Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Celanese Corp | a2013938-karsecuritization.htm |

| EX-10.3 - EXHIBIT 10.3 - Celanese Corp | a2013938-kex103.htm |

| EX-10.1 - EXHIBIT 10.1 - Celanese Corp | a2013938-kex101.htm |

Exhibit 10.2

RECEIVABLES PURCHASE AGREEMENT

DATED AS OF AUGUST 28, 2013

BY AND AMONG

CE RECEIVABLES LLC,

as Seller,

as Seller,

CELANESE INTERNATIONAL CORPORATION,

as initial Servicer,

as initial Servicer,

THE VARIOUS CONDUIT PURCHASERS, RELATED COMMITTED PURCHASERS, LC BANKS AND PURCHASER AGENTS FROM TIME TO TIME PARTY HERETO,

AND

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH,

as Administrator

as Administrator

TABLE OF CONTENTS | |||||

Page | |||||

ARTICLE I. | AMOUNTS AND TERMS OF THE PURCHASES | 1 | |||

Section 1.1 | Purchase Facility | 1 | |||

Section 1.2 | Making Purchases | 2 | |||

Section 1.3 | Purchased Interest Computation | 4 | |||

Section 1.4 | Settlement Procedures | 4 | |||

Section 1.5 | Fees | 8 | |||

Section 1.6 | Payments and Computations, Etc. | 8 | |||

Section 1.7 | Increased Costs | 9 | |||

Section 1.8 | Break Funding Costs | 10 | |||

Section 1.9 | Inability to Determine the Euro-Rate | 10 | |||

Section 1.10 | Taxes | 10 | |||

Section 1.11 | Letters of Credit | 13 | |||

Section 1.12 | Issuance of Letters of Credit | 14 | |||

Section 1.13 | Requirements For Issuance of Letters of Credit | 14 | |||

Section 1.14 | Disbursements, Reimbursement | 14 | |||

Section 1.15 | LC Collateral Account | 15 | |||

Section 1.16 | Documentation | 15 | |||

Section 1.17 | Determination to Honor Drawing Request | 15 | |||

Section 1.18 | Nature of Reimbursement Obligations | 16 | |||

Section 1.19 | Liability for Acts and Omissions | 17 | |||

ARTICLE II. | REPRESENTATIONS AND WARRANTIES; COVENANTS; TERMINATION EVENTS | 18 | |||

Section 2.1 | Representations and Warranties; Covenants | 18 | |||

Section 2.2 | Termination Events | 18 | |||

ARTICLE III. | INDEMNIFICATION | 18 | |||

Section 3.1 | Indemnities by the Seller | 18 | |||

Section 3.2 | Indemnities by the Servicer | 20 | |||

ARTICLE IV. | ADMINISTRATION AND COLLECTIONS | 20 | |||

Section 4.1 | Appointment of the Servicer | 20 | |||

Section 4.2 | Duties of the Servicer | 21 | |||

Section 4.3 | Account Arrangements | 22 | |||

Section 4.4 | Enforcement Rights | 22 | |||

Section 4.5 | Responsibilities of the Seller | 23 | |||

Section 4.6 | Servicing Fee | 23 | |||

Section 4.7 | Authorization and Action of the Administrator and Purchaser Agents | 23 | |||

Section 4.8 | Nature of Administrator’s Duties; Delegation of Administrator’s Duties; Exculpatory Duties | 24 | |||

Section 4.9 | UCC Filings | 25 | |||

Section 4.10 | Agent’s Reliance, Etc | 25 | |||

Section 4.11 | Administrator and Affiliates; Agent Roles | 26 | |||

Section 4.12 | Notice of Termination Events | 26 | |||

Section 4.13 | Non-Reliance on Administrator, Purchaser Agents and other Purchasers; Administrators and Affiliates | 26 | |||

Section 4.14 | Indemnification | 27 | |||

Section 4.15 | Successor Administrator | 27 | |||

i

TABLE OF CONTENTS (continued) | |||||

Page | |||||

ARTICLE V. | MISCELLANEOUS | 28 | |||

Section 5.1 | Amendments, Etc | 28 | |||

Section 5.2 | Notices, Etc | 28 | |||

Section 5.3 | Successors and Assigns; Assignability; Participations; Replacement of Purchasers | 28 | |||

Section 5.4 | Costs and Expenses | 32 | |||

Section 5.5 | No Proceedings; Limitation on Payments | 32 | |||

Section 5.6 | Confidentiality | 33 | |||

Section 5.7 | GOVERNING LAW AND JURISDICTION | 33 | |||

Section 5.8 | Execution in Counterparts | 34 | |||

Section 5.9 | Survival of Termination | 34 | |||

Section 5.10 | WAIVER OF JURY TRIAL | 34 | |||

Section 5.11 | Entire Agreement | 34 | |||

Section 5.12 | Headings | 34 | |||

Section 5.13 | Right of Setoff | 34 | |||

Section 5.14 | Purchaser Groups’ Liabilities | 34 | |||

Section 5.15 | Sharing of Recoveries | 35 | |||

Section 5.16 | USA PATRIOT Act | 35 | |||

Section 5.17 | Defaulting Purchasers | 35 | |||

Section 5.18 | Construction | 35 | |||

Section 5.19 | Interpretation; Accounting Terms and Principles | 35 | |||

EXHIBIT I | DEFINITIONS |

EXHIBIT II | CONDITIONS OF PURCHASES |

EXHIBIT III | REPRESENTATIONS AND WARRANTIES |

EXHIBIT IV | COVENANTS |

EXHIBIT V | TERMINATION EVENTS |

SCHEDULE I | RESERVED |

SCHEDULE II | LOCK-BOX BANKS, LOCK-BOXES AND LOCK-BOX ACCOUNTS |

SCHEDULE III | RESERVED |

SCHEDULE IV | PURCHASER GROUPS AND MAXIMUM COMMITMENTS |

SCHEDULE V | PAYMENT INSTRUCTIONS |

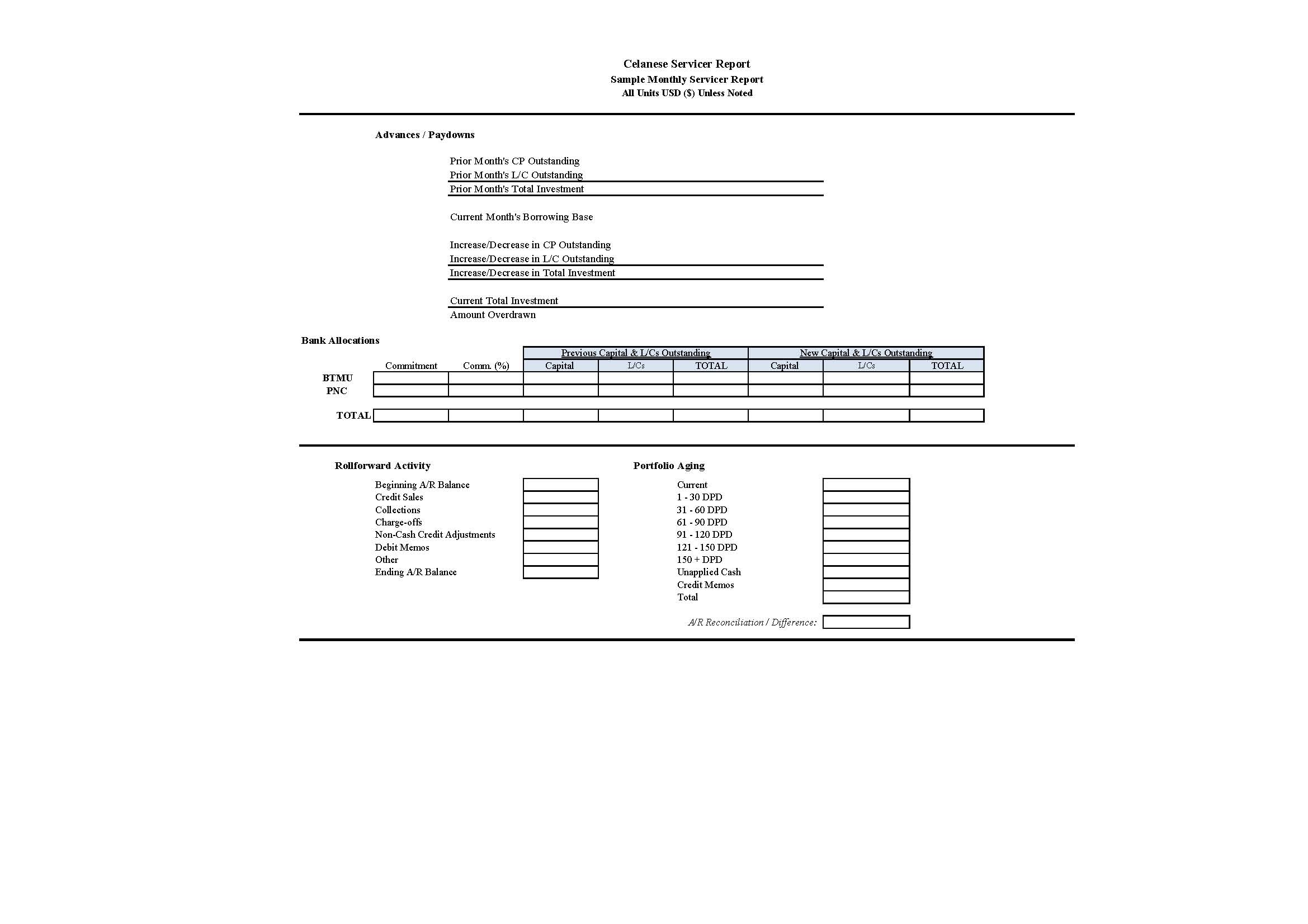

ANNEX A | FORMS OF INFORMATION PACKAGE |

ANNEX B | FORM OF PURCHASE NOTICE |

ANNEX C | FORM OF PAYDOWN NOTICE |

ANNEX D | FORM OF COMPLIANCE CERTIFICATE |

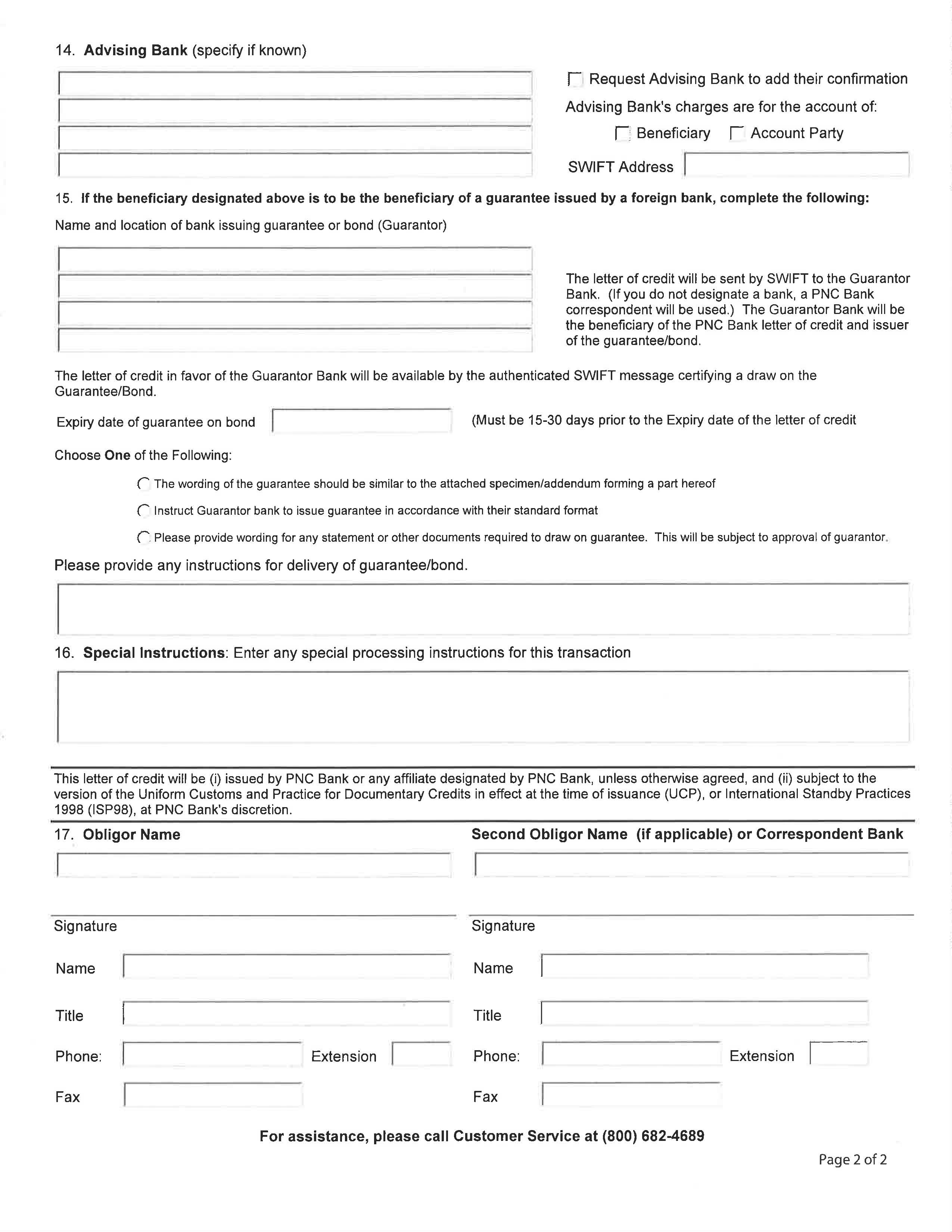

ANNEX E | FORM OF LETTER OF CREDIT APPLICATION |

ANNEX F | FORM OF TRANSFER SUPPLEMENT |

ii

This RECEIVABLES PURCHASE AGREEMENT (as amended, restated, supplemented or otherwise modified from time to time, this “Agreement”) is entered into as of August 28, 2013 by and among CE RECEIVABLES LLC, a Delaware limited liability company, as seller (the “Seller”), CELANESE INTERNATIONAL CORPORATION, a Delaware corporation (“Celanese International”), as initial servicer (in such capacity, together with its successors and permitted assigns in such capacity, the “Servicer”), the various CONDUIT PURCHASERS, RELATED COMMITTED PURCHASERS, LC BANKS and PURCHASER AGENTS from time to time party hereto, and THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH, as administrator (in such capacity, together with its successors and assigns in such capacity, the “Administrator”).

PRELIMINARY STATEMENTS.

Certain terms that are capitalized and used throughout this Agreement are defined in, or by reference in, Exhibit I. References in the Exhibits, Schedules and Annexes hereto to the “Agreement” refer to this Agreement, as amended, supplemented or otherwise modified from time to time.

The Seller (i) desires to sell, transfer and assign an undivided percentage ownership interest in a pool of receivables, and the Purchasers desire to acquire such undivided percentage ownership interest, as such percentage interest shall be adjusted from time to time based upon, in part, reinvestment payments that are made by such Purchasers, and (ii) may, subject to the terms and conditions hereof, request that the LC Banks issue or cause the issuance of one or more Letters of Credit.

In consideration of the mutual agreements, provisions and covenants contained herein, the sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

ARTICLE I.

AMOUNTS AND TERMS OF THE PURCHASES

Section 1.1 Purchase Facility.

(a) On the terms and subject to the conditions hereof, the Seller may, from time to time before the Termination Date, (i) request that (x) the Conduit Purchasers make purchases (and deemed purchases) of and reinvestments in, or (y) only if a Conduit Purchaser denies such request or is unable to fund (and provides notice of such denial or inability to the Seller, the Administrator and its Purchaser Agent) or if the applicable Purchaser Group does not include a Conduit Purchaser, the Related Committed Purchasers in the applicable Purchaser Group ratably make purchases (and deemed purchases) of and reinvestments in, undivided percentage ownership interests with regard to the Purchased Interest from the Seller and (ii) request that the LC Banks issue or cause the issuance of Letters of Credit (each such purchase, deemed purchase, reinvestment or issuance is referred to herein as a “Purchase”). Subject to Section 1.4(b) concerning reinvestments, at no time will a Conduit Purchaser have any obligation to make a Purchase. Each Related Committed Purchaser severally hereby agrees, on the terms and subject to the conditions hereof, to make purchases of and reinvestments in undivided percentage ownership interests with regard to the Purchased Interest from the Seller from time to time from the Closing Date to (but excluding) the Termination Date, and, on the terms of and subject to the conditions of this Agreement, each LC Bank hereby agrees to issue Letters of Credit in return for undivided percentage ownership interests with regard to the Purchased Interest from the Seller from time to time from the Closing Date to (but excluding) the Termination Date. Notwithstanding anything set forth in this Section 1.1(a) or otherwise herein to the contrary, under no circumstances shall any Purchaser be required to make any purchase or reinvestment hereunder (including, without limitation, any Purchases deemed to have been requested by Seller pursuant to Section 1.14(a)) or to issue any Letter of Credit hereunder, in either case, if, after giving effect to such Purchase:

(i) | any event has occurred and is continuing, or would result from such Purchase, that constitutes a Termination Event or an Unmatured Termination Event; |

(ii) | the Purchased Interest would exceed 100%; |

1

(iii) | the sum of (x) the Aggregate Capital plus (y) the Aggregate LC Amount, would exceed the Purchase Limit; |

(iv) | the Exposure of such Purchaser’s Purchaser Group would exceed such Purchaser Group’s Group Commitment; or |

(v) | the sum of (x) such Purchaser’s outstanding Capital, plus (y) the aggregate amount available to be drawn under all Letters of Credit (if any) issued by such Purchaser, would exceed such Purchaser’s Commitment. |

The Seller may, subject to this Section 1.1(a) and the other requirements and conditions herein, use the proceeds of any purchase by the Purchasers hereunder to satisfy any Reimbursement Obligation to the LC Banks pursuant to Section 1.14 below.

(b) The Seller may, upon at least three (3) Business Days’ prior written notice to the Administrator and each Purchaser Agent (except as otherwise provided below), terminate the Purchase Facility in whole or, upon at least three (3) Business Days’ prior written notice to the Administrator and each Purchaser Agent, from time to time, irrevocably reduce in part the unused portion of the Purchase Limit (but not below the amount that would cause the Aggregate Capital plus the Aggregate LC Amount to exceed the Purchase Limit or would cause the Exposure of any Purchaser Group to exceed its Group Commitment, in each case after giving effect to such reduction); provided, that each partial reduction shall be in the amount of at least $1,000,000, or an integral multiple of $500,000 in excess thereof, and that, unless terminated in whole, the Purchase Limit shall in no event be reduced below $75,000,000. The Administrator shall promptly advise the Purchaser Agents of any notice received by it pursuant to this Section 1.1(b). In addition to and without limiting any other requirements for termination, prepayment and/or the funding of the LC Collateral Account hereunder, no termination of the Purchase Facility shall be effective unless and until (i) the amount on deposit in the LC Collateral Account is at least equal to the Aggregate LC Amount plus the Expected LC Fees, (ii) the Aggregate Capital is reduced to zero and (iii) all other amounts owed to the Administrator, the Purchaser Agents and the Purchasers under this Agreement and each of the other Transaction Documents have been paid in full.

Section 1.2 Making Purchases.

(a) The Seller may request a purchase (but not reinvestment) of undivided percentage ownership interests with regard to the Purchased Interest hereunder to be made in cash on any day upon the Seller’s irrevocable written notice in the form of Annex B (each, a “Purchase Notice”) delivered to the Administrator and each Purchaser Agent in accordance with Section 5.2, which notice must be received by the Administrator and each Purchaser Agent by 1:00 p.m. (New York City time) at least two (2) Business Days before the requested Purchase Date, and which notice shall specify (A) the amount requested to be paid to the Seller (such amount, which shall not be less than $1,000,000 and shall be in integral multiples of $500,000 in excess thereof, being the Capital relating to the undivided percentage ownership interest then being purchased with respect to each Purchaser Group), (B) the date of such purchase (which shall be a Business Day) and (C) the pro forma calculation of the Purchased Interest after giving effect to the increase in the Aggregate Capital and any change in the Aggregate LC Amount resulting from such purchase.

(b) On the date of each Purchase requested by the Seller pursuant to Section 1.2(a), each applicable Conduit Purchaser or Related Committed Purchaser, as the case may be, shall, upon satisfaction of the applicable conditions set forth in Exhibit II, make available to the Seller in same day funds, at the Purchase Account (or such other account as may be designated in writing by the Seller to the Administrator and each Purchaser Agent), an amount equal to the portion of Capital relating to the undivided percentage ownership interest then being purchased by such Purchaser in accordance with the following paragraph.

Each Purchase made pursuant to this Section 1.2(b) shall be funded ratably by the Purchaser Groups based upon their respective Ratable Shares; provided, however, that if, prior to funding such Purchase (and, if applicable, applying the proceeds thereof in satisfaction of the Reimbursement Obligation), any Purchaser Group’s Exposure Percentage is less than its Ratable Share (including, without limitation, due to the issuance of Letters of Credit by one or more LC Banks), 100% of such Purchase shall be funded by such Purchaser Group (or, if multiple Purchaser Groups’

2

Exposure Percentages are less than their respective Ratable Shares, by such Purchaser Groups, ratably based upon their respective available Group Commitments) up to the amount necessary to cause all Purchaser Groups’ Exposures to equal their respective Ratable Shares, and any remainder of such Purchase shall be funded ratably by the Purchaser Groups based upon their respective Ratable Shares. Each Purchaser Group’s portion of any Purchase made pursuant to this Section 1.2(b) shall be funded either (i) by the Conduit Purchaser(s), if any, in such Purchaser Group if they so elect in their sole discretion, or (ii) alternatively, by the Related Committed Purchasers in such Purchaser Group ratably based upon their respective Commitment Percentages. For the avoidance of doubt, this paragraph shall not be construed to require any Purchaser to fund any Purchase unless all applicable conditions precedent set forth in this Agreement (including, without limitation, the conditions set forth in Section 1.1(a)) have been satisfied.

(c) Effective on the date of each Purchase pursuant to this Agreement, the Seller hereby sells and assigns to the Administrator for the benefit of the Purchasers (ratably, based on their respective Capital and the amounts available to be drawn under their respective Letters of Credit) an undivided percentage ownership interest in: (i) each Pool Receivable then existing, (ii) all Related Security with respect to such Pool Receivables and (iii) all Collections with respect to, and other proceeds of, such Pool Receivables and Related Security.

(d) To secure all of the Seller’s obligations (monetary or otherwise) under this Agreement and the other Transaction Documents to which it is a party, whether now or hereafter existing or arising, due or to become due, direct or indirect, absolute or contingent (collectively, the “Obligations”), the Seller hereby grants to the Administrator (for the benefit of the Administrator, the Purchasers, the Purchaser Agents and their respective permitted assigns) a security interest in all of the Seller’s right, title and interest (including any undivided interest of the Seller) in, to and under all of the following, whether now or hereafter owned, existing or arising: (i) all Pool Receivables, (ii) all Related Security with respect to such Pool Receivables, (iii) all Collections with respect to such Pool Receivables, (iv) the Lock-Box Accounts and all Collections on deposit therein, and all certificates and instruments, if any, from time to time evidencing such Lock-Box Accounts and amounts on deposit therein, (v) all rights (but none of the obligations) of the Seller under the Purchase and Sale Agreement and (vi) all proceeds of, and all amounts received or receivable under any or all of, the foregoing (collectively, the “Pool Assets”). The Seller hereby authorizes the Administrator to file financing statements naming the Seller as debtor or seller and describing the collateral covered thereby as “all of the debtor’s personal property or assets” or words to that effect, notwithstanding that such wording may be broader in scope than the collateral described in this Agreement. The Administrator (on behalf of itself, the Purchasers, the Purchaser Agents and their respective permitted assigns) shall have, with respect to the Pool Assets, and in addition to all the other rights and remedies available to the Administrator and the Purchasers, all the rights and remedies of a secured party under any applicable UCC.

(e) Provided that no Termination Event or Unmatured Termination Event exists and is continuing, the Seller may request, from time to time, in a written notice given to the Administrator and each Purchaser Agent, not less than 30 days and not more than 150 days prior to each anniversary of the Closing Date, that the then-current Scheduled Termination Date be extended to the date that is one year after such then-current Scheduled Termination Date. In the event that the Purchasers in any Purchaser Group are agreeable to such extension, the Administrator shall so notify the Seller and the Servicer in writing (it being understood that the Purchasers may accept or decline such a request in their sole discretion and on such terms as they may elect) and the Seller, the Servicer, the Purchasers, the Purchaser Agents and the Administrator shall enter into such documents as the Purchasers may reasonably deem necessary or appropriate to reflect such extension. In the event the Purchasers in any Purchaser Group decline the request for such extension, such Purchasers (or their Purchaser Agent) shall so notify the Administrator, and the Administrator shall so notify the Seller of such determination; provided, that the failure of the Administrator to affirmatively notify the Seller of any Purchasers’ election regarding such extension request within 30 days following receipt of such request shall be deemed to be a refusal by such Purchasers to grant the requested extension (any Purchaser Group that declines or is deemed to refuse such an extension, an “Exiting Purchaser Group”). If the Scheduled Termination Date is extended with respect to one or more, but less than all, Purchaser Groups, then the Purchase Limit shall be reduced by an amount equal to the Group Commitment(s) of the Exiting Purchaser Group(s).

(f) Each Related Committed Purchaser’s and LC Bank’s obligations hereunder shall be several, such that the failure of any Related Committed Purchaser or LC Bank to make a payment in connection with any Funded Purchase hereunder or to issue any Letter of Credit hereunder, as the case may be, shall not relieve any other Related

3

Committed Purchaser or LC Bank of its obligations hereunder to make payment for any Funded Purchase or to issue any Letter of Credit.

Section 1.3 Purchased Interest Computation.

The Purchased Interest shall be initially computed on the Closing Date. Thereafter, until the Termination Date, the Purchased Interest shall be automatically recomputed (or deemed to be recomputed) on each Business Day other than a Termination Day. The Purchased Interest shall become zero on the Final Payout Date.

Section 1.4 Settlement Procedures.

(a) The collection of the Pool Receivables shall be administered by the Servicer in accordance with this Agreement. The Seller shall provide to the Servicer on a timely basis all information needed for such administration, including notice of the occurrence of any Termination Day and current computations of the Purchased Interest.

(b) The Servicer shall, on each day on which Collections of Pool Receivables are received (or deemed received) by the Seller or the Servicer:

(i) identify, track, and hold, or cause to be held, in trust for the benefit of the Purchasers, out of such Collections, an amount equal to the sum of (x) the Aggregate Discount accrued through such day for each Portion of Capital and not previously identified, tracked and held in trust, (y) an amount equal to the fees set forth in the Fee Letters accrued and unpaid through such day and not previously identified, tracked and held in trust, and (z) an amount equal to the aggregate of the Purchasers’ Share of the Servicing Fee accrued through such day and not previously identified, tracked and held in trust;

(ii) subject to Section 1.4(f), if such day is not a Termination Day, remit to the Seller, ratably, on behalf of the Purchasers, the remainder of such Collections. Such remainder shall, to the extent representing a return of the Aggregate Capital, be automatically reinvested, ratably, according to each Purchaser’s Capital, in Pool Receivables and in the Related Security, Collections and other proceeds with respect thereto; provided, however, that if, after giving effect to any such reinvestment, (x) the Purchased Interest would exceed 100% or (y) the Aggregate Capital plus the Aggregate LC Amount would exceed the Purchase Limit then in effect, then the Servicer shall not remit such remainder to the Seller or reinvest, but shall identify, track and hold, or cause to be held, in trust for the Administrator (for the benefit of the Purchasers for distribution on the next Settlement Date pursuant to Section 1.4(d)(i)(C) or 1.4(d)(ii), as applicable) (and following the occurrence of a Termination Event or during the continuance of an Unmatured Termination Event shall, at the request of the Administrators segregate in a separate account approved by the Administrator) a portion of such Collections that, together with the other Collections identified and tracked pursuant to this paragraph, shall equal the amount necessary to reduce the Purchased Interest to 100% or cause the Aggregate Capital plus the Aggregate LC Amount to not exceed the Purchase Limit, as the case may be (determined as if such Collections set aside had been applied to reduce the Aggregate Capital and/or the Aggregate LC Amount at such time); provided, further, that if the Scheduled Termination Date has been extended by one or more Purchaser Groups pursuant to Section 1.2(e) and, on such day, there are one or more Exiting Purchaser Groups with Adjusted Exposures greater than zero (each such day, a “Non-Extension Day”), then each Exiting Purchaser Group’s ratable share (determined based upon the respective Adjusted Exposures of the various Purchaser Groups) of Collections shall not be reinvested or remitted to the Seller and shall instead be held in trust for the benefit of such Exiting Purchaser Groups pursuant to clause (iii) below;

(iii) if such day is a Termination Day (or any Non-Extension Day), identify, track and hold, or cause to be held, in trust for the benefit of all Purchasers (in the case of a Termination Day) or Exiting Purchaser Groups (in the case of a Non-Extension Day that is not a Termination Day), as applicable (and following the occurrence of a Termination Event or during the continuance of an Unmatured Termination Event shall, at the request of the Administrators segregate in a separate account approved by the Administrator), the entire remainder of such Collections (or in the case of any Non-Extension Day that is not also a Termination Day, an amount equal to the Exiting Purchaser Groups’ ratable share of such Collections based on their respective

4

Adjusted Exposures; provided, however, that solely for purposes of determining such Exiting Purchaser Groups’ ratable share of such Collections, such Exiting Purchaser Groups’ Adjusted Exposure shall be deemed to remain constant from the first Non-Extension Day until the date such Exiting Purchaser Groups’ Adjusted Exposures have been reduced to zero; it being understood that if a Termination Day occurs following a Non-Extension Day, such Exiting Purchaser Groups’ Adjusted Exposures shall be recalculated taking into account amounts received by such Exiting Purchaser Groups in respect of this parenthetical and, thereafter, Collections shall be set aside for all Purchasers ratably in respect of their respective Adjusted Exposures (as recalculated)); and

(iv) release to the Seller (subject to Section 1.4(f)) for its own account any Collections in excess of: (w) amounts required to be reinvested in accordance with clause (ii) plus (x) the amounts that are required to be set aside pursuant to clause (i) above, pursuant to the proviso to clause (ii) above and pursuant to clause (iii) above, plus (y) the Seller’s Share of the Servicing Fee accrued and unpaid through such day and all reasonable and appropriate out-of-pocket costs and expenses of the Servicer for servicing, collecting and administering the Pool Receivables plus (z) all other amounts then due and payable by the Seller under this Agreement to the Purchasers, the Purchaser Agents, the Administrator, and any other Indemnified Party or Affected Person.

(c) On each Settlement Date, the Servicer shall, in accordance with the priorities set forth in Section 1.4(d), deposit into the account specified by each Purchaser Agent all Collections held for the Administrator, the Purchaser Agents and the Purchasers pursuant to Section 1.4(b) and 1.4(f); provided, that if Celanese International or an Affiliate thereof is the Servicer, such day is not a Termination Day and the Administrator has not notified Celanese International (or such Affiliate) that such right is revoked, Celanese International (or such Affiliate), as Servicer, may retain the portion of the Collections set aside pursuant to Section 1.4(b)(i) that represents the aggregate of the Purchasers’ Share of the Servicing Fee. On or prior to the fifth (5th) Business Day of each calendar month following the end of the Settlement Period, each Purchaser Agent will notify the Servicer telephonically, by electronic mail or by facsimile of the amount of Discount accrued with respect to each Portion of Capital during the most recently ended calendar month.

(d) The Servicer shall distribute the Collections held for the Administrator, the Purchaser Agents and the Purchasers described in Section 1.4(c) in the following order of priority:

(i) if such distribution occurs on a day that is not a Termination Day:

(A) first, to the Purchaser Agents ratably according to the Discount and Fees accrued during such Settlement Period (for the benefit of the relevant Purchasers within such Purchaser Agent’s Purchaser Group) in payment in full of all such accrued Discount with respect to each Portion of Capital maintained by such Purchasers and all such accrued Fees; it being understood that each Purchaser Agent shall distribute such amounts to the Purchasers within such Purchaser Agent’s Purchaser Group ratably according to Discount and Fees owing, respectively;

(B) second, if the Servicer has set aside amounts in respect of the Servicing Fee pursuant to Section 1.4(b)(i) and has not retained such amounts pursuant to Section 1.4(c), to the Servicer (payable in arrears on each Settlement Date) in payment in full of the aggregate of the Purchasers’ Share of accrued Servicing Fees so set aside;

(C) third, if any such Collections are then being held in trust for the benefit of the Purchasers pursuant to Section 1.4(b)(ii) or 1.4(f), such Collections shall be distributed to the Purchaser Agents ratably (based on the Adjusted Exposures of their respective Purchaser Groups at such time) (for the benefit of the relevant Purchasers in their respective Purchaser Groups); provided, that each Purchaser Agent shall apply any amount distributed to it pursuant to this clause in the following order of priority: (x) first, in payment in full of the outstanding Capital of the Purchasers in its Purchaser Group, and (y) second, to the LC Collateral Account for the benefit of any LC Bank in its Purchaser Group to cash collateralize such LC Bank’s outstanding Letters of Credit until the amount held in the LC Collateral Account equals 100% of the aggregate amount

5

available to be drawn under such Letters of Credit plus the amount of all Expected LC Fees with respect thereto; and

(D) fourth, if any such Collections are then being held in trust for the benefit of an Exiting Purchaser Group pursuant to Section 1.4(b)(iii), such Collections shall be distributed to the Purchaser Agent for such Existing Purchaser Group (for the benefit of the Purchasers in such Exiting Purchaser Group); provided, that such Purchaser Agent shall apply any amount distributed to it pursuant to this clause in the following order of priority: (x) first, in payment in full of the outstanding Capital of the Purchasers in such Exiting Purchaser Group, and (y) second, to the LC Collateral Account for the benefit of any LC Bank in such Exiting Purchaser Group to cash collateralize such LC Bank’s outstanding Letters of Credit until the amount held in the LC Collateral Account equals 100% of the aggregate amount available to be drawn under such Letters of Credit plus the amount of all Expected LC Fees with respect thereto; and

(ii) if such distribution occurs on a Termination Day:

(A) first, to the Servicer (if other than Celanese International or an Affiliate thereof), in payment in full of the Purchasers’ Share of all accrued Servicing Fees;

(B) second, to the Purchaser Agents ratably (based on the aggregate accrued and unpaid Discount and Fees payable to their respective Purchaser Groups at such time) (for the benefit of the relevant Purchasers in their respective Purchaser Groups) in payment in full of all accrued Discount with respect to each Portion of Capital funded or maintained by the Purchasers and all accrued Fees;

(C) third, to the Purchaser Agents ratably (based on the Adjusted Exposures of their respective Purchaser Groups at such time) (for the benefit of the relevant Purchasers in their respective Purchaser Groups) in an amount, for each Purchaser Group, equal to such Purchaser Group’s Aggregate Exposure; provided, that each Purchaser Agent shall apply any amount distributed to it pursuant to this clause in the following order of priority: (x) first, in payment in full of the outstanding Capital of the Purchasers in its Purchaser Group, and (y) second, to the LC Collateral Account for the benefit of any LC Bank in its Purchaser Group to cash collateralize such LC Bank’s outstanding Letters of Credit until the amount held in the LC Collateral Account equals 100% of the aggregate amount available to be drawn under such Letters of Credit plus the amount of all Expected LC Fees with respect thereto;

(D) fourth, if the Adjusted Exposures of all Purchaser Groups have been reduced to zero, all accrued Discount and Fees have been paid in full and the aggregate of the Purchasers’ Share of all accrued Servicing Fees payable to the Servicer (if other than Celanese International or an Affiliate thereof) have been paid in full, to each Purchaser Agent ratably, based on the remaining amounts, if any, payable to each Purchaser in such Purchaser Agent’s Purchaser Group (for the benefit of the relevant Purchasers in such Purchaser Agent’s Purchaser Group), the Administrator and any other Indemnified Party or Affected Person in payment in full of any other amounts owed thereto by the Seller or the Servicer hereunder; and

(E) fifth, to the Servicer (if the Servicer is Celanese International or an Affiliate thereof) in payment in full of the aggregate of the Purchasers’ Share of all accrued Servicing Fees.

After the Adjusted Exposures of all Purchaser Groups have been reduced to zero, all accrued Discount, Fees and Servicing Fees have been paid in full and all other amounts payable by the Seller and the Servicer to each Purchaser Group, the Administrator or any other Indemnified Party or Affected Person hereunder and under the other Transaction Documents have been paid in full, all additional Collections with respect to the Purchased Interest shall be paid to the Seller for its own account.

(e) For the purposes of this Section 1.4:

(i) if on any day the Outstanding Balance of any Pool Receivable is either (A) reduced or canceled as a result of (I) any defective, rejected, returned goods or services, any cash or other discount, or

6

any failure by an Originator to deliver any goods or perform any services or otherwise perform under the underlying Contract or invoice, (II) any change in or cancellation of any of the terms of such Contract or invoice or any other adjustment by the Originator, the Servicer or the Seller which reduces the amount payable by the Obligor on the related Receivable, (III) any rebates, warranties, allowances or charge-backs or (IV) any setoff or credit in respect of any claim by the Obligor thereof (whether such claim arises out of the same or a related transaction or an unrelated transaction) or (B) subject to any specific dispute, offset, counterclaim or defense whatsoever (except the discharge in bankruptcy of the Obligor thereof), in either case, the Seller shall be deemed to have received on such day a Collection of such Pool Receivable in the amount of such reduction, adjustment, cancellation or dispute and shall, (x) prior to the Termination Date, hold any and all such amounts in trust for the benefit of the Purchasers and their assigns and, on the following Settlement Date, apply such amounts in accordance with this Section 1.4 or (y) on or after the Termination Date, within two (2) Business Days of such reduction or adjustment, pay any and all such amounts in respect thereof to a Lock-Box Account for the benefit of the Purchasers and their assigns and for application pursuant to Section 1.4;

(ii) if (x) the representation and warranty in Section l(j) of Exhibit III is not true on the day such representation and warranty is made or deemed made or (y) if any of the representations or warranties in Section 1(r) of Exhibit III is not true with respect to any Pool Receivable, the Seller shall be deemed to have received a Collection of the full Outstanding Balance of such Pool Receivable existing on the date of such designation, as applicable, and shall, within two (2) Business Days of the Seller or the Servicer having knowledge or notice of any such inaccuracy, pay the amount of such deemed Collection to a Lock-Box Account (or as otherwise directed by the Administrator at such time) for the benefit of the Purchasers for application pursuant to Section 1.4(b) (Collections deemed to have been received pursuant to Section 1.4(e)(i) or (ii) are hereinafter sometimes referred to as “Deemed Collections”);

(iii) except as provided in Section 1.4(e)(i) and (ii) or as otherwise required by Applicable Law or the relevant Contract, all Collections received from an Obligor of any Receivable shall be applied to the Receivables of such Obligor in the order of the age of such Receivables, starting with the oldest such Receivable, unless such Obligor designates that its payment is to be applied to specific Receivables; and

(iv) if and to the extent the Administrator, any Purchaser Agent or any Purchaser shall be required for any reason to pay over to an Obligor (or any trustee, receiver, custodian or similar official in any Insolvency Proceeding) any amount received by it hereunder, such amount shall be deemed not to have been so received by such Person but rather to have been retained by the Seller and, accordingly, such Person shall have a claim against the Seller for such amount, payable when and to the extent that any distribution from or on behalf of such Obligor is made in respect thereof.

(f) If at any time the Seller shall wish to cause a voluntary reduction (in whole or in part) of the Aggregate Capital, the Seller may do so as follows:

(i) the Seller shall give the Administrator and each Purchaser Agent written notice in substantially the form of Annex C (each, a “Paydown Notice”) at least two Business Days prior to the date of such reduction, which Paydown Notice shall include, among other things, the amount of such proposed reduction and the proposed date on which such reduction will commence;

(ii) (A) on the proposed date of the commencement of such reduction and on each day thereafter, the Servicer shall cause Collections not to be reinvested until the amount thereof not so reinvested shall equal the desired amount of reduction or (B) the Seller shall (from its own funds) remit to the Purchaser Agents (for the benefit of the Purchasers in their respective Purchaser Groups), no later than 1:00 p.m. (New York City time), in immediately available funds, an amount equal to the desired amount of such reduction together with accrued and unpaid Aggregate Discount with respect to the amount of the Aggregate Capital reduced thereby and any amount due and payable under Section 1.8(a) in connection therewith, ratably based on such Purchaser Agent’s Purchasers’ portion of the Aggregate Capital reduced thereby and portion of the related Aggregate Discount;

7

(iii) in the case of clause (ii)(A) above, the Servicer shall hold such Collections in trust for the benefit of the Purchasers ratably (based on their respective Portions of Capital funded thereby) for payment to the Purchaser Agents (for the benefit of the relevant Purchasers in such Purchaser Agent’s Purchaser Group) in accordance with Section 1.4(d) on the next Settlement Date immediately following the current Settlement Period or such other date approved by the Administrator and each Purchaser Agent, and the Aggregate Capital (together with the Capital of any related Purchaser) shall be deemed reduced in the amount to be paid to each such Purchaser Agent (on behalf of its related Purchasers) only when in fact finally so paid; and

(iv) any such amounts owing by the Seller pursuant to Section 1.8 related to such reduction shall be distributed pursuant to Section 1.4(c) on the Settlement Date immediately following the date of such reduction;

provided, that the amount of any such reduction of the Aggregate Capital shall be not less than $1,000,000 and shall be an integral multiple of $500,000.

Section 1.5 Fees.

The Seller shall pay to the Administrator, the Purchaser Agents, and the Purchasers, as applicable, certain fees in the amounts and on the dates set forth in (i) that certain fee letter agreement, dated as of Closing Date, among the Seller, the Servicer, the Purchaser Agents (on behalf of their respective Purchaser Groups), the LC Banks and the Administrator (as amended, restated, supplemented or otherwise modified from time to time, the “RPA Fee Letter”) and (ii) that certain fee letter agreement, dated as of the Closing Date, among the Seller, the Servicer, the Administrator and the LC Banks (as amended, restated, supplemented or otherwise modified from time to time, the “Agent Fee Letter”; together with the RPA Fee Letter, individually, a “Fee Letter” and collectively, the “Fee Letters”).

Section 1.6 Payments and Computations, Etc.

(a) All amounts to be paid or deposited by the Seller or the Servicer hereunder or under any other Transaction Document shall be made without reduction for offset or counterclaim and shall be paid or deposited no later than 1:00 p.m. (New York City time) on the day when due in immediately available funds to each account designated by each applicable Purchaser Agent (for the benefit of the Purchasers in such Purchaser Agent’s Purchaser Group) and/or the Administrator, as applicable. All amounts received after 1:00 p.m. (New York City time) will be deemed to have been received on the next Business Day. Except as expressly set forth herein (including, without limitation, as set forth in Sections 1.4(b)(ii) or (iii) with respect to Collections held in trust for Exiting Purchaser Groups), each Purchaser Agent shall distribute the amounts paid to it hereunder for the benefit of the Purchasers in its Purchaser Group to the Purchasers within its Purchaser Group ratably (x) in the case of such amounts paid in respect of Discount and Fees, according to the Discount and Fees payable to such Purchasers, (y) in the case of amounts paid in respect of the Reimbursement Obligation or to cash collateralize a Letter of Credit, to the applicable LC Bank or LC Collateral Account and (z) in the case of such amounts paid in respect of Capital (or in respect of any other obligations other than Discount and Fees or described in clause (y) above), according to the outstanding Capital funded by such Purchasers.

(b) The Seller or the Servicer, as the case may be, shall, to the extent permitted by law, pay interest on any amount not paid or deposited by the Seller or the Servicer, as the case may be, when due hereunder, at an interest rate equal to the Default Rate, payable on demand.

(c) All computations of interest under Section 1.6(b) and all computations of Discount, fees and other amounts hereunder shall be made on the basis of a year of 360 (or 365 or 366, as applicable, with respect to Discount or other amounts calculated by reference to the Base Rate) days for the actual number of days elapsed. Whenever any payment or deposit to be made hereunder shall be due on a day other than a Business Day, such payment or deposit shall be made on the next Business Day and such extension of time shall be included in the computation of such payment or deposit.

8

Section 1.7 Increased Costs.

(a) Increased Costs Generally. If any Change in Law shall:

(i) impose, modify or deem applicable any reserve, special deposit, liquidity, compulsory loan, insurance charge or similar requirement against assets of, deposits with or for the account of, or credit extended or participated in by, any Affected Person (except any such reserve included in the calculation of the Euro-Rate through the Euro-Rate Reserve Percentage);

(ii) subject any Affected Person to any Taxes (other than Indemnified Taxes, Taxes described in clauses (b) through (d) of the definition of Excluded Taxes or Connection Income Taxes) on its loans, loan principal, letters of credit, commitments or other obligations, or its deposits, reserves, other liabilities or capital attributable thereto; or

(iii) impose on any Affected Person any other condition, cost or expense (other than Taxes) affecting this Agreement, the Purchased Interest, any Portion of Capital, any Discount or any Letter of Credit;

and the result of any of the foregoing shall be to increase the cost to such Affected Person of (A) acting as Administrator, a Purchaser Agent or a Purchaser hereunder or as a Program Support Provider with respect to the transactions contemplated hereby, (B) purchasing, funding or maintaining the ownership of undivided percentage ownership interests with regard to the Purchased Interest (or interests therein) or any Portion of Capital, (C) issuing or maintaining any Letter of Credit or (D) maintaining its obligation to fund or maintain such ownership or any such Portion of Capital or to issue or maintain any such Letter of Credit, or to reduce the amount of any sum received or receivable by such Affected Person hereunder, then, upon request of such Affected Person (or its Purchaser Agent), the Seller will pay to such Affected Person such additional amount or amounts as will compensate such Affected Person for such additional costs incurred or reduction suffered.

(b) Capital Requirements. If any Affected Person determines that any Change in Law affecting such Affected Person or any lending office of such Affected Person or such Affected Person’s holding company, if any, regarding capital or liquidity requirements, has or would have the effect of reducing the rate of return on such Affected Person’s capital or on the capital of such Affected Person’s holding company, if any, as a consequence of (A) this Agreement, (B) the commitments of such Affected Person hereunder or under any related Program Support Agreement, (C) the ownership of undivided percentage ownership interests with regard to the Purchased Interest (or interests therein) or any Portion of Capital or (D) any Letter of Credit, to a level below that which such Affected Person or such Affected Person’s holding company could have achieved but for such Change in Law (taking into consideration such Affected Person’s policies and the policies of such Affected Person’s holding company with respect to capital adequacy and liquidity), and determined to be material by such Affected Person then from time to time, upon request of such Affected Person (or its Purchaser Agent), the Seller will pay to such Affected Person such additional amount or amounts as will compensate such Affected Person or such Affected Person’s holding company for any such reduction suffered.

(c) Certificates for Reimbursement. A certificate of an Affected Person (or its Purchaser Agent on its behalf) setting forth the amount or amounts necessary to compensate such Affected Person or its holding company, as the case may be, as specified in clause (a) or (b) of this Section and delivered to the Seller, shall be conclusive absent manifest error. The Seller shall, subject to the priorities for payment set forth in Section 1.4, pay such Affected Person’s Purchaser Agent (for the account of such Affected Person) the amount shown as due on any such certificate on the first Settlement Date occurring at least 10 days after the Seller’s receipt of such certificate.

(d) Delay in Requests. Promptly after any determination is made by an Affected Person that it will make a request for increased compensation pursuant to this Section 1.7, such Affected Person shall notify the Seller. Failure or delay on the part of any Affected Person to demand compensation pursuant to this Section shall not constitute a waiver of such Affected Person’s right to demand such compensation; provided that the Seller shall not be required to compensate an Affected Person pursuant to this Section for any increased costs incurred or reductions suffered more than 120 days prior to the date that such Affected Person notifies the Seller of the Change in Law giving rise to such increased costs or reductions and of such Affected Person’s intention to claim compensation therefor (except that, if

9

the Change in Law giving rise to such increased costs or reductions is retroactive, then the 120-day period referred to above shall be extended to include the period of retroactive effect thereof).

Section 1.8 Break Funding Costs.

(a)The Seller will compensate each Purchaser in accordance with the terms of this Section 1.8 for all losses, expenses and liabilities (including any loss, expense or liability incurred by reason of the liquidation or reemployment of deposits or other funds acquired by such Purchaser in order to fund or maintain any Portion of Capital hereunder) as a result of (i) any repayment (in whole or in part) of any Portion of Capital of such Purchaser on any day other than a Settlement Date or (ii) any Funded Purchase not being completed by the Seller in accordance with its request therefor pursuant to Section 1.2. Such losses, expenses and liabilities will include the amount, if any, by which (A) the additional Discount that would have accrued had such repayment or failure to Purchase not have occurred, exceeds (B) the income, if any, received by the applicable Purchaser.

(b) A certificate of a Purchaser (or its related Purchaser Agent) setting forth the amount or amounts necessary to compensate such Purchaser as specified in Section 1.8(a) and delivered to the Seller and the Administrator, shall be conclusive absent manifest error. The Seller shall pay such Purchaser’s related Purchaser Agent (for the account of such Purchaser) the amount shown as due on any such certificate on the first Settlement Date to occur at least 10 days after the Seller’s receipt of such certificate.

Section 1.9 Inability to Determine the Euro-Rate.

(a) If the Administrator (or any Purchaser Agent) reasonably determines on any day (which determination shall be final and conclusive absent manifest error) that, by reason of circumstances affecting the interbank eurodollar market generally, (i) deposits in dollars are not being offered to banks in the interbank eurodollar market for such day, (ii) adequate means do not exist for ascertaining the Euro-Rate for such day or (iii) the Euro-Rate does not accurately reflect the cost to any Purchaser (as determined by such Purchaser or such Purchaser’s Purchaser Agent) of maintaining any Portion of Capital during any Settlement Period (or portion thereof), then the Administrator (or any Purchaser Agent) shall give notice thereof to the Seller. Thereafter, until the Administrator or such Purchaser Agent notifies the Seller that the circumstances giving rise to such suspension no longer exist, (A) no Portion of Capital shall be funded at the Alternate Rate determined by reference to the Euro-Rate and (B) the Discount for any outstanding Portions of Capital then funded at the Alternate Rate determined by reference to the Euro-Rate shall be converted to the Alternate Rate determined by reference to the Base Rate.

(b) If, on any day, the Administrator shall have been notified by any Affected Person that such Affected Person has reasonably determined (which determination shall be final and conclusive) that any Change in Law, or compliance by such Affected Person with any Change in Law, shall make it unlawful or impossible for such Affected Person to fund or maintain any Portion of Capital at the Alternate Rate determined by reference to the Euro-Rate, the Administrator shall notify the Seller thereof. Upon receipt of such notice, until the Administrator notifies the Seller that the circumstances giving rise to such determination no longer apply, (A) no Portion of Capital shall be funded at the Alternate Rate determined by reference to the Euro-Rate and (B) the Discount for any outstanding Portions of Capital then funded at the Alternate Rate determined by reference to the Euro-Rate shall be converted to the Alternate Rate determined by reference to the Base Rate either (i) on the last day of the then current Settlement Period if such Affected Person may lawfully continue to maintain such Portion of Capital at the Alternate Rate determined by reference to the Euro-Rate to such day, or (ii) immediately, if such Affected Person may not lawfully continue to maintain such Portion of Capital at the Alternate Rate determined by reference to the Euro-Rate to the last day of the then-current Settlement Period.

Section 1.10 Taxes.

(a) Payments Free of Taxes. Any and all payments by or on account of any obligation of the Seller under any Transaction Document shall be made without deduction or withholding for any Taxes, except as required by Applicable Law. If any Applicable Law (as determined in the good faith discretion of an applicable Withholding Agent) requires the deduction or withholding of any Tax from any such payment by a Withholding Agent, then the applicable

10

Withholding Agent shall be entitled to make such deduction or withholding and shall timely pay the full amount deducted or withheld to the relevant Governmental Authority in accordance with Applicable Law, and, if such Tax is an Indemnified Tax, then the sum payable by the Seller shall be increased as necessary so that after such deduction or withholding has been made (including such deductions and withholdings applicable to additional sums payable under this Section), the applicable Affected Person receives an amount equal to the sum it would have received had no such deduction or withholding been made.

(b) Payment of Other Taxes by the Seller. The Seller shall timely pay to the relevant Governmental Authority in accordance with Applicable Law, or, at the option of the Administrator, timely reimburse it for the payment of, any Other Taxes.

(c) Indemnification by the Seller. The Seller hereby indemnifies each Affected Person, within ten (10) days after demand therefor, for the full amount of any (A) Indemnified Taxes (including Indemnified Taxes imposed or asserted on or attributable to amounts payable under this Section) payable or paid by such Affected Person or required to be withheld or deducted from a payment to such Affected Person and any reasonable expenses arising therefrom or with respect thereto, whether or not such Indemnified Taxes were correctly or legally imposed or asserted by the relevant Governmental Authority and (B) Taxes (other than Taxes described in clause (a) and (d) of the definition of Excluded Taxes) that arise because a Purchase is not treated for U.S. federal, state, local or franchise tax purposes as intended under Section 1.10(k) (such indemnification will include any U.S. federal, state or local income and franchise taxes necessary to make such Affected Person whole on an after-tax basis taking into account the taxability of receipt of payments under this clause (B) and any reasonable expenses (other than Taxes) arising out of, relating to, or resulting from the foregoing). A certificate as to the amount of such payment or liability delivered to the Seller by an Affected Person (with a copy to the Administrator), or by the Administrator on its own behalf or on behalf of an Affected Person, shall be conclusive absent manifest error.

(d) Indemnification by the Purchasers. Each Purchaser (other than the Conduit Purchasers) shall severally indemnify the Administrator, within ten (10) days after demand therefor, for (i) any Indemnified Taxes attributable to such Purchaser, its related Conduit Purchaser or any of their respective Affiliates that are Affected Persons (but only to the extent that the Seller and the other Celanese Parties have not already indemnified the Administrator for such Indemnified Taxes and without limiting any obligation of the Seller or any other Celanese Party to do so), (ii) any Taxes attributable to the failure of such Purchaser, its related Conduit Purchaser or any of their respective Affiliates that are Affected Persons to comply with Section 5.3(b) relating to the maintenance of a Participant Register and (iii) any Excluded Taxes attributable to such Purchaser, its related Conduit Purchaser or any of their respective Affiliates that are Affected Persons, in each case, that are payable or paid by the Administrator in connection with any Transaction Document, and any reasonable expenses arising therefrom or with respect thereto, whether or not such Taxes were correctly or legally imposed or asserted by the relevant Governmental Authority. A certificate as to the amount of such payment or liability delivered to any Purchaser (or its Purchaser Agent) by the Administrator shall be conclusive absent manifest error. Each Purchaser hereby authorizes the Administrator to set off and apply any and all amounts at any time owing to such Purchaser, its related Conduit Purchaser or any of their respective Affiliates that are Affected Persons under any Transaction Document or otherwise payable by the Administrator to such Purchaser, its related Conduit Purchaser or any of their respective Affiliates that are Affected Persons from any other source against any amount due to the Administrator under this clause (d).

(e) Evidence of Payments. As soon as practicable after any payment of Taxes by the Seller to a Governmental Authority pursuant to this Section 1.10, the Seller shall deliver to the Administrator the original or a certified copy of a receipt issued by such Governmental Authority evidencing such payment, a copy of the return reporting such payment or other evidence of such payment reasonably satisfactory to the Administrator.

(f) Status of Affected Persons. (I) Any Affected Person that is entitled to an exemption from or reduction of withholding Tax with respect to payments made under any Transaction Document shall deliver to the Seller and the Administrator, at the time or times reasonably requested by the Seller or the Administrator, such properly completed and executed documentation reasonably requested by the Seller or the Administrator as will permit such payments to be made without withholding or at a reduced rate of withholding. In addition, any Affected Person, if reasonably requested by the Seller or the Administrator, shall deliver such other documentation prescribed by Applicable Law or

11

reasonably requested by the Seller or the Administrator as will enable the Seller or the Administrator to determine whether or not such Affected Person is subject to backup withholding or information reporting requirements. Notwithstanding anything to the contrary in the preceding two sentences, the completion, execution and submission of such documentation (other than such documentation set forth in Sections 1.10(f)(ii)(A) and (ii)(B) and 1.10(g) below) shall not be required if, in the Affected Person’s reasonable judgment, such completion, execution or submission would subject such Affected Person to any material unreimbursed cost or expense or would materially prejudice the legal or commercial position of such Affected Person.

(ii) Without limiting the generality of the foregoing:

(A) an Affected Person that is a U.S. Person shall deliver to the Seller and the Administrator from time to time upon the reasonable request of the Seller or the Administrator, executed originals of IRS Form W-9 certifying that such Affected Person is exempt from U.S. federal backup withholding tax;

(B) any Affected Person that is not a U.S. Person shall, to the extent it is legally entitled to do so, deliver to the Seller and the Administrator (in such number of copies as shall be requested by the Affected Person) from time to time upon the reasonable request of the Seller or the Administrator, whichever of the following is applicable:

(1) in the case of such an Affected Person claiming the benefits of an income tax treaty to which the United States is a party, (x) with respect to payments of interest under any Transaction Document, executed originals of IRS Form W-8BEN establishing an exemption from, or reduction of, U.S. federal withholding Tax pursuant to the “interest” article of such tax treaty and (y) with respect to any other applicable payments under any Transaction Document, IRS Form W-8BEN establishing an exemption from, or reduction of, U.S. federal withholding Tax pursuant to the “business profits” or “other income” article of such tax treaty;

(2) executed originals of IRS Form W-8ECI;

(3) in the case of such an Affected Person claiming the benefits of the exemption for portfolio interest under Section 881(c) of the Code, (x) a certificate to the effect that such Affected Person is not a “bank” within the meaning of Section 881(c)(3)(A) of the Code, a “10 percent shareholder” of the Seller within the meaning of Section 881(c)(3)(B) of the Code, or a “controlled foreign corporation” described in Section 881(c)(3)(C) of the Code (a “U.S. Tax Compliance Certificate”) and (y) executed originals of IRS Form W-8BEN; or

(4) to the extent such Affected Person is not the beneficial owner, executed originals of IRS Form W-8IMY, accompanied by IRS Form W-8ECI, IRS Form W-8BEN, a U.S. Tax Compliance Certificate, IRS Form W-9, and/or other certification documents from each beneficial owner, as applicable; provided that, if such Affected Person is a partnership and one or more direct or indirect partners of such Affected Person are claiming the portfolio interest exemption, such Affected Person may provide a U.S. Tax Compliance Certificate on behalf of each such direct and indirect partner; and

(C) any Affected Person that is not a U.S. Person shall, to the extent it is legally entitled to do so, deliver to the Seller and the Administrator (in such number of copies as shall be requested by the recipient), from time to time upon the reasonable request of the Seller or the Administrator, executed originals of any other form prescribed by Applicable Law as a basis for claiming exemption from or a reduction in U.S. federal withholding Tax, duly completed, together with such supplementary documentation as may be prescribed by Applicable Law to permit the Seller or the Administrator to determine the withholding or deduction required to be made.

(g) Documentation Required by FATCA. If a payment made to an Affected Person under any Transaction Document would be subject to U.S. federal withholding Tax imposed by FATCA if such Affected Person were to fail

12

to comply with the applicable reporting requirements of FATCA (including those contained in Section 1471(b) or 1472(b) of the Code, as applicable), such Affected Person shall deliver to the Seller and the Administrator at the time or times prescribed by law and at such time or times reasonably requested by the Seller or the Administrator such documentation prescribed by Applicable Law (including as prescribed by Section 1471(b)(3)(C)(i) of the Code) and such additional documentation reasonably requested by the Seller or the Administrator as may be necessary for the Seller and the Administrator to comply with their obligations under FATCA and to determine that such Affected Person has complied with such Affected Person’s obligations under FATCA or to determine the amount to deduct and withhold from such payment. Solely for purposes of this clause (g), “FATCA” shall include any amendments made to FATCA after the date of this Agreement and any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement entered into in connection with FATCA.

(h) Treatment of Certain Refunds. If any Affected Person determines, in its sole discretion, exercised in good faith, that it has received a refund or credit of any Taxes as to which it has been reimbursed or indemnified by the Seller or with respect to which the Seller has paid additional amounts pursuant to this Section, it shall pay over such refund or credit to the Seller (but only to the extent of indemnity payments made, or additional amounts paid, by the Seller under this Section with respect to the Taxes giving rise to such refund), net of all out-of-pocket expenses of such Affected Person and without interest (other than any interest paid by the relevant Governmental Authority with respect to such refund); provided that the Seller, upon the request of such Recipient, agrees to repay the amount paid over to the Seller pursuant to this paragraph (f) (plus any penalties, interest, or other charges imposed by the relevant Governmental Authority) to such Affected Person in the event such Affected Person is required to repay such refund to such Governmental Authority. Notwithstanding anything to the contrary in this paragraph (h), in no event will the Affected Person be required to pay any amount to the Seller pursuant to this paragraph (h) the payment of which would place the Affected Person in a less favorable net after-Tax position than the Affected Person would have been in if the Tax subject to indemnification and giving rise to such refund had not been deducted, withheld or otherwise imposed and the indemnification payments or additional amounts with respect to such Tax had never been paid. The foregoing shall not be construed to require any Affected Person to make available its tax returns (or any other information relating to its Taxes which it deems confidential) to the Seller or any other Person.

(i) Survival. Each party’s obligations under this Section 1.10 shall survive the resignation or replacement of the Administrator or any assignment of rights by, or the replacement of, a Purchaser or any other Affected person, the termination of the Commitments and the repayment, satisfaction or discharge of all the Seller’s and the Servicer’s obligations hereunder.

(j) Updates. Each Affected Person agrees that if any form or certification it previously delivered pursuant to this Section 1.10 expires or becomes obsolete or inaccurate in any respect, it shall update such form or certification or promptly notify the Seller and the Administrator in writing of its legal inability to do so.

(k) Intended Tax Treatment. Notwithstanding anything to the contrary herein or in any other Transaction Document, all parties to this Agreement covenant and agree to treat any Purchase and any Reimbursement Obligation hereunder as debt (and all Discount as interest) for all federal, state, local and franchise tax purposes and agree not to take any position on any tax return inconsistent with the foregoing, except as otherwise required pursuant to a “determination” within the meaning of Section 1313(a) of the Code (or any comparable provision of any state, local or foreign law), it being understood that the parties to this Agreement will otherwise defend in good faith such agreed upon position prior to such determination; provided, however, that neither the Seller nor any Affiliate nor any of the Purchaser nor any of their Affiliates will be obligated to litigate any challenge to such agreed upon position by a Governmental Authority.

Section 1.11 Letters of Credit.

Subject to the terms and conditions hereof, each LC Bank shall issue or cause the issuance of Letters of Credit (“Letters of Credit”) on behalf of the Seller (and, if applicable, on behalf of, or for the account of, an Originator or an Affiliate of an Originator in favor of such beneficiaries as such Originator or such Affiliate may elect with the consent of the Seller); provided, however, that, for the avoidance of doubt, no LC Bank will be required to issue or cause to be issued any Letter of Credit under any of the circumstances listed in clauses (i) through (v) of Section 1.1(a). All amounts

13

drawn upon Letters of Credit shall accrue Discount for each day on and after the applicable Reimbursement Date that such drawn amounts shall have not been reimbursed by the Seller or from Collections.

Section 1.12 Issuance of Letters of Credit.

(a) The Seller may request that any LC Bank, upon three (3) Business Days’ prior written notice submitted on or before 2:00 p.m., New York City time (or such later date and time as such LC Bank may agree in its sole discretion), issue a Letter of Credit by completing and delivering to the Administrator and each Purchaser Agent in accordance with Section 5.2 (i) the applicable LC Bank’s form of Letter of Credit Application (the “Letter of Credit Application”), substantially in the form of Annex E hereto, and a Purchase Notice, substantially in the form of Annex B hereto, in each case completed to the satisfaction of the Administrator and the applicable LC Bank, and (ii) such other certificates, documents and other papers and information as the applicable LC Bank may reasonably request. The Seller will also have the right to give instructions and make agreements with respect to any Letter of Credit Application and the disposition of documents, and to agree with the applicable LC Bank upon any amendment, extension or renewal of any Letter of Credit.

(b) Each Letter of Credit will, among other things, (i) provide for the payment of sight drafts or other written demands for payment when presented for honor thereunder in accordance with the terms thereof and when accompanied by the documents described therein and (ii) have an expiry date not later than twelve (12) months after the date of issuance, extension or renewal, as the case may be, of such Letter of Credit and in no event later than twelve (12) months after the Termination Date. The terms of each Letter of Credit may include customary “evergreen” provisions providing that such Letter of Credit’s expiry date shall automatically be extended for additional periods not to exceed twelve (12) months unless, not less than thirty (30) days (or such longer period as may be specified in such Letter of Credit) (the “Notice Date”) prior to the applicable expiry date, the applicable LC Bank delivers written notice to the beneficiary thereof declining such extension; provided, however, that if (x) any such extension would cause the expiry date of such Letter of Credit to occur after the date that is twelve (12) months after the Termination Date or (y) the applicable LC Bank determines that any condition precedent (including, without limitation, those set forth in Section 1.1(a) or Exhibit II) to issuing such Letter of Credit hereunder (as if such Letter of Credit were then being first issued) is not satisfied (other than any such condition requiring the Seller to submit a Purchase Notice or Letter of Credit Application in respect thereof), then the applicable LC Bank, in the case of clause (x) above, may, or, in the case of clause (y) above, shall, use reasonable efforts in accordance with (and to the extent permitted by) the terms of such Letter of Credit to prevent the extension of such expiry date (including notifying the Seller and the beneficiary of such Letter of Credit in writing prior to the Notice Date that such expiry date will not be so extended). Each Letter of Credit shall be subject either to the Uniform Customs and Practice for Documentary Credits (2007 Revision), International Chamber of Commerce Publication No. 600, and any amendments or revisions thereof adhered to by the applicable LC Bank or the International Standby Practices (ISP98-International Chamber of Commerce Publication Number 590), and any amendments or revisions thereof adhered to by the applicable LC Bank, as determined by the applicable LC Bank.

Section 1.13 Requirements For Issuance of Letters of Credit.

The Seller shall authorize and direct the applicable LC Bank to name the Seller, an Originator or an Affiliate of an Originator as the “Applicant” or “Account Party” of each Letter of Credit.

Section 1.14 Disbursements, Reimbursement.

In the event of any request for a drawing under a Letter of Credit by the beneficiary or transferee thereof, the applicable LC Bank will promptly notify the Administrator, each Purchaser Agent and the Seller of such request, which notice may be made orally if promptly confirmed in writing. The Seller shall reimburse (such obligation to reimburse the applicable LC Bank, the “Reimbursement Obligation”) the applicable LC Bank (i) if the Seller shall have received notice of such drawing prior to 10:00 a.m., New York City time, on any Business Day, no later than 3:00 p.m., New York City time, on such Business Day, or (ii) otherwise, noon, New York City time, on the Business Day immediately following the day that the Seller receives such notice (each such date for reimbursement, a “Reimbursement Date”) in an amount equal to the amount so paid by the applicable LC Bank. Any cash collateral held in the LC Collateral

14

Account by or on behalf of an LC Bank in respect of a Letter of Credit shall be applied to discharge the Seller’s Reimbursement Obligation with respect thereto so long as, prior to the occurrence of a Termination Event, any remaining cash collateral with respect to that Letter of Credit equals or exceeds any undrawn amount under that Letter of Credit following such application. Any remaining portion of the Seller’s Reimbursement Obligation shall be funded by the Seller either from its own funds or from the proceeds of a Purchase requested by the Seller and made by the Purchasers in accordance with Section 1.2 (subject to all the conditions precedent for such Purchases hereunder). If the Seller fails to reimburse an LC Bank for the full amount of any drawing under a Letter of Credit by the applicable time on the Reimbursement Date, such LC Bank (or its Purchaser Agent) shall notify the Administrator and each other Purchaser Agent of such failure.

For the avoidance of doubt, any amount paid by an LC Bank in satisfaction of a drawing under a Letter of Credit shall constitute Capital of such LC Bank for all purposes hereof until such time as the Seller satisfies its Reimbursement Obligation with respect thereto or such Capital is repaid in accordance with Section 1.4.

Section 1.15 LC Collateral Account.

(a) If any Letters of Credit are outstanding and undrawn on the Termination Date, the applicable LC Collateral Account shall be funded from Collections (or by other funds available to the Seller) in an amount equal to the aggregate undrawn face amount of such Letters of Credit plus fees to accrue through the stated expiration dates thereof.

(b) Funds in the applicable LC Collateral Account will be used to reimburse the applicable LC Bank for fees related to the Letters of Credit and for any draws on the Letters of Credit which have not been reimbursed by the Seller or repaid from Collections. If at any time the amount of the funds on deposit in an LC Bank’s LC Collateral Account exceeds the aggregate amount available to be drawn under such LC Bank’s Letters of Credit at such time, plus the amount of the Expected LC Fees therefor at such time, such excess amount shall be released from such LC Collateral Account. In addition, from time to time prior to the Termination Date, the Seller (or the Servicer on its behalf) may request, by written notice to the Administrator and each Purchaser Agent not less than two (2) Business Days prior to a Settlement Date, that amounts be released from the LC Collateral Account on such Settlement Date so long as after giving effect to such release and the application of such amounts as Collections on in accordance with Section 1.4 on such Settlement Date, the Purchased Interest does not exceed 100% and no Termination Event or Unmatured Termination Event has occurred and is continuing. Any amounts released from the LC Collateral Account pursuant to the foregoing two sentences shall be released to the Servicer (or if so requested by the Administrator, to a separate account approved by the Administrator) to be applied as a Collection of Pool Receivables in accordance with Section 1.4 (and shall constitute “Collections” for all purposes thereof). Any funds on deposit in the LC Collateral Account after all Letters of Credit have expired, all draws on the Letters of Credit have been reimbursed, all fees due with respect to the Letters of Credit have been paid in full, and this Agreement has been terminated, shall be remitted to the Seller.

Section 1.16 Documentation.

The Seller agrees to be bound by the terms of the Letter of Credit Application and by the applicable LC Bank’s reasonable interpretations of any Letter of Credit issued for the Seller and by the applicable LC Bank’s written regulations and customary practices relating to letters of credit, though the applicable LC Bank’s reasonable interpretation of such regulations and practices may be different from the Seller’s own. In the event of a conflict between the Letter of Credit Application and this Agreement, this Agreement shall govern. It is understood and agreed that, except in the case of gross negligence or willful misconduct by the applicable LC Bank, the applicable LC Bank shall not be liable for any error, negligence and/or mistakes, whether of omission or commission, in following the Seller’s instructions or those contained in the Letters of Credit or any modifications, amendments or supplements thereto.

Section 1.17 Determination to Honor Drawing Request.

In determining whether to honor any request for drawing under any Letter of Credit by the beneficiary thereof, the applicable LC Bank shall be responsible only to determine that the documents and certificates required to be delivered under such Letter of Credit have been delivered and that they comply on their face with the requirements of such Letter

15

of Credit and that any other drawing condition appearing on the face of such Letter of Credit has been satisfied in the manner so set forth.

Section 1.18 Nature of Reimbursement Obligations.

The obligations of the Seller to reimburse an LC Bank upon a draw under a Letter of Credit, shall be absolute, unconditional and irrevocable, and shall be performed strictly in accordance with the terms of this Article I under all circumstances, including the following circumstances:

(i) the Seller’s lack of funds available to satisfy its Reimbursement Obligation or the unavailability (for any reason) of Purchases under Section 1.2;

(ii) any lack of validity or enforceability of any Letter of Credit or any set-off, counterclaim, recoupment, defense or other right which the Seller, any Originator or any Affiliate thereof on behalf of which a Letter of Credit has been issued may have against any LC Bank, the Administrator, any Purchaser, any Purchaser Agent or any other Person for any reason whatsoever;

(iii) any claim of breach of warranty that might be made by the Seller or any LC Bank against the beneficiary of a Letter of Credit, or the existence of any claim, set-off, defense or other right which the Seller or any LC Bank may have at any time against a beneficiary, any successor beneficiary or any transferee of any Letter of Credit or the proceeds thereof (or any Persons for whom any such transferee may be acting), any LC Bank, the Administrator, any Purchaser or any Purchaser Agent or any other Person, whether in connection with this Agreement, the transactions contemplated herein or any unrelated transaction (including any underlying transaction between the Seller or any Subsidiaries of the Seller or any Affiliates of the Seller and the beneficiary for which any Letter of Credit was procured);

(iv) the lack of power or authority of any signer of, or lack of validity, sufficiency, accuracy, enforceability or genuineness of, any draft, demand, instrument, certificate or other document presented under any Letter of Credit, or any such draft, demand, instrument, certificate or other document proving to be forged, fraudulent, invalid, defective or insufficient in any respect or any statement therein being untrue or inaccurate in any respect, even if the Administrator or the applicable LC Bank has been notified thereof;

(v) payment by any LC Bank under any Letter of Credit against presentation of a demand, draft or certificate or other document which does not comply with the terms of such Letter of Credit other than as a result of the gross negligence or willful misconduct of the applicable LC Bank;