Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - SMITHFIELD FOODS INC | d559173dex312.htm |

| EX-31.1 - EX-31.1 - SMITHFIELD FOODS INC | d559173dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 28, 2013

Commission file number: 1-15321

SMITHFIELD FOODS, INC.

(Exact name of registrant as specified in its charter)

| Virginia | 52-0845861 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 200 Commerce Street Smithfield, Virginia |

23430 | |

| (Address of principal executive offices) | (Zip Code) | |

(757) 365-3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.50 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the shares of registrant’s Common Stock held by non-affiliates as of October 28, 2012 was approximately $2.2 billion. This figure was calculated by multiplying (i) the $20.54 last sales price of registrant’s Common Stock as reported on the New York Stock Exchange on the last business day of the registrant’s most recently completed second fiscal quarter by (ii) the number of shares of registrant’s Common Stock not held by any executive officer or director of the registrant or any person known to the registrant to own more than five percent of the outstanding Common Stock of the registrant. Such calculation does not constitute an admission or determination that any such executive officer, director or holder of more than five percent of the outstanding shares of Common Stock of the registrant is in fact an affiliate of the registrant.

At August 5, 2013, 139,196,460 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

Explanatory Note

On May 28, 2013, Smithfield Foods, Inc., a Virginia corporation (“Smithfield,” “we,” “our,” “us” or the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Shuanghui International Holdings Limited, a corporation formed under the laws of the Cayman Islands (“Shuanghui”) and Sun Merger Sub, Inc., a Virginia corporation and wholly owned subsidiary of Shuanghui (“Merger Sub”), pursuant to which Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Shuanghui. At the effective time of the Merger, each share of the Company’s common stock issued and outstanding immediately prior to such effective time (other than shares held by the Company or its wholly owned subsidiaries, or by Shuanghui or Merger Sub) will be automatically converted into the right to receive $34.00 in cash, without interest and less any applicable withholding taxes (the “Merger Consideration”). In addition, upon completion of the Merger, all then-outstanding stock-based compensation awards, whether vested or unvested, will be converted into the right to receive the Merger Consideration, less the exercise price of such awards, if any. A special meeting of the Company’s shareholders (the “Special Meeting”) has been scheduled for September 24, 2013 for the purpose of voting on the approval of the Merger Agreement, the related plan of merger and the Merger. The closing of the Merger is subject to various conditions, including the condition that the Merger Agreement and the related plan of merger be approved by the affirmative vote of the holders of a majority of all of the outstanding shares of the Company’s common stock entitled to vote thereon at the Special Meeting. The closing of the Merger is also subject to the receipt of certain regulatory approvals and other customary closing conditions. Additional information about the Merger and the Merger Agreement is set forth in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May 29, 2013 and in the Company’s definitive proxy statement filed with the SEC on August 19, 2013 (the “Proxy Statement”) with respect to the Special Meeting.

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Company’s Annual Report on Form 10-K for the fiscal year ended April 28, 2013, originally filed with the SEC on June 18, 2013 (the “Original Filing”). This Amendment is being filed to amend Part III of the Original Filing to include the information required by and not included in Part III of the Original Filing because the Company no longer intends to file a definitive proxy statement for an annual meeting of shareholders within 120 days of the end of its fiscal year ended April 28, 2013. Part IV of the Original Filing is being amended solely to add as exhibits certain new certifications in accordance with Rule 13a-14(a) promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and the Company has not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing other than as expressly indicated in this Amendment. Accordingly, this Amendment should be read in conjunction with the Original Filing and the Company’s other filings made with the SEC on or subsequent to June 18, 2013.

2

Table of Contents

TABLE OF CONTENTS

| PAGE | ||||||

| PART III | ||||||

| ITEM 10. |

4 | |||||

| ITEM 11. |

7 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

37 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

40 | ||||

| ITEM 14. |

44 | |||||

| ITEM 15. |

45 | |||||

| 50 | ||||||

3

Table of Contents

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Information required by this Item regarding our executive officers is included in Part I of this Annual Report on Form 10-K.

Directors

Term ending upon 2015 Annual Meeting

Joseph W. Luter, III

Director since 1975

Age 74

Committees served: Executive (chair)

Mr. Luter, III has served as Chairman of the Board since 1975. He previously served as Consultant to the Company from August 2006 to August 2010 and Chairman of the Board and Chief Executive Officer of the Company from 1975 to 2006. Mr. Luter, III is the father of Joseph W. Luter, IV, one of our executive officers.

Qualifications, Attributes, Skills and Experience:

Mr. Luter, III is uniquely qualified to serve as a member of the Company’s Board of Directors due to his unmatched operational and leadership experience with the Company and deep knowledge in the meat processing and hog production industry from his service as CEO of the Company for over 30 years during which time the Company transformed from a small regional company to a Fortune 250 company with significant international operations.

C. Larry Pope

Director since 2006

Age 58

Committees served: Executive

Mr. Pope has served as President and Chief Executive Officer of the Company since 2006. He previously served as President and Chief Operating Officer of the Company from 2001 to 2006 and Vice President and Chief Financial Officer from 2000 to 2001.

Qualifications, Attributes, Skills and Experience:

Mr. Pope’s over 30 year career at the Company spans a variety of senior management roles and responsibilities which bring an in-depth knowledge of the Company and broad experience in operational, finance, accounting and risk management matters. Further, as the Company’s CEO, Mr. Pope has expertise in corporate strategy, organizational leadership and international operations.

Wendell H. Murphy, Sr.

Director since 2000

Age 74

Committees served: Sustainability, Community and Public Affairs; Executive

Although now a private investor, Mr. Murphy previously was Chairman of the Board and Chief Executive Officer of Murphy Farms, Inc. of Rose Hill, North Carolina, a hog producer, prior to the Company’s purchase of such business in January 2000. Mr. Murphy also served as director of the Company from 1991 to 1998.

Qualifications, Attributes, Skills and Experience:

Mr. Murphy’s qualifications to serve as director include decades of industry and leadership experience in the hog production industry as the founder of Murphy Family Farms which, at the time the Company bought it, was one of the largest hog production businesses in the country. Mr. Murphy’s extensive knowledge of our business has been further enhanced in his service as a director for approximately 20 years. Mr. Murphy, as a former member of the North Carolina legislature, also brings public affairs and state government experience to the Board. The Board further benefits from his entrepreneurial experience and spirit.

4

Table of Contents

Hon. Paul S. Trible, Jr.

Director since 2007

Age 66

Committees served: Nominating and Governance (chair); Sustainability, Community and Public Affairs

Mr. Trible has served as President of Christopher Newport University since 1996. He served as U.S. Senator from 1983 to 1989 and as Member of U.S. House of Representatives from 1977 to 1983.

Qualifications, Attributes, Skills and Experience:

Mr. Trible has leadership experience as president of a public liberal arts university with an enrollment of 4,800 students for over fifteen years and his service as U.S. Senator and U.S. Congressman. The Board also benefits from Mr. Trible’s public policy expertise and first-hand knowledge of the workings of the state and federal government.

Term ending upon 2014 Annual Meeting

Margaret G. Lewis

Director since 2011

Age 59

Committees served: Audit

Ms. Lewis is President of HCA’s Capital Division, which includes facilities in northern, central and southwestern Virginia, New Hampshire, Indiana and Kentucky. She began her career with HCA in 1978 and held several positions in nursing management and quality management before becoming Chief Nursing Officer of HCA’s Richmond Division in 1997. Ms. Lewis became Chief Operating Officer of CJW Medical Center in 1998 and Chief Executive Officer in 2001. She is a registered nurse and a diplomat of the American College of Healthcare Executives.

Qualifications, Attributes, Skills and Experience:

Ms. Lewis brings extensive leadership experience and management skills to the Board. Her variety of senior management roles provides expertise in executive decision-making and strategic planning.

David C. Nelson

Director since 2008

Age 54

Committees served: Compensation; Sustainability, Community and Public Affairs

Mr. Nelson has served as Global Strategist, Animal Protein, Grains and Oilseeds for the Food & Agribusiness Research Advisory group at Rabobank International since July 2010. Previously, he was a Portfolio Manager of Altima One World Agriculture Fund, an affiliate of Altima Partners, which is a European hedge fund manager, from 2008 until July 2010. Additionally, Mr. Nelson served as an analyst and Managing Director of Credit Suisse from 1997 to 2007 and as Assistant Director of Research and Managing Director of NatWest Markets from 1990 to 1997. Mr. Nelson has also served on a number of advisory boards, including to the U.S. Census of Agriculture, National Soybean Processors Association, National Pork Board and U.S. Feed Grains Council.

Qualifications, Attributes, Skills and Experience:

Mr. Nelson brings valuable insight to the Board as an agribusiness analyst in the animal protein and grains industry, as well as his expertise regarding the commodities markets. In addition, the Board values Mr. Nelson’s knowledge of Wall Street and the capital markets.

Frank S. Royal, M.D.

Director since 2002

Age 73

Committees served: Audit; Nominating and Governance; Compensation (chair)

Dr. Royal has been a physician since 1969. Within the past five years, he has served as a director of SunTrust Banks, Inc., Dominion Resources, Inc., and CSX Corporation.

Qualifications, Attributes, Skills and Experience:

Dr. Royal has significant experience and knowledge of the requirements, rules, issues and concerns that a public company faces. He has extensive public company board experience with significant leadership positions on the various boards that he has served, including prior service on the boards of several Fortune 500 companies, including more than a decade of service as a director of Smithfield.

5

Table of Contents

Term ending upon 2013 Annual Meeting

Hon. Carol T. Crawford

Director since 2000

Age 70

Committees served: Compensation; Sustainability, Community and Public Affairs (chair)

Ms. Crawford is an attorney and a consultant on international trade law. She formerly served as Commissioner of the United States International Trade Commission (USITC) from 1991 until 2000 and Assistant Attorney General of the United States from 1989 until 1990. Previously she served as Associate Director of the Office of Management and Budget at the White House from 1985 through 1989 and Director of the Federal Trade Commission’s Bureau of Consumer Protection from 1982 to 1985. She serves on the Board of Trustees of Torray Fund, a publicly-held mutual fund.

Qualifications, Attributes, Skills and Experience:

Ms. Crawford has extensive experience in the public policy arena, including her work in international trade. Her role as USITC Commissioner required in-depth analysis of corporate operating and financial data, as well as an understanding of the marketplace dynamics of many different industries. Her experience and expertise in legal, regulatory, consumer and international trade issues are of benefit to the Company, as it operates in several countries and under numerous governmental and regulatory regimes here in the U.S and abroad.

Richard T. Crowder

Director since 2011

Age 73

Committees served: Nominating and Governance

Dr. Crowder has served as an adjunct professor of International Trade at the College of Agriculture and Life Sciences at Virginia Polytechnic Institute and State University since 2008. From January 2006 until April 2007, he served as chief agriculture negotiator at the Office of the U.S. Trade Representative, responsible for directing all U.S. agricultural trade negotiations worldwide, including multilateral negotiations in the World Trade Organization, as well as regional and bilateral negotiations. Dr. Crowder also served as a senior advisor to the U.S. Trade Representative from May 2007 until April 2008. Dr. Crowder is a director of Neogen Corporation, a publicly traded company in the food and animal safety products business. He currently serves on the Board of Trustees of Farm Foundation, a public charity engaged in issues shaping agriculture, food systems and rural regions.

Qualifications, Attributes, Skills and Experience:

Dr. Crowder has extensive knowledge of international trade, and in particular agricultural trade, which brings valuable insight to the Board on matters relevant to the Company and its industry. Dr. Crowder also has public company board experience and currently serves on the Audit Committee and Stock Option Committee of Neogen Corporation.

John T. Schwieters

Director since 2001

Age 73

Committees served: Audit (chair); Nominating and Governance

Mr. Schwieters is Senior Executive and member of the Executive Committee of Perseus L.L.C., a merchant bank and private equity fund management company, since 2012, after serving as Senior Advisor from 2009 to 2012 and Vice Chairman from 2000 to 2009. From 1989 to 2000, Mr. Schwieters served as Managing Partner, Mid-Atlantic Region, Arthur Andersen LLP. He is a director of Danaher Corporation and Choice Hotels International, Inc. and within the past five years has also served as a director of Union Street Acquisition Corp. and Manor Care, Inc.

Qualifications, Attributes, Skills and Experience:

Mr. Schwieters has extensive knowledge and experience in the areas of public accounting, tax accounting and finance, as he led the Mid-Atlantic region of one of the world’s largest accounting firms after previously leading that firm’s tax practice in the Mid-Atlantic region. He also has extensive public company board experience having chaired the Audit Committees of several public companies, including current service as chair of the Audit Committees of Danaher Corporation and Choice Hotels International, Inc.

6

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10% of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and to provide us copies of these reports. Based solely on a review of the copies of these reports furnished to us and written representations that no other reports were required to be filed, we believe that all filing requirements applicable to our officers, directors and beneficial owners of greater than 10% of our common stock have been complied with during the fiscal year ended April 28, 2013, except that Mr. Luter, IV was late in reporting one transaction and Mr. Thamodaran was late in reporting one holding.

Code of Business Conduct and Ethics

We maintain a Code of Business Conduct and Ethics (the “Code”) applicable to all of our employees, officers and directors. The purpose of the Code is to convey our policies and practices for conducting business in accordance with applicable law and the highest ethical standards. Any waiver of the Code for executive officers or directors will be made only by the Board of Directors or its Audit Committee and will be promptly disclosed. In support of the Code, we have provided employees with a number of avenues for the reporting of ethics violations or similar concerns, including an anonymous telephone hotline. A compliance committee chaired by our Chief Legal Officer administers the Code and requires all directors and executive officers to complete an annual certification relating to ethics and compliance with the law, the Code and other Company policies. The chair of the compliance committee reports periodically to the Audit Committee on the administration of the Code and is required to report promptly any violation of the Code by an executive officer or director to the Chair of the Audit Committee. The Code was adopted by the Board of Directors and is reviewed periodically by the Nominating and Governance Committee. The Code is available for review on our website at http://investors.smithfieldfoods.com/documents.cfm, and we will post any amendments to, or waivers from, the Code on that website.

Audit Committee; Audit Committee Financial Expert

The Company has a separately-designated standing audit committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The members of the Audit Committee are Mr. Schwieters (Chair), Ms. Lewis and Dr. Royal. The Board of Directors has determined that Mr. Schwieters, Chair of the Audit Committee, is an “audit committee financial expert” as defined by Item 407(d)(5) of Regulation S-K. Further, the Board of Directors has determined that Mr. Schwieters qualifies as an independent director in accordance with the listing standards of the New York Stock Exchange (the “NYSE”).

| ITEM 11. | EXECUTIVE COMPENSATION |

The information set forth in this Item 11 includes only limited information about the impact of the consummation of the Merger on executive and director compensation. Additional information about the impact of the consummation of the Merger on such compensation can be found in the Proxy Statement.

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis (“CD&A”) provides you with detailed information regarding the material elements of compensation paid to our executive officers as well as the considerations and objectives underlying our compensation policies and practices. This information provides context for the compensation disclosures in the tables and related discussions that follow. The Compensation Committee of the Board, which oversees our executive compensation program, is referred to as the “Committee” in this CD&A. When we refer to the “named executives” we are referring to our Chief Executive Officer (CEO), our Chief Financial Officer (CFO) and our three other most highly compensated officers.

7

Table of Contents

This CD&A discusses the compensation decisions for the named executives shown in the “Summary Compensation Table” below. They are:

| Name |

Title | |

| C. Larry Pope | President and Chief Executive Officer | |

| Robert W. Manly, IV | Executive Vice President and Chief Financial Officer | |

| George H. Richter | President and Chief Operating Officer, Pork Group | |

| Joseph B. Sebring | President of John Morrell | |

| Joseph W. Luter, IV | Executive Vice President, Sales and Marketing, Pork Group |

Executive Summary

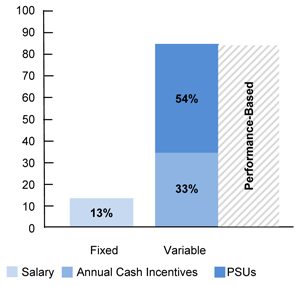

Our executive compensation philosophy is to motivate our executive officers continually to improve operating performance and, ultimately, increase our Company’s share price. Therefore, our annual and equity-based long-term incentives are opportunities for compensation – they pay out when performance is strong and do not pay out when performance is disappointing. Consequently, a substantial majority of each named executive’s total potential compensation - and in the case of our CEO, 87% - is variable and is earned only if performance objectives are achieved.

The nearby chart illustrates how performance-based compensation constitutes a substantial part of the pay mix for our CEO:

2013 CEO TOTAL DIRECT COMPENSATION(1)

| (1) | “Total direct compensation” excludes changes in pension value, the Company match under our 401(k) plan and perquisites, each of which is included in the “Summary Compensation Table” below. |

Fiscal 2013 Business Highlights

In 2013, we delivered strong operating results in our Pork and International segments but our consolidated results were adversely affected by difficult conditions in the hog production industry. Fiscal 2013 highlights included:

| • | Net income of $183.8 million. |

| • | Record sales of $13.2 billion. |

| • | Pork Group operating profit second best in Company history. |

8

Table of Contents

| • | Packaged meats volumes up 4% and operating profit up 17%. |

| • | International operating profit up 153%. |

| • | Continued debt reduction, resulting in interest expense reduction of 5%. |

| • | Repurchased 19.1 million shares of stock, representing 12% of the shares outstanding. |

| • | Consolidated net income before deduction for taxes and incentive payments to key employees (a measure we refer to as consolidated pre-tax profits and often use as a performance measure for incentive awards) was $272.4 million. |

In fiscal 2013, we continued to deliver consistent growth in our packaged meats business with increased volume and market share and broader distribution of our core brands. Furthermore, notwithstanding recessionary pressures and higher raw material costs, which adversely impacted results of Campofrío Food Group, a company listed on the Madrid and Barcelona Stock Exchanges (“CFG”) (in which we have a 37% interest), operating profits in our International segment more than doubled compared to fiscal 2012. However, we incurred significant losses in the hog production segment as live hog market prices decreased 6% while raising costs increased 6% year over year. Through our risk management strategy, we were able to mitigate our losses in hog production to produce results that were better than the industry average.

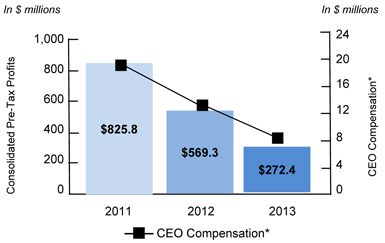

Relationship between Company Performance and CEO Compensation

The nearby chart illustrates the relationship between Company performance, measured by consolidated pre-tax profits, and the direct compensation of our CEO from 2011 to 2013. Pre-tax profits historically have been the key metric used in establishing performance goals for our CEO and other executives whose responsibilities are not limited to particular business segments. Accordingly, the CEO’s total direct compensation moves up and down in proportion to the Company’s profitability. In fiscal 2013, this linkage resulted in a significant decline in our CEO’s cash incentive compensation compared to the previous two years ($2.7 million in fiscal 2013 versus $5.7 million in fiscal 2012 and $13.0 million in fiscal 2011, calculated prior to Mr. Pope’s election to defer a portion of his annual cash incentive award). Fiscal 2011 and fiscal 2012 were the two most profitable years in the Company’s history. In contrast, in fiscal 2013, while the Company experienced strong results in its Pork and International segments, consolidated results declined as a result of significant losses in the Hog Production segment.

COMPANY PERFORMANCE AND CEO COMPENSATION

MOVE TOGETHER

| * | Mr. Pope’s total compensation as reported in the 2013 Summary Compensation Table below, excluding change in pension value. |

Recent Compensation Design Changes

The Company regularly assesses the compensation program to ensure that it properly aligns the interests of our shareholders and senior management. While the Company has reported record earnings in two of the last three years

9

Table of Contents

and achieved important strategic objectives for debt and cost reduction, our stock price failed to reflect the impact of these achievements prior to the announcement of the Merger. Therefore, we implemented a number of key changes in the compensation program over the last two years in order to more closely align executive compensation to shareholder interests. The following are changes that were made to our CEO’s compensation for fiscal 2013 and 2012:

| Under the New Design |

Under the Old Design |

Effect of Change on Compensation | ||

| Fiscal 2013 |

||||

| Redesigned the performance conditions for the performance stock unit awards (PSUs) to (1) utilize total shareholder return (TSR) in the performance measure, (2) measure TSR over a three-year period and (3) compare our TSR to the average TSR of a peer group of 18 companies | PSUs awarded in fiscal 2012 are earned if we achieve pre-tax profits of at least $150 million in either fiscal 2012 or 2013 | Creates a direct link between a significant portion of our CEO’s compensation and our success in increasing shareholder value relative to our peers. | ||

| No stock options awarded | Awarded stock options covering 100,000 shares in fiscal 2012 | Eliminated a category of compensation that was valued at $936,000 in fiscal 2012. | ||

| Reduced the value of PSUs awarded to $4.4 million. | Awarded PSUs in fiscal 2012 valued at $5.1 million | Reduced the value of the CEO’s PSU award by approximately $700,000, or 14%, compared to his fiscal 2012 award. | ||

| Fiscal 2012 |

||||

| Annual cash incentive award equal to 1% of consolidated pre-tax profits subject to a cap of $8 million | Annual cash incentive award equal to 1.5% of pre-tax profits between $100 million and $400 million and 2% of pre-tax profits in excess of $400 million | Reduced the amount paid by $2.2 million, or 28%, compared to what our CEO would have received under the previous formula. | ||

| Amended the formula for calculating benefits under our supplemental executive retirement plan (SERP) to cap at $5 million the amount of compensation in any year that can be used in determining final average pay | The SERP formula capped final average pay at $5 million, but imposed no cap on the amount of compensation in any year that can be used in calculating final average pay | Reduced the amount of the increase in the present value of the CEO’s pension benefits by $5.9 million, or 64%, compared to what he would have realized had the SERP formula not been amended. | ||

Executive Compensation Practices

Below we highlight certain executive compensation practices we employ to align executive compensation with shareholder interests. Also listed below are certain compensation practices we do not employ because we do not believe they would serve our shareholders’ long-term interests.

What We Do

| • | Pay for Performance. We tie pay to operating profit and stock price performance. Most of our executives’ potential compensation is not guaranteed but is tied to financial goals for corporate and business unit performance. |

| • | Total Shareholder Return Metric. Beginning in fiscal 2013, a substantial part of our CEO’s potential equity compensation is tied to our total shareholder return relative to that of a peer group of companies. |

| • | Management Stock Ownership Guidelines. In fiscal 2010, we adopted share ownership guidelines for all officers at the Vice President level and above. |

| • | Independent Compensation Consulting Firms. The Compensation Committee utilizes independent compensation consulting firms which provide no other services to the Company. |

10

Table of Contents

| • | Holding Period on Deferred Stock Awards. We have a three year holding period on shares purchased through deferrals of the executives’ cash incentive awards. |

| • | No Severance Benefits Except Following a Change in Control. Severance benefits are payable to an executive only if the executive is terminated, or resigns for good reason, during or following a change in control. |

| • | Clawback Policy. We can recover incentive compensation wrongly awarded to an executive officer where the officer’s fraud or willful misconduct led to a material restatement of financial results. |

| • | Review Tally Sheets. We review tally sheets for all of our executive officers prior to making annual executive compensation decisions. |

What We Don’t Do

| • | No Employment Contracts. We do not have employment contracts with any of our executive officers. |

| • | No Repricings. Our stock incentive plans and listing standards prohibit us from repricing options without shareholder approval. |

| • | No Income Tax Gross-ups. We do not provide income tax gross-ups for personal benefits other than relocation and other broad-based benefits. |

| • | No Excise Tax Gross-ups. We do not provide excise tax gross-ups for change in control benefits. |

Incentives Awarded Under the Pay-for-Performance Philosophy

Our executive compensation program is designed and operated to attract and retain top talent, to reward corporate financial and operational performance through annual incentives, and to align our executives’ financial interests with those of our shareholders through equity-based compensation awards. During the last three fiscal years, our pay-for-performance philosophy was evidenced through the following new (or continuing) programs:

Performance Awards Granted

| Program |

Performance Measured |

Performance and Pay Results for Year (or To Date) | ||

| Annual Cash Incentives |

||||

| 2013 Corporate Annual Cash Incentive Awards | Consolidated pre-tax profits | Incentives earned due to positive pre-tax profits on a consolidated basis | ||

| 2013 Pork Group Annual Cash Incentive Awards | Pork Group pre-tax profits | Incentives earned due to positive Pork Group pre-tax profits | ||

| 2012 Corporate Annual Cash Incentive Awards | Consolidated pre-tax profits | Incentives earned due to positive pre-tax profits on a consolidated basis | ||

| 2012 Pork Group Annual Cash Incentive Awards | Pork Group pre-tax profits | Incentives earned due to positive Pork Group pre-tax profits | ||

| 2011 Corporate Annual Cash Incentive Awards | Consolidated pre-tax profits | Incentives earned due to record pre-tax profits on a consolidated basis | ||

| 2011 Pork Group Annual Cash Incentive Awards | Pork Group pre-tax profits | Incentives earned due to record pre-tax profits by the Pork Group | ||

| Stock Option Awards | ||||

| 2012 Stock Options (granted June 2011) | Increase in stock price — no value created unless stock price increases from date of grant | Granted with exercise price of $21.94, vesting ratably over three years. Had an intrinsic value of $3.99 per share at fiscal year-end with Smithfield stock trading at $25.93 | ||

11

Table of Contents

| Program |

Performance Measured |

Performance and Pay Results for Year (or To Date) | ||

| 2011 Stock Options (granted June 2010) | Increase in stock price — no value created unless stock price increases from date of grant | Granted with exercise price of $15.43, vesting ratably over three years. Had an intrinsic value of $10.50 per share at fiscal year-end with Smithfield stock trading at $25.93 | ||

| Performance Share Unit Awards | ||||

| 2013 Performance Share Units – Corporate (granted June 2012) | Total shareholder return over three year period compared to a peer group | Measurement period still open | ||

| 2013 Performance Share Units – Pork Group (granted June 2012) | No shares earned unless (1) Pork Group achieves specified levels of unit volume growth in fiscal 2013 and (2) consolidated pre-tax profits are at least $150 million in fiscal 2013 | Shares earned at target level based on 4% volume growth and consolidated pre-tax profits of over $150 million | ||

| 2012 Performance Share Units – Corporate (granted June and July 2011) | Consolidated profit before tax (CPBT) – no shares earned unless CPBT reaches $100 million in fiscal 2012 or 2013 | Performance condition met in fiscal 2012. Shares vest ratably over two years from date of grant | ||

| 2012 Performance Share Units – Pork Group (granted June 2011) | No shares earned unless Pork Group achieves specified levels of unit volume growth in fiscal 2012 | No shares earned as volume growth condition was not met. Awards have therefore expired without any payout | ||

| 2011 Performance Share Units – Corporate (granted June 2010) | Consolidated profit before tax – no shares earned unless CPBT reaches $100 million in fiscal 2011 or 2012 | Performance condition met in fiscal 2011. Shares vested ratably over two years from date of grant | ||

| 2011 Performance Share Units – Pork Group (granted June 2010) | No shares earned unless (1) Pork Group achieves specified levels of unit volume growth in fiscal 2011 and (2) consolidated profit before tax reaches $100 million in fiscal 2011 | No shares earned as volume growth condition was not met, notwithstanding record Pork Group pre-tax profit. Awards have therefore expired without any payout | ||

2012 Say on Pay Vote Results

At the 2012 Annual Meeting of Shareholders, we held our second advisory vote on executive compensation. We again received substantial support for the compensation of our named executives, with approximately 83% of the votes cast on the “say on pay” proposal approving such compensation (up slightly from 82% the year before).

Following our first say on pay vote at the 2011 Annual Meeting, we reviewed the proxy advisory reports issued by Institutional Shareholder Services, Inc. and Glass Lewis & Co. and held one-on-one discussions with one large institutional shareholder regarding our executive compensation policies and practices. Feedback from these sources was then evaluated by the Compensation Committee along with the results of the 2011 say on pay advisory vote. This evaluation resulted in several important changes to executive compensation, including a decision to make annual cash incentive awards subject to caps and a decision to more directly link the value of our PSU awards to

12

Table of Contents

shareholder value by changing the performance metric for such awards from consolidated pre-tax profits to TSR over a three year period as measured against a peer group of companies. These and other changes made to our executive compensation program during fiscal 2012 and fiscal 2013 were designed to reduce the executive’s cash compensation potential in favor of longer-term equity compensation potential, supplement our operating performance metrics with one focused on relative stock price performance and increase the period over which the equity performance goals are measured to three years.

The above changes, including those made for the fiscal 2013 compensation program, were previously disclosed in our proxy statement for the 2012 Annual Meeting of Shareholders. The Compensation Committee reviewed the results of the 2012 say on pay advisory vote but did not make any further changes to the fiscal 2013 compensation program as a result.

Compensation Philosophy and Objectives

The primary goal of our executive compensation program is the same as our goal for operating the Company — to maximize short-term and long-term corporate performance and thereby create value for our shareholders. To achieve this goal we have designed an executive compensation program based on the following principles:

| • | Paying for performance — A significant portion of our executives’ compensation should be subject to corporate, segment and/or business unit performance measures. Performance-based compensation can vary widely from year to year depending on our performance, which is impacted by, among other things, the volatile nature of our agricultural commodity-based industry and governmental food and energy policy. In recent years, average payouts of performance-based compensation (excluding equity awards) ranged from 0% to 90% of our executives’ total cash compensation. In fiscal 2013, performance-based cash compensation constituted on average 69% of our named executives’ total cash compensation compared to 76% the year before. Factoring in equity incentives as well, 82% of our named executives’ total direct compensation in fiscal 2013 was subject to the satisfaction of performance conditions. |

| • | Alignment with the interests of our shareholders — Equity-based awards can be an effective means of aligning an executive’s financial interests with those of our shareholders by providing value to the executive if the market price of our stock increases. In addition, many of our cash and equity incentive awards are tied to key financial performance measures that are expected to correlate with the creation of shareholder value. |

| • | Attracting and retaining top talent — The compensation of our executives must be competitive with the organizations with which we compete for talent so that we may attract and retain talented and experienced executives. Our executives have, on average, approximately 22 years of experience with Smithfield and its predecessors. |

Each element of our compensation program is designed to further one or more of these principles. The structure of a particular executive’s compensation may vary depending on the scope and level of that executive’s responsibilities. For an executive with corporate-level responsibilities, performance-based cash compensation is generally based on Smithfield’s consolidated results of operation. For an executive responsible for the Pork Group or an individual business unit within that group, performance-based cash compensation is generally based on the operating results of the Pork Group thus encouraging coordination of efforts among the individual business units in order to maximize the financial performance of the entire Pork Group. Occasionally an executive responsible for an individual business unit may receive performance-based cash compensation based on the operating results or other performance measure of that unit, particularly if that unit operates more or less independently of other units.

Determining Executive Compensation

The Committee is responsible for developing and administering the compensation program for executive officers and other key employees. The Committee may delegate some or all of its responsibilities to one or more subcommittees whenever necessary to comply with any statutory or regulatory requirements or otherwise deemed appropriate by the Committee. The Committee has the authority to retain consultants and other advisors to assist the Committee with its duties and has sole authority to approve the fees and other retention terms of such consultants and advisors.

The CEO makes recommendations to the Committee regarding the salaries, cash incentive award arrangements, option grants and other forms of equity incentive awards, if any, for key employees, including all executive officers.

13

Table of Contents

For executive officers whose cash incentive awards are based partly on individual performance, the CEO’s evaluation of such performance is provided to and reviewed by the Committee. To assist the Committee in carrying out its responsibilities, the Committee utilizes independent compensation consultants. The Committee also annually reviews executive pay tallies for our executive officers detailing the amount of each element of total compensation and accumulated equity holdings. Based on the foregoing, the Committee uses its judgment in making compensation decisions that will best carry out our philosophy and objectives for executive compensation.

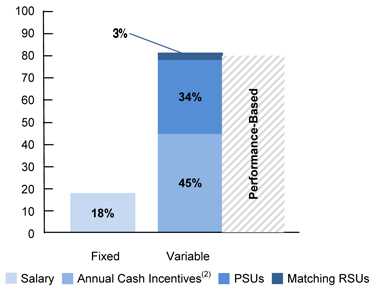

Elements of Compensation

We have three elements of total direct compensation: salary, annual cash incentives and long-term equity-based incentives (options, PSUs and matching RSUs). As shown in the accompanying chart, 82% of total direct compensation to the named executives in 2013 was performance-based.

2013 NAMED EXECUTIVE OFFICERS

TOTAL DIRECT COMPENSATION

| (1) | “Total direct compensation” excludes changes in pension value, the Company match under our 401(k) plan and perquisites, each of which is included in the Summary Compensation Table below. |

| (2) | Includes any portion of an executive’s annual cash incentive award that he elected to defer under the management stock purchase program and received RSUs in exchange. |

Base Salary

Base salaries are intended to provide a level of compensation sufficient to attract and retain an effective management team when considered in combination with the performance-based and other components of our executive compensation program. The relative levels of base salary for executive officers are designed to reflect each executive officer’s scope of responsibility and accountability within the company. Base salaries are reviewed annually to determine if they are equitably aligned within the Company and are at sufficient levels to attract and retain top talent. Consistent with our greater emphasis on performance-based pay, base salaries for executives are normally changed infrequently.

The Committee’s application of this policy over the last three years is summarized below:

| • | For fiscal 2010 and 2011, none of our named executives received an increase in salary. |

| • | In determining salaries for fiscal 2010 and 2011, the Committee also considered the Company’s net losses in fiscal 2010 and 2009 and the difficult economic conditions at those times. |

14

Table of Contents

| • | For fiscal 2012, the Committee approved increases of 14% and 3% in Mr. Manly’s and Mr. Sebring’s salaries, respectively, in recognition of increased managerial responsibilities. None of the other named executives received an increase in salary for fiscal 2012. |

| • | For fiscal 2013, the Committee approved increases of 7% and 2% in Mr. Manly’s and Mr. Sebring’s salaries, respectively, in recognition of increased managerial responsibilities. None of the other named executives received an increase in salary for fiscal 2013. |

Cash Incentive Awards

We provide performance-based annual cash incentive opportunities to our executives under our shareholder-approved incentive plans. The awards use performance criteria that seek to ensure a direct link between the executives’ performance and the amount of incentive compensation earned as well as encourage coordination of efforts among business units within the same operating segment. Awards have generally used a formula based on pre-tax, pre-incentive payment profits, either company-wide or for a particular operating segment depending on the executive’s scope of responsibility. Occasionally an executive responsible for an individual business unit may receive a cash incentive award based on the operating results or other performance measure of that unit, particularly if that unit operates more or less independently of other units. At the beginning of each year, the Committee receives management’s recommendations on the performance criteria and cash incentive award formulas for the year. In evaluating these recommendations, the Committee considers the performance of the Company and the respective segments and business units in recent years.

Historically, the Committee has imposed minimum performance thresholds on annual incentive awards. Given the effect of the record profitability of the Company in fiscal 2011 on the size of the cash incentive payouts and a determination on the part of the committee to rebalance the mix of cash and equity components of the executives’ compensation, the annual cash incentive awards for certain executive officers, including the CEO, were modified beginning in fiscal 2012 to reduce the award amounts at higher levels of pre-tax profit, eliminate the thresholds and cap the total potential payouts. For example, the cash incentive awards for fiscal 2012 and fiscal 2013 for Mr. Pope were equal to 1% of consolidated pre-tax profits subject to a cap of $8 million.

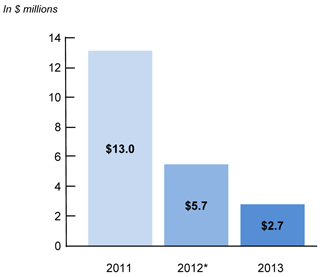

The following chart shows for the last three fiscal years the actual cash incentive awards paid to our CEO.

ANNUAL CASH INCENTIVE AWARDS - CEO

| * | The amount shown includes the portion of Mr. Pope’s annual cash incentive award that he elected to defer under the management stock purchase program. |

15

Table of Contents

Fiscal 2011 and 2012 were the best and second best years in our history in terms of pre-tax profits on a consolidated basis and for the Pork Group, which were the primary metrics used in the performance goals for the named executives’ annual incentive awards. This is reflected in the relative sizes of the annual incentive awards for those years compared to fiscal 2013 in which losses in the hog production segment significantly reduced the Company’s consolidated pre-tax profits.

Additional Cash Awards

We have sometimes paid additional cash awards to executive officers in amounts the Committee has determined appropriate to reward elements of performance that were not reflected in the annual cash incentive awards. Mr. Sebring received a cash award of $250,000 in fiscal 2013 in recognition of his efforts in successfully negotiating a licensing and supply agreement between one of the company’s subsidiaries, John Morrell & Co., and Nathan’s Famous, Inc. Among other things, the agreement grants to the Company certain rights and obligations to manufacture, distribute, market and sell certain “Nathan’s Famous” licensed food products.

Equity Incentive Awards

General. We provide long-term incentive compensation in the form of stock options and performance share units. These equity awards can serve as an effective motivational tool by aligning the executive’s economic interests with those of our shareholders. The ultimate value, if any, of stock options is dependent on increases in the market price of our common stock which encourages longer-term, more strategic decision-making. Performance share unit awards provide similar motivation for our executives and the performance conditions under such awards assure a close correlation between Company performance and the value realized by the executives. Because all of our stock option awards and many of our performance share unit awards are granted with time-based vesting, these programs also promote long-term tenure.

Committee Considerations. Our CEO recommends to the Committee the recipients and sizes of stock option and performance share unit awards. In evaluating these recommendations and making its determinations, the Committee considers a number of factors, including:

| • | whether the executive’s responsibilities require strategic decision-making involving a substantial portion of our business, and |

| • | the Committee’s subjective evaluation of the executive’s potential contribution to our future success. |

Equity awards constitute a larger percentage of total compensation for corporate-level executives than for segment and business unit management in recognition of the corporate-level executives’ greater responsibility for overall results and indirectly the market price of our common stock.

2013 PSU Awards. For our CEO and CFO, the 2013 PSU awards were subject to performance conditions based on the Company’s stock price performance compared to an industry peer group of 18 companies over a three year period. The peer group was selected with the assistance of the Committee’s compensation consultants and consists of Campbell Soup Company, Chiquita Brands International, Inc., ConAgra Foods, Inc., Dean Foods, Inc., General Mills, Inc., H. J. Heinz Company, Hershey Foods Corp., Hormel Foods Corporation, J. M. Smucker Company, Inc., Kellogg Company, Kraft Foods, Inc., McCormick & Company, Inc., Pilgrim’s Pride Corporation, Sanderson Farms, Inc., Sara Lee Corporation (Hillshire Brands Company), Seaboard Corporation, Seneca Foods Corporation, and Tyson Foods Inc.

The performance share unit awards for executives in the Pork Group were subject to performance conditions keyed to unit volume growth of the Pork Group’s packaged meats business combined with a consolidated pre-tax profits condition. The Committee believes that the incentives created by the volume growth performance condition better align the Pork Group executives’ interests with the Company’s operational goals for this segment of our business. Because the volume growth condition was met at the target level and the consolidated pre-tax profits condition was satisfied, the performance share unit awards for the Pork Group executives paid out at the target level.

2013 RSU Awards. Pursuant to the management stock purchase program under the 2008 Plan, executives may voluntarily elect to defer up to 25% of the payouts under their annual cash incentive awards and receive restricted stock units (RSUs) in exchange. The RSUs are generally payable in shares of common stock on a date, which may not be less than three years from the date of deferral, specified by the executive. The Company provides a 100%

16

Table of Contents

match of the executive’s deferral in the form of RSUs that vest on the third anniversary of the date of deferral and are payable in shares of common stock. Of the named executives, only Messrs. Sebring and Luter, IV, elected to defer a portion of their annual cash incentive awards for fiscal 2013.

The foregoing awards are described in greater detail below.

Additional Compensation Elements

Retirement Plans. Our executive officers participate in the same retirement plans on the same terms as provided to most of our salaried employees. These plans consist of several company-funded pension plans and an employee-funded 401(k) savings plan (with employer match), all of which are tax-qualified, and a non-tax qualified supplemental pension plan. Under a tax-qualified plan, we are eligible for a tax deduction for our contributions for the year to which the contributions relate, while the benefits are taxable to the participant for the year in which they are ultimately received. Under a plan that is not tax-qualified, we are not eligible for a tax deduction until the year in which the benefits are paid to the participant.

Our retirement plans are intended to provide an appropriate level of replacement income upon retirement. All salaried employees participating in one of the qualified pension plans and earning more than $255,000 are eligible to participate in the non-tax qualified supplemental pension plan. The supplemental pension plan allows us to provide pension benefits comparable to those that would be available under the Smithfield Foods Salaried Pension Plan (one of the tax-qualified plans) if the federal income tax laws did not include limits on covered compensation and benefits. Therefore, the supplemental pension plan allows all participating salaried employees to receive a pension benefit that is approximately the same percentage of their earnings, except that the amount of compensation in any year that can be used in calculating benefits is capped at $5 million. The supplemental benefit plan uses the same benefit formulas as the Smithfield Foods Salaried Pension Plan and uses the same types of compensation to determine benefit amounts. We do not utilize a more favorable pension benefit formula for management than for other salaried employees. For more information about our pension plans, please refer to the Pension Benefits table and related discussion below.

Participation in the 401(k) savings plan is voluntary. Therefore the amount of compensation deferred and the amount of our match varies among employees, including the executives. However, the same formulas are used to determine benefits for all participants in this plan. Furthermore, the plan does not involve any above-market returns, as returns depend on actual investment results.

Perquisites and Other Benefits. We provide a limited number of perquisites, without tax gross-ups, to our executive officers. The Summary Compensation Table below contains an itemized disclosure of all perquisites to named executives, regardless of amount. We believe that these perquisites are reasonable and consistent with those paid to other executives in our industry. Providing these perquisites thus helps to keep our base compensation packages competitive. With regard to the personal use of corporate aircraft, the Committee has established an annual usage limitation of $75,000 for our CEO. Personal use of corporate aircraft by other employees, including other executive officers, is limited and must be approved by our CEO.

We also provide certain benefits to substantially all salaried employees that are not included as perquisites in the Summary Compensation Table for the named executives because they are broadly available. These include health and welfare benefits, disability and life insurance, education and tuition reimbursement and an employee assistance program.

We have established a matching contribution program through the Smithfield-Luter Foundation, a charitable foundation affiliated and funded by us, pursuant to which the foundation will match the contributions by certain of our employees, including all of the executive officers, to qualified, tax-exempt non-profit organizations up to $2,500 annually per employee. In addition, at the time our CEO was appointed to the office of chief executive officer, the Committee authorized a match for additional charitable contributions made by him of up to $100,000 per year, subject to an aggregate limit of $500,000. The Company provided matches aggregating $102,500 in fiscal 2013 for charitable contributions made by our CEO, as disclosed in the note to column (i) to the Summary Compensation Table below. We believe these charitable contributions are an important corporate activity which helps promote a charitable spirit in our employees and furthers our connection with the communities in which we do business.

Change in Control Severance Plan. In fiscal 2011, the Board of Directors adopted the Smithfield Foods, Inc. Change in Control Executive Severance Plan (the “Severance Plan”). The Severance Plan provides the executives with certain cash payments and other benefits in the event their employment is terminated, or they resign for good reason, during a potential change in control or within two years following a change in control. The Board of Directors believes that the Severance Plan will help to retain qualified employees, and allow key management to focus on the Company’s business during periods of an actual or potential change in control by providing them with a level of economic security in the event of a termination of their employment. In connection with the execution and delivery of the Merger Agreement, on May 28, 2013, the Severance Plan was amended only as it would apply to the Merger and only as it would apply to our CEO and the five officers who report directly to our CEO (collectively, the “Senior Executives”). The Merger, if consummated, will constitute a change in control for purposes of the Severance Plan. A more detailed description of the Severance Plan and the benefits payable thereunder upon a change in control is provided below.

17

Table of Contents

Impact of the Merger Agreement

Pursuant to the terms of the Merger Agreement, Merger Sub will merge with and into the Company with the Company surviving the Merger as a wholly owned subsidiary of Shuanghui. At the effective time of the Merger, each share of the Company’s common stock issued and outstanding immediately prior to such effective time (other than shares held by the Company or its wholly owned subsidiaries, or by Shuanghui or Merger Sub) will be automatically converted into the right to receive the Merger Consideration. In addition, upon completion of the Merger, all then-outstanding stock-based compensation awards, whether vested or unvested, will be converted into the right to receive the Merger Consideration, less the exercise price of such awards, if any. The closing of the Merger is subject to the approval of the Merger Agreement and the related plan of merger by the Company’s shareholders at the Special Meeting, as well as the receipt of certain regulatory approvals and other customary closing conditions.

In light of the pending Merger, the Company made certain adjustments to its executive compensation program for fiscal 2014. These adjustments include (i) the making of no new stock option awards, (ii) a general reduction in the size of PSU awards, (iii) the modification of the change in control provisions of the 2014 PSU awards so that vesting of the new awards would occur at the target, rather than the maximum, amount of shares upon the closing of the Merger, and (iv) an amendment to the Severance Plan only as it would apply to the Merger and only as it would apply to our CEO and the Senior Executives, as more fully described below. In addition, in connection with the negotiation of the Merger Agreement, Shuanghui had requested that a retention program be established in connection with the Merger to aid in the retention of certain of the Company’s officers and other key employees. In response to this request, on May 28, 2013, the Company’s board of directors and the Compensation Committee approved a retention bonus program (the “Retention Bonus Program”) for certain of the Company’s officers, including the named executives, and other key employees. The Retention Bonus Program is more fully described below.

Other Compensation Policies and Practices

Timing of Awards. It is the Committee’s policy to grant stock options within a prescribed “window period” following our release of year-end financial results. This window period generally runs from the third until the 12th business day following the release. Exceptions to this policy may be made in connection with a new hire or a change in an existing officer’s title or duties or when the regular window period is closed.

Prohibition on Repricing. Our 2008 Stock Incentive Plan (“2008 Plan”) expressly prohibits any action that would (i) lower the exercise price of a stock option, whether by amendment, cancellation or otherwise, after the award is made or (ii) otherwise be treated as a repricing under generally accepted accounting principles without the prior approval of our shareholders. For purposes of NYSE listing standards, our 1998 Stock Incentive Plan (the “1998 Plan”) is deemed to prohibit such repricing practices as well. We are not allowed under the NYSE listing standards to make any change to the plans to permit these practices without shareholder approval.

Clawback Policy. In fiscal 2011, the Board of Directors adopted a new policy addressing the potential recovery of incentive compensation in the event of a material restatement of the Company’s financial results. This policy applies to all of the Company’s executive officers, plus its principal accounting officer (“Senior Executives”). Under this policy, the Company may seek to recover incentive compensation previously awarded to a Senior Executive, to the extent that the incentive compensation was based on performance during fiscal periods materially affected by a material restatement of the Company’s financial results. The Board must first determine that the Senior Executive engaged in fraud or willful misconduct that caused or otherwise contributed to the need for the restatement. This policy does not limit the legal remedies the Company may seek against any employee for fraudulent or illegal conduct. The policy was not adopted in response to any particular concerns nor has the Company ever had to restate its financial results.

Management Stock Ownership Guidelines. The Committee believes it is important for senior management to build and maintain a long-term ownership position in the Company, to further align their financial interests with those of

18

Table of Contents

our stockholders and thereby encourage the creation of long-term value. Therefore, in fiscal 2010, the Committee established stock ownership guidelines for all members of management at the level of vice president and above. Covered officers must meet these ownership guidelines by the later of January 1, 2015 or five years after the commencement of employment for a newly-hired officer. Under the guidelines, the target value of shares to be held has been established as a multiple of annual base salary, which varies by officer level, as set forth below:

| President and CEO | 4 times base salary | |

| Pork Group President and Chief Operating Officer | 3 times base salary | |

| Executive Vice Presidents, Senior Vice Presidents and Vice Presidents | 2 times base salary | |

| Independent Operating Company Presidents | 2 times base salary |

In determining compliance with the ownership guidelines, we include shares held directly by the officer, shares held by immediate family members, restricted stock where the restrictions have lapsed, shares held in benefit plans including under the management stock purchase program discussed below and other types of beneficial ownership as approved by the Committee. Compliance with the ownership guidelines is measured as of the end of each fiscal year with the value being based on the average closing price of a share of stock for the previous year. An officer, who was previously in compliance with the ownership guidelines and ceases to be in compliance because of a decline in the value of the stock, will have one additional year to regain compliance. If an officer fails to attain the specified stock ownership level, the Committee may take appropriate actions, including adjustments to the incentive compensation payments to the officer.

Management Stock Purchase Program. To assist management in meeting our stock ownership guidelines, the Committee recommended, and the Board of Directors approved, a management stock purchase program under the 2008 Plan pursuant to which officers may voluntarily elect to defer up to 25% of the payouts under their annual cash incentive awards and receive deferred shares of stock and the Company will provide a 100% match of the officer’s deferral. Stock purchased with the Company’s match is subject to three-year cliff vesting and will be forfeited if the officer voluntarily terminates employment before vesting. Stock purchased with the officers’ deferrals generally may not be removed from the plan for at least three years. Interests in the plan consist of restricted stock units that are payable solely in stock.

Deductibility of Compensation. For fiscal 2013, Section 162(m) of the tax code placed a limit of $1 million on the amount of compensation that we may deduct in one year with respect to our CEO and each of the next four most highly compensated executives. Certain performance-based compensation approved by shareholders is not subject to this deduction limit. Our incentive plans and the awards made under them have been structured with the intention that the cash incentive payments and equity awards be qualified performance-based compensation not subject to Section 162(m). We view preserving tax deductibility as an important objective, but not the sole objective, in establishing executive compensation. In specific instances, we may authorize executive compensation arrangements that are not fully tax deductible but which promote other important objectives.

Role of Compensation Consultants

The Committee has directly engaged and regularly consults with independent consultants for advice on executive compensation matters. The Committee’s primary consultant is Pay Governance, Inc. The Committee also utilizes Towers Watson & Co. from time to time. The consultants provide advice regarding the Company’s executive compensation strategy and programs, including the compensation of the CEO and other executive officers; general compensation program design; the impact of regulatory, tax and legislative changes on our compensation program; the compensation practices of competitors and executive compensation trends. From time to time the consultants are engaged to perform specific market comparisons of the Company’s executive compensation program, or aspects thereof, to those of comparable companies. Consistent with their roles as independent consultants to the Committee, the consultants provide no other services to the Company. The consultants may work directly with management on behalf of the Committee, but such work is always performed under the control and supervision of the Committee. The Committee regularly meets with the consultants in executive session without management.

19

Table of Contents

Summary Compensation Table

The following table includes information concerning compensation paid to or earned by our “Named Executive Officers” listed in the table for the fiscal years ended April 28, 2013, April 29, 2012 and May 1, 2011.

| Name and Principal Position (a) |

Year (b) |

Salary ($) (c) |

Bonus ($) (d) |

Stock Awards ($) (e) |

Option Awards ($) (f) |

Non- Equity Incentive Plan Compensation ($) (g) |

Change in Pension Value and Non- Qualified Deferred Compensation Earnings ($) (h) |

All Other Compensation ($) (i) |

Total ($) (j) |

|||||||||||||||||||||||||||

| C. Larry Pope |

2013 | 1,100,000 | — | 4,420,000 | — | 2,724,076 | 2,201,377 | 332,937 | 10,778,390 | |||||||||||||||||||||||||||

| 2012 | 1,100,000 | — | 6,128,000 | 936,000 | 4,707,032 | 3,314,395 | 332,368 | 16,517,795 | ||||||||||||||||||||||||||||

| 2011 | 1,100,000 | 250,000 | 3,514,000 | 655,000 | 13,015,880 | 1,492,642 | 200,727 | 20,228,249 | ||||||||||||||||||||||||||||

| Robert W. Manly, IV |

2013 | 750,000 | — | 2,210,000 | — | 1,362,038 | 4,323,221 | 50,997 | 8,696,256 | |||||||||||||||||||||||||||

| 2012 | 700,000 | — | 3,556,750 | 468,000 | 2,353,516 | 4,242,027 | 38,318 | 11,358,611 | ||||||||||||||||||||||||||||

| 2011 | 600,000 | 250,000 | 2,196,250 | 327,500 | 4,693,455 | 440,405 | 37,482 | 8,545,092 | ||||||||||||||||||||||||||||

| George H. Richter |

2013 | 800,000 | — | 576,900 | — | 3,225,455 | 1,387,062 | 68,367 | 6,057,784 | |||||||||||||||||||||||||||

| 2012 | 800,000 | — | 2,083,112 | 374,400 | 3,342,159 | 1,519,305 | 63,866 | 8,182,842 | ||||||||||||||||||||||||||||

| 2011 | 800,000 | 250,000 | — | 262,000 | 3,582,315 | 902,675 | 44,711 | 5,841,701 | ||||||||||||||||||||||||||||

| Joseph B. Sebring |

2013 | 735,000 | 250,000 | 1,075,864 | — | 1,219,021 | 648,418 | 80,598 | 4,008,901 | |||||||||||||||||||||||||||

| 2012 | 719,519 | — | 1,041,556 | 234,000 | 1,121,080 | 1,993,937 | 176,361 | 5,286,453 | ||||||||||||||||||||||||||||

| 2011 | 700,000 | 250,000 | — | 163,750 | 1,791,157 | 807,822 | 78,767 | 3,791,496 | ||||||||||||||||||||||||||||

| Joseph W. Luter, IV |

|

2013 2012 2011 |

|

|

700,000 700,000 700,000 |

|

|

— — |

|

|

1,084,262 2,045,242 — |

|

|

— 234,000 163,750 |

|

|

1,232,022 1,342,290 972,129 |

|

|

1,062,222 1,010,801 335,877 |

|

|

166,729 155,946 171,283 |

|

|

4,245,235 5,488,279 2,693,039 |

| |||||||||

Stock Awards (Column (e)) and Option Awards (Column (f))

Represents the aggregate grant date fair value of the awards made with respect to each fiscal year as computed in accordance with FASB ASC Topic 718. These amounts do not correspond to the actual value that may be recognized by each Named Executive Officer. Additional information regarding outstanding awards, including corresponding exercise prices and expiration dates, can be found in the “Outstanding Equity Awards at Fiscal Year-End” table below. The assumptions used in determining the grant date fair values of the stock and option awards are set forth in “Note 11: Equity” to our Consolidated Financial Statements, included in the Original Filing. For Messrs. Sebring and Luter, IV, the amount in column (e) for fiscal 2013 includes $787,414 and $795,812, respectively, as the value of restricted stock units (RSUs) issued to these executives pursuant to their election to defer a portion of their annual cash incentive awards pursuant to the management stock purchase program under the Company’s 2008 Incentive Compensation Plan (the “2008 Plan”). For Messrs. Pope, Manly, Richter, Sebring and Luter, IV, the amount in column (e) for fiscal 2013 includes $4,420,000, $2,210,000, $576,900, $288,450 and $288,450, respectively, as the grant date fair value for performance share units granted on June 12, 2012. Assuming the highest performance conditions for these performance share unit grants had been achieved, the maximum grant date fair value for these awards for Messrs. Pope, Manly, Richter, Sebring and Luter, IV would have been $7,692,000, $3,846,000, $961,500, $480,750 and

20

Table of Contents

$480,750, respectively. The June 2012 performance share unit awards for Messrs. Richter, Sebring and Luter, IV vested at their target levels on June 12, 2013. The June 2012 performance share unit awards for Messrs. Pope and Manly would vest at their maximum levels upon the closing of the Merger. See “Discussion for Summary Compensation Table and Grants of Plan-Based Awards: Equity Incentive Awards” below for further information on the fiscal 2013 awards.

Non-Equity Incentive Plan Compensation (Column (g))

Represents cash incentive payouts pursuant to awards made under the performance award component of the 2008 Plan, excluding the portion, if any, the executive elected to defer pursuant to the management stock purchase program under the 2008 Plan. Under the program, executives may elect to defer up to 25% of their annual cash incentive award into restricted stock units. These RSUs entitle the executive to receive an equal number of shares of common stock at the date elected by the executive (generally either the executive’s separation from service or a date not less than three years following issuance of the RSUs). The RSUs issued pursuant to any such deferral are included in column (h) of the Grants of Plan-Based Awards table below.

Change in Pension Value and Nonqualified Deferred Compensation Earnings (Column (h))

Represents the aggregate increase in the actuarial present value of the Named Executive Officer’s accumulated benefits under our tax-qualified pension plans and non-tax-qualified supplemental pension plan accrued during fiscal 2013, fiscal 2012 and fiscal 2011. The change in the present value of the accrued pension benefits is impacted by variables such as additional years of service, age, changes in plan provisions, changes in compensation and the discount rate used in the present value calculation. The Company changed its discount rate in valuing pension liabilities from 4.75% in fiscal 2012 to 4.45% in fiscal 2013 based on a similar decrease in corporate bond yields used to set the discount rate each year. The change in the discount rate resulted in an increase in the present value of the pension benefits in fiscal 2013. The increase in the present value of the pension benefits does not reflect any changes in how our executives’ retirement benefits are determined under the pension plans. The table below shows the impact of the decrease in the discount rate and other variables on the present value of the Named Executive Officers’ pension benefits:

| Pope ($) |

Manly ($) |

Richter ($) |

Sebring ($) |

Luter, IV ($) |

||||||||||||||||

| 2012 Present Value |

16,744,612 | 7,307,573 | 6,541,166 | 8,407,260 | 3,370,337 | |||||||||||||||

| Change due to: |

||||||||||||||||||||

| • Final average pay increase |

— | 2,928,084 | 667,540 | 175,237 | 362,924 | |||||||||||||||

| • Additional year of service |

1,409,566 | 941,022 | 537,751 | 252,112 | 382,148 | |||||||||||||||

| • Discount rate change |

791,811 | 454,115 | 181,771 | 221,069 | 317,150 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Increase |

2,201,377 | 4,323,221 | 1,387,062 | 648,418 | 1,062,222 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2013 Present Value |

18,945,989 | 11,630,794 | 7,928,228 | 9,055,678 | 4,432,559 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The methodology used in calculating such increases, including the underlying assumptions, is described or referenced under “Pension Benefits: Discussion of Retirement Plans” below.

All Other Compensation (Column (i))

Includes for fiscal 2013 Company matches under our 401(k) plan as follows: Mr. Pope — $5,100; Mr. Manly — $5,308; Mr. Richter — $5,100; Mr. Sebring — $4,825; and Mr. Luter, IV — $2,500.

21

Table of Contents

Also includes our incremental cost, as shown in the following table, of perquisites provided to the Named Executive Officers during fiscal 2013, consisting of: the personal use of Company aircraft, spousal travel expenses, personal use of a car leased by us, including all operating and maintenance costs, excess life and other insurance benefits, charitable contribution match, and country club and social club memberships.

| Name |

Company Aircraft ($) |

Spousal Travel Expenses ($) |

Company- Leased Automobile ($) |

Excess Life and Other Insurance Benefits ($) |

Charitable Contribution Match ($) |

Club Memberships ($) |

||||||||||||||||||

| C. Larry Pope |

75,000 | 10,033 | 35,076 | 2,322 | 102,500 | — | ||||||||||||||||||

| Robert W. Manly, IV |

7,590 | — | 35,395 | 2,704 | — | — | ||||||||||||||||||

| George H. Richter |

29,331 | — | 23,126 | 10,713 | — | 97 | ||||||||||||||||||

| Joseph B. Sebring |

35,120 | — | 33,795 | 6,858 | — | — | ||||||||||||||||||

| Joseph W. Luter, IV |

31,654 | — | 28,359 | 810 | 500 | — | ||||||||||||||||||