Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HARVEST NATURAL RESOURCES, INC. | d583108d8k.htm |

EnerCom's The Oil &

Gas Conference 18

August 12, 2013

Exhibit 99.1

® |

Forward Looking

Statements NYSE: HNR

www.harvestnr.com

2

Cautionary

Statements:

Certain statements in this presentation are forward-looking and are based upon

Harvest’s current belief as to the outcome and timing of future events.

All statements other than statements of historical facts including

planned

capital

expenditures,

increases

in

oil

and

gas

production,

Harvest’s

outlook

on

oil

and

gas

prices,

estimates of oil and gas reserves, business strategy and other plans, estimates,

projections, and objectives for future operations,

are

forward-looking

statements

within

the

meaning

of

the

“safe

harbor”

provisions

of

the

Private

Securities

Litigation Reform Act of 1995. Important factors that could cause actual results to

differ materially from those in the forward-looking statements herein include

Harvest’s concentration of assets in Venezuela; timing and extent of changes in

commodity prices for oil and gas; political and economic risks associated with international operations; and other risk

factors

as

described

in

Harvest’s

Annual

Report

on

Form

10-K

and

other

public

filings.

Should

one

or

more

of

these

risks

or

uncertainties

occur,

or

should

underlying

assumptions

prove

incorrect,

Harvest’s

actual

results

and

plans

could

differ materially from those expressed in the forward-looking statements. Harvest

undertakes no obligation to publicly update or revise any forward-looking

statements. Harvest may use certain terms such as resource base, contingent resources,

prospective resources, probable reserves, possible reserves, non-proved reserves

or other descriptions of volumes of reserves. These estimates are by their

nature more speculative than estimates of proved reserves and accordingly, are subject to

substantially greater risk of being actually realized by the Company. Investors

are urged to consider closely the disclosure in our 2012 Annual Report on Form

10-K and other public filings available from Harvest at 1177 Enclave Parkway, Houston, Texas, 77077

or from the SEC’s website at www.sec.gov.

Contingent resources are resources that are potentially recoverable but not yet considered

mature enough for commercial

development

due

to

technological

or

business

hurdles.

Prospective

resources

are

those

quantities

of

hydrocarbons which are estimated, as of a given date, to be potentially recoverable from

undiscovered accumulations by application of future development projects. They

indicate exploration opportunities and development potential in the event a discovery

is made and should not be construed as contingent resources or reserves. The contingent and

prospective resources included in this presentation were internally developed by Harvest

Natural Resources. |

About

Harvest NYSE: HNR

www.harvestnr.com

3

Market Data

Exchange/Ticker

NYSE: HNR

Market Capitalization *

$ 174 MM

Enterprise Value

$ 243 MM

Cash (06/30/2013)

$ 9.8 MM

Debt (06/30/2013)

$ 79 MM

Shares Outstanding

39.5 MM

Institutional Ownership

75%

*

As of August 7, 2013 |

Highlights

NYSE: HNR

www.harvestnr.com

4

Venezuela continues strong production growth

Up 16% in 2012

Current production 43,000 bopd, up 19% vs. 2012 average

“2 for 2”

Exploration in pre-salt offshore Gabon

Ruche discovery in 2011

Tortue discovery in 2013

49 million bbl oil discovered on block

Large scale outboard potential identified

Proven hydrocarbon system onshore Indonesia

Oil and gas encountered in two exploration wells

3

rd

well expected to spud 1

Q 2014

Process underway for Gabon and Indonesia farmout/sale

Colombia entry

st |

Venezuela -

Petrodelta

NYSE: HNR

www.harvestnr.com

5

32% Equity Interest in Petrodelta

Six fields, 9.9 billion barrels of gross

oil-in-place

Growth underway

Current production rate of 43,000

bopd

Successful development program

ongoing in Temblador, Isleño and

El Salto

El Salto producing 20,000 bopd

Isleño producing 2,200 bopd from

three horizontal wells

Five drilling rigs operating plus one

new rig assembling on location

Operations generating solid

financial performance

2012 CFO of $248 million (gross)

$84 million in dividends (net to HNR)

received since 2008

$9.8 million (net to HNR) in dividends

declared and receivable

Cash

Surplus

Jan

2010

-

2013

Q2:

$90 million net to HNR 32% interest

2009

2010

2011

2012

2013 1H

Cash From Operations ($MM, Gross)

140

192

196

248

126

Production (MMBOE, Gross)

8.6

8.9

11.8

13.5

7.1

Proved Reserves (MMBOE, net to Harvest)

46.3

50.0

43.3

38.4

36.9

2P Reserves (MMBOE, net to Harvest)

83.3

103.6

103.8

100.2

98.7

3P Reserves (MMBOE, net to Harvest)

224.3

220.6

210.5

204.6

203.1

South Monagas Unit (SMU):

New Fields:

El Salto, Temblador, Isleño

Total Area Petrodelta’s Fields: 1000.03 Km

Uracoa, Tucupita, Bombal

2 |

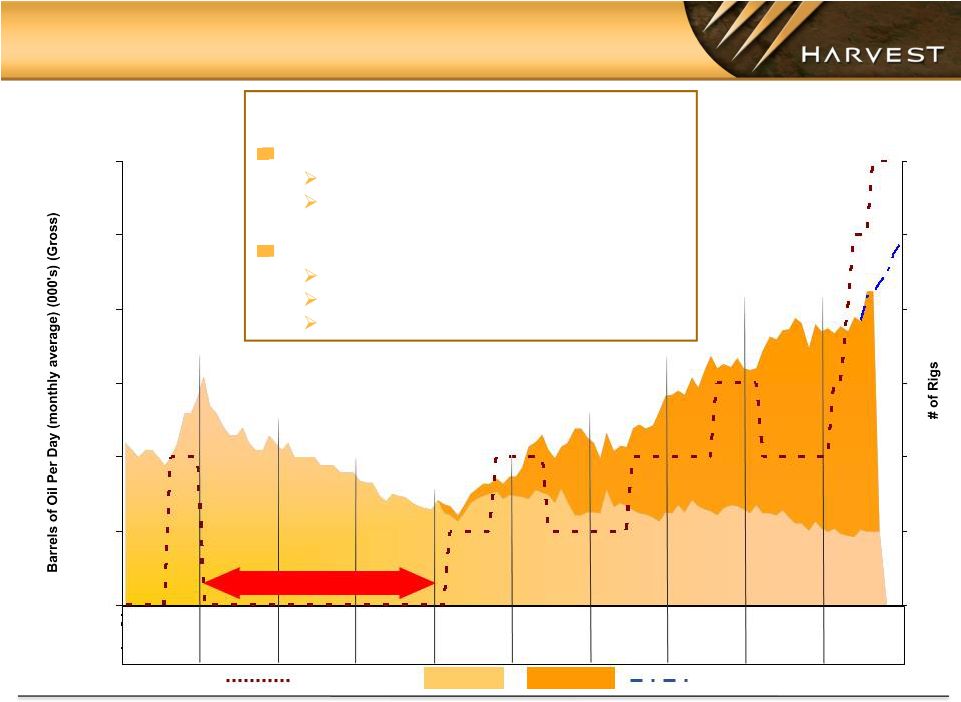

Petrodelta Production

NYSE: HNR

www.harvestnr.com

6

# of Drilling Rigs

New Fields

SMU

Production Outlook

2004

2005 2006

2007

2008 2009 2010 2011

2012 2013

2013 Outlook

41,300 BOPD average full year

38,211 BOPD average Q2 2013

43,000 BOPD current

$210 million Capex for 2013

New fields Infrastructure

6 rigs at year-end for development wells

25 new oil wells

60

50

40

30

20

10

0

6

5

4

3

2

1

0

Conversion Process |

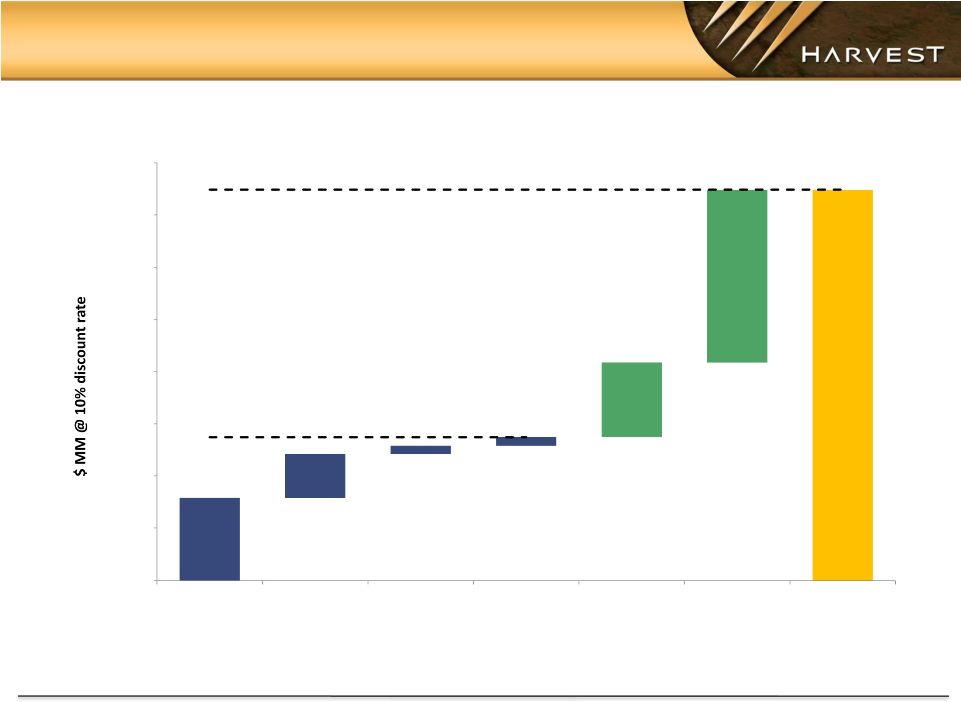

Petrodelta Reserves Valuation

NYSE: HNR

www.harvestnr.com

7

(1)

Net to HNR after 33.33% royalty

At December 31, 2012

Six fields with 9.9 billion barrels gross OOIP

38.4 million BOE net Proven, 166.2 million BOE net Probable and Possible

2013 Drilling Program at El Salto, Temblador and Isleño fields will continue to

drive reserve additions and increase production

Petrodelta Reserves Value

(After Tax

(2)

-

Net to HNR 32% Interest

)

(2)

After Venezuelan Income Taxes but before U.S. Income Taxes

1,600

1,800

1,200

1,400

800

1,000

600

400

200

0

NPV10

@ WTI = $50/BBL

NPV10

@ WTI = $70/BBL

NPV10

@ WTI = $100/BBL

Possible

Probable

Proved

Ryder Scott reserve report @ 12/31/2012

WTI =

$94.2/BBL, Petrodelta oil price = $95.9/BBL

(Net to Harvest Natural Resources 32% Interest and

net of 33.33% royalties)

Net Resource Base

(1)

Proved

Probable Oil, MMBBL

34.5

54.7

99.5

Gas, BCF

23.2

42.9

29.4

Total, MMBOE

38.4

61.8

104.4

Proved

2P

3P

Reserves (MMBOE)

(1)

38.4

100.2

204.6

After –

Tax PV10 ($MM):

As of 12/31/2012:

450

917

1,647

Per BOE

$11.7

$9.2

$8.1

Possible |

Gabon

– Dussafu Block

NYSE: HNR

www.harvestnr.com

8

GABON

Lucina

Etame

Yombo

Ruche

Walt

Whitman

Moubenga

GMC-1X

Tortue

Avouma

Ebouri

North

Tchibala

South Tchibala

HNR PROPERTIES

GAMBA PROSPECTS/LEADS

OTHER PROSPECTS/LEADS

OIL FIELDS

GAS DISCOVERY

680,000 acre PSC, Offshore Gabon

66.667% operated interest

49 MMBO mean contingent resources

discovered

3 Exploration Period

•

Extends to May 27, 2016

•

Work commitments completed

Key HNR Activities to Date

Tortue Discovery (2013)

•

28 MMBO Mean Contingent Resources

Ruche Discovery (2011)

•

14 MMBO Mean Contingent Resources

Development planning nearing completion

•

POD to be submitted 3Q 2013

Central Dussafu 3D acquired 2011

•

Final PSDM processing complete

Outboard 3D Seismic planned 2013

•

Large Dentale structures seen on 2D

•

Analogous to nearby Diaman prospect

currently being drilled by Total

rd |

NYSE: HNR

www.harvestnr.com

9

Tortue Exploration Well DTM-1

Oil discovery in pre-salt Gamba and Dentale

reservoirs, 53m net pay

Appraisal sidetrack DTM-1 ST1, 20m net pay

in Dentale

Well suspended pending future appraisal and

development studies

DTM-1

Gamba

Structure

Dentale

Structure

DTM-1 ST1

N

Tortue Marin-1

Reservoir

STOIIP (MMBO)

Contingent

Resources

(MMBO)

Mean

P10

Mean

P10

Gamba

24

42

9

16

Dentale

72

129

19

39

Total

96

171

28

55

Dussafu –

Tortue Discovery |

Dussafu -

Ready for Development

NYSE: HNR

www.harvestnr.com

10

Work-In-Progress

Subsurface engineering

Project and facilities engineering

Logistics planning

Well completion design

Equipment selection

Expect FEED complete 3Q 2013

First production by mid 2015

Project sanction by partners 2013

Long lead items to be ordered

Declaration of commerciality

Initial Tortue wells drilled in 2014

FPSO installed 1Q 2015

Continued development through

2015-16

Well and facility layout for sub-sea tiebacks

to FPSO located at Tortue Field |

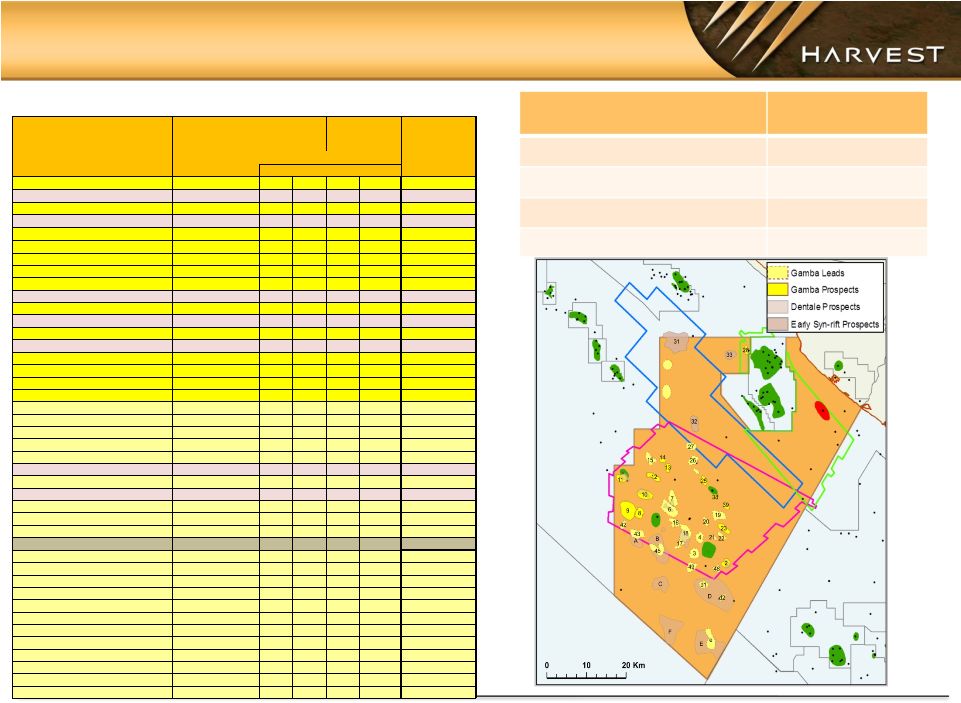

Dussafu Resource Potential

NYSE: HNR

www.harvestnr.com

11

Resource Type

Mean MMBO

Contingent Resource

49

13 Prospects (unrisked)

201

16 Leads (unrisked)

765

TOTAL

1015

Name

Formation

Unrisked

STOIIP

Unrisked

Recoverable

Reserves

Overall

Lead/Prospect

COS

Oil/Condensate (MMBBl)

P10

Mean

P10

Mean

2 Tchibobo NE

Gamba

43

25

14

8

40%

2 Tchibobo NE

Mid Dentale

109

60

33

18

40%

12 Moubenga East

Gamba

113

70

38

23

35%

12 Moubenga East

Mid Dentale

145

64

33

14

12%

11 Moubenga updip

Gamba

34

23

11

8

29%

13 Bougainvillea N amplitude

Gamba

48

28

16

9

52%

14 Bougainvillea N NW amplitude

Gamba

26

19

9

6

45%

8 Hibiscus Updip

Gamba

39

23

13

7

30%

9 Mupale

Gamba

118

70

39

22

28%

9 Mupale

Mid Dentale

107

51

25

11

27%

10 Hibiscus North

Gamba

144

74

47

24

26%

10 Hibiscus North

Mid Dentale

94

41

21

9

16%

23

Gamba

59

40

20

13

34%

23

Mid Dentale

46

23

11

5

41%

25 NW Walt Whitman

Gamba

32

20

11

7

39%

28 West M'Bya

Gamba

28

19

9

6

35%

38 SE Walt Whitman

Gamba

22

14

7

5

39%

39 SSE Walt Whitman

Gamba

30

19

10

6

39%

3 Tchibobo N West

Gamba

112

53

37

17

18%

4 Tchibobo N NW

Gamba

39

19

13

6

18%

6 Dussafu West

Gamba

118

62

39

20

23%

15

Gamba

74

51

25

17

20%

18

Gamba

99

48

33

16

20%

18

Mid Dentale

91

38

21

8

12%

19 Dussafu East

Gamba

89

44

30

14

26%

19 Dussafu East

Mid Dentale

197

88

45

20

17%

26 Jedi West

Gamba

89

53

29

17

27%

42 Hibiscus South

Gamba

26

14

9

4

23%

49 Tchibobo West

Gamba

37

25

13

8

14%

31 Mukombo Combined

M'Bya/Lucina

143

81

23

12

13%

Outboard leads

A Gamba Lead 43 (Ruche SW)

Gamba

44

27

15

9

14%

A Dentale Lead 5

Dentale

137

65

41

19

19%

B Gamba Lead 45 (Ruche SE)

Gamba

54

34

18

11

14%

B Dentale Lead 4

Dentale

406

171

121

51

20%

C Dentale Lead 3

Dentale

307

157

92

47

19%

D Gamba Lead D1

Gamba

27

17

9

6

14%

D Gamba Lead D2

Gamba

14

9

5

3

14%

D Dentale Lead 1

Dentale

1643

698

493

209

17%

E Gamba Lead

Gamba

75

50

25

16

14%

E Dentale Lead 2

Dentale

817

415

245

124

19%

F Dentale

Lead 6 Dentale

800

369

241

111

15%

Exploration Prospects and Leads |

Dussafu Outboard Leads

NYSE: HNR

www.harvestnr.com

12

Dussafu outboard leads in relation to nearby

Dentale exploration activity

Total / Cobalt / Marathon drilling Diaman-1 targeting 250-

800 MMBO

Shell / CNOOC expected to drill 2 well in BC9/10 in 2013

Vaalco / Sasol / Sinopec drilling Ovoka-1 well targeting

140 MMBO

Acquiring 3D is key to de-risking outboard leads

Dussafu Outboard Leads

Based on 2D seismic

BC9/10

Diaman-1

At TD

250-800 MMBO

Ovoka

Drilling

140 MMBO

Lead A

30-50 MMBO

Lead C

50-100 MMBO

Lead F

110-250 MMBO

Lead E

140-270 MMBO

Lead B

60-140 MMBO

Lead D

200-500 MMBO |

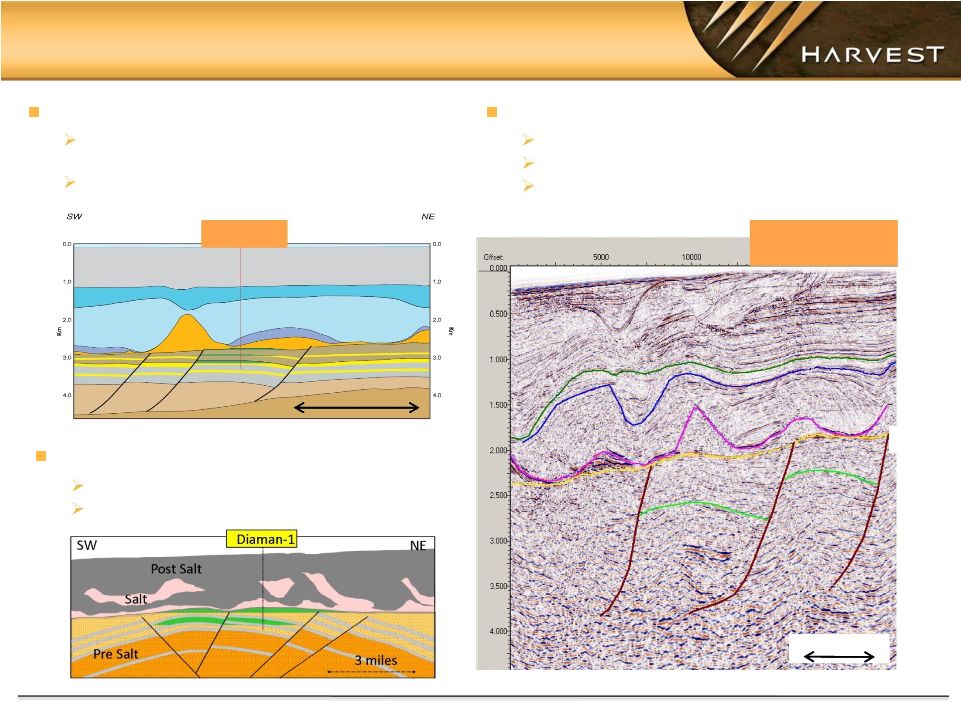

NYSE: HNR

www.harvestnr.com

13

South Gabon Pre-Salt Structures

Tortue-1

Tortue Discovery (Harvest 2013)

Gamba & Dentale structures formed by listric normal

faults detaching on older Melania shale

Dentale consists of stacked lacustrine and fluvial deltaic

channel systems

Diaman Prospect (Total/Marathon/Cobalt)

Well targeted stacked Gamba & Dentale reservoirs

Large faulted anticline

Dussafu Outboard Leads (Harvest)

Defined by multiple 2D lines

Stacked Gamba and Dentale potential

Closures are larger than seen on inboard portion of

block

3 miles

Marathon Oil Investor Presentation

Top Salt

Top Gamba

Dentale

Marker

Madiela

3 miles

Dussafu Outboard

Lead D |

Dussafu Potential Value, Net to Harvest

NYSE: HNR

www.harvestnr.com

14

Exploration Program Mean

Risked Value: $947

$317

$167

$31

$35

$284

$663

$1,497

Contingent Resources

Mean Value: $550

Total Mean Value:

$1497

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Tortue

Ruche

Walt Whitman

Moubenga

Inboard Expl

Mean

Outboard Expl Total Resource

Mean

Mean Value |

NYSE: HNR

www.harvestnr.com

15

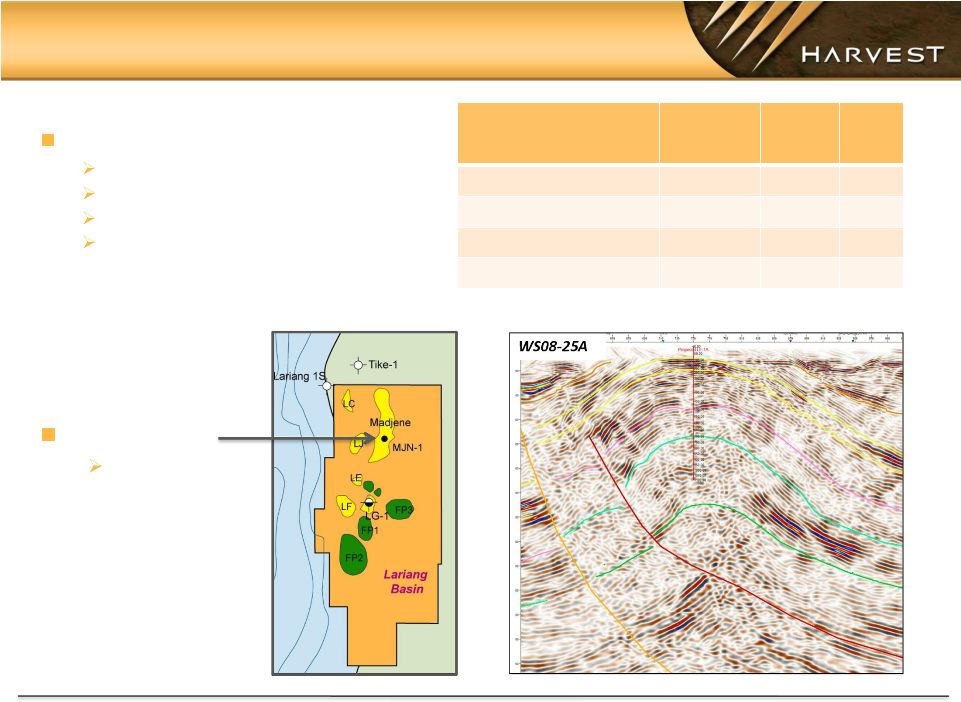

Indonesia -

Budong-Budong

611,943 acre PSC

71.5% WI -

Onshore West Sulawesi

4 year extension to Jan 2017

Harvest became operator in April 2013

Proven Petroleum System

Lariang and Karama sub-basins

Source kitchen known

Extensive oil and gas seeps

Undrilled structures on seismic and surface

anticlines

LG-1 and KD-1 wells drilled in 2011-12

Oil and gas encountered in overpressured

sands

Farming Down

Madjene

Prospect

(MJN-1)

Prospect and Leads

Inventory

Mean

MMBO

Prospects (13)

660

Leads (10)

In-progress

TOTAL

660

HNR LICENSE

BACK THRUST PROSPECTS/LEADS

FOLD BELT LEADS

STRATIGRAPHIC PROSPECTS/LEADS |

Budong-Budong Madjene Prospect

NYSE: HNR

www.harvestnr.com

16

Madjene Prospect

Thrusted anticline

Stacked reservoir targets

Pliocene and Miocene sands

96 MMBO total mean unrisked

reserves

MJN-1 well

1Q 2014

Unrisked Gross

Reserves

Mean

MMBO

P10

MMBO

COS

%

Pliocene 490 Sand

44

74

30%

Upper Miocene Sand

37

64

21%

Middle Miocene Sand

15

27

20%

TOTAL

96

165 |

Colombia Entry

NYSE: HNR

www.harvestnr.com

17

HNR Farmin to VSM14 and VSM15 Blocks

Signed agreements with operators of blocks

Subject to approval of the Colombia ANH

HNR 75% operated interest in both blocks*

VSM 14 –

137,061 gross acres

VSM 15 –

105,721 gross acres

Phase 1 Exploration through Dec 2015

Investment Rationale

Compelling unconventional and conventional

potential

2000+ ft Cretaceous La Luna/Tetuan shales in

synclines from 5,000-12,000 ft depths

Thrust-related structures

Favorable political and fiscal environment

Favorable risk-reward

Nearby infrastructure

Emerging unconventional focus in Colombia

Harvest prior unconventional success

2 years of studies on international unconventional

Upper Magdalena Basin

VSM 15

VSM 14

La Hocha

Palermo

Oil Pipeline

*

Harvest's

acquisition

of

the

Participating

Interest

and

the

transfer

of

operatorship

on

VSM14

and

VSM15

are

subject

to

the

approval

of

the

Colombia

ANH

COLOMBIA

NEIVA

San Francisco

Dina

Tenay

Palo Grande

Caguan

Tello

Antares

Brisas

Balcon

Los Mangos

La Canada

20km |

Cretaceous Shale Characteristics

NYSE: HNR

www.harvestnr.com

18

VSM 15

VSM 14

1

2

Villeta

TOC 2%

50-70 feet net pay

10-16% porosity

30-50 MMBO/sq mile

La Luna

TOC 3%

100-220 feet net pay

8-14% porosity

50-70 MMBO/sq mile

Tetuan

TOC 3.7%

100-230 feet net pay

8-12% porosity

50-90 MMBO/sq mile

Total Cretaceous Section

TOC 2-3.7%

250-550 feet net pay

8-16% porosity

130-210 MMBO/sq mile

Villeta

faulted out

3

1,160’

gross

1

2,040’

gross

Cretaceous Shales

on or near blocks VSM14-15

Villeta

La Luna

Tetuan

2

1,750’

gross

Log analysis by NuTech Shale Vision

HC filled porosity

Permeability

La Luna

Tetuan

3 |

NuTech Log Analysis

Unconventional Reservoirs –

Comparison

NYSE: HNR

www.harvestnr.com

19

Eagleford

1

1

La Luna

Middle Mag

Niobrara

3

3

Feet

100

200

300

350

0

VSM 14/15 La Luna

VSM 14/15 Tetuan |

Why

Invest in Harvest? NYSE: HNR

www.harvestnr.com

20

Significant Valuation Gap

Currently trading at 1/3 of the after-tax proceeds from failed

Petrodelta sale

Trading at a discount to valuation of contingent resources for

existing discoveries in Dussafu Block in Gabon

Near-term development with first oil by first half 2015

High-impact exploration portfolio in pre-salt offshore

Two blocks onshore Colombia in government approval stage

Large scale potential in unconventional and conventional

|