Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GOLUB CAPITAL BDC, Inc. | v352060_8-k.htm |

GBDC Golub Capital BDC, Inc. Investor Presentation Quarter Ended June 30, 2013 www.golubcapitalbdc.com

1 Disclaimer Some of the statements in this presentation constitute forward - looking statements, which relate to future events or our future performance or financial condition. The forward - looking statements contained in this presentation involve risks and uncertainties, including statements as to: our future operating results; our business prospects and the prospects of our portfolio companies; the effect of investments that we expect to make; our contractual arrangements and relationships with third parties; actual and potential conflicts of interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other affiliates of Golub Capital Incorporated and Golub Capital LLC (collectively, "Golub Capital"); the dependence of our future success on the general economy and its effect on the industries in which we invest; the ability of our portfolio companies to achieve their objectives; the use of borrowed money to finance a portion of our investments; the adequacy of our financing sources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; the ability of GC Advisors to locate suitable investments for us and to monitor and administer our investments; the ability of GC Advisors or its affiliates to attract and retain highly talented professionals; our ability to qualify and maintain our qualification as a regulated investment company and as a business development company; the impact on our business of the Dodd - Frank Wall Street Reform and Consumer Protection Act and the rules and regulations issued thereunder; and the effect of changes to tax legislation and our tax position. Such forward - looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. We have based the forward - looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward - looking statements. Actual results could differ materially from those implied or expressed in our forward - looking statements for any reason, and future results could differ materially from historical performance. Although we undertake no obligation to revise or update any forward - looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed or in the future may file with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K. This presentation contains statistics and other data that have been obtained from or compiled from information made available by third - party service providers. We have not independently verified such statistics or data. 8/5/2013

2 Summary of Quarterly Results Third Fiscal Quarter 2013 Highlights ▪ Net investment income for the quarter ended June 30, 2013 was $12.0 million, or $0.32 per share, as compared to $10.4 million, or $0.32 per share, for the quarter ended March 31, 2013. ▪ Net increase in net assets resulting from operations for the quarter ended June 30, 2013 was $12.7 million, or $0.34 per share, as compared to $12.3 million, or $0.38 per share, for the quarter ended March 31, 2013. ▪ Net asset value per share for the quarter ended June 30, 2013 was $15.12, as compared to $14.80 for the quarter ended March 31, 2013. ▪ New middle - market investment commitments in the amount of $288.4 million were made for the quarter ended June 30, 2013. Approximately 20% of the new investment commitments were senior secured loans, 62% were one stop loans, 16% were second lien loans and 2% were equity securities. Of the new investment commitments, $268.4 million funded at close. Overall, total investments in portfolio companies at fair value increased by approximately $179.4 million during the three months ended June 30, 2013. ▪ Effective May 31, 2013 , Golub Capital BDC, Inc. (the “Company”) has agreed to co - invest with United Insurance Company of America (“United Insurance”) through Senior Loan Fund LLC (“Senior Loan Fund”), an unconsolidated Delaware limited liability company, primarily in senior secured loans of middle market companies.

3 Financial Highlights Q3 2 013 Q2 2 013 Q1 2 013 Q4 2 01 2 Q3 2 01 2 Net investment income per share $ 0.32 $ 0.32 $ 0.34 $ 0.30 $ 0.26 Net spread payments from the total return swap (“TRS”) 1 N/A N/A N/A 0.01 0.04 Net investment income per share + TRS 1 0.32 0.32 0.34 0.31 0.30 Net realized /unrealized gain (loss) per share 0.02 0.06 (0.01) 0.03 (0.05) Earnings per share 0. 34 0. 38 0. 33 0. 34 0. 2 1 Net asset value per share 15.12 1 4.80 1 4.66 1 4.60 1 4.58 Distributions paid per share 0.32 0.32 0.32 0.32 0.32 Q3 2 013 Q2 2 013 Q1 2 013 Q4 2 01 2 Q3 2 01 2 Total Fair Value of Investments (000s) $ 967,792 $ 788,442 $ 768,342 $ 672,910 $ 636,632 Number of Portfolio Investments 135 135 129 121 11 6 Average Investment Size (000s) $ 7,169 $ 5,840 $ 5,956 $ 5,561 $ 5,488 Fair Value as a Percentage of Principal (Loans) 98.7% 98.7% 98.4% 98.5% 98.5% 1. As a supplement to generally accepted accounting principles (“GAAP”), the Company has provided this non - GAAP performance result. The Company believes that this non - GAAP financial measure is useful because it is inclusive of net spread payments received on the u nderlying loans in the TRS which was a recurring source of revenue and liquidity to pay dividends to investors. Although this non - GAAP fin ancial measure is intended to enhance investors’ understanding of the Company’s business and performance, this non - GAAP financial measure should not be considered an alternative to GAAP.

4 Summary of Portfolio Highlights Originations and Net Funds Growth ▪ New commitments totaled $288.4 million for the quarter ended June 30, 2013. ▪ Net growth in investments in securities, at fair value, for the quarter ended June 30, 2013 was $179.4 million, a 22.7% increase from March 31, 2013. Select Portfolio Funds Roll Data (in millions) Q3 2 013 Q2 2 013 Q1 2 013 Q4 2 01 2 Q3 2 01 2 New Investment Commitments $ 288.4 $ 58.1 $ 262.2 $ 113.4 $ 52.4 Exits (includes full & partial payoffs) of Investments 92.7 37.6 145.8 70.9 34 . 1 Net Funds Growth 1 179.4 20.1 95.4 36.3 22.8 Asset Mix of the Investment Portfolio Q3 2 013 Q2 2 013 Q1 2 013 Q4 2 01 2 Q3 2 01 2 Senior Secured 33% 33% 33% 41 % 41 % One Stop 50% 49% 47% 39% 37% Second Lien 10% 10% 11% 7% 7% Subordinated Debt 4 % 5 % 6 % 10 % 1 2% Equity 3% 3% 3% 3% 3% 1. Net funds growth includes the impact of new investments and exits of investments as noted in the table above, as well as othe r v ariables such as net fundings on revolvers, net change in unamortized fees, net change in unrealized gains (losses), etc.

5 Quarterly Statements of Financial Condition As of ( Dollar amounts in thousands , except per share data) June 30, 2013 (unaudited ) March 31, 2013 (unaudited ) December 31, 2012 (unaudited ) September 30, 2012 (audited ) June 30, 2012 (unaudited ) Assets Investments in securities, at fair value $ 967,792 $ 788,442 $ 768,342 $ 672,910 $ 636,632 Cash and cash equivalents 12,936 8,950 21,420 13,891 18,070 Restricted cash and cash equivalents 21,689 84,214 39,226 37,036 45,059 Cash collateral on deposit with custodian – – – – 1,287 Other assets 13,340 11,572 10,015 10,259 10,474 Total Assets $ 1,015,757 $ 893,178 $ 839,003 $ 734,096 $ 711,522 Liabilities Debt $ 403,800 $ 385,700 $ 400,450 $ 352,300 $ 329,800 Interest payable 2,426 1,304 2,473 1,391 2,269 Management and incentive fee payable 5,808 5,069 4,782 4,203 4,070 Payable for investments purchased – – 10,456 – – Other liabilities 2,225 1,452 1,452 1,073 1,172 Total Liabilities 414,259 393,525 419,613 358,967 337,311 Total Net Assets 601,498 499,653 419,390 375,129 374,211 Total Liabilities and Net Assets $ 1,015,757 $ 893,178 $ 839,003 $ 734,096 $ 711,522 Net Asset Value per Share $ 15.12 $ 14.80 $ 14.66 $ 14.60 $ 14.58 Debt to Equity 0.67x 0.77x 0.95x 0.94x 0.88x Asset Coverage 1 349.9% 298.6% 257.4% 263.2% 282.1% 1. On September 13, 2011, we received exemptive relief from the SEC to permit us to exclude the debt of our small business inves tme nt company (“SBIC”) subsidiary from our 200% asset coverage test. As such, the asset coverage ratio excludes the debentures from the SBIC.

6 Quarterly Operating Results For the three months ended ( Dollar amounts in thousands , except share and per share data) June 30, 2013 (unaudited) March 31, 2013 (unaudited) December 31 , 2 01 2 (unaudited) September 30 , 2 01 2 (unaudited) June 30 , 2 01 2 (unaudited) Investment Income Interest income $ 21,187 $ 19,617 $ 18,327 $ 16,219 $ 14,811 Dividend income 1,081 479 267 – – Total Investment Income 22,268 20,096 18,594 16,219 14,811 Expenses Interest and other debt financing expenses 2,967 3,292 2,995 2,970 2,565 Base management fee 3,114 2,686 2,468 2,308 2,220 Incentive fee 2,785 2,468 2,394 1,967 1,917 Other operating expenses 1,402 1,256 1,159 1,183 1,131 Total Expenses 10,268 9,702 9,016 8,428 8,133 Net Investment Income 12,000 10,394 9,578 7,791 6,678 Net Gain (Loss) on Investments Net realized gain (loss) on investments and derivative instruments (77) – 94 (585) 1,158 Net unrealized appreciation (depreciation) on investments and derivative instruments 734 1,857 (353) 1,539 (2,443) Net Gain (Loss) on Investments 657 1,857 (259) 954 (1,285) Net Increase in Net Assets Resulting from Operations $ 12,657 $ 12,251 $ 9,319 $ 8,745 $ 5,393 Per Share Earnings P er Share $ 0.34 $ 0.38 $ 0.33 $ 0.34 $ 0.21 Net Investment Income $ 0.32 $ 0.32 $ 0.34 $ 0.30 $ 0.26 Distributions Paid $ 0.32 $ 0.32 $ 0.32 $ 0.32 $ 0.32 Weighted average common shares outstanding 37,118,379 32,532,794 27,933,613 25,663,827 25,639,680 Common shares outstanding at end of period 39,791,805 33,754,512 28,605,336 25,688,101 25,663,009

7 41% 41% 33% 33% 33% 37% 39% 47% 49% 50% 7% 7% 11% 10% 10% 12% 10% 6% 5% 4% 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Senior Secured One Stop Second Lien Subordinated Debt Equity Portfolio Highlights – Asset Mix $636,632 New Investment Commitments End of Period Investments 92% 34% 22% 36% 20% 63% 61% 25% 62% 15% 38% 16% 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Senior Secured One Stop Second Lien Subordinated Debt Equity $52,363 5 % 3% 3 % 3 % $113,354 $672,910 3 % $262,247 2 % 3 % $768,342 1 % $58,115 $967,792 3 % 3 % $788,442 $288,444 2 %

8 10.0% 10.5% 11.2% 10.6% 9.9% 9.3% 9.5% 9.7% 9.5% 9.2% 3.6% 3.5% 3.4% 3.5% 2.9% 6.4% 7.0% 7.8% 7.1% 7.0% 0.5% 0.4% 0.3% 0.3% 0.3% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Total Yield on Investments Interest Income Yield Wtd. Avg. Debt Wtd. Avg. Investment Spread 3-Month London Interbank Offered Rate ("LIBOR") 1 3 2 4 Portfolio Highlights – Debt Investment Spread Analysis 1. Total yield on investments is calculated as (a) the actual amount earned on such investments, including interest income and a mor tization of fees and discounts, divided by (b) the daily average of total earning investments at fair value. 2. Interest income yield is calculated as (a) the actual amount earned on such investments, including interest income but exclud ing amortization of fees and discounts, divided by (b) the daily average of total investments at fair value. 3. The weighted average cost of debt is calculated as (a) the actual amount incurred on such debt obligations divided by (b) the da ily average of total debt obligations. 4. The weighted average investment spread is calculated as (a) the total yield on investments less (b) the weighted average cost of debt.

9 Portfolio Highlights – Selected Information Portfolio Rotation – Debt Investments Q3 2 01 3 Q2 2 01 3 Q1 2 01 3 Q4 2 01 2 Q3 2 01 2 Weighted average interest rate of new investments 1,2 8.0% 8.8% 8.3% 8.0% 8.2% Weighted average interest rate on investments that were sold or paid - off 8.9% 10.2% 8.2% 8.2% 6.7% Weighted average spread over LIBOR of new floating rate investments 2 6.6% 6.2% 6.9% 6.8% 6.7% Weighted average interest rate of new fixed rate investments N/A 16.0% N/A N/A 8.0% Weighted average fees on new investments 1.3% 1.1% 1.8% 2.2% 1 .7% Portfolio Composition – Floating vs. Fixed Investments Q3 2 01 3 Q2 2 01 3 Q1 2 01 3 Q4 2 01 2 Q3 2 01 2 Percentage of fixed rate investments 3.6% 7.1% 6.9% 9.9% 11 .8% Percentage of floating rate investments 93.2% 89.7% 89.9% 86.9% 85.4% Percentage of equity investments 3.2% 3.2% 3.2% 3.2% 2.8% Non - Accrual – Debt Investments Q3 2 01 3 Q2 2 01 3 Q1 2 01 3 Q4 2 01 2 Q3 2 01 2 Non - accrual investments at amortized cost (000s) $ 6,616 $ 8,428 $ 8,149 $ 8,910 $ 9,666 Non - accrual investments / Total portfolio at amortized cost 0.7 % 1 .1% 1 .1% 1 .3% 1 .5% Non - accrual investments at fair value (000s) $ 841 $ 2,392 $ 2,493 $ 3,222 $ 4,243 Non - accrual investments / Total portfolio at fair value 0.1% 0.3% 0.3% 0.5% 0.7% 1. Weighted average interest rate on new investments is based on the contractual interest rate at the time of funding. For varia ble rate loans, the contractual rate is calculated using current LIBOR, the spread over LIBOR and the impact of any LIBOR floor. For f ixe d rate loans, the contract rate is the stated fixed rate. 2. For the quarter ended June 30, 2012, we have excluded $20.4 million of broadly syndicated loans held for short term investment purposes. These loans had a weighted average interest rate of 2.6% and a weighted average spread over LIBOR of 2.2%. Had we included th e b roadly syndicated loans in these rates, our weighted average interest rate of new investments would have been 5.9% and our weighted ave rage spread over LIBOR would have been 4.8 %.

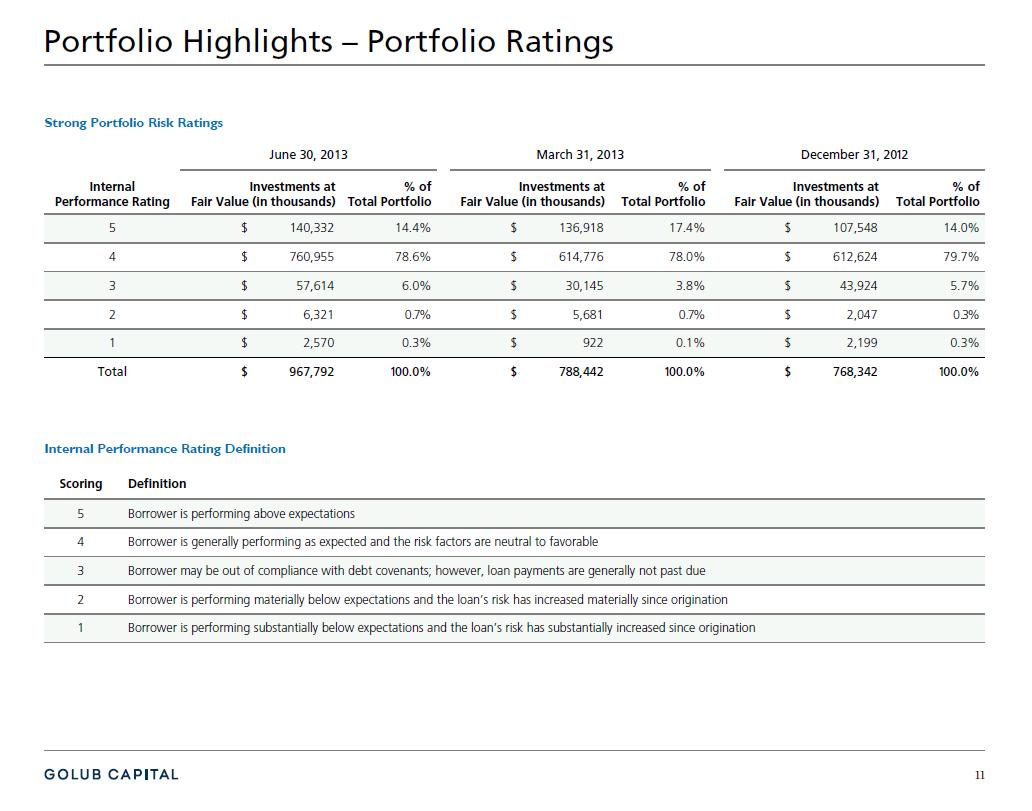

10 Credit Quality Credit Quality – Investment Portfolio ▪ Fundamental credit quality remains strong with non - earning assets representing 0.1% of the total investments at fair value as of June 30, 2013. One non - earning account (Pillar Processing LLC) was returned to accrual status; it had cost and fair value of $1.6 million and $1.5 million, respectively, as of June 30, 2013. ▪ Internal performance ratings 1 on the investment portfolio have remained stable for the past several quarters and over 90.0% of the investments in our portfolio had an internal performance rating of 4 or higher as of June 30, 2013. ▪ The fair value of debt investments as a percentage of principal amount remained stable at 98.7% for the period ended June 30, 2013. 1. Please see Internal Performance Ratings Definitions on the following page.

11 Portfolio Highlights – Portfolio Ratings Scoring Definition 5 Borrower is performing above expectations 4 Borrower is generally performing as expected and the risk factors are neutral to favorable 3 Borrower may be out of compliance with debt covenants; however, loan payments are generally not past due 2 Borrower is performing materially below expectations and the loan’s risk has increased materially since origination 1 Borrower is p erforming substantially below expectations and the loan’s risk has substantially increased since origination June 30, 2013 March 31, 2013 December 31 , 2 01 2 Internal Performance Rating Investments at Fair Value (in thousands) % of Total Portfolio Investments at Fair Value (in thousands) % of Total Portfolio Investments at Fair Value (in thousands) % of Total Portfolio 5 $ 140,332 14.4% $ 136,918 17.4% $ 107,548 14.0% 4 $ 760,955 78.6% $ 614,776 78.0% $ 612,624 79.7% 3 $ 57,614 6.0% $ 30,145 3.8% $ 43,924 5.7% 2 $ 6,321 0 .7 % $ 5,681 0 .7 % $ 2,047 0 .3 % 1 $ 2,570 0.3% $ 922 0.1% $ 2,199 0.3% Total $ 967,792 1 00.0% $ 788,442 1 00.0% $ 768,342 1 00.0% Strong Portfolio Risk Ratings Internal Performance Rating Definition

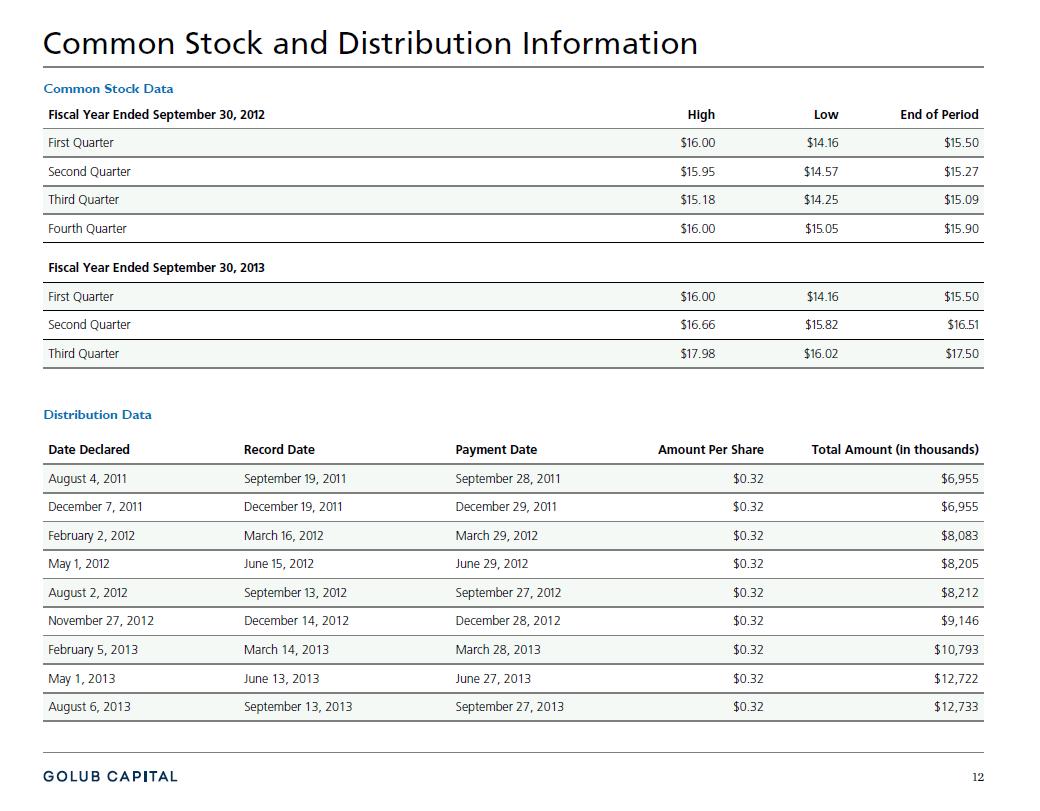

12 Common Stock and Distribution Information Common Stock Data Distribution Data Date Declared Record Date Payment Date Amount Per Share Total Amount (in thousands) August 4, 2 01 1 September 1 9, 2 01 1 September 28, 2 01 1 $0.32 $6,955 December 7, 2 01 1 December 1 9, 2 01 1 December 29, 2 01 1 $0.32 $6,955 February 2, 2 01 2 March 1 6, 2 01 2 March 29, 2 01 2 $0.32 $8,083 May 1 , 2 01 2 June 1 5, 2 01 2 June 29, 2 01 2 $0.32 $8,205 August 2, 2 01 2 September 1 3, 2 01 2 September 27, 2 01 2 $0.32 $8,212 November 27, 2012 December 14, 2012 December 28, 2012 $0.32 $9,146 February 5, 2013 March 14, 2013 March 28, 2013 $0.32 $10,793 May 1, 2013 June 13, 2013 June 27, 2013 $0.32 $12,722 August 6, 2013 September 13, 2013 September 27, 2013 $0.32 $12,733 Fiscal Year Ended September 30, 2 01 2 High Low End of Period First Quarter $1 6.00 $1 4 .1 6 $1 5.50 Second Quarter $1 5.95 $1 4.57 $1 5.27 Third Quarter $1 5.18 $1 4.25 $1 5.09 Fourth Quarter $1 6 .00 $15 .05 $1 5.90 Fiscal Year Ended September 30, 2 01 3 First Quarter $1 6.00 $1 4 .1 6 $1 5.50 Second Quarter $1 6 .66 $15 .82 $16..51 Third Quarter $1 7.98 $1 6.02 $17 .50

13 Liquidity and Investment Capacity Cash and Cash Equivalents ▪ Unrestricted cash totaled $12.9 million as of June 30, 2013. ▪ Restricted cash totaled $21.7 million as of June 30, 2013. Restricted cash was held in our securitization vehicle, SBIC subsidiaries and our revolving credit facility and is available for new investments that qualify for acquisition by these entities. Debt Facilities ▪ As of June 30, 2013, subject to leverage and borrowing base restrictions, we had $63.2 million available for additional borrowings on our revolving credit facility. ▪ As of June 30, 2013, we had $3.8 million in available and approved debentures through our wholly owned SBIC subsidiaries . An additional $61.0 million of debentures are also available through our SBIC subsidiaries, subject to customary SBA regulatory requirements. ▪ For the three months ended June 30, 2013, the effective annualized average interest rate on our total debt outstanding was 2.9%, a decrease from an effective interest rate of 3.5% for the three months ended March 31, 2013. The decrease was primarily attributable to receiving the full quarterly benefit of the repricing of our Class A Notes issued through our securitization vehicle on February 15, 2013. The pricing on the Class A Notes decreased from LIBOR plus 2.40% to LIBOR plus 1.74%.

14 Liquidity and Investment Capacity Senior Loan Fund ▪ Effective May 31, 2013, the Company has agreed to co - invest with United Insurance Company of America (“United Insurance”) through Senior Loan Fund LLC (“Senior Loan Fund”), an unconsolidated Delaware limited liability company, primarily in senior secured loans of middle market companies. ▪ Senior Loan Fund is governed by an investment committee with equal representation from the Company and United Insurance . All material portfolio company decisions and other decisions must be approved by the investment committee. ▪ Senior Loan Fund will be capitalized with subordinated notes and equity capital contributions from United Insurance and the Company as transactions are completed . United Insurance has committed $12.5 million of subordinated notes to Senior Loan Fund and the Company has committed $87.5 million of subordinated notes to Senior Loan Fund, none of which were funded at June 30, 2013 . ▪ Average investment size initially will range between $2.0 and $4.0 million. ▪ Senior Loan Fund will seek to raise senior debt from a third party when Senior Loan Fund has invested in a sufficiently large and diversified pool of investments .