Attached files

| file | filename |

|---|---|

| 8-K - CORONUS SOLAR INC. FORM 8-K (8/15/2013). - Coronus Solar Inc. | crnsf8k-8152013.htm |

| EX-10.3 - FORM OF PROXY. - Coronus Solar Inc. | exh10-3.htm |

| EX-10.2 - FORM OF LOCK-UP AGREEMENT. - Coronus Solar Inc. | exh10-2.htm |

| EX-10.1 - SHARE PURCHASE AND DEVELOPMENT SERVICES AGREEMENT. - Coronus Solar Inc. | exh10-1.htm |

| EX-99.1 - PRESS RELEASE. - Coronus Solar Inc. | exh99-1.htm |

Exhibit 10.4

FOURTH ADDENDUM TO

PROMISSORY NOTE

(Development Expenses)

This is the Fourth Addendum (this “Fourth Addendum”) to the Promissory Note (Development Expenses) in the principal amount of $4,000,000 dated December 20, 2012 (the “Promissory Note”). This Fourth Addendum is dated and effective as of August 9, 2013 (the “Effective Date”)

1. EXTENSION OF MATURITY DATE. The parties executing this Fourth Addendum (the “Coronus Parties”) have previously entered into the Promissory Note as well as the First Addendum to Promissory Note on April 11, 2013 (the “First Addendum”), the Second Addendum to Promissory Note on April 26, 2013 (the “Second Addendum”), and the Third Addendum to Promissory Note on July 30, 2013 (the “Third Addendum”). The Maturity Date, as modified previously by First Addendum, Second Addendum and Third Addendum, is extended and shall be due on August 16, 2013, subject to the automatic extension provision in Section 2 below.

2. AUTOMATIC EXTENSION OF MATURITY DATE. Coronus Parent has entered into a Share Purchase and Development Services Agreement executed with Redwood Solar Development LLC (“Redwood”) on August 9th, 2013 (the “Agreement”). If, as set forth in the Agreement, Redwood receives legally valid executed irrevocable Lock-Up Agreements and Proxy statements appointing Clean Focus Corporation, acting through its designated officers, from Coronus Parent shareholders holding not less than eighty percent (80%) of the issued and outstanding common shares of Coronus Parent on or prior to August 16, 2013, the Maturity Date shall automatically extend to the earlier of: 1) the date of the Coronus Parent Annual & Special Meeting (the “Meeting”) scheduled for 10:00 am (Vancouver B.C. time) on September 16, 2013 in the event that the Transaction as defined in the Lock-Up Agreement is not approved at the Meeting, or ii) the close of business (Vancouver B.C. time) on the Closing Date as defined in the Agreement.

3. SHAREHOLDER MEETING. As stated in the Agreement, at the time and at the place defined in the Agreement a meeting of the shareholders of Coronus Parent is scheduled and duly announced to vote to approve the Transaction (as defined in the Agreement). If the Transaction is not approved at that time, the loan evidenced by the Loan Documents as defined in the Promissory Note (the “Loan”), shall be in immediately due and payable, with all cure rights being waived and foregone by Coronus Parent. If the Loan is not immediately repaid in full, in any legal proceeding brought to enforce the Loan and enforce the security interests of the lender, Coronus Parent and all Coronus related parties, affiliates and subsidiaries a party to the Loan shall confess judgment and shall not raise any defenses to the immediate exercise of remedies allowed with respect to the default of the Loan, including, without limitation, a

|

Execution Form

|

1

|

Fourth Addendum to the Promissory

Note / CFFC/ Coronus Energy Inc. and

Borrower Entities

|

declaration of foreclosure on all assets of the Coronus Parties which are not waivable under principles of Canadian law.

4. RATIFICATION. Except as the Maturity Date has been modified and extended in accordance with Section 1., immediately above, the Coronus Parties agree that the Promissory Note is ratified and confirmed in full and remains in full force and effect.

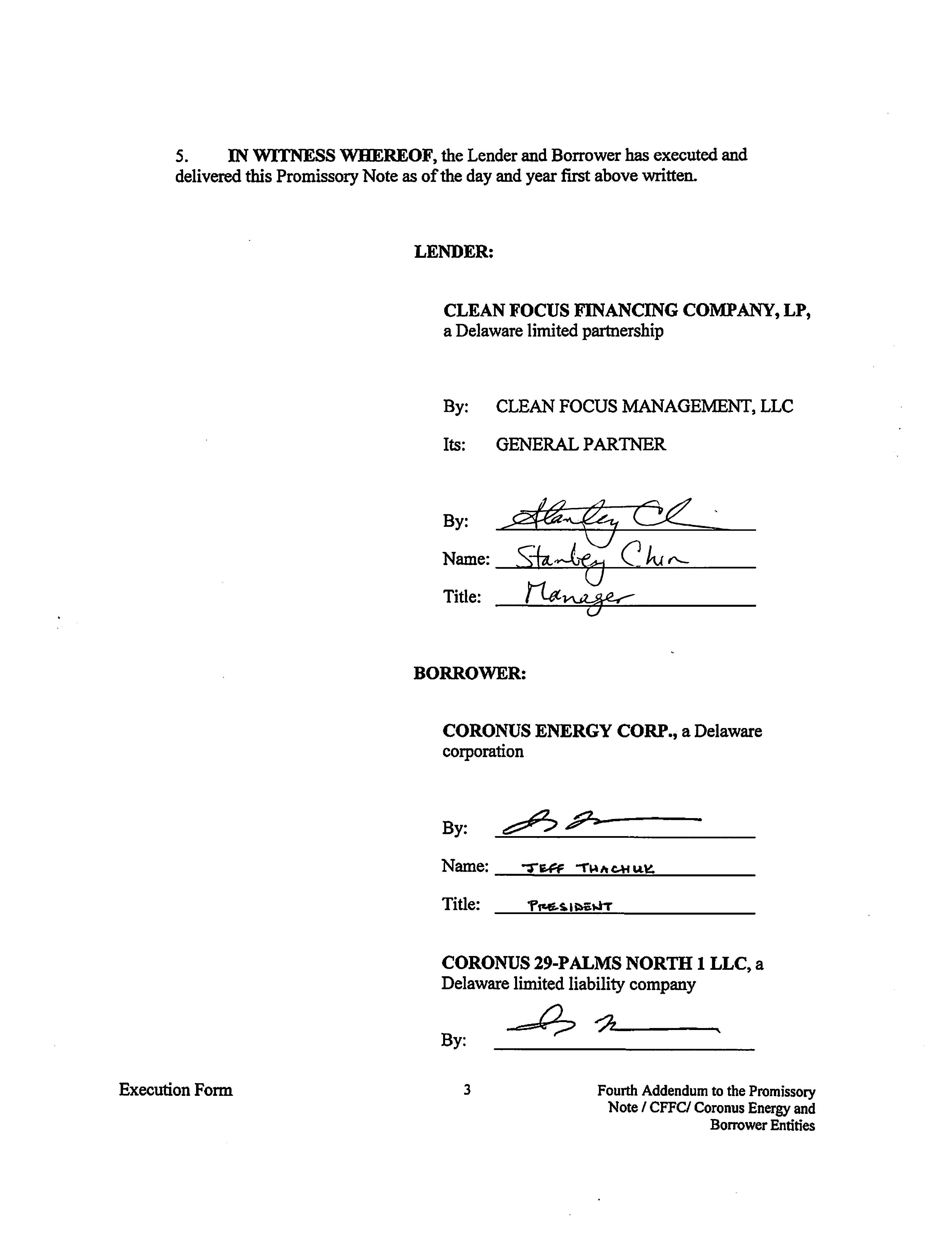

[Signatures Commence on Next Page]

|

Execution Form

|

2

|

Fourth Addendum to the Promissory

Note / CFFC/ Coronus Energy Inc. and

Borrower Entities

|