Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FMC CORP | fmc813138k.htm |

FMC Corporation Paul Graves Executive Vice President and Chief Financial Officer August, 2013

Safe Harbor Statement Safe Harbor Statement • These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements. • Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended. • The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. Non-GAAP Financial Terms • These slides contain certain “non-GAAP financial terms” which are defined on our website at www.fmc.com. In addition, we have also provided on our website at www.fmc.com reconciliations of non-GAAP terms to the closest GAAP term. Amounts in this presentation focus on Adjusted Earnings for all EBIT and EPS references. 2

FMC: Sustained Profitable Growth • Proven record of superior financial performance − 2012 revenue $3.7 billion and $738 million in EBIT • Business portfolio well positioned, with high margins and return on invested capital − Three strong core platforms − Low reliance on GDP cycles • Strong financial position: liquid balance sheet and substantial free cash flow • Track record of creating significant shareholder value 3 Sales ($B) EBIT ($B) Adj. EPS ($/Diluted S/O) 12% CAGR 16% CAGR 2012 22.9% 19% CAGR - 1.0 2.0 3.0 4.0 2009 2010 2011 2012 - 0.2 0.4 0.6 0.8 1.0 2009 2010 2011 2012 - 0.5 1.0 1.5 2.0 2.5 3.0 0% 10% 20% 30% 2009 2010 2011 2012 ROIC Invested Capital $2.08 $2.47 $2.99 $3.48 $- $1.00 $2.00 $3.00 $4.00 $5.00 2009 2010 2011 2012

LTM June 30, 2013 Results ($ millions) • Soda Ash • Lithium • Food • Pharmaceuticals • Nutraceuticals • Herbicides, Insecticides, Fungicides, Seed Treatment, Biologicals FMC Corporation • Peroxygens • Environmental Solutions 4 * FMC Peroxygens was reclassified as a Discontinued Operation as of July 2013. This change will be reflected in the September 30, 2013 Form 10-Q in which all periods will be recast.

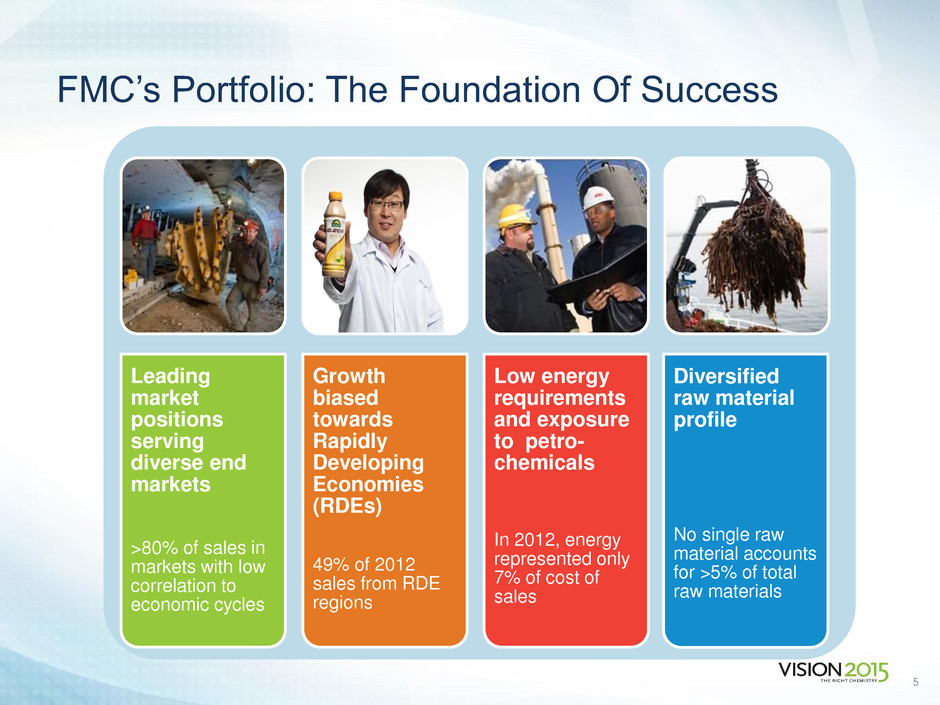

FMC’s Portfolio: The Foundation Of Success 5 5 Leading market positions serving diverse end markets >80% of sales in markets with low correlation to economic cycles Low energy requirements and exposure to petro- chemicals In 2012, energy represented only 7% of cost of sales Diversified raw material profile No single raw material accounts for >5% of total raw materials Growth biased towards Rapidly Developing Economies (RDEs) 49% of 2012 sales from RDE regions

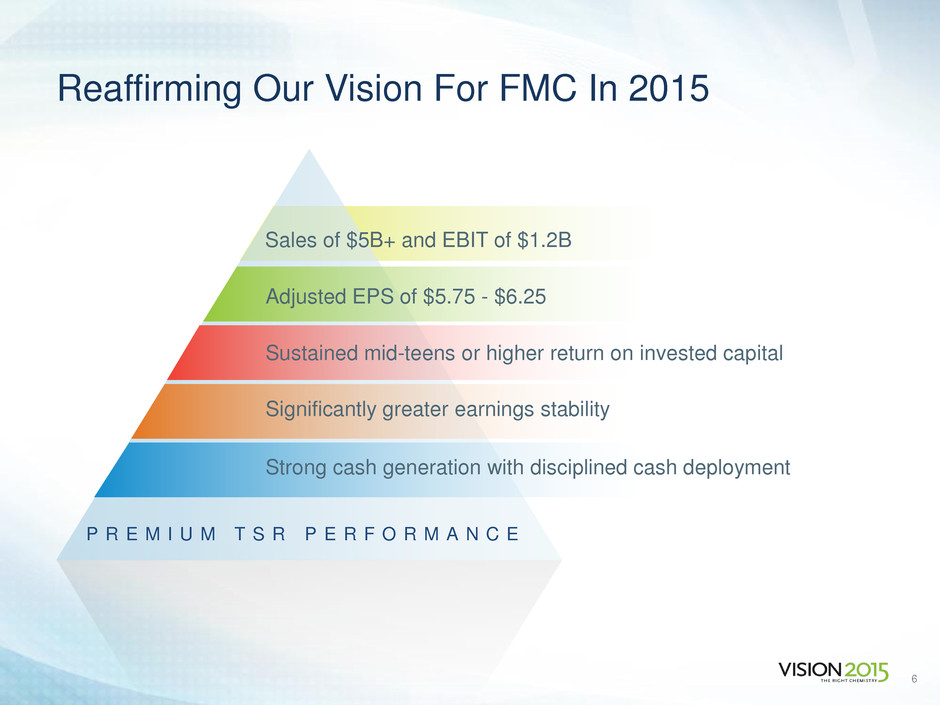

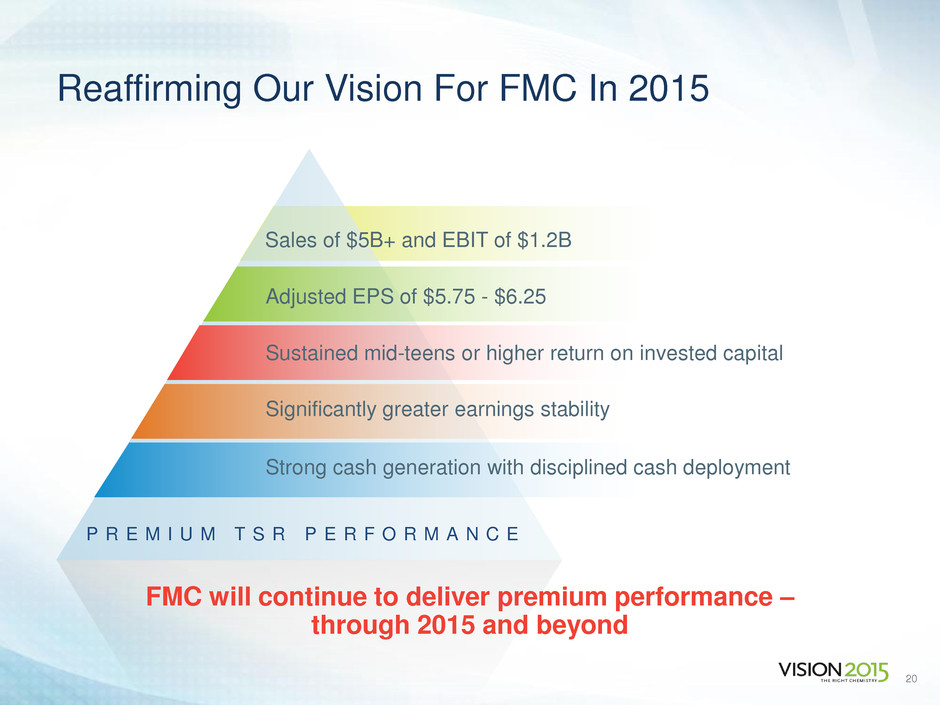

Reaffirming Our Vision For FMC In 2015 6 P R E M I U M T S R P E R F O R M A N C E Strong cash generation with disciplined cash deployment Significantly greater earnings stability Sustained mid-teens or higher return on invested capital Sales of $5B+ and EBIT of $1.2B Adjusted EPS of $5.75 - $6.25

FMC Agricultural Solutions Overview • An agile, innovative, customer- focused and highly profitable business • Global in scope, with particular strength in the Americas • Sustainable competitive advantage driven by unique business model • Industry leading technologies and services that bring solutions to customers • Growth areas: Crops, Geographies, Seed Treatment, Biologicals 7 F M C A G R I C U L T U R A L S O L U T I O N S Herbicides 39% Fungicides 11% Insecticides 50% 2012 Sales Mix North America 21% Europe, Middle East & Africa 9% Asia Pacific 16% Latin America 54% 2012 Sales by End Market

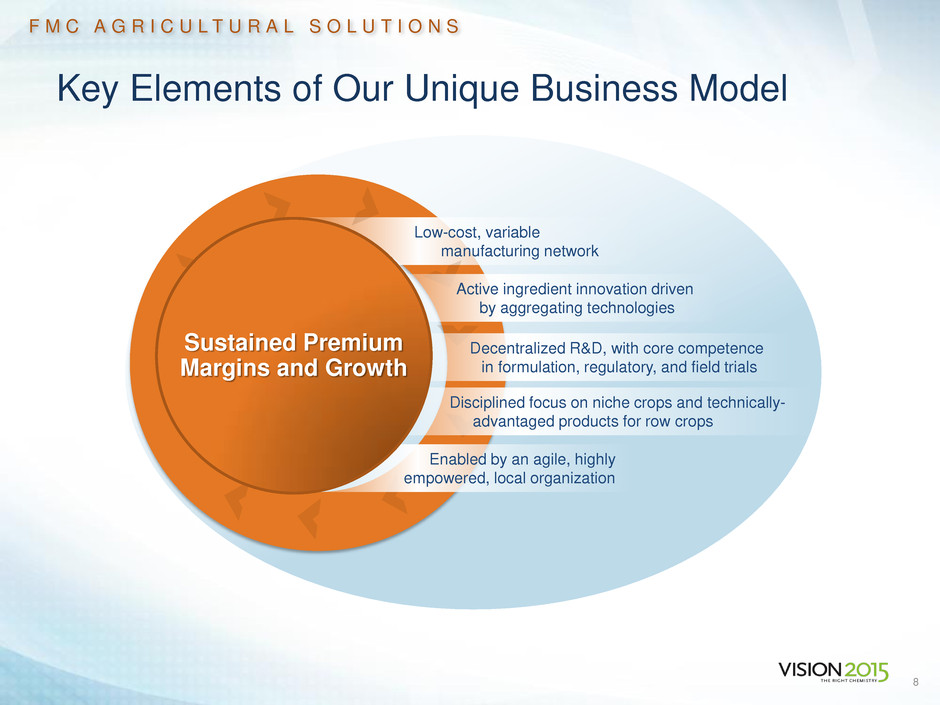

Key Elements of Our Unique Business Model 8 F M C A G R I C U L T U R A L S O L U T I O N S Low-cost, variable manufacturing network Active ingredient innovation driven by aggregating technologies Disciplined focus on niche crops and technically- advantaged products for row crops Decentralized R&D, with core competence in formulation, regulatory, and field trials Enabled by an agile, highly empowered, local organization Sustained Premium Margins and Growth

11 – 20 % Each Fruits and Vegetables Sugarcane Cotton Soybean 6 – 10 % Each 2 - 5% Each Potato Wheat Sunflower Focus on Niche Crops And Pockets Of Technical Differentiation In Row Crops 9 FMC Mix By Crop F M C A G R I C U L T U R A L S O L U T I O N S Corn Rice Turf/Home & Garden Oilseeds

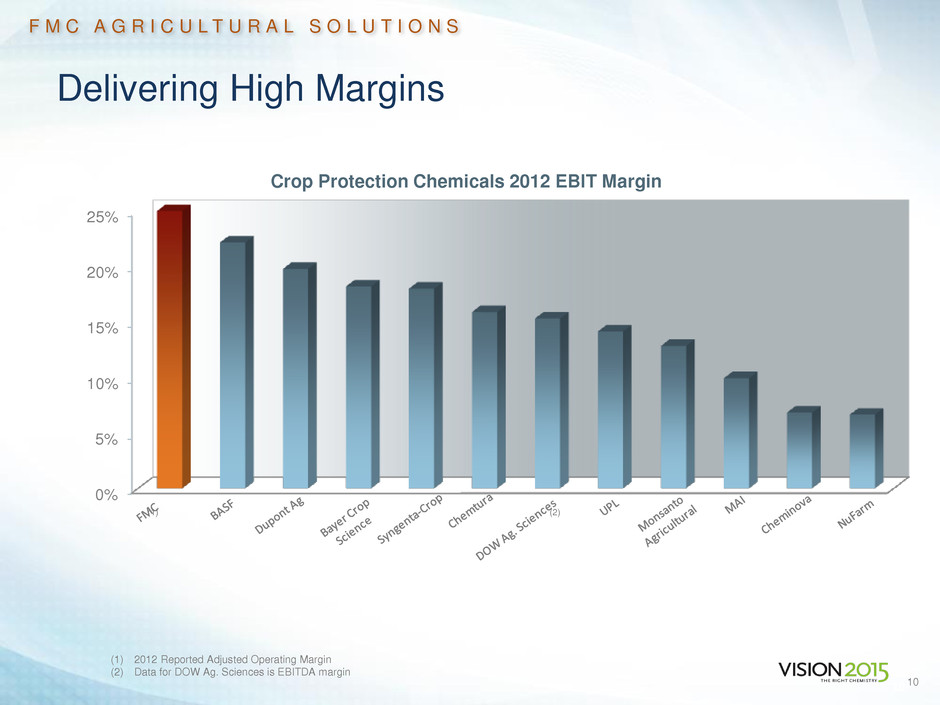

Delivering High Margins (1) 2012 Reported Adjusted Operating Margin (2) Data for DOW Ag. Sciences is EBITDA margin 10 10 Crop Protection Chemicals 2012 EBIT Margin F M C A G R I C U L T U R A L S O L U T I O N S (1) (2) 0% 5% 10% 15% 20% 25%

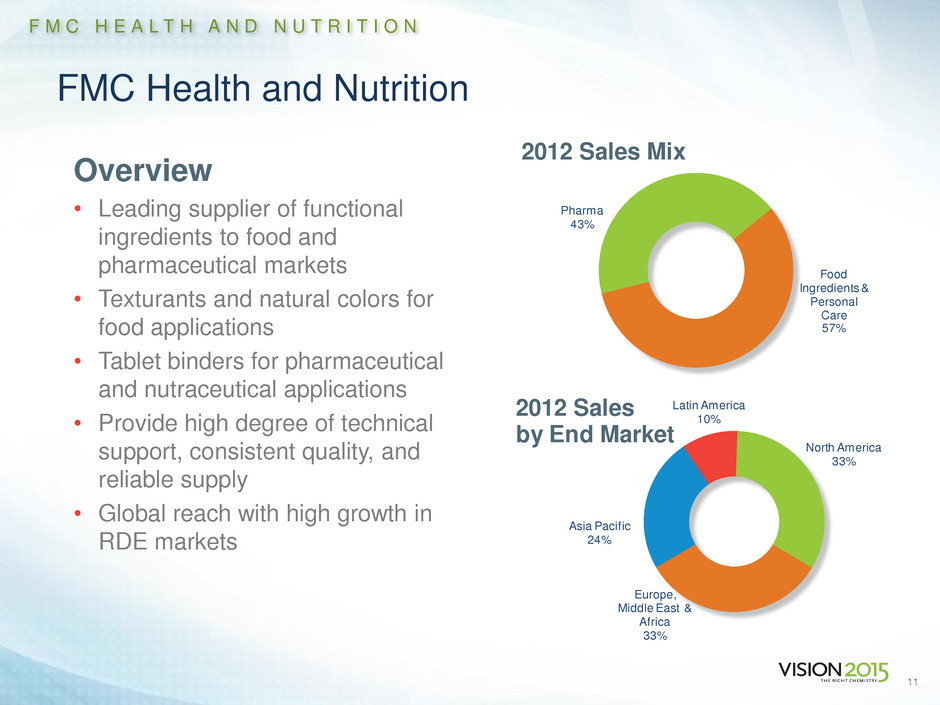

FMC Health and Nutrition Overview • Leading supplier of functional ingredients to food and pharmaceutical markets • Texturants and natural colors for food applications • Tablet binders for pharmaceutical and nutraceutical applications • Provide high degree of technical support, consistent quality, and reliable supply • Global reach with high growth in RDE markets 11 F M C H E A L T H A N D N U T R I T I O N Pharma 43% Food Ingredients & Personal Care 57% 2012 Sales Mix North America 33% Europe, Middle East & Africa 33% Asia Pacific 24% Latin America 10% 2012 Sales by End Market

Epax: An Attractive Expansion Point In Nutraceuticals And Pharmaceutical API 12 Overview • Leading producer of premium grades of omega-3 EPA/DHA fatty acids • Premium-positioned functional ingredient backed by strong clinical data • Two manufacturing locations: Alesund, Norway and Seal Sands, UK • Sustainable competitive advantage driven by purification and concentration processing and supply chain know-how − Products/feedstock derived from marine- based, traceable raw materials − Low-cost manufacturing relative to other competitive technologies • Targets customer segments currently served by FMC Health and Nutrition Epax strengths complement existing FMC core competencies F M C H E A L T H A N D N U T R I T I O N North America 29% Europe, Middle East & Africa 38% Asia Pacif ic 33% Latin America 0% 2012 Sales by End Market

Nutraceutical Segment: Fast-Growing and Highly Fragmented Ingredient Industry • Global nutraceutical ingredient market projected to reach $24B by 2015(1) • Estimated annual growth rate of 7%; faster growth if clinically confirmed health benefits and broad applications • Growth driven by: − Population increase combined with aging demographic − Health care expenditure per capita increase (75%+ over the next five years, RDE-driven) − Stricter government quality control and regulations of nutritional products − General rebound of global GDP • Fragmented industry creates acquisition opportunities − Top 10 account for ~50% of market; balance spread across ~3,000 players 13 (1) Freedonia - World Nutraceutical Ingredients November 2011 F M C H E A L T H A N D N U T R I T I O N

Omega-3 Projected to Lead Nutraceutical Growth: $2B Growing 12% to 15% Over Next 5 Years(1) • Common uses include dietary supplements, pharmaceutical, food applications and infant nutrition • One of the most widely studied nutraceuticals; large-scale studies overwhelmingly support health benefits • Omega-3’s projected growth reflects clinically proven cardiovascular benefits and expanding use in dietary supplements and nutritional therapies • Two current FDA-approved Omega-3 pharmaceutical products; additional 30 in various stages of clinical trial(2) • Fastest growth is in premium, high concentration / high purity segments driven by expanding pharmaceutical applications and increasing consumer awareness of DHA/EPA % importance • Majority of players do not have ability to produce high and very-high concentrates 14 (1) Frost and Sullivan 2011 (2) Global Market for EPA/DHA Omega-3 Products - Sep 2012 F M C H E A L T H A N D N U T R I T I O N

Epax Produces High and Ultra-High Concentration Omega-3 15 OMEGA 3 Alesund, Norway • Produces high- concentration Omega-3 • Sold into the supplement and food markets • Shipped to Seals Sands for additional processing Pharmaceutical Supplement Functional Food Ingredient Purification/Concentration Ultra-High Concentration FMC FMC F M C H E A L T H A N D N U T R I T I O N Seals Sand, UK • Produces ultra-high concentration Omega-3 • Sold into the pharmaceutical and supplement markets Naturally-Derived Ingredient • Sustainable sourcing of anchovies and other fish Customer Base • Premium active ingredient adds relevance into target end-market segments • Overlap with existing Health and Nutrition customer base

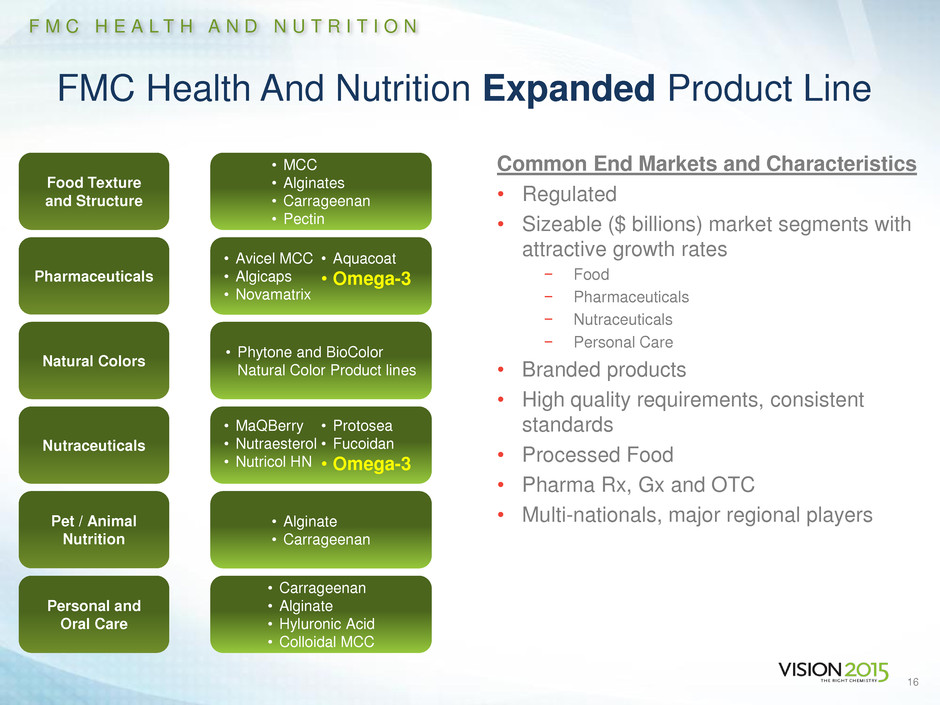

FMC Health And Nutrition Expanded Product Line Common End Markets and Characteristics • Regulated • Sizeable ($ billions) market segments with attractive growth rates − Food − Pharmaceuticals − Nutraceuticals − Personal Care • Branded products • High quality requirements, consistent standards • Processed Food • Pharma Rx, Gx and OTC • Multi-nationals, major regional players 16 Personal and Oral Care Food Texture and Structure Pet / Animal Nutrition Pharmaceuticals Nutraceuticals Natural Colors F M C H E A L T H A N D N U T R I T I O N • Carrageenan • Alginate • Hyluronic Acid • Colloidal MCC • MCC • Alginates • Carrageenan • Pectin • Alginate • Carrageenan • Avicel MCC • Algicaps • Novamatrix • Aquacoat • Omega-3 • MaQBerry • Nutraesterol • Nutricol HN • Protosea • Fucoidan • Omega-3 • Phytone and BioColor Natural Color Product lines

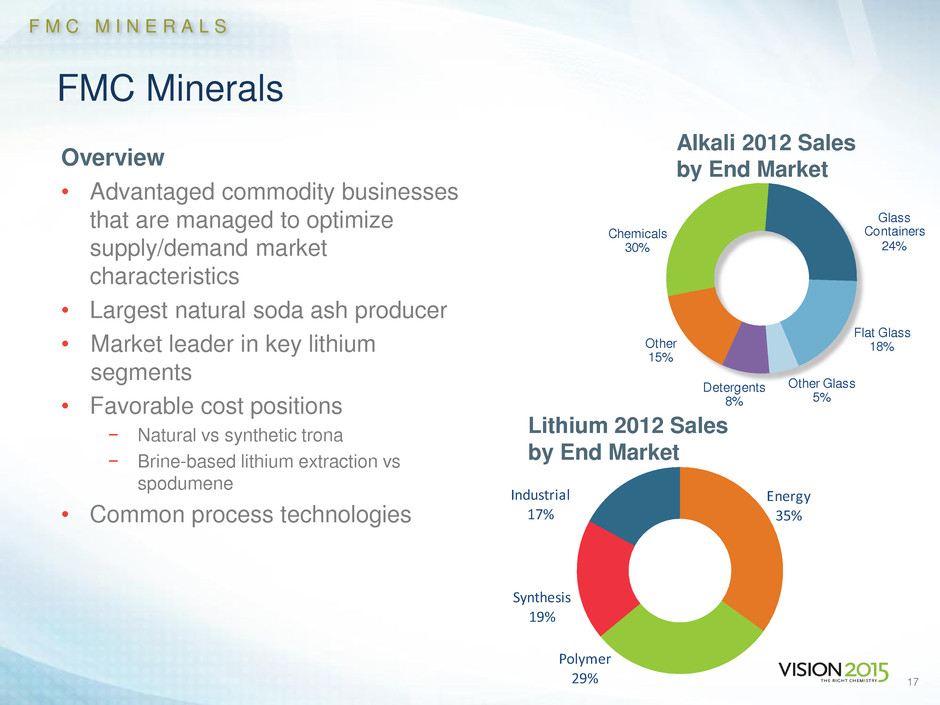

FMC Minerals Overview • Advantaged commodity businesses that are managed to optimize supply/demand market characteristics • Largest natural soda ash producer • Market leader in key lithium segments • Favorable cost positions − Natural vs synthetic trona − Brine-based lithium extraction vs spodumene • Common process technologies 17 F M C M I N E R A L S Chemicals 30% Glass Containers 24% Flat Glass 18% Other Glass 5% Detergents 8% Other 15% 2012 Sales by End Market Alkali 2012 Sales by End Market Lithium 2012 Sales by End Market Energy 35% Polymer 29% Synthesis 19% Industrial 17%

FMC Minerals: Challenges of 2013 Turning Into Tailwinds For 2014 2013 Challenges • Lithium manufacturing process issues related to the recent expansion project • Trough in soda ash export pricing 2014 Tailwinds • Completing process implementation changes in 3Q13 • Expect 4Q14 Lithium operating margins to return to historic levels • Capacity rationalization and increased demand to restore supply/demand balance 18 F M C M I N E R A L S

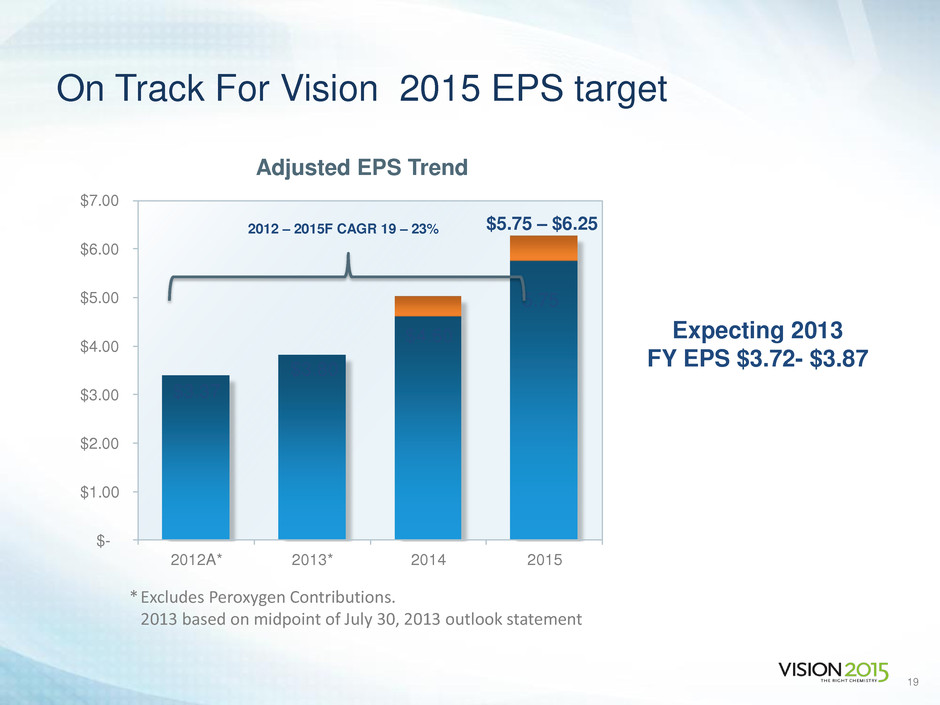

$3.37 $3.80 $4.60 5.75 $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 2012A* 2013* 2014 2015 On Track For Vision 2015 EPS target 19 Expecting 2013 FY EPS $3.72- $3.87 Adjusted EPS Trend $5.75 – $6.25 2012 – 2015F CAGR 19 – 23% * Excludes Peroxygen Contributions. 2013 based on midpoint of July 30, 2013 outlook statement

Reaffirming Our Vision For FMC In 2015 20 P R E M I U M T S R P E R F O R M A N C E Strong cash generation with disciplined cash deployment Significantly greater earnings stability Sustained mid-teens or higher return on invested capital Sales of $5B+ and EBIT of $1.2B Adjusted EPS of $5.75 - $6.25 FMC will continue to deliver premium performance – through 2015 and beyond

Glossary of Financial Terms & Reconciliations of GAAP to Non-GAAP 21

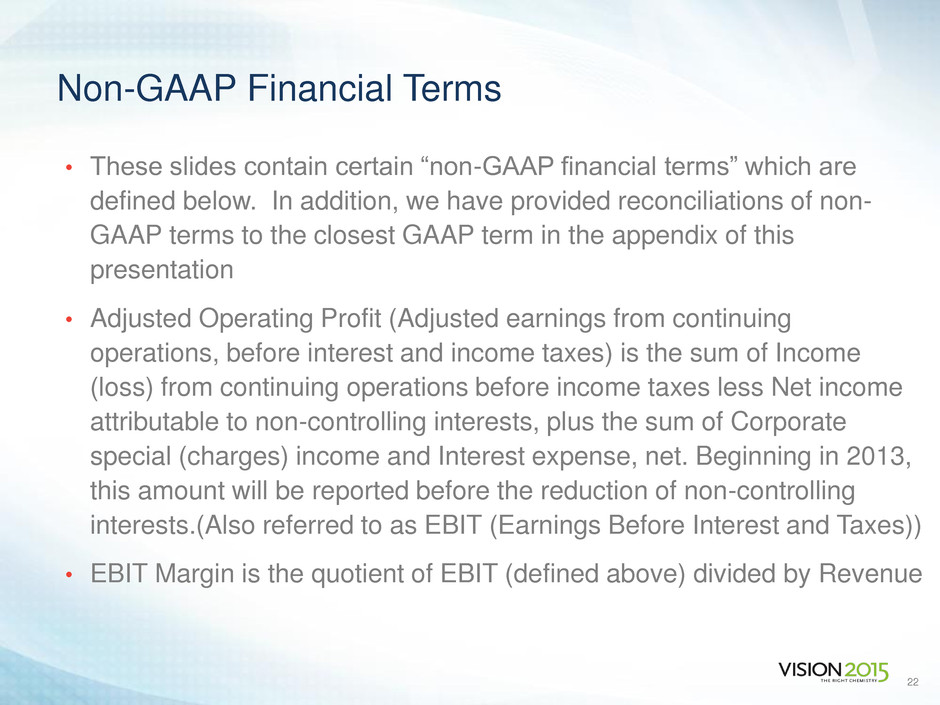

• These slides contain certain “non-GAAP financial terms” which are defined below. In addition, we have provided reconciliations of non- GAAP terms to the closest GAAP term in the appendix of this presentation • Adjusted Operating Profit (Adjusted earnings from continuing operations, before interest and income taxes) is the sum of Income (loss) from continuing operations before income taxes less Net income attributable to non-controlling interests, plus the sum of Corporate special (charges) income and Interest expense, net. Beginning in 2013, this amount will be reported before the reduction of non-controlling interests.(Also referred to as EBIT (Earnings Before Interest and Taxes)) • EBIT Margin is the quotient of EBIT (defined above) divided by Revenue Non-GAAP Financial Terms 22

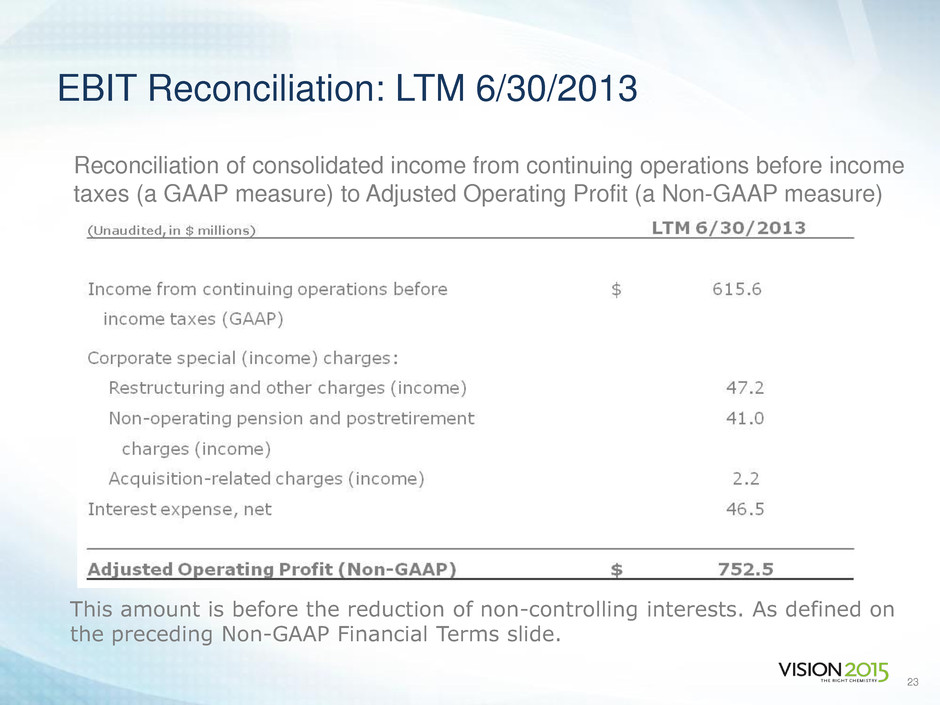

Reconciliation of consolidated income from continuing operations before income taxes (a GAAP measure) to Adjusted Operating Profit (a Non-GAAP measure) EBIT Reconciliation: LTM 6/30/2013 This amount is before the reduction of non-controlling interests. As defined on the preceding Non-GAAP Financial Terms slide. 23