Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MERCANTILE BANK CORP | d584453d8k.htm |

| EX-2.1 - EX-2.1 - MERCANTILE BANK CORP | d584453dex21.htm |

| EX-10.2 - EX-10.2 - MERCANTILE BANK CORP | d584453dex102.htm |

| EX-10.1 - EX-10.1 - MERCANTILE BANK CORP | d584453dex101.htm |

| EX-10.3 - EX-10.3 - MERCANTILE BANK CORP | d584453dex103.htm |

| EX-99.1 - EX-99.1 - MERCANTILE BANK CORP | d584453dex991.htm |

Michigan’s

Community Bank August 15, 2013 | Investor Presentation

Exhibit 99.2 |

Forward-Looking Statement Disclosure

2

This presentation contains comments or information that constitute forward-looking

statements (within the meaning of the Private Securities Litigation Reform Act of

1995) that are based on current expectations that involve a number of risks and

uncertainties. These forward looking statements are subject to a number of factors and

uncertainties which could cause Mercantile Bank Corporation’s

(“MBWM”), Firstbank Corporation’s (“FBMI”) or the combined company’s actual results and

experience to differ from the anticipated results and expectations expressed in such

forward looking statements. Forward looking statements speak only as of the date

they are made and neither MBWM nor FBMI assumes any duty to update forward looking

statements. These forward-looking statements include, but are not limited to, statements about (i) the

expected benefits of the transaction between MBWM and FBMI, including future financial and

operating results, accretion and earn-back, cost savings, enhanced revenues,

long term growth, and the expected market position of the combined company that may

be realized from the transaction, and (ii) MBWM and FBMI’s plans, objectives, expectations and

intentions and other statements contained in this presentation that are not historical

facts. Other statements identified by words such as “expects,”

“anticipates,” “will,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “positioned,”

“projects” or words of similar meaning generally are intended to identify

forward-looking statements. Management's determination of the provision and

allowance for loan losses, the carrying value of acquired loans, goodwill, and the fair

value of investment securities involve judgments that are inherently

forward-looking. These statements are based upon the current beliefs and

expectations of MBWM’s and FBMI’s management and are inherently subject to significant business,

economic and competitive risks and uncertainties, many of which are beyond their respective

control. In addition, these forward-looking statements are subject to

assumptions with respect to future business strategies and decisions that are

subject to change. Actual results may differ materially from those indicated or implied in

the forward-looking statements. There is no assurance that the due

diligence process would identify all risks associated with the transaction and no

assurance that the conditions to closing will be satisfied. Additional information

concerning risks is contained in MBWM’s and FBMI’s most recently filed

Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current

Reports on Form 8-K and other SEC filings. |

Strategically

Compelling

Creates the 3

rd

largest Michigan-based bank by pro forma market capitalization and pro forma

deposit market share

Effective use of excess capital, expected to enhance profitability and shareholder

value Combined franchise is positioned for long term growth, with the size

and scale to compete more effectively in the current market

Geographically diverse and attractively mixed loan portfolio, coupled with stable

and valuable core funding

Enhances breadth of banking products for all customers

Strengthens competitive positioning throughout Michigan and enhances ability to

serve clients Complementary cultures and strong ties to community

~20%

core

EPS

accretion

projected

in

2014

(excluding

transaction

expenses)

~20% EPS accretion projected in 2015

Conservative and achievable cost savings

Manageable tangible book value dilution with an earn-back of approximately 4.5

years Internal rate of return of approximately 15%

Pro

forma

capital

ratios

above

“well

capitalized”

guidelines

and

strong

pro

forma

TCE

/

TA

ratio

of

greater than 8.0% at closing

Financially

Attractive

Transaction Highlights

3 |

Combined Franchise

4

Balance

Sheet

Franchise

Deposit &

Loan

Composition

Market

Statistics

Pro Forma

($ in 000s)

Assets

1,343,750

$

1,457,046

$

2,800,796

$

Deposits

1,061,315

1,208,302

2,269,617

Gross Loans, including held for sale

1,058,662

975,796

2,034,458

Branches

7

46

53

Deposits / Branch

151,616

$

26,267

$

42,823

$

Core Deposits / Total Deposits

(1)

76.7%

86.8%

81.7%

Cost of Deposits

(2)

0.83%

0.39%

0.59%

Commercial & Industrial Loans (%)

(2)

24.8%

15.1%

20.1%

Closed End 1-4 Family (%)

(2)

4.8%

26.8%

15.3%

Commercial Real Estate Loans (%)

(2)

54.8%

35.7%

45.7%

Yield on Loans

(2)

4.86%

5.58%

5.21%

Market Capitalization

(3)

163,430

$

134,489

$

314,953

$

Dividend Yield

(4)

2.6%

1.4%

2.6%

52-week Average Daily Trading Volume (shares)

17,690

7,114

24,804

Source: SNL Financial and Company filings. Note: GAAP financial data as of

6/30/2013 except where noted. Pro forma column represents combined financial data, before

purchase accounting adjustments.

(1)

Core deposits defined as total deposits less time deposits > $100k. Based upon regulatory

financials. (2)

Based upon regulatory financials. Pro forma yield and cost based upon weighted average. (3)

As of 8/14/13. Pro forma assumes shares issued at transaction price. (4)

As of 8/14/13. Assumes pro forma dividend yield remains constant from MBWM standalone. |

Pro

Forma Highlights (6/30/2013) Branches

53

Assets

$2.8 B

Loans

$2.0 B

Deposits

$2.3 B

Michigan’s Community Bank

MBWM (7)

FBMI (46)

A strong, western and central Michigan

franchise

# 3 pro forma deposit market share

ranking among institutions

headquartered in Michigan

Increased revenue generation

opportunities

Increased

scale

–

serving

a

larger,

diversified client base

Added convenience and wider product

and service offering for customers

Increased market visibility

5 |

Transaction Terms

Board Composition

Transaction Value

Ownership Split

Name &

Headquarters

Executives

MBWM Special

Dividend

$18.77 per share or $151.5 million

(1)

52% MBWM / 48% FBMI

Mercantile expects to declare and pay a special dividend of $2.00 per share to

Mercantile shareholders prior to the closing of the merger, subject to the

satisfaction of the closing conditions set forth in the merger

agreement Mercantile Bank Corporation / Grand Rapids, Michigan

EVP: Robert Kaminski (MBWM)

Equal representation at the bank and holding company from each of MBWM and FBMI,

respectively •

Thomas Sullivan (FBMI) to be chairman through December 31, 2014

•

Michael Price (MBWM) to be chairman beginning January 1, 2015

Required Approvals

Customary regulatory and shareholder approvals of both MBWM and FBMI shareholders

Consideration

100% stock

Fixed exchange ratio of 1.000x share of MBWM common stock for each share of FBMI

common stock Targeted Closing

December 31, 2013

EVP:

Samuel Stone (FBMI)

CFO:

Charles Christmas (MBWM)

(1)

Based on MBWM closing price of $18.77 on 8/14/13. Does not give effect

to $2.00 per share dividend paid to MBWM

shareholders. 6

Board Chair: Thomas Sullivan (FBMI)

President & CEO: Michael Price (MBWM) |

Firstbank Corporation

Core Deposits

(1)

Net Interest Margin (%)

Nonaccrual Loans ($M)

A Low Cost, High Quality Core Deposit Franchise…

7

% Core

$B

4.05

4.08

4.03

4.07

4.03

4.05

3.99

3.91

3.83

3.89

3.25%

3.50%

3.75%

4.00%

4.25%

4.50%

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2

'12

Q3

'12

Q4

'12

Q1

'13

Q2

'13

25

20

21

23

22

18

16

16

13

12

21

21

21

21

21

22

21

21

21

20

$0

$10

$20

$30

$40

$50

$60

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2

'12

Q3

'12

Q4

'12

Q1

'13

Q2

'13

Nonaccrual Loans ($M)

Reserves ($M)

$1.02

$1.02

$1.05

$1.04

$1.07

$1.04

$1.05

$1.07

$1.09

$1.05

83.3%

83.5%

84.1%

84.9%

85.6%

85.6%

85.9%

86.0%

87.0%

86.8%

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

80.0%

82.0%

84.0%

86.0%

88.0%

90.0%

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2

'12

Q3

'12

Q4

'12

Q1

'13

Q2

'13

Core Deposits ($B)

Core Deposits (% of Total Deposits)

Overview

Over $1 billion in low cost core deposits

Strong net interest margin and mortgage business

supporting stable and growing pre-tax, pre-provision

earnings

Asset quality metrics have continued to improve, with

strong reserve coverage of nonperforming loans

Strong capital position, having recently exited preferred

stock issued under TARP

Source: SNL Financial. Deposit composition is per regulatory filings. (1)

Core deposits defined as total deposits less time deposits great than $100,000. |

Mercantile Bank Corporation

Source: SNL Financial and internal Company documents.

A Leading Western Michigan Commercial Lender…

Overview

Wholesale Funding

Net Interest Margin (%)

A leading and disciplined commercial lender in western

Michigan

Demonstrating strong organic loan growth, with $126M in

new originations in the first six months of 2013

Significant improvements in asset quality

Strong profitability with a stable margin and significantly

reduced reliance on wholesale funding

World class banking technology

8

Nonaccrual Loans ($M)

55

43

40

45

39

29

25

19

12

11

42

39

39

37

31

30

28

29

26

25

$0

$10

$20

$30

$40

$50

$60

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2

'12

Q3

'12

Q4

'12

Q1

'13

Q2

'13

Nonaccrual Loans ($M)

Reserves ($M)

3.64

3.61

3.50

3.65

3.73

3.63

3.67

3.62

3.68

3.66

3.25%

3.50%

3.75%

4.00%

4.25%

4.50%

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2

'12

Q3

'12

Q4

'12

Q1

'13

Q2

'13

839

842

851

855

845

851

888

931

932

910

572

523

452

376

352

343

315

305

268

246

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

Q1

'11

Q2

'11

Q3

'11

Q4

'11

Q1

'12

Q2

'12

Q3

'12

Q4

'12

Q1

'13

Q2

'13

Local Funds

Wholesale Funds

Wholesale Funds as % of Total Funds

% of Total

$M |

#3 Ranked Bank

Headquartered in Michigan Total

Number of

Deposits

Market

Rank

Institution

Branches

($M)

Share

1

Flagstar Bancorp Inc.

111

$9,096

5.46%

2

Chemical Financial Corp.

157

4,804

2.88

3

Pro Forma

53

2,349

1.41

3

Talmer Bancorp Inc.

41

2,023

1.21

4

Independent Bank Corp.

72

1,775

1.07

5

Macatawa Bank Corp.

27

1,246

0.75

6

Firstbank Corp.

46

1,243

0.75

7

Mercantile Bank Corp.

7

1,106

0.66

8

MBT Financial Corp.

24

1,018

0.61

9

Isabella Bank Corporation

28

981

0.59

10

Lake Michigan Financial Corp.

5

808

0.48

11

Northwestern Bancorp

27

785

0.47

12

United Bancorp Inc.

18

766

0.46

13

Arbor Bancorp Inc.

7

712

0.43

14

Capitol Bancorp Ltd.

10

679

0.41

15

First State Financial Corp.

11

501

0.30

16

First National Bancshares Inc.

3

472

0.28

17

Keweenaw Financial Corporation

10

457

0.27

18

Mackinac Financial Corp

12

430

0.26

19

Southern Michigan Bancorp Inc.

17

418

0.25

20

ChoiceOne Financial Services

12

403

0.24

Total (1-10 MI-Based)

518

$24,100

14.46%

Total (All Michigan)

(1)

2,915

$166,627

100.00%

Growing Market Share

9

Top 10 Ranking in Key Markets

Grand Rapids-Wyoming, MI MSA

5

Pro Forma

5

Mercantile Bank Corp. (MI)

18

Firstbank Corp. (MI)

Lansing-East Lansing, MI MSA

8

Pro Forma

12

Mercantile Bank Corp. (MI)

15

Firstbank Corp. (MI)

Kalamazoo-Portage, MI MSA

6

Pro Forma

6

Firstbank Corp. (MI)

NA

Mercantile Bank Corp. (MI)

Mount Pleasant, MI MSA

2

Pro Forma

2

Firstbank Corp. (MI)

NA

Mercantile Bank Corp. (MI)

Alma, MI MSA

2

Pro Forma

2

Firstbank Corp. (MI)

NA

Mercantile Bank Corp. (MI)

Note: Deposit data as of 6/30/2012; pro forma for pending acquisitions to the extent

discernible.

(1)

Includes all institutions with deposits in Michigan, regardless of headquarters.

Source: SNL Financial. Table above reflects deposit market share rankings for Michigan based

institutions only. |

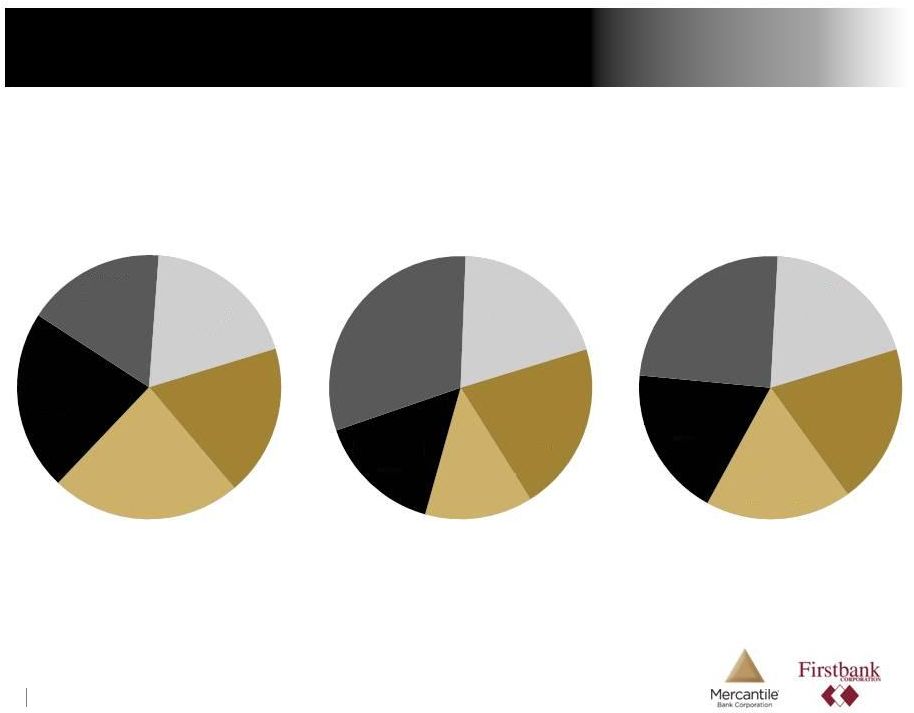

Total Deposits: $1.1B

MRQ Cost: 0.83%

Total Deposits: $1.2B

MRQ Cost: 0.39%

Total Deposits: $2.3B

MRQ Cost: 0.59%

Strong Core Funding

Pro Forma

10

Source: SNL Financial

Note: Based on bank holding company regulatory data as of 6/30/2013. Pro forma cost

of deposits calculated as a weighted average.

Firstbank

Mercantile

Noninterest

Bearing

21%

Time >$100K

13%

Time <$100K

15%

Money

Market

31%

Other

Interest

Bearing

20%

Noninterest

Bearing

20%

Time >$100K

18%

Time <$100K

19%

Money

Market

24%

Other

Interest

Bearing

19%

Noninterest

Bearing

19%

Time >$100K

23%

Time <$100K

22%

Money

Market

17%

Other

Interest

Bearing

19% |

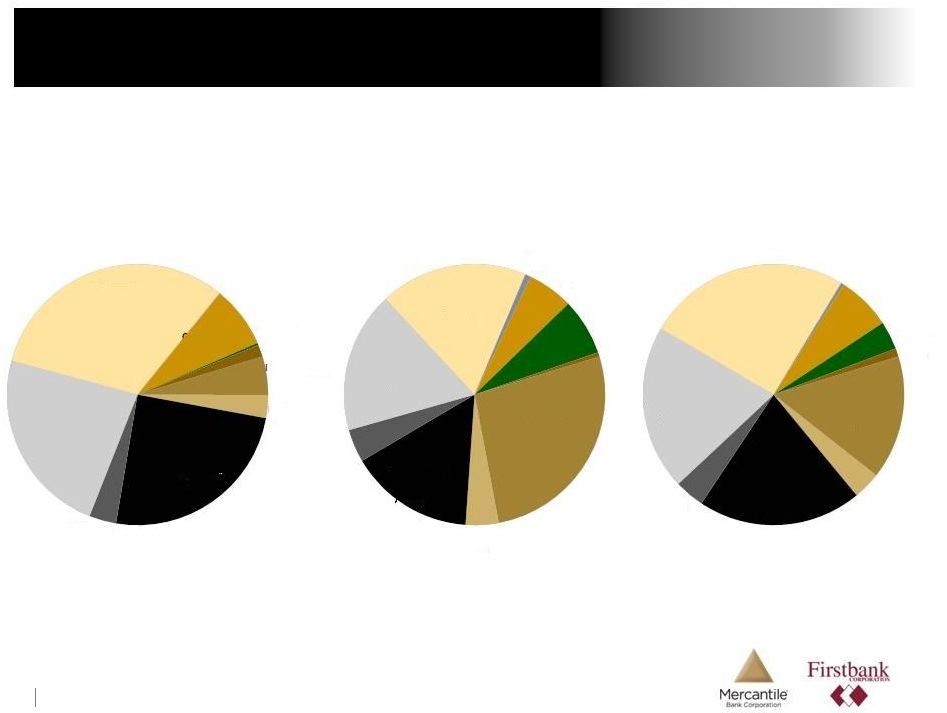

Total Loans: $1.1B

Yield: 4.86%

Total Loans: $1.0B

Yield: 5.58%

Total Loans: $2.0B

Yield: 5.21%

Diversified Loan Portfolio Positioned for Growth

11

Pro Forma

Firstbank

Mercantile

Source: SNL Financial

Note: Based on bank holding company regulatory data as of 6/30/2013. Pro forma

yield on loans calculated as a weighted average.

Closed End 1

-

4

Family

5%

HELOC

3%

Commercial &

Industrial

25%

Multifamily

3%

Owner-Occ.

CRE

23%

Non Owner-

Occ.

CRE

32%

Farm Loans

<1%

Construction

8%

Consumer

<1%

Other

1%

Closed End 1-4

Family

27%

HELOC

4%

Commercial &

Industrial

15%

Multifamily

4%

Owner-Occ.

CRE

17%

Non Owner-

Occ.

CRE

18%

Farm Loans

1%

Construction

6%

Consumer

7%

Other

<1%

Closed End 1-4

Family

15%

HELOC

3%

Commercial &

Industrial

20%

Multifamily

4%

Owner-Occ.

CRE

21%

Non Owner-

Occ.

CRE

25%

Farm Loans

<1%

Construction

7%

Consumer

4%

Other

1% |

Comprehensive due diligence process including core

systems, legal and credit

•

Both organizations use the same core processing

software

Two tiered credit due diligence process completed by

senior management and 3rd party loan review team for

both banks

Analyzed credit files, underwriting methodology and policy

and portfolio management processes

MBWM’s extensive credit reviews focused on the largest

relationships, adversely classified assets and watch list

loans

•

Individually reviewed 100% of relationships with a

balance greater than $4 million

•

Individually reviewed more than 50% of all

commercial loans

•

Individually reviewed all adversely classified assets

with a balance greater than $600,000

FBMI completed comparable diligence on MBWM

Due Diligence Highlights

Credit Mark

Estimated loan mark of $24.5 million, or 2.5% of FBMI’s

portfolio

•

2.1x coverage of NPLs (excluding TDRs)

•

0.7x coverage of NPLs (including TDRs)

Validated by an experienced 3rd party vendor

Due Diligence

Other Estimated Fair Value Adjustments

Loan interest rate mark-up of $6 million (net asset value

write-up)

Trust preferred securities mark-down of $15 million (net

asset value write-up)

Deposit mark-up of $2 million (net asset value write-down)

Borrowings mark-up of $1 million (net asset value write-

down)

12 |

EPS

Capital

IRR

Internal rate of return of approximately 15%

TCE / TA > 8% at closing

Total RBC ratio > 13.5% at closing

~11% dilution estimated at closing

Accretive to stand-alone tangible book

value in approximately 4.5 years

(2)

~20% core

(1)

EPS accretion in 2014

~20%+ EPS accretion in 2015

Pro Forma Financial Impact

Attractive Returns

Earnings are based on internal management estimates

•

$1.40 and $1.45 for MBWM in 2014 and 2015,

respectively

•

$1.79 and $1.74 for FBMI in 2014 and 2015,

respectively

No

revenue enhancements or cross-sell opportunities have

been assumed

Conservative and achievable cost savings of approximately

$5.5 million pre-tax. 60% phased in 2014, and 100%

thereafter

Gross loan mark of $24.5 million, or 2.5% of loans, validated

by an experienced 3 party vendor

One-time merger related expenses of $7.2 million after-tax

Core deposit intangible of 1.5%, amortized sum-of-the-years

digits over 10 years

Special cash dividend of $2.00 per share to MBWM

shareholders expected to be paid prior to closing (and

reflected in relative tangible book value dilution)

December 31, 2013 estimated closing

(1)

Core EPS excludes the impact of the restructuring expenses.

(2)

Earn-back period is defined as the number of years for pro forma tangible

book value per share to exceed stand-alone projected tangible book value

per share. 13

Key Assumptions

rd

Tangible

Book

Value |

Combined franchise is positioned for long term growth with the scale, management

team and financial strength to compete effectively in the current market

Attractive financial returns for all shareholders

Significantly accretive to EPS and maintains strong capital position

Geographically diverse and attractively mixed loan portfolio, coupled with stable

and valuable core funding

Creates Michigan’s premier community bank

Enhances competitive positioning across Michigan, creating an institution with the

financial capacity and experience to be a leading consolidator of community

banks Summary

14 |

Additional Information

15

Communications in this presentation do not constitute an offer to sell or the solicitation of an offer

to buy any securities or a solicitation of any vote or approval. The proposed merger and

issuance of MBWM common stock in connection with the proposed merger will be submitted to

MBWM’s shareholders for their consideration, and the proposed merger will be submitted to

FBMI’s shareholders for their consideration. MBWM will file with the Securities and Exchange Commission

(“SEC”) a registration statement on Form S-4 that will include a joint proxy statement

to be used by MBWM and FBMI to solicit the required approval of their respective shareholders

in connection with the proposed merger and will constitute a prospectus of MBWM. MBWM and FBMI

may also file other documents with the SEC concerning the proposed merger. INVESTORS AND

SECURITY HOLDERS OF MBWM AND FBMI ARE URGED TO READ THE JOINT PROXY STATEMENT AND PROSPECTUS

REGARDING THE PROPOSED MERGER AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders may obtain a free

copy of the joint proxy statement and prospectus and other documents containing important

information about MBWM and FBMI, once such documents are filed with the SEC, through the website

maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by MBWM will be

available free of charge on MBWM’s website at www.mercbank.com under the tab

“Investor Relations.” Copies of documents filed with the SEC by FBMI will be

available free of charge on FBMI’s website at www.firstbankmi.com under the tab “Investor

Relations.”

MBWM, FBMI and certain of their respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from the shareholders of MBWM and FBMI in

connection with the proposed transaction. Information about the directors and executive

officers of MBWM is set forth in its proxy statement for its 2013 annual meeting of

shareholders, which was filed with the SEC on March 15, 2013. Information about the directors

and executive officers of FBMI is set forth in its proxy statement for its 2013 annual meeting

of shareholders, which was filed with the SEC on March 15, 2013. These documents can be

obtained free of charge from the sources indicated above. Other information regarding the

participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the joint proxy statement and prospectus and other

relevant materials to be filed with the SEC when they become available. |