Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - AMERICAN EAGLE ENERGY Corp | v353714_8k.htm |

American Eagle Energy Corp (AMZG) Investor Presentation August 2013 Williston Basin (Bakken / Three Forks) Oil Focused Operator

F ORWARD L OOKING I NFORMATION 2 This presentation includes forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended (the “Securities Act”), and Section 21 E of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”) . All statements other than statements of historical facts are forward - looking statements . Such statements can be identified by the use of forward - looking terminology such as “believe,” “expect,” “may,” “should,” “seek,” “on - track,” “plan,” “project,” “forecast,” “intend” or “anticipate,” or the negative thereof or comparable terminology, or by discussions of vision, strategy or outlook, including statements related to our beliefs and intentions with respect to our growth strategy, including the amount we may invest, the location, and the scale of the drilling projects in which we intend to participate ; our beliefs with respect to the potential value of drilling projects ; our beliefs with regard to the impact of environmental and other regulations on our business ; our beliefs with respect to the strengths of our business model ; our assumptions, beliefs, and expectations with respect to future market conditions ; our plans for future capital expenditures ; and our capital needs, the adequacy of our capital resources, and potential sources of capital . You are cautioned that our business and operations are subject to a variety of risks and uncertainties, many of which are beyond our control and, consequently, our actual results may differ materially from those projected by any forward - looking statements . The SEC permits oil and natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically producible, as of a given date, by application of development projects to known accumulations . We use certain terms in this presentation, such as total potential, unrisked potential, de - risked, un - risked drilling locations and EUR (expected ultimate recovery), that the SEC’s guidelines strictly prohibit us from using in our SEC filings . These terms represent our internal estimates of volumes of oil and natural gas that are not proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques and are not intended to correspond to probable or possible reserves as defined by SEC regulations . By their nature these estimates are more speculative than proved, probable or possible reserves and subject to greater risk they will not be realized . The company has based these forward - looking statements on current expectations and assumptions about future events . While the company’s management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the company’s control . Accordingly, results actually achieved may differ materially from expected results in these statements . Forward - looking statements speak only as of the date they are made . The company does not undertake, and specifically disclaims, any obligation to update any forward - looking statements to reflect events or circumstances occurring after the date of such statements, other than as may be required by applicable law or regulation . You are urged not to place undue reliance on these forward - looking statements . You are also urged to carefully review and consider the various disclosures made by the company in its reports filed with the SEC, which attempt to advise interested parties of the risks and factors that may affect its business, financial condition, results of operation and cash flows . If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, the company’s actual results may vary materially from those expected or projected . All forward-looking statements speak only as of the date of this presentation and American Eagle Energy Corporation assumes no obligation to, and expressly disclaims any obligation to, update or revise any forward-looking statement, except as required by law . You should not place undue reliance on these forward-looking statements .

A MERICAN E AGLE E NERGY C ORPORATION Proven expertise • Experienced Williston Basin operating & technical team • Management was on the Halliburton team that originally developed the Elm Coulee Field • Grassroots presence in the Basin combining the right partners with the right assets Proven results • Drilled & completed 20 wells (Bakken/Three Forks) as operator in Spyglass Project area • 2 Q 2013 average production of 1 , 288 BOEPD ( 100 % oil) • June 2013 Proved Reserves of 6 . 5 MMBOE ( 93 % oil) and PV - 10 of $ 170 . 4 million Positioned for significant growth • Significantly increasing acreage, WI, production and reserves via the drill bit and acquisitions • Low risk development plan to delineate and unlock further reserves/production • Other nearby operators proving out the Company’s reserve value and potential • Operating “under the radar” with an attractive valuation and other pending catalysts : • National exchange listing • Increasing stockholder liquidity • Institutional awareness 3

American Eagle Energy Corporation is an exploration & production operator focused on the Williston Basin (Bakken and Three Forks Formations), based in Denver, Colorado . 4 C OMPANY O VERVIEW • Listing: OTCQX : AMZG • Common Shares Outstanding 1 : 55.1 MM • Market Capitalization @ $2.04/share 2 : $112.3 MM • Options 1 : 5.5 MM • Diluted Shares Outstanding 1 : 60.6 MM • Working Capital 3 : $12.1 MM • Debt 3 : $68.0 MM • Enterprise Value 3 : $168.2 MM • Management and Insider Ownership: 22% • Securities Counsel: Baker Hostetler • Auditor: Hein & Associates • Independent Reserve Engineer: MHA Petroleum Consultants 1 As of August 22 nd , 2013 2 Market data as of the close on August 22 nd , 2013 3 As of June 30 th , 2013 , pro forma for August 2013 issuance of 5 million shares at $ 2 . 00 and $ 68 million Morgan Stanley credit facility drawdown

Brad Colby – President / CEO • 30 years of successful exploration and geological experience • Technical background in engineering and geology • Experienced in asset acquisition, development, and drilling joint ventures • Strong business background combined with technical background results in skilled leadership Tom Lantz – COO • 35 year history in Williston Basin • At Halliburton, led the development of the new technology that combined horizontal drilling with hydraulic fracture stimulation, enabling the economic drilling of the Bakken • Facilitated the shift in the oil industry’s focus to resource plays • Worldwide experience in resource play engineering • Extensive operations, management, and technical experience Richard (Dick) Findley – Chairman • 35 year history working with Williston Basin geology • Credited with the Elm Coulee discovery in the Williston Basin, one of the largest onshore oil fields in the U . S . • Awarded AAPG Explorer of the Year in 2006 and Texas A&M University Michael Halbouty Medal M ANAGEMENT 5

W ILLISTON B ASIN – O PERATING A REA 6

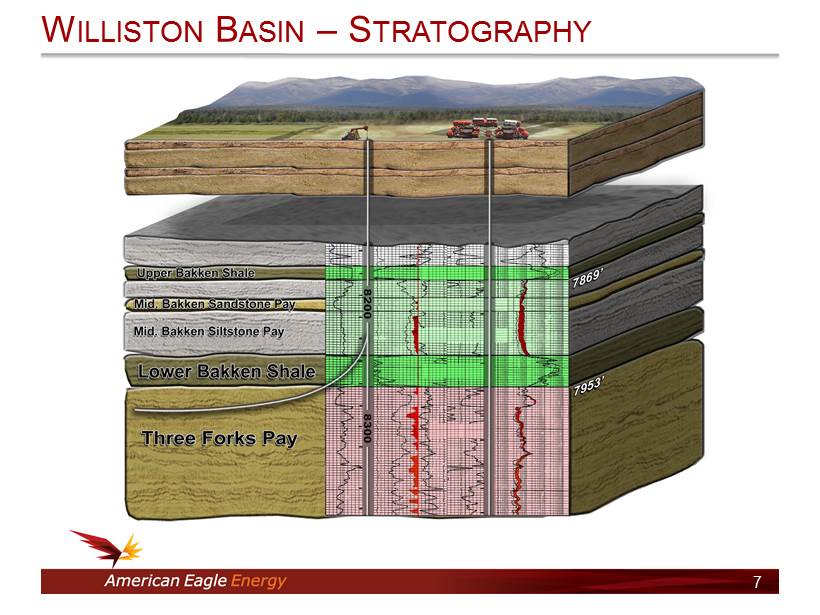

7 W ILLISTON B ASIN – S TRATOGRAPHY

Spyglass continues to be de - risked by American Eagle and other operators. S PYGLASS – P RODUCING W ELLS 8 Bakken Well Three Forks Well

W ILLISTON B ASIN – A CREAGE 9 Acq. #1 Acq. #2 DSU 1 Gross Net AMZG Net Net AMZG Net Net AMZG Prospect Area DSUs Acres Acres Acres WI Acres Acres WI Acres Acres WI Spyglass - Proved 7 1,280 8,960 3,560 40% 1,085 4,645 52% 1,085 5,730 64% Spyglass - Proved 7 800 5,600 2,325 42% 580 2,905 52% 580 3,485 62% Spyglass - Proved 14 14,560 5,885 40% 1,665 7,550 52% 1,665 9,215 63% Spyglass - Unproved 18 1,280 23,040 3,525 15% 3,075 6,600 29% 3,075 9,675 42% Spyglass - Unproved 7 800 5,600 1,600 29% 775 2,375 42% 775 3,150 56% Spyglass - Unproved 25 28,640 5,125 18% 3,850 8,975 31% 3,850 12,825 45% Total Spyglass - Operated 39 43,200 11,010 25% 5,515 16,525 38% 5,515 22,040 51% Non-Operated 4,850 3,750 8,600 3,750 12,350 Total Spyglass 15,860 9,265 25,125 9,265 34,390 Other Non-Core 2 12,000 12,000 12,000 Total Net Acres 27,860 37,125 46,390 1 DSUs near Canadian border include partial sections that average 800 acre drill spacing units 2 Mostly Sheridan & Daniels Counties, MT and Saskatchewan, Canada Pro-Forma #1 Pro-Forma #1 & #2 Acquisition #2Current Acquisition #1

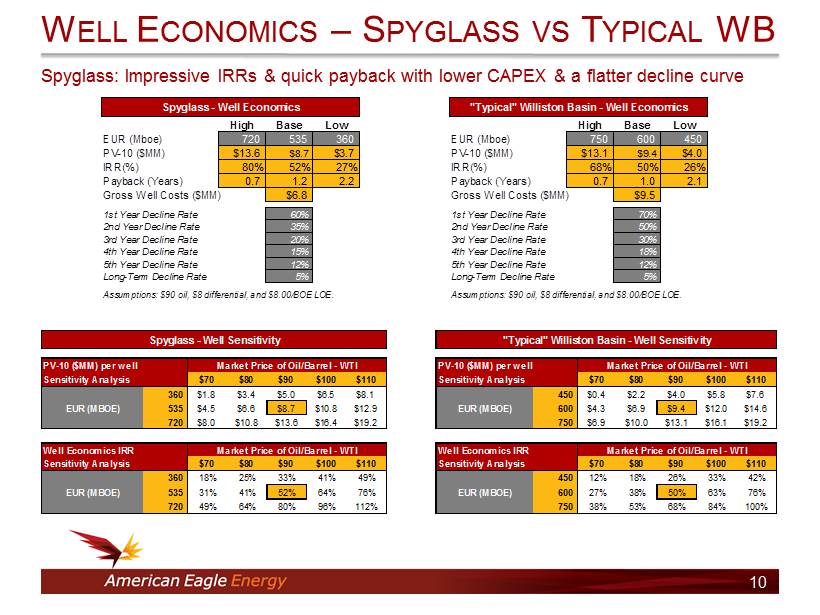

Spyglass: Impressive IRRs & quick payback with lower CAPEX & a flatter decline curve W ELL E CONOMICS – S PYGLASS VS T YPICAL WB 10 PV-10 ($MM) per well Market Price of Oil/Barrel - WTI PV-10 ($MM) per well Market Price of Oil/Barrel - WTI Sensitivity Analysis $70 $80 $90 $100 $110 Sensitivity Analysis $70 $80 $90 $100 $110 360 $1.8 $3.4 $5.0 $6.5 $8.1 450 $0.4 $2.2 $4.0 $5.8 $7.6 EUR (MBOE) 535 $4.5 $6.6 $8.7 $10.8 $12.9 EUR (MBOE) 600 $4.3 $6.9 $9.4 $12.0 $14.6 720 $8.0 $10.8 $13.6 $16.4 $19.2 750 $6.9 $10.0 $13.1 $16.1 $19.2 Well Economics IRR Market Price of Oil/Barrel - WTI Well Economics IRR Market Price of Oil/Barrel - WTI Sensitivity Analysis 0% $70 $80 $90 $100 $110 Sensitivity Analysis 0% $70 $80 $90 $100 $110 360 18% 25% 33% 41% 49% 450 12% 18% 26% 33% 42% EUR (MBOE) 535 31% 41% 52% 64% 76% EUR (MBOE) 600 27% 38% 50% 63% 76% 720 49% 64% 80% 96% 112% 750 38% 53% 68% 84% 100% Spyglass - Well Sensitivity "Typical" Williston Basin - Well Sensitivity High Base Low EUR (Mboe) 720 535 360 PV-10 ($MM) $13.6 $8.7 $3.7 IRR(%) 80% 52% 27% Payback (Years) 0.7 1.2 2.2 Gross Well Costs ($MM) $6.8 1st Year Decline Rate 60% 2nd Year Decline Rate 35% 3rd Year Decline Rate 20% 4th Year Decline Rate 15% 5th Year Decline Rate 12% Long-Term Decline Rate 5% Assumptions: $90 oil, $8 differential, and $8.00/BOE LOE. Spyglass - Well Economics High Base Low EUR (Mboe) 750 600 450 PV-10 ($MM) $13.1 $9.4 $4.0 IRR(%) 68% 50% 26% Payback (Years) 0.7 1.0 2.1 Gross Well Costs ($MM) $9.5 1st Year Decline Rate 70% 2nd Year Decline Rate 50% 3rd Year Decline Rate 30% 4th Year Decline Rate 18% 5th Year Decline Rate 12% Long-Term Decline Rate 5% Assumptions: $90 oil, $8 differential, and $8.00/BOE LOE. "Typical" Williston Basin - Well Economics

P RODUCTION & R ESERVES 11 - 500 1,000 1,500 2,000 2,500 Q1: 12 Q2: 12 Q3:12 Q4:12 Q1: 13 Q2: 13 147 251 364 706 972 1,288 600 600 BOEPD Production Growth Represents recently announced Acquisition #1 of 600 BOEPD Represents recently announced Acquisition #2 of 600 BOEPD $173.4MM $98.0MM Proved Reserves PV - 10, Including Acquisitions #1 and #2 PD PUD • AMZG and Acquisitions #1 and #2 Proved Reserves estimated by MHA Petroleum Consultants 2,488 $271.4 $103.5MM $66.9MM Proved Reserves PV - 10 as of 6/1/13 PD PUD $0 $50 $100 $150 $200 $250 $300 12/31/11 12/31/12 6/1/13 $35.5 $118.5 $170.4 $50.5 $50.5 Millions PV - 10 Growth

Summary of 2013 Spyglass Drilling Activity: • 9 gross (3.9 net) operated Spyglass wells completed in first half of 2013. • 11 gross wells remaining in Spyglass JV Carry / Farm - Out. • 3 remaining gross wells to be drilled outside of JV Carry / Farm - Out. CAPEX G UIDANCE 12 American Eagle’s initial 2013 capital budget called for drilling a total of 23 gross operated Spyglass wells with 1 to 2 drilling rigs . 2011 2012 2013E Gross Operated Wells Drilled 0 14 23 Net Operated Wells Drilled 0 5.8 6.7 American Eagle Operated Well Summary $ - $5 $10 $15 $20 $25 $30 $35 $40 2011 2012 2013E $6 $19 $37 Millions Capital Expenditures

D RILLING I NVENTORY 13 Project Area DSUs DSU Size (Acres) Net Acres Potential Wells per DSU 1 Unrisked Potential Locations NRI NRI Wells Per Well EUR (Mboe) 2 Total Unrisked Potential (Mmboe) Spyglass Proved 7 1,280 3,560 8 22 80% 18 545 9.7 Spyglass Proved 7 800 2,325 8 23 80% 19 360 6.7 Spyglass Unproved 18 1,280 3,525 8 22 80% 18 545 9.6 Spyglass Unproved 7 800 1,600 8 16 80% 13 360 4.6 Total Operated 39 11,010 84 30.6 Williston Non-Operated 4,850 8 30 80% 24 545 13.2 Total Potential 15,860 114 43.8 1 Management estimates based on 4 Three Forks wells and 4 Middle Bakken wells per drilling spacing unit 2 EUR based on assumptions from 3rd party reserve report as of 6/1/2013 Current Project Area DSUs DSU Size (Acres) Net Acres Potential Wells per DSU 1 Unrisked Potential Locations NRI NRI Wells Per Well EUR (Mboe) 2 Total Unrisked Potential (Mmboe) Spyglass Proved 7 1,280 5,730 8 36 80% 29 545 15.6 Spyglass Proved 7 800 3,485 8 35 80% 28 360 10.0 Spyglass Unproved 18 1,280 9,675 8 60 80% 48 545 26.4 Spyglass Unproved 7 800 3,150 8 32 80% 25 360 9.1 Total Operated 39 22,040 163 61.1 Williston Non-Operated 12,350 8 77 80% 62 545 33.7 Total Potential 34,390 240 94.7 1 Management estimates based on 4 Three Forks wells and 4 Middle Bakken wells per drilling spacing unit 2 EUR based on assumptions from MHA 3rd party reserve report as of 6/1/2013 Pro-Forma Post Acquisition #1 and #2

C APITALIZATION 14 6/30/13 Equity + MS Debt 1 Pro-Forma (All amounts in 000's) Cash 17,052$ -$ 17,052$ Working Capital (CA - CL, excl. cash & debt) (63,513)$ 58,611$ (4,902)$ Debt: Macquarie 15,389$ (15,389)$ -$ Morgan Stanley -$ 68,000$ 68,000$ Shareholders Equity: Common Stock & Additional Paid-In Capital 31,666 10,000 41,666 Accumulated Deficit (6,716) (4,000) (10,716) Total Shareholders Equity 24,950$ 30,950$ Shares Outstanding 50,068 55,068 Share Price (as of 8/22/13) 2.04$ 2.04$ Market Capitalization 102,139$ 112,339$ Plus:Debt 15,389 68,000 Less:Cash (17,052) (17,052) Working Capital 63,513 4,902 Enterprise Value 163,989$ 168,189$ 1 Accounts for 5.0MM shares sold at $2.00/sh and $68.0MM initial drawdown from Morgan Stanley credit facility American Eagle Energy - Capitalization Summary

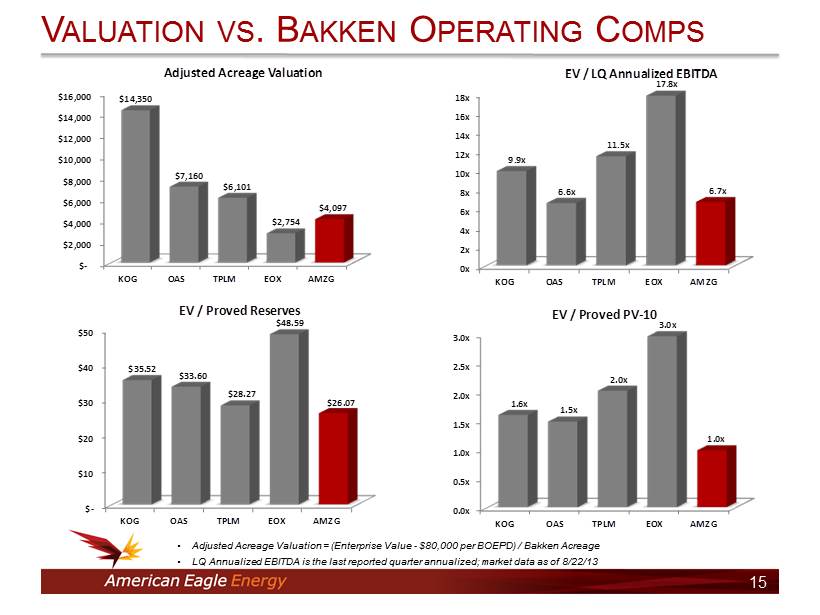

V ALUATION VS . B AKKEN O PERATING C OMPS 15 $ - $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 KOG OAS TPLM EOX AMZG $14,350 $7,160 $6,101 $2,754 $4,097 Adjusted Acreage Valuation $ - $10 $20 $30 $40 $50 KOG OAS TPLM EOX AMZG $35.52 $33.60 $28.27 $48.59 $26.07 EV / Proved Reserves 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x KOG OAS TPLM EOX AMZG 1.6x 1.5x 2.0x 3.0x 1.0x EV / Proved PV - 10 • Adjusted Acreage Valuation = (Enterprise Value - $80,000 per BOEPD) / Bakken Acreage • LQ Annualized EBITDA is the last reported quarter annualized; market data as of 8/22/13 0x 2x 4x 6x 8x 10x 12x 14x 16x 18x KOG OAS TPLM EOX AMZG 9.9x 6.6x 11.5x 17.8x 6.7x EV / LQ Annualized EBITDA

V ALUATION – S UPPORTING D ETAIL • Market data as of the close on August 22 nd , 2013 • KOG’s debt and cash have been adjusted for their July $ 400 million offering, as well as their July $ 660 million acquisition . The acquisition’s 5 , 600 BOEPD current production has been added to KOG’s last quarter and 2013 E production . • TPLM’s August offering and pending acquisition have been included ; PV - 10 has been estimated for the acquisition based on TPLM’s current PV - 10 /reserve ratio . 16 (Millions, except per share values) Metric KOG OAS TPLM EOX Peer Average AMZG Current Stock Price 9.85$ 39.24$ 6.55$ 6.71$ 2.04$ Shares Outstanding 265.6 93.5 82.8 42.5 55.1 Market Capitalization 2,615.8$ 3,670.4$ 542.1$ 284.9$ 112.3$ Debt + Pref 2,822.3$ 1,200.0$ 201.7$ 26.1$ 68.0$ Working Capital 321.4$ 55.3$ 97.4$ 50.9$ 12.1$ Enterprise Value 5,116.7$ 4,815.1$ 646.4$ 260.2$ 2,709.6$ 168.2$ Production (Last Quarter BOEPD) 28,800 30,171 5,150 1,393 1,288 Production Value @ $80,000 / Barrel 2,304.0$ 2,413.7$ 412.0$ 111.4$ 103.0$ Net Williston Basin Acreage 196,000 335,383 94,564 54,000 169,987 15,900 Other Acreage Adjustment (50,000) Value / Acre of Other Acreage 750$ Adjusted Williston Net Acreage 196,000 335,383 44,564 54,000 157,487 15,900 Value of Acreage (Net of Last Quarter BOEPD) 2,812.7$ 2,401.4$ 271.9$ 148.7$ 65.1$ LQ Annualized EBITDA 1 516.5$ 734.1$ 56.4$ 14.6$ 25.2$ 1 Annualized based on most recent reported quarter as of 8/22/13 Valuation Metric Peer Group Valuation Multiples Peer Average AMZG Premium / Discount to Peers Enterprise Value / Acre (Adj.) 14,350$ 7,160$ 6,101$ 2,754$ 7,591$ 4,097$ (46%) Enterprise Value / Last Quarter BOEPD 177,663$ 159,594$ 125,510$ 186,770$ 162,384$ 130,582$ (20%) EV / LQ Annualized EBITDA 1 9.9x 6.6x 11.5x 17.8x 11.4x 6.7x (42%)

Sold 5 . 0 MM shares of common stock $ 2 . 00 /share in August 2013 • 17 % premium to prior day’s closing price . Morgan Stanley credit facility of up to $ 200 MM closed in August 2013 • $ 68 MM initial drawdown, used to pay - down existing debt, for working capital and development . • $ 40 MM contingent upon closing Acquisition # 1 and financial covenants and conditions . • Interest rate of 5 . 5 % - 10 . 5 % , based on AMZG’s Proved Developed Reserves to debt ratio Carry and Farm - Out Agreements • JV partner pays 100 % of AMZG’s well development costs for up to 5 Bakken wells in an area of proved Three Forks wells, operated by AMZG, with AMZG receiving 50 % of its NRI for each well until ( 1 ) the JV partner has recouped 112 % of the development costs ; or ( 2 ) after two years at which point AMZG pays remaining obligation for JV partner to recoup 112 % on a per - well basis . Then 100 % of AMZG’s well bore interests revert back to AMZG . • JV partner also agrees to pay 100 % of AMZG’s well development costs for up to 6 Three Forks or Bakken wells in unproved area, operated by AMZG, with the JV partner receiving 100 % of AMZG’s NRI in each well until the JV partner has recouped 112 % of the development costs on a per - well basis . Then 30 % of AMZG’s well bore interests revert back to AMZG . • The agreements allow the delineation of the Bakken and Three Forks formations across the Spyglass Project acreage on attractive terms . R ECENT F INANCING AND A GREEMENTS 17

Agreement to purchase ~ 18 , 500 net acres from JV partner for $ 94 million, adding 1 , 200 BOEPD to production and increasing WI from 40 % to 63 % in proved area • Purchasing production for $ 78 , 333 per BOEPD, very favorable compared to peer group average EV/production of $ 162 , 384 • Immediately increases drilling inventory in the Spyglass Project area • Acquisition financing provided through a reserves - based loan with initial availability of $ 108 MM • PV - 10 PD : $ 69 . 9 MM 1 • PV - 10 PUD : $ 31 . 1 MM 1 • Total Proved : $ 101 . 0 MM 1 • ~ 1 , 200 barrels of oil equivalents per day of production • ~ 18 , 500 net acres A CQUISITION #1 AND #2 1 MHA Petroleum Consultants Reserve Run as of 6/1/2013 - $90.15/barrel and $3.50/ mcf flat pricing 18

K EY I NVESTMENT H IGHLIGHTS Proven and aligned operating management team • Experienced Williston Basin operating & technical team • Management and insiders own approximately 22 % of shares outstanding • Management has a track record of organically : • Increasing production • Multiplying reserves • Aggregating acreage positions Recently announced acquisitions, JVs, and financing can add immediate value • Acquisitions locked in at accretive terms • Acquisitions add immediate production, drilling inventory, and reserve potential • Joint ventures allow for the Bakken & Three Forks delineation of the Spyglass acreage • Secured a Morgan Stanley credit facility of up to $ 200 million Near - term catalysts for growth • Accelerated development plan continues to unlock key reserve value • National exchange listing application pending • Operating “under the radar” with an attractive valuation • Increasing liquidity • Institutional awareness 19

Marty Beskow, CFA Vice President of Capital Markets & Strategy American Eagle Energy Corporation 2549 West Main Street, Suite 202 Littleton, CO 80120 303 - 798 - 5235 ir@amzgcorp.com C ONTACT I NFORMATION 20