Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - PALL CORP | pallcorp_8kxq4fy2013.htm |

| EX-99.1 - PRESS RELEASE, DATED AUGUST 29, 2013 (FURNISHED PURSUANT TO ITEM 2.02) - PALL CORP | exhibit991q4fy13.htm |

Better Lives. Better Planet.SM © 2013 Pall Corporation Q4 and Full Year FY 2013 Financial Results August 29, 2013 Exhibit 99.2

2 The matters discussed in this presentation contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Results for the third quarter of fiscal year 2013 are preliminary until the Company's Form 10-K is filed with the Securities and Exchange Commission on or before September 30, 2013. Forward-looking statements are those that address activities, events or developments that the Company or management intends, expects, projects, believes or anticipates will or may occur in the future. All statements regarding future performance, earnings projections, earnings guidance, management’s expectations about its future cash needs, dilution from the disposition or future allocation of capital and effective tax rate, and other future events or developments are forward- looking statements. Forward-looking statements are those that use terms such as “may,” “will,” “expect,” “believe,” “intend,” “should,” “could,” “anticipate,” “estimate,” “forecast,” “project,” “plan,” “predict,” “potential,” and similar expressions. Forward-looking statements contained in this and other written and oral reports are based on management’s assumptions and assessments in light of past experience and trends, current conditions, expected future developments and other relevant factors. The Company’s forward-looking statements are subject to risks and uncertainties and are not guarantees of future performance, and actual results, developments and business decisions may differ materially from those envisaged by the Company’s forward-looking statements. Such risks and uncertainties include, but are not limited to, those discussed in Part I–Item 1A.–Risk Factors in the 2012 Form 10-K, and other reports the Company files with the Securities and Exchange Commission, including: the impact of legislative, regulatory and political developments globally; the impact of the uncertain global economic environment; the extent to which adverse economic conditions may affect the Company’s sales volume and results; demand for the Company’s products and business relationships with key customers and suppliers, which may be impacted by their cash flow and payment practices; delays or cancellations in shipments; the Company’s ability to develop and commercialize new technologies or obtain regulatory approval or market acceptance of new technologies; the Company’s ability to enforce patents and protect proprietary products and manufacturing techniques; increase in costs of manufacturing and operating costs; the Company’s ability to achieve and sustain the savings anticipated from its structural cost improvement initiatives; volatility in foreign currency exchange rates, interest rates and energy costs and other macroeconomic challenges currently affecting the Company; the Company’s ability to meet its regulatory obligations; costs and outcome of pending or future claims or litigation; the Company’s ability to comply with environmental, health and safety laws and regulations; changes in product mix, market mix and product pricing, particularly relating to the expansion of the systems business; the effect of a serious disruption in the Company’s information systems; fluctuations in the Company’s effective tax rate; the Company’s ability to successfully complete or integrate any acquisitions; competition, including the impact of pricing and other actions by the Company’s competitors; the effect of litigation and regulatory inquiries associated with the restatement of the Company’s prior period financial statements; the Company’s ability to attract and retain management talent or the loss of members of its senior management team; the effect of the restrictive covenants in the Company’s debt facilities; and the effect of product defects and recalls. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company makes these statements as of the date of this disclosure and undertakes no obligation to update them, whether as a result of new information, future developments or otherwise. Management uses certain non-GAAP measurements to assess the Company’s current and future financial performance. The non-GAAP measurements do not replace the presentation of the Company’s GAAP financial results. These measurements provide supplemental information to assist management in analyzing the Company’s financial position and results of operations. The Company has chosen to provide this information to facilitate meaningful comparisons of past, present and future operating results and as a means to emphasize the results of ongoing operations. Reconciliations of the non-GAAP financial measures used throughout this presentation to the most directly comparable GAAP measures appear at the end of this presentation in the Appendix and are also available on Pall’s website at www.pall.com/investor Forward-Looking Statements

3 Conference Call Replay Info Toll-Free: 855.859.2056 International: 404.537.3406 Conference ID: 26704892 Internet: www.pall.com/investor

4 FY 2013 Summary FY 2013 pro forma EPS up 9% on 1% revenue (ex-FX) growth 2013: Good evolution in a multi-year journey – Operational momentum continues – R&D translating to commercial wins – Cost saving initiatives improving bottom line – Systems rationalization complete Caution on the macro environment – Focus on sales execution All remarks in this presentation are on a “Continuing Operations” basis, which excludes the results of the Blood product line divestiture, unless indicated otherwise. A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix. Delivering results in a challenging environment

5 $722 $717 $2,672 $2,648 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 Revenue % Growth Ex-FX Q4 Full Year Financial Overview (1) Includes estimated Japanese Yen transactional FX impact 0f ~$0.03. Dollars in millions, except EPS data A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix $0.86 $0.90 $2.80 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 Pro forma EPS % Growth Q4 Full Year 9% 5% 19.3% 18.8% 17.0% 17.7% 10.0% 15.0% 20.0% Operating Profit Margin Increase in Basis Points Q4 Full Year -50 bps +70 bps FY 2012 FY 2013 Q4 Full Year FY2012 0.86$ 2.80$ EBIT (0.01) 0.18 Translational FX (0.03) (0.10) Sharecount & other 0.08 0.16 FY2013 0.90$ 3.04$ Pro forma EPS Bridge 1% 0% FY 2012 FY 2013 FY 2012 FY 2013 $3.04 (1)

6 Fourth Quarter Life Sciences Consumables $316 / +4% Industrial Consumables $284 / -4% Industrial Systems $79 / -9% Life Sciences Systems $38 / +33% 40% 44% 11% 5% FY 2013 Sales by Segment Life Sciences Consumables $1,198 / +8% Industrial Consumables $1,097 / -3% Full Year Industrial Systems $242 / -6% Life Sciences Systems $111 / -7% 45% 42% 9% 4% Dollars in millions Percentages outside pie charts and at bottom of page represent sales change excluding FX Percentages inside pie charts represent percent of total sales A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Life Sciences: $354 / +6% Industrial: 363 / -5% Total Sales: $717 / 0% Life Sciences: $1,309 / +6% Industrial: 1,339 / -4% Total Sales: $2,648 / +1%

7 Orders Q4 YoY Δ Ex-FX Full Year YoY Δ Ex-FX Consumables $ 315 5% $ 1,226 8% Systems 25 -37% $ 111 2% Total Life Sciences $ 340 0% $ 1,337 8% Sales Q4 YoY Δ Ex-FX Full Year YoY Δ Ex-FX Consumables $ 316 4% $ 1,198 8% Systems 38 33% $ 111 -7% Total Life Sciences $ 354 6% $ 1,309 6% 0% 30% 60% Life Sciences Segment Performance Dollars in millions A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix 0% 30% 60% 57.8% -40 bps 56.8% -110 bps 24.4% -110 bps 24.2% -150 bps FY 2012 FY 2013 Gross Margin Segment Margin Q4 / Full Year BioPharmaceuticals consumables: +6% / +10% Medical consumables: +5% / +9% Food & Beverage consumables: -4% / 0% Q4 Full Year Q4 Full Year 57.9% 58.2% 25.7% 25.5%

8 46.5% +110 bps 45.4% Industrial Segment Performance Dollars in millions A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Sales Q4 YoY Δ Ex-FX Full Year YoY Δ Ex-FX Consumables $ 284 -4% $ 1,097 -3% Systems 79 -9% $ 242 -6% Total Industrial $ 363 -5% $ 1,339 -4% Orders Q4 YoY Δ Ex-FX Full Year YoY Δ Ex-FX Consumables $ 286 -1% $ 1,062 -6% Systems 51 -48% $ 216 -22% Total Industrial $ 337 -13% $ 1,278 -9% Q4 / Full Year Process Technologies consumables: +1% / -5% Aerospace consumables: -10% / +7% Microelectronics consumables: -7% / -7% 14.6% +300 bps 11.6% 0% 30% 60% 0% 30% 60% 46.0% +10 bps 46.3% +30 bps 16.0% 18.8% FY 2012 FY 2013 Gross Margin Segment Margin Q4 Full Year Q4 Full Year 46.0% 45.9% 17.4% 14.0% +200 bps +140 bps

9 Cash Flow YTD FY13 YTD FY12 Operating Cash Flow 384$ 475$ CapEx (110) (159) Free Cash Flow 274$ 316$ Other Significant Sources/(Uses) of Cash: Proceeds from sale of assets 538$ 27$ Acquisition of businesses (22) (168) Dividends (108) (89) Borrowing/Repayment under Financing Facilities (35) (10) Stock Buybacks (250) (121) Dollars in millions A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Cash, net of debt, $299mm as of July 31, 2013 FY 2013 Sale of Blood Product Line Reduced by one-time tax-related payments

10 Total Revenue Low to mid single digit growth Segment Revenue Life Sciences: Mid to high single digit growth Industrial: Flat − Modest consumables growth Pro Forma EPS $3.30 – $3.50 Represents growth of 9% – 15% Estimate excludes Discrete Items, future acquisitions and related costs FY 2014 Outlook Other Key Assumptions Gross Margins − 20 to 40 bps improvement SG&A − Reducing by ~100 bps as a % of sales FX − Translational: $0.00 – $0.03 − Assumed rates: − Euro / USD: 1.33 − GBP / Euro: 0.85 − USD / Yen: 98.0 Tax Rate: 23% R&D: Modest increase Share Repurchase: $250mm Sales changes exclude FX Revenue and EPS Guidance Modeling Guidance

Better Lives. Better Planet.SM © 2013 Pall Corporation Appendix

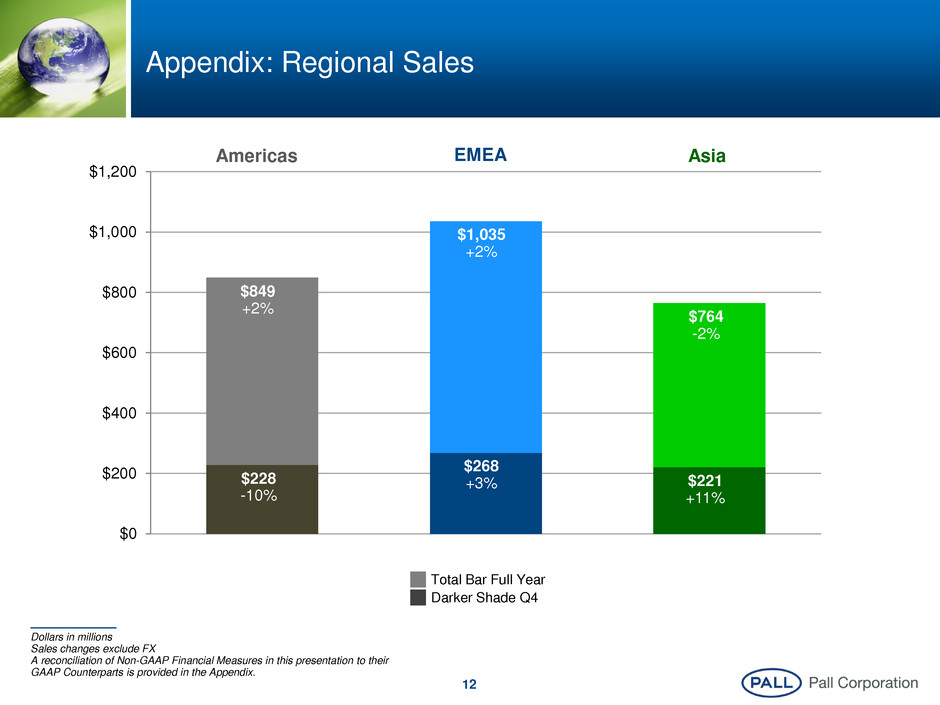

12 $0 $200 $400 $600 $800 $1,000 $1,200 $228 -10% $268 +3% $221 +11% Americas EMEA Asia $849 +2% $1,035 +2% $764 -2% Appendix: Regional Sales Dollars in millions Sales changes exclude FX A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix. Darker Shade Q4 Total Bar Full Year

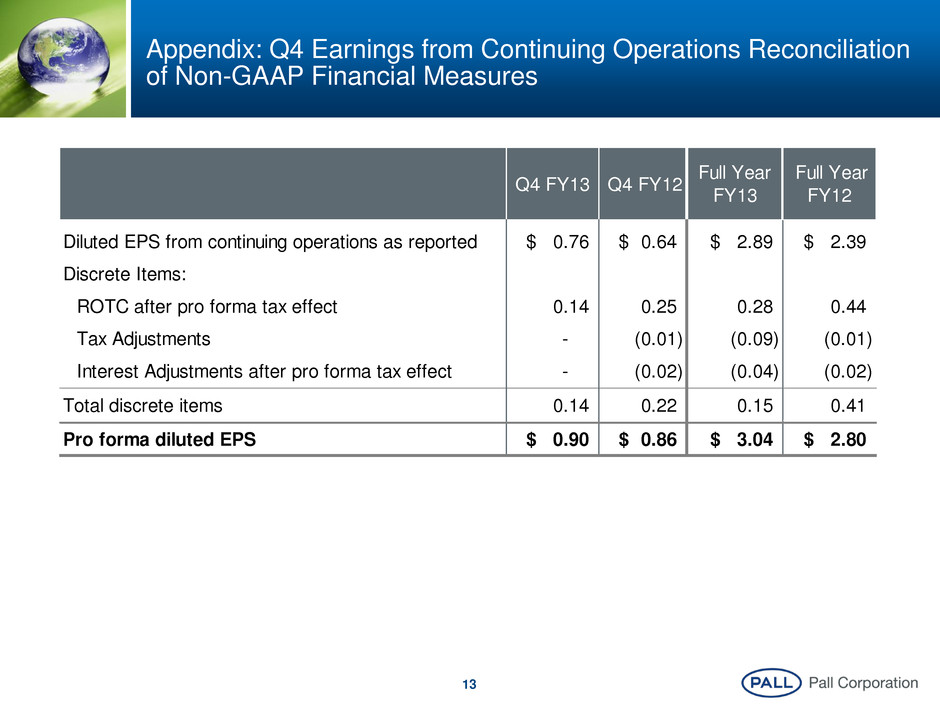

13 Appendix: Q4 Earnings from Continuing Operations Reconciliation of Non-GAAP Financial Measures Diluted EPS from continuing operations as reported 0.76$ 0.64$ 2.89$ 2.39$ Discrete Items: ROTC after pro forma tax effect 0.14 0.25 0.28 0.44 Tax Adjustments - (0.01) (0.09) (0.01) Interest Adjustments after pro forma tax effect - (0.02) (0.04) (0.02) Total discrete items 0.14 0.22 0.15 0.41 Pro forma diluted EPS 0.90$ 0.86$ 3.04$ 2.80$ Q4 FY13 Q4 FY12 Full Year FY12 Full Year FY13

14 Appendix: Q4 Life Sciences Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Q4 FY13 Q4 FY13 Estimated Impact of FX Q4 FY13 Estimate Excluding FX Q4 FY12 % Change Excluding FX Consumables Sales: BioPharmaceuticals 215,211$ (1,021)$ 216,232$ 204,778$ 5.6% Food & Beverage 47,364 (255) 47,619 49,701 -4.2% Medical 53,965 (90) 54,055 51,487 5.0% Consumables Total 316,540$ (1,366)$ 317,906$ 305,966$ 3.9% Systems Sales 37,605$ (409)$ 38,014$ 28,674$ 32.6% Total Life Sciences 354,145$ (1,775)$ 355,920$ 334,640$ 6.4% Dollars in thousands

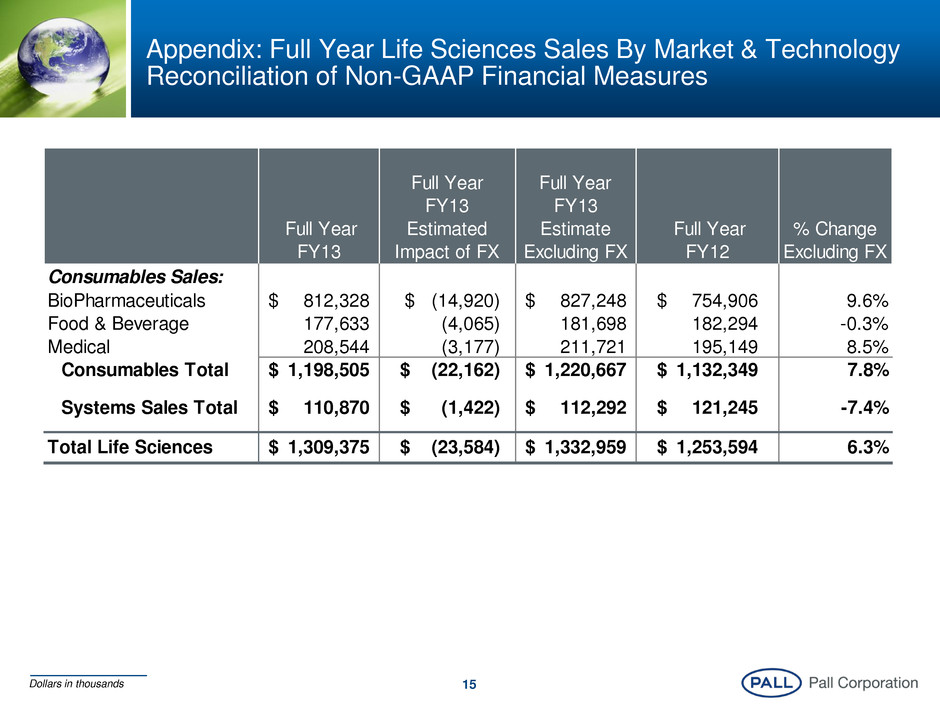

15 Appendix: Full Year Life Sciences Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Full Year FY13 Full Year FY13 Estimated Impact of FX Full Year FY13 Estimate Excluding FX Full Year FY12 % Change Excluding FX Consumables Sales: BioPharmaceuticals 812,328$ (14,920)$ 827,248$ 754,906$ 9.6% Food & Beverage 177,633 (4,065) 181,698 182,294 -0.3% Medical 208,544 (3,177) 211,721 195,149 8.5% Consumables Total 1,198,505$ (22,162)$ 1,220,667$ 1,132,349$ 7.8% Systems Sales Total 110,870$ (1,422)$ 112,292$ 121,245$ -7.4% Total Life Sciences 1,309,375$ (23,584)$ 1,332,959$ 1,253,594$ 6.3% Dollars in thousands

16 Appendix: Q4 Industrial Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Q4 FY13 Q4 FY13 Estimated Impact of FX Q4 FY13 Estimate Excluding FX Q4 FY12 % Change Excluding FX Consumables Sales: Process Technologies 151,299$ (1,710)$ 153,009$ 151,457$ 1.0% Aerospace 59,417 (229) 59,646 66,573 -10.4% Mi r electr nics 72,746 (4,398) 77,144 82,541 -6.5% Consumables Total 283,462$ $ (6,337) 289,799$ $ 300,571 -3.6% Systems Sales 79,211$ (423)$ 79,634$ $ 87,160 -8.6% Total Industrial 362,673$ (6,760)$ 369,433$ 387,731$ -4.7%3 5 Dollars in thousands

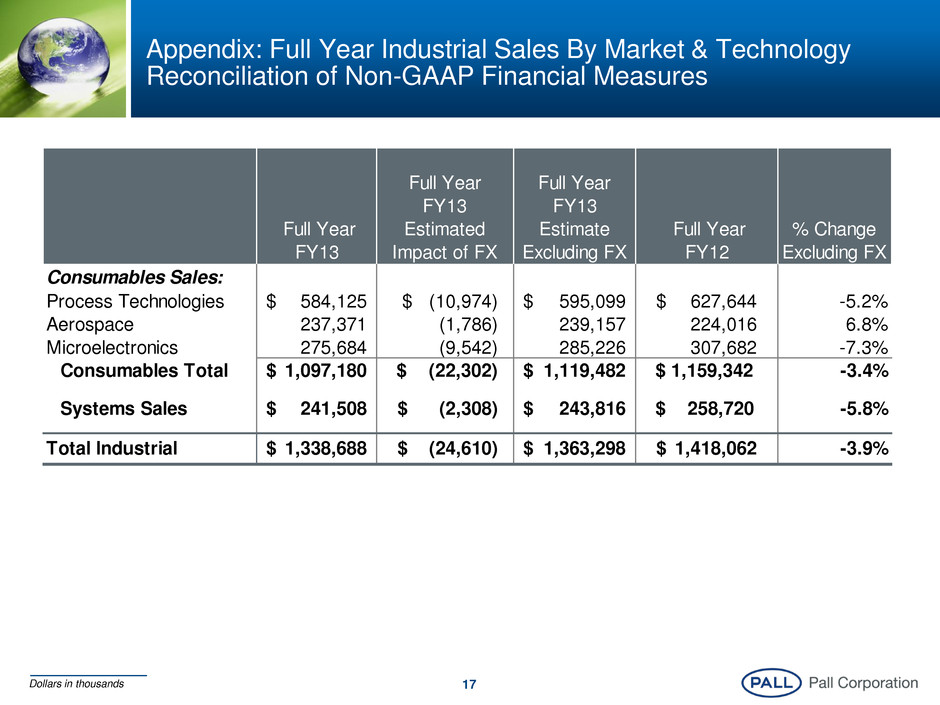

17 Appendix: Full Year Industrial Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Full Year FY13 Full Year FY13 Estimated Impact of FX Full Year FY13 Estimate Excluding FX Full Year FY12 % Change Excluding FX Consumables Sales: Process Technologies 584,125$ (10,974)$ 595,099$ 627,644$ -5.2% Aerospace 237,371 (1,786) 239,157 224,016 6.8% Mi r electronics 275,684 (9,542) 285,226 307,682 -7.3% Consumables Total 1,097,180$ $ (22,302) 1,119,482$ $ 1,159,342 -3.4% Systems Sales 241,508$ (2,308)$ 243,816$ $ 258,720 -5.8% Total Industrial 1,338,688$ (24,610)$ 1,363,298$ 1,418,062$ -3.9%5 Dollars in thousands

18 Appendix: Q4 Orders by Technology Reconciliation of Non-GAAP Financial Measures Dollars in thousands Q4 FY13 Q4 FY13 Estimated Impact of FX Q4 FY13 Estimate Excluding FX Q4 FY12 % Change Excluding FX Life Sciences Orders: Consumables 315,043$ (636)$ 315,679$ 299,610$ 5.4% Systems 24,917 (278) 25,195 39,750 -36.6% Life Sciences Total 339,960$ (914)$ 340,874$ 339,360$ 0.4% Industrial Orders: C nsumables 286,322$ (5,578)$ 291,900$ 295,449$ -1.2% Systems 50,385 (328) 50,713 97,174 -47.8% Industrial Total 336,707$ (5,906)$ 342,613$ 392,623$ -12.7% Total Pall 676,667$ (6,820)$ 683,487$ 731,983$ -6.6%

19 Appendix: Full Year Orders by Technology Reconciliation of Non-GAAP Financial Measures Dollars in thousands Full Year FY13 Full Year FY13 Estimated Impact of FX Full Year FY13 Estimate Excluding FX Full Year FY12 % Change Excluding FX Life Sciences Orders: Consumables 1,225,836$ (22,349)$ 1,248,185$ 1,156,314$ 7.9% Systems 110,831 (2,296) 113,127 110,454 2.4% Life Sciences Total 1,336,667$ (24,645)$ 1,361,312$ 1,266,768$ 7.5% Industrial Orders: C nsumables 1,062,215$ (22,569)$ 1,084,784$ 1,157,752$ -6.3% Systems 215,721 (1,603) 217,324 278,991 -22.1% Industrial Total 1,277,936$ (24,172)$ 1,302,108$ 1,436,743$ -9.4% Total Pall 2,614,603$ (48,817)$ 2,663,420$ 2,703,511$ -1.5%

20 Appendix: Sales by Region Reconciliation of Non-GAAP Financial Measures Q4 FY13 Q4 FY13 Estimated Impact of FX Q4 FY13 Estimate Excluding FX Q4 FY12 % Change Excluding FX Americas 227,977$ (1,586)$ 229,563$ 255,740$ -10.2% Europe 268,263 8,357 259,906 253,396 2.6% Asia 220,578 (15,306) 235,884 213,235 10.6% Total Pall 716,818$ (8,535)$ 725,353$ 722,371$ 0.4% Dollars in thousands Full Year FY13 Full Year FY13 Estimated Impact of FX Full Year FY13 Estimate Excluding FX Full Year FY12 % Change Excluding FX Americas 849,486$ (6,471)$ 855,957$ 839,984$ 1.9% Europe 1,034,515 (13,250) 1,047,765 1,022,952 2.4% Asia 764,062 (28,473) 792,535 808,720 -2.0% Total Pall 2,648,063$ (48,194)$ 2,696,257$ 2,671,656$ 0.9%

21 Appendix: Q4 Operating Profit Reconciliation of Non-GAAP Financial Measures Operating Profit Q4 FY13 Q4 FY12 Life Sciences segment profit 85,757$ 86,121$ Industrial segment profit 68,075 67,552 Total segment profit 153,832$ 153,673$ General corporate expenses (19,377) (14,338) Operating profit 134,455$ 139,335$ % of Sales 18.8% 19.3% ROTC 18,685 35,857 Interest expense, net 4,874 2,495 Earnings before income taxes 110,896$ 100,983$ Dollars in thousands

22 Appendix: Full Year Operating Profit Reconciliation of Non-GAAP Financial Measures Operating Profit Full Year FY13 Full Year FY12 Life Sciences segment profit 319,271$ 319,312$ Industrial segment profit 214,798 198,747 Total segment profit 534,069$ 518,059$ General corporate expenses (66,640) (64,114) Operating profit 467,429$ 453,945$ % of Sales 17.7% 17.0% ROTC 40,182 66,858 Interest expense, net 15,621 20,177 Earnings before income taxes 411,626$ 366,910$ Dollars in thousands

Better Lives. Better Planet.SM © 2013 Pall Corporation www.pall.com/green