Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STIFEL FINANCIAL CORP | d581804d8k.htm |

| EX-99.1 - EX-99.1 - STIFEL FINANCIAL CORP | d581804dex991.htm |

2

nd

Quarter 2013

Financial Results Presentation

August 8, 2013

Exhibit 99.2 |

1

Disclaimer

Forward-Looking Statements

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

that

involve

significant

risks,

assumptions,

and

uncertainties,

including

statements

relating

to

the

market

opportunity

and

future

business

prospects

of

Stifel

Financial

Corp.,

as

well

as

Stifel,

Nicolaus

&

Company,

Incorporated

and

its

subsidiaries

(collectively,

“SF”

or

the

“Company”).

These

statements

can

be

identified

by

the

use

of

the

words

“may,”

“will,”

“should,”

“could,”

“would,”

“plan,”

“potential,”

“estimate,”

“project,”

“believe,”

“intend,”

“anticipate,”

“expect,”

and

similar

expressions.

In

particular,

these

statements

may

refer

to

our

goals,

intentions,

and

expectations,

our

business

plans

and

growth

strategies,

our

ability

to

integrate

and

manage

our

acquired

businesses,

estimates

of

our

risks

and

future

costs

and

benefits,

and

forecasted

demographic

and

economic

trends

relating

to

our

industry.

You

should

not

place

undue

reliance

on

any

forward-looking

statements,

which

speak

only

as

of

the

date

they

were

made.

We

will

not

update

these

forward-looking

statements,

even

though

our

situation

may

change

in

the

future,

unless

we

are

obligated

to

do

so

under

federal

securities laws.

Actual

results

may

differ

materially

and

reported

results

should

not

be

considered

as

an

indication

of

future

performance.

Factors

that

could

cause

actual

results

to

differ

are

included

in

the

Company’s

annual

and

quarterly

reports

and

from

time

to

time

in

other

reports

filed

by

the

Company

with

the

Securities

and

Exchange

Commission

and

include,

among

other

things,

changes

in

general

economic

and

business

conditions,

actions

of

competitors,

regulatory

and

legal

actions,

changes

in

legislation,

and

technology

changes.

Use

of

Non-GAAP

Financial

Measures

The

Company

utilized

non-GAAP

calculations

of

presented

net

revenues,

compensation

and

benefits,

non-compensation

operating

expenses,

income

before

income

taxes,

provision

for

income

taxes,

net

income,

compensation

and

non-compensation

operating

expense

ratios,

pre-tax

margin

and

diluted

earnings

per

share

as

an

additional

measure

to

aid

in

understanding

and

analyzing

the

Company’s

financial

results

for

the

three

and

six

months

ended

June

30,

2013.

Specifically,

the

Company

believes

that

the

non-GAAP

measures

provide

useful

information

by

excluding

certain

items

that

may

not

be

indicative

of

the

Company’s

core

operating

results

and

business

outlook.

The

Company

believes

that

these

non-GAAP

measures

will

allow

for

a

better

evaluation

of

the

operating

performance

of

the

business

and

facilitate

a

meaningful

comparison

of

the

Company’s

results

in

the

current

period

to

those

in

prior

periods

and

future

periods.

Reference

to

these

non-GAAP

measures

should

not

be

considered

as

a

substitute

for

results

that

are

presented

in

a

manner

consistent

with

GAAP.

These

non-GAAP

measures

are

provided

to

enhance

investors'

overall

understanding

of

the

Company’s

financial

performance. |

2

Chairman’s Comments

“We

are

pleased

to

announce

record

revenues

for

the

second

quarter

and

for

the

first

six

months

of

2013

in

both

the

Global

Wealth

Management

and

the

Institutional

Group,

especially

against

the

challenging

market

conditions

in

the

quarter.

We

are

very

encouraged

with

our

investment

banking

results,

which

demonstrate

the

breadth

of

our

capabilities.

The

merger

with

KBW

continues

to

exceed

our

expectations,

and

we

are

gaining

market

share

in

the

financial

institutions

space.

Thi

s quarter,

we

look

forward

to

the

contributions

from

the

institutional

fixed

income

sales

and

trading

professionals

who

joined

us

from

Knight

Capital

Group.” |

KBW Update

First Half Performance

Advisory

#1 by number of FIG mergers

#1 by number of Bank mergers

#1 by Bank deal value

Representative of the acquirer or seller on 7 out of the 10

largest bank deals

Capital Markets

Bookrunner on all four bank initial public offerings in the

first half

Notable Q2 Capital Markets Bookrun Offerings

Zions Bancorporation -

$301 million preferred offering

First PacTrust Bancorp -

$40 million preferred offering

First NBC Bank -

$115 million initial public offering

Fidelity Southern Corporation -

$69 million follow-on

offering

KBW Equities

Superior recognition in Greenwich Associates

rankings for Research, Sales and Trading

Improving equity trading market share:

Market share in adv. volume for KBW

Regional Bank Index (KRX) components was

4.6% for 1H 2013, compared to 3.1% for 1H

2012

Market share in adv. volume for small-cap

banks was 8.4% for 1H 2013, compared to

5.2% for 1H 2012

Successful July Community Bank Conference:

Record attendance with over 700 attendees

and over 1,500 investor meetings organized

Stifel / KBW fixed income:

Integration efforts underway

M&A Statistics Source: SNL Financial; Includes transactions announced since 1/1/2013; Data

as of 7/1/2013 Note:

Includes

only

whole

institution

transactions

in

the

United

States

Capital markets offerings inclusive of select Stifel transactions pre-closing

Small-cap

banks

includes

the

largest

50

banks

under

KBW

Research

coverage

sub-$1bn

market

cap. |

Financial

Financial

Results

Results |

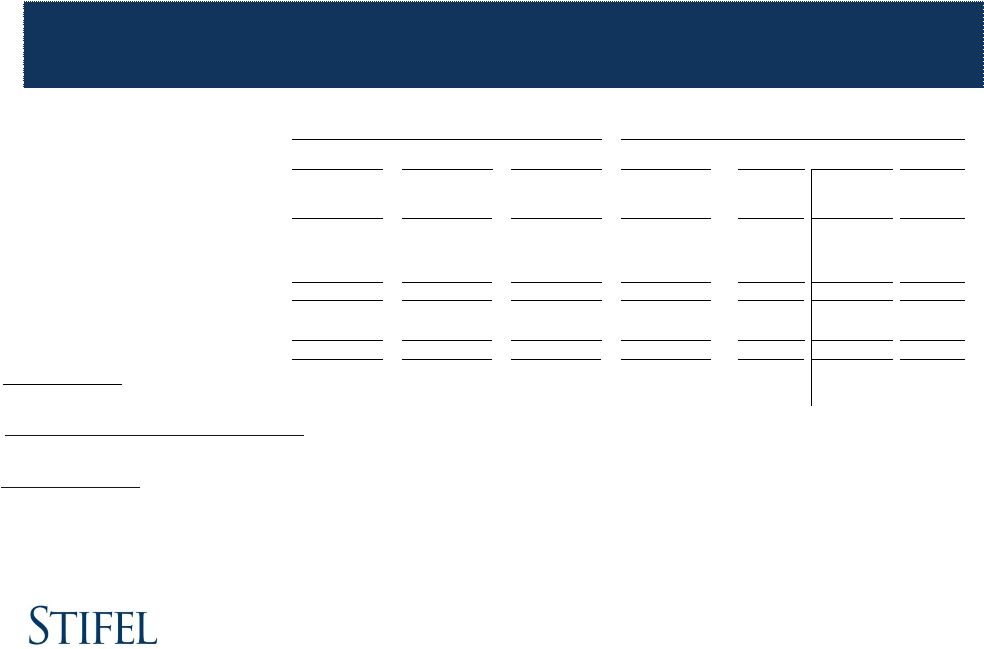

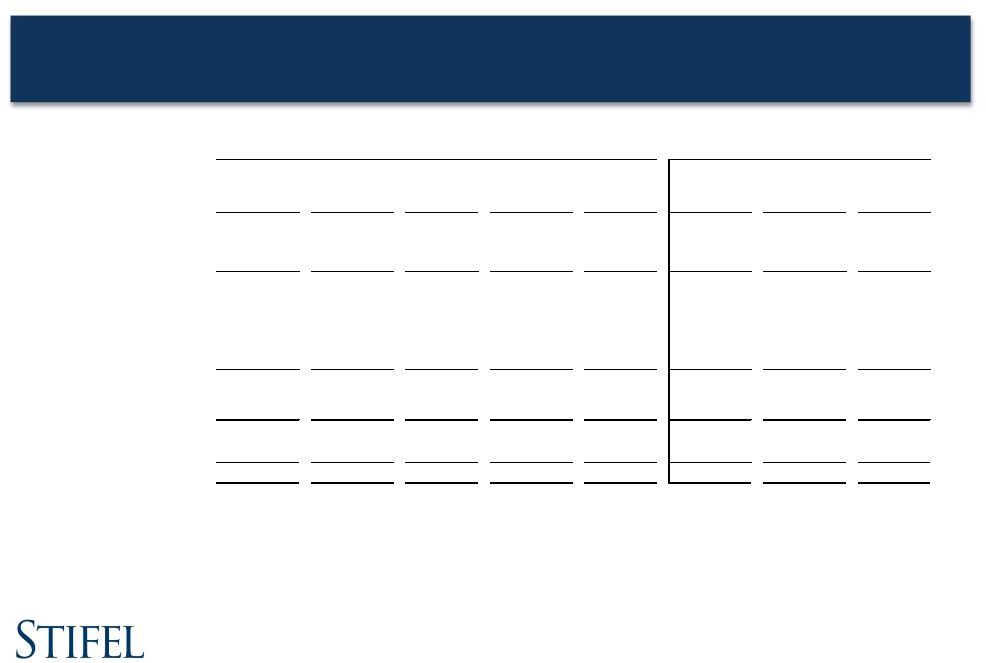

Stifel Financial

Corp. Results Three months ended June 30, 2013

5

($ in thousands, except per share amounts)

GAAP

Non-Core

Non-GAAP

6/30/12

% Change

3/31/13

% Change

Total revenues

511,421

$

1,736

$

513,157

$

384,264

$

33.5%

453,240

$

13.2%

Interest expense

12,685

-

12,685

9,857

28.7%

11,460

10.7%

Net revenues

498,736

1,736

500,472

374,407

33.7%

441,780

$

13.3%

Compensation and benefits

321,331

(6,018)

315,313

239,374

31.7%

281,941

11.8%

Non-comp operating expenses

126,207

(14,974)

111,233

91,159

22.0%

96,155

15.7%

Total non-interest expenses

447,538

(20,992)

426,546

330,533

29.0%

378,096

12.8%

Income before income taxes

51,198

22,728

73,926

43,874

68.5%

63,684

16.1%

Provision for income taxes

21,763

7,807

29,570

17,738

66.7%

23,808

24.2%

Net income

29,435

$

14,921

$

44,356

$

26,136

$

69.7%

39,876

$

11.2%

Earnings per share:

Diluted

0.40

$

0.60

$

0.42

$

42.9%

0.58

$

3.4%

Weighted average number of shares outstanding:

Diluted

74,090

74,090

62,678

18.2%

69,189

7.1%

Ratios to net revenues:

Compensation and benefits

64.4%

63.0%

63.9%

63.8%

Non-comp operating expenses

25.3%

22.2%

24.4%

21.8%

Income before income taxes

10.3%

14.8%

11.7%

14.4%

Three Months Ended June 30, 2013

Three Months Ended

(1)

Non-core adjustments consist of merger-related revenues and expenses associated with

our acquisitions of KBW, the Knight Capital Fixed Income business and Miller Buckfire.

_________________________________________________________

(1) |

6

Three Months Ended

($ in thousands)

9/30/13

12/31/13

Estimate

Actual

Estimate

Estimate

Operating expenses:

Compensation

6,200

$

6,000

$

2,500

$

400

$

Non-Compensation Operating Expenses

6,800

15,000

5,000

7,100

Total estimated non-core operating expenses

13,000

21,000

7,500

7,500

Retention - KFI

-

-

22,000

-

Total estimated non-core operating expenses - Acquisition-related

13,000

$

21,000

$

29,500

$

7,500

$

6/30/13

Non-Core Expense Projections

Acquisition-Related Expenses |

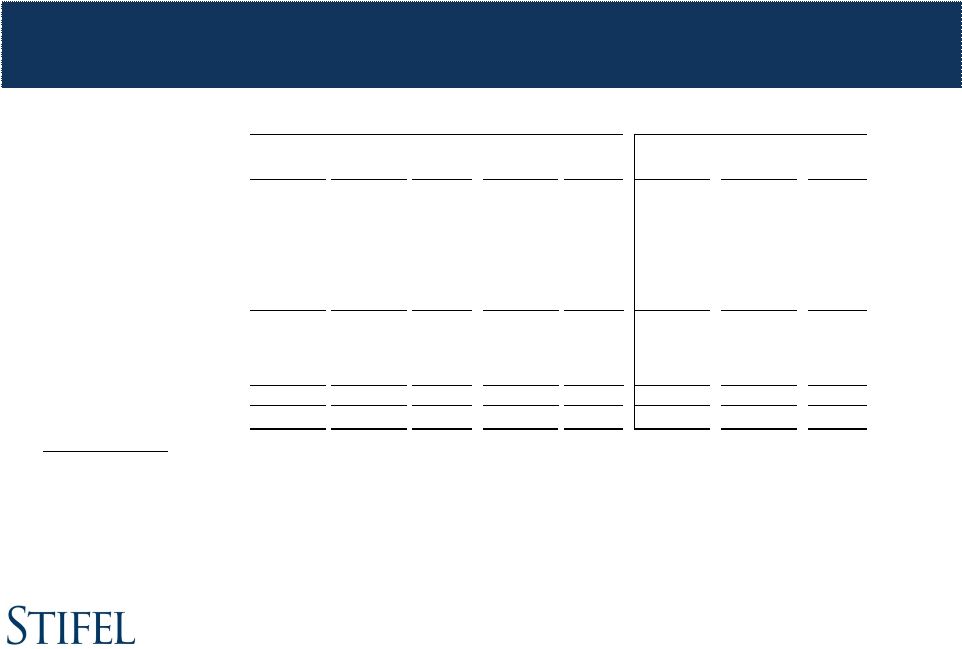

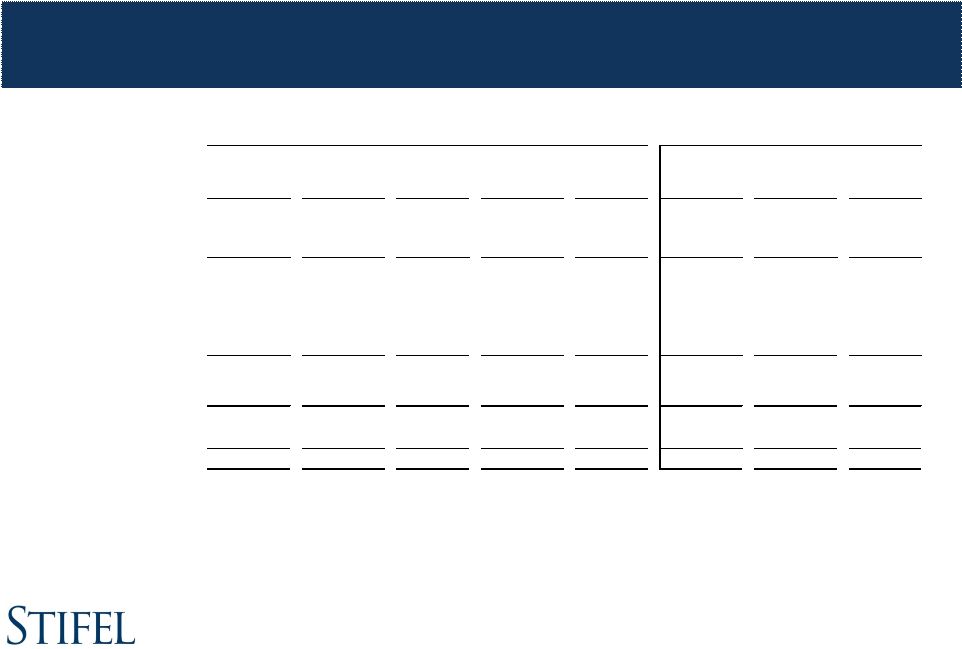

Stifel Financial

Corp. Results Six months ended June 30, 2013

7

($ in thousands, except per share amounts)

GAAP

Non-Core

Non-GAAP

6/30/12

% Change

Total revenues

964,661

$

1,744

$

966,405

$

793,607

$

21.8%

Interest expense

24,145

-

24,145

18,867

28.0%

Net revenues

940,516

1,744

942,260

774,740

21.6%

Compensation and benefits

637,058

(39,804)

597,254

494,078

20.9%

Non-comp operating expenses

228,914

(21,526)

207,388

177,534

16.8%

Total non-interest expenses

865,972

(61,330)

804,642

671,612

19.8%

Income before income taxes

74,544

63,074

137,618

103,128

33.4%

Provision for income taxes

30,490

22,888

53,378

42,219

26.4%

Net income

44,054

$

40,186

$

84,240

$

60,909

$

38.3%

Earnings per share:

Diluted

0.62

$

1.18

$

0.97

$

21.6%

Weighted average number of shares outstanding:

Diluted

71,627

71,627

62,700

14.2%

Ratios to net revenues:

Compensation and benefits

67.7%

63.4%

63.8%

Non-comp operating expenses

24.4%

22.0%

22.9%

Income before income taxes

7.9%

14.6%

13.3%

Six Months Ended June 30, 2013

Six Months Ended

(1)

Non-core adjustments consist of a charges related to expensing stock

awards issued as retention in connection with the acquisition of KBW and other

merger-related revenues and expenses associated with our acquisitions of KBW, the

Knight Capital Fixed Income business and Miller Buckfire.

_________________________________________________________

(1) |

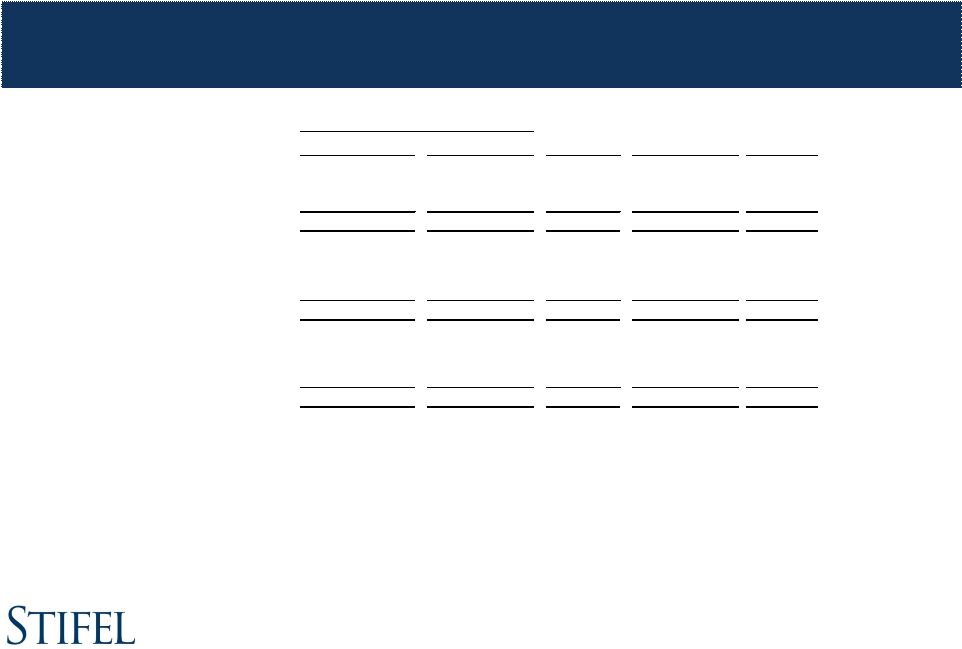

Source of

Revenues 8

($ in thousands)

6/30/13

6/30/12

%

Change

3/31/13

%

Change

6/30/13

6/30/12

%

Change

Commissions

157,168

$

127,427

$

23.3%

148,648

$

5.7%

305,816

$

250,730

$

22.0%

Principal transactions

111,448

91,564

21.7%

107,244

3.9%

218,692

207,797

5.2%

Brokerage revenues

268,616

218,991

22.7%

255,892

5.0%

524,508

458,527

14.4%

Capital raising

74,146

40,733

82.0%

51,199

44.8%

125,345

95,566

31.2%

Advisory

47,968

26,630

80.1%

27,180

76.5%

75,148

42,235

77.9%

Investment banking

122,114

67,363

81.3%

78,379

55.8%

200,493

137,801

45.5%

Asset mgt and service fees

76,088

65,311

16.5%

68,912

10.4%

145,000

126,129

15.0%

Other

11,670

5,418

115.4%

20,212

(42.3%)

31,882

18,712

70.4%

Total operating revenues

478,488

357,083

34.0%

423,395

13.0%

901,883

741,169

21.7%

Interest revenue

32,933

27,181

21.2%

29,845

10.3%

62,778

52,438

19.7%

Total revenues

511,421

384,264

33.1%

453,240

12.8%

964,661

793,607

21.6%

Interest expense

12,685

9,857

28.7%

11,460

10.7%

24,145

18,867

28.0%

Net revenues

498,736

$

374,407

$

33.2%

441,780

$

12.9%

940,516

$

774,740

$

21.4%

Three Months Ended

Six Months Ended |

($ in

thousands) 6/30/13

6/30/12

%

Change

3/31/13

%

Change

6/30/13

6/30/12

%

Change

Private client group

160,889

$

143,475

$

12.1%

158,392

$

1.6%

319,282

$

292,876

$

9.0%

Equity brokerage

66,788

38,466

73.6%

52,000

28.4%

118,788

82,638

43.7%

Fixed income brokerage

40,939

37,050

10.5%

45,500

(9.9%)

86,439

83,013

4.1%

Institutional brokerage

107,727

75,516

42.7%

97,500

10.5%

205,227

165,651

23.9%

Total Brokerage Revenues

268,616

$

218,991

$

22.7%

255,892

$

5.0%

524,509

$

458,527

$

14.4%

Three Months Ended

Six Months Ended

9

Brokerage Revenues by Segment |

Core

Non-Interest Expenses Three months ended June 30, 2013

($ in thousands)

6/30/13

(1)

6/30/12

% Change

3/31/13

% Change

6/30/13

(1)

6/30/12

3/31/13

Net revenues

500,472

$

374,407

$

33.7%

441,788

$

13.3%

100.0%

100.0%

100.0%

Compensation and benefits

294,446

219,004

34.4%

259,135

13.6%

58.8%

58.5%

58.7%

Transitional pay

(2)

20,867

20,370

2.4%

22,806

(8.5%)

4.2%

5.4%

5.2%

Total compensation and benefits

315,313

239,374

31.7%

281,941

11.8%

63.0%

63.9%

63.8%

Occupancy and equipment rental

38,306

32,320

18.5%

31,501

21.6%

7.7%

8.6%

7.1%

Communication and office supplies

24,604

20,797

18.3%

21,858

12.6%

4.9%

5.6%

4.9%

Commissions and floor brokerage

9,616

7,747

24.1%

8,669

10.9%

1.9%

2.1%

2.0%

Other operating expenses

38,707

30,295

27.8%

34,127

13.4%

7.7%

8.1%

7.6%

Total non-comp operating expenses

111,233

91,159

22.0%

96,155

15.7%

22.2%

24.3%

21.8%

Total non-interest expense

426,546

330,533

29.0%

378,096

12.8%

85.2%

88.3%

85.6%

Income before income taxes

73,926

43,874

68.5%

63,692

16.1%

14.8%

11.7%

14.4%

Provision for income taxes

29,570

17,738

66.7%

23,808

24.2%

5.9%

4.6%

5.4%

Non-GAAP net income

44,356

$

26,136

$

69.7%

39,884

$

11.2%

8.9%

7.0%

9.0%

Non-core expenses (after-tax)

(14,921)

-

(25,265)

GAAP net income

29,435

$

26,136

$

14,619

$

Three Months Ended

% of Net revenues

10

_________________________________________________________

(1)

Excludes non-core adjustments consisting of merger-related revenues and expenses

associated with our acquisitions of KBW, the Knight Capital Fixed Income business and Miller Buckfire.

(2)

Transition pay includes amortization of upfront notes, signing bonuses and retention

awards. |

Core

Non-Interest Expenses Six months ended June 30, 2013

($ in thousands)

6/30/13

(1)

6/30/12

% Change

6/30/13

(1)

6/30/12

Net revenues

942,260

$

774,740

$

21.6%

100.0%

100.0%

Compensation and benefits

555,424

455,336

22.0%

58.9%

58.8%

Transitional pay

(2)

41,830

38,742

8.0%

4.4%

5.0%

Total compensation and benefits

597,254

494,078

20.9%

63.4%

63.8%

Occupancy and equipment rental

69,808

63,111

10.6%

7.4%

8.1%

Communication and office supplies

46,462

41,170

12.9%

4.9%

5.3%

Commissions and floor brokerage

18,285

15,359

19.1%

1.9%

2.0%

Other operating expenses

72,833

57,894

25.8%

7.7%

7.5%

Total non-comp operating expenses

207,388

177,534

16.8%

22.0%

22.9%

Total non-interest expense

804,642

671,612

19.8%

85.4%

86.7%

Income before income taxes

137,618

103,128

33.4%

14.6%

13.3%

Provision for income taxes

53,378

42,219

26.4%

5.7%

5.3%

Non-GAAP net income

84,240

$

60,909

$

38.3%

8.9%

7.9%

Non-core expenses (after-tax)

(40,186)

-

GAAP net income

44,054

$

60,909

$

Six Months Ended

% of Net revenues

11

_________________________________________________________

(1)

Excludes non-core adjustments consisting of a charge related to expensing stock

awards issued as retention in connection with the acquisition of KBW and other merger-related

revenues and expenses associated with our acquisitions of KBW, the Knight Capital Fixed Income

business and Miller Buckfire. (2)

Transition pay includes amortization of upfront notes, signing bonuses and retention

awards. |

Segment

Comparison - Core

12

($ in thousands)

6/30/13

(1)

6/30/12

%

Change

3/31/13

%

Change

6/30/13

(1)

6/30/12

%

Change

Net revenues:

Global Wealth Management

282,717

$

239,300

$

18.1%

266,957

$

5.9%

549,674

$

486,908

$

12.9%

Institutional Group

220,476

136,026

62.1%

176,437

25.0%

396,913

285,270

39.1%

Other

(2,721)

(919)

196.1%

(1,606)

69.4%

(4,327)

2,562

(268.9%)

500,472

$

374,407

$

33.7%

441,788

$

13.3%

942,260

$

774,740

$

21.6%

Operating contribution:

Global Wealth Management

78,924

$

61,036

$

29.3%

69,499

$

13.6%

148,423

$

129,914

$

14.2%

Institutional Group

30,059

17,863

68.3%

28,137

6.8%

58,196

41,867

39.0%

Other

(35,057)

(35,025)

0.2%

(33,944)

3.4%

(69,001)

(68,653)

0.6%

73,926

$

43,874

$

68.5%

63,692

$

16.2%

137,618

$

103,128

$

33.4%

Three Months Ended

Six Months Ended

(1)

Core (non-GAAP) results for the three and six months ended June 30, 2012 are the same as

GAAP results.

_________________________________________________________

|

Global Wealth

Management ($ in thousands)

6/30/13

6/30/12

% Change

3/31/13

% Change

6/30/13

6/30/12

% Change

Commissions

104,576

$

88,417

$

18.3%

102,086

$

2.4%

206,662

$

179,437

$

15.2%

Principal transactions

56,313

55,058

2.3%

56,307

0.0%

112,620

113,439

(0.7%)

Asset management & service fees

75,976

65,169

16.6%

68,934

10.2%

144,910

125,755

15.2%

Net interest

24,505

18,227

34.5%

21,486

14.1%

45,991

35,869

28.2%

Investment banking

15,334

8,384

82.9%

11,103

38.1%

26,437

20,786

27.2%

Other income

6,013

4,045

48.7%

7,041

(14.6%)

13,054

11,622

12.3%

Net revenues

282,717

239,300

18.1%

266,957

5.9%

549,674

486,908

12.9%

Compensation and benefits

163,156

140,629

16.0%

157,596

3.5%

320,752

283,980

12.9%

Non-comp operating expenses

40,637

37,635

8.0%

39,862

1.9%

80,499

73,014

10.3%

Total non-interest expenses

203,793

178,264

14.3%

197,458

3.2%

401,251

356,994

12.4%

Income before income taxes

78,924

$

61,036

$

29.3%

69,499

$

13.6%

148,423

$

129,914

$

14.2%

Ratios to net revenues:

Compensation and benefits

57.7%

58.8%

59.0%

58.4%

58.3%

Non-comp operating expenses

14.4%

15.7%

15.0%

14.6%

15.0%

Income before income taxes

27.9%

25.5%

26.0%

27.0%

26.7%

Three Months Ended

Six Months Ended

13 |

Stifel Bank

& Trust (an operating unit of GWM)

14

As of

6/30/13

6/30/12

% Change

3/31/13

% Change

Assets

$

4,306,447

$

3,052,867

41.1

$

3,872,677

11.2

Investment securities

2,956,073

1,844,875

60.2

2,440,146

21.1

Retained loans, net

983,788

709,079

38.7

886,597

11.0

Loans held for sale

152,246

117,166

29.9

165,698

(8.1)

Deposits

4,007,050

2,776,684

44.3

3,556,568

12.7

Allowance for loan losses

10,919

$

5,781

$

88.9

9,406

$

16.1

Allowance as a percentage of loans

1.10

%

0.88

%

1.01

%

Non-performing loans

1,042

$

1,872

$

(44.3)

1,063

$

(2.0)

Other non-performing assets

173

634

(72.7)

373

(53.6)

Non-performing assets

1,215

$

2,506

$

(51.5)

1,436

$

(15.4)

Non-performing assets as a percentage of

total assets

0.03

%

0.08

%

0.04

%

As of |

Institutional

Group Revenues ($ in thousands)

6/30/13

6/30/12

% Change

3/31/13

% Change

6/30/13

6/30/12

% Change

Institutional brokerage:

Equity

66,788

$

38,466

$

73.6%

52,000

$

28.4%

118,788

$

82,638

$

43.7%

Fixed income

40,939

37,050

10.5%

45,500

(9.9%)

86,439

83,013

4.1%

107,727

75,516

42.7%

97,500

10.5%

205,227

165,651

23.9%

Investment Banking:

Capital raising

Equity

44,640

17,651

152.9%

24,380

83.1%

69,020

49,201

40.3%

Fixed income

14,173

14,698

(3.6%)

15,715

(9.8%)

29,888

25,579

16.8%

58,813

32,349

81.8%

40,095

46.7%

98,908

74,780

32.3%

Advisory fees

47,967

26,630

80.1%

27,180

76.5%

75,147

42,235

77.9%

Investment banking

106,780

58,979

81.0%

67,275

58.7%

174,055

117,015

48.7%

Other

(1)

5,969

1,531

289.9%

11,662

(48.8%)

17,631

2,604

577.0%

Total net revenue

220,476

$

136,026

$

62.1%

176,437

$

25.0%

396,913

$

285,270

$

39.1%

Three Months Ended

Six Months Ended

15

_________________________________________________________

(1)

Includes net interest and other income. |

Institutional

Group Revenues ($ in thousands)

6/30/13

6/30/12

% Change

3/31/13

% Change

6/30/13

6/30/12

% Change

Institutional brokerage:

Equity

66,788

$

38,466

$

73.6%

52,000

$

28.4%

118,788

$

82,638

$

43.7%

Fixed income

40,939

37,050

10.5%

45,500

(9.9%)

86,439

83,013

4.1%

107,727

75,516

42.7%

97,500

10.5%

205,227

165,651

23.9%

Investment Banking:

Capital raising

Equity

44,640

17,651

152.9%

24,380

83.1%

69,020

49,201

40.3%

Fixed income

14,173

14,698

(3.6%)

15,715

(9.8%)

29,888

25,579

16.8%

58,813

32,349

81.8%

40,095

46.7%

98,908

74,780

32.3%

Advisory fees

47,967

26,630

80.1%

27,180

76.5%

75,147

42,235

77.9%

Investment banking

106,780

58,979

81.0%

67,275

58.7%

174,055

117,015

48.7%

Other

(1)

5,969

1,531

289.9%

11,662

(48.8%)

17,631

2,604

577.0%

Total net revenue

220,476

$

136,026

$

62.1%

176,437

$

25.0%

396,913

$

285,270

$

39.1%

Three Months Ended

Six Months Ended

16

_________________________________________________________

* Percentage not meaningful.

(1)

Includes net interest and other income. |

17

Financial

Financial

Condition

Condition |

Capital

Structure As of June 30, 2013

(in thousands, except ratios)

($ in thousands)

Total Assets

8,493,191

$

Stockholders' Equity

1,897,990

$

6.70% senior notes, due 2022

175,000

$

5.375% senior notes, due 2022

150,000

Non-recourse debt, 6.75%, due 2016

53,024

Debentures to Stifel Financial Capital Trusts II, III, & IV

82,500

Total Capitalization

2,358,514

$

Ratios:

Debt to Equity

13.6%

Leverage Ratio

3.6x

Equity Capitalization

4.5x

18

(1)

Debt

to

equity

ratio

includes

the

debentures

to

Stifel

Financial

Capital

Trusts

($82.5m),

non-recourse

debt

($55.9m),

and

Senior

Notes

($325.0m)

divided

by

stockholders’

equity.

(2)

Leverage ratio = total assets divided by total capitalization.

(3)

Equity capitalization = total assets divided by stockholders’equity.

_________________________________________________________

(1)

(2)

(3) |

As of

6/30/13

6/30/12

% Change

3/31/13

% Change

Total assets (000s):

Stifel Nicolaus & Stifel Financial

4,186,744

$

3,085,668

$

35.7%

4,261,078

$

(1.7%)

Stifel Bank

4,306,447

3,052,867

41.1%

3,872,677

11.2%

Total assets

8,493,191

$

6,138,535

$

38.4%

8,133,755

$

4.4%

Total shareholders' equity (000s):

Stifel Nicolaus & Stifel Financial

1,613,003

$

1,140,188

$

41.5%

1,613,398

$

(0.0%)

Stifel Bank

284,987

231,657

23.0%

290,268

(1.8%)

Total shareholders' equity

1,897,990

$

1,371,845

$

38.4%

1,903,666

$

(0.3%)

Leverage ratio:

Stifel Nicolaus & Stifel Financial

2.0

2.2

(8.5%)

2.1

(1.6%)

Stifel Bank

15.1

13.2

14.6%

13.3

13.3%

Total leverage ratio

3.6

3.8

(4.5%)

3.4

4.8%

Financial advisors

(1)

2,069

2,028

2.0%

2,063

0.3%

Full-time associates

5,759

5,196

10.8%

5,680

1.4%

Locations

357

332

7.5%

357

0.0%

Total client assets (000s)

(2)

150,628,000

$

131,026,000

$

15.0%

147,119,000

$

2.4%

As of

19

Other Financial Data

(1)

Includes

145,

156

and

148

independent

contractors

as

of

June

30,

2013,

June

30,

2012

and

March

31,

2013.

(2)

Includes

money-market

and

FDIC-insured

balances.

Prior

period

amounts

have

been

adjusted

to

conform

to

the

current

period

presentation.

_________________________________________________________

|

Q&A

Q&A |