Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED COMMUNITY FINANCIAL CORP | d590363d8k.htm |

2013 Annual Meeting

August 2013

Exhibit 99 |

Patrick W. Bevack

President and Chief Executive Officer |

Forward-Looking Statement Disclosure

3

When used in this presentation the words or phrases “will likely

result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project” or

similar expressions are intended to identify “forward-looking

statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements are subject to

certain risks and uncertainties, including changes in economic

conditions in United Community’s market area, changes in

policies by regulatory agencies, fluctuations in interest rates, demand for

loans in Home Savings’ market area, and competition, that could

cause actual results to differ materially from results

presently anticipated or projected. United Community cautions

readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made.

United Community advises readers that the factors listed above

could affect United Community’s financial performance and

could cause United Community’s actual results for future

periods to differ materially from any opinions or statements

expressed with respect to future periods in any current statements.

United Community undertakes no obligation to update any

forward-looking statement to reflect events or

circumstances after the date on which the statement is made.

Actual results may differ materially from our statements due to

a number of risks and uncertainties, including those described in the

Company’s Form 10-K for the year ended December 31, 2012 and

subsequent filings. Please refer to these SEC documents

for a complete list of risk factors.

|

Non-GAAP Financial Measures

4

This presentation contains financial information determined by methods

other than those prescribed by accounting principles generally

accepted in the United States of America ("GAAP").

Management uses these non-GAAP financial measures because

it believes that they are useful for evaluating our operations

and performance over periods of time, as well as in managing

and evaluating our business and in discussions about our

operations and performance. Management believes these

non-GAAP financial measures provide users of our financial

information

with

meaningful

measures

for

assessing

our

financial

results,

as

well as a comparison to financial results for prior periods.

These non-GAAP financial measures should not be considered

as a substitute for financial measures determined in accordance

with GAAP and may not be comparable to other similarly titled

financial measures used by other companies. A reconciliation of

the differences between our non-GAAP financial measures and

the most comparable GAAP measures accompanies the use of such non-

GAAP financial measures within the body of this presentation.

|

Major Goals

5

Achieve termination of the Regulatory Orders at the Bank

and Holding Company

Establish a strong management team that works well together

Improve asset quality and establish a strong credit culture

Raise a sufficient amount of capital to strengthen the

financials of the Company and to position us to take

advantage of future opportunities

Established upon being named CEO |

Review of Financial Performance

Asset Quality

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

1Q

'11

2Q

'11

3Q

'11

4Q

'11

1Q

'12

2Q

'12

3Q

'12

4Q

'12

1Q

'13

2Q

'13

Classified Assets

($000’s)

6

We reduced classified assets from

$253.9 million to $44.9 million, a

reduction of $209.0 million over

the last eighteen months

–

Classified Assets is comprised

of Classified Loans plus Real

Estate Owned (REO) and

repossessed assets

–

Classified Loans are loans

that have a well-defined

weakness |

Review of Financial Performance (cont.)

Asset Quality

$0

$50,000

$100,000

$150,000

$200,000

1Q

'11

2Q

'11

3Q

'11

4Q

'11

1Q

'12

2Q

'12

3Q

'12

4Q

'12

1Q

'13

2Q

'13

Nonperforming Assets

($000’s)

7

We reduced nonperforming assets

from $156.6 million to $40.5

million, a $116.1 million

improvement over the last

eighteen months

–

Nonperforming Assets

includes Nonperforming

Loans plus REO and

repossessed assets

–

Nonperforming Loans include

loans that are 90 days past

due and nonaccrual loans |

Review of Financial Performance (cont.)

Stock Price

Stock Price

January 1, 2011 through June 30, 2013

8

The stock price improved from

$1.27 per share at the end of the

fourth quarter of 2011 to $4.65 at

the end of the second quarter of

2013

UCFC’s market capitalization at

the end of the fourth quarter of

2011 was $41.4 million, compared

to $233.4 million at the end of the

second quarter of 2013

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

1Q

'11

2Q

'11

3Q

'11

4Q

'11

1Q

'12

2Q

'12

3Q

'12

4Q

'12

1Q

'13

2Q

'13 |

Review of Financial Performance (cont.)

Stock Price

% Price Change Compared to SNL U.S. Bank and Thrift

January 1, 2011 through June 30, 2013

UCFC’s stock price performance

was significantly better than the

average of other banks and thrifts

over the past two years |

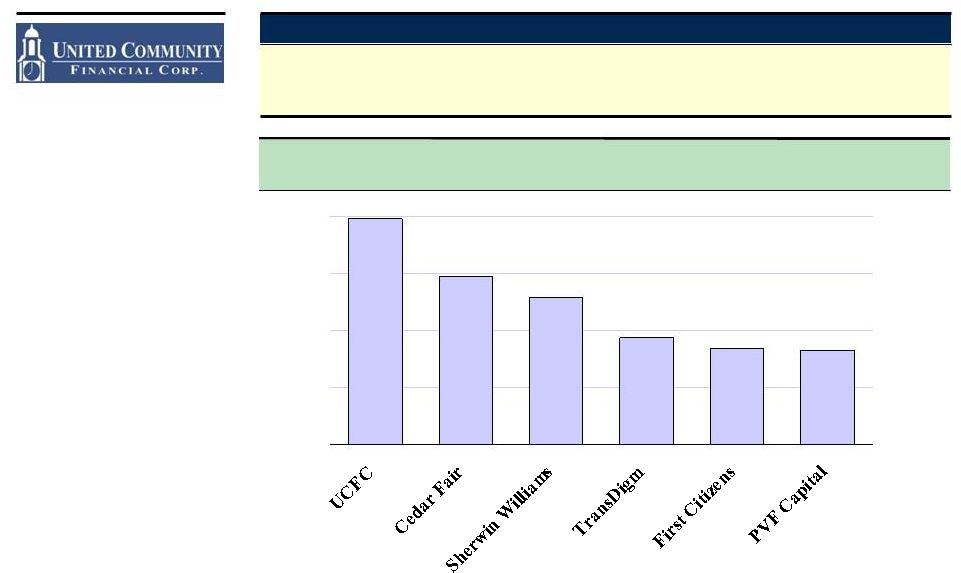

Top Performing Ohio Businesses

Top Two-Year Returns

Two-Year Return as of April 30, 2013

Source: S&P Capital IQ

0%

50%

100%

150%

200% |

James R. Reske

Chief Financial Officer and Treasurer |

Operations

33 Branches and 9 Loan Production Offices

Headquartered in Youngstown, Ohio, but its market area extends across

northern Ohio and into western Pennsylvania

Overview

12 |

Major Accomplishments

2012 and 2013 YTD

13

Bulk sale of troubled assets

–

Home Savings successfully completed a bulk sale of a substantial

amount of the Bank’s troubled loans, along with other assets, to

an unrelated party on September 21, 2012

•

The bulk sale lifted $92.7 million of classified assets off of the

Bank’s books

Completion of the capital raise

–

In the first half of 2013, the Company completed a $47.0 million

capital raise

Lifting of regulatory orders

–

The Bank’s Consent Order was lifted in January 2013

–

The Holding Company’s Cease and Desist Order was lifted in July

2013

•

Both the Bank and the Holding Company remain under informal

memorandums of understanding with the regulators

Overview |

Capital Ratios

Capital Adequacy at Home Savings

C & D

8.0%

“Well-

Capitalized”

5.0%

Tier 1 Leverage Ratio (Core Capital / Average Assets)

Home Savings

Notes:

1.

The Bank C&D was issued in August 2008, and its capital

requirements went into effect as of 12/31/08

2. On

March

30,

2012,

the

C&D

was

terminated

and

the

Bank

was

issued

a

Consent

Order

3.

On January 31, 2013, the Consent Order was lifted and the Bank entered

into an MOU Total Risk-Based Capital to Risk-Weighted

Assets Home Savings

C & D /

Consent

Order/MOU

12.0%

“Well-

Capitalized”

10.0%

14

Capital

Consent

Order

9.0%

MOU

8.5%

Home Savings is now considered

well-capitalized

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

7.49%

8.20%

8.33%

8.50%

8.68%

8.22%

8.47%

8.71%

8.23%

7.84%

8.44%

8.40%

8.13%

8.16%

8.96%

9.32%

8.37%

8.70%

9.84%

10.03%

C&D

(1)

Consent

Order

(2)

MOU

(3)

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

11.8%

12.1%

12.5%

12.8%

13.0%

12.8%

12.7%

13.2%

13.1%

12.5%

13.0%

13.5%

13.3%

14.6%

15.2%

16.4%

16.0%

16.2%

18.3%

19.4%

C&D

(1)

Consent

Order

(2)

MOU

(3) |

Review of Financial Performance

UCFC

Earnings

Analysis

(1)

Earnings prior to tax, loan

loss provision and other

items

Provision expense

Goodwill charge

Key

Income tax

UCFC’s ability to generate pre-

tax, pre-provision earnings has

helped to offset the effect of loan

loss provision expense over the

course of this credit cycle

The wave of the credit cycle is

demonstrated in UCFC’s

provision expense

Butler Wick

Earnings

Notes:

1.

The table above contains certain financial information determined to

be a presentation not in accordance with GAAP. We have

provided information about significant events that occurred

during the period because we believe this information is useful to

both investors and management and aids in the overall

understanding of their impact on the Company’s overall performance. Users

should consider this financial information a supplementary tool for

analysis purposes and not substitute it for GAAP net

income 2.

Total reflects $150,000 of AMT tax

15

($MM):

$24.1

$4.1 ($35.3) ($16.8)

($37.3)

$0.2 ($20.4) $6.2

(2)

2006

2007

2008

Net Income

2009

2010

2011

2012

Bulk Sale Provision

(25.3)

(62.4)

(9.9)

(33.6)

(29.4)

(4.3)

39.7

31.4

26.2

24.9

9.5

(3.2)

(24.7)

(49.1)

(28.8)

18.0

24.9

18.4

$0.9

$0.2

3.2

(0.9)

(12.4)

1.2

$1.1

$2.4

$2.0

$4.9

($70)

($60)

($50)

($40)

($30)

($20)

($10)

$0

$10

$20

$30

$40

$50

2006

2007

2008

2009

2010

2011

2012

1H 2013

1H 2013 |

Reductions in Real Estate Owned (REO)

Real Estate Acquired through Foreclosure

REO Inflows/Outflows: through June 30, 2013

($MM)

REO Inflows/Outflows: 2012

($MM)

16

80 Properties

19 Properties

105 Properties

166 Properties

256 Properties

77 Properties

167 Properties

166 Properties

$18.1

$0.9

($7.8)

$11.2

($20)

$0

$20

12/31/12 Balance

Inflows

Outflows

6/30/13 Balance

$32.9

$6.0

($20.8)

$18.1

($40)

($20)

$0

$20

$40

12/31/11 Balance

Inflows

Outflows

12/31/12 Balance

UCFC’s REO portfolio shrank

from 256 properties worth $32.9

million at the end of 2011 to 166

properties worth $18.1 million at

December 31, 2012

Since December 31, 2011, the

Company took in 77 properties

worth $6.0 million, but sold 167

properties worth $20.8 million

As of December 31, 2012 ($MM):

Bal.

No.

–

Residential

$6.3

75

–

Construction

10.0

79

–

Commercial

1.8

12

$18.1

166

UCFC’s REO portfolio shrank

from 166 properties worth $18.1

million at the end of 2012 to 105

properties worth $11.2 million at

June 30, 2013

Since December 31, 2012, the

Company took in 19 properties

worth $0.9 million, but sold 80

properties worth $7.8 million

As of June 30, 2013 ($MM):

Bal.

No.

–

Residential

$3.4

56

–

Construction

6.9

41

–

Commercial

0.9

8

$11.2

105 |

Interest Rate Risk

The Benefits of a Rising Rate Environment

Impact of Immediate 200 bp Rate Increase on Next 12 Months Net Interest

Income UCFC’s goal is to effectively

manage interest rate risk

Interest rate risk can be measured

in many different ways, including

the effect on net interest income

due to a rise in interest rates

UCFC is currently asset-sensitive

As of June 30, 2013, if interest

rates should suddenly rise (here, a

hypothetical instantaneous 200

basis point positive parallel yield

curve shift), UCFC’s projected net

interest income would increase by

approximately $3.2 million

17

($000) |

Earning Assets

Reduction of Higher-Risk Asset Classes

UCFC’s mix of earning assets has

changed significantly over the

course of the economic crisis

–

Higher-risk lending categories

have declined

–

Securities make up a larger

portion of earning assets

UCFC’s Deferred Tax Asset

(DTA) was $28.8 million at

December 31, 2012

–

The DTA is revalued annually

–

Updated valuations would

take into account the tax

effect of any unrealized loss

in the securities portfolio

18

1-4 Family

$922.3, 37%

Consumer

$343.9, 14%

Comm’l RE

$578.9, 23%

Construction

$279.9, 11%

Commercial

$94.5, 4%

1-4 Family

$576.3, 34%

Commercial

$23.6, 1%

Construction

$35.3, 2%

Consumer

$195.4, 12%

Comm’l RE

$187.6, 11%

Notes:

1.

The loan segments are presented net of the allowance for loan

losses. Loans available for sale are included

in

the

1-4

family

segment

along

with

all

deferred

fees

2.

The

securities

segment

is

inclusive

of

AFS

securities

along

with

fed

funds

sold

and

FHLB

stock

Securities and Other

(2)

$666.8, 40%

Securities and Other

(2)

$263.9, 11%

Interest-earning Assets

Total Earning Assets as of 12/31/2008

(1)

Total: $2.5 billion

Total Earning Assets as of 6/30/2013

(1)

Total: $1.7 billion |

UCFC has shifted its funding mix

away from higher-cost time

deposits in favor of lower-cost

core deposits

Total cost of deposits was 0.51%

at June 30, 2013

Deposits & Borrowings as of 12/31/2008

Total Deposits: $1.9 billion

Total Borrowings: $462.9 million

Deposits & Borrowings as of 6/30/13

Total Deposits: $1.5 billion

Total Borrowings: $140.6 million

Interest-bearing Liabilities

Note:

1.

Includes term FHLB borrowings and term repos

19

Deposits and Borrowings

Reduced Reliance on Time Deposits while Increasing Core Deposits

Total Checking

$205.7, 9%

Money Market

$273.4, 11%

Savings

$181.6, 8%

CDs

$1,225.3, 52%

Term Borrowings

(1)

$281.2, 12%

Overnight Borrowings

$181.7, 8%

Term Borrowings

(1)

$140.6, 9%

CDs

$526.1, 34%

Savings

$273.0, 17%

Money Market

$334.2, 21%

Total Checking

$300.5, 19%

Rate Schedule

Total Checking

0.39% Term

Borrowings 4.28%

Money Market

2.76%

Overnight Borrowings 2.07%

Savings

0.45%

CDs

4.29%

Cost of Deposits: 3.19%

Cost of Funds: 3.27%

Rate Schedule

Cost of Deposits: 0.51%

Cost of Funds: 0.86%

Total Checking

0.05% Term

Borrowings 4.28%

Money Market

0.27%

Savings

0.11%

CDs

1.23% |

United Community Financial Corp.

NASDAQ: UCFC

www.UCFCONLINE.com

www.HOMESAVINGS.com

Headquarters

275 West Federal Street

Youngstown, Ohio 44503

20

Questions |