Attached files

| file | filename |

|---|---|

| EX-4.1 - EXHIBIT 4.1 - PIKSEL, INC. | v353498_ex4-1.htm |

| EX-3.1 - EXHIBIT 3.1 - PIKSEL, INC. | v353498_ex3-1.htm |

| EX-3.2 - EXHIBIT 3.2 - PIKSEL, INC. | v353498_ex3-2.htm |

| EX-4.3 - EXHIBIT 4.3 - PIKSEL, INC. | v353498_ex4-3.htm |

| 8-K - FORM 8-K - PIKSEL, INC. | v353498_8-k.htm |

EXECUTION COPY

LITIGATION WARRANT AGREEMENT

THIS WARRANT AGREEMENT (this “Agreement”), dated as of August 19, 2013, is entered into by and between Piksel, Inc., a Delaware corporation (the “Corporation”), and Continental Stock Transfer & Trust Company, a New York corporation (the “Warrant Agent”).

WHEREAS, pursuant to the terms and conditions of the Third Amended Plan of Reorganization, dated August 6, 2013, as the same may be amended, modified or restated from time to time (the “Plan”) relating to the reorganization of the Corporation under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”), the Corporation is issuing warrants (each a “Warrant,” and collectively, the “Warrants”) to holders of Allowed Subordinated Claims (as defined in the Plan) in Class 6 of the Plan in exchange for such Claims; pursuant to the Plan, the Warrants shall be exercisable until the Expiration Date (as defined below) and will enable holders thereof to purchase up to one (1) share of the Corporation’s Series A-2 Common Stock (as defined in the Plan) per dollar of such holder’s Allowed Subordinated Claim at an exercise price of $0.205 per share (the “Exercise Price”);

WHEREAS, the Warrants are being issued pursuant to an offering in reliance on the exemption afforded by section 1145 of the Bankruptcy Code from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), and of any applicable state securities or “blue sky” laws;

WHEREAS, the Corporation desires the Warrant Agent to act on behalf of the Corporation, and the Warrant Agent is willing to so act, in connection with the issuance, registration and exercise of the Warrants;

WHEREAS, the Corporation desires to provide for the form and provisions of the Warrant Certificate (as defined below) and the Warrants, the terms upon which shall govern the Warrants issued by the Corporation and the respective rights, limitation of rights and immunities of the Corporation, the Warrant Agent and the holders of the Warrants; and

WHEREAS, all acts and things have been done and performed which are necessary to make the Warrants evidenced by the Warrant Certificate, when executed on behalf of the Corporation and countersigned by or on behalf of the Warrant Agent, as provided herein, the valid, binding and legal obligations of the Corporation, and to authorize the execution and delivery of this Agreement.

NOW, THEREFORE, in consideration of the mutual agreements herein contained, the parties hereto agree as follows:

| 1 |

1. Appointment of Warrant Agent. The Corporation hereby appoints the Warrant Agent to act as agent for the Corporation in connection with the Warrants, and the Warrant Agent hereby accepts such appointment and agrees to perform the same in accordance with the terms and conditions set forth in this Agreement.

2. Warrants.

2.1 Form of Warrant. Each warrant certificate (the “Warrant Certificate”) shall be (a) issued in registered form only, (b) in substantially the form of Exhibit A hereto, the provisions of which are incorporated herein and (c) signed by, or bear the facsimile signature of, the Chief Executive Officer or the Chief Financial Officer and the Secretary of the Corporation. In the event the person whose signature or facsimile signature has been placed upon any Warrant Certificate shall have ceased to serve in the capacity in which such person signed the Warrant Certificate before such Warrant Certificate is issued, it may be issued with the same effect as if he or she had not ceased to be such at the date of issuance.

2.2 Effect of Countersignature. Unless and until the Warrant Certificate is countersigned by the Warrant Agent pursuant to this Agreement, a Warrant shall be invalid and of no effect and may not be exercised by the holder thereof.

2.3 Registration.

2.3.1 Warrant Register. The Warrant Agent shall maintain books (the “Warrant Register”) for the registration of the issuance of the Warrant Certificates. Upon the issuance of the Warrant Certificates, the Warrant Agent shall issue and register the Warrants in the names of the respective holders thereof in such denominations and otherwise in accordance with instructions delivered to the Warrant Agent by the Corporation.

2.3.2 Registered Holder. The Corporation and the Warrant Agent may deem and treat the person in whose name such Warrant Certificate shall be registered upon the Warrant Register (the “registered holder”) as the absolute owner of such Warrant Certificate and of each Warrant represented thereby (notwithstanding any notation of ownership or other writing on the Warrant Certificate made by anyone other than the Corporation or the Warrant Agent), for the purpose of any exercise thereof, and for all other purposes, and neither the Corporation nor the Warrant Agent shall be affected by any notice to the contrary.

3. Terms and Exercise of Warrants.

3.1 Exercise Price. Each Warrant Certificate shall, when countersigned by the Warrant Agent, entitle the registered holder thereof, subject to the provisions of such Warrant Certificate and of this Warrant Agreement, to purchase from the Corporation the number of shares of Series A-2 Common Stock stated therein at the Exercise Price until the Expiration Date.

3.2 Duration of Warrants. A Warrant may be exercised at any time on any Business Day (as defined below) only during the period (“Exercise Period”) commencing on the date such Warrant is issued or instructed to be issued by the Corporation (the “Issuance Date”) and terminating at 5:00 P.M., New York City time on the date that is thirty (30) days from the Issuance Date (the “Expiration Date”). Each Warrant not exercised on or before the Expiration Date shall become void, and all rights thereunder and all rights in respect thereof under this Agreement shall cease at the close of business on the Expiration Date. As used herein, the term “Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in the City of New York are authorized or required by law or executive order to remain closed.

| 2 |

3.3 Exercise of Warrants.

3.3.1 Payment. Subject to the provisions of the Warrant Certificate and this Warrant Agreement, a Warrant, when the Warrant Certificate is countersigned by the Warrant Agent and surrendered at the office of the Warrant Agent, or at the office of its successor as Warrant Agent, in the Borough of Manhattan, City and State of New York, with the election form attached to the Warrant Certificate, attached hereto as Exhibit B, duly executed, and by paying in full the Exercise Price for each full share of Series A-2 Common Stock as to which the Warrant is exercised, and any and all applicable taxes due in connection with the exercise of the Warrant, by certified or official bank check or by bank wire transfer in immediately available funds, in each case payable to the order of the Warrant Agent (or as otherwise agreed to by the Corporation). To the extent applicable, the aggregate Exercise Price shall be rounded up to the nearest penny.

3.3.2 Issuance of Certificates.

(a) As soon as practicable after the exercise of any Warrant and the clearance of the funds in payment of the Exercise Price, the Corporation shall issue to the registered holder of such Warrant a certificate or certificates representing the number of full shares of Series A-2 Common Stock to which he, she or it is entitled, registered in the name or names that the Warrant being so exercised is registered. Such Series A-2 Common Stock issuable upon the exercise of the Warrants shall result in holders thereof receiving a pro rata portion of the Series A-2 Common Stock, with the pro rata portion based on a fraction (expressed as a percentage), the numerator of which shall be the dollar amount of the Holder’s Allowed Subordinated Claim (not satisfied by Available Cash (as defined in the Plan)) and the denominator of which shall be the aggregate number of issued and then-outstanding shares of Class A2 Common Stock, inclusive of the shares to be issued to exercising holders of the Litigation Warrants. Warrants may not be exercised by, or securities issued to, any registered holder in any state in which such exercise or issuance would be unlawful.

(b) In no event shall the Corporation be required to “net cash settle” the exercise of any Warrants.

3.3.3 Valid Issuance. All shares of Series A-2 Common Stock issued upon the proper exercise of a Warrant in conformity with this Agreement shall be validly issued, fully paid and nonassessable.

3.3.4 Date of Issuance. Each person in whose name any such certificate for shares of Series A-2 Common Stock is issued shall for all purposes be deemed to have become the holder of record of such shares on the date on which the Warrant was exercised and payment of the Exercise Price was made; provided, that such date is no later than the Expiration Date, but irrespective of the date of delivery of such certificate, except that, if the date of such exercise and payment is a date when the stock transfer books of the Corporation are closed, such person shall be deemed to have become the holder of such shares at the close of business on the next succeeding date on which the stock transfer books are open.

| 3 |

3.4 No Anti-Dilution Protection. Shares of Series A-2 Common Stock issuable upon the exercise of any Warrants shall be subject to dilution as set forth in the Plan, including, without limitation, by the exercise of Litigation Warrants (as defined in the Plan). To the extent such Litigation Warrants are exercised, the proceeds from such exercise shall be distributed on a pro rata basis to each holder of Series A-2 Common Stock immediately prior to such exercise in accordance with the Corporation’s Amended and Restated Certificate of Incorporation. The term pro rata as used herein shall mean a fraction (expressed as a percentage), the numerator of which shall be the number of shares held by a then Series A-2 Common Stock holder and the denominator of which shall be the aggregate number of outstanding shares of Series A-2 Common Stock (exclusive of the shares to be issued to such exercising Litigation Warrant holder). For the avoidance of doubt, the exercising holder of such Litigation Warrants shall not be entitled to proceeds from the exercise of such holder’s Litigation Warrants.

4. Other Provisions Relating to Rights of Holders of Warrants.

4.1 No Rights as Stockholder. A Warrant does not entitle the registered holder thereof to any of the rights of a stockholder of the Corporation, including, without limitation, the right to receive dividends, or other distributions, exercise any preemptive rights to vote or to consent or to receive notice as stockholders in respect of the meetings of stockholders or the election of directors of the Corporation or any other matter.

4.2 Lost, Stolen, Mutilated or Destroyed Warrants. If any Warrant Certificate is lost, stolen, mutilated or destroyed, the Corporation and the Warrant Agent may, on such terms as to indemnity or otherwise as they may in their discretion impose (which terms shall, in the case of a mutilated Warrant Certificate, include the surrender thereof), issue a new Warrant Certificate of like denomination, tenor and date as the Warrant Certificate so lost, stolen, mutilated or destroyed. Any such new Warrant Certificate shall constitute a substitute contractual obligation of the Corporation, whether or not the allegedly lost, stolen, mutilated or destroyed Warrant Certificate shall be at any time enforceable by anyone.

4.3 Reservation of Common Stock. The Corporation shall at all times reserve and keep available a number of its authorized but unissued shares of Series A-2 Common Stock that will be sufficient to permit the exercise in full of all outstanding Warrants issued pursuant to this Agreement.

4.4 Securities Law Compliance.

(a) The Warrants (including any Series A-2 Common Stock issued upon exercise thereof) are issued pursuant to an exemption from the registration requirements of Section 5 of the Securities Act provided by section 1145 of the Bankruptcy Code. Any Warrant or underlying share of Series A-2 Common Stock that is received, purchased or owned by any “underwriter” as defined in section 1145(b)(1) of the Bankruptcy Code, may not be resold by such holder, and such holder may not be able to transfer any Warrants or Series A-2 Common Stock issuable upon exercise of any Warrant in the absence of an exemption from registration under the Securities Act and state securities laws.

| 4 |

(b) In the event that an exemption under section 1145 of the Bankruptcy Code with respect to Warrants or shares of Series A-2 Common Stock underlying the Warrants is not effective or available, or because such exercise would be unlawful with respect to a registered holder in any state, the registered holder shall not be entitled to exercise such Warrants and such Warrants may have no value and expire worthless.

4.5 Limitation on Monetary Damages. In no event shall the registered holder of a Warrant be entitled to receive damages, monetary or otherwise, for failure to settle any Warrant exercise if the Series A-2 Common Stock issuable upon exercise of the Warrants is not exempt from registration pursuant to section 1145 of the Bankruptcy Code or has not been registered with the Securities and Exchange Commission pursuant to an effective registration statement or if a current prospectus is not available for delivery by the Warrant Agent.

4.6 No Warrant Transfers. Notwithstanding anything to the contrary herein, no Warrant shall be transferable to any person or any entity, and any attempt to so transfer or any purported transfer shall be void ab initio.

5. Concerning the Warrant Agent and Other Matters.

5.1 Payment of Taxes. The Corporation shall from time to time promptly pay all taxes and charges that may be imposed upon the Corporation or the Warrant Agent in respect of the issuance or delivery of shares of Series A-2 Common Stock upon the exercise of Warrants, but the Corporation shall not be obligated to pay any transfer taxes in respect of the Warrants or such shares.

5.2 Resignation, Consolidation or Merger of Warrant Agent.

5.2.1 Appointment of Successor Warrant Agent. The Warrant Agent, or any successor to it hereafter appointed, may resign its duties and be discharged from all further duties and liabilities hereunder after giving sixty (60) days’ notice in writing (a “Resignation Notice”) to the Corporation. Upon receipt by the Corporation of a Resignation Notice, or if the office of the Warrant Agent becomes vacant by resignation or incapacity to act or otherwise, the Corporation shall appoint in writing a successor Warrant Agent in place of the Warrant Agent. If the Corporation shall fail to make such appointment within a period of thirty (30) days after it has received a Resignation Notice from the Warrant Agent, then the holder of any Warrant may apply to the Supreme Court of the State of New York for the County of New York for the appointment of a successor Warrant Agent at the Corporation’s cost. Any successor Warrant Agent, whether appointed by the Corporation or by such court, shall be a corporation organized and existing under the laws of the State of New York, in good standing and having its principal office in the Borough of Manhattan, City and State of New York, and authorized under such laws to exercise corporate trust powers and subject to supervision or examination by federal or state authority. After appointment, any successor Warrant Agent shall be vested with all the authority, powers, rights, immunities, duties and obligations of its predecessor Warrant Agent with like effect as if originally named as Warrant Agent hereunder, without any further act or deed; but if for any reason it becomes necessary or appropriate, the predecessor Warrant Agent shall execute and deliver, at the expense of the Corporation, an instrument transferring to such successor Warrant Agent all the authority, powers and rights of such predecessor Warrant Agent hereunder; and upon request of any successor Warrant Agent the Corporation shall make, execute, acknowledge and deliver any and all instruments in writing for more fully and effectually vesting in and confirming to such successor Warrant Agent all such authority, powers, rights, immunities, duties and obligations.

| 5 |

5.2.2 Notice of Successor Warrant Agent. In the event a successor Warrant Agent shall be appointed, the Corporation shall give notice thereof to the predecessor Warrant Agent and the transfer agent for the Series A-2 Common Stock not later than the effective date of any such appointment.

5.2.3 Merger or Consolidation of Warrant Agent. Any corporation into which the Warrant Agent may be merged or with which it may be consolidated or any corporation resulting from any merger or consolidation to which the Warrant Agent shall be a party shall be the successor Warrant Agent under this Agreement without any further act.

5.3 Fees and Expenses of Warrant Agent.

5.3.1 Remuneration. The Corporation agrees to pay the Warrant Agent reasonable remuneration for its services as such Warrant Agent hereunder and will reimburse the Warrant Agent upon demand for all expenditures that the Warrant Agent may reasonably incur in the execution of its duties hereunder.

5.3.2 Further Assurances. The Corporation agrees to perform, execute, acknowledge and deliver or cause to be performed, executed, acknowledged and delivered all such further and other acts, instruments and assurances as may reasonably be required by the Warrant Agent for the carrying out or performing of the provisions of this Agreement.

5.4 Liability of Warrant Agent.

5.4.1 Reliance on Corporation Statement. Whenever in the performance of its duties under this Warrant Agreement the Warrant Agent shall deem it necessary or desirable that any fact or matter be proved or established by the Corporation prior to taking or suffering any action hereunder, such fact or matter (unless other evidence in respect thereof be herein specifically prescribed) may be deemed to be conclusively proved and established by a statement signed by the Chief Executive Officer or Chief Financial Officer of the Corporation and delivered to the Warrant Agent. The Warrant Agent may rely upon such statement for any action taken or suffered in good faith by it pursuant to the provisions of this Agreement.

5.4.2 Indemnity. The Warrant Agent shall be liable hereunder only for its own gross negligence, willful misconduct or bad faith. The Corporation agrees to indemnify the Warrant Agent and save it harmless against any and all liabilities, including judgments, costs and reasonable counsel fees, for anything done or omitted by the Warrant Agent in the execution of this Agreement, except as a result of the Warrant Agent’s gross negligence, willful misconduct or bad faith.

| 6 |

5.4.3 Exclusions. The Warrant Agent shall have no responsibility with respect to the validity of this Agreement or with respect to the validity or execution of any Warrant (except its countersignature of the Warrant Certificate); nor shall it be responsible for any breach by the Corporation of any covenant or condition contained in this Agreement or in any Warrant; nor shall it by any act hereunder be deemed to make any representation or warranty as to the authorization or reservation of any shares of Series A-2 Common Stock to be issued pursuant to this Agreement or any Warrant or as to whether any shares of Series A-2 Common Stock will when issued be valid and fully paid and nonassessable.

5.5 Acceptance of Agency. The Warrant Agent hereby accepts the agency established by this Agreement and agrees to perform the same upon the terms and conditions herein set forth and, among other things, shall account promptly to the Corporation with respect to Warrants exercised and concurrently account for, and pay to the Corporation, all moneys received by the Warrant Agent for the purchase of shares of Series A-2 Common Stock through the exercise of Warrants.

6. Miscellaneous Provisions.

6.1 Successors. All the covenants and provisions of this Agreement by or for the benefit of the Corporation or the Warrant Agent shall bind and inure to the benefit of their respective successors and assigns.

6.2 Notices. Any notice, statement or demand authorized by this Warrant Agreement to be given or made by the Warrant Agent or by the holder of any Warrant to or on the Corporation shall be delivered by hand or sent by registered or certified mail or overnight courier service, addressed (until another address is filed in writing by the Corporation with the Warrant Agent) as follows:

Piksel, Inc.

26 West 17th Street, 2nd Floor

New York, New York 10011

Attn: Fabrice Hamaide

Facsimile: (212) 206-7059

with a copy to:

Bracewell & Giuliani LLP

1251 Avenue of the Americas

New York, New York 10020

Attn: Jennifer Feldsher and Robert Burns

Facsimile: (212) 508-6101

| 7 |

Any notice, statement or demand authorized by this Agreement to be given or made by the holder of any Warrant or by the Corporation to or on the Warrant Agent shall be delivered by hand or sent by registered or certified mail or overnight courier service, addressed (until another address is filed in writing by the Corporation with the Warrant Agent) as follows:

Continental Stock Transfer & Trust

Company

17 Battery Place, 8th Floor

New York, NY 10004

Attn: Margaret Villani

Any notice, sent pursuant to this Warrant Agreement shall be effective, if delivered by hand, upon receipt thereof by the party to whom it is addressed, if sent by overnight courier, on the next Business Day of the delivery to the courier, and if sent by registered or certified mail on the third day after registration or certification thereof.

6.3 Legend for Underlying Series A-2 Common Stock. Each Stock Certificate shall bear the following legend:

“THE SECURITIES REPRESENTED BY THIS STOCK CERTIFICATE HAVE BEEN ISSUED PURSUANT TO SECTION 1145 OF THE U.S. BANKRUPTCY CODE AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR ANY APPLICABLE STATE SECURITIES LAWS. SUCH SECURITIES MAY NOT BE SOLD, ASSIGNED OR OTHERWISE TRANSFERRED EXCEPT IN ACCORDANCE WITH SECTION 1145 OF THE BANKRUPTCY CODE OR, IF APPLICABLE, THERE IS AN OPINION FROM COUNSEL TO THE COMPANY THAT SUCH SALE, ASSIGNMENT OR OTHER TRANSFER MAY BE MADE PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE STATUTES.”

6.4 Applicable Law. The validity, interpretation and performance of this Agreement and of the Warrants shall be governed in all respects by the laws of the State of New York, without giving effect to conflicts of law principles that would result in the application of the substantive laws of another jurisdiction. The Corporation hereby agrees that any action, proceeding or claim against it arising out of or relating in any way to this Agreement shall be brought and enforced in the courts of the State of New York, Borough of Manhattan or the United States District Court for the Southern District of New York, and irrevocably submits to such jurisdiction, which jurisdiction shall be exclusive. The Corporation hereby waives any objection to such exclusive jurisdiction and that such courts represent an inconvenient forum. Any such process or summons to be served upon the Corporation may be served by transmitting a copy thereof by registered or certified mail, return receipt requested, postage prepaid, addressed to it at the address set forth in Section 6.4 hereof. Such mailing shall be deemed personal service and shall be legal and binding upon the Corporation in any action, proceeding or claim.

6.5 Persons Having Rights Under this Agreement. Nothing in this Agreement expressed in, and nothing that may be implied from, any of the provisions hereof is intended, or shall be construed, to confer upon, or give to, any person or corporation other than the parties hereto and the registered holders of the Warrants, any right, remedy or claim under or by reason of this Warrant Agreement or of any covenant, condition, stipulation, promise or agreement hereof. All covenants, conditions, stipulations, promises and agreements contained in this Warrant Agreement shall be for the sole and exclusive benefit of the parties hereto and their successors and assigns and of the registered holders of the Warrants.

| 8 |

6.6 Examination of the Warrant Agreement. A copy of this Agreement shall be available at all reasonable times at the office of the Warrant Agent in the Borough of Manhattan, City and State of New York, for inspection by the registered holder of any Warrant. The Warrant Agent may require any such holder to submit his, her or its Warrant for inspection by it.

6.7 Counterparts. This Agreement may be executed in any number of original or facsimile counterparts and each of such counterparts shall for all purposes be deemed to be an original, and all such counterparts shall together constitute but one and the same instrument.

6.8 Effect of Headings. The section headings herein are for convenience only and are not part of this Warrant Agreement and shall not affect the interpretation thereof.

6.9 Amendments. This Agreement may be amended by the parties hereto without the consent of any registered holder.

6.10 Severability. Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be prohibited by or invalid under applicable law, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of this Agreement.

[Signature page follows]

| 9 |

IN WITNESS WHEREOF, this Agreement has been duly executed by the parties hereto as of the day and year first above written.

| PIKSEL, INC. | ||

| By: | /s/ Fabrice Hamaide | |

| Name: | Fabrice Hamaide | |

| Title: | CFO | |

| CONTINENTAL STOCK TRANSFER & TRUST COMPANY | ||

| By: | /s/ Margaret Villani | |

| Name: | Margaret Villani | |

| Title: | Vice President | |

| 10 |

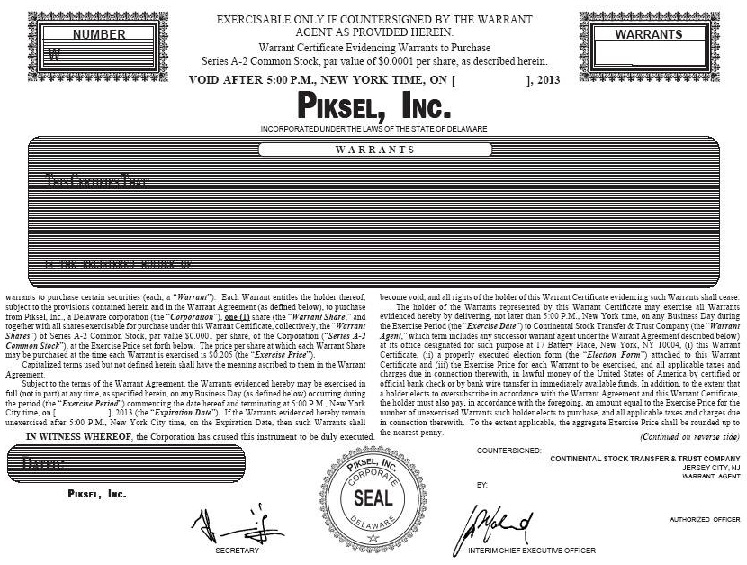

EXHIBIT A

Form of Warrant Certificate

| 11 |

| 12 |

EXHIBIT B

Form of Election Form

PIKSEL, INC. (f/k/a KIT digital, Inc.)

SHARES OF SERIES A-2 COMMON STOCK

ISSUABLE UPON EXERCISE OF NON-TRANSFERABLE

WARRANTS TO EXERCISE FOR SUCH SHARES

ELECTION FORM

I (We) acknowledge receipt of your letter and the enclosed materials relating to the offering of shares of series A-2 common stock, par value $0.0001 per share (the “Shares”) of Piksel, Inc. (the “Company”), issuable upon the exercise of warrants (“Warrants”).

In this form, I hereby elect to exercise the Warrants to purchase Shares distributed with respect to the Allowed Subordinated Claim (as defined in the Plan), pursuant to the terms and subject to the conditions set forth in the Warrant Agreement, dated as of August 19, 2013, by and between the Company and Continental Stock Transfer & Trust Company, and as described in that certain Third Amended Plan of Reorganization, dated August 6, 2013, filed by KIT digital, Inc. (the “Plan”).

| BOX 1. ¨ | I do not elect to exercise my Warrants. | |||

| BOX 2. ¨ |

I elect to exercise my Warrants in full and purchase Shares as set forth below:

| |||

|

Dollar value of Allowed Subordinated Claim |

warrant ratio |

exercise price |

payment | |

| Warrant Exercise | _________________ x | 1.0 x | $0.205 = | $____________ |

| FORM OF PAYMENT: | |

| ¨ | Payment in the following amount is enclosed: $____________. |

| ¨ | Payment by wire transfer in accordance with the following instructions: JPMorgan Chase, Account Name: CST AAF Piskel, Inc. Warrant, ABA # 021000021, Account # 475580893 |

Dated: ______________ __, 2013

Name __________________________

(Please Print)

/ / / / - / / /- / / / / /

(Insert Social Security or Other Identifying Number of Holder)

Address ________________________

________________________

Signature _______________________

This Warrant may only be exercised by presentation to the Warrant Agent at the following location:

Continental Stock Transfer & Trust Company

17 Battery Place, 8th Floor

New York, NY 10004

Attn: Corporate Actions Department

Telephone Number for Confirmation: (800) 509-5586

| 13 |

The method of delivery of this Election Form is at the option and risk of the exercising holder and the delivery of this Election Form will be deemed to be made only when actually received by the Warrant Agent and must be received prior to 5:00 p.m., New York City time, on [__________], 2013 (the “Expiration Date”). If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended. In all cases, sufficient time should be allowed to assure timely delivery and clearance of payment prior to 5:00 p.m. New York City time, on the Expiration Date.

______________________________

Signature

Signature must conform in all respects to the name of the holder as specified on the face of the Warrant Certificate.

| 14 |