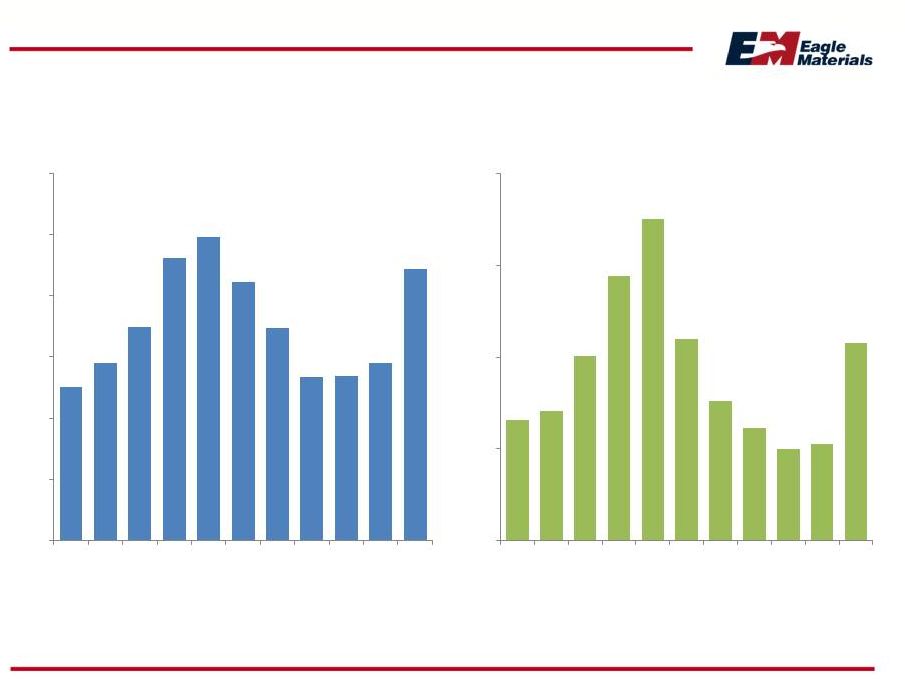

Repair and Remodeling Outlook

Harvard’s Outlook Suggests Growing Strength

44 |

Financial Discipline is a Key Enabler of Success

An Eagle Hallmark

Capital Structure

Funding Strategy

Use of Cash

45 |

Financial Summary

Profitable Performance Throughout the Cycle

Note: Dollars in millions. For fiscal years ending March 31. Pro forma LTM

periods include Acquired Assets. (1)

(2)

Adjusted Revenues

(1)

Adjusted EBITDA

(2)

46

$501

$579

$699

$925

$994

$845

$695

$533

$537

$581

$889

$0

$200

$400

$600

$800

$1,000

$1,200

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

PF

$131

$141

$201

$289

$351

$220

$152

$123

$100

$105

$216

$0

$100

$200

$300

$400

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

PF

Includes

our

proportionate

share

of

our

JV’s

revenues.

Adjusted

Revenues

is

a

non-GAAP

measure.

See

slides

titled

“Non-GAAP

Reconciliation”

in

the

Appendix.

PF

Adjusted

Revenues

includes

revenues

for

the

Acquired

Assets

from

April

1,

2012

through

November

30,

2012

(Acquisition

Date).

Adjusted EBITDA represents earnings before: (i) interest, taxes,

depreciation and amortization; (ii) certain other non-cash or non-routine

items; and (iii) acquisition costs and other

overhead

costs

allocated

to

the

Acquired

Assets.

Adjusted

EBITDA

is

a

non-GAAP

measure.

See

slides

titled

“Non-GAAP

Reconciliation”

in

the

Appendix.

PF

Adjusted

EBITDA includes EBITDA for the Acquired Assets from April 1, 2012 through November

30, 2012 (Acquisition Date). |

Eagle Evolution Since Peak of Last Cycle

Long-Standing Goal of Doubling Peak-to-Peak Earnings Power

1.

One-third more productive capacity in place

Cement: Illinois expansion (additional 470,000 tons)

Wallboard: Ultra-efficient plant built in Georgetown

Paper: 350,000 ton capacity today (220,000 tons last peak)

2.

Cement acquisitions increased capacity by 60% November 30, 2012

Two cement plants and related assets

3.

Shift of cement product mix toward oil well and other specialties

Class H at Texas Lehigh was ~25% now over 50%

4.

We believe that over time our frac sand opportunity has as much

earnings contribution potential as does cement or wallboard

47 |

Capital Structure

Net Debt-to-Cap

38%

35%

41%

40%

Net Debt-to-Equity

62%

55%

70%

68%

3/31/11

3/31/12

3/31/13

6/30/13

48

$462

$473

$696

$725

$285

$260

$485

$491

$-

$200

$400

$600

$800

Equity

Net Debt |

Debt Maturity Profile

$9.5

$57.0

$8.0

$81.2

$36.5

Fiscal Years

49

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

2014

2015

2016

2017

2018

2019

2020

2005 Senior Notes

2007 Senior Notes |

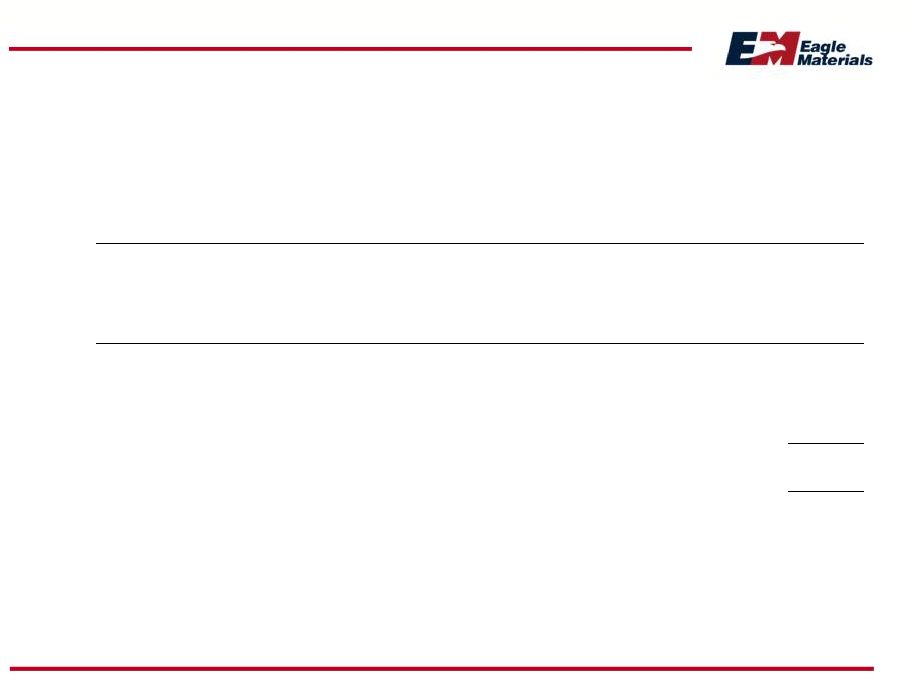

Disciplined Use of Cash

$ Millions

Maintenance

Dividends

Growth and

Improvement

Share

Repurchases

Note:

Issued

3.5

million

shares

in

FY

13

pursuant

to

the

Lafarge

Acquisition

Assets.

50

$0

$100

$200

$300

$400

$500

$600

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13 |

Investment Summary

Eagle Materials

•

Low cost producer

•

Leading positions in attractive markets

•

Now in early innings of the up-cycle

•

Favorable secular demand trends, especially for cement and frac-sand

•

Recently acquired assets have increased Eagle’s cement capacity by 60%

•

Track record of sound strategic choices and superior operational

execution

•

Healthy capital structure and increasing capacity to fund growth

51 |

Non-GAAP Reconciliation

52 |

Non-GAAP Reconciliation

Adjusted EBITDA

$ million

3/31/03

3/31/04

3/31/05

3/31/06

3/31/07

3/31/08

3/31/09

3/31/10

3/31/11

3/31/12

PF

3/31/13

Net Income

$ 57.6

$ 66.9

$ 106.7

$ 161.0

$ 202.7

$ 97.8

$ 41.8

$ 29.0

$ 14.8

$ 18.7

$ 57.7

Plus:

Taxes

29.0

35.2

51.4

80.1

101.6

46.6

20.4

10.3

1.9

3.2

26.4

Interest

9.6

3.8

3.3

6.3

5.4

21.1

28.9

21.5

16.5

16.6

15.8

DD&A

33.2

33.0

34.5

38.6

40.0

44.9

51.2

50.8

49.2

50.1

56.9

Other

Charges

1.4

2.2

5.5

3.2

1.8

9.7

9.8

11.0

17.9

15.9

14.9

Adjusted

EBITDA

$ 131

$ 141

$ 201

$ 289

$ 351

$ 220

$ 152

$ 123

$ 100

$ 105

$ 171

Acquired Assets EBITDA for the eight months ended 11/30/12 (see attached)

$ 45

FY 2013 Pro Forma Total Adjusted EBITDA

$ 216

Adjusted EBITDA represents earnings before (i) interest, taxes, depreciation and

amortization, (ii) certain other non-cash or non-routine items, and

(iii) acquisition costs and other overhead costs allocated to the Lafarge Target Business. Adjusted

EBITDA is a non-GAAP measure that provides supplemental information regarding

the operating performance of our business

without

regard

to

financing

methods,

capital

structures

or

historical

cost

bases

and

is

used

as

a

benchmark

for

evaluating

the

creditworthiness

of

particular

issuers.

Adjusted

EBITDA

should

not,

however,

be

considered

as

an

alternative

to net income, operating income, cash flow from operations or any other measure of

financial performance in accordance with GAAP.

53 |

Non-GAAP Reconciliation

Adjusted EBITDA

$ million

6 months ended

9/30/12

2 months ended

11/30/12

8 months

Acquired Assets Net Earnings

$ 5

$ 4

Plus:

Taxes

3

3

Interest

1

1

DD&A

11

3

Overhead

Allocation

Adjustment

12

2

Acquired Assets EBITDA

$ 32

$ 13

$ 45

The following provides a reconciliation of the Acquired Assets EBITDA for the 8

months ended 11/30/12: 54 |

Non-GAAP Reconciliation

Adjusted Revenue

$ million

3/31/03

3/31/04

3/31/05

3/31/06

3/31/07

3/31/08

3/31/09

3/31/10

3/31/11

3/31/12

PF

3/31/13

Eagle

$ 429

$ 503

$ 617

$ 860

$ 918

$ 748

$ 599

$ 468

$ 462

$ 495

$ 643

Joint

Venture

(50%)

72

76

82

65

76

97

96

65

75

86

96

Total

$ 501

$ 579

$ 699

$ 925

$ 994

$ 845

$ 695

$ 533

$ 537

$ 581

$ 739

Acquired Assets Revenue for 8 months ended 11/30/12 (see attached)

$ 150

Pro Forma Total

$ 889

55 |

Non-GAAP Reconciliation

Adjusted Revenue

$ million

9 months ended

9/30/12

2 months ended

11/30/12

8 months

Acquired Assets Revenue

$ 112

$ 38

$ 150

56

The following provides a reconciliation of the Acquired Assets revenue for the 8 months ended 11/30/12: |

MAJOR FACILITIES

GYPSUM WALLBOARD PLANTS

AMERICAN GYPSUM COMPANY

Albuquerque, New Mexico

Bernalillo, New Mexico

Gypsum, Colorado

Duke, Oklahoma

Georgetown, South Carolina

PAPERBOARD MILL

REPUBLIC PAPERBOARD

COMPANY LLC

Lawton, Oklahoma

LEGEND

CEMENT PLANTS

CEMENT TERMINALS

WALLBOARD PLANTS

WALLBOARD DISTRIBUTION YARDS

CONCRETE OPERATIONS

AGGREGATES OPERATIONS

PAPERBOARD MILL

DALLAS HEADQUARTERS

MARYSVILLE

RENO (FERNLEY)

ALBUQUERQUE

BERNALILLO

AUSTIN (BUDA)

DALLAS

DUKE

LAWTON

LASALLE

GEORGETOWN

LARAMIE

GYPSUM

TULSA

KANSAS CITY, KS & MO

CONCRETE, AGGREGATES, SAND PLANTS

CENTEX MATERIALS LLC

Austin and Buda, Texas

MATHEWS READYMIX LLC

Marysville, California

TALON CONCRETE AND AGGREGATES LLC

Kansas

&

Missouri

–

10

locations

WESTERN AGGREGATES LLC

Marysville, California

NORTHERN WHITE SAND COMPANY LLC

Corpus Christi, Texas

CEMENT PLANTS

CENTRAL PLAINS CEMENT

COMPANY LLC

Sugar Creek, Missouri

Tulsa, Oklahoma

ILLINOIS CEMENT COMPANY LLC

LaSalle, Illinois

MOUNTAIN CEMENT COMPANY

Laramie, Wyoming

NEVADA CEMENT COMPANY

Fernley, Nevada

TEXAS LEHIGH CEMENT

COMPANY LP

Buda, Texas

(50% joint venture)

SAND PLANT |

Contact Information

Steve Rowley

President and CEO

(214) 432-2020

srowley@eaglematerials.com

Craig Kesler

Executive Vice President and CFO

(214) 432-2013

ckesler@eaglematerials.com

Bob Stewart

Executive Vice President, Strategy, Corporate Development and Communications

(214) 432-2040

bstewart@eaglematerials.com

Eagle Materials

Inc. NYSE: EXP

www.eaglematerials.com

58 |