Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MAXIM INTEGRATED PRODUCTS INC | maxm8-kinvestorpresentatio.htm |

| EX-99.2 - TRANSCRIPT - MAXIM INTEGRATED PRODUCTS INC | maxim8-kexhibit9928x15x2013.htm |

Maxim Integrated to Acquire Volterra Semiconductor August 15, 2013

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements generally can be identified by phrases such as Maxim, Volterra or management of either company "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe the proposed transaction, including its financial impact and expected benefits and timing, and other statements of management's beliefs, intentions or goals, including related to the proposed transaction, also are forward-looking statements. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the combined companies or the price of Maxim or Volterra stock. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including but not limited to: the ability of the parties to consummate the proposed transaction and the satisfaction of the conditions precedent to consummation of the proposed transaction, including the ability to secure regulatory approvals at all or in a timely manner; any adverse impacts on the business of Maxim or Volterra during the pendency of the proposed transaction; the ability of Maxim to successfully integrate Volterra's operations, product lines and technology and realize additional opportunities for growth; the ability of Maxim to realize synergies in terms of growth and cost savings; and the other risks and important factors contained and identified in Maxim's and Volterra’s most recent Annual Report on Form 10-K, and other SEC filings of the companies, that could cause actual results to differ materially from the forward-looking statements. All forward-looking statements included in this news release are made as of the date hereof, based on the information available to Maxim as of the date hereof, and Maxim assumes no obligation to update any forward-looking statement except as required by law. 2 Safe Harbor Statement

This announcement and the description contained herein are for informational purposes only and are not an offer to purchase or a solicitation of an offer to sell securities of Volterra. Maxim has not commenced the tender offer for shares of Volterra’s stock described in this announcement. Upon commencement of the tender offer, Maxim and its wholly-owned subsidiary intend to file with the U.S. Securities and Exchange Commission (SEC) a tender offer statement on Schedule TO and related exhibits, including an offer to purchase, letter of transmittal, and other related documents. Following commencement of the tender offer, Volterra will file with the SEC a solicitation/recommendation statement on Schedule 14D-9 and, if required, will file a proxy statement or information statement with the Securities and Exchange Commission in connection with the merger at a later date. Such documents will be mailed to stockholders of record and will also be made available for distribution to beneficial owners of shares of Volterra’s stock. The solicitation of offers to buy shares of Volterra’s stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents. Stockholders should read the offer to purchase and solicitation/recommendation statement, the tender offer statement on Schedule TO. the proxy statement, the information statement and all related documents and exhibits if and when such documents are filed and become available, as they will contain important information about the tender offer and the proposed merger. Stockholders can obtain these documents when they are filed and become available free of charge from the SEC's website at www.sec.gov, by contacting the investor relations departments of Maxim or Volterra at their respective email addresses included below or from the information agent Maxim selects. 3 Notice to Investors

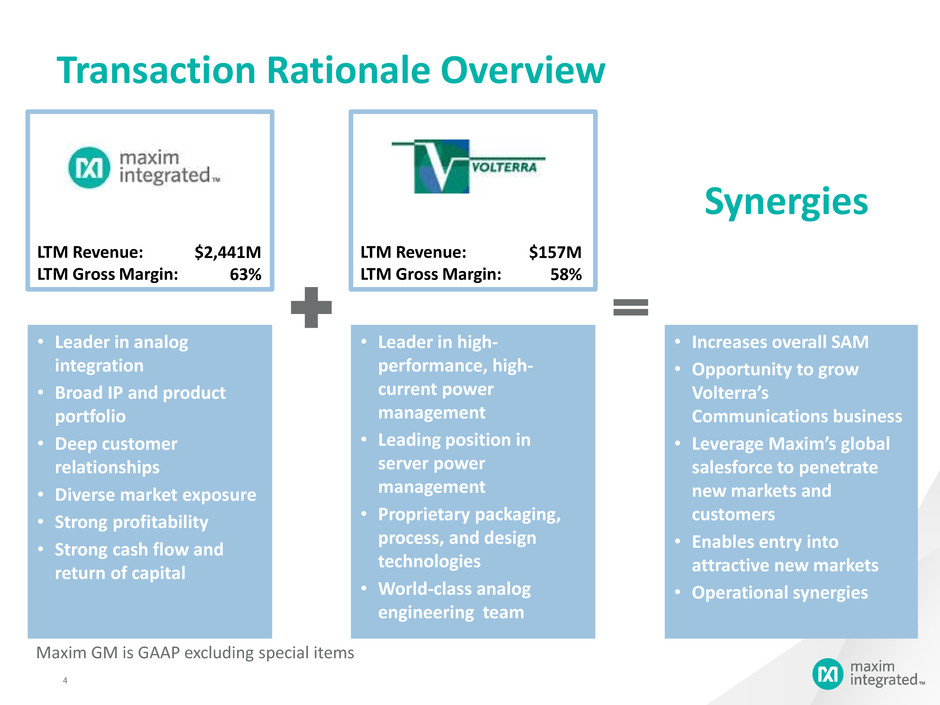

4 LTM Revenue: LTM Gross Margin: • Leader in analog integration • Broad IP and product portfolio • Deep customer relationships • Diverse market exposure • Strong profitability • Strong cash flow and return of capital • Leader in high- performance, high- current power management • Leading position in server power management • Proprietary packaging, process, and design technologies • World-class analog engineering team • Increases overall SAM • Opportunity to grow Volterra’s Communications business • Leverage Maxim’s global salesforce to penetrate new markets and customers • Enables entry into attractive new markets • Operational synergies Synergies $2,441M 63% LTM Revenue: LTM Gross Margin: $157M 58% Transaction Rationale Overview Maxim GM is GAAP excluding special items

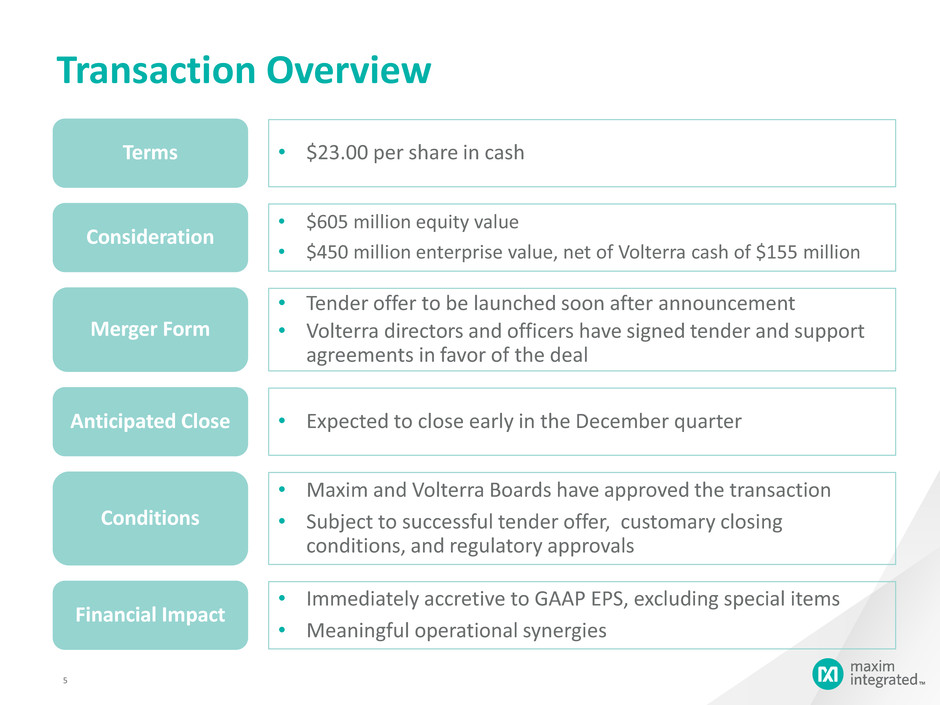

• $23.00 per share in cash 5 Terms Consideration Conditions • $605 million equity value • $450 million enterprise value, net of Volterra cash of $155 million • Maxim and Volterra Boards have approved the transaction • Subject to successful tender offer, customary closing conditions, and regulatory approvals Anticipated Close • Expected to close early in the December quarter Merger Form • Tender offer to be launched soon after announcement • Volterra directors and officers have signed tender and support agreements in favor of the deal Financial Impact • Immediately accretive to GAAP EPS, excluding special items • Meaningful operational synergies Transaction Overview

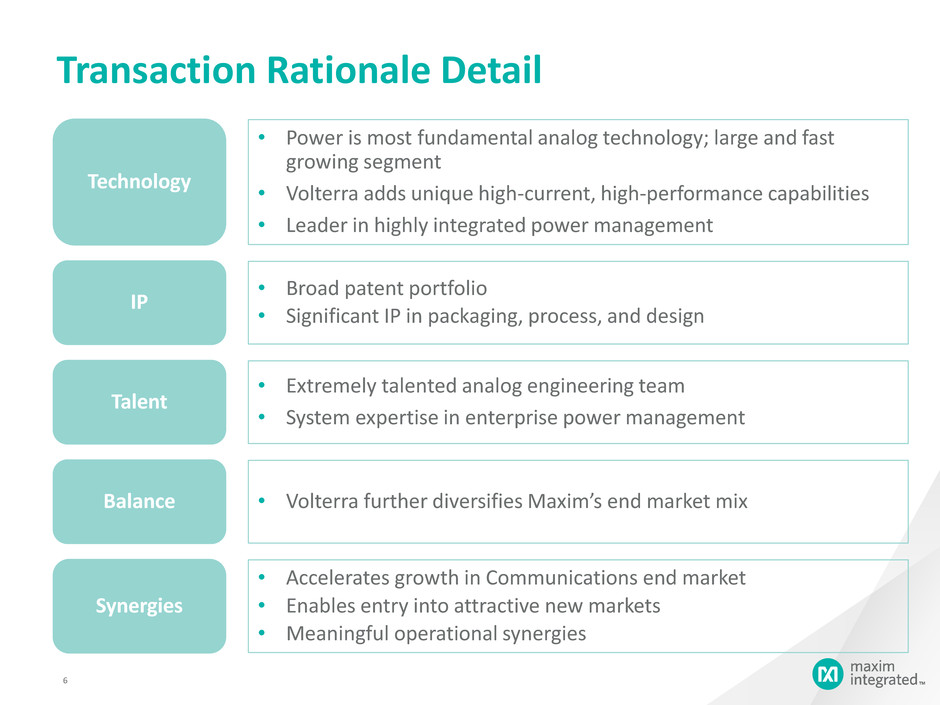

6 • Power is most fundamental analog technology; large and fast growing segment • Volterra adds unique high-current, high-performance capabilities • Leader in highly integrated power management Technology IP Synergies • Broad patent portfolio • Significant IP in packaging, process, and design • Accelerates growth in Communications end market • Enables entry into attractive new markets • Meaningful operational synergies Balance • Volterra further diversifies Maxim’s end market mix Talent • Extremely talented analog engineering team • System expertise in enterprise power management Transaction Rationale Detail

Innovation Unique technology breakthroughs that address a compelling market need Integration Combining diverse analog and mixed signal technologies to save customers effort, space, cost, & power Balance Mix of high-growth businesses with stable, highly profitable businesses 7 Complementary to Maxim’s Strategy Vo lt er ra P os it io n • Seven generations of high- current density solutions • Record of innovation across design, process, packaging and system solutions • Volterra has a highly differentiated integrated power management solution • Integration has inherent size and efficiency advantages • Technology applicable to diverse markets and applications • Further diversifies Maxim’s end market mix • Attractive new growth opportunities: Solar and Battery

8 Communications Infrastructure • Power density • Performance Enterprise • Power density • Performance Consumer • Space, cost, power Mobile • Space, battery life Medical/Industrial • Portability, reliability Automotive • Space, weight • Fewer parts = higher reliability Energy • Size • Efficiency Analog Integration: Not Just a Mobile Trend

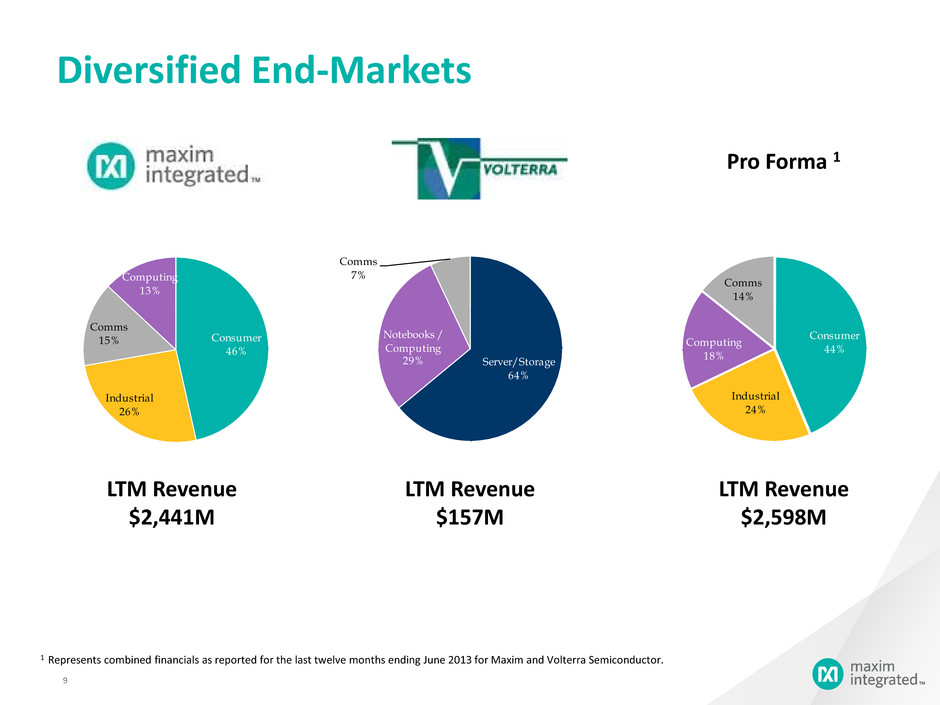

Consumer 46% Industrial 26% Comms 15% Computing 13% 9 Pro Forma 1 LTM Revenue $2,441M LTM Revenue $157M LTM Revenue $2,598M 1 Represents combined financials as reported for the last twelve months ending June 2013 for Maxim and Volterra Semiconductor. Server/Storage 64% Notebooks / Computing 29% Comms 7% Consumer 44% Industrial 24% Computing 18% Comms 14% Diversified End-Markets

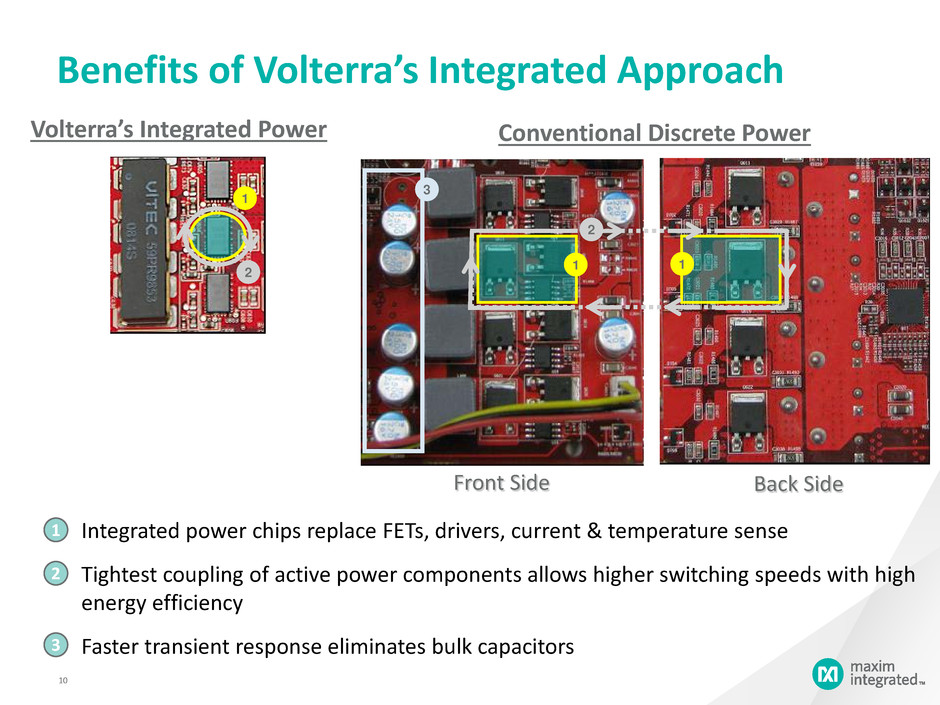

• Integrated power chips replace FETs, drivers, current & temperature sense • Tightest coupling of active power components allows higher switching speeds with high energy efficiency • Faster transient response eliminates bulk capacitors Conventional Discrete Power Volterra’s Integrated Power Front Side Back Side 1 1 1 1 2 2 2 3 3 Benefits of Volterra’s Integrated Approach 10

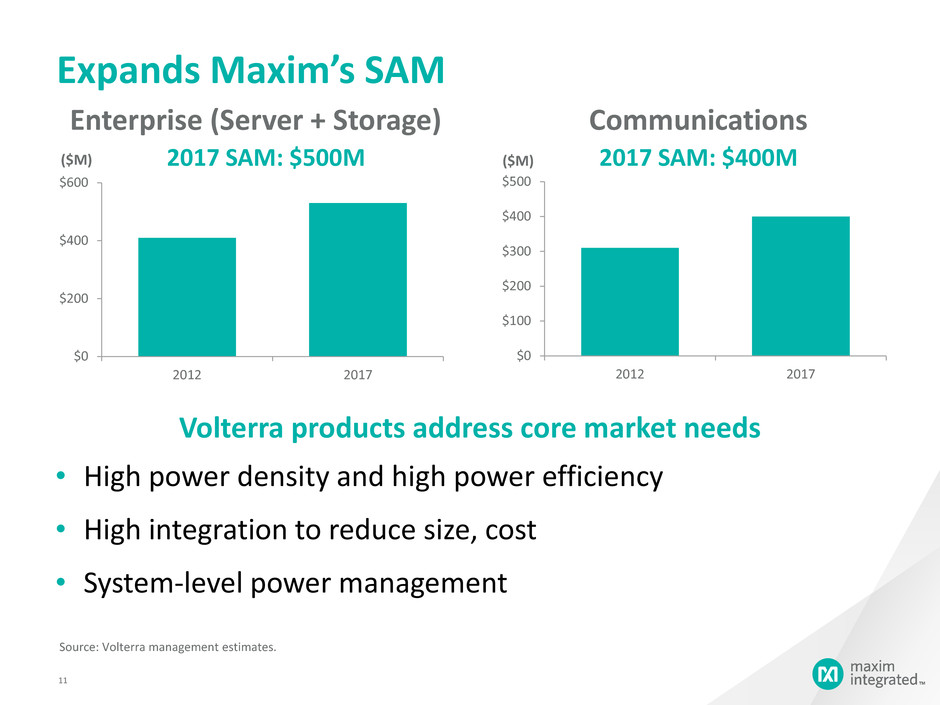

11 Source: Volterra management estimates. Enterprise (Server + Storage) Communications $0 $200 $400 $600 2012 2017 $0 $100 $200 $300 $400 $500 2012 2017 Volterra products address core market needs • High power density and high power efficiency • High integration to reduce size, cost • System-level power management 2017 SAM: $500M 2017 SAM: $400M Expands Maxim’s SAM ($M) ($M)

Financial Overview 12 Last Twelve Months Long-Term Model Maxim Volterra Pro Forma2 Revenue ($M) $2,441 $157 $2,598 Gross Margin1 62.7% 57.6% 62.4% 61% - 64% Operating Margin1 27.5% 9.7% 26.4% 30%+ • Large revenue base with approximately $2.6 billion in LTM revenue • Strong combined gross and operating margins • Significant cash flow generation Source: SEC Filings Note: LTM ending June 30, 2013. 1 Maxim: GAAP excluding special items; Volterra: Includes stock-based compensation expense. 2 Combined financials assume no synergies.

Summary • Power is the most fundamental analog technology • Volterra’s products open incremental $900M 2017 SAM opportunity for Maxim • Leader in highly integrated power management solutions • Highly talented analog engineering team • Valuable patent portfolio in packaging, process, and design • Maxim’s preferred supplier status and broader market reach enables faster adoption of Volterra technology • Acquisition immediately accretive to earnings 13