Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Novelis Inc. | form8-kxearningsreleaseq12.htm |

| EX-99.1 - EX99.1EARNINGSRELEASE - Novelis Inc. | novelisq1fy14results.htm |

©2013Novelis Inc. 1 August 12, 2013 Philip Martens President and Chief Executive Officer Steve Fisher Senior Vice President and Chief Financial Officer Novelis Q1 Fiscal Year 2014 Earnings Conference Call EXHIBIT 99.2

©2013Novelis Inc. 2 Safe Harbor Statement Forward-Looking Statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward-looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward-looking statements in this presentation are statements about expected FRP market growth globally and in our key product segments of beverage can, automotive and specialties. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our metal hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing for future capital requirements; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our customers operate; changes in the fair value of derivative instruments; cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our customers’ industries; changes in government regulations, particularly those affecting taxes, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our principal credit agreement and other financing agreements; the effect of taxes and changes in tax rates; and our indebtedness and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2013 are specifically incorporated by reference into this presentation. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures as defined by SEC rules. We think that these measures are helpful to investors in measuring our financial performance and liquidity and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for GAAP financial measures. We have included reconciliations of each of these measures to the most directly comparable GAAP measure. In addition, a more detailed description of these non-GAAP financial measures used in this presentation, together with a discussion of the usefulness and purpose of such measures, is included in our Current Report on Form 8-K furnished to the SEC with our earnings press release.

©2013Novelis Inc. 3 Agenda Business Review Novelis Strategy Detailed Financial Performance Summary & Outlook

©2013Novelis Inc. 4 Business Review

©2013Novelis Inc. 5 First Quarter Highlights Softer than Expected Demand in Can; Continued Strength in Auto Negative Regional Pricing Impacts Focus on Cost Control and Driving Recycling Benefits Excellent Progress on Strategic Expansions

©2013Novelis Inc. 6 Regional Business Highlights Europe Continued Strong Auto & Can Demand offset Some Softness in Specialties Improved Operating Performance and Good Cost Control Asia North America South America Stronger Demand Across All Product Segments Unfavorable Regional Pricing Dynamics due to High MJP Recycling Strategy Driving Significant Benefits Open Capacity in Can Market Driving Down Prices Softer Can Demand Significant Opportunity in Auto; Began Commissioning New Finishing Lines in July Strong Can Demand 2HFY14 Driven by World Cup Customer Qualification Largely Complete at Cold Mill Expansion; Accelerated Ramp- Up Expected to Meet Demand

©2013Novelis Inc. 7 Novelis’ Strategy

©2013Novelis Inc. 8 Global Strategic Investments United States Finishing ~240kt Korea Rolling ~350kt China Finishing ~120kt Brazil Rolling ~220kt Rolling Capacity Expansion Automotive Finishing Line(s) Recycling ~190kt Recycling ~400kt Recycling ~265kt Germany Recycling Expansions Strengthening Novelis’ Global Footprint

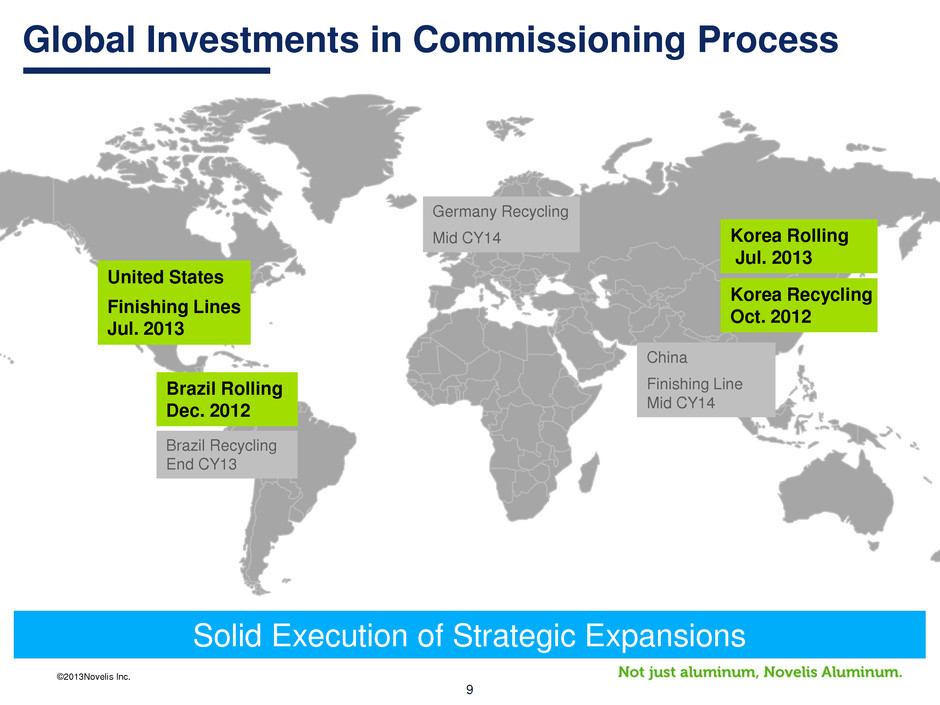

©2013Novelis Inc. 9 Global Investments in Commissioning Process Solid Execution of Strategic Expansions United States Finishing Lines Jul. 2013 Korea Recycling Oct. 2012 Brazil Rolling Dec. 2012 China Finishing Line Mid CY14 Brazil Recycling End CY13 Germany Recycling Mid CY14 Korea Rolling Jul. 2013

©2013Novelis Inc. 10 Korea Rolling Mill Commissioned ~350kt Incremental Rolling Capacity at Ulsan & Yeongju Began Commissioning July 2013 Accelerated Ramp to Full Capacity over Approximately Two Years Will Contribute ~60kt Shipments in FY14 Largely Completes ~$400 Million Rolling & Recycling Expansion in Asia

©2013Novelis Inc. 11 North America Auto Finishing Lines ~240kt Automotive Finishing Lines in Oswego Began Commissioning July 2013 Commissioning Ramp will Accelerate Through Remainder of Fiscal Year Undergoing Customer Qualification Process

©2013Novelis Inc. 12 Detailed Financial Performance

©2013Novelis Inc. 13 First Quarter Highlights Shipments Down 2% to 708 Kilotonnes Adjusted EBITDA Down 21% to $204 Million Net Income of $14 Million; Excluding Certain Items, Net Income $21 Million Negative Free Cash Flow Before CapEx of $108 Million Liquidity of $730 Million (Q1FY14 vs. Q1FY13)

©2013Novelis Inc. 14 2.6 2.4 200 350 500 650 800 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 Q1FY13 Q1FY14 Shipments Sales 0 50 100 150 200 250 300 South America Asia Europe North America Q1FY14 Q1FY13 16% (3%) (11%) 0% Sales (Billions) • Third Party Shipments (Kt) Shipments & Sales Total Company Shipments by Region

©2013Novelis Inc. 15 Q1FY14 Adjusted EBITDA (Millions) Q1FY13 $259 L-T Incentive Plan Conversion (14) Volume (16) Price/Mix (48) Cost 23 FX/Metal Price Lag/Other 0 Q1FY14 $204 One-time employee plan amendment Lower priced contracts, higher local market premium in Asia, and unfavorable mix in Europe with offsetting cost savings Significant scrap benefits and cost containment partially offset by Inflation and higher fixed cost base Favorable FX in Europe and Primary Operations offset Metal Price Lag

©2013Novelis Inc. 16 Pricing Dynamics Pricing Challenge Opportunity to Offset Overhang of Excess Mill Capacity in Mature Can Market Increased Demand for Auto will Constrain Hot Mill Capacity and Rebalance Supply & Demand Regional Premiums Doubled Over the Last Year Increased Competition due to Open Capacity from Slower Growth in China Minimize Impact by Increasing Scrap Inputs Resurgence of Growth in China North America Asia

©2013Novelis Inc. 17 (Millions) Capital Expenditures 167 775 181 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 Q1 FY FY14 FY13 ~700- 750E Another Key Capital Investment Year to Capture Future Growth

©2013Novelis Inc. 18 (Millions) Free Cash Flow Before CapEx FY14 FY13 Negative Q1 FCF before Capex Driven by: Semi-Annual Bond Interest Payment of $107 Million Higher Working Capital (2) (108) ($120) ($100) ($80) ($60) ($40) ($20) $0 Q1

©2013Novelis Inc. 19 Summary & Outlook

©2013Novelis Inc. 20 Summary Softer than Expected Can Demand Offset by Continued Strength in Auto Focus on Cost Containment & Driving Recycling Benefits to Help Offset Pricing Pressures Excellent Progress on Strategic Expansions

©2013Novelis Inc. 21 Outlook – 2HFY14 Improving Global Demand in Key Product Segments Normalized Weather Patterns World Cup in Brazil Continued Substitution to Aluminum Automotive Sheet Continued Cost Containment Efforts Increased Benefits from Higher Use of Recycled Inputs Expansions Driving Growth Increased Rolling Capacity in Brazil and Korea

©2013Novelis Inc. 22 Questions & Answers

©2013Novelis Inc. 23 Appendix

©2013Novelis Inc. 24 (in $ m) Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 FY13 Q1 FY14 Net Income (loss) Attributable to Our Common Shareholder 91 49 3 59 202 14 - Interest, net (73) (72) (74) (73) (293) (75) - Income tax (provision) benefit (21) (37) (11) (14) (83) (3) - Depreciation and amortization (73) (69) (76) (74) (292) (77) - Noncontrolling interests - (1) - - (1) - EBITDA 258 228 164 220 871 169 - Unrealized gain (loss) on derivatives 13 (24) 4 21 14 (12) - Realized gain (loss) on derivative instruments not included in segment income 2 - - 3 5 2 - Proportional consolidation (11) (9) (11) (10) (41) (11) - Restructuring charges, net (5) (16) (5) (19) (45) (9) - Gain (loss) on assets held for sale 5 (2) - - 3 - - Gain (loss) on Extinguishment of Debt - - - (7) (7) - - Others costs, net (5) 2 (9) (8) (19) (5) Adjusted EBITDA 259 277 185 240 961 204 Other Income (expense) Included in Adjusted EBITDA - Metal price lag 6 26 (9) (0) 23 (2) - Foreign currency remeasurement 4 2 1 0 6 3 - Purchase accounting (3) (3) (3) (3) (13) (3) Income Statement Reconciliation To Adjusted EBITDA

©2013Novelis Inc. 25 (in $m) FY13 FY14 Q1 Q2 Q3 Q4 Full Year Q1 Cash Provided by (used in) Operating Activities (5) 122 (95) 181 203 (102) Cash Provided by (used in) Investing Activities (152) (152) (201) (242) (747) (187) Less: Proceeds from Sales of Fixed Assets (12) 5 (13) (1) (21) - Free Cash Flow (169) (25) (309) (62) (565) (289) Free Cash Flow

©2013Novelis Inc. 26 1) Metal Price Lag Net of Related Hedges: On certain sales contracts we experience timing differences on the pass through of changing aluminum prices from our suppliers to our customers. Additional timing differences occur in the flow of metal costs through moving average inventory cost values and cost of goods sold. This timing difference is referred to as Metal Price Lag. We have a risk management program in place to minimize the impact of this “lag”. 2) Foreign Currency Remeasurement Net of Related Hedges: All Balance Sheet accounts not denominated in functional currency are remeasured every period to the period end exchange rates. This impacts our profitability. Like Metal Price Lag, we have a risk management program in place to minimize the impact of such remeasurement. 3) Purchase Accounting: Following our acquisition, the consideration and transaction costs paid by Hindalco in connection with the transaction were “pushed down” to us and were allocated to the assets acquired and the liabilities assumed. These allocations are amortized over periods, impacting our profitability. Explanation of Other Income (Expense) in Adjusted EBITDA