Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMARIN CORP PLC\UK | d579867d8k.htm |

Exhibit 99.1

Amarin Reports Second Quarter 2013 Financial Results

and Provides Update on Operations

- Conference Call Set for 4:30 p.m. EST Today -

BEDMINSTER, N.J., and DUBLIN, Ireland, August 8, 2013 — Amarin Corporation plc (Nasdaq: AMRN), a late-stage biopharmaceutical company focused on the commercialization and development of therapeutics to improve cardiovascular health, today announced financial results for Q2, the quarter ended June 30, 2013, and provided an update on company operations.

Key Amarin accomplishments since March 31, 2013 include:

| • | Recognized $5.5 million in product revenue from Vascepa sales in Q2, the first full quarter of Vascepa sales ($1.8 million in net value of Vascepa was deferred at the end of Q2 for product sold to wholesalers but not recognized as revenue under GAAP) |

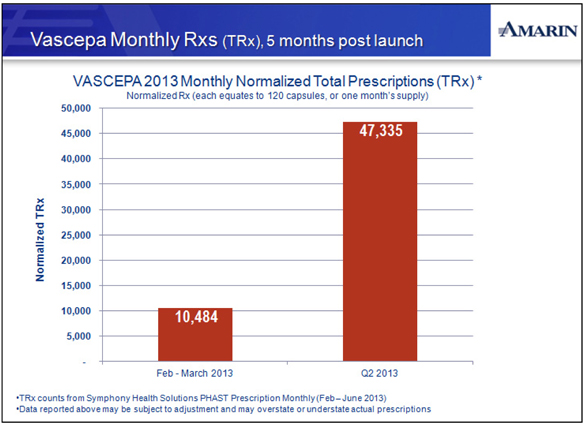

| • | Normalized prescriptions, based upon data from Symphony Health, increased in Q2 to 47,335 from 10,484 in Q1, comprised of normalized prescriptions from February and March only |

| • | Improved formulary access by increasing number of lives covered with Tier 2 status to greater than 72 million with over 190 million lives covered on formulary overall |

| • | Increased the number of physicians prescribing Vascepa to over 9,000 |

| • | Advanced planning and preparation for the anticipated launch of Vascepa for the ANCHOR indication, progressing towards advisory committee date of October 16, 2013 and PDUFA date of December 20, 2013 |

| • | Reported statistically significant reductions in median particle concentrations of total very-low-density lipoprotein (VLDL) by 12.2%, total low-density lipoprotein (LDL) by 7.7%, and small LDL particles by 13.5% when Vascepa 4 g/day was added to optimized statin therapy for 12 weeks, compared with placebo, in post-hoc analyses of the ANCHOR Phase 3 clinical trial data |

| • | Continued to enroll patients in the REDUCE-IT cardiovascular outcomes trial in which the mean and median baseline triglyceride, or TG, levels in patients participating in the study to date are >200 mg/dL, a level which is intentionally higher than studied in recently conducted outcomes trials of other prescription lipid modifying therapies |

| • | Increased patents issued or allowed in the United States to 27, adding 5 in Q2, which include multiple claims covering the administration of pure EPA to lower triglycerides with or without statin therapy (16 year-to-date), all but two of the 27 have patent terms extending into 2030, with more than 30 additional patent applications being prosecuted in the United States alone |

| • | Expanded approved active pharmaceutical ingredient, or API, suppliers for Vascepa from one to three with sNDA approvals for BASF and Chemport Inc. |

| • | Completed an equity financing in July resulting in approximately $121.1 million in estimated net proceeds which, when combined with the company’s $149.4 million of cash on June 30, 2013, provides a solid financial foundation from which to further grow the company and seek profitability |

“Since the end of Q1, revenues, prescription levels, prescribing physicians and lives covered under Tier 2 have all more than doubled,” said Joseph Zakrzewski, Chairman and Chief Executive Officer of Amarin. “We have witnessed the awareness, knowledge level and utilization of Vascepa strengthen and expand across our group of targeted physicians. The efficacy and safety profile of Vascepa for its approved indication continue to be well received and we plan to continue to drive increased physician awareness and managed care coverage to further grow revenues. In addition, we believe we are well positioned for approval by the U.S. Food and Drug Administration, or FDA, in December to expand Vascepa labeling from our approved MARINE indication to the significantly larger population represented by our proposed ANCHOR indication.”

Operational update

Commercialization update

Amarin’s direct sales force, consisting of approximately 275 sales professionals, launched Vascepa on January 28, 2013, for use as an adjunct to diet to reduce triglyceride levels in adult patients with severe (>500 mg/dL) hypertriglyceridemia, the initial indication for Vascepa, or MARINE indication. Amarin reports that, since launch, access to clinicians has been good, and that it has yet to hear any significant negative reaction to the efficacy or safety profile of Vascepa. Amarin’s sales professionals are currently targeting the limited group of clinicians who are the highest prescribers of other lipid therapies and seeking, in particular, to increase awareness and knowledge of Vascepa among this group. Amarin believes that Vascepa is well differentiated in this market based on its safety profile, which is comparable to placebo, and on its spectrum of demonstrated lipid benefit at 4 g/day, including statistically significant reductions in TGs, Apo B, VLDL-C, and non-HDL-C, with no increase in LDL-C, also known as bad cholesterol.

Vascepa additional indication progress

In parallel with marketing Vascepa for the MARINE indication, Amarin is pursuing FDA approval of Vascepa for the ANCHOR indication, a second indication in a significantly larger adult patient population, those with mixed dyslipidemia and TG levels between 200 and 499 mg/dL.

As previously announced, in a clinical trial of the use of Vascepa in the ANCHOR indication, Vascepa demonstrated statistically significant reductions in a broad spectrum of lipid and inflammatory markers, on top of optimized statin therapy, including significant reduction in LDL-C compared to placebo. The FDA has accepted for review Amarin’s Supplemental New Drug Application, or sNDA, for the ANCHOR indication and has assigned a PDUFA action date of December 20, 2013 for this sNDA. In addition, the FDA has scheduled a meeting of the Endocrinologic and Metabolic Drugs Advisory Committee (EMDAC) to review the ANCHOR application to be held on October 16, 2013. The safety results from the ANCHOR trial are included in the current label for Vascepa.

The ANCHOR study, which evaluated the efficacy of Vascepa in lowering triglycerides on top of optimized statin therapy for adult mixed dyslipidemia patients with high triglyceride levels (>200 to <500 mg/dL), was conducted under a special protocol assessment, or SPA, agreement with the FDA. An SPA is generally considered to be binding upon the FDA except in limited circumstances, such as if the FDA identifies a substantial scientific issue essential to its determining the efficacy or safety of a drug. Amarin has not been informed by FDA of any such essential issue. Amarin believes that it achieved all of the requirements of the SPA agreement. In particular, in the ANCHOR trial, with Vascepa 4 grams per day, all primary and secondary efficacy endpoints were achieved, including a reduction in LDL-C levels compared to placebo. Amarin is optimistic that the FDA will approve Vascepa for this indication and looks forward to the advisory committee meeting as an opportunity to highlight the positive safety and efficacy profile of Vascepa. If approved, Vascepa will be the first drug in its class to be approved for this multi-billion dollar market opportunity. Approximately one in five adults in the United States have triglyceride levels of >200 mg/dL.

Vascepa exclusivity update

Amarin continues to make significant progress in its effort to expand patent protection for Vascepa and now has 27 patents issued or allowed in the United States with over 30 additional U.S. patent applications being prosecuted. This patent portfolio includes claims covering Vascepa’s pharmaceutical composition and methods of use for the MARINE indication, ANCHOR indication and other potential uses of Vascepa. Amarin is also pursuing patent applications related to Vascepa in multiple jurisdictions outside the United States. In May 2013, the European Patent Office granted a patent covering the use of Vascepa based on the results from the MARINE trial. All but two of the granted patents in the United States have expiry dates extending into 2030 and the majority of U.S. patent applications, if and when allowed, are anticipated to have expiry dates in or beyond 2030. Patent protection for Vascepa is augmented by protection provided by trade secrets, existing manufacturing barriers to entry and anticipated three- or five-year regulatory exclusivity.

REDUCE-IT and other Vascepa-related clinical development

During Q2, the FDA accepted Amarin’s sNDA for the ANCHOR indication, a precondition for which was that the REDUCE-IT cardiovascular outcomes study be substantially underway. Consistent with Amarin’s Special Protocol Assessment (SPA) agreement, and based on the company’s discussions with the FDA, the company does not believe the final results of the REDUCE-IT study will be required for FDA approval of Vascepa for the ANCHOR indication, although there can be no assurance that this will

be the case. During Q2, the mean and median baseline triglyceride levels for patients participating to date in the REDUCE-IT cardiovascular outcomes study has been confirmed to be >200 mg/dL. As intended, these are higher baseline TG levels than levels studied in other recent outcomes trials of other lipid modifying therapies. Results of the REDUCE-IT study will not be available until a specified number of cardiovascular events have been observed, the timing of which is not expected in the near-term.

Financial update

Amarin reported cash and cash equivalents on-hand of $149.4 million at June 30, 2013. On July 12, 2013, Amarin completed a public offering resulting in additional net proceeds to Amarin of approximately $121.1 million, after deducting the company’s portion of estimated offering expenses, resulting in aggregate pro forma cash and cash equivalents of $270.5 million as of June 30, 2013.

Vascepa’s commercial launch commenced on January 28, 2013 in the United States. The quarter ended June 30, 2013 is the first full quarter of Vascepa sales. Amarin reported net product revenues for the quarter ended June 30, 2013 of $5.5 million as compared to revenue of $2.3 million for the quarter ended March 31, 2013 and no revenues in the corresponding periods of 2012. In accordance with U.S. Generally Accepted Accounting Principles (US GAAP), and consistent with Q1 reporting, until the company has more operating history with the commercialization of Vascepa, it is recognizing revenue based not on its sales to wholesalers but based on the resale of Vascepa for the purpose of filling prescriptions. For the six months ended June 30, 2013, the net value of Vascepa sold to wholesalers was $9.6 million, and, as a result, in addition to $7.8 million in recognized revenue, Amarin recorded deferred revenue of $1.8 million at June 30, 2013. Cash collections from the sale of Vascepa in the quarter ended June 30, 2013 were approximately $6.6 million for a total of $9.4 million collected from wholesalers since the launch of Vascepa.

Consistent with industry practice, the net price of Vascepa for the six months ended June 30, 2013 reflects the deduction of one-time discounts paid to wholesalers to stock Vascepa in advance of Vascepa’s launch in January 2013, as well as the costs of a co-payment rebate card program and customary payor rebates and allowances. The net price also includes adjustments for other customary amounts.

Cost of goods sold during the quarter ended June 30, 2013 was $2.8 million as compared to $1.3 million for the quarter ended March 31, 2013. Gross margin as a percentage of net revenues improved from 45% to 48% in the second quarter as compared to the first quarter of 2013. The majority of Vascepa capsules sold during the six months ended June 30, 2013 included API sourced from a single API supplier. Amarin’s purchases of API from this supplier in 2012 and early 2013 are at higher cost per kilogram than expected future purchases from this supplier. The unusually high cost of goods, as a percentage of revenue, is attributable to a number of things including the geographic location of our suppliers, exchange rate exposures and lower volume and less favorable economic terms than those with other API suppliers. Amarin expects steady state gross margin as a percentage of product revenues to approach the high seventies to low eighties as it increases purchase volumes and sources lower cost API. In April 2013, sNDAs were approved for two comparatively lower cost API suppliers, BASF and Chemport Inc. While current inventory is comprised primarily of inventory from the initial supplier, unless the company secures substantial price concessions from the initial supplier, it anticipates shifting a substantial portion of future API purchases to these lower cost suppliers.

Under U.S. GAAP, Amarin reported a net loss of $39.8 million in the second quarter of 2013, or basic and diluted loss per share of $0.26. This net loss included $5.1 million in non-cash, share-based

compensation expense, $1.0 million in non-cash, warrant compensation income, and a $18.8 million gain on the change in the fair value of derivatives. In the second quarter of 2012, GAAP net loss was $53.9 million, or basic and diluted loss per share of $0.38, and included $4.8 million in non-cash share-based compensation expense, $1.9 million in non-cash warrant compensation expense, and a $18.9 million loss on the change in the fair value of derivatives.

For the six months ended June 30, 2013, Amarin reported a net loss of $101.9 million, or basic and diluted loss per share of $0.68. This net loss included $10.0 million in non-cash share-based compensation expense, $1.5 million in non-cash warrant compensation income, and a $22.5 million gain on the change in the fair value of derivatives. For the six months ended June 30, 2012, GAAP net loss was $142.2 million, or basic and diluted loss per share of $1.03, and included $8.7 million in non-cash share-based compensation expense, $4.2 million in non-cash warrant compensation expense, and a $85.1 million loss on the change in the fair value of derivatives.

Excluding non-cash gains or losses for share-based compensation, warrant compensation and change in value of derivatives, non-GAAP adjusted net loss was $54.5 million for the three months ended June 30, 2013, or non-GAAP adjusted basic and diluted loss per share of $0.36, as compared to non-GAAP adjusted net loss of $28.3 million, or non-GAAP adjusted basic and diluted loss per share of $0.20 for the same period in 2012. Adjusted net loss was $115.9 million for the six months ended June 30, 2013, or non-GAAP adjusted basic and diluted loss per share of $0.77, as compared to non-GAAP adjusted net loss of $44.1 million, or non-GAAP adjusted basic and diluted loss per share of $0.32 for the same period in 2012.

Amarin reported cash and cash equivalents decreased in aggregate by $110.8 million from December 31, 2012 as compared to June 30, 2013. Net cash outflows from operations were $52.8 million in the second quarter of 2013 as compared to $59.6 million in the first quarter of 2013. As stated previously, Amarin anticipates its first quarter net cash outflows from operations to be its highest quarter of net cash outflows from operations during 2013. Amarin anticipates that it will experience continued reductions in quarterly net cash outflows from operations with future quarterly results below the results of the second quarter.

During the six months ended June 30, 2013, net cash outflows included approximately $48.2 million paid for sales and marketing related expenses in conjunction with the initial commercial launch of Vascepa, approximately $16.7 million paid in support of the REDUCE-IT cardiovascular outcomes study and approximately $16.3 million for Vascepa API, purchased in conjunction with the buildup of commercial supply and for clinical trial material. Of this $16.3 million in API purchases, $3.0 million was included as a component of research and development expense because it was received from suppliers prior to qualification by the FDA and the balance was capitalized as inventory.

Amarin’s liabilities as of June 30, 2013, excluding the fair value of the non-cash warrant derivative liability, totaled approximately $273.0 million, which includes $141.5 million for the carrying value of exchangeable debt and $86.7 million for the carrying value of the hybrid debt financing that we entered into in December 2012.

As of June 30, 2013, Amarin had approximately 150.7 million ADSs outstanding as well as approximately 9.9 million, 11.2 million, and 0.9 million equivalent shares underlying warrants, stock options, and restricted or deferred stock units, respectively, at average exercise prices of $1.44, $7.47 and $8.49, respectively. In addition, $150 million in exchangeable senior notes issued in January 2012 are exchangeable prior to October 15, 2031 into an aggregate of 17.0 million ADSs (based on an initial exchange price of approximately $8.81 per ADS), subject to certain specified conditions. The notes accrue

interest at an annual rate of 3.5%, payable semiannually in arrears on January 15 and July 15, beginning July 15, 2012. The notes will mature on January 15, 2032, unless earlier repurchased or redeemed by the company or exchanged by the holders. In conjunction with Amarin’s previously announced financing in July 2013, Amarin issued 21.7 million additional ADSs.

Amarin’s operational priorities

Operational priorities in the second half of 2013 are:

| • | Increasing revenues from sales of Vascepa |

| • | Continuing managed care migration coverage from Tier 3 to Tier 2 |

| • | Ensuring a successful ANCHOR advisory committee meeting |

| • | Gaining approval of the ANCHOR indication sNDA; PDUFA date of December 20, 2013 |

| • | Planning for the successful commercialization of the ANCHOR indication |

| • | Obtaining additional patent awards from the USPTO |

| • | Continuing development of a fixed-dose combination of Vascepa and a leading statin |

| • | Submitting an sNDA for a fourth API supplier |

| • | Publishing additional data from Amarin’s clinical trials |

Conference call and webcast information

Amarin will host a conference call at 4:30 p.m. EST (8:30 p.m. UTC/GMT) today, August 8, 2013. To participate in the call, please dial (877) 407-8033 within the United States or (201) 689-8033 from outside the United States. A replay of the call will be made available for a period of two weeks following the conference call. To hear a replay of the call, dial (877) 660-6853 (inside the U.S.) or (201) 612-7415 (outside the U.S.). A replay of the call will also be available through Amarin’s website shortly after the call. For both dial-in numbers please use conference ID 416486. The conference call can also be heard live through the investor relations section of Amarin’s website at www.amarincorp.com.

Use of non-GAAP adjusted financial information

Included in this press release and the conference call referenced above are non-GAAP adjusted financial information as defined by U.S. Securities and Exchange Commission Regulation G. The GAAP financial measure most directly comparable to each non-GAAP adjusted financial measure used or discussed, and a reconciliation of the differences between each non-GAAP adjusted financial measure and the comparable GAAP financial measure, are included in this press release after the condensed consolidated financial statements.

Non-GAAP adjusted net loss was derived by taking GAAP net loss and adjusting it for non-cash gains or losses for share-based compensation, warrant compensation, and change in value of derivatives. Management believes that these non-GAAP adjusted measures provide investors with a better understanding of the company’s historical results from its core business operations. While management believes that these non-GAAP adjusted financial measures provide useful supplemental information to investors regarding the underlying performance of the company’s business operations, investors are reminded to consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures prepared in accordance with GAAP. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP. In addition, it should be noted that these non-GAAP financial measures may be different from non-GAAP measures used by other companies, and management may utilize other measures to illustrate performance in the future.

About Vascepa® (icosapent ethyl) capsules

Vascepa® (icosapent ethyl) capsules, known in scientific literature as AMR101, is a highly pure-EPA omega-3 prescription product in a 1 gram capsule.

Indications and Usage

| • | Vascepa (icosapent ethyl) is indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (³500 mg/dL) hypertriglyceridemia. |

| • | The effect of Vascepa on the risk for pancreatitis and cardiovascular mortality and morbidity in patients with severe hypertriglyceridemia has not been determined. |

Important Safety Information for Vascepa

| • | Vascepa is contraindicated in patients with known hypersensitivity (e.g., anaphylactic reaction) to Vascepa or any of its components and should be used with caution in patients with known hypersensitivity to fish and/or shellfish. |

| • | The most common reported adverse reaction (incidence >2% and greater than placebo) was arthralgia (2.3% for Vascepa, 1.0% for placebo). |

FULL VASCEPA PRESCRIBING INFORMATION CAN BE FOUND AT WWW.VASCEPA.COM.

Forward-looking statements

This press release contains forward-looking statements, including statements about the commercial launch of Vascepa, including the number of total prescriptions to date and the potential for future growth, expectations for revenue growth, product awareness, receptivity of clinicians to and patient experience with Vascepa; expectations regarding managed care coverage migration from Tier 3 to Tier 2 and continued growth in Tier 2 coverage; the pricing terms of commercial supply for Vascepa; expectations regarding gross margins and cost of goods sold (COGS); the timing and outcome of FDA decisions regarding Amarin’s sNDA for the ANCHOR indication and regulatory exclusivity; the efficacy, safety and therapeutic benefits of Vascepa; the ability of Amarin to develop a fixed-dose combination of Vascepa and a leading statin; Amarin’s ability to obtain sufficient patent protection and regulatory exclusivity for its product and product candidates, maintain trade secrets, and take advantage of existing manufacturing barriers to entry; continued enrollment of patients in Amarin’s REDUCE-IT cardiovascular outcomes study; continued publication of study data; and continued assessment of collaboration prospects for commercialization of Vascepa. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. In particular, as disclosed in its previous filings with the U.S. Securities and Exchange Commission, Amarin’s ability to effectively commercialize Vascepa will depend in part on its ability to create market demand for Vascepa through education, marketing and sales activities, to achieve market acceptance of Vascepa, to receive adequate levels of reimbursement from third-party payers, to develop and maintain a consistent source of commercial supply at a competitive price, and to obtain and maintain patent protection and regulatory exclusivity. Among the factors that could cause actual results to differ materially from those described or projected herein include the following: uncertainties associated generally with research and development, clinical trials and related regulatory approvals; the risk that Special Protocol Assessment agreements with the FDA are not a guarantee that FDA will approve a product candidate upon submission; the risk that the

FDA may not complete its review of the ANCHOR sNDA by the PDUFA action date or grant new chemical entity regulatory exclusivity to Vascepa; the risk that historical REDUCE-IT clinical trial enrollment and randomization rates may not be predictive of future results and related cost may increase beyond expectations; the risk that patent applications may not result in issued patents, trade secrets may not be maintained and that circumstances that create manufacturing barriers to entry may not last; the risk that Amarin may not enter into a collaboration agreement for the commercialization of Vascepa in the ANCHOR indication under favorable terms or at all or market the ANCHOR indication successfully on its own; and the risk that publications of scientific data may not accept proposals to publish Vascepa data. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin’s filings with the U.S. Securities and Exchange Commission, including its most recent Quarterly Report on Form 10-Q. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Amarin undertakes no obligation to update or revise the information contained in this press release, whether as a result of new information, future events or circumstances or otherwise.

Vascepa has been approved for use by the FDA as an adjunct to diet to reduce triglyceride levels in adult patients with severe (³500 mg/dL) hypertriglyceridemia. Vascepa is under various stages of development for potential use in other indications that have not been approved by the FDA. Nothing in this press release should be construed as marketing the use of Vascepa in any indication that has not been approved by the FDA.

Important information regarding prescriptions data and product revenue

The historical prescription data provided in this press release is based on data published by a third party as of July 16, 2013. Although Amarin believes these data are prepared on a period to period basis in a manner that is generally consistent and that such results are indicative of current prescription trends, these data are based on estimates and should not be relied upon as definitive. These data may overstate or understate actual prescriptions. Based on other data available to Amarin and the history of such third-party prescription estimates in the early stages of launch of other new pharmaceutical products, Amarin believes that the trends provided by this information can be useful to gauge current prescription levels. Amarin commenced its commercial launch of Vascepa on January 28, 2013. Accordingly, there is a very limited amount of information available at this time to determine the actual number of total prescriptions for Vascepa. Amarin believes that investors should view these data with caution, as data for this single and limited period may not be representative of a trend consistent with the results presented or otherwise predictive of future results. Seasonal fluctuations in pharmaceutical sales, for example, may affect future prescription trends of Vascepa as could change in prescriber sentiment and other factors. Amarin believes investors should consider its results during this quarter together with its results over several future quarters, or longer, before making an assessment about potential future performance. The commercial launch of a new pharmaceutical product is a complex undertaking, and Amarin’s ability to effectively and profitably launch Vascepa will depend in part on its ability to generate market demand for Vascepa through education, marketing and sales activities, its ability to achieve market acceptance of Vascepa, its ability to generate product revenue and its ability to receive adequate levels of reimbursement from third-party payers. See “Risk Factors—Risks Related to the Commercialization and Development of Vascepa” included in Part II, Item 1A. Risk Factors in Amarin’s most recent Quarterly Report on Form 10-Q.

Availability of other information about Amarin

Investors and others should note that we communicate with our investors and the public using our company website (www.amarincorp.com), our investor relations website (http://www.amarincorp.com /investor-splash.html), including but not limited to investor presentations and investor FAQs, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that we post on these channels and websites could be deemed to be material information. As a result, we encourage investors, the media, and others interested in Amarin to review the information that we post on these channels, including our investor relations website, on a regular basis. This list of channels may be updated from time to time on our investor relations website and may include social media channels. The contents of our website or these channels, or any other website that may be accessed from our website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933.

Amarin Contact Information:

Joseph Bruno

Director, Investor Relations and Corporate Communications

Amarin Corporation plc

In U.S.: +1 (908) 719-1315

investor.relations@amarincorp.com

CONSOLIDATED BALANCE SHEET DATA

(U.S. GAAP)

Unaudited

| June 30, 2013 | December 31, 2012 | |||||||

| (in thousands) | ||||||||

| ASSETS | ||||||||

| Current Assets: |

||||||||

| Cash and cash equivalents |

$ | 149,426 | $ | 260,242 | ||||

| Restricted cash |

1,400 | — | ||||||

| Accounts receivable |

2,267 | — | ||||||

| Inventory |

28,514 | 21,262 | ||||||

| Deferred tax asset |

936 | 937 | ||||||

| Other current assets |

2,171 | 3,253 | ||||||

|

|

|

|

|

|||||

| Total current assets |

$ | 184,714 | $ | 285,694 | ||||

| Property, plant and equipment, net |

706 | 811 | ||||||

| Deferred tax asset |

12,880 | 8,044 | ||||||

| Other non-current assets |

5,335 | 4,951 | ||||||

| Intangible asset, net |

11,032 | 11,355 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 214,667 | $ | 310,855 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current Liabilities: |

||||||||

| Accounts payable |

$ | 9,688 | $ | 17,458 | ||||

| Accrued interest payable |

9,555 | 2,520 | ||||||

| Deferred revenue |

1,833 | — | ||||||

| Accrued expenses and other liabilities |

14,358 | 5,224 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

$ | 35,434 | $ | 25,202 | ||||

|

|

|

|

|

|||||

| Long-Term Liabilities: |

||||||||

| Warrant derivative liability |

36,028 | 54,854 | ||||||

| Exchangeable senior notes |

141,457 | 134,250 | ||||||

| Long-term debt |

86,687 | 85,153 | ||||||

| Long-term debt redemption feature |

8,600 | 14,577 | ||||||

| Other long-term liabilities |

795 | 816 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

$ | 309,001 | $ | 314,852 | ||||

|

|

|

|

|

|||||

| Stockholders’ Deficit: |

||||||||

| Common stock |

124,893 | 124,597 | ||||||

| Additional paid-in capital |

630,565 | 619,266 | ||||||

| Treasury stock |

(217 | ) | (217 | ) | ||||

| Accumulated deficit |

(849,575 | ) | (747,643 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ deficit |

$ | (94,334 | ) | $ | (3,997 | ) | ||

|

|

|

|

|

|||||

| Total Liabilities and Stockholders’ Deficit |

$ | 214,667 | $ | 310,855 | ||||

|

|

|

|

|

|||||

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

(U.S. GAAP)

Unaudited

| Three Months Ended June 30 (in thousands, except per share amounts) |

Six Months Ended June 30 (in thousands, except per share amounts) |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Product revenues |

$ | 5,500 | $ | — | $ | 7,842 | $ | — | ||||||||

| OPERATING EXPENSES: |

||||||||||||||||

| Cost of goods sold |

2,844 | — | 4,131 | — | ||||||||||||

| Research and development (1) |

17,489 | 14,066 | 39,327 | 18,822 | ||||||||||||

| Selling, general and administrative (1) |

33,961 | 13,635 | 73,228 | 27,662 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

54,294 | 27,701 | 116,686 | 46,484 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(48,794 | ) | (27,701 | ) | (108,844 | ) | (46,484 | ) | ||||||||

| Gain (loss) on change in fair value of derivative liabilities (2) |

18,841 | (18,930 | ) | 22,461 | (85,139 | ) | ||||||||||

| Interest expense, net |

(9,345 | ) | (4,317 | ) | (18,205 | ) | (8,268 | ) | ||||||||

| Other (expense) income, net |

(411 | ) | (52 | ) | (536 | ) | 16 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations before taxes |

(39,709 | ) | (51,000 | ) | (105,124 | ) | (139,875 | ) | ||||||||

| Provision for (benefit from) income taxes |

65 | 2,904 | (3,192 | ) | 2,314 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net and comprehensive loss |

$ | (39,774 | ) | $ | (53,904 | ) | $ | (101,932 | ) | $ | (142,189 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss per share: |

||||||||||||||||

| Basic and diluted |

$ | (0.26 | ) | $ | (0.38 | ) | $ | (0.68 | ) | $ | (1.03 | ) | ||||

| Weighted average shares: |

||||||||||||||||

| Basic and diluted |

150,694 | 140,550 | 150,562 | 138,280 | ||||||||||||

| (1) | A substantial portion of the Amarin’s marketing, general and administrative costs represents non-cash warrant based compensation to former officers. Excluding non-cash stock and warrant based compensation, research and development expenses were $16,691 and $12,924 for the three months ending June 30, 2013 and 2012, respectively and selling, general and administrative expenses were $30,672 and $8,085, respectively, for the same periods. |

| (2) | Non-cash gains and losses result from changes in the fair value of a warrant derivative liability and long-term debt redemption feature. |

The following is a reconciliation of the non-GAAP financial measures used by Amarin to describe its financial results determined in accordance with United States generally accepted accounting principles (GAAP). An explanation of these measures is also included under the heading “Use of non-GAAP adjusted financial information” above.

RECONCILIATION OF NON-GAAP LIABILITIES

Unaudited

| June 30, 2013 | December 31, 2012 | |||||||

| (in thousands) | ||||||||

| Current Liabilities: |

||||||||

| Accounts payable |

$ | 9,688 | $ | 17,458 | ||||

| Accrued interest payable |

9,555 | 2,520 | ||||||

| Deferred revenue |

1,833 | — | ||||||

| Accrued expenses and other liabilities |

14,358 | 5,224 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

$ | 35,434 | $ | 25,202 | ||||

|

|

|

|

|

|||||

| Long-Term Liabilities: |

||||||||

| Warrant derivative liability |

36,028 | 54,854 | ||||||

| Exchangeable senior notes |

141,457 | 134,250 | ||||||

| Long-term debt |

86,687 | 85,153 | ||||||

| Long-term debt redemption feature |

8,600 | 14,577 | ||||||

| Other long-term liabilities |

795 | 816 | ||||||

|

|

|

|

|

|||||

| Total liabilities – GAAP |

$ | 309,001 | $ | 314,852 | ||||

|

|

|

|

|

|||||

| Warrant derivative liability |

(36,028 | ) | (54,854 | ) | ||||

|

|

|

|

|

|||||

| Total liabilities – non GAAP |

$ | 272,973 | $ | 259,998 | ||||

|

|

|

|

|

|||||

RECONCILIATION OF NON-GAAP NET LOSS

Unaudited

| Three Months Ended June 30 (in thousands, except per share amounts) |

Six Months Ended June 30 (in thousands, except per share amounts) |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net loss for EPS1 – GAAP |

$ | (39,774 | ) | $ | (53,904 | ) | $ | (101,932 | ) | $ | (142,189 | ) | ||||

| Share based compensation expense |

5,090 | 4,834 | 9,963 | 8,709 | ||||||||||||

| Warrant compensation (income) expense |

(1,003 | ) | 1,858 | (1,455 | ) | 4,232 | ||||||||||

| (Gain) loss on change in fair value of derivatives |

(18,841 | ) | 18,930 | (22,461 | ) | 85,139 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted net loss for EPS1 – non GAAP |

(54,528 | ) | (28,282 | ) | (115,885 | ) | (44,109 | ) | ||||||||

|

1 basic and diluted |

||||||||||||||||

| Loss per share: |

||||||||||||||||

| Basic and diluted EPS – non GAAP |

$ | (0.36 | ) | $ | (0.20 | ) | $ | (0.77 | ) | $ | (0.32 | ) | ||||

| Weighted average shares: |

||||||||||||||||

| Basic and diluted |

150,694 | 140,550 | 150,562 | 138,280 | ||||||||||||