Attached files

| file | filename |

|---|---|

| 8-K - OPEXA THERAPEUTICS, INC. 8-K - Acer Therapeutics Inc. | a50690734.htm |

| EX-99.1 - EXHIBIT 99.1 - Acer Therapeutics Inc. | a50690734ex99_1.htm |

Exhibit 99.2

Opexa Therapeutics, Inc. Second Quarter 2013 Earnings Update Call 14 August 2013 NASDAQ: OPXA Precision Immunotherapy TM

2 Forward-Looking

Statements This earnings presentation contains forward-looking

statements which are made pursuant to the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. Statements contained

in this release, other than statements of historical fact, constitute

"forward-looking statements." The words "expects," "believes,"

"anticipates," "estimates," "may," "could," "intends," and similar

expressions are intended to identify forward-looking statements. The

forward-looking statements in this presentation do not constitute

guarantees of future performance. Investors are cautioned that

statements in this presentation which are not strictly historical

statements, including, without limitation, statements regarding the

development of the Company's product candidate, Tcelna (imilecleucel-T),

constitute forward-looking statements. Such forward-looking statements

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from those anticipated. These risks

and uncertainties include, but are not limited to, risks associated

with: market conditions; our capital position; the rights and

preferences provided to the Series A convertible preferred stock and

investors in the convertible secured notes we issued in July 2012

(including a secured interest in all of our assets); our ability to

compete with larger, better financed pharmaceutical and biotechnology

companies; new approaches to the treatment of our targeted diseases; our

expectation of incurring continued losses; our uncertainty of developing

a marketable product; our ability to raise additional capital to

continue our development programs (including to undertake and complete

any ongoing or further clinical studies for Tcelna), including in this

regard our ability to satisfy various conditions required to access the

financing potentially available under the purchase agreements with

Lincoln Park Capital Fund, LLC (“Lincoln Park”) (such as the minimum

closing price for our common stock and the requirement for an ongoing

trading market for our stock); our ability to raise additional capital

through the sale of shares of our common stock under the purchase

agreements with Lincoln Park or under our at-the-market (ATM) facility;

our ability to maintain compliance with NASDAQ listing standards; the

success of our clinical trials (including the Phase IIb trial for Tcelna

in secondary progressive MS which, depending upon results, may determine

whether Ares Trading SA (“Merck”) elects to exercise its option for an

exclusive license to Tcelna for the treatment of MS (the “Option”));

whether Merck exercises its Option and, if so, whether we receive any

development or commercialization milestone payments or royalties from

Merck pursuant to the Option; our dependence (if Merck exercises its

Option) on the resources and abilities of Merck for the further

development of Tcelna; the efficacy of Tcelna for any particular

indication, such as for relapsing remitting MS or secondary progressive

MS; our ability to develop and commercialize products; our ability to

obtain required regulatory approvals; our compliance with all Food and

Drug Administration regulations; our ability to obtain, maintain and

protect intellectual property rights (including for Tcelna); the risk of

litigation regarding our intellectual property rights or the rights of

third parties; the success of third party development and

commercialization efforts with respect to products covered by

intellectual property rights that we may license or transfer; our

limitedmanufacturing capabilities; our dependence on third-party

manufacturers; our ability to hire and retain skilled personnel; our

volatile stock price; and otherrisks detailed in our filings with the

SEC. These forward-looking statements speak only as of the date made. We

assume no obligation or undertaking to update any forward-looking

statements to reflect any changes in expectations with regard thereto or

any change in events, conditions or circumstances on which any such

statement is based. You should, however, review additional disclosures

we make in our Annual Reports on Form 10 K, Quarterly Reports on Form

10-Q, and Current Reports on Form 8-K filed with the SEC.

3 Investment Thesis •

T-cell platform company • Esteemed Scientific Advisory Board • Precision

ImmunotherapyTM potentially optimizes benefit-risk profile • Targeting

an unmet medical need in a potentially substantial market • Option

Agreement with Merck Serono, a strong commercial partner • Replacement

value of company is multiples of present market cap • Attractive

potential risk-reward profile for long term/value investors •

Goal-oriented management team focused on value creation

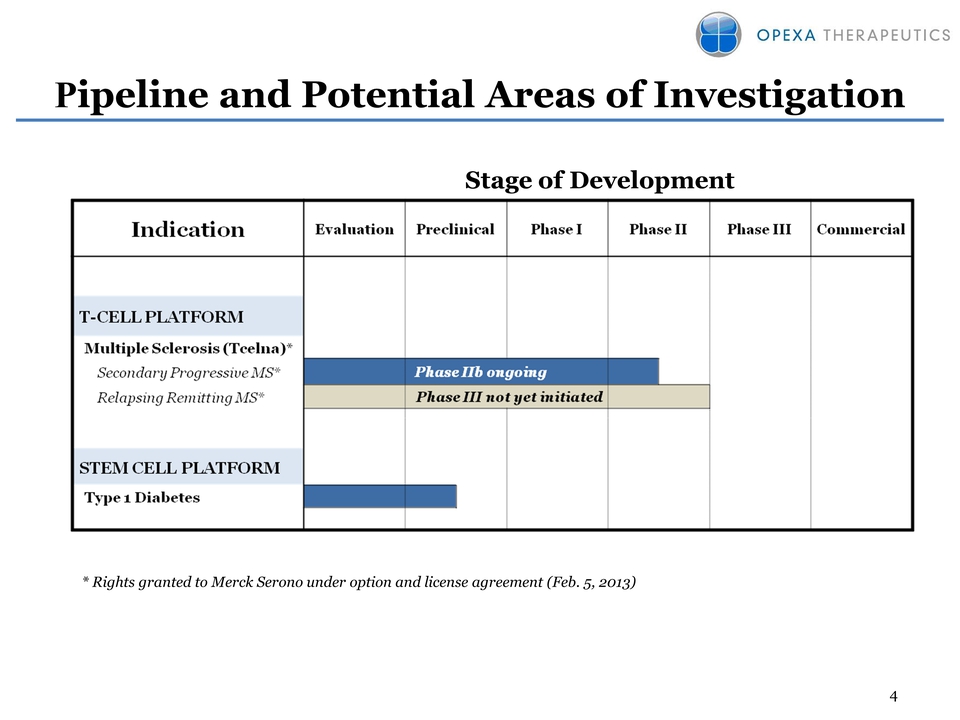

4 Pipeline and Potential

Areas of Investigation Stage of Development * Rights granted to Merck

Serono under option and license agreement (Feb. 5, 2013)

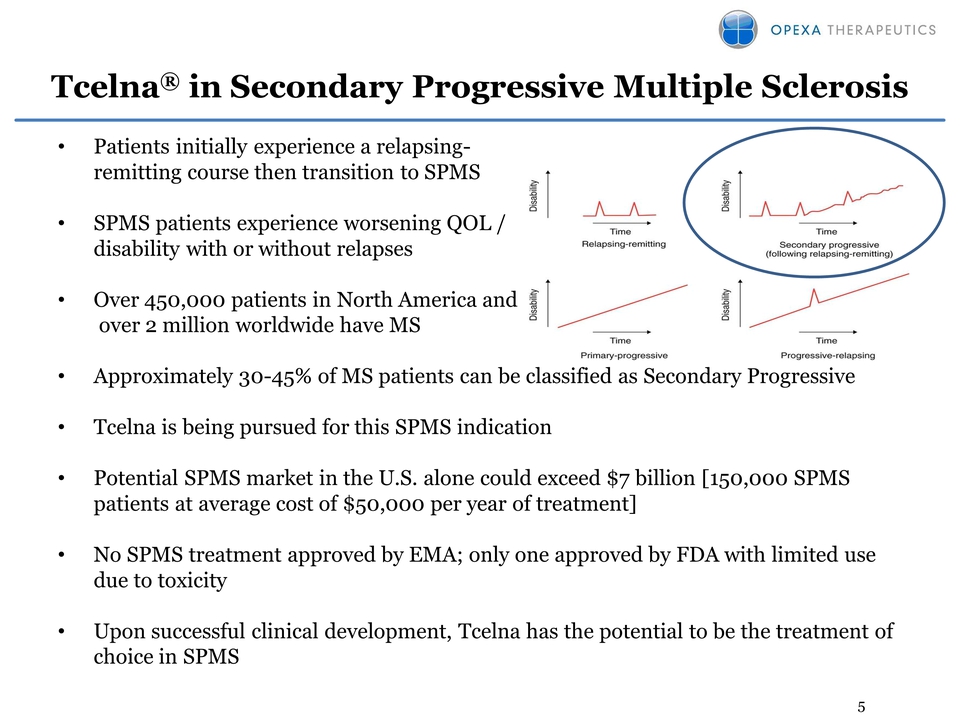

5 Tcelna® in Secondary

Progressive Multiple Sclerosis • Patients initially experience a

relapsingremitting course then transition to SPMS • SPMS patients

experience worsening QOL / disability with or without relapses • Over

450,000 patients in North America and over 2 million worldwide have MS •

Approximately 30-45% of MS patients can be classified as Secondary

Progressive • Tcelna is being pursued for this SPMS indication •

Potential SPMS market in the U.S. alone could exceed $7 billion [150,000

SPMS patients at average cost of $50,000 per year of treatment] • No

SPMS treatment approved by EMA; only one approved by FDA with limited

use due to toxicity • Upon successful clinical development, Tcelna has

the potential to be the treatment of choice in SPMS

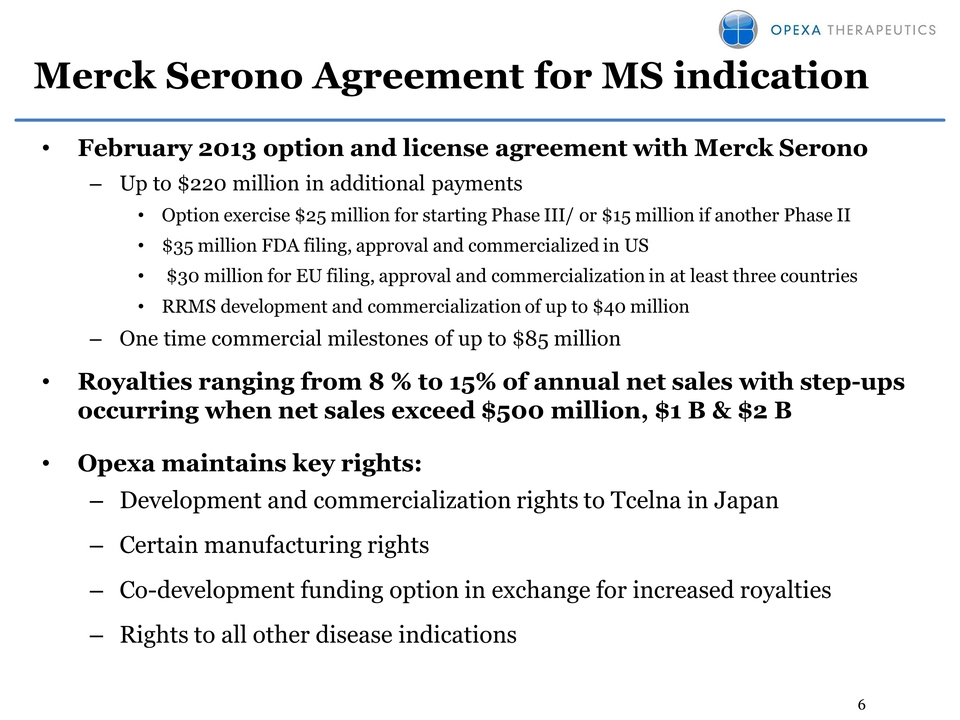

6 Merck Serono Agreement

for MS indication • February 2013 option and license agreement with

Merck Serono – Up to $220 million in additional payments • Option

exercise $25 million for starting Phase III/ or $15 million if another

Phase II • $35 million FDA filing, approval and commercialized in US •

$30 million for EU filing, approval and commercialization in at least

three countries • RRMS development and commercialization of up to $40

million – One time commercial milestones of up to $85 million• Royalties

ranging from 8 % to 15% of annual net sales with step-ups occurring when

net sales exceed $500 million, $1 B & $2 B • Opexa maintains key rights:

– Development and commercialization rights to Tcelna in Japan – Certain

manufacturing rights – Co-development funding option in exchange for

increased royalties – Rights to all other disease indications

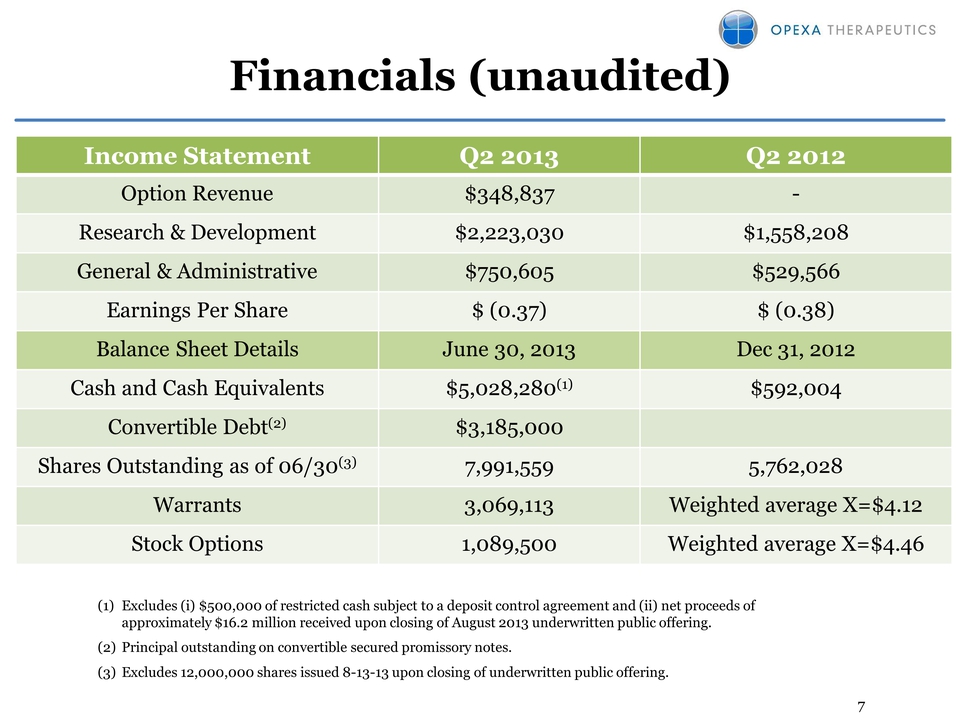

7 Financials (unaudited)

Income Statement Q2 2013 Q2 2012 Option Revenue $348,837 - Research &

Development $2,223,030 $1,558,208 General & Administrative $750,605

$529,566 Earnings Per Share $ (0.37) $ (0.38) Balance Sheet Details June

30, 2013 Dec 31, 2012 Cash and Cash Equivalents $5,028,280(1) $592,004

Convertible Debt(2) $3,185,000 Shares Outstanding as of 06/30(3)

7,991,559 5,762,028 Warrants 3,069,113 Weighted average X=$4.12 Stock

Options 1,089,500 Weighted average X=$4.46 (1) Excludes (i) $500,000 of

restricted cash subject to a deposit control agreement and (ii) net

proceeds of approximately $16.2 million received upon closing of August

2013 underwritten public offering. (2) Principal outstanding on

convertible secured promissory notes. (3) Excludes 12,000,000 shares

issued 8-13-13 upon closing of underwritten public offering.

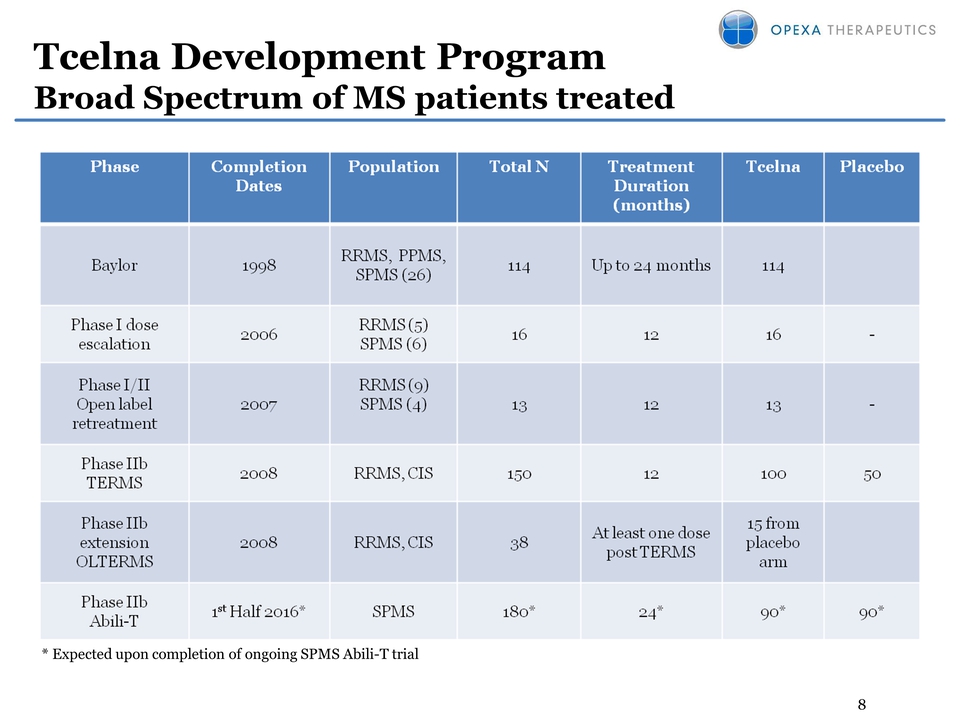

8 Tcelna Development

Program Broad Spectrum of MS patients treated * Expected upon completion

of ongoing SPMS Abili-T trial

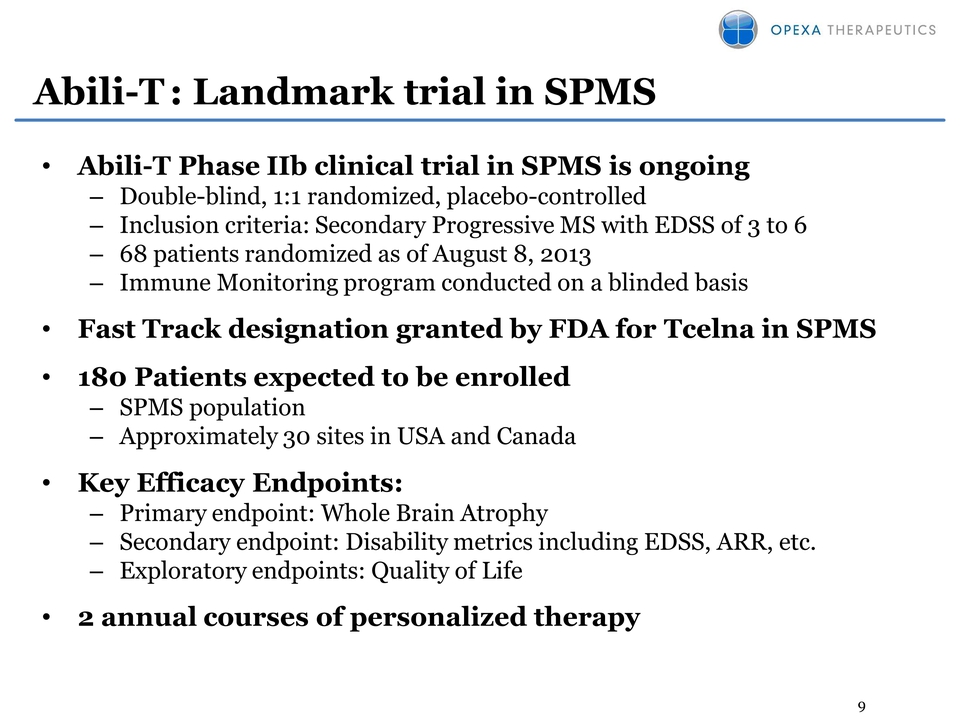

9 Abili-T: Landmark trial

in SPMS • Abili-T Phase IIb clinical trial in SPMS is ongoing –

Double-blind, 1:1 randomized, placebo-controlled – Inclusion criteria:

Secondary Progressive MS with EDSS of 3 to 6 – 68 patients randomized as

of August 8, 2013 – Immune Monitoring program conducted on a blinded

basis• Fast Track designation granted by FDA for Tcelna in SPMS • 180

Patients expected to be enrolled – SPMS population – Approximately 30

sites in USA and Canada • Key Efficacy Endpoints: – Primary endpoint:

Whole Brain Atrophy – Secondary endpoint: Disability metrics including

EDSS, ARR, etc. – Exploratory endpoints: Quality of Life • 2 annual

courses of personalized therapy

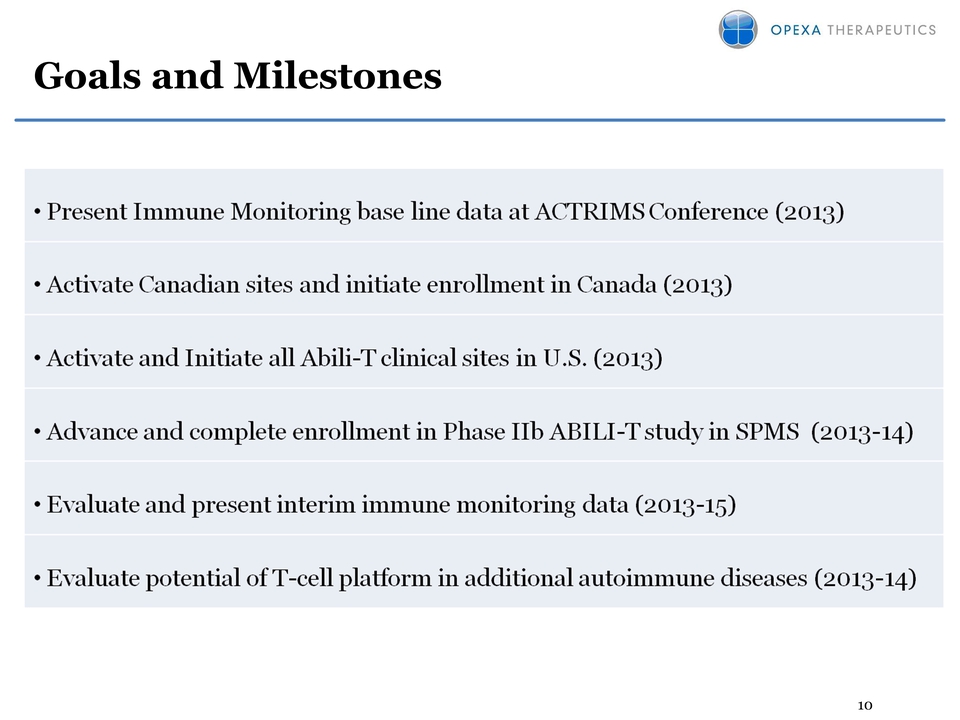

10 Goals and Milestones

11 Investment Highlights • Lead product, Tcelna®, a T-cell immunotherapy for Multiple Sclerosis (MS) • Currently conducting a Phase 2b clinical trial in Secondary Progressive MS (SPMS) • Limited treatment options currently available for SPMS • Potential SPMS market in North America alone could exceed $7 Billion • Tcelna positioned as potential first-to-market personalized T-cell immunotherapy • Option and license agreement secured with Merck Serono for Tcelna in MS indications only, worldwide excluding Japan • Opexa’s in-house cGMP manufacturing enables close control of process and COGS • In previous MS clinical studies, Tcelna has demonstrated good safety and potential indications of clinical efficacy• FDA has granted Opexa Fast Track Designation for Tcelna in SPMS