Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Millennial Media Inc. | a13-18435_18k.htm |

| EX-99.1 - EX-99.1 - Millennial Media Inc. | a13-18435_1ex99d1.htm |

| EX-99.2 - EX-99.2 - Millennial Media Inc. | a13-18435_1ex99d2.htm |

Exhibit 99.3

|

|

August 13, 2013 |

|

|

Safe Harbor This presentation contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “may,” “will,” “could,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “continue,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to expected synergies from the combination, expected full year 2013 pro forma combined guidance, expectations regarding the timing of closing, potential strategic benefits of the combination, our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. These and other risks and uncertainties associated with our business are described in our filings from time to time with the Securities and Exchange Commission. Any forward-looking statement you see or hear during this presentation reflects our current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions, and therefore are not guarantees of future performance. We assume no obligation and do not intend to update these forward-looking statements even if new information becomes available in the future. Included in this presentation are certain measures presented on a basis other than in accordance with generally accepted accounting principles (GAAP). Millennial Media believes presentation of these non-GAAP measures are useful to understand Millennial Media's performance, as it excludes certain non-cash and other charges that many investors believe may obscure Millennial Media’s on-going operating results. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these historical non-GAAP financial measures to their most directly comparable GAAP financial measure included in this presentation and in the 10-K and other filings Millennial Media has filed with the SEC. 2 |

|

|

Agenda Introduction Transaction Overview Strategic Rationale 3 |

|

|

Call Participants Paul Palmieri Chairman & CEO Millennial Media George Bell CEO Jumptap Michael Avon EVP & CFO Millennial Media 4 |

|

|

Overview of Jumptap 5 1 $53.0 revenue for Jumptap excludes Portal revenue. 2011-2012 revenue growth based on revenue excluding Portal. |

|

|

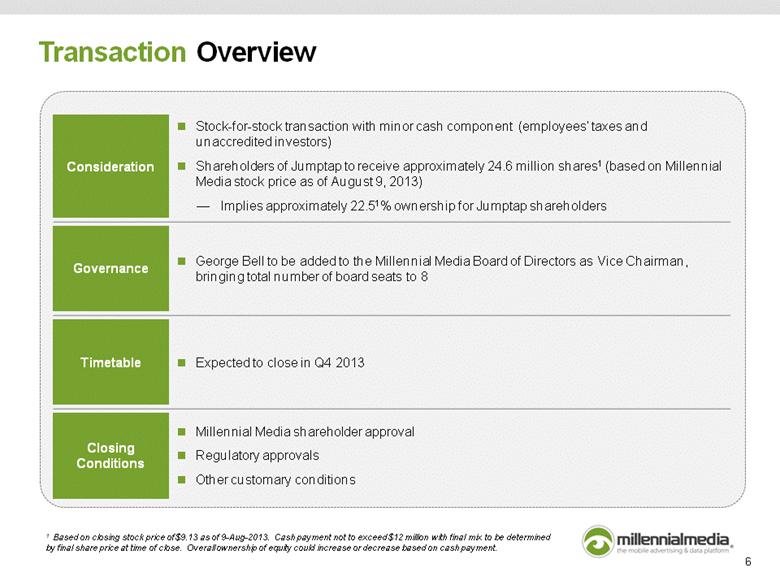

Transaction Overview 6 1 Based on closing stock price of $9.13 as of 9-August-2013. Cash payment not to exceed $12 million with final mix to be determined by final share price at time of close. Overall ownership of equity could increase or decrease based on cash payment. |

|

|

Complementary assets and capabilities (technology, data, RTB, IP) Bolsters position as clear market leader among independent mobile advertising providers Strategic Highlights Deepens management bench in a fast growing and competitive environment Estimated synergies and future cost avoidance of $ 20-25 million in 2015 7 2012 Market Share US Third Party Mobile Display Unique opportunity to add scale, benefiting both sets of platform participants, developers and advertisers Combination creates clear independent market leader Source: IDC Google 29.0% Pro Forma Combined Millennial Media 28.7% Apple 14.8% All Others 27.5% Jumptap Contribution 10.7% |

|

|

Global Scale Matters 8 Developers desire a limited set of partners to monetize their apps Advertisers and agencies seek to buy at scale, with fewer, full-service partners Data driven business model with powerful network effects Mobile advertising opportunity is global Market is demanding global digital advertising platforms |

|

|

Complementary Assets and Capabilities 9 Brand & Premium Performance Performance / RTB Some Brand Demand Side Focus First Party Third Party Partnerships Data Asset Smartphone, Tablet Smartphone, Tablet, PC Screens Targeted North America, APAC, Europe, LatAm US Markets Served Strategically Positioned with Mobile Developers Exchange Buying Supply Side Focus |

|

|

Accelerates Millennial Media’s Programmatic Strategy 10 Sophisticated Bidding Tools To Be Launched This Year >2 Billion RTB Requests Per Day |

|

|

Adding Management Team Depth 11 Bob Hammond | CTO, Jumptap Previously SVP of Technology at Vibrant Media Prior to that, VP of Engineering at Yahoo for video platform and syndication Bob joined Yahoo through the acquisition of Maven Networks where he led engineering Frank Weishaupt | COO, Jumptap Leads sales and operations at Jumptap Spent 10 years at Yahoo where he played a number of key operating roles including VP of Advertising Marketplaces where he led monetization strategy for North America’s search, display and platform business Adam Soroca | Chief Product Officer, Jumptap History with Jumptap of over 8 years Key architect of the Jumptap’s performance business, exchange buying capabilities and cross-screen solution |

|

|

Synergies and Integration Costs 12 Synergies Primarily cost avoidance Engineering/product and sales professionals fill previously planned hiring needs at Millennial Media Data center consolidation Ad serving platform consolidation Other G&A Integration Costs Expected one-time transaction and integration cost of approximately $11 million in 2013 |

|

|

Financial Overview 13 Note: Jumptap figures are preliminary and unaudited. 1 $53.0 revenue for Jumptap excludes Portal revenue. 2011-2012 revenue growth based on revenue excluding Portal. 2 Adjusted Gross Profit and Adjusted EBITDA conformed to Millennial Media reporting policies. Expected Pro Forma Combined Full Year 2013 Guidance: Revenue: $340 – $350 million Adjusted EBITDA: $(1) – $1 million Expected Synergies: 2015: $20–25 million |

|

|

Timetable to Close 14 |

|

|

15 With Jumptap, The Millennial Media Platform Will Be The Leading Audience and Data Platform For Digital Media Globally recognized brand The only independent leader with significant scale Trusted partner to both brand and performance advertisers Differentiated technology platform powered by growing data asset and targeting capabilities Independent company focused on the mobile advertising opportunity Significant patent portfolio |

|

|

AEBITDA RECONCILIATION 16 |

|

|

Additional Information 17 Additional Information about the Proposed Acquisition and Where You Can Find It Millennial Media, Inc. (“Millennial”) plans to file a proxy statement with the Securities and Exchange Commission (the “SEC”) relating to a solicitation of proxies from its stockholders in connection with a special meeting of stockholders of Millennial to be held for the purpose of voting on the issuance of the shares of Millennial common stock to be issued in connection with the proposed acquisition (the “Shares”). BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE ISSUANCE OF THE SHARES CONTEMPLATED BY THE PROPOSED ACQUISITION, MILLENNIAL SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement and other relevant materials, and any other documents filed by Millennial with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, stockholders of Millennial may obtain free copies of the documents filed with the SEC by contacting Millennial’s Investor Relations department at (410) 522-8705, or Investor Relations, Millennial Media, Inc.,2400 Boston Street, Suite 201, Baltimore, Maryland 21224. You may also read and copy any reports, statements and other information filed by Millennial with the SEC at the SEC public reference room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. Interests of Certain Participants in the Solicitation Millennial and its executive officers and directors may be deemed to be participants in the solicitation of proxies from the stockholders of Millennial in favor of the proposed transaction. A list of the names of Millennial‘s executive officers and directors, and a description of their respective interests in Millennial, are set forth in the proxy statement for Millennial’s 2013 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2013, and in any documents subsequently filed by its directors and executive officers under the Securities and Exchange Act of 1934, as amended. If and to the extent that executive officers or directors of Millennial will receive any additional benefits in connection with the proposed transaction that are unknown as of the date of this filing, the details of such benefits will be described in the proxy statement and security holders may obtain additional information regarding the interests of Millennial’s executive officers and directors in the proposed transaction by reading the proxy statement when it becomes available. |