Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUDSON VALLEY HOLDING CORP | d586615d8k.htm |

Metro New York’s

Premier Business Bank

Seizing Tomorrow’s Opportunities

While Maintaining Our Core Fundamentals

August 2013

Exhibit 99.1 |

1

Safe Harbor Statement

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of

1995:

This presentation contains various forward-looking statements with respect to

earnings, credit quality and other financial and business matters within the

meaning of the Private Securities Litigation Reform Act of 1995. These

forward-statements can be identified by words such as “expects,” “anticipates,”

“intends,” “believes,” “estimates,” “predicts”

and words of similar import. The Company cautions that these forward-looking statements are subject to

numerous assumptions, risks and uncertainties, and that statements relating to future

periods are subject to uncertainty because of the increased likelihood of

changes in underlying factors and assumptions. Actual results could differ materially from forward-looking statements.

Factors that may cause actual results to differ materially from those contemplated by

such forward-looking statements, include, but are not limited to, statements

regarding: (a) our ability to comply with the formal agreement entered into with the Office of the Comptroller of the Currency (the “OCC”) and any

additional restrictions placed on us as a result of future regulatory exams or changes

in regulatory policy implemented by the OCC or other bank regulators; (b) the

OCC and other bank regulators may require us to further modify or change our mix of assets, including our concentration in certain types of loans, or

require us to take further remedial actions; (c) our ability to deploy our excess cash,

reduce our expenses and improve our operating leverage and efficiency; (d)

the results of the investigation of A.R. Schmeidler & Co., Inc. by the Securities and Exchange Commission (the “SEC”) and the Department of Labor (the

“DOL”) and the possibility that our management’s attention will be

diverted to the SEC and DOL investigations and settlement discussions and we will incur

further costs and legal expenses; (e) the adverse affects on the business of A.R.

Schmeidler & Co., Inc. and our trust department arising from a settlement

with the SEC and DOL investigations; (f) our inability to pay quarterly cash dividends

to shareholders in light of our earnings, the current and future economic

environment, Federal Reserve Board guidance, our Bank’s capital plan and other

regulatory requirements applicable to Hudson Valley or Hudson Valley Bank; (g)

the possibility that we may need to raise additional capital in the future and our ability to raise such capital on terms that are favorable to us; (h)

further increases in our non-performing loans and allowance for loan losses; (i)

ineffectiveness in managing our commercial real estate portfolio; (j) lower than

expected future performance of our investment portfolio; (k) a lack of opportunities for growth, plans for expansion (including opening new branches)

and increased or unexpected competition in attracting and retaining customers; (l)

continued poor economic conditions generally and in our market area in

particular, which may adversely affect the ability of borrowers to repay their loans

and the value of real property or other property held as collateral for such

loans; (m) lower than expected demand for our products and services; (n) possible

impairment of our goodwill and other intangible assets; (o) our inability to

manage interest rate risk; (p) increased expense and burdens resulting from the

regulatory environment in which we operate and our inability to comply with

existing and future regulatory requirements; (q) our inability to maintain regulatory

capital above the minimum levels Hudson Valley Bank has set as its minimum

capital levels in its capital plan provided to the OCC, or such higher capital levels as may be required; (r) proposed legislative and regulatory action

may adversely affect us and the financial services industry; (s) future increased

Federal Deposit Insurance Corporation, or FDIC, special assessments or changes

to regular assessments; (t) potential liabilities under federal and state environmental laws.

For a more detailed discussion of these factors, see the Risk Factors discussion in the

Company’s most recent Annual Report on Form 10-K, and subsequent

Quarterly Reports on Form 10-Q. The forward-looking statements included in this presentation are made only as of the date hereof and the

Company undertakes no obligation to update or revise any of its forward-looking

statements.

Unless otherwise noted, information presented is from Company sources. |

2

Hudson Valley’s Business Model

•

Commercial bank focused on small and middle market businesses, professional service

firms

and

their

principals

–

they

view

us

as

their

“private

bankers”

•

Niche businesses synergistically compliment each other to form the core of HVB’s

business model

•

Relationship

Focus

--

high

quality

banking

products

and

exceptional

personal

service

Focus on

Targeted

Niche

Segments

Attorneys

Not-For-

Profits

Property

Managers

Real Estate

Developers

Municipal-

ities

Trusts

General

Business |

3

NOT A TRADITIONAL RETAIL COMMUNITY BANK

•

A

“Community

Business

Bank”

founded

to

focus

on

small

and

middle

market

commercial

customers and their principals

•

Focus on targeted niche businesses, entrepreneurs and professional service firms with

high deposit transaction volume throughout the Metro New York area

•

Low-cost, core deposits = foundation of customer relationships

•

We

sell

service,

with

a

strong

commitment

to

acting

as

a

“private

bank”

to

our

niche

commercial

customers

WE LEND WHERE WE LIVE

•

Providing

prudent,

conservatively

underwritten

loans

in

our

home

market

•

Stable and deep management team has extensive in-market experience and is highly

accessible to customers

•

Unique Metro NYC market allows for competitive positioning with high-touch service

and significant opportunities for growth

A Differentiated Business Model |

4

Our Mission is Unchanged

OUR METRO NYC SMALL-

AND MID-SIZED COMMERCIAL CUSTOMERS

REMAIN OUR FOUNDATION AND OUR PRIORITY

•

What changes is the number and diversity of products offered to serve them

OBJECTIVE IS TO GAIN COMPETITIVE ADVANTAGE WHILE MAINTAINING

COMPLIANCE

•

More nimble in adapting to new environments, products, and competitors

•

More effectively serve our niche markets with an even broader array of customized

products that meet their needs |

5

Metro New York Franchise

•

$2.8 billion commercial bank with 28 branches throughout Westchester, Rockland, the

Bronx, Manhattan and Brooklyn in New York •

Largest bank headquartered in Westchester County

•

Historic growth achieved by taking share from larger national bank competitors

•

There are more than 33,000 small and middle market companies with revenues of $1

million or more in this market Source: SNL Financial; deposit data as of

06/30/2012; branch count and map as of 06/30//2013 Branch Network - County Level

Deposits

Branches

(1)

US $000s

New York State

Westchester

17

1,770,169

$

New York (Manhattan)

4

321,111

Bronx

4

194,924

Rockland

2

75,508

Kings (Brooklyn)

1

11,883

(1) 6 Connecticut branches are excluded and closed July-2013 and 2 New York

branches consolidated into other branch locations in June-2013 |

6

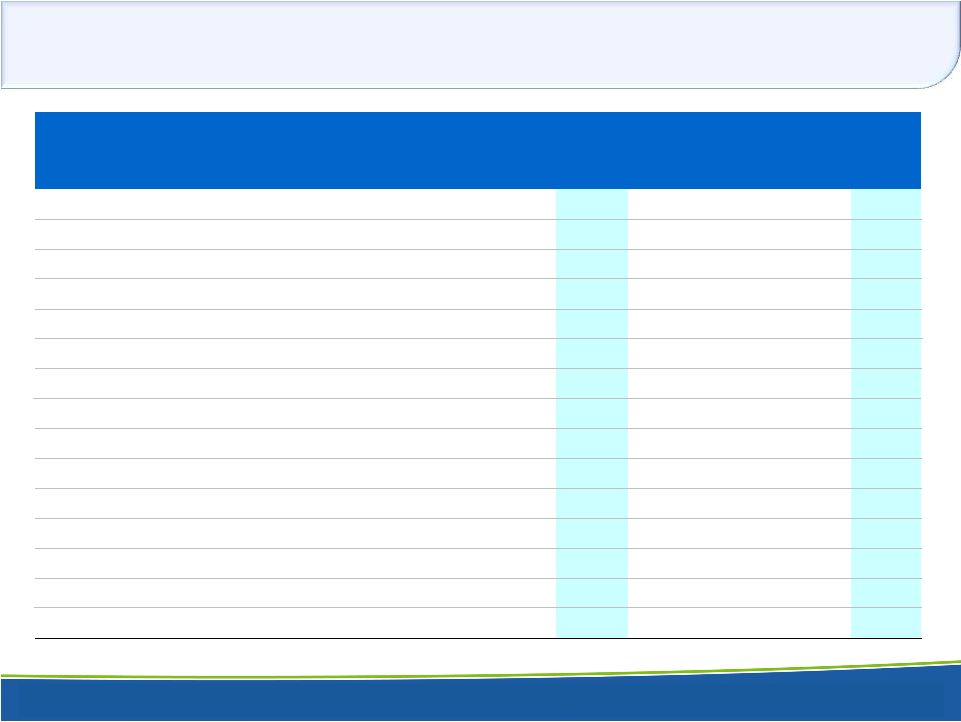

Summary Financial Highlights

3.66%

65.00%

0.94%

9.07%

8.6%

VS.

PEERS:

(1)

Excludes income from loan sales.

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of June 30, 2013. (Dollars in thousands, except per share

amounts) 2012

2012 (1)

2013

Net Interest Income

$56,804

$56,804

$42,314

Non Interest Income

$25,143

$9,208

$8,398

Non Interest Expense

$41,910

$41,910

$39,429

Net Income

$22,974

$13,603

$7,138

Diluted Earnings Per Share

$1.17

$0.69

$0.36

Dividends Per Share

$0.36

$0.36

$0.12

Net Interest Margin

4.34%

4.34%

3.12%

Return on Average Equity

15.90%

12.24%

4.88%

Return on Average Assets

1.63%

1.21%

0.49%

Efficiency Ratio

61.97%

61.97%

76.52%

Tangible Common Equity Ratio

9.6%

9.6%

9.0%

Average Assets

$2,820,157

$2,820,157

$2,904,681

Average Net Loans

$1,787,290

$1,787,290

$1,415,970

Average Deposits

$2,437,442

$2,437,442

$2,540,060

Average Stockholders' Equity

$288,918

$288,918

$292,290

Six Months Ended June 30 |

7

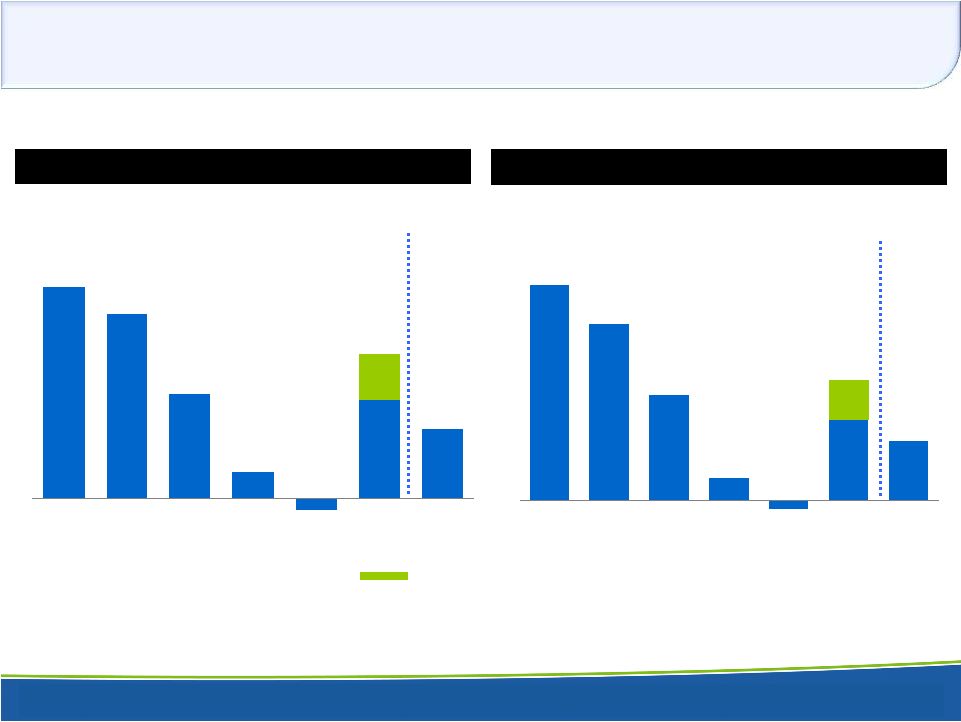

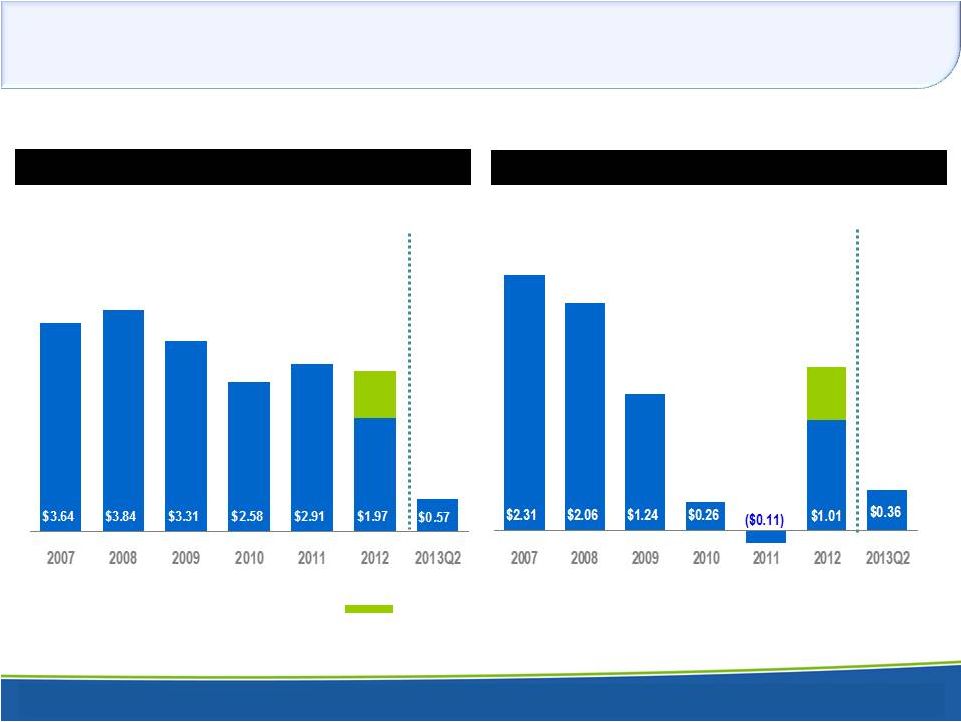

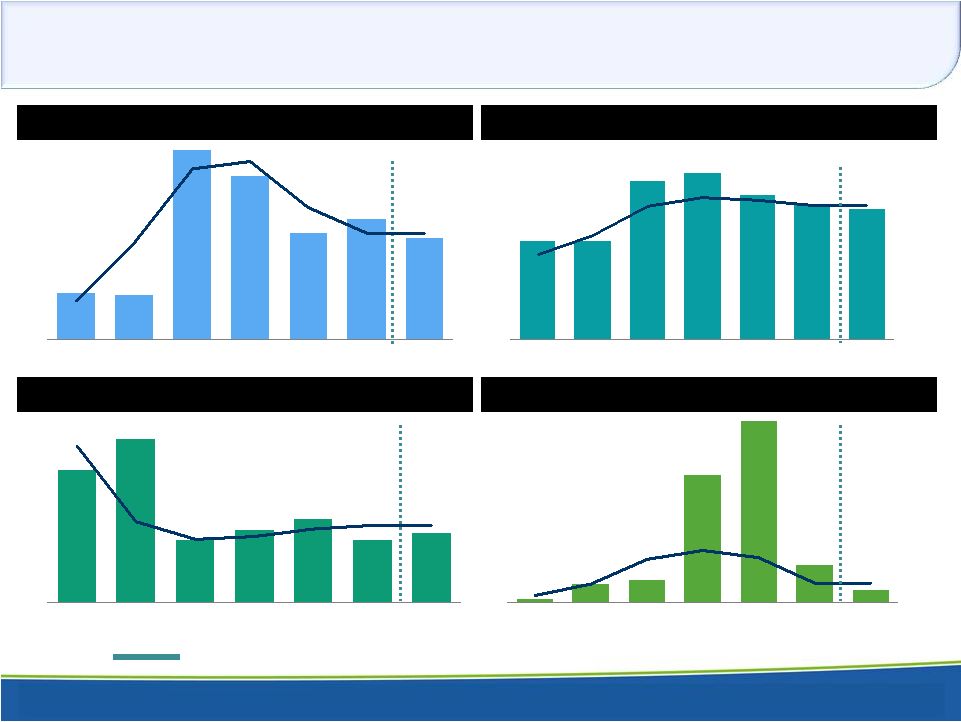

Historical Profitability

Income from loan sale

1.02

10.05

1.49

1.30

0.74

0.18

0.70

0.49

-0.08

2007

2008

2009

2010

2011

2012

2013Q2

RETURN

ON AVERAGE

ASSETS %

RETURN ON

AVERAGE EQUITY

%

18.00

14.76

8.74

6.82

4.88

1.75

-0.72

2007

2008

2009

2010

2011

2012

2013Q2 |

8

Historical Profitability

Income from loan sale

$2.78

Pre-Tax Pre-Provision Diluted Earnings per Share is a Non-GAAP

measure. See Appendix slide 43 for reconciliation $1.49

PRE

-TAX

PRE

-PROVISION DILUTED

EARNINGS

PER SHARE*

DILUTED

EARNINGS

PER

SHARE

|

9

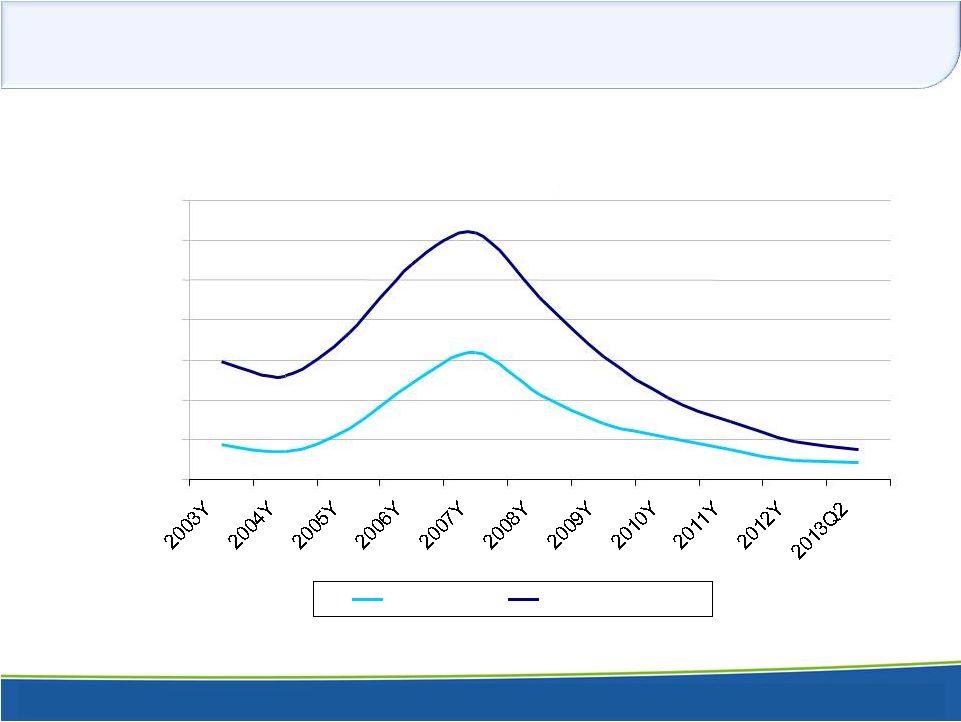

Net Interest Margin

(1)

Fully tax equivalent basis.

(2)

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of June 30, 2013. 0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013Q2

Net Interest Margin (FTE)

Yield on Loans

Cost of Deposits

Federal Funds Rate

VS. 3.79%

PEERS

(1,2) |

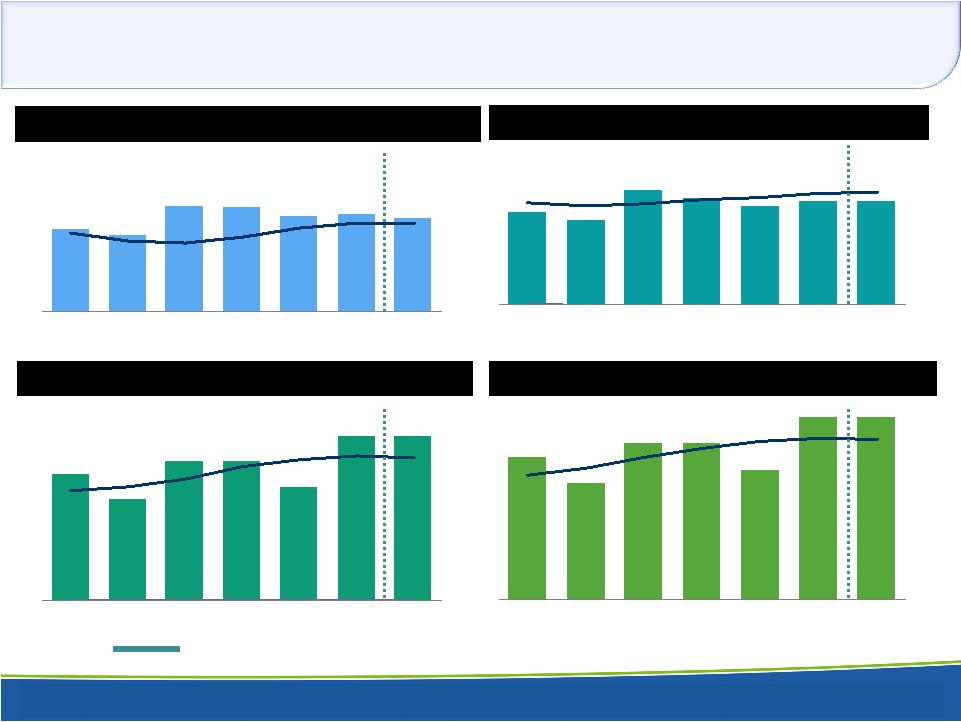

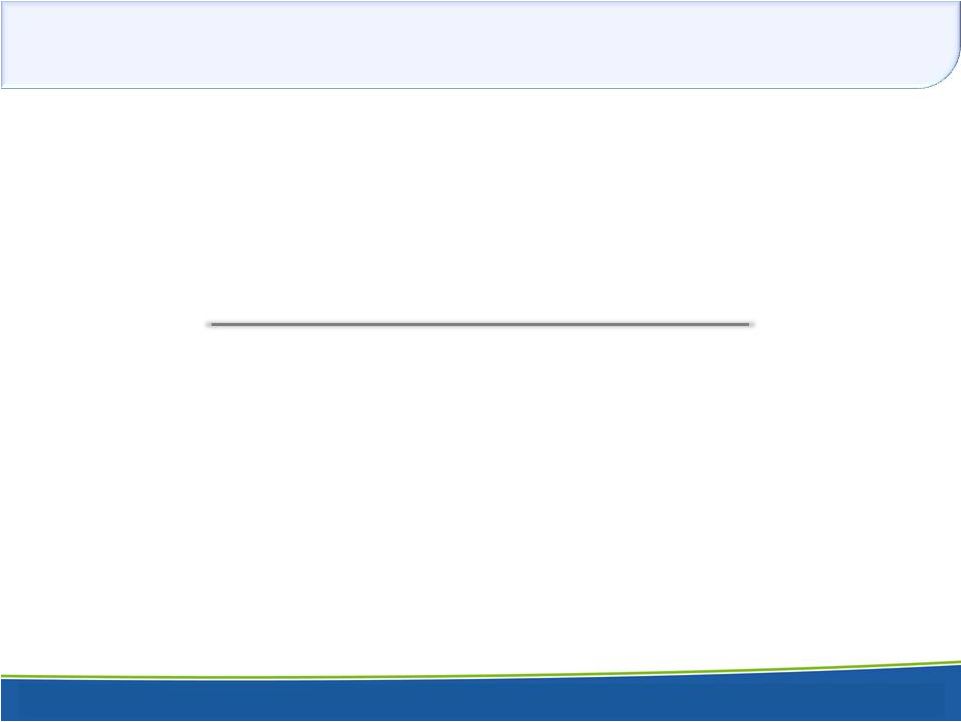

10

Strong Capital Position

Median of US-based, publicly traded commercial banks with assets between $1-$5

billion as of June 30, 2013. 7.9

7.3

10.1

10.0

9.1

9.3

9.0

2007

2008

2009

2010

2011

2012

2013Q2

8.3

7.5

10.2

9.6

8.8

9.3

9.3

2007

2008

2009

2010

2011

2012

2013Q2

12.6

10.1

13.9

13.9

11.3

16.5

16.5

2007

2008

2009

2010

2011

2012

2013Q2

13.8

11.3

15.2

15.2

12.6

17.7

17.7

2007

2008

2009

2010

2011

2012

2013Q2

TANGIBLE

COMMON

EQUITY

/

TANGIBLE

ASSETS

%

LEVERAGE

RATIO

%

TIER

1

RISK

BASED

CAPITAL

RATIO

%

TOTAL

RISK

BASED

CAPITAL

RATIO

% |

11

Summary –

Why HVB is Different

•

“Private Bank”

model emphasizes selling service over products

•

Value of service relationship outweighs price sensitivity in HVB’s

highly specialized, targeted niche customer segments

•

Loyal depositors trust HVB with their operating cash management

needs,

providing

a

stable

source

of

low-cost

deposits

–

and

an

opportunity for future business |

12

Growth Strategy

ORGANIC GROWTH IS OUR STRENGTH

•

We have been successful in going to market in a very focused way

in the highly competitive

Metro NYC commercial banking market

–

Larger bank M&A in the market provides opportunities to acquire new customers and

new talent with intact books of business

•

Referrals and reputation for service have historically generated

profitable, controlled growth

in customers

•

Always seeking to grow sources of fee revenue

–

A.R. Schmeidler acquisition in 2004 is a good example of investing in a niche business

with strong fee generating capabilities

•

Breadth and depth of niche business markets in Metro NYC provide

unusually high growth

opportunities compared to other areas of the U.S.

•

Opportunistic and targeted M&A could supplement organic growth in the future,

particularly in fee income |

13

HOW DO WE DO IT?

•

Weekly reporting from branches about significant customer activity

–

Reporting provides market and customer intelligence

–

Reported to Chairman, President, EVPs, key managers

–

Outlines loan/deposit/customer opportunities

–

Highlights significant accomplishments from the week

•

Reporting to the Board on Relationships at Risk

–

Raises

executive

awareness

–

NO

SURPRISES

–

Flat corporate structure means highest-level executives know the

customers and can personally reach out

Institutional Attention to Relationships |

14

Relationship Management = Differentiation

•

Hiring the right people to manage and service relationships

•

All

3,600

Relationships

assigned

to

an

Officer

–

approximately

2/3rds

assigned

to

a

Relationship Manager (RM)

–

Relationships are measured on total balances, not just loan balances

–

Depositors receive high-touch personalized service just like borrowers

•

Branch

Managers

have

the

other

1/3rd

assigned

to

them

and

“co-manage”

all

RM

assigned relationships

•

Branch Managers and Relationship Managers have very good, cooperative

relationships

•

Branches responsible for daily servicing and providing an exceptional customer

banking experience

•

Relationship Managers provide ongoing professional skill, communication and any

necessary decision making |

15

Leveraging Relationships for Additional Business

RELATIONSHIP MANAGEMENT DEEP DIVE INITIATIVE

•

Objective:

Ongoing

annual

Structured,

joint

(Branch

Manager/RM)

review

and meeting with all relationships to

–

Review existing business

–

Seek additional business

–

Ask for referrals

•

The Private Banking and Middle Market Model (versus the Retail banking

approach) |

16

Balance Sheet Diversification is Underway

OUR BALANCE SHEET IS IN TRANSITION

•

Redeployment efforts are underway to diversify balance sheet in an efficient and

profitable way

–

We are implementing three approaches simultaneously:

1.

Asset purchases –

NEAR TERM

2.

Loan

participations

with

other

institutions

–

NEAR

&

LONG

TERM

3.

Building internal ability to originate, underwrite and service non-CRE

credits –

LONG TERM |

17

Liquidity Deployment and Portfolio Diversity

•

Primarily in our metro New York markets

•

Enhancing and complementing small-

and mid-sized commercial

banking customer focus

•

Additional opportunities outside CRE

•

Possible initiatives include:

–

Additional asset purchases

–

Loan participations

–

Diversification |

18

Liquidity Deployment: In-Market Participations

•

Build on longstanding CRE-participation experience with new

opportunities

–

Continue to underwrite both the borrower and the lead lender

•

Some examples

–

New large-regional bank relationship

•

Participations on upper middle market and large corporate C&I

–

New peer-bank relationship

•

Receivables financing

•

Mortgage warehouse financing

•

Other non-CRE lending |

19

Liquidity Deployment: Diversifying Offering

•

New products for our niche commercial customers and their owners, principals and

managers

•

Focused on metro New York

•

Some examples

–

Equipment leasing

•

Excellent opportunities for deals sized from $250,000 to $5 million

•

Categories including building equipment (e.g. HVAC), business, office,

medical, dental and light industrial equipment

–

Jumbo residential mortgage and home equity products complementing

commercial

•

For existing commercial customer owners, principals and managers, a

broader array of competitive residential options than previously

•

For prospective customers, a whole new line of products at our bankers’

disposal to develop new commercial relationships

•

No retail marketing or advertising |

20

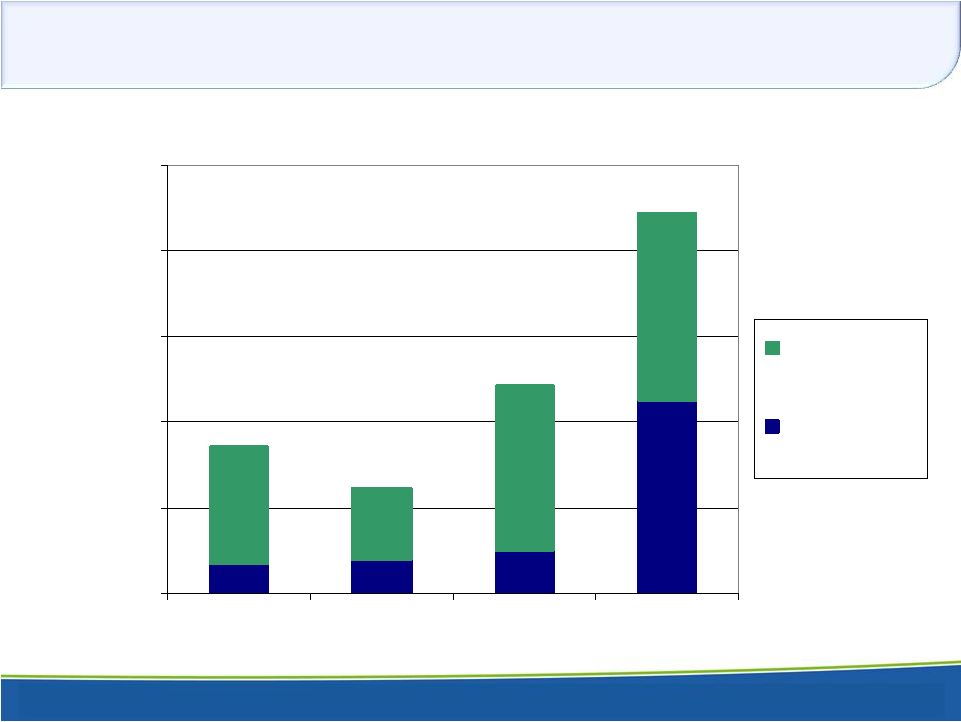

Liquidity Deployment

$-

$50,000,000

$100,000,000

$150,000,000

$200,000,000

$250,000,000

2012 Q3

2012 Q4

2013 Q1

2013 Q2

Investment

Purchases

Loan Originations

& Purchases |

21

Redeployment Aimed at Balance Sheet Efficiency

Diversifying by simultaneously implementing three approaches

1.Asset

purchases

–

CURRENT

•

$36.3 Million in Residential ARMs purchased in 2Q13

•

Evaluating others

2.Loan

participations

with

other

institutions

–

NEAR

TERM

•

Building on HVB’s longstanding CRE-participation experience by leveraging

other institutions’ expertise and infrastructure for C&I and

residential lending 3.Building

internal

ability

to

originate,

underwrite

and

service

non-CRE

credits

–

NEAR

&

LONG

TERM

•

Focus is new products for longstanding niche business and industry targets in metro

NYC –

New commercial lending including equipment leases, lines of credit, term loans, ABL,

etc. –

Complementary

jumbo

mortgage

and

HELOC

products

for

RMs

to

offer

commercial-account

principals

All while continuing to leverage historic strength in CRE underwriting to capitalize on

solid demand from quality CRE credits |

22

Loan Originations and Payoffs

$-

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

2012 Q3

2012 Q4

2013 Q1

2013 Q2

Loan

Originations

&

Purchases

Loan Payoffs &

Paydowns |

23

Successful Measures to Manage Concentrations

MEASURES TO MANAGE CONCENTRATIONS

•

Effective risk management process

•

Active pipeline management process

•

Commitment to developing non-CRE lines of business

•

Participate with in-market financial institutions to reduce CRE

exposure while maintaining strategic relationships

CONCENTRATION MEASURES

Q1-13

Q2-13

TARGET

CRE % of Risk Based

Capital 319.7%

333.7%

326.6%

< 400%

Classified Assets % of Risk Based

Capital 36.2%

36.2%

31.0%

< 25%

Q4-12

In

2Q13

purchased

$36.3

million

in

residential

ARMs

supported

by in-market collateral |

24

Asset Quality Measures Strengthen Balance Sheet

NONACCRUAL

LOANS

/ TOTAL

ASSETS

%

LOAN

LOSS

RESERVE

/ GROSS

LOANS

%

LOAN

LOSS

RESERVE

/ NONACCRUAL

LOANS

%

NET

CHARGEOFFS

/ AVERAGE

NET

LOANS

%

Median of US-based, publicly traded commercial banks with assets between $1-$5

billion as of June 30, 2013. 1.33

1.33

2.13

2.25

1.95

1.81

1.75

2007

2008

2009

2010

2011

2012

2013Q2

0.47

2.70

3.85

0.25

0.07

0.77

0.39

2007

2008

2009

2010

2011

2012

2013Q2

0.46

0.44

1.90

1.64

1.07

1.20

1.01

2007

2008

2009

2010

2011

2012

2013Q2

162

200

76

89

103

76

86

2007

2008

2009

2010

2011

2012

2013Q2 |

25

Core Deposits –

The Jewel of the Franchise

Low Cost, Dependable Source of Funding

How we Identify, Maintain and Grow Them! |

26

Institutional Attention to Relationships

HOW DO WE DO IT?

•

Business managed by relationship profitability rather than volume of accounts

–

Very different from traditional retail banking models

•

“Relationship

Status”

reflects

achievement

of

a

profitability

hurdle

•

“Resumes”

for each actively maintained relationship

–

i.e. how the business came into the Bank; who their key service

providers are (attorney, accountant, insurance broker, etc.); how they

like to be entertained

–

Who really makes the banking decision in each relationship

•

Recognize that the core deposit is a key source of value for both our clients and

for Hudson Valley –

value proposition is mutually beneficial for the clients we

target |

27

Marketing for Core Deposits

HOW WE IDENTIFY, SECURE AND GROW THEM!

•

Marketing

to

the

right

business

segments

–

large

deposits,

low

activity,

not

as

rate sensitive

•

Marketing

“relationship”

and

“service”

versus

interest

rate

•

Utilizing testimonials and recommendations of current customers

–

Ongoing

calling

–

10,200

documented

calls

in

2012

and

5,272

in

the

1st half of 2013

–

Calls made to prospective individuals/businesses that have recently

interacted with a Hudson Valley RM or client |

June 30, 2012

HVB

HVB

Peers

(2)

Core Deposits / Total Deposits

(1)

96%

97%

88%

Non Interest Bearing/Total Deps

40%

38%

21%

Deposits / Total Funding

98%

98%

92%

Loans / Deposits Ratio

(3)

62%

55%

80%

Cost of Total Deposits

26 bp

20 bp

38 bp

Deposit Metrics

June 30, 2013

Period Ended

28

A Core Deposit Driven Franchise

(1)

Core Deposits defined as total deposits less time deposits >$100,000.

(2)

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of June 30, 2013. (3)

Represents Net Loans to Deposits |

29

A Core Deposit Driven Franchise

DEPOSIT

COMPOSITION

–

June

30,

2013

(1)

Net loans excluding loans held-for-sale.

(2)

Core Deposits defined as total deposits less time deposits >$100,000.

Money

Market,

34%

Demand,

38%

Savings, 5%

Time > $100m,

3%

Time < $100m,

1%

Checking with

Interest, 19%

71%

55%

89%

97%

50%

60%

70%

80%

90%

100%

2007

2008

2009

2010

2011

2012

2013

Loan/Dep Ratio

Core/Total Deposits

(2)

(1)

TOTAL DEPOSITS – $2,625 MILLION CORE FUNDING |

30

HVB Funding

Advantage

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of June 30, 2013. Cost of Deposits

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

HVB

National Peers |

31

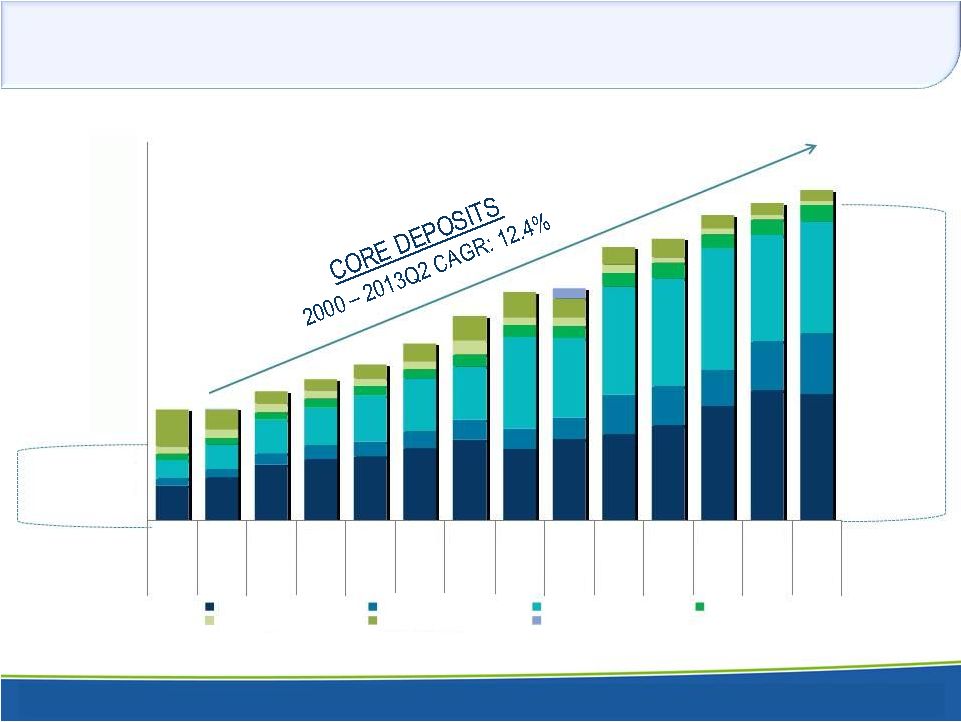

Deposit Growth Drives Long-Term Profitability

67.2%

CORE

DEPOSITS

(1)

96.6%

CORE

DEPOSITS

(1)

VS.

88.3% FOR

PEERS

(2)

(1)

Core deposits defined as total deposits less time deposits > $100,000 and brokered

deposits. December 2006 Includes approximately $127 million of deposits as part of New York National Bank acquisition

(2)

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of June 30, 2013. $0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

$2,500

$2,750

$3,000

$880

$888

$1,027

$1,125

$1,235

$1,408

$1,626

$1,813

$1,839

$2,173

$2,234

$2,425

$2,520

$2,625

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Jun

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Demand Deposits

Checking with Interest

Money Market Accounts

Savings Accounts

Time Deposits < $100m

Time Deposits > $100m

Brokered Deposits |

32

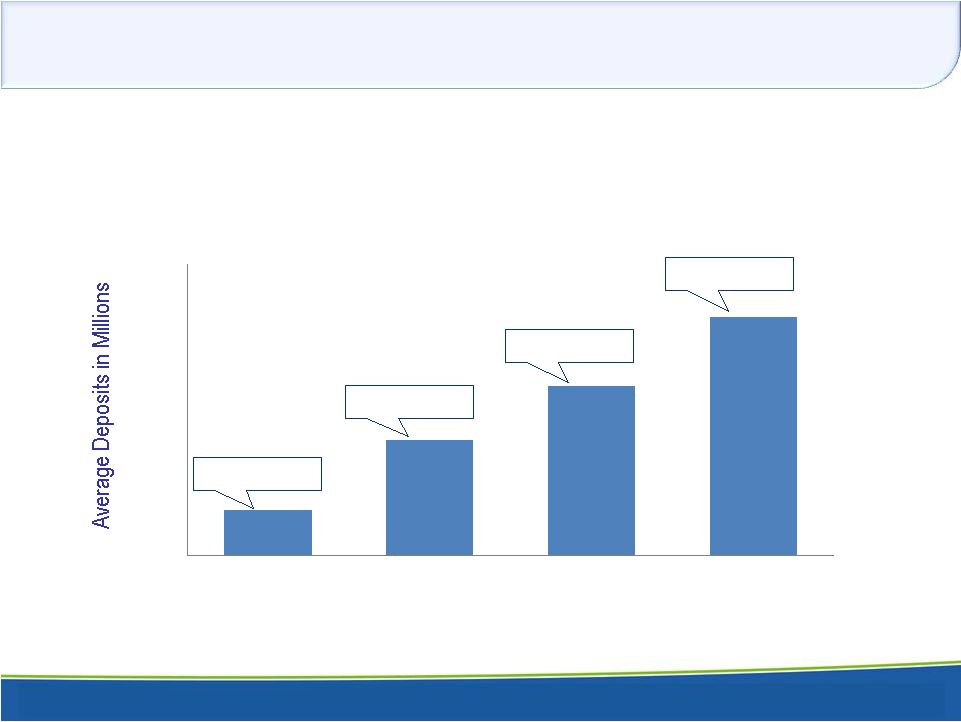

Branch Network –

Local Service & Execution

•

Low-cost branch infrastructure supports core deposit franchise

•

Branch value grows with age –

deeper penetration into existing relationships and new referrals

increase deposits per branch over time

6 Branches

11 Branches

(2)

(1)

6 Connecticut

branches

excluded

closed

July

-

2013

(2)

2 New

York

branches

were

consolidated

June

-

2013

6 Branches

5 Branches

June 2013 YTD Avg Deposit Balances per Branch

(1)

$21.3

$55.1

$81.3

$114.3

$0

$20

$40

$60

$80

$100

$120

$140

< 5 Yrs

5-10 Yrs

10-20 Yrs

> 20 Yrs

Age of Branch |

33

Key Takeaways

HISTORIC DIFFERENTIATING QUALITIES REMAIN OUR STRENGTH

•

Low-cost core deposit base = source of stable funding for future growth

•

Efficient mindset is in our DNA

•

“Private Bank”

approach wins and retains customers

AN INCREASINGLY NIMBLE AND SOPHISTICATED BANK

•

Ahead of the curve in adopting best practices typically reserved

for $10-$25 billion banks

•

Increased sophistication = heightened competitive edge

•

Developing diversified lending skills as a strategic and tactical focus

USING ENHANCED OPERATIONAL EFFECTIVENESS TO OUR ADVANTAGE

•

Quicker reaction to customers’

needs

•

Quicker reaction to regulatory and market changes

•

Quicker ability to diversify lending sources and maximize capital allocation

–

Results in: Quicker ability to grow shareholder returns |

34

THANK YOU

THANK YOU

FOR YOUR INTEREST IN

FOR YOUR INTEREST IN

HUDSON VALLEY HOLDING

HUDSON VALLEY HOLDING

CORP.

CORP. |

35

Ticker: HVB

Ticker: HVB

www.hudsonvalleybank.com

www.hudsonvalleybank.com

APPENDIX

APPENDIX

FINANCIAL DETAIL AND NON-GAAP

FINANCIAL DETAIL AND NON-GAAP

RECONCILIATION

RECONCILIATION |

36

New York Metro Market Profile

DEMOGRAPHICS

•

Along with being rich in deposits and HVB’s niche businesses, the market also has

very favorable demographics

Consumer Demographics (1)

Manhattan /

NY

Brooklyn

Bronx

Westchester

Rockland

Total

Population

1,585,873

2,504,700

1,385,108

949,113

311,687

19,378,102

Housing Units (2)

847,090

1,000,293

511,896

370,821

104,057

8,108,103

Home ownership rate

22.8%

30.3%

20.7%

62.7%

71.0%

55.2%

Persons per household, 2006-

2010

2.09

2.68

2.79

2.64

3.02

2.59

Median household income 2006-

2010

$64,971

$43,567

$34,264

$79,619

$82,534

$55,603

Median Income Per Capita

$59,149

$23,605

$17,575

$47,814

$34,304

$30,948

Unemployment Rate (3)

8.7%

9.4%

11.8%

6.2%

5.9%

7.6%

Business Demographics (4)

Revenues: < $1 million

137,028

85,670

29,701

54,096

16,678

323,173

Revenues: $1 million - $5 million

13,535

4,113

1,398

3,172

914

23,132

Revenue: > $5 million

6,651

1,129

472

1,238

266

9,756

Revenue: Not reported

18,393

8,897

4,465

5,606

1,669

39,030

Total Business Entities

175,607

99,809

36,036

64,112

19,527

395,091

(3)

County

unemployment

rates

as

of

June,

2013

Bureau

of

Labor

Statistics

(4)

Hoovers|D&B

(2)

A

housing

unit

is

defined

as

a

house,

an

apartment,

a

mobile

home,

a

group

of

rooms,

or

a

single

room

that

is

occupied

(1)

2010

US

Census

Quick

Facts

by

State|County |

37

New York Metro Market Profile

NICHE BUSINESSES

•

Just as this market is deposit rich, it is also rich with HVB’s targeted niche

businesses •

We have leading market share among Westchester attorneys and property managers

•

High

growth

potential

in

all

other

segments

and

counties,

each

with

HVB

market

share

currently

<2%

1 –

Dunn & Bradstreet Market Data based on Primary & Secondary NAICS

codes DATA DEMONSTRATES TREMENDOUS UNTAPPED ORGANIC GROWTH POTENTIAL IN HVB’S

CORE NICHE MARKETS Segment

Manhattan /

NY

Brooklyn

Bronx

Westchester

Rockland

Total

Attorney

9,251

1,784

546

2,266

563

14,410

Not for Profit

7,512

8,413

3,288

3,322

1,365

23,900

Real Estate Investors

4,169

1,251

578

933

227

7,158

Property Managers

5,253

3,202

1,269

1,907

499

12,130

Municipalities

809

417

283

537

197

2,243

Sub-Total

26,994

15,067

5,964

8,965

2,851

59,841

HVB NICHE BUSINESS BY COUNTY

(1) |

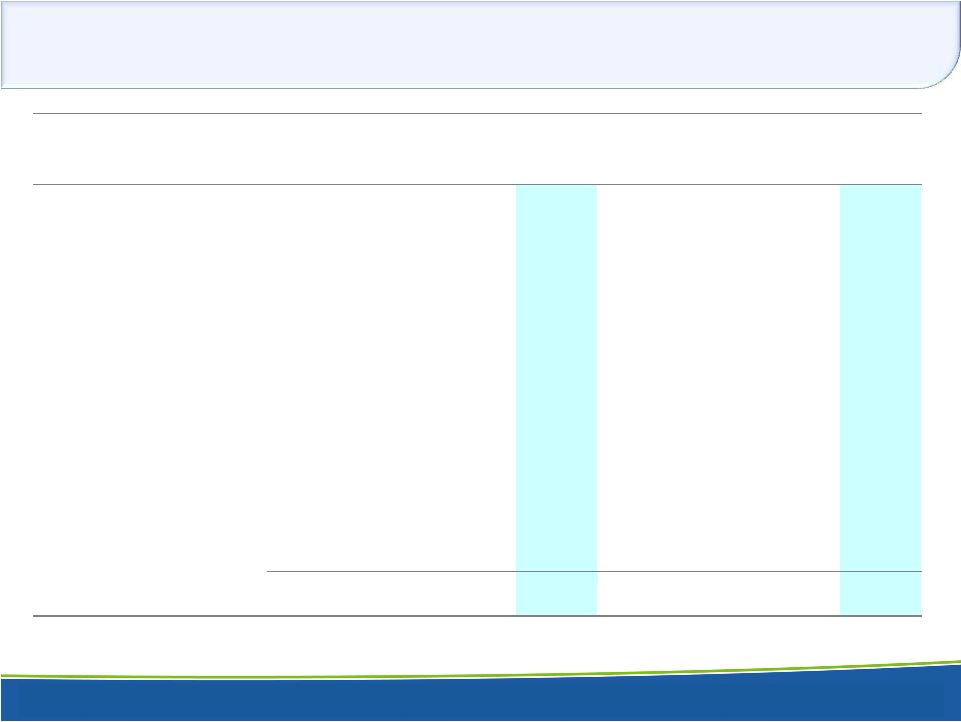

38

Client Retention

RELATIONSHIPS

ARE

NOT

BUILT

OVERNIGHT

–

IT

TAKES

TIME

DISTRIBUTION OF STRATEGIC CLIENT

RELATIONSHIPS (AS OF JUNE 30, 2013)

SEGMENT

% <2 YEARS

TENURE

% 2 TO 5

YEARS

TENURE

% 5 TO 10

YEARS

TENURE

% > 10 YEARS

TENURE

Attorney

4%

29%

30%

36%

Not-for-Profit

5%

31%

19%

45%

Property Managers /

Real Estate Investors

13%

40%

14%

33%

Municipalities

4%

27%

13%

56%

General Business

5%

26%

21%

48%

•

The

wait

is

worth

it

–

the

value

of

the

relationship

generally

increases

over

time |

39

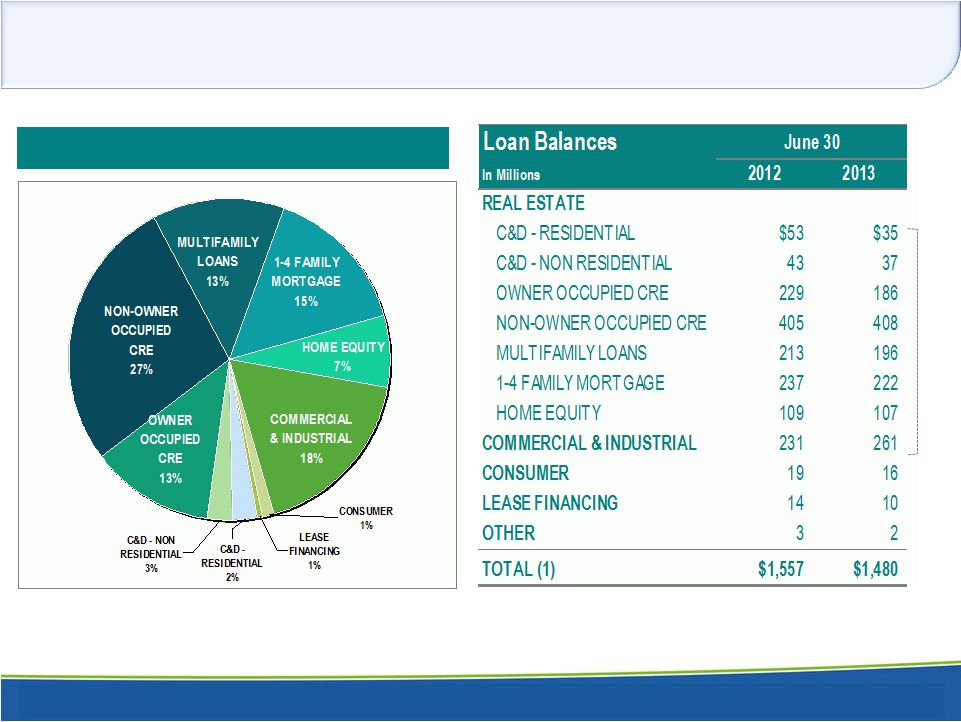

Strength in Diversified Commercial Lending

80%

LOAN COMPOSITION –

June 30, 2013

(1)

Total is gross of unearned income. |

40

HVB General Business Average Loan = $509,713

Businesses in Market > 395,091

> $201 BILLION LENDING OPPORTUNITY

Market Potential Example

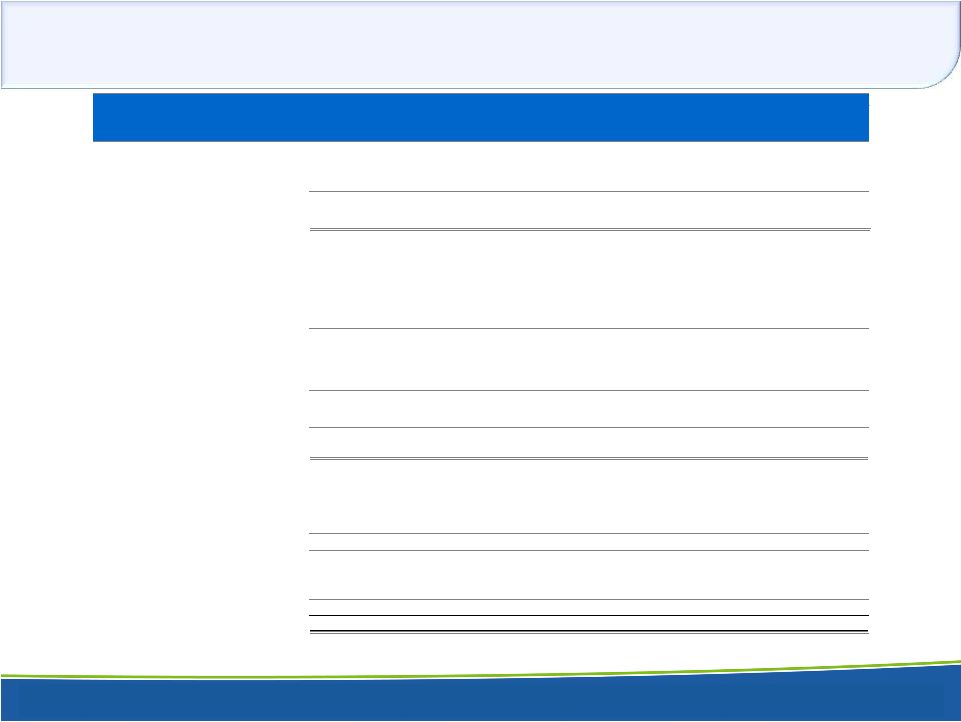

AS OF JUNE 30, 2013

SEGMENT

% OF STRATEGIC

CLIENT

RELATIONSHIPS

% OF

TOTAL BANK

DEPOSITS

AVERAGE

DEPOSITS PER

STRATEGIC CLIENT

RELATIONSHIP

(IN THOUSANDS)

% OF STRATEGIC

CLIENT

RELATIONSHIPS

WITH LOANS

Attorney

29%

20%

$853

29%

Not-for-Profit

18%

14%

$919

38%

Property

Managers/Real Estate

Investors

17%

23%

$1,618

59%

Municipalities

2%

8%

$4,970

7%

General Business

34%

24%

$839

49%

TOTAL / AVERAGE

100%

89%

$1,070 |

41

Quarterly Summary Financial Highlights

(a)

Excludes income from loan sales.

Dollars in thousands, except per share amounts

Q3 2011

Q4 2011

Q1 2012 (a)

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Net Interest Income

$30,038

$30,739

$31,296

$31,296

$25,508

$24,115

$22,410

$21,246

$21,068

Non Interest Income

$5,714

$4,136

$4,419

$20,354

$4,789

$4,353

$4,346

$4,517

$3,881

Non Interest Expense

$20,090

$18,967

$20,876

$20,876

$21,034

$20,035

$20,593

$19,611

$19,818

Net Income (Loss)

$8,508

($22,901)

$8,656

$18,013

$4,961

$3,134

$3,073

$3,651

$3,487

Net Interest Margin

4.47%

4.60%

4.75%

4.75%

3.93%

3.60%

3.28%

3.18%

3.06%

Diluted Earnings (Loss) Per Share

$0.43

($1.17)

$0.44

$0.92

$0.25

$0.16

$0.16

$0.18

$0.18

Dividends Per Share

$0.18

$0.18

$0.18

$0.18

$0.18

$0.18

$0.18

$0.06

$0.06

Return on Average Equity

11.33%

-30.07%

12.20%

25.51%

6.72%

4.32%

4.18%

5.02%

4.75%

Return on Average Assets

1.18%

-3.19%

1.21%

2.53%

0.71%

0.44%

0.43%

0.51%

0.47%

Efficiency Ratio

56.67%

52.79%

56.81%

56.81%

68.06%

69.33%

75.73%

74.97%

78.12%

Tangible Common Equity Ratio

9.6%

9.1%

9.6%

9.6%

9.6%

9.2%

9.3%

9.6%

9.0%

Average Assets

$2,872,159

$2,867,304

$2,845,223

$2,845,223

$2,795,090

$2,874,634

$2,883,086

$2,859,443

$2,949,423

Average Net Loans

$1,928,888

$2,028,587

$1,997,391

$1,997,391

$1,577,190

$1,505,942

$1,467,153

$1,422,132

$1,409,875

Average Deposits

$2,468,359

$2,463,056

$2,466,159

$2,466,159

$2,408,726

$2,489,378

$2,514,818

$2,493,021

$2,586,583

Average Stockholders' Equity

$300,338

$304,624

$282,459

$282,459

$295,378

$290,189

$293,886

$290,950

$293,616

Earnings |

42

Quarterly Loan Balances

(1)

Total is gross of unearned income.

Dollars in Millions

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

REAL ESTATE

C&D - RESIDENTIAL

62

53

51

53

48

34

27

35

C&D - NON RESIDENTIAL

83

57

56

43

43

41

43

37

OWNER OCCUPIED CRE

318

244

256

229

195

181

177

186

NON-OWNER OCCUPIED CRE

500

447

449

405

389

369

399

408

MULTIFAMILY LOANS

507

228

225

213

209

196

195

196

1-4 FAMILY MORTGAGE

187

175

232

237

214

216

189

222

HOME EQUITY

118

113

111

109

109

110

106

107

COMMERCIAL & INDUSTRIAL

222

219

222

231

266

289

250

261

CONSUMER

28

27

27

19

20

19

17

16

LEASE FINANCING

13

12

15

14

14

14

11

10

OTHER

2

0

1

3

3

3

1

2

TOTAL (1)

$2,040

$1,575

$1,645

$1,557

$1,510

$1,472

$1,415

$1,480

Period Ending |

43

Non-GAAP Reconciliation

(a) Year Ended Dec 31,2012

(b) The loan sale in the first quarter of 2012 resulted in a gross gain of

$15,935. Related income taxes totaled $6,578. Excluding

Loan Sale

in thousands except share and per share

numbers

2007

2008

2009

2010

2011

2012(a)

2012(a,b)

2013

Net Income as reported

34,483

$

30,877

$

19,012

$

5,113

$

(2,137)

$

29,181

$

19,824

$

7,138

$

Income attributable to participating

shares as reported

-

-

-

-

-

(85)

(57)

(96)

Net Income attributable to common

shares as reported

34,483

$

30,877

$

19,012

$

5,113

$

(2,137)

$

29,096

$

19,766

$

7,042

$

Net Income as reported

34,483

$

30,877

$

19,012

$

5,113

$

(2,137)

$

29,181

$

19,824

$

7,138

$

Exclude:

Income Tax (1)

18,259

15,646

7,310

(1,406)

(5,413)

16,945

10,367

3,083

Provision for Loan Loss (2)

1,470

11,025

24,306

46,527

64,154

8,507

8,507

1,061

Income attributable to participating

shares (3)

-

-

-

-

-

(158)

(112)

(152)

Pre-tax, Pre-provision Earnings

54,212

$

57,548

$

50,628

$

50,234

$

56,605

$

54,474

$

38,586

$

11,130

$

Weighted Average Diluted common

shares

14,906,752

14,973,866

15,307,674

19,455,971

19,462,055

19,545,037

19,545,037

19,572,975

Diluted Earnings per Share as reported

2.31

$

2.06

$

1.24

$

0.26

$

(0.11)

$

1.49

$

1.01

$

0.36

$

Effects of (1) and (2) above

1.33

$

1.78

2.07

2.32

3.02

1.30

0.96

0.21

Pre-Tax, Pre-Provision Diluted Earnings

per Common Share

3.64

$

3.84

$

3.31

$

2.58

$

2.91

$

2.79

$

1.97

$

0.57

$

Tangible Equity Ratio:

Total Stockholders' Equity:

As reported

203,687

$

207,500

$

293,678

$

289,917

$

277,562

$

290,971

$

290,971

$

289,466

$

Less: Goodwill and other intangible

assets

20,296

25,040

27,118

26,296

25,493

24,745

24,745

24,650

Tangible stockholders' equity

183,391

$

182,460

$

266,560

$

263,621

$

252,069

$

266,226

$

266,226

$

264,816

$

Total Assets:

As reported

2,330,748

$

2,540,890

$

2,665,556

$

2,669,033

$

2,797,670

$

2,891,246

$

2,891,246

$

2,981,975

$

Less: Goodwill and other intangible

assets

20,296

25,040

27,118

26,296

25,493

24,745

24,745

24,650

Tangible assets

2,310,452

$

2,515,850

$

2,638,438

$

2,642,737

$

2,772,177

$

2,866,501

$

2,866,501

$

2,957,325

$

Tangible equity ratio

7.9%

7.3%

10.1%

10.0%

9.1%

9.3%

9.3%

9.0% |

44

THANK YOU FOR YOUR INTEREST IN

THANK YOU FOR YOUR INTEREST IN

HUDSON VALLEY HOLDING CORP.

HUDSON VALLEY HOLDING CORP.

Ticker: HVB

Ticker: HVB

www.hudsonvalleybank.com

www.hudsonvalleybank.com

August 2013

August 2013 |