Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RED MOUNTAIN RESOURCES, INC. | d582744d8k.htm |

Exhibit 99.1 |

2

Disclaimer

This

presentation

does

not

constitute

an

offer

to

sell

or

a

solicitation

of

an

offer

to

buy

securities

nor

does

it

constitute

an

offer

or

solicitation

In

any

jurisdiction

in

which

such

offer,

solicitation

or

sale

would

be

unlawful

prior

to

registration

or

qualification

under

the

securities

laws

of

any

such

jurisdiction.

Any

such

offer

may

only

be

made

pursuant

to

a

registration

statement

or

pursuant

to

an

exemption

from

registration,

if

available.

No

general

solicitation

whatsoever

is

made

or intended hereby.

Cautionary and Forward-Looking Statements

In

addition

to

statements

of

historical

fact,

this

presentation

contains

forward-looking

statements.

The

presentation

of

outlooks,

projections,

estimates,

targets

and

other

forward-looking

information

in

this

presentation

is

subject

to

a

number

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

reflected

in

such

statements.

Readers

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements,

which

reflect

management’s

analysis

only

as

of

the

date

hereof.

Without

limiting

the

generality

of

the

foregoing,

words

such

as

“may,”

“will,”

“expect,”

“believe,”

“anticipate,”

“intend,”

or

“could”

or

the

negative

variations

thereof

or

comparable

terminology

are

intended

to

identify forward-looking

statements.

These

forward-looking

statements

are

subject

to

numerous

assumptions,

risks

and

uncertainties

that

may

cause

actual

results

to

be

materially

different

from

any

future

results

expressed

or

implied

in

those

statements.

Risks

and

uncertainties

that

could

prevent

the

Company

from

achieving

any

stated

goals

include,

but

are

not

limited

to,

the

following:

a.

volatility or decline of our stock price;

b.

potential fluctuation in annual or quarterly results;

c.

dilution related to additional issuances of securities;

d.

declines or volatility in the prices we receive for our oil and natural gas;

e.

general economic conditions, whether internationally, nationally

or in the regional and local market areas in which we do business;

f.

our ability to generate sufficient cash flow from operations, borrowings or other

sources to enable us to fully develop our oil and natural gas properties;

g.

risks associated with drilling, including completion risks, cost

overruns and the drilling of non-economic wells or dry holes;

h.

uncertainties associated with estimates of proved oil and natural gas reserves;

i.

the

presence

or

recoverability

of

estimated

oil

and

natural

gas

reserves

and

the

actual

future

production

rates

and

associated

costs;

j.

risks and liabilities associated with acquired companies and properties;

k.

risks related to integration of acquired companies and properties;

l.

potential defects in title to our properties;

m.

our

ability

to

raise

additional

capital

to

fund

future

capital

expenditures;

n.

cost and availability of drilling rigs, equipment, supplies, personnel and oilfield

services; o.

geological concentration of our reserves;

p.

environmental

or

other

governmental

regulations,

including

legislation

of

hydraulic

fracture

stimulation

and

elimination

of

income

tax

incentives

available

to

our

industry;

q.

our

ability

to

secure

firm

transportation

for

oil

and

natural

gas

we

produce

and

to

sell

the

oil

and

natural

gas

at

market

prices;

r.

exploration and development risks;

s.

management’s ability to execute our plans to meet our goals;

t.

our ability to retain key members of our management team;

u.

weather conditions;

v.

actions or inactions of third-party operators of our properties;

w.

costs and liabilities associated with environmental, health and safety laws;

x.

ability to find and retain skilled personnel;

y.

operating hazards attendant to the oil and natural gas business;

and

z.

competition in the oil and natural gas industry.

The

Company

undertakes

no

obligation

to

publicly

revise

these

forward-looking

statements

to

reflect

events

or

circumstances

that

arise

after

the

date

hereof,

except

as

required

by

applicable

law.

The

financial

and

operating

projections

contained

in

this

presentation

represent

our

reasonable

estimates

as

of

the

date

of

this

presentation.

Neither

our

auditors

nor

any

other

third

party

has

examined,

reviewed

or

compiled

the

projections

and,

accordingly,

none

of

the

foregoing

expresses

an

opinion

or

other

form

of

assurance

with

respect

thereto.

The

assumptions

upon

which

the

projections

are

based

are

described

in

more

detail

herein.

Some

of

these

assumptions

inevitably

will

not

materialize,

and

unanticipated

events

may

occur

that

could

affect

our

results.

Therefore,

our

actual

results

achieved

during

the

periods

covered

by

the

projections

will

vary

from

the

projected

results.

Prospective

investors

are

cautioned

not

to place undue

reliance on the projections included herein.

Pro

forma

production

data

reflects

the

acquisition

of

Cross

Border

Resources,

Inc.

(OTCQB:XBOR)

(“Cross

Border”)

as

if

it

occurred

on

June

1,

2012.

As

of

May

31,

2013,

RMR

owned

83.3%

of

the

outstanding

common

stock

of

Cross

Border. |

3

Corporate Overview

Red Mountain Resources, Inc. (“RMR”)

Listing (OTCQB)

RDMP

Share Price

$0.75

Common Shares Outstanding (MM)

126.0

Market Cap (MM)

$94.5

Total Debt (MM)

$24.1

Cash (MM)

$5.8

Enterprise Value (MM)

$112.8

Management and Insider Ownership

10+%

Company Auditor

Hein & Associates LLP; Darilek, Butler & Associates, PLLC (Cross

Border)

Independent Reserve Engineer Auditor

Cawley, Gillespie & Associates, Inc.

Market data as of close on August 5, 2013 |

4

Company Overview

Pro Forma Production¹ : 886 (BOE/D) –

53% oil

Reserves²: 3.5 MMBOE (as of 6/1/13)

53% Proved Developed

Drilling Inventory: 450 gross (369 net) potential

locations

1

Average net daily production sold for the twelve months ended May 31, 2013.

Includes net production sold represented by the 17% of Cross Border’s common

stock not owned by RMR.

2

As

of

June

1,

2013.

Includes

reserves

represented

by

the

17%

of

Cross

Border’s

common

stock

not

owned

by

RMR.

Acreage Chart

Gross

Net

Developed Permian

11,108

5,237

Undeveloped Permian

325,743

25,774

Undeveloped

Southwest

NM

5

Minerals

536,340

268,170

Developed South Texas

4,776

1,405

Kansas

6,656

6,656

TOTAL

884,623

307,242

98% of Acreage Either Owned Mineral Rights or

Leases Held by Production as of May 31, 2013

3

3

Includes acreage represented by the 17% of Cross Border’s common stock not owned

by RMR

4

Includes mineral ownership.

5

Reflects mineral ownership.

Summary of Combined Properties of RMR,

Cross Border, and Bamco

4 |

5

Strategic Growth Oriented Business Plan

2013E

2014E/2015E

Exit rate daily production to exceed

1,500+ Boepd

Exit rate daily production to exceed

3,000+ Boepd

Uplist on NYSE MKT, potential reverse

stock split

Increase shareholder awareness and

institutional investor base

Target debt service coverage ratio

greater than 5x

Target debt/EBITDA ratio below 3x

Hedging program in place to limit

downside and ensure adequate cash

flows to perpetuate growth

Conventional balance sheet and capital structure

Increase liquidity of stock

Organic growth through the drill bit

RMR completes reverse merger with

Black Rock Capital, acquiring

property assets and 13.2% share in

Cross Border

June 2011

RMR closes private placement raise of

$22.2MM; executes $4MM

secured note; closes $2.75MM conv.

debt

Nov./Dec. 2011

RMR successfully drills and

completes Madera 24-2H with peak

24-hour flow rate of 1,144 Bbls and

772 Mcf for a total of 1,273 Boe;

increases Cross Border ownership to

29.9%

January 2012

Jan./Feb. 2013

RMR increases ownership stake in

Cross Border to 80%, triggering

consolidation; RMR obtains $100MM

credit facility and completes $6MM

equity financing; consolidates debt of

Cross Border and RMR; completion of

cross conveyance with Chevron on

Madera prospect

April/May 2013

RMR consolidates financials

of Cross Border and

completes private placement

of additional $3MM of

equity; RMR increases Cross

Border ownership to 83%

May 2013

July 2013

RMR drills and completes

Madera 24-3H well with

initial production rate of

1,491 Boe (81% oil)

RMR launches $11.25MM

Unit Offering |

6

Board and Management Team

10+ years experience

within the energy industry,

CEO since June 2011

Significant oil & gas

experience, including

management, operations,

finance and corporate

development

Highly experienced team with 10% equity stake

Key Team Members

45+ years experience

within energy industry;

owner of RK Ford &

Associates, Inc. and partner

in Western Drilling, Inc.

Geographical experience in

18 U.S. states and 12

countries

ALAN W. BARKSDALE

Chairman, President, CEO

RANDELL K. FORD

Director

DAVID M. HEIKKINEN

Director

RICHARD Y. ROBERTS

Director

PAUL N. VASSILAKOS

Director

15+ years experience

within energy industry;

CEO of Heikkinen Energy

Advisors, LLC.

Served as Head of E&P

Research for Tudor,

Pickering, Holt & Co. and

as Exploration and

Production Analyst for

Capital One Southcoast,

Inc.

Co-founded Roberts,

Raheb & Gradler LLC, a

regulatory/legislative

consulting firm

From 1990 to 1995 was a

commissioner of the

Securities and Exchange

Commission, during which

time he was actively

involved in a wide range of

subjects affecting the

capital markets

Served as interim

President & CEO of RMR

from February-March

2011

Serves as asst. treasurer

of Cullen Agricultural

Holding Corp. and founder

of Petrina Advisors, Inc., a

privately held advisory

firm

MICHAEL R. UFFMAN

Chief Financial Officer

10+ years of experience in

the financial sector of the

energy industry

Prior experience includes

Global Hunter Securities,

LLC, Dahlman Rose & Co.,

Capital One Southcoast,

Inc., and KPMG LLP

TOMMY W. FOLSOM

EVP, Director of Exp. & Prod.

40+ years of experience in

the energy industry

Prior experience includes

Enerstar Resources O & G,

LLC, Murchison Oil and

Gas, Inc., Vision Energy,

Inc., and Santa Fe Energy,

Inc.

HILDA D. KOUVELIS

Chief Accounting Officer

25+ years of experience in

the financial sector of the

energy industry

Prior experience includes

TransAtlantic Petroleum

Ltd., Sky Petroleum Inc.,

Ascent Energy, Inc., and

PetroFina S.A.

EARL M. SEBRING

Sr. Consulting Geologist,

Interim President Cross Border

35+ years experience

within energy industry;

owner of Sebring

Exploration Texas, Inc.

Geographical experience

in Permian Basin, Gulf

Coast, Oklahoma, and

numerous countries

JACK C. BRADLEY

Vice President, Director of

Business Development

9+ years experience within

energy industry at The

StoneStreet Group and

Sebring Exploration Texas,

Inc.

Extensive experience in

Permian Basin, Val Verde

Basin, South Texas |

7

Capex Plan and Data

2014 Capital Expenditure Plan

2014 Capital Expenditure By Percent

Gross Wells

CAPEX

(in millions)

Percent

Tom Tom Workovers

18

$4.0

10%

Tom Tom New Wells

18

$13.0

33%

Cowden

3

$2.5

6%

Madera

5

$18.5

47%

Shafter Lake

1

$0.5

1%

Non Op

10

$1.0

3%

TOTAL

55

$39.5

100% |

|

9

Permian Basin Focus

Property Overview

300,000 net acres in West Texas and New Mexico

30,000 net acres classified as Permian Basin

Acreage position provides opportunity for reserve adds and

production growth with exposure to:

Large acreage position creates long-term upside

98% of acreage either owned mineral rights or leases held by

production

Significant operating experience and aligned with premier

operating partners on non-operated assets

Uniquely positioned ownership and team provides access to

services and basin-wide well data |

10

|

11

Madera Short-Lateral Economics

High

Base

Low

EUR (Mboe)

467

400

333

PV-10 ($M)

$6,980

$5,074

$3,051

IRR (%)

89%

60%

36%

Payback (Years)

1.3

1.7

2.4

Gross Well Cost ($M)

$6,500

$6,500

$6,500

IP (Boe/d)

807

700

587

B-factor

1.2

1.2

1.2

Sensitivity Case Assumptions (4,620’

Lateral Length)

Representative Base Type Curve / Development Economics

WTI Oil

Price ($/bbl)

PV-10 ($M)

Payout (yrs)

IRR (%)

HIGH CASE

$80

$5,431

1.6

65%

$90

$6,980

1.3

89%

$100

$8,530

1.1

119%

BASE CASE

$80

$3,731

2.1

43%

$90

$5,074

1.7

60%

$100

$6,418

1.4

80%

LOW CASE

$80

$1,927

3.1

25%

$90

$3,051

2.4

36%

$100

$4,177

1.9

48%

Sensitivity to Oil Price -

IRR

Oil Price Sensitivity

* Base case calculated with $90 WTI oil and $3.50 Henry Hub gas,

adjusted

prices are $83.37/bbl and $4.88/mcf |

12

Madera Long-Lateral Economics

High

Base

Low

EUR (Mboe)

667

567

467

PV-10 ($M)

$11,769

$8,706

$5,880

IRR (%)

163%

101%

61%

Payback (Years)

1.1

1.4

1.8

Gross Well Cost ($M)

$7,500

$7,500

$7,500

IP (Boe/d)

1140

967

807

B-factor

1.2

1.2

1.2

Sensitivity Case Assumptions (6,930’

Lateral Length)

Representative Base Type Curve / Development Economics

WTI Oil

Price ($/bbl)

PV-10 ($M)

Payout (yrs)

IRR (%)

HIGH CASE

$80

$9,603

1.3

117%

$90

$11,769

1.1

163%

$100

$13,935

1.0

221%

BASE CASE

$80

$6,870

1.6

74%

$90

$8,706

1.4

101%

$100

$10,542

1.2

136%

LOW CASE

$80

$4,349

2.2

44%

$90

$5,880

1.8

61%

$100

$7,411

1.5

81%

Sensitivity to Oil Price -

IRR

Oil Price Sensitivity |

13

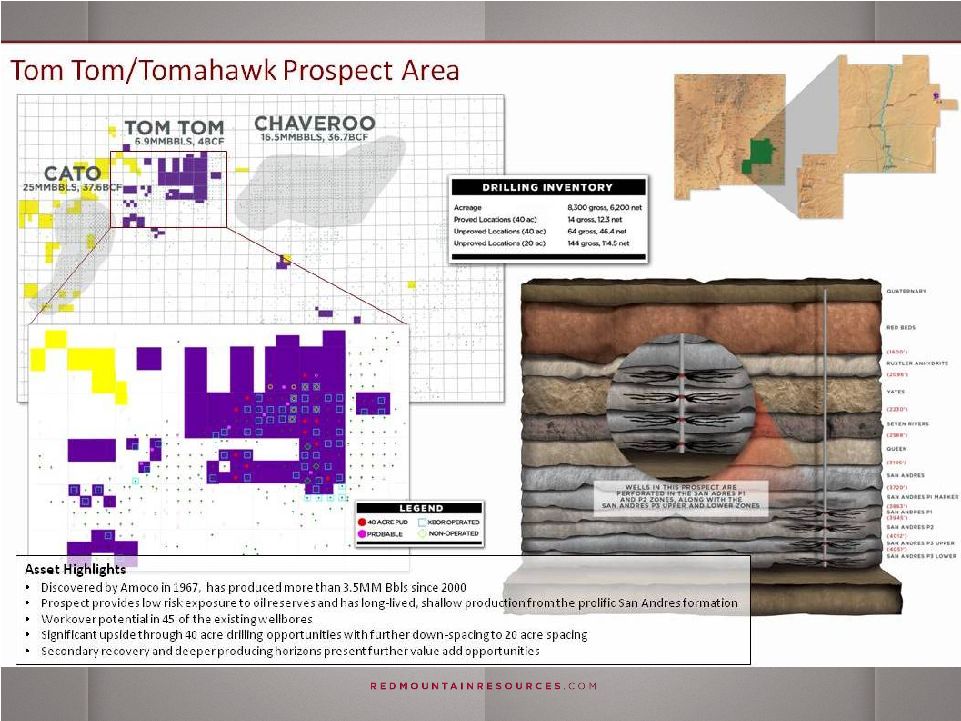

Significant Exposure to Low-Risk San Andres Reserves

The

San

Andres

formation

is

an

oil

and

gas

bearing

member

of

the

Upper

Permian

occurring

in

the

geologic

provinces

of

West

Texas

and

Southeast

New

Mexico

•

The

San

Andres

and

Grayburg

formations

have

contributed

the

most

growth

of

oil

reserves

in

recent

decades

•

Already

achieved

high

recovery

efficiencies

with

extensive

use

of

water

flood

and

CO2

recovery

programs

in

these

formations

Source: U.S. Geologic Survey dated April 2012

Of the 3.25 billion barrels of oil reserves

expected to be produced from the

Permian Basin through 2015, the

Northwest shelf San Andres platform

carbonate composes 21% of this total,

or 680 MMBBLS.

Source: American Association of Petroleum Geologist

Bulletin dated May 2005

San Andres Overview

Northwest Shelf San Andres Potential |

14

|

15

San Andres Area Economics

High

Base

Low

EUR (Mboe)

60

50

40

PV-10 ($M)

$1,335

$1,004

$673

IRR (%)

98%

70%

46%

Payback (Years)

1.5

1.8

2.3

Gross Well Cost ($M)

$800

$800

$800

IP (Boe/d)

47

40

33

B-factor

1

1

1

Sensitivity Case Assumptions

Representative Base Type Curve / Development Economics

WTI Oil

Price ($/bbl)

PV-10 ($M)

Payout (yrs)

IRR (%)

HIGH CASE

$80

$1,070

1.7

75%

$90

$1,335

1.5

98%

$100

$1,600

1.3

126%

BASE CASE

$80

$779

2.1

53%

$90

$1,004

1.8

70%

$100

$1,229

1.5

89%

LOW CASE

$80

$487

2.7

34%

$90

$673

2.3

46%

$100

$858

1.9

59%

Sensitivity to Oil Price -

IRR

Oil Price Sensitivity |

16

Non-Operated New Mexico

LUSK

Well Name

Well Type

Operator

IP Date

Oil IP

Gas IP

Cum Oil

Cum Gas

WI

Southeast Lusk 33

Federal 2H

Horizontal

Cimarex

3/7/2012

301

598

76,215

76,105

37.50%

Southeast Lusk 33

Federal 3H

Horizontal

Cimarex

2/29/2012

634

483

103,041

108,167

37.50%

Fecta 33 Fed 1H

Horizontal

Oxy

5/2/2012

623

1,053

103,847

91,407

12.49%

South Lusk 28

Federal 1

Vertical

Apache

6/22/2012*

165

275

9,364

21,423

33.75%

TURKEY TRACK

Well Name

Well Type

Operator

IP Date

Oil IP

Gas IP

Cum Oil

Cum Gas

WI

Zircon 2 St Com 1H

Horizontal

Mewbourne

1/13/2012

297

202

70,127

141,424

12.50%

Bradley 30 Fed 3H

Horizontal

Mewbourne

12/4/2012

286

215

10,737

14,473

4.49%

Zircon 2 EH St 1H

Horizontal

Mewbourne

1/12/2013

241

359

4,696

5,491

12.50%

2

nd

Bone Spring Wells

Operating Partners Within the Area

* Test date of recompletion

RED LAKE

Well Name

Well Type

Operator

IP Date

Oil IP

Gas IP

Cum Oil

Cum Gas

WI

Southern Union 30

State 1

Vertical

Lime Rock

7/23/2012

99

154

9,607

19,895

12.5%

Roo 22 State 2

Vertical

Oxy

8/21/2012

278

523

1,798

3,303

3.13%

Roo 22 State 1

Vertical

Oxy

10/6/2012

264

228

N/A

N/A

3.13%

HENSHAW

Well Name

Well Type

Operator

IP Date

Oil IP

Gas IP

Cum Oil

Cum Gas

WI

High Lonesome 26

Fed Com 1

Vertical

Concho

12/1/2008

610

3,198

67,040

619,709

3.13%

Yeso Wells

Abo Wells |

17

Central Kansas Properties

•

6,656 gross and net acres

•

100% working interest; 80% NRI

•

Target zones: Arbuckle, Lansing Kansas City, Penn,

Reagan, and Granite Wash

•

Established and growing acreage position

•

Expected economics from vertical Arbuckle: 50 MBOE

and well cost of approximately $400,000

Asset Highlights |

18

Offering Exposure to the Permian at a Discount

(EV/Acre in the Permian Basin)

*Calculated after assigning value to production and acreage value in areas outside the

Permian. See appendix for derivation. **No value assigned to RDMP for SW New

Mexico acreage where mineral rights are owned. |

19

Investment Highlights

Uniquely positioned property set

•

Large acreage position, geographically focused in Permian, Kansas, and onshore Gulf Coast of

Texas •

98% of the acreage consists of either owned mineral rights or leases held by production

Potential reserves and production base

•

Pro forma average daily net production sold of 886 Boe/d¹

•

1,500+ potential gross locations

Strong production profile to execute development plans

•

Significant free cash flow from existing assets to invest in development plan

•

Significant PUD inventory for further free cash flow growth

Experienced management and technical team

•

Successful track record of creating value

•

Cost-effective operator with significant operating experience

More than 300 years of combined experience in our core areas

1

Average

net

daily

production

sold

for

the

twelve

months

ended

May

31,

2013,

includes

net

production

sold

represented

by

the

17%

of

Cross

Border’s

common

stock

not

owned

by

RMR. |

|

21

Permian Adjusted Enterprise Value Derivation

Company

Ticker

Market Cap

Total Debt

Cash

Enterprise Value

Laredo Petroleum Holdings Inc

LPI

$3,181.6

$1,364.1

$43.6

$4,502.0

Approach Resources Inc

AREX

$998.8

$154.5

$55.3

$1,098.0

Concho Resources Inc

CXO

$9,849.1

$3,298.7

$1.0

$13,146.8

Energen Corp

EGN

$4,802.1

$2,000.0

$20.3

$4,783.8

Pioneer Natural Resources Co

PXD

$25,000.3

$3,037.7

$695.6

$27,342.4

Diamondback Energy Inc

FANG

$1,711.9

$41.3

$81.9

$1,671.2

Cimarex Energy Co

XEC

$10,079.0

$872.6

$4.5

$10,947.1

Red Mountain Resources Inc

RDMP

$94.5

$24.1

$5.8

$112.8

LPI

AREX

CXO

EGN

PXD

FANG

RDMP

Enterprise Value

$ 4,502,032,560

$ 1,097,980,305

$ 13,146,805,550

$ 6,781,788,840

$ 27,342,419,320

$ 1,671,234,539

$ 112,771,298

Production Value

Most Recent Avg Daily Production (BBLS)

15,617

3,780

57,456

28,484

75,073

4,914

470

x $80,000 per flowing BBLS

$ 80,000

$ 80,000

$ 80,000

$ 80,000

$ 80,000

$ 80,000

$ 80,000

$ 1,249,360,000

$ 302,400,000

$ 4,596,480,000

$ 2,278,720,000

$ 6,005,840,000

$ 393,120,000

$ 37,600,000

Most Recent Avg Daily Production (MCF)

119,262

31,320

202,464

256,350

606,828

10,056

2,496

x $6,000 per flowing MCF

$ 6,000

$ 6,000

$ 6,000

$ 6,000

$ 6,000

$ 6,000

$ 6,000

$ 715,572,000

$ 187,920,000

$ 1,214,784,000

$ 1,538,100,000

$ 3,640,968,000

$ 60,336,000

$ 14,376,000

Acreage Adjustment

Location

San Juan Basin

Eagleford Shale

Kansas

Net Acres

140,000

117,000

6,656

Other Acreage $/Acre

$ 4,000

$ 10,000

$ 150

Other Acreage Adjustment

$ -

$ -

$ -

$ 560,000,000

$ 1,170,000,000

$ -

$ 998,400

Location

Black Warrior Basin

Barnett Shale

S. Texas

Net Acres

147,000

114,000

1,405

Other Acreage $/Acre

$ 100

$ 1,000

$ 100

Other Acreage Adjustment

$ -

$ -

$ -

$ 14,700,000

$ 114,000,000

$ -

$ 140,500

Location

Other

Net Acres

733,000

Other Acreage $/Acre

$ 100

Other Acreage Adjustment

$ -

$ -

$ -

$ -

$ 73,300,000

$ -

$ -

Total Acreage Adjustment

$ -

$ -

$ -

$ 574,700,000

$ 1,357,300,000

$ -

$ 1,138,900

Permian Acreage Value

$ 2,537,100,560

$ 607,660,305

$ 7,335,541,550

$ 2,390,268,840

$ 16,338,311,320

$ 1,217,778,539

$ 59,056,398

Net Permian Acres

200,600

152,000

626,192

300,000

900,000

54,142

31,011

EV / Net Permian Acre

$12,648/acre

$3,998/acre

$11,715/acre

$7,968/acre

$18,154/acre

$22,492/acre

$1,904/acre

Source: Company Documents and Filings, Bloomberg, PLS. Note: Acreage values based on recent

transactions of nearby properties. (In $ millions) |