Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NTS, INC. | nts_8k.htm |

| EX-99.1 - EARNING RELEASE - NTS, INC. | nts_ex991.htm |

Exhibit 99.2

2Q FY2013

Financial Results

CONFERENCE CALL

Presenters

2

• Guy Nissenson, Chairman, President & CEO

• Niv Krikov, CFO

Safe Harbor Statement

This presentation may contain forward-looking statements. The words or phrases "would be", "will allow", "should“, "intends to", "will likely result", "are

expected to", "will continue", "is anticipated", "estimate", "plan", "project", or similar expressions are intended to identify "forward-looking statements".

Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties. These

risks and uncertainties include issues related to the ability to: obtain sufficient funding to continue operations, maintain adequate cash flow, profitably

exploit new business, license and sign new agreements; issues related to rapidly changing technology and evolving standards in the industries in which

the Company and its subsidiaries operate; the Company’s ability to compete effectively and adjust to rapidly changing market dynamics; the

unpredictable nature of consumer preferences; and other factors set forth in the Company's most recently filed annual report and/or registration

statement. In addition, these and other factors may cause financials results to fluctuate from one financial quarter to another. Statements made herein

are as of the date of this presentation and should not be relied upon as of any subsequent date. The Company cautions not to place undue reliance on

such statements. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-

looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement. You should carefully

review the risks and uncertainties described in other documents that the Company files from time to time with the U.S. Securities and Exchange

Commission.

expected to", "will continue", "is anticipated", "estimate", "plan", "project", or similar expressions are intended to identify "forward-looking statements".

Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties. These

risks and uncertainties include issues related to the ability to: obtain sufficient funding to continue operations, maintain adequate cash flow, profitably

exploit new business, license and sign new agreements; issues related to rapidly changing technology and evolving standards in the industries in which

the Company and its subsidiaries operate; the Company’s ability to compete effectively and adjust to rapidly changing market dynamics; the

unpredictable nature of consumer preferences; and other factors set forth in the Company's most recently filed annual report and/or registration

statement. In addition, these and other factors may cause financials results to fluctuate from one financial quarter to another. Statements made herein

are as of the date of this presentation and should not be relied upon as of any subsequent date. The Company cautions not to place undue reliance on

such statements. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-

looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement. You should carefully

review the risks and uncertainties described in other documents that the Company files from time to time with the U.S. Securities and Exchange

Commission.

3

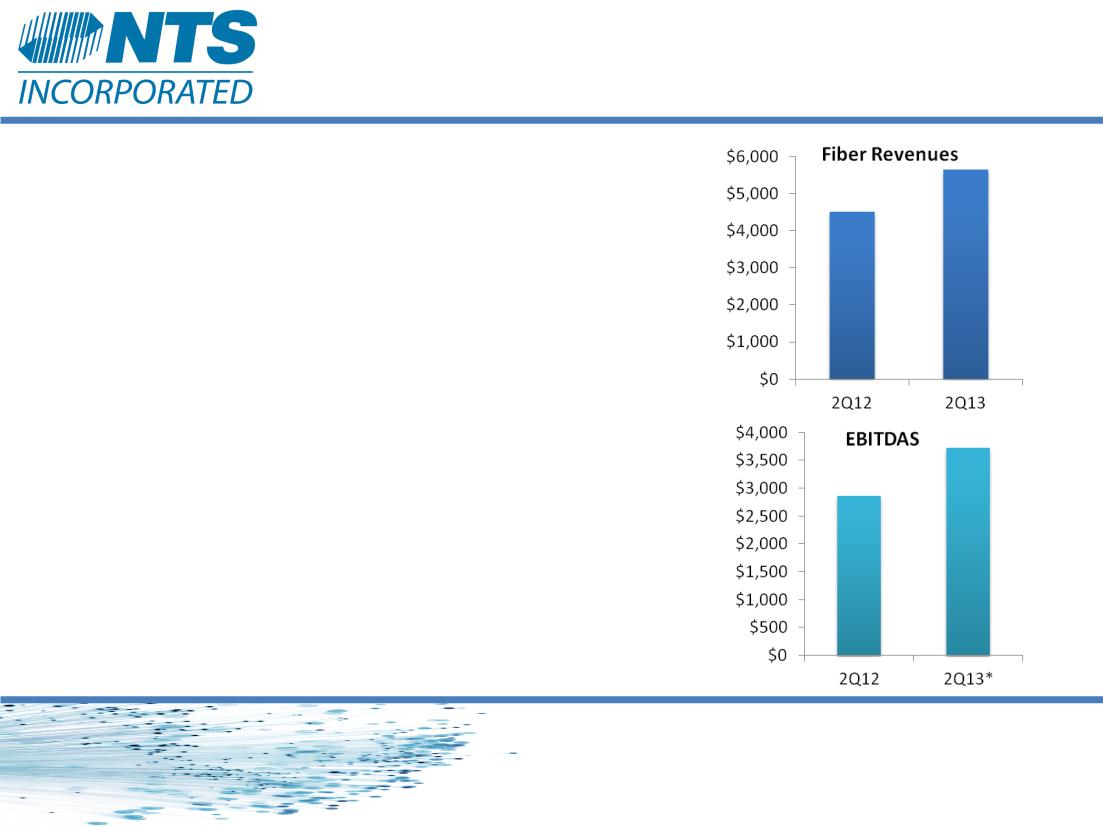

Recent Progress: 2Q13

4

• Continued steady revenue growth

– Fiber revenues grew 25% to $5.7 million

– Total revenues of $15.2 million

• Adjusted EBITDAS* grew 29.8% to $3.7 million

• Signed first customer in Abilene, TX

• 480 customers added

• Construction delays in Wichita Falls and Hammond

created backlog of 700 high margin business

customers

created backlog of 700 high margin business

customers

• Expect significant customer and fiber revenue

growth as installations are completed

growth as installations are completed

* Adjusted EBITDAS excludes $1.5 million in write offs and a significantly higher than usual bad debt expense. Please refer to

the 2Q13 press release for Adjusted EBITDAS Reconciliation

the 2Q13 press release for Adjusted EBITDAS Reconciliation

|

|

2013

|

2012

|

|

Revenues

Services on FTTP Network

Growth Rate

|

$ 5,653

25%

|

$ 4,513

|

|

Leased loop services &other

Growth Rate

|

$ 9,534

-10%

|

$ 10,571

|

|

Total Revenues

Growth Rate

|

$ 15,186

1%

|

$ 15,085

|

|

Expenses

Cost of Services

% of Sales

|

6,731

45%

|

6,820

45%

|

|

SG&A Expenses

% of Sales

|

6,401

42%

|

5,437

36%

|

|

Financing expense, net

|

1,661

|

1,119

|

|

Total Expenses

|

16,700

|

15,008

|

|

Net Income (loss)

|

(985)

|

73

|

|

Basic & diluted income (loss) per share

|

$ (0.02)

|

$ 0.00

|

|

Basic & diluted weighted averaged

number of shares

|

41,237,618

|

41,186,596

|

|

EBITDAS

|

$ 3,721

|

$ 2,866

|

|

% of sales

|

25%

|

19%

|

Income Statement

(in thousands, except per share data)

Quarter Ended June 30,

5

Balance Sheet Highlights

6

|

|

As of 6/30/13

|

As of 12/31/12

|

|

Current Assets

|

|

|

|

Cash

|

$ 9,937

|

$ 3,909

|

|

Accounts receivable, net

|

4,532

|

5,157

|

|

Prepaid expenses and other receivables

|

3,400

|

3,809

|

|

19,009

|

13,912

|

|

|

Fixed Assets, Net

|

98,295

|

89,468

|

|

Total Assets

|

$ 121,959

|

$ 108,483

|

|

Current Liabilities

|

|

|

|

Short-term bank credit and current maturities of

notes payable |

3,861

|

2,542

|

|

Trade payables

|

12,345

|

8,499

|

|

Other liabilities and accrued expenses

|

4,644

|

5,069

|

|

Current maturities of bonds

|

3,753

|

3,627

|

|

Total Current Liabilities

|

24,899

|

20,161

|

|

Notes Payable to the US Department of Agriculture, Net of

Current Maturities |

41,310

|

35,520

|

|

Notes Payable, Net of Current Maturities

|

18,950

|

14,411

|

|

7,587

|

7,027

|

|

|

Other Long-Term Liabilities

|

533

|

1,680

|

|

Total Liabilities

|

94,979

|

81,079

|

|

Total Stockholders’ Equity

|

26,980

|

27,404

|

(in thousands)

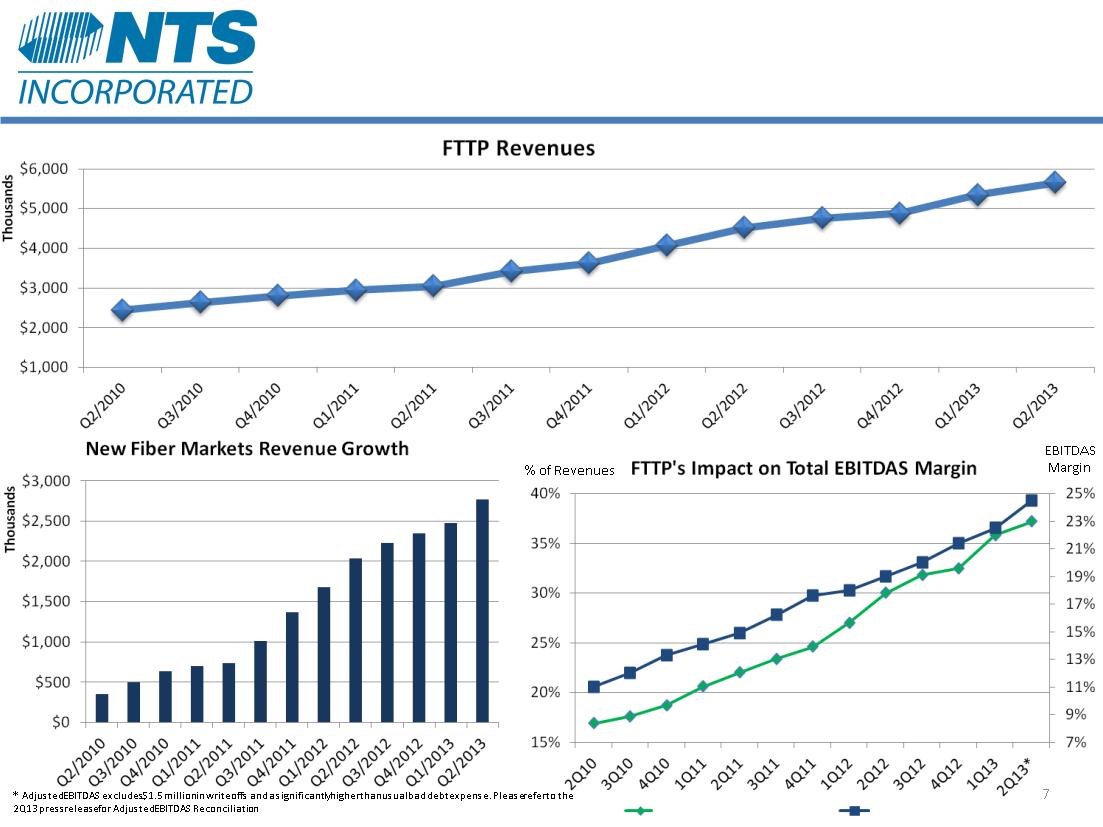

Organic FTTP Growth

FTTP % Overall Revenues

EBITDAS Margin

Fiber Metrics

As of June 30, 2013:

–Total Fiber Passings: 45,181

–Total Fiber Customers: 10,881

• Business Fiber Customers: 2,961

• Residential Fiber Customers: 7,920

–Monthly Fiber ARPU:

• Fiber ARPU for Business: $389

• Fiber ARPU for Residential: $100

–Churn:

•Fiber Business Churn: 0.63%

•Fiber Residential Churn: 1.46%

8

9

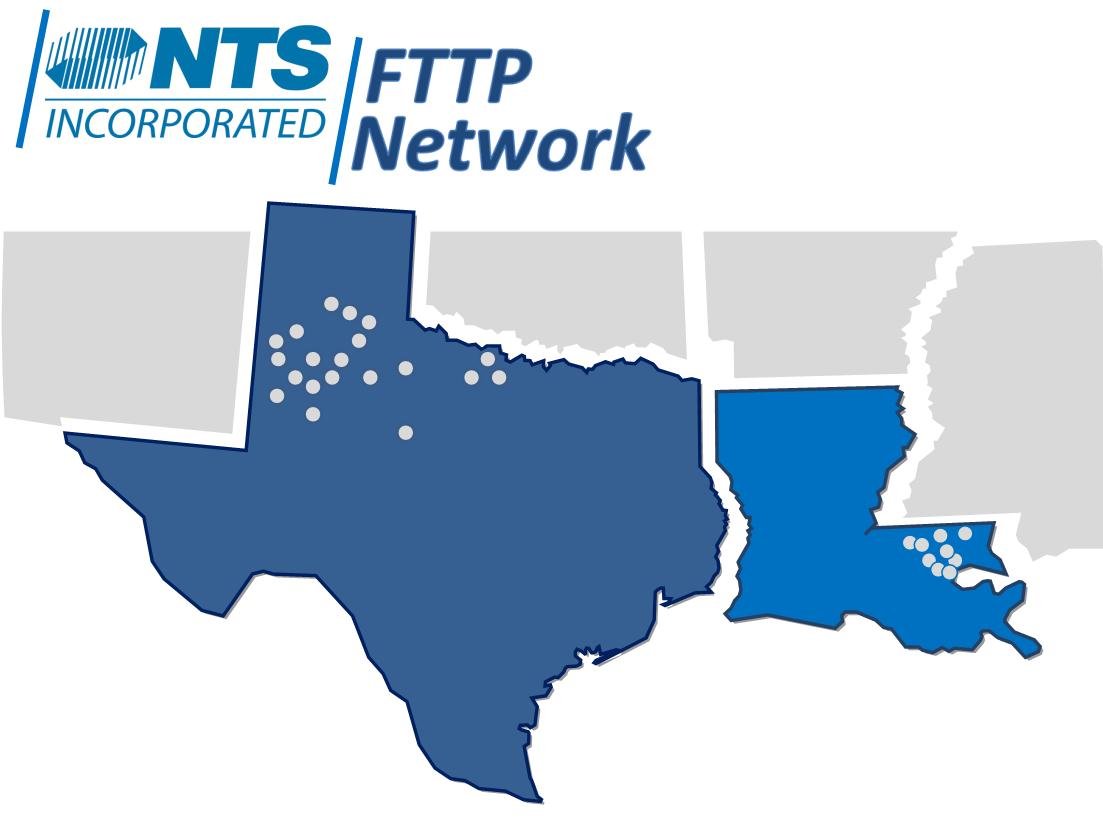

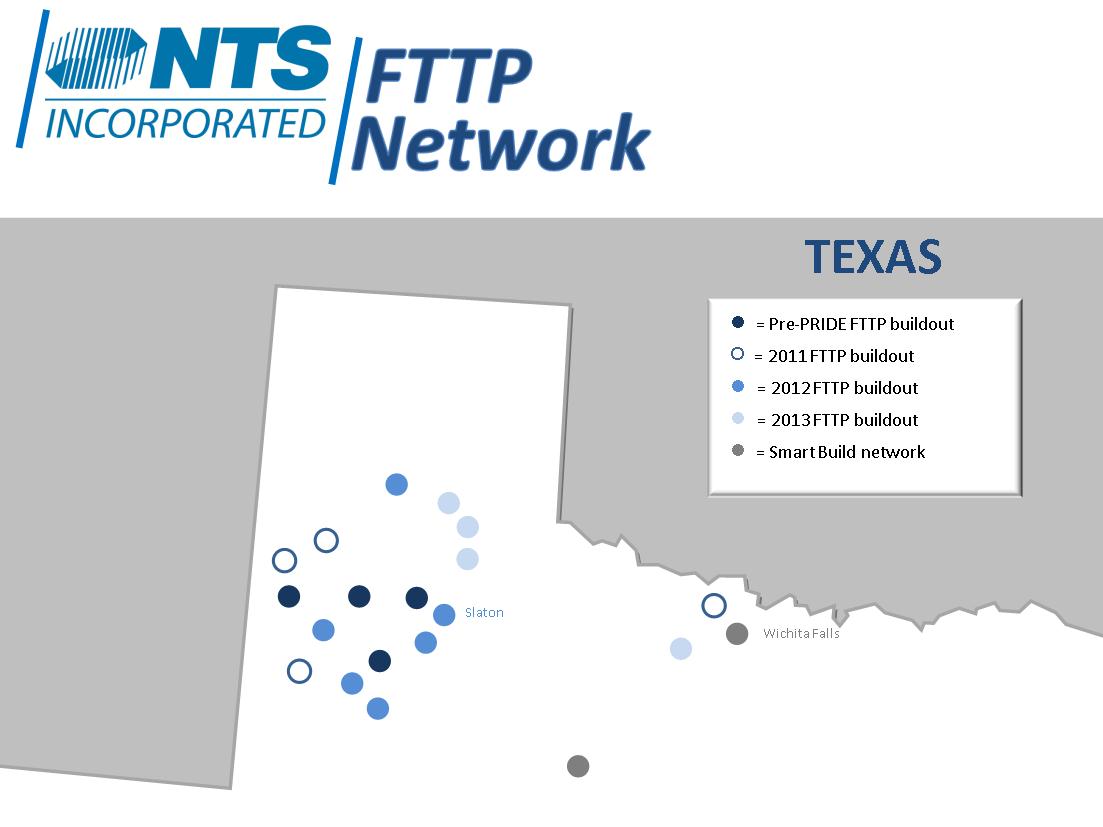

Connected First Fiber Customer in Abilene, TX

• Abilene build out is a “metro build” targeting more than 1,000

business customers modeled after the Company’s metro build in

Wichita Falls, Texas.

business customers modeled after the Company’s metro build in

Wichita Falls, Texas.

• NTS Fiber Network now in 18 communities in Texas

• Historically seen strong adoption rates in new markets for our high

speed triple play offering

speed triple play offering

COVERAGE MAP

10

COVERAGE MAP

Plainview

Iowa Park

Littlefield

Levelland

Smyer

Burkburnett

Lamesa

Ropesville

Wilson

Brownfield

Meadow

Hale Center

Abernathy

Lubbock

New Deal

Whitharral

Wolfforth

11

Abilene

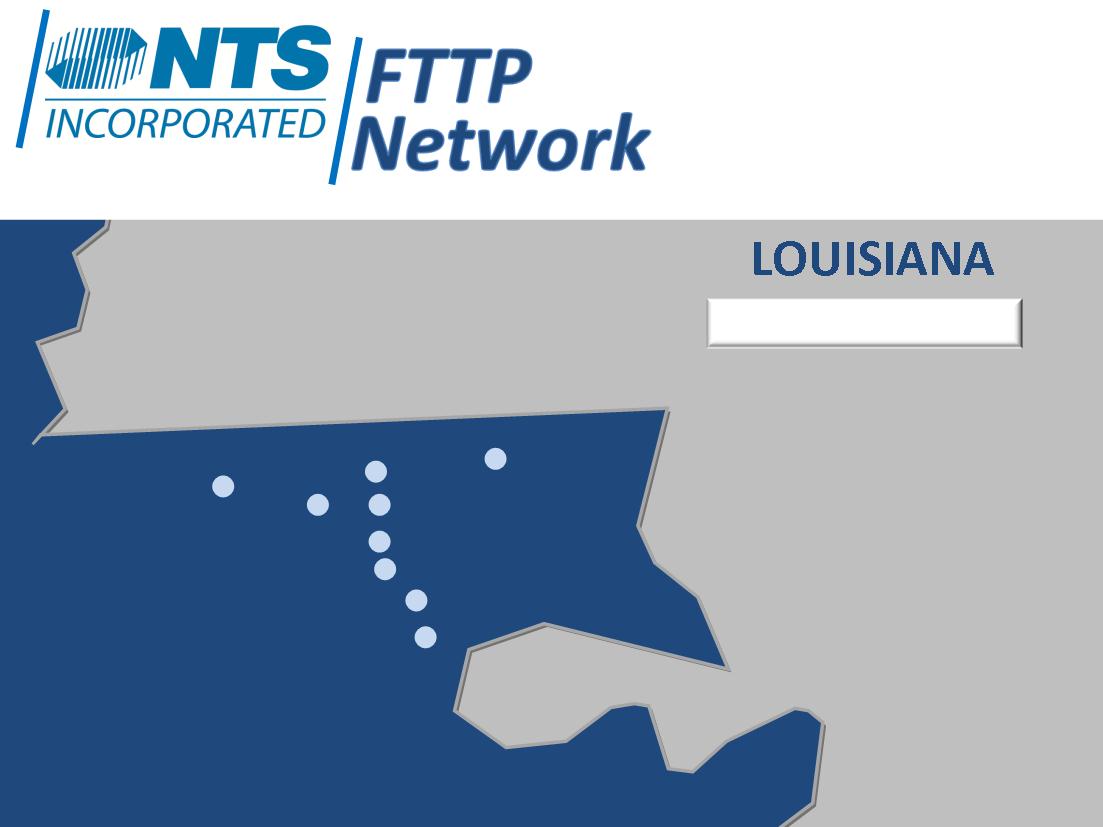

Tickfaw

Independence

Ponchatoula

Pine Grove

Natalbany

Franklinton

Montpelier

Amite

Hammond

COVERAGE MAP

● = 2013 FTTP buildout

12

Key Initiatives

13

• Convert current backlog to installed customers

• Execute Louisiana network buildout

• Continue to aggressively manage costs

– New corporate headquarters in downtown Lubbock

• Moving to company-owned building (Metro Tower)

• Smartbuild strategy succeeding; continue to evaluate

opportunities

opportunities

14

Q & A

Thank You