Attached files

| file | filename |

|---|---|

| 8-K - META FINANCIAL GROUP, INC 8-K 8-20-2013 - META FINANCIAL GROUP INC | form8k.htm |

Exhibit 99.1

Forward Looking Statements Corporate Profile: Meta Financial Group, Inc.®, (“Meta Financial” or the “Company”) and its wholly-owned subsidiary, MetaBank™ (the “Bank” or “MetaBank”), may from time to time make written or oral “forward-looking statements,” including statements contained in its filings with the Securities and Exchange Commission (“SEC”), in its reports to stockholders, and in other communications by the Company, which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements include statements with respect to the Company’s beliefs, expectations, estimates, and intentions that are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such statements address, among others, the following subjects: future operating results; customer retention; loan and other product demand; important components of the Company’s balance sheet and income statements; growth and expansion; new products and services, such as those offered by the Bank or Meta Payment Systems® (“MPS”), a division of the Bank; credit quality and adequacy of reserves; technology; and the Company’s employees. The following factors, among others, could cause the Company’s financial performance to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), as well as efforts of the United States Treasury in conjunction with bank regulatory agencies to stimulate the economy and protect the financial system; inflation, interest rate, market, and monetary fluctuations; the timely development of and acceptance of new products and services offered by the Company as well as risks (including reputational and litigation) attendant thereto and the perceived overall value of these products and services by users; the risks of dealing with or utilizing third parties; the scope of restrictions and compliance requirements imposed by the supervisory directives and/or the Consent Orders entered into by the Company and the Bank with the Office of Thrift Supervision (the functions of which were transferred to the Office of the Comptroller of the Currency (“OCC”) and the Federal Reserve) and any other such regulatory actions which may be initiated; the impact of changes in financial services’ laws and regulations, including but not limited to our relationship with our regulators, the OCC and the Federal Reserve; technological changes, including, but not limited to, the protection of electronic files or databases; acquisitions; litigation risk in general, including, but not limited to, those risks involving the MPS division; the growth of the Company’s business, as well as expenses related thereto; changes in consumer spending and saving habits; and the success of the Company at managing and collecting assets of borrowers in default. The foregoing list of factors is not exclusive. Additional discussions of factors affecting the Company’s business and prospects are contained in the Company’s periodic filings with the SEC. The Company expressly disclaims any intent or obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries. Other important information about the Company is available at http://www.metafinancialgroup.com *

Meta Management * J. Tyler Haahr Chairman, President and Chief Executive Officer, Meta Financial Group Tyler Haahr has been with Meta Financial Group since March 1997. Previously he was a partner with the law firm of Lewis and Roca LLP, Phoenix, Arizona. Tyler received his B.S. degree with honors at the University of South Dakota in Vermillion, SD. He graduated with honors from the Georgetown University Law Center, Washington, D.C. Brad C. Hanson President, Meta Payment Systems and EVP, Meta Financial Group and MetaBank Brad Hanson founded Meta Payment Systems in May 2004. He has more than 20 years of experience in financial services, including numerous banking, card industry and technology-related capacities. During his career Brad has played a significant role in the development of the prepaid card industry. Brad graduated from the University of South Dakota in Vermillion, SD with a degree in Economics. David W. Leedom Chief Financial Officer, Meta Financial Group and MetaBank Dave Leedom joined Meta Payment Systems in January 2007 and assumed the CFO responsibilities for Meta Financial Group and MetaBank in October 2007. Dave is a certified public accountant (CPA) with more than 35 years of professional experience, including 28 years in the financial services industry. During this time Dave worked at Coopers & Lybrand (PricewaterhouseCoopers) and Citibank. Dave received a B.S.of Business Administration in Accounting degree from the University of Iowa.

Who we are … Assets Strong Economy and Local Markets $1,318 M NetSpend Money Network Blackhawk * $341 M Iowa South Dakota MetaBank Retail Bank Meta Payment Systems Meta Financial Group Solid Partners

Who we are … Meta Financial Group (NASDAQ: CASH) Added to Russell 2000 Index in June 2013 Top 5 in ABA Banking Journal’s annual Performance Ranking for $1B-$10B banks Sandler O’Neill’s Small-Cap All Star list Unique cost of funds advantage of 0.17% at 06/30/13 (MetaBank) Retail Bank Solid community bank Strong local economy 11 branch locations in Iowa and South Dakota Meta Payment Systems (MPS) Dynamic payment systems division Top prepaid card issuer in US Strong deposit growth Nationally focused *

Strategic Direction Grow MPS Division Scalable operating infrastructure Leverage low/no cost funds Diverse product set: reloadable, payroll, gift, incentive and travel MPS “financial inclusion” programs for unbanked, underbanked Exercise “Early Adopter” advantage in regulatory compliance Ensure strong credit, investment quality Emphasize asset diversification, yield enhancement New product initiatives – payments, deposits and credit (e.g. MyTurn) *

Compliance and Oversight Systems Early adopter of sophisticated compliance systems Investments in program design, training and technology Implemented enhanced BSA/AML technology Enhanced infrastructure will support growth with moderating expenses High competitive barriers to entry Expertise, Capital, Compliance Operational infrastructure High start-up costs Substantial progress with OCC *

Growing our business Capitalizing on synergies: community banking, MPS MPS provides MFG over $1.1 billion in no-cost funds High growth industry segment Material benefits as interest rates normalize Leveraging MPS leadership in prepaid card segment High growth industry Meta sponsors 70% of U.S. “white label” ATMs Emergent leader in “virtual cards” for electronic settlements 33 patents with over a dozen pending *

Total Deposits * Fiscal Year End September 30 Deposits-$millions Cost of Funds

Retail Bank Successful regional enterprise Over a half-century in business 11 locations in Iowa and S. Dakota Stable, profitable operations Strong, loyal customer base Diverse customer base Attractive combination of retail, commercial and agricultural Expect loan growth to increase going forward Very strong credit quality *

* Where MetaBank is located Brookings Sioux Falls Storm Lake Des Moines

Financial Highlights Net Income $3.7 million in third quarter of fiscal 2013, +53% over prior year Strong earnings profile ROAA of 0.77% and ROAE of 9.09% for third quarter 2013 Strong and improving asset quality NPAs markedly lower than peer group Increased franchise value Compliance and risk management initiatives Capital management Capital raise supports growth opportunities *

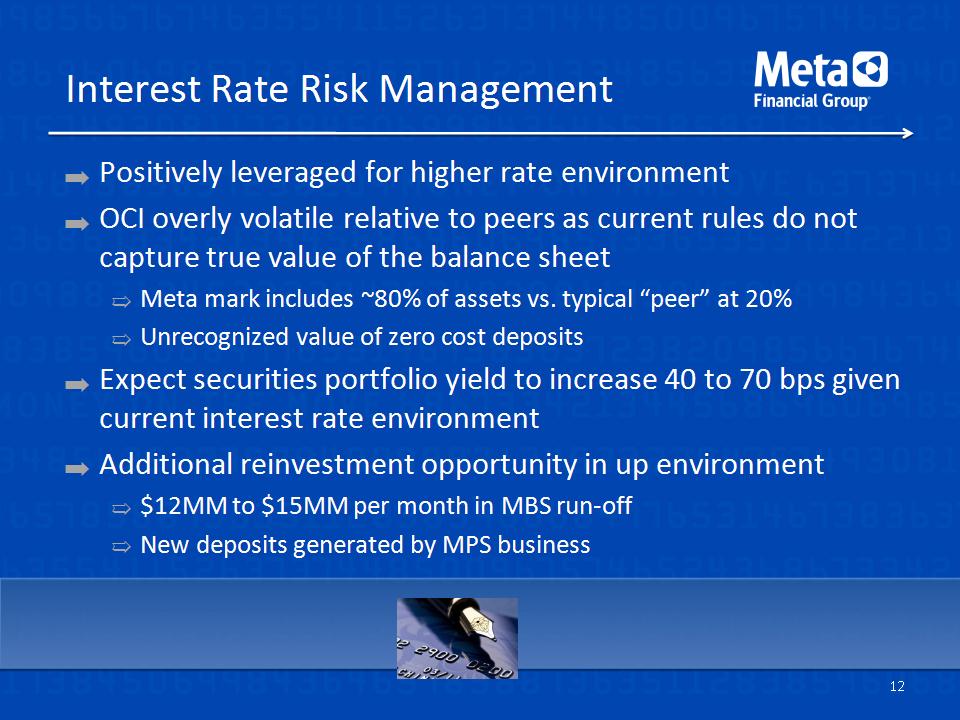

Interest Rate Risk Management Positively leveraged for higher rate environment OCI overly volatile relative to peers as current rules do not capture true value of the balance sheet Meta mark includes ~80% of assets vs. typical “peer” at 20% Unrecognized value of zero cost deposits Expect securities portfolio yield to increase 40 to 70 bps given current interest rate environment Additional reinvestment opportunity in up environment $12MM to $15MM per month in MBS run-off New deposits generated by MPS business *

Capital Management Successfully raised $61.0 million in new capital $13.2 million in May 2012 – private placement $34.2 million in September 2012 – private placement $13.6 million in July-August 2013 – ATM offering Investors include existing and new shareholders, and strategic partners Maintain strong capital ratios Common Equity Tier 1 capital at least 8% Risk-Based over 20% Support growth and potential acquisition opportunities *

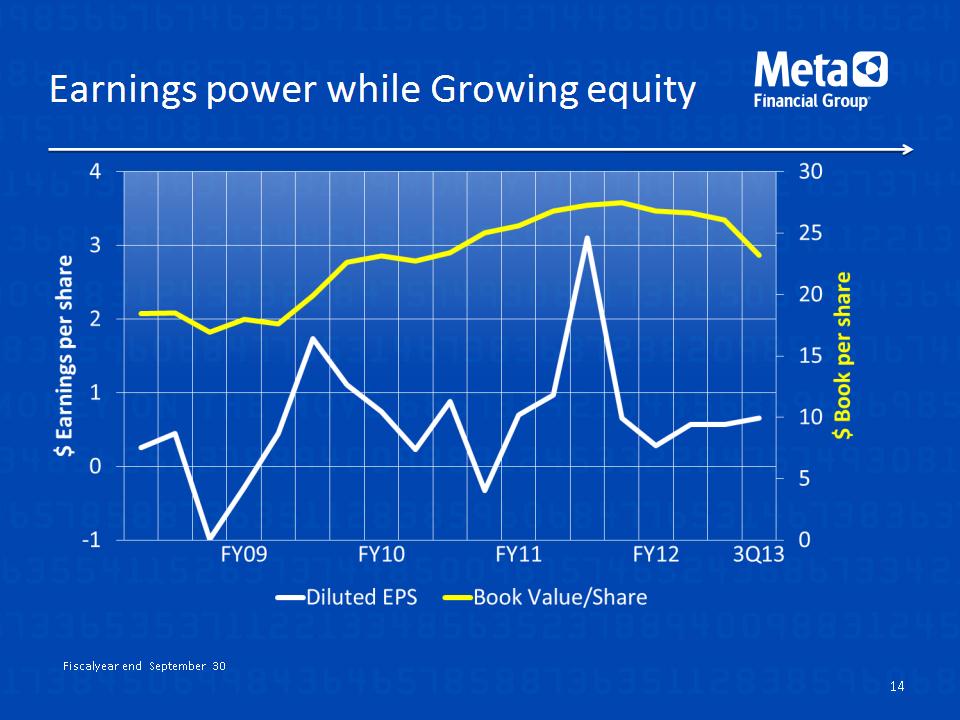

Earnings power while Growing equity * Fiscal year end September 30

Balance Sheet ($000s) * Sep08 Sep09 Sep10 Sep11 Sep12 Jun13* Cash And Cash Equivalents 15,088 47,778 94,248 132,149 106,067 62,211 Investments and MBS 218,189 345,574 511,011 615,320 998,826 1,248,482 Loans Receivable Net 425,633 395,065 369,563 314,484 329,689 335,936 Other Assets 110,585 93,409 64,037 64,825 61,412 86,578 Assets 769,495 881,826 1,038,859 1,126,778 1,495,994 1,733,207 Liabilities 721,392 835,374 968,144 1,047,699 1,387,222 1,586,207 Shareholders' Equity 48103 46,452 70,715 79,079 108,772 147,000 Liabilities and Equity 769,495 881,826 1,038,859 1,126,778 1,495,994 1,733,207 *Does not include Jul-Aug13 capital raise Quarter Average Fiscal Year End September 30

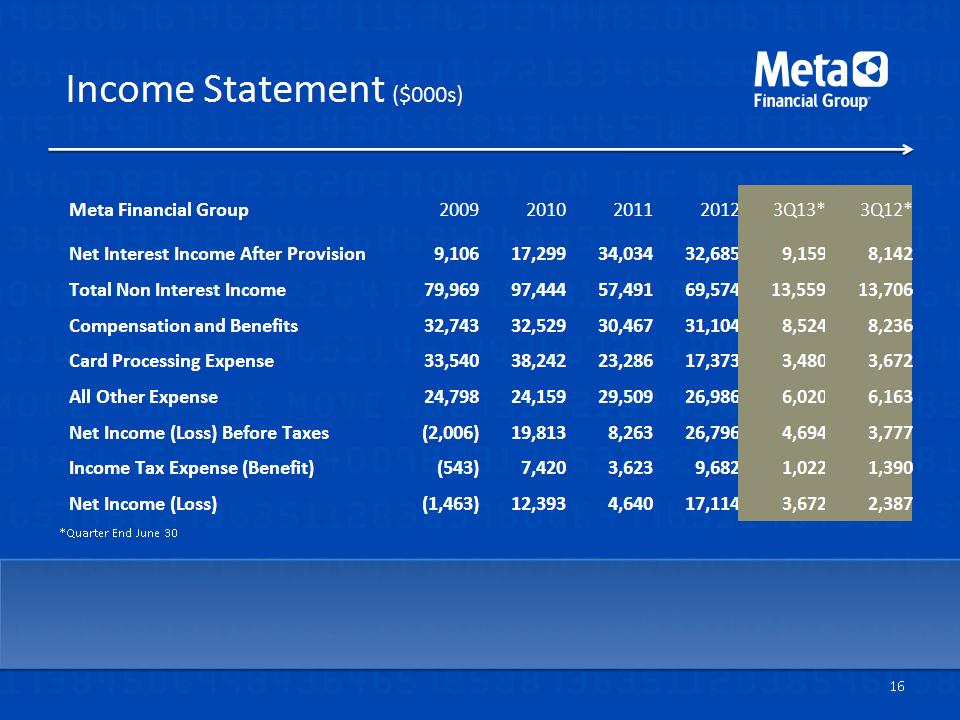

Income Statement ($000s) * Meta Financial Group 2009 2010 2011 2012 3Q13* 3Q12* Net Interest Income After Provision 9,106 17,299 34,034 32,685 9,159 8,142 Total Non Interest Income 79,969 97,444 57,491 69,574 13,559 13,706 Compensation and Benefits 32,743 32,529 30,467 31,104 8,524 8,236 Card Processing Expense 33,540 38,242 23,286 17,373 3,480 3,672 All Other Expense 24,798 24,159 29,509 26,986 6,020 6,163 Net Income (Loss) Before Taxes (2,006) 19,813 8,263 26,796 4,694 3,777 Income Tax Expense (Benefit) (543) 7,420 3,623 9,682 1,022 1,390 Net Income (Loss) (1,463) 12,393 4,640 17,114 3,672 2,387 *Quarter End June 30

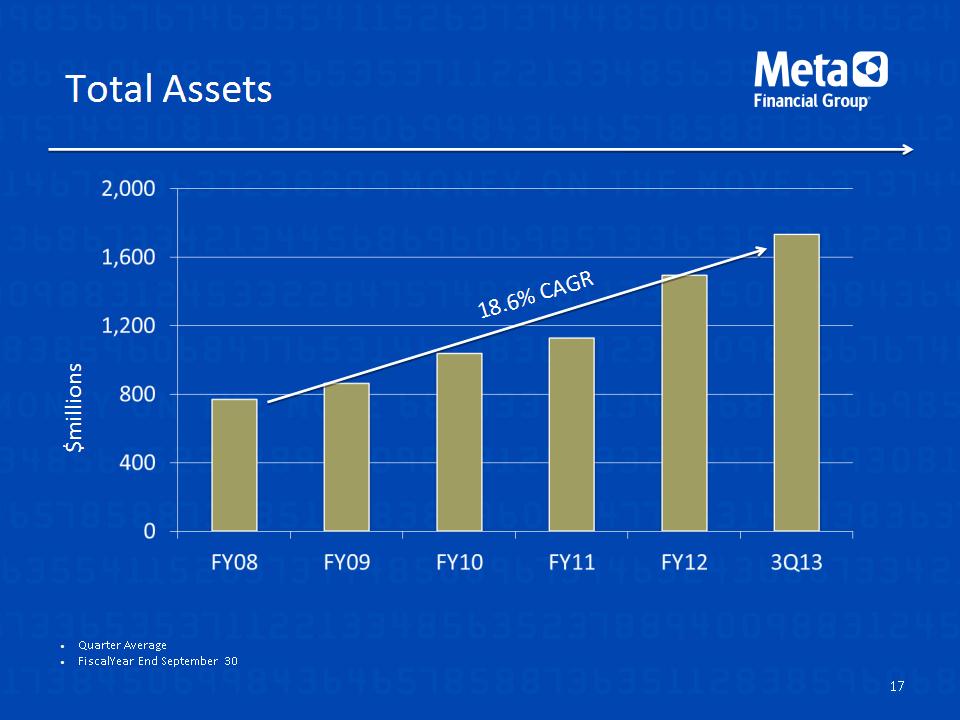

Total Assets * Quarter Average Fiscal Year End September 30 18.6% CAGR $millions

Total Net Loans * Quarter Average Fiscal Year End September 30 $millions

Non-Performing Assets * Fiscal Year End September 30 $millions of non-performing assets % of total assets

Total Revenue * Fiscal Year End September 30 $millions

Total Net Income (Loss) * Fiscal Year End September 30 $millions * $11.4M gain on sale of GNMA securities

Meta Value Proposition Leading issuer of prepaid debit cards Springboard into other products and services Strong capital position Capacity to fund significant growth objectives Steady dividend policy Potential for sharp upward trend in earnings Normalized interest rates and asset diversification ~85% of deposits are no-cost *

* NASDAQ: CASH