Attached files

| file | filename |

|---|---|

| EX-4.1 - FORM OF THE BRIDGE NOTES PURSUANT TO A SUBSCRIPTION AGREEMENT - CODESMART HOLDINGS, INC. | f8k050313a2ex4i_codesmart.htm |

| EX-10.1 - FORM OF SHARE EXCHANGE AGREEMENT - CODESMART HOLDINGS, INC. | f8k050313a2ex10i_codesmart.htm |

| EX-10.2 - FORM OF SUBSCRIPTION AGREEMENT - CODESMART HOLDINGS, INC. | f8k050313a2ex10ii_codesmart.htm |

| EX-10.6 - FORM OF EMPLOYMENT AGREEMENT - CODESMART HOLDINGS, INC. | f8k050313a2ex10vi_codesmart.htm |

| EX-10.13 - WAIVER AND AMENDMENT TO SHARE EXCHANGE AGREEMENT - CODESMART HOLDINGS, INC. | f8k050313a2ex10xiii_codsmart.htm |

| EX-10.3 - FORM OF SECURITIES PURCHASE AGREEMENT - CODESMART HOLDINGS, INC. | f8k050313a2ex10iii_codesmart.htm |

| EX-10.7 - LICENSE AND SUPPLY AGREEMENT - CODESMART HOLDINGS, INC. | f8k050313a2ex10vii_codesmart.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No.2

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 3, 2013

|

CodeSmart Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Florida

|

333-180653

|

45-4523372

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

275 Seventh Avenue, 7th floor

New York, NY 10001

|

||

|

(Address of Principal Executive Offices)

|

646-627-7326

Registrant’s telephone number, including area code

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

USE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to:

|

●

|

The “Company,” “we,” “us,” or “our,” are references to the combined business of CodeSmart Holdings, Inc. (formerly known as First Independence Corp.), The CodeSmart Group, Inc., and American Coding Quality Association, LLC.

|

|

“CODESMART™” refers to The CodeSmart Group, Inc., a corporation incorporated under the State of Nevada.

|

|

|

●

|

“ACQA” refers to American Coding Quality Association, LLC, a limited liability company incorporated under the State of Delaware.

|

|

●

|

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States.

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended.

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

|

Forward Looking Statements

This Current Report on Amendment No. 2 to Form 8-K/A and other reports filed by registrant from time to time with the Securities and Exchange Commission (collectively, the “Filings”) contain or may contain forward-looking statements and information that is based upon beliefs of, and information currently available to, registrant’s management, as well as estimates and assumptions made by registrant’s management. When used in the Filings, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to registrant or registrant’s management identify forward-looking statements. Such statements reflect the current view of registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to registrant’s industry and registrant’s operations and results of operations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K/A. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Amendment No. 2 on Form 8-K/A to conform our statements to actual results or changed expectations, or the results of any revision to these forward-looking statements.

Item 1.01 Entry Into A Material Definitive Agreement

Share Exchange Agreement

On May 3, 2013, the Company, The CodeSmart Group, Inc. (“CODESMART™”), a Nevada corporation and stockholders of CODESMART™ who collectively own 68.06% of CODESMART™ (the “CodeSmart Stockholders”) entered into and consummated transactions pursuant to a Share Exchange Agreement (the “Share Exchange Agreement,” such transaction referred to as the “Share Exchange Transaction”), whereby (i) the Company issued to the CodeSmart Stockholders an aggregate of 3,062,500 shares of its common stock, par value $.0001 (“Common Stock”), in exchange for 68.06% of equity interests of CODESMART™ held by the CodeSmart Stockholders. As a result of the Share Exchange Transaction, CODESMART™ became a subsidiary of the Company. Pursuant to the Share Exchange Agreement and after the Share Exchange Transaction, the Company implemented a 2-for-1 forward stock split of Common Stock, effective as of June 14, 2013 (the “Forward Split”).

2

The Share Exchange Agreement contains representations and warranties by us, CODESMART™ and the CodeSmart Stockholders which are customary for transactions of this type such as, with respect to the Company: organization, good standing and qualification to do business; capitalization; subsidiaries; authorization and validity of the transaction and transaction documents; consents being obtained or not required to consummate the transaction; no conflict or violation of Articles of Incorporations and By-laws, with respect to CODESMART™: authorization; capitalization; and title to CODESMART™’s common stock being exchanged, and with respect to CodeSmart Stockholders: authorization; no conflict or violation of law; investment purpose; accredited investor status; reliance on exemption on the Company’s Common Stock to be exchanged; and transfer or resale pursuant to the 1933 Act, as amended.

PIPE

Also on May 3, 2013 and simultaneous with the closing of the Share Exchange Transaction, the Company consummated a private placement of its Common Stock pursuant to a Securities Purchase Agreement (the “PIPE SPA”) with certain accredited investors (“PIPE Investors”), where the Company sold an aggregate of 168,750 shares of Common Stock for gross proceeds of $270,000 (the “PIPE”). The PIPE SPA contains representations and warranties of the Company that are customary to this type of transactions. Under the PIPE SPA, the Company granted piggy-back registration rights to the PIPE Investors, where the Company will be obligated to include the Common Stock sold in the PIPE in a registration statement which the Company prepares to file with the SEC relating to an offering for the Company’s own account or the account of others under the Securities Act, other than an underwritten offering or on Form S-4 or Form S-8.

Lockup Agreement

The Company and certain shareholders of the Company entered into a Lockup Agreement (the “Lockup Agreement”) on May 3, 2013, whereby such shareholders shall not offer or sell any securities owned by them within two months from the date the Lockup Agreement was signed, and starting from the third month through the twelfth month anniversary from May 3, 2013, such shareholders are permitted to sell the Company’s securities of no more than 5% of the weekly trading volume of the Company’s Common Stock. The Lockup Agreement will expire on the one year anniversary from the date when the Lockup Agreement was signed.

Item 2.01Completion of Acquisition or Disposition of Assets

On May 3, 2013, we completed the acquisition of CODESMART™ pursuant to the Share Exchange Agreement. The acquisition was accounted for as a reverse merger and recapitalization effected by a share exchange. CODESMART™ is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

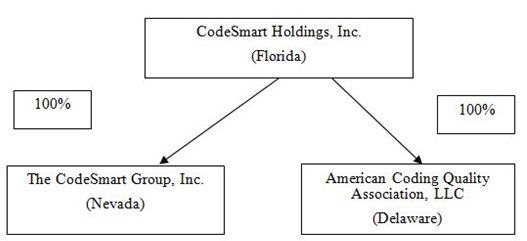

OUR CORPORATE STRUCTURE

The Company is a Florida corporation incorporated on February 10, 2012 in the State of Florida. Following the acquisition of CODESMART™, CODESMART™ became our direct subsidiary effective on May 3, 2013. On June 3, 2013, the Company entered into a Contribution Agreement (the “Contribution Agreement”) with American Coding Quality Association, LLC (“ACQA”), whereby the sole owner of ACQA contributed 100% of the membership interests of ACQA to the Company and immediately after the effectiveness of the Contribution Agreement, ACQA became a wholly-owned subsidiary of the Company. On May 7, 2013, International Alliance Solutions LLC (“IAS”) transferred and assigned the trademark “CODESMART™” to The CodeSmart Group, Inc., In addition, on July 11, 2013, CODESMART™ entered into an Assignment Agreement with IAS, where IAS agreed to transfer to CODESMART™ its remaining assets, including but not limited to IAS's rights in any agreements that it is a party to.

Effective on June 14, 2013, the Company changed its name from “First Independence Corp.” to “CodeSmart Holdings, Inc.” and its trading symbol has been changed to “ITEN.”

3

On August 20, 2013, the Company, CODESMART™, and Marc Kovens who owned 11,500,000 shares of the common stock of CODESMART™, representing 31.94% of the total outstanding shares of CODESMART™ (“Kovens”) entered into and consummated transactions pursuant to a Share Exchange Agreement (the “Kovens Share Exchange Agreement”), whereby (i) the Company issued to Kovens an aggregate of 2,808,000 shares of the Company’s Common Stock and (ii) the Company paid Kovens in cash $1,350,000, in exchange for the 31.94% of equity interests of CODESMART™ held by Kovens. As a result of the transaction, CODESMART™ became a wholly-owned subsidiary of the Company. The following diagram sets forth the structure of the Company as of the date of this Report:

OUR BUSINESS

Overview

CodeSmart Holdings, Inc., formerly known as First Independence Corp., was incorporated in the State of Florida on February 10, 2012. Our activities since inception consisted of primarily of trying to develop a facility to create our own private label pourable food products (hot and cold) for national supermarket chains and specialty stores. Immediately following the closing of the Share Exchange Transaction, the Company incorporated the business of CODESMART™. On June 3, 2013, ACQA contributed 100% of its membership interests to the Company and became a wholly-owned subsidiary. On August 20, 2013, upon a consummation of a share exchange agreement with Kovens, who owned 11,500,000 shares of the common stock of CODESMART™, CODESMART™ became a wholly-owned subsidiary of the Company.

CODESMART™ was formed on October 3, 2012, as a corporation under the laws of the state of Nevada. CODESMART™ engages in the business of ICD-10 preparation, education and implementation. ACQA was formed on September 23, 2011 by the founders of CODESMART™. ACQA intends to become a certification association for medical coding and quality. ACQA plans to generate revenue from membership fees, exam certification fees, and conduct industry conferences and seminars.

ICD-10 is the 10th revision of the International Statistical Classification of Diseases and Related Health Problems (“ICD-10”), a medical classification list by the World Health Organization (“WHO”). This system is utilized by the medical industry for medical diagnosis codes, which is the method by which healthcare professionals request payment for services rendered in various medical and health care situations. The codes also are the basis of all clinical data as to all procedures that have been performed. Every medical insurance claim submitted to insurance companies has to be accompanied by a medical code for the condition, treatments, diagnosis and any procedures performed by healthcare providers for the treatment of an illness, injury or disease. Said another way, the financial side of the medical industry and the business practices of healthcare providers are dependent on the medical codes.

As the new medical coding system, ICD-10 is mandated by Centers for Medicare & Medicaid Services (“CMS”) to take effect on October 1, 2014. In addition, the ICD-10 code sets are not a simple update of the ICD-9 code sets, the previous system. The ICD-10 code sets have fundamental changes in structure and concepts that make them very different from ICD-9. With the mandated switch from ICD-9 to ICD-10 rapidly approaching, we believe there will be a significant shortage of coders and billers. To address this anticipated demand, CODESMART™ has established CODESMART™ UNIVERSITY on October 4, 2012. CODESMART™ UNIVERSITY is a featured solution to the ICD-10 education and a program that provides complete interactivity, audio lectures, performance based education, access to live professors, and interactive tools to reinforce learning according to the ICD-10 PlayBook of Health Information Management Systems Society (“HIMMS”), the national healthcare association (http://www.himss.org/library/icd-10/playbook/sponsors?navItemNumber=13498). CODESMART™ UNIVERSITY offers the education program in ICD-10 to educate existing coders and practitioners, as well as new coders into the industry to help with the shortage of medical coders for ICD-10.

4

CODESMART™ UNIVERSITY is composed of an integrated package of services, which were designed to provide a complete integrated solution for ICD-10 conversion to healthcare professionals. CODESMART™’s core focus is to furnish the US healthcare industry with educated, trained and qualified ICD-10 certified coders. CODESMART™ is utilizing its partnership with the Florida International University (the “FIU”), which provides support as strategic partner to host CODESMART™ UNIVERSITY on a private label basis for universities and colleges nationally pursuant to a Course Development and Management Services and License Agreement. CODESMART™ UNIVERSITY provides an integrating program which is supported by its vast infrastructure of professors and subject matter experts who are currently working for the school. CODESMART™ has already begun to enroll students into its existing coders and new coder programs.

Our Products

ICD-10 Online Training

CODESMART™ UNIVERSITY provides a dynamic on-line training program that teaches current and new medical coding professionals to be proficient with using the new ICD-10-CM/PCS coding systems. We provide three types of different training courses in implementing the ICD-10 coding programs: ICD-10 training for existing coding professionals, ICD-10 training for new coding professionals, and ICD-10 for clinicians. The CODESMART™ learning platform, supported by Florida International University (FIU), offers the most interactive approach to learn ICD-10 nationally. It addresses the three ways of learning, tactile, verbal, and audio. The course design allows interactivity within each course, and provides access to outside resources for additional learning. The three dimensional design of the course actually allows students to learn anatomy and physiology through virtual dissection of the human body parts and many types of interactive exercises to reinforce learning.

Consulting Services

CODESMART™ also provides a number of ancillary services, which integrate to provide a complete ICD-10 and revenue cycle solution, including but not limited to the following:

|

●

|

Training and education for ICD-10 -CODESMART™ has the ability to provide highly qualified management and staff, including qualified ICD-10 trainers;

|

|

●

|

ICD 10 preparation for healthcare providers;

|

|

●

|

Outsourced coding/auditing;

|

|

●

|

Placement Service for trainers and coders; and

|

|

●

|

Clinical documentation improvement programs and training

|

Workshops and Corporate Training

CODESMART™ plans to host live instructional workshops at a variety of different sites, including but not limited to hospitals, schools, or other continuing education courses. Additionally, we plan to air these instructional workshops via webinar.

CODESMART™ also plans to offer extra certifications/ courses (Specialty Certifications) to the following practice areas or specialties:

● Physicians

● Dental

● Chiropractors

● Nursing

● Surgery

● Radiology

5

When appropriate corporate/hospital/facility/practice training in other subject areas such as practice management, project management and training will also be offered to prospective students.

Conventions /Conferences

CODESMART™ plans to host annual meetings/conventions with various continuing education programs. Exhibitors and vendors at such events will be able to present new products to the coders, office managers, physicians (and other certification holders). Initially we anticipate these being small regional meetings until we grow into the ability to host meetings on a national scale.

Our Market Opportunity

As a well-developed industry in the United States, the healthcare industry had approximately $2.6 trillion spending in 2010. (http://www.npr.org/blogs/health/2012/03/19/148932689/health-care-in-america-follow-the-money). In this industry, a nationwide shortage of medical coders is well recognized, and the needs for more better-trained coders are exacerbated by the implementation of ICD-10 (http://1199seiubenefits.org/wp-content/uploads/2012/06/Addressing-the-Demand-for-Medical-Coders.pdf). Experts project that a significant shortage of new coders will generate thousands of job opportunities as skilled ICD-10 coders will be needed during the next 5 years as the industry transitions from ICD-9, the previous coding system, to ICD-10. (http://www.modernhealthcare.com/article/20130615/MAGAZINE/306159957).

We believe businesses that need ICD-10 training and support services will include hospitals, physicians, ambulatory centers, clinics, nursing homes and any other provider who codes for reimbursement. In addition to businesses, our students may come from colleges and universities, professional and vocational schools, consulting firms, healthcare IT firms, EHR companies, individual consultants, and other related firms.

The Department of Health and Human Services oversees medical diagnosis codes, and the new system, ICD-10, has already been mandated. All medical service providers in the United States must be ICD-10 compliant by no later than October 1, 2014. Currently, there are over 18 million workers in healthcare industries (http://www.cdc.gov/niosh/topics/healthcare/), and we believe most of the physicians, nurses, medical coders, and hospital employees in the U.S. need to receive this mandatory expertise through training and education. The old medical code system had approximately 16,000 codes, and ICD-10 has approximately 155,000 codes, highlighting the significant amount of education regarding codes that need to take place in order for medical practitioners and hospitals to be compliant and continue to qualify for payments (http://www.icd10watch.com/headline/icd-10-gets-one-year-pushback).

Additionally, we believe there will be a projected shortage of coders in the near future as the healthcare industry is in a growing mode as a result of the increased utilization of hospital services by an aging population and the growth of tests and treatments. (http://1199seiubenefits.org/wp-content/uploads/2012/06/Addressing-the-Demand-for-Medical-Coders.pdf). For these reasons, Forbes has reported that there is going to be significant demand for ICD-10 trained coders over the coming years, especially for coders that are new to the industry, who may be able to make over $60,000 per year without a college degree (http://www.forbes.com/sites/davidwhelan/2011/10/11/how-to-get-an-80000-job-in-health-care-without-a-college-degree). The workload for implementing ICD-10 is much greater because the specificities between ICD-9 and ICD-10 coding are very different and the level of detail in ICD-10 requires an entirely different skill set. Thus, we will be focusing our efforts on becoming a leader in educating and training the new ICD-10 coders.

We believe that our alliance with FIU offers a significant advantage in providing distribution and outreach channels with high schools, community colleges and other associations.

6

The following groups will be especially targeted for careers in coding ICD-10:

|

●

|

Senior population

|

|

●

|

High School Graduates

|

|

●

|

Community Colleges

|

|

●

|

Military Veterans

|

|

●

|

Disabled

|

|

●

|

Federal and State Programs

|

|

●

|

Unemployment Offices

|

We anticipate reaching these markets will be done through advertising, community outreach and setting up relationships with the various channels and distribution networks. To assist in the marketing the CODESMART™ UNIVERSITY to new coders, we are establishing a loan financing program for students with a national financing company. Having this program in place will draw students to our program and increase access to a much larger population of potential students who may not otherwise be able to afford tuition costs.

Strategic Partnerships/Alliances

From November 2012 to August 2013, the Company entered into several consulting agreements and established extensive relationship with strategic partners around the country, including colleges and universities, consulting firms, healthcare companies, technology companies, staffing companies, and other outsourced coding/billing companies. Pursuant to these agreements, our strategic partners promote and market our ICD-10 training courses, refer clients, organize public relationship activities, and build brand recognition for our products.

Customers

Customers for our products and services include:

|

●

|

Physicians

|

|

●

|

Hospital

|

|

●

|

Coders

|

|

●

|

Billers

|

|

●

|

Outsourced coding and billing companies

|

|

●

|

Nurses

|

|

●

|

Physician assistants

|

|

●

|

Nursing Homes

|

|

●

|

Ambulatory Centers

|

|

●

|

Clinics

|

Marketing and Sales

CODESMART™ is undertaking a marketing campaign with a multi-faceted approach to covering different healthcare market segments.

Identifying the CODESMART™ brand and delivering our message to healthcare facilities is a critical component of our marketing plan. Our target market is entity or person who needs to code for reimbursement, including but not limited to, hospitals, physicians, ambulatory centers, and nursing homes.

We have initiated a sponsorship campaign and are now endorsed by HIMMS, a cause-based, not-for-profit organization focusing on providing optimal use of information technology (IT) and management systems for healthcare. HIMMS created the ICD-10 PlayBook, which provides critical information to assist hospitals, ambulatory centers, practitioners, and their staff in transitioning to ICD-10 and provides the industry with resources related to their ICD-10 transition. Our main target population is the hospitals, and there are more than 5000 registered hospitals according to American Hospital Association (http://www.aha.org/research/rc/stat-studies/fast-facts.shtml and other health systems nationally. We believe that this program will help generate various leads, build our CODESMART™ UNIVERSITY brand and give us a recognizable identity as an organization known to ensure the right coding procedures, offering good quality education in the industry for coders and clinicians.

7

We have initiated a relationship with a direct marketing company for the education space to engage in nationwide campaign to generate leads for CODESMART™ UNIVERSITY. A public relations campaign integrated with the lead generation program is in the process of being designed and executed and will include advertising and press coverage in magazines, radio, television, industry publications, trade shows, industry associations, press releases, social media, etc. These will be part of our branding strategy.

In addition, we have begun a social media campaign utilizing blogs, twitter, Facebook, and LinkedIn. A targeted campaign will be made to the following distribution groups:

|

1.

|

Technology companies

|

|

2.

|

Healthcare management companies

|

|

3.

|

Group purchasing organizations

|

|

4.

|

Law firms

|

|

5.

|

CPAs

|

|

6.

|

Our strategic partners

|

|

7.

|

Consulting firms

|

|

8.

|

Trade associations

|

|

9.

|

Universities, colleges and other educational organizations

|

|

10.

|

Outsourced coding and billing companies

|

In addition, the Company will continue to speak at industry functions and maintain presence in industry associations. Further, we are planning to exhibit CODESMART™ UNIVERSITY at different industry events on an ongoing basis.

As we grow, we plan to bring on new business development professionals and account management specialists with strong healthcare background to pursue sales in two distinct markets, which are healthcare organizations (providers and payers) and potential new coders consisting of those looking for new career opportunities. These market segments require different sales strategies. The healthcare organization would require a more sophisticated and consultative sale while the recruitment of potential new coders will focus on unemployed or individuals in a career transition. We currently have significant distribution relationships in place that will need to be managed and cultivated by account representatives.

Competitive Environment/Comparison of ICD-10 Online Curriculums

In CODESMART™ UNIVERSITY, ICD-10 online curriculums provide trainings for the following in one school: existing coders, new coders and clinicians in a certification program.

Consulting companies which have created on-line learning platforms do not provide training for new coders, only existing coders and clinicians but less interactive and not designed by education design experts. Many organizations are only capable of providing limited onsite training resources. American Health Information Management Association (“AHIMA”) is currently training onsite for ICD-10 trainers. Thus, we provide an interactive on-line education program, which include intuitive professors’ help and mentor to the students through the program. In addition, the study programs are difficult to replicate and building an on-line university of our caliber is a barrier to entry.

8

CODESMART™ Programs

|

CODESMART™ ICD-10 training to

New Medical Professionals

|

Very thorough in anatomy,

physiology and pharmacology.

Over 900 hours

|

|

CODESMART™ ICD-10 training to

Existing Medical Professionals

|

Includes the courses listed above,

which is unique in our approach

Over 200 hours

|

|

CODESMART™ ICD-10

training to Clinicians

|

Doesn’t include courses listed above, but does include Clinical Document Improvement

15 hours

|

Coding School Development and Costs/Operations

The curriculum was developed by the CODESMART™ educational team lead by the Dean of CODESMART™ UNIVERSITY and our network of subject matter experts. We used certified trained subject matter experts in the industry for ICD-10 and related subject matter for the curriculum.

FIU is providing the customer service and back office support for CODESMART™ UNIVERSITY. FIU will continue to provide operational and administrative support for the University. This will include webhosting, customer service, continued programming and development of new courses. There will be constant updates to the content as rules and regulations change. Additionally, we plan to create new courses over the next few years that go beyond coding and clinical documentation.

New Course programs slated for the future include: trainers, project management, and healthcare IT curriculum.

CODESMART™ will also update the content of the courses in respond to the new requirements. Our professors/subject matter experts provide these updates and will be available to answer questions from students as well to help monitor their respective courses.

We intend to add consultants and certified coders to the team of our University. In addition, our systems will be structured to focus on execution and business impact of our courses and curriculums, such as the development of a roadmap for all major activities required for completion of our course as well as recommendations for program governance and coordination throughout the project.

Technology

We have technology in tracking sales/commissions and software to track sales, keep database of coders/candidates and deployment of staff will be utilized. Outsourced coders are virtual and based where they live in order to recruit and have access to the best available talent. We have software to code remotely which provides a safe and secure environment and it is HIPAA compliant.

Our websites continue to be revised as new curriculum is launched. Search engine optimization will also be completed in the near future. This will be managed internally.

Our Growth Strategy

We intend to pursue the following strategies to drive our future growth:

| ● |

Generate enrollment growth. We intend to continue to drive increased enrollments through targeted marketing and recruiting efforts as well as through referrals.

|

9

| ● |

Enhance curriculum to include new programs in Health IT, continuing education for coders, clinical documentation, and other related programs.

|

| ● |

Expand presence consulting and outsourced coding business.

|

| ● |

Develop a loan financing program with related products and programs attached to provide to the customers so they keep a long term relationship with CODESMART™.

|

| ● |

Strengthen awareness and recognition of the CODESMART™ brand. The CODESMART™ brand already enjoys recognition within ICD-10 coding community. We have developed a comprehensive brand strategy and intend to invest in further developing awareness of both the CODESMART™ brand and the core philosophy behind our learning system.

|

| ● |

Continue to align with large distribution partners who give us exclusivity in targeted markets, thus locking out the competition.

|

Significant Accomplishments

● The CODESMART™ name and brand has been approved as a trademark with the U.S. Patent Office.

● Distribution arrangements are already in place with a couple of companies.

● The Company entered into long-term agreement regarding a “choice” program with AMERINET, Inc., one of the country’s three largest hospital group purchasing organizations (“GPO”) representing 2800 hospitals. This program gives CODESMART an endorsement from AMERINET as the premier provider of all ICD-10 related services. The hospital members who are partners in the GPO receive incentives by AMERINET to utilize CODESMART™ products because we are an AMERINET choice partner.

● CODESMART™ University has been endorsed by two regional extension centers in Florida, a federal program overseen by the Office of National Coordinator For Health Information Technology (“ONC”), who promotes electronic health information and ICD-10 to over 6,000 providers in South Florida.

Intellectual Property

Trademarks and Trade Secrets

On May 7, 2013, The CodeSmart Group, Inc. entered into an Assignment of Trademark and Trademark Application Agreement with IAS, whereby IAS transferred the trademark of “CODESMART™” to the The CodeSmart Group, Inc.

We will also use confidentiality agreements and non-compete agreements to protect our proprietary rights.

License

CODESMART™ grants permission to various universities and colleges to use the ICD-10 training program. Pursuant to a license agreement with the FIU, CODESMART™ grants FIU permission to use the content of the ICD-10 coding program on FIU’s online courses, and FIU is responsible to provide course development and management on the CODESMART™ online courses and remit the course fees to CODESMART™. FIU has completed the on-line course development and the courses are open to the students. We also entered into an agreement with the University of Central Florida (the “UCF”), whereby we granted a license to use the ICD-10 training curriculums to the UCF and the UCF provides the platform of online courses for the ICD-10 programs.

10

Employees

CODESMART™ currently has 10 full-time employees. CODESMART™ considers its employee relations to be good, and to date has not experienced a work stoppage due to a labor dispute. None of CODESMART™’s employees are represented by a labor union. For further information see section 5.02 below.

Bridge Financing of CODESMART™

On April 15 and April 24, 2013, CODESMART™ conducted a bridge offering of approximately $250,000 of its Secured Convertible Promissory Notes (the “Bridge Notes”) to two accredited investors (the “Bridge Investors”) pursuant to that certain Subscription Agreement dated as April 12, 2013. The Bridge Notes are of a term of 90 days and may be converted into the securities offered in the first private placement of the Company with which CODESMART™ consummates its business combination after the issuance of the Bridge Notes (the “Private Placement”). The conversion price of the Bridge Notes is 100% of the price of the securities sold in the Private Placement. As a result of the consummation of the Share Exchange Transaction and the PIPE on May 3, 2013, the Bridge Notes may be converted, at the option of the Bridge Investors, into shares of Common Stock at the conversion price of $1.6 per share without given effect to the Forward Split.

On June 14, 2013, one of the Bridge Investors converted all the principal amount of its Bridge Note of $110,000 together with accrued interests into 278,896 shares of Common Stock (“Conversion Shares”), which is in the process of being corrected to be 139,448 shares. On July 10, 2013, another Bridge Investor converted his Bridge Note of $140,000 together with accrued interest into a total of 358,360 shares of Conversion Shares which were later corrected to be 179,180 shares on August 23, 2013. As of the date of this Report, all of the Bridge Notes have been converted.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF

OPERATIONS

This Current Report on Form 8-K/A contains forward-looking statements within the meaning of the federal securities laws. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,” “management believes” and similar language. Except for the historical information contained herein, the matters discussed in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this Current Report are forward-looking statements that involve risks and uncertainties. The cautionary language in this Current Report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from those projected. Except as may be required by law, we undertake no obligation to update any forward-looking statement to reflect events after the date of this Current Report on Form 8-K/A.

Plan of Operations

The Company plans to implement operations and reach their goals and objectives by hiring talented people to play key roles throughout the organization. The Company utilizes a hiring process with a long term successful track record. It has a philosophy in hiring the best talent along with a strong branding and marketing campaign. The marketing campaign will be multifaceted and include a very aggressive direct marketing campaign along with building strong distribution partnerships as it has already begun to do. The majority of the funds received in offerings of the Company's securities will be put into marketing, branding, and sales activities along with operational support activities. The success of the Company will be directly related to the money to be spent on marketing and sales campaigns and support. Building a national brand and creating market awareness will be critical. Supporting sales and customers will also be important from an operational perspective.

11

Over the next twelve months of operations, the Company has a goal of enrolling approximately 1,000 existing coders, 1,500 clinicians and approximately 5,000 new coders over the next 12 months. Management has targeted $6.0 million in gross revenue for the fiscal year ending December 31, 2013. Management anticipates generating revenues from college and universities on a private label basis, partnerships with cooperating hospital programs, and coding partners.

Results of Operations for the three months ended March 31, 2013

Revenue and Gross Profit

During the three months ended March 31, 2013, the Company earned $7,600 in tuition revenue for two students. The Company incurred $3,177 in costs associated with earning the revenue.

General and Administrative Expenses

General and administrative expenses for the three months ended March 31, 2013 consisted primarily of compensation and benefits in the amount of $28,410 to our founders, professional fees totaling $47,500 associated with the Company’s share exchange transaction, as well as other general and administrative expenses totaling $8,268.

Loss from Operations

Loss from operations for the three months ended March 31, 2013 was $79,755. The loss was primarily attributable to the general and administrative expenses as detailed above offset by minimal tuition revenue.

Net Loss

Net Loss from operations for the three months ended March 31, 2013 was $79,755. The net loss was primarily attributable to the general and administrative expenses as detailed above offset by minimal tuition revenue.

Inflation did not have a material impact on the Company’s operations for the period. Other than the foregoing, management knows of no trends, demands, or uncertainties that are reasonably likely to have a material impact on the Company’s results of operations.

Results of Operations for the Period October 3, 2012 (Inception)to December 31, 2012

General and Administrative Expenses

General and administrative expenses for the period ended December 31, 2012 consisted primarily of compensation in the amount of $19,935 to our founders and minimum other general and administrative expenses totaling $3,451.

Loss from Operations

Loss from operations for the period ended December 31, 2012 was $23,386. The loss was primarily attributable to the general and administrative expenses as detailed above.

Net Loss

Net Loss from operations for the period ended December 31, 2012 was $23,386. The net loss was primarily attributable to the general and administrative expenses as detailed above.

Inflation did not have a material impact on the Company’s operations for the period. Other than the foregoing, management knows of no trends, demands, or uncertainties that are reasonably likely to have a material impact on the Company’s results of operations.

12

Capital Resources and Liquidity

The following table summarizes total current assets, liabilities and working capital at March 31, 2013.

|

March 31, 2013

|

||||

|

Current Assets

|

$

|

-

|

||

|

Current Liabilities

|

$

|

50,806

|

||

|

Working Capital Deficit

|

$

|

(50,806

|

)

|

|

At March 31, 2013, we had a working capital deficit of $50,806. The Company has yet to commence significant commercialization of its products, and recorded $7,600 and $7,600 respectively of gross revenue for the three months ended March 31, 2013 and for the period October 3, 2012 (date of inception) to March 31, 2013.

Net cash used for operating activities for the three months ended March 31, 2013 was $31,074. The net loss for the three months ended March 31, 2013 was $79,755. Cash used in operating activities was primarily for compensation and general and administrative expenses.

Net cash obtained through all financing activities for the three months ended March 31, 2013 was $25,000. This consisted of $25,000 in proceeds from the sale and issuance of common stock.

Going Concern

As reflected in the accompanying financial statements, the Company has a net loss and net cash used in operations of $79,755 and $31,074, respectively, for the three months ended March 31, 2013 and a deficit accumulated during the development stage of $103,141 as of March 31, 2013.

The ability of the Company to continue its operations is dependent on Management's plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements. The Company may need to incur additional liabilities with certain related parties to sustain the Company’s existence.

Management has targeted $6.0 million in gross revenue for the fiscal year ending December 31, 2013. Management anticipates generating revenues from college and universities on a private label basis, partnerships with cooperating hospital programs, and coding partners.

In order to achieve the above growth, the Company will need to raise $3.0 to $5.0 million funding through capital raise to support the growth of its current and expected future operations as well as to achieve its strategic objectives. The Company believes its current available cash along with anticipated revenues may be insufficient to meet its cash needs for the near future if it does not receive the anticipated additional funding. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all. In that event, the Company would be required to change its growth strategy and seek funding on that basis, if at all.

From May 2013, management intends to use $175,000 per month for the next 12 months in general and administrative expenses. In order to execute the revenue growth plan, management intends to devote approximately $500,000 to develop a direct sales force, estimated $175,000 in expenses on a pay per lead program, and estimated $145,000 in direct marketing. The Company currently plans to spend $50,000 to further enhance and build out the online training programs.

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

In response to the above, management will:

|

-

|

seek additional third party debt and/or equity financing;

|

|

-

|

continue with the implementation of the business plan;

|

|

-

|

increase revenue commercialization of the technology.

|

To date all of our funding has been generated from private investments. During the next twelve months we anticipate raising funding to continue expansion; however as of this writing we only have sufficient funds to proceed with basic company operations only. We do not have sufficient funds to fully implement our business plan until such time that we are able to raise additional funding, to which there is no guarantee. If we do not obtain the funds necessary for us to continue our business activities we may need to curtail or cease our operations until such time as we have sufficient funds.

13

Recent Accounting Pronouncements

There are no recent accounting pronouncements that are expected to have an effect on the Company’s financial statements.

Critical Accounting Policies

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (“GAAP”). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Our significant accounting policies are summarized in Note 2 of our financial statements. While all these significant accounting policies impact our financial condition and results of operations, we view certain of these policies as critical. Policies determined to be critical are those policies that have the most significant impact on our financial statements and require management to use a greater degree of judgment and estimates. Actual results may differ from those estimates. Our management believes that given current facts and circumstances, it is unlikely that applying any other reasonable judgments or estimate methodologies would cause effect on our consolidated results of operations, financial position or liquidity for the periods presented in this report.

We believe the following critical accounting policies and procedures, among others, affect our more significant judgments and estimates used in the preparation of our consolidated financial statements:

Development Stage Company

The Company's financial statements are presented as those of a development stage enterprise. Activities during the development stage primarily include equity based financing and further implementation of the business plan, including research and development.

Revenue Recognition and Deferred Revenue

Revenues will consist primarily of tuition and fees derived from courses taught by the University online as well as from related educational resources that the University provides to its students, such as access to our online materials and learning management system. Tuition revenue and most fees from related educational resources will be recognized pro-rata over the applicable period of instruction. The University will maintain an institutional tuition refund policy, which provides for all or a portion of tuition to be refunded if a student withdraws during stated refund periods. Certain States in which students reside impose separate, mandatory refund policies, which override the University’s policy to the extent in conflict. If a student withdraws at a time when a portion or none of the tuition is refundable, then in accordance with its revenue recognition policy, the University will immediately recognize as revenue the tuition that was not refunded. Since the University will recognize revenue pro-rata over the term of the course and because, under its institutional refund policy, the amount subject to refund is never greater than the amount of the revenue that has been deferred, under the University’s accounting policies revenue will not be recognized with respect to amounts that could potentially be refunded. The University will also charge students annual fees for library, technology and other services, which will be deferred and recognized over the related service period. Deferred revenue and student deposits in any period will represent the excess of tuition, fees, and other student payments received as compared to amounts recognized as revenue and will be reflected as current liabilities in the accompanying consolidated balance sheets. The University’s educational programs have starting and ending dates that differ from its fiscal quarters. Therefore, at the end of each fiscal quarter, a portion of revenue from these programs is not yet earned. Other revenues may be recognized as sales occur or services are performed. The Company recorded $7,600 and $7,600 respectively of gross revenue for the three months ended March 31, 2013 and for the period October 3, 2012 (date of inception) to March 31, 2013.

14

Instructional Costs and Services

Instructional costs and services will consist primarily of costs related to the administration and delivery of the Company's educational programs. This expense category includes compensation for faculty and administrative personnel, costs associated with online faculty, curriculum and new program development costs, bad debt expense related to accounts receivable, financial aid processing costs, technology license costs and costs associated with other support groups that provide services directly to the students. The Company recorded $3,177 and $3,177 respectively of instructional costs and service costs for the three months ended March 31, 2013 and for the period October 3, 2012 (date of inception) to March 31, 2013.

Marketing and Promotional Costs

Marketing and promotional costs will include compensation of personnel engaged in marketing and recruitment, as well as costs associated with purchasing leads, producing marketing materials, and advertising. Such costs are generally affected by the cost of advertising media and leads, the efficiency of the Company's marketing and recruiting efforts, compensation for the Company's enrollment personnel and expenditures on advertising initiatives for new and existing academic programs. Advertising costs will consist primarily of marketing leads and other branding and promotional activities. Non-direct response advertising activities are expensed as incurred, or the first time the advertising takes place, depending on the type of advertising activity. There were no marketing and promotional costs incurred for the period.

Stock-based Compensation

The Company accounts for stock-based compensation in accordance with ASC Topic 718, “Accounting for Stock-Based Compensation" established financial accounting and reporting standards for stock-based employee compensation. It defines a fair value based method of accounting for an employee stock option or similar equity instrument. The Company accounts for compensation cost for stock option plans in accordance with ASC 718. The Company accounts for share based payments to non-employees in accordance with ASC 505-50 “Accounting for Equity Instruments Issued to Non-Employees for Acquiring, or in Conjunction with Selling, Goods or Services”.

The Company recognizes all forms of share-based payments, including stock option grants, warrants and restricted stock grants, at their fair value on the grant date, which are based on the estimated number of awards that are ultimately expected to vest.

Share based payments, excluding restricted stock, are valued using a Black-Scholes option pricing model. Share based payment awards issued to non-employees for services rendered are recorded at either the fair value of the services rendered or the fair value of the share-based payment, whichever is more readily determinable. The grants are amortized on a straight-line basis over the requisite service periods, which is generally the vesting period. If an award is granted, but vesting does not occur, any previously recognized compensation cost is reversed in the period related to the termination of service. Stock based compensation expenses are included in cost of goods sold or selling, general and administrative expenses, depending on the nature of the services provided, in the Statement of Operations. For the period (October 3, 2012 (date of inception) to December 31, 2012 share based compensation amounted to $2,335. There was no share based compensation for the three months ended March 31, 2013.

15

Off Balance Sheet Arrangements:

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

DESCRIPTION OF PROPERTY

Our principal executive office is located at 275 Seventh Avenue, 7th Floor, New York, NY 10001. An office space will possibly be rented in South Florida.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Directors and Executive Officers

The following table sets forth the name and position of each of our current executive officers and directors. All directors hold office until the next annual meeting of stockholders or until their respective successors are elected, except in the case of death, resignation or removal:

|

Name

|

Age

|

Position

|

|

Ira Shapiro

|

52

|

Chief Executive Officer and Chairman of the Board of Directors

|

|

Sharon Franey

|

52

|

Chief Operating Officer and Director

|

A brief biography of our director is more fully described in Item 5.02, which is incorporated herein by reference.

Committees

We do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. Also, we do not have an “audit committee financial expert” on our board of directors as that term is defined by Item 401(d)(5)(ii) of Regulation S-K. We do not believe it is necessary for our board of directors to appoint such committees because the volume of matters that come before our board of directors for consideration permits the directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees.

Director Independence

Our securities are not listed on a national securities exchange or in an inter-dealer quotation system which has requirements that directors be independent. We do not have majority of independent directors.

Code of Ethics

Our Board of Directors adopted a code of ethics filed as Exhibit 14.1 to the Registration Statement on S-1 filed on April 11, 2012, and is incorporated by reference herein. The Code of Ethics applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The code of ethics address, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

16

EXECUTIVE COMPENSATION

Summary Compensation

The following summary compensation table sets forth all compensation awarded to, earned by, or paid to the named executive officers paid by CodeSmart Holdings, Inc. (f/k/a First Independence Corp.) during the period from inception (February 10, 2012) through May 3, 2013.

|

Name and Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive

Plan

Compensation

($)

|

Non-

Qualified

Deferred

Compensation

Earnings

($)

|

All Other

Compensation

($)

|

Totals

($)

|

|||||||||||||||||||||||||

|

(1) Bruno Pasquali

|

2012, 2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

- | |||||||||||||||||||||||||

|

(2) Nigel G. Lindsay

|

2012, 2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

- | |||||||||||||||||||||||||

|

(1)

|

Mr. Bruno Pasquali is the founder and was sole executive officer and director of the Company until February 6, 2013 and did not receive any personal compensation for his services as such.

|

|

|

(2)

|

Mr. Nigel G. Lindsay was appointed Chief Executive Officer and sole director on February 6, 2013 and resigned from all his positions on May 3, 2013.

|

Option Grants Table

There were no individual grants of stock options to purchase our common stock made to the executive officers named in the Summary Compensation Table from inception through May 3, 2013.

CODESMART™ Summary Compensation

The following table sets forth information for CODESMART™’s most recently completed fiscal year concerning the compensation of Ira Shapiro, our Chief Executive Officer (“CEO”) and all other executive officers of Company during the most recently completed fiscal year ended December 31, 2012.

|

Name and

Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive

Plan

Compensation

($)

|

Non-

Qualified

Deferred

Compensation

Earnings

($)

|

All Other

Compensation

($)

|

Totals

($)

|

|||||||||||||||||||||||||||

|

Ira Shapiro

CEO, Chairman

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||||||||

|

Sharon Franey

COO, Director

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||||||||

17

Aggregated Option Exercises and Fiscal Year-End Option Value Table

There were no stock options exercised since the date of inception of the Company, February 10, 2012, through the date of this Current Report on Form 8-K by the executive officers named in the Summary Compensation Tables.

Long-Term Incentive Plan (“LTIP”) Awards Table

There were no awards made to any named executive officers in the last completed fiscal year under any LTIP.

Compensation of Directors

None of our directors are compensated for their roles as such.

Option Plan

We currently do not have a Stock Option Plan, however, we may to issue stock options pursuant to a Stock Option Plan in the future. Such stock options may be awarded to management, employees, members of the Company’s Board of Directors and consultants of the Company.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDPENDENCE

Transactions with related persons

Our policy is that a contract or transaction either between the Company and a director, or between a director and another company in which he is financially interested is not necessarily void or void-able if the relationship or interest is disclosed or known to the board of directors and the stockholders are entitled to vote on the issue, or if it is fair and reasonable to our company.

The Company is not a party to any transaction (where the amount involved exceeded the lesser of $120,000 or 1% of the average of our assets for the last two fiscal years) in which an director, executive officer, holder of more than five percent of our common stock, or any member of the immediate family of any such person have or will have a direct or indirect material interest and no such transactions are currently proposed.

Independent Directors

For purposes of determining independence, the Company has adopted the definition of independence as contained in NASDAQ Market Place Rules 4200. Pursuant to the definition, the Company has determined that none of its directors is independent.

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides the names and addresses of each person known to us to own more than 5% of our outstanding shares of common stock as of the date of this report, and by the officers and directors, individually and as a group. Except as otherwise indicated, all shares are owned directly and the shareholders listed possesses sole voting and investment power with respect to the shares shown. Below is the security ownership table as of the date of this Report.

|

Name and Address of Beneficial Owner(1)

|

Title of Class

|

Amount

|

Percent of Class(2)

|

|||||||

|

Directors and named Executive Officers

|

||||||||||

|

Ira Shapiro

|

Common Stock

|

2,850,000

|

15.14

|

%

|

||||||

|

Series A Preferred Stock

|

1

|

100

|

%

|

|||||||

|

Sharon Franey

5029 Apple Lane,

Mohnton, PA 19540

|

Common Stock

|

2,912,500

|

15.47

|

%

|

||||||

|

All Directors and executive officers

as a group (2 persons)

|

Common Stock

|

5,762,500

|

30.61

|

%

|

||||||

|

Series A Preferred Stock

|

1

|

100

|

%

|

|||||||

|

5% Security Holders

|

||||||||||

|

Marc Kovens

60 Edgewater Dr.

Coral Gables, FL 33133

|

Common Stock

|

2,808,000

|

14.92

|

%

|

||||||

|

ICD Capital, LLC (3)

455 Elm Street, Suite 100

Graham, TX 76450

|

Common Stock

|

955,000

|

5.07

|

% | ||||||

(1) Except as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table. Unless otherwise indicated, the address of the beneficial owner is 275 Seventh Avenue, 7th Floor, New York, NY 10001.

(2) Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares as to which a shareholder has sole or shared voting power or investment power, and also any shares which the shareholder has the right to acquire within 60 days, including upon exercise of common shares purchase options or warrants. There were 18,826,697 shares of common stock issued and outstanding as of the date of this Report.

(3) Alfred G. Allen, III is the member of ICD Capital LLC (“ICD”) and has the power to vote and dispose the Company’s securities owned by ICD. Therefore, Mr. Allen may be deemed as the beneficial owner of the Common Stock owned by ICD.

19

DESCRIPTION OF SECURITIES

General

On May 3, 2013, the Company filed Articles of Amendments to its Articles of Incorporation to:

(i) increase the aggregate number of shares which the Company shall have authority to issue from 110,000,000 shares of Common Stock and zero preferred stock to 500,000,000 shares of Common Stock and 100,000,000 shares of preferred stock, par value $.0001 per share;

(ii) designate the rights of Series A convertible preferred stock, par value $.0001 per share, which is convertible into common stock on a one-to-one basis, with no dividend rights and no liquidation preferences.

Common Stock

The Company’s common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any Preferred Stock. Holders of the Company’s common stock representing fifty percent (50%) of the Company’s capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of the Company’s stockholders. The Company’s Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of Preferred Stock created by the Company’s Board of Directors from time to time, the holders of shares of the Company’s Common Stock will be entitled to such cash dividends as may be declared from time to time by the Company’s Board of Directors from funds available therefore.

Subject to any preferential rights of any outstanding series of Preferred Stock created from time to time by the Company’s Board of Directors, upon liquidation, dissolution or winding up, the holders of shares of the Company’s common stock will be entitled to receive pro rata all assets available for distribution to such holders.

Holders of the Company’s common stock have no preemptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

The Company currently has one class of Preferred Stock, the Series A Preferred Stock, par value $.0001 per share (the “Series A Preferred Stock”), and there is one share of Series A Preferred Stock issued and outstanding. The Series A Preferred Stock is convertible into shares of Common Stock on a one-for-one basis and is entitled to 60% of the total votes on all matters so long as the Series A Preferred Stock is outstanding, with no dividend rights and no rights to liquidation preferences.

The Company’s Board of Directors is authorized by its Articles of Incorporation to issue Preferred Stock from time to time in one or more series with such designations, preferences and relative participating, optional or other special rights and qualifications, limitations or restrictions, thereof, as shall be stated in the resolutions adopted by the Company’s Board of Directors providing for the issuance of the Preferred Stock.

Warrants

There are no outstanding warrants to purchase our securities.

Options

There are no outstanding options to purchase our securities.

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON

EQUITY AND RELATED STOCKHOLDER MATTERS

While there is no established public trading market for our Common Stock, our Common Stock is quoted on the OTC Markets OTCQB, under the symbol “FICFD,” and will be changed to "ITEN" on July 15, 2013.

The market price of our Common Stock is subject to significant fluctuations in response to variations in our quarterly operating results, general trends in the market and other factors, over many of which we have little or no control. In addition, broad market fluctuations, as well as general economic, business and political conditions, may adversely affect the market for our Common Stock, regardless of our actual or projected performance.

20

We have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Holders

As of May 9, 2013, we had 6,231,250 shares of our common stock par value, $.0001 issued and outstanding. There were approximately 32 beneficial owners of our common stock.

The Transfer Agent for our capital stock is Island Stock Transfer, located at 15500 Roosevelt Boulevard, Suite 301.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

LEGAL PROCEEDINGS

There are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years. No director or executive officer has been convicted of a criminal offense or is the subject of a pending criminal proceeding during the past ten years. No director or executive officer has been the subject of any order, judgment or decree of any court permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities during the past ten years. No director or officer has been found by a court to have violated a federal or state securities or commodities law during the past ten years.

21

In addition, there are no material proceedings to which any affiliate of our Company, or any owner of record or beneficially of more than five percent of any class of voting securities of our Company, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. Currently there are no legal proceedings pending or threatened against us. We are not currently involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations.

There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our Company or any of our subsidiaries, threatened against or affecting our Company, our common stock, any of our subsidiaries or of our Company’s or our Company’s subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

However, from time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

RECENT SALES OF UNREGISTERED SECURITIES

Reference is made to Item 3.02 of this Current Report on Form 8-K for a description of recent sales of unregistered securities, which is hereby incorporated by reference.

INDEMNIFICATION OF OFFICERS AND DIRECTORS

Neither the Articles of Incorporation nor the Bylaws of CodeSmart Holdings, Inc. provide for indemnification of our directors. However, Section 607.0850 of the Florida Statutes provides indemnification of officers, directors, employees, and agents.

The general effect of the foregoing is to indemnify a control person, officer or director from liability under certain circumstances, thereby making us responsible for any expenses or damages incurred by such control person, officer or director in any action brought against them based on their conduct in such capacity, provided they did not engage in fraud or criminal activity.

We have been advised that in the opinion of the Securities and Exchange Commission indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s decision.

Pursuant to the Share Exchange Agreement, on May 3, 2013, we issued 3,062,500 shares of our Common Stock to the CodeSmart Stockholders, in exchange for 68.06% of the outstanding shares of CODESMART™. Such securities were not registered under the Securities Act of 1933. We relied on exemptions under Section 4(2) and Rule 701 of the Securities Act of 1933 to issue the Company’s shares in the Share Exchange Transaction.

On May 3, 2013, we issued 168,750 shares of Common Stock to certain accredited investors for an aggregate proceed of $270,000 pursuant to the Securities Purchase Agreement dated May 3, 2013. Such securities were issued in reliance upon the exemption from registration provided by Rule 506 of Regulation D promulgated under the Securities Act of 1933.

22

On May 3, 2013, Nigel Lindsay (“Lindsay”), a majority shareholder of the Company, entered into a Securities Purchase Agreement (the “Purchase Agreement,” such transaction, the “Purchase Transaction”) with CODESMART™, pursuant to which Lindsay sold to CODESMART™ his 9,000,000 shares of Common Stock of the Company (the “Majority Interests”) for an aggregate amount of $231,000. Immediately after the Purchase Transaction on May 3, 2013, the 9,000,000 shares of Common Stock were cancelled.

Simultaneous with the consummation of the Purchase Transaction, the Company consummated the Share Exchange Transaction with CodeSmart Stockholders, where CodeSmart Stockholders received an aggregate of 3,062,500 shares of the Common Stock in exchange for 68.06% of the equity interests of CODESMART™.

Also simultaneous with the Purchase Transaction and the Share Exchange Transaction, the Company sold a total of 168,750 shares of Common Stock to the PIPE Investors in the PIPE.