Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MRC GLOBAL INC. | d584868d8k.htm |

Barclays

Energy Distribution Day August 15, 2013

1

MRC Global Inc. // Barclays Energy Distribution Day

August 15, 2013

Exhibit 99.1 |

Barclays Energy

Distribution Day August 15, 2013

2

2

This presentation contains forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act, as amended,

including, for example, statements about the Company’s business strategy, its industry,

its future profitability, growth in the Company’s various markets, and the Company’s expectations, beliefs, plans, strategies,

objectives, prospects and assumptions. These forward-looking statements are not guarantees

of future performance. These statements involve

known

and

unknown

risks,

uncertainties

and

other

factors

that

may

cause

the

Company’s

actual

results

and

performance

to

be

materially different from any future results or performance expressed or implied by these

forward-looking statements. For a discussion of key risk factors, please see the risk

factors disclosed in the Company’s annual report on Form 10-K for the year ended December 31, 2012 and

the registration statement (including a prospectus and prospectus supplement) for the offering to

which this communication relates, which are available

on

the

SEC’s

website

at

www.sec.gov

and

on

the

Company’s

website,

www.mrcglobal.com.

Undue reliance should not be placed on the Company’s forward-looking statements.

Although forward-looking statements reflect the Company’s good faith beliefs, reliance

should not be placed on forward-looking statements because they involve known and unknown risks,

uncertainties and other factors, which may cause our actual results, performance or achievements to

differ materially from anticipated future results, performance or achievements expressed or

implied by such forward-looking statements. The Company undertakes no obligation to

publicly update or revise any forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise.

Statement Regarding Use of Non-GAAP Measures:

The Non-GAAP financial measures contained in this presentation (EBITDA, Adjusted EBITDA, Adjusted

Gross Profit and variations thereof) are

not

measures

of

financial

performance

calculated

in

accordance

with

GAAP

and

should

not

be

considered

as

alternatives

to

net

income

(loss) or any other performance measure derived in accordance with GAAP or as alternatives to cash

flows from operating activities as a measure

of

our

liquidity.

They

should

be

viewed

in

addition

to,

and

not

as

a

substitute

for,

analysis

of

our

results

reported

in

accordance

with

GAAP, or as alternative measures of liquidity. Management believes that certain non-GAAP

financial measures provide a view to measures similar to those used in evaluating our

compliance with certain financial covenants under our credit facilities and provide financial statement

users meaningful comparisons between current and prior year period results. They are also used

as a metric to determine certain components of performance-based compensation. The

adjustments and Adjusted EBITDA are based on currently available information and certain

adjustments that we believe are reasonable and are presented as an aid in understanding our operating results. They are not

necessarily indicative of future results of operations that may be obtained by the Company.

Forward Looking Statements and Non-GAAP Disclaimer |

Barclays Energy

Distribution Day August 15, 2013

3

By the Numbers

Industry Sectors

Product Categories

Business Model

2013E

Sales

Guidance

Midpoint

$5.2 B

Upstream

Line Pipe / OCTG

Locations

400+

Countries

44+

Midstream

Valves

Customers

18,000+

Suppliers

18,000+

Downstream/

Industrial

Fittings / Flanges

SKU’s

175,000+

Company Snapshot

MRO

72%

Projects

28%

U.S.

75%

Canada

14%

Europe / Asia Pacific

11%

MRC is the largest global distributor of pipe, valves and fittings (PVF) to the energy industry

1.

Percentage of sales for the six months ended June 30, 2013

2.

MRO revenue generated from broad based contracts covering both ongoing capital and operating needs of

customers. 1

2 |

Barclays Energy

Distribution Day August 15, 2013

4

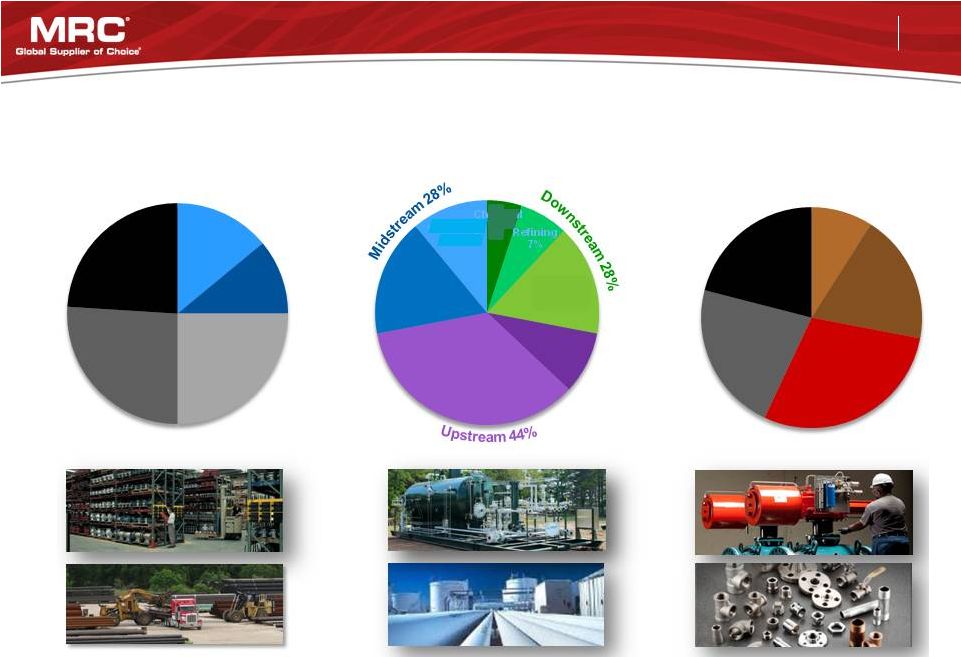

By Geography

By Product Line

Transmission

17%

By Industry Sector

MRC Revenue Diversification

Production

Infrastructure,

Materials &

Supplies

35%

Note: Percentage of sales for the six months ended June 30, 2013.

Drilling &

Completion

Tubulars

9%

Chemical

5%

Refining

7%

Other/

Industrial

16%

Gas Utility

11%

Canada

14%

Europe/

Asia

Pacific

11%

Western

US

25%

Gulf Coast

26%

Eastern

US

24%

OCTG

9%

Line Pipe

19%

Valves

29%

Fittings &

Flanges

22%

Other

21% |

Barclays Energy

Distribution Day August 15, 2013

5

Benefits of MRC

•

Supplier Registration / Preferred Supplier List

•

Global footprint

•

Integrated IT procurement systems

Integrated Supply Chain Services

•

Inventory Consignment / Just-in-Time Delivery

•

Customized IT Solutions

•

Warehouse Management

•

Technical Assistance / Product Recommendation

•

Cost Savings and Efficiencies

•

Logistics Management

Why Customers Choose Distribution & MRC

Generating savings and efficiencies for our customers

while enabling them to focus on their core competencies

PVF is low cost

relative to overall

cost of maintenance

or project spend so

service is integral |

Barclays Energy

Distribution Day August 15, 2013

6

MRC plays a critical role in the complex, technical, global energy supply chain

Long-Term Customer & Supplier Relationships

CUSTOMERS

SUPPLIERS |

Barclays Energy

Distribution Day August 15, 2013

7

Where Our Customers Need Us To Be

Leading

industrial

distributor

of

PVF

globally

to

the

energy

and

industrials

sectors

Houston, TX

Edmonton, AB

Bradford, UK

Singapore

Perth, AU

North America

International

Branches

U.S. = 145+

Canada = 45+

50+

Distribution Centers

U.S.= 8

Canada = 1

U.K. = 1

Singapore = 1

Australia = 2

Netherlands = 1

Valve Automation Centers

U.S. =12

Canada = 1

12

Pipe Yards

U.S. = 95+

Canada = 25+

10 |

Barclays Energy

Distribution Day August 15, 2013

8

Strategic Objectives

•

2012: Global Shell valve contract

•

2013: Global Celanese PVF contract

•

More expected

•

Lowered OCTG as a percentage of

inventory / sales

•

Focus on valve and valve automation

•

Strengthen offerings in stainless and

alloy PFF

•

Add product lines to complete global PVF offerings

•

2012: Production Specialty Services

•

2013: Flow Control Products, Permian Basin –

Valve & valve automation

•

NAWAH –

Iraqi alliance

•

Service

customers

where

they

spend

–

currently

an

international focus

•

Target

Accounts:

develop

the

“next

75”

customers

•

Top

25

customers

represent

49%

of

revenue

1

All

Other

-

18,000+

customers

Targeted Growth Accounts

Top 1 -

25

Customer Mix

-

Revenue

~2/3 of sales are under contract

95% renewal rate since 2000

1. Percentage of sales for the six months ended June 30, 2013

.

27%

24%

49%

Organic Growth

Growth from Mergers & Acquisitions

Execute Global Preferred

Supplier Contracts

Rebalance Product Mix to

Higher Margin Items |

Barclays Energy

Distribution Day August 15, 2013

9

End Market Opportunities

Aging Infrastructure & New Legislation

Driving Pipeline Replacement

4

Global E&P Spending

1.

Percentage of sales for the six months ended June 30, 2013

2.

Source: Barclays 2013 E&P Spending Outlook Mid Year Update.

3.

Source: Industrial Info Resources: June 2013

4.

Source: Pipeline Safety and Hazardous Materials Administration, Wall Street Journal, for Top 10 states

by pipeline mileage Global Petroleum Refining &

Chemical Processing Spend

MRC Revenue Mix by End Market

$-

$200

$400

$600

$800

$1,000

2011A

2012A

2013E

2014E

2015E

United States

Canada

Outside North America

$-

$50

$100

$150

$200

$250

$300

$350

$400

2010A

2011A

2012A

2013E

2014E

2015E

United States

Canada

Outside North America

Upstream

44%

Downstream

28%

Midstream

28%

Built after

1970

37%

Built

before

1970

63%

2

3

1 |

Barclays Energy

Distribution Day August 15, 2013

10

Today

10 –

15 Years Ago

Next 1 to 5 Years

Changing PVF Energy Distribution Landscape

Consolidating energy industry benefits global players

Decentralized

Procurement

•

PVF purchasing

handled locally

•

Separate contracts by

product class

Centralized

Procurement

•

Purchasing more

consolidated

•

Contracts by end segment

•

Contracts cover PVF

•

Customers align with

suppliers with size/scale Global

Procurement

•

Global upstream /

midstream / downstream

PVF contracts |

Barclays Energy

Distribution Day August 15, 2013

11

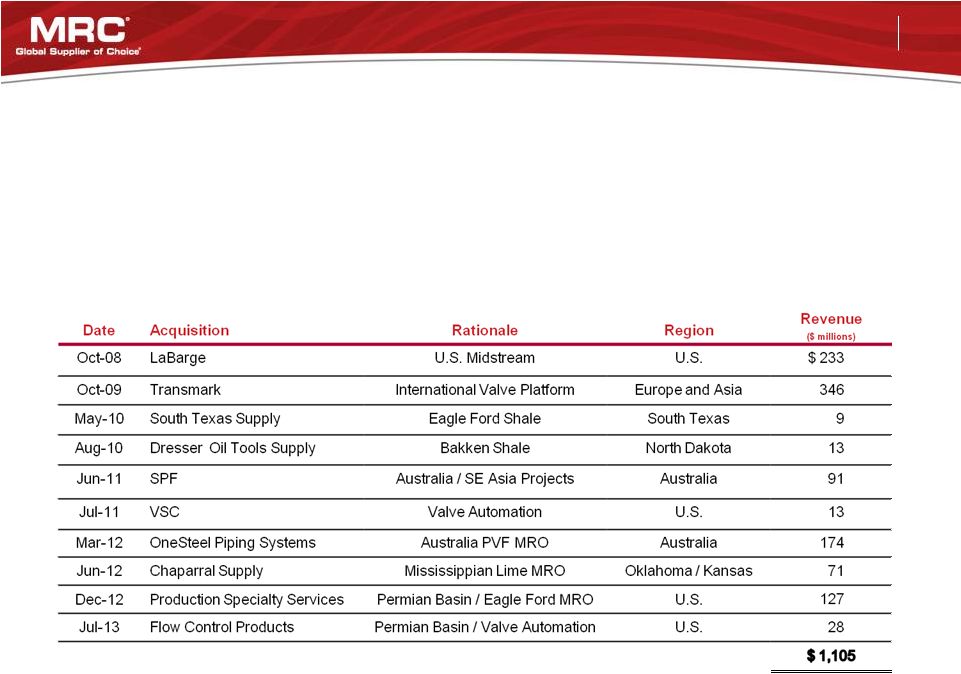

Note: Reflects reported revenues for the year of acquisition

M&A -

Track Record of Strategic Acquisitions

Acquisition Priorities

•

Branch platforms/infrastructure for North American shale plays

•

Global valve and valve automation

•

Global stainless/alloys

•

International

branch

platform

for

“super

majors”

E&P

spend |

Barclays Energy

Distribution Day August 15, 2013

12

Financial Overview |

Barclays Energy

Distribution Day August 15, 2013

13

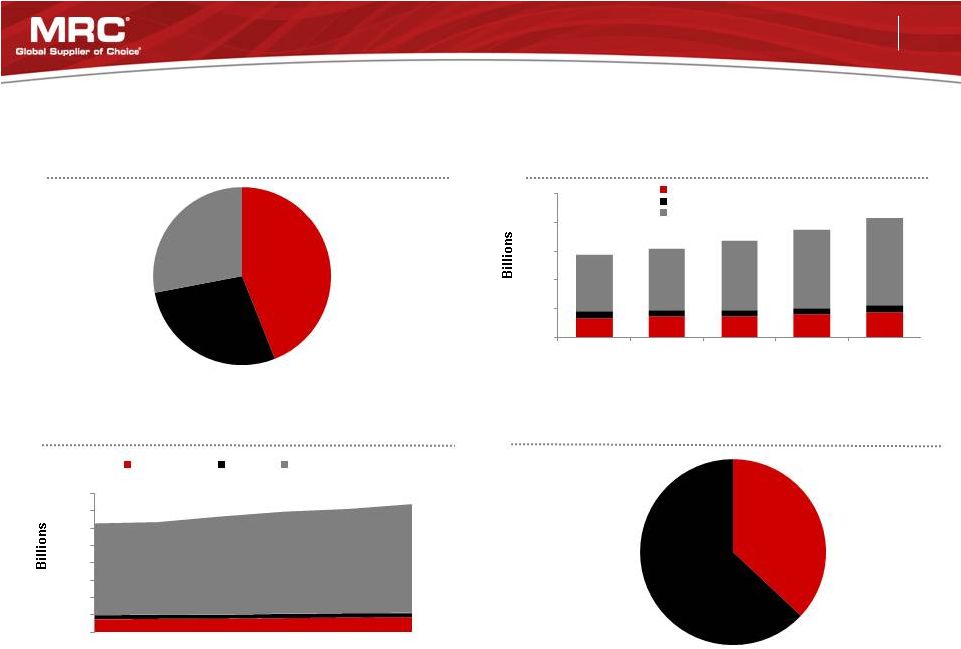

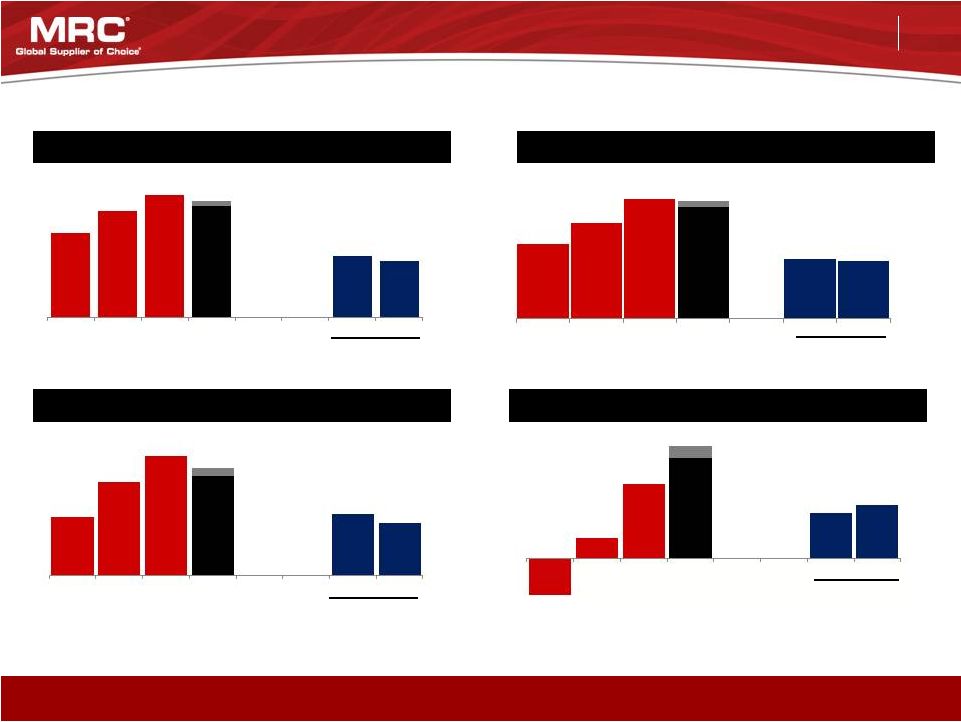

Financial Metrics

Sales

Adjusted Gross Profit and % Margin

Adjusted EBITDA and % Margin

8.5%

($ in millions, except per share data)

Y-o-Y

Growth

28%

24%

(4%)

Y-o-Y

Growth

61%

29%

(14%)

Longer term revenue growth and improving profitability

Y-o-Y

Growth

27%

15%

(7%)

Diluted EPS

Y-o-Y

Growth

NM

259%

43%

Six months

ended June 30

17.2%

17.6%

19.0%

20%

19%

18.8%

19.9%

$1,040

$3,846

$4,832

$5,571

$5,100

$2,813

$2,573

2010

2011

2012

2013

Guidance

2012

2013

Six months

ended June 30

$5,300

$663

$850

$1,058

$988

$530

$512

2010

2011

2012

2013

Guidance

2012

2013

Six months

ended June 30

$224

$360

$463

$385

$239

$203

2010

2011

2012

2013

Guidance

2012

2013

$415

$(0.61)

$0.34

$1.22

$1.65

$0.75

$0.88

2010

2011

2012

2013

Guidance

2012

2013

$ 1.85

Six months

ended June 30

5.8%

7.5%

8.3%

7.8%

7.5%

8.5%

7.9%

5.8%

7.5%

8.3%

7.8%

7.5%

8.5%

7.9% |

Barclays Energy

Distribution Day August 15, 2013

14

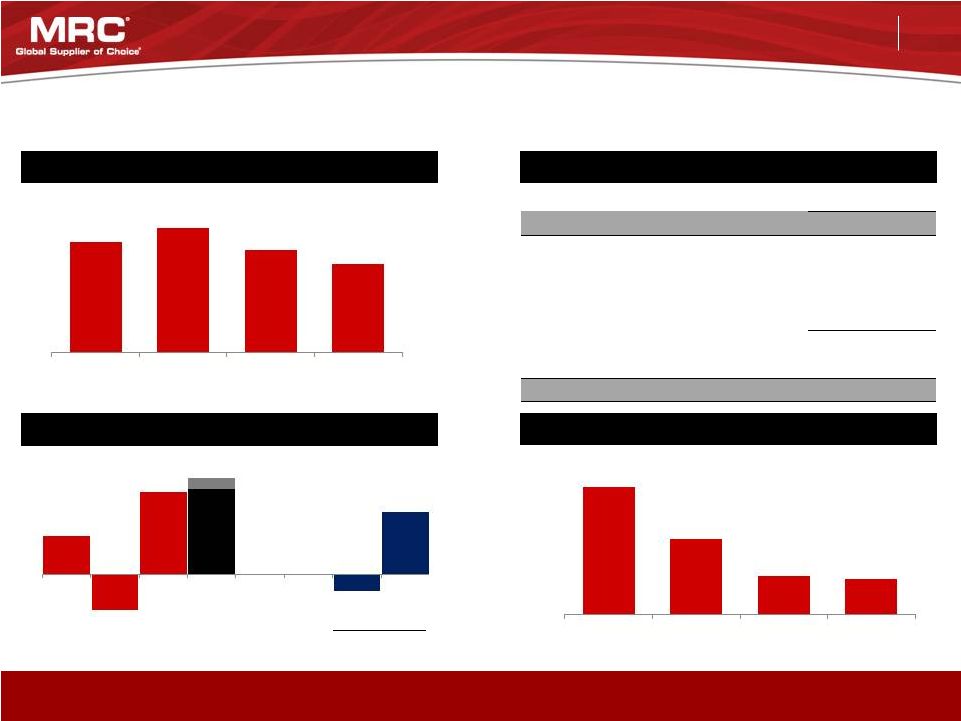

Balance Sheet Metrics

Total Debt

Capital Structure

Cash Flow from Operations

Net Leverage

($ in millions)

Strong balance sheet and cash flow

June 30, 2013

Cash and Cash Equivalents

$ 38

Total Debt (including current portion):

Term Loan B due 2019, net of discount

640

Global ABL Facility due 2017

439

Other

6

Total Debt

$ 1,084

Total Equity

1,261

Total Capitalization

$ 2,345

Six months

ended June 30

$1,360

$1,527

$1,257

$1,084

2010

2011

2012

June

-13

$113

$(103)

$240

$250

$(47)

$182

2010

2011

2012

2013

Guidance

2012

2013

$280

8.7 x

5.2 x

2.6x

2.45x

2010

2011

2012

June

-13 |

Barclays Energy

Distribution Day August 15, 2013

15

Drivers

•

Growth in global energy

consumption drives capital

investment

•

Infrastructure to support

transmission and distribution of

energy

•

Increase in downstream energy

conversion businesses to produce

end products

Revenue Growth

10-12%

Adjusted Gross Profit Margin

20%

Adjusted EBITDA Margin

10%

Leverage

2.0 –

3.0x

Targets (through cycle)

Investment Thesis Summary

•

Organic

•

Acquisitions

2-3%

8-9% |

Barclays Energy

Distribution Day August 15, 2013

16

Appendix |

Barclays Energy

Distribution Day August 15, 2013

17

Six months ended

June 30

December 31

($ in millions)

2013

2012

2012

2011

2010

Net income (loss)

$ 90.0

$ 68.9

$ 118.0

$ 29.0

$ (51.8)

Income tax expense (benefit)

44.2

37.5

63.7

26.8

(23.4)

Interest expense

30.5

64.4

112.5

136.8

139.6

(Decrease) increase in LIFO reserve

(15.6)

18.5

(24.1)

73.7

74.6

Write off of debt issuance costs

-

1.7

1.7

9.5

-

Loss (gain) on early extinguishment of debt

-

11.4

114.0

-

-

Depreciation and amortization

11.2

8.6

18.6

17.0

16.6

Amortization of intangibles

26.0

24.8

49.5

50.7

53.9

Change in fair value of derivative instruments

(2.4)

(0.9)

(2.2)

(7.0)

4.9

Equity based compensation expense

4.6

3.6

8.5

8.4

3.7

Foreign currency losses (gains)

13.4

1.5

(0.8)

(0.6)

0.3

Inventory write-down

-

-

-

-

0.4

M&A transaction & integration expenses

-

-

-

0.5

1.4

Pension settlement

-

-

4.4

-

-

Legal and consulting expenses

-

-

(1.2)

9.9

4.2

Joint venture termination

-

-

-

1.7

-

Provision for uncollectible accounts

-

-

-

0.4

(2.0)

Severance and related costs

-

-

-

1.1

3.2

Franchise taxes

-

-

-

0.4

0.7

Closed locations

-

-

-

-

(0.7)

Other expenses

0.8

(1.2)

0.6

2.2

(1.4)

Adjusted EBITDA

$ 202.7

$ 238.8

$ 463.2

$ 360.5

$ 224.2

Adjusted EBITDA Reconciliation |

Barclays Energy

Distribution Day August 15, 2013

18

Six months

ended

June

30

December 31

($ in millions)

2013

2012

2012

2011

2010

Gross Profit

$ 490.5

$ 478.2

$ 1,013.7

$ 708.2

$ 518.1

Depreciation and amortization

11.2

8.6

18.6

17.0

16.6

Amortization of intangibles

26.0

24.8

49.5

50.7

53.9

(Decrease) increase in LIFO reserve

(15.6)

18.5

(24.1)

73.7

74.6

Adjusted Gross Profit

$ 512.1

$ 530.1

$ 1,057.7

$ 849.6

$ 663.2

Adjusted Gross Profit GAAP Reconciliation |