Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUNTINGTON INGALLS INDUSTRIES, INC. | q22013earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - HUNTINGTON INGALLS INDUSTRIES, INC. | hii2013q2earningsrelease.htm |

Q2 2013 Earnings Presentation August 7, 2013 Mike Petters President and Chief Executive Officer Barb Niland Corporate Vice President, Business Management and Chief Financial Officer EXHIBIT 99.2

Statements in this presentation, other than statements of historical fact, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those expressed in these statements. Factors that may cause such differences include: changes in government and customer priorities and requirements (including government budgetary constraints, shifts in defense spending, and changes in customer short-range and long-range plans); our ability to obtain new contracts, estimate our future contract costs and perform our contracts effectively; changes in government regulations and procurement processes and our ability to comply with such requirements; our ability to realize the expected benefits from consolidation of our Ingalls facilities; natural disasters; adverse economic conditions in the United States and globally; risks related to our indebtedness and leverage; and other risk factors discussed in our filings with the U.S. Securities and Exchange Commission. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business, and we undertake no obligation to update any forward-looking statements. You should not place undue reliance on any forward-looking statements that we may make. This presentation also contains non-GAAP financial measures and includes a GAAP reconciliation of these financial measures. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures. Safe Harbor 2

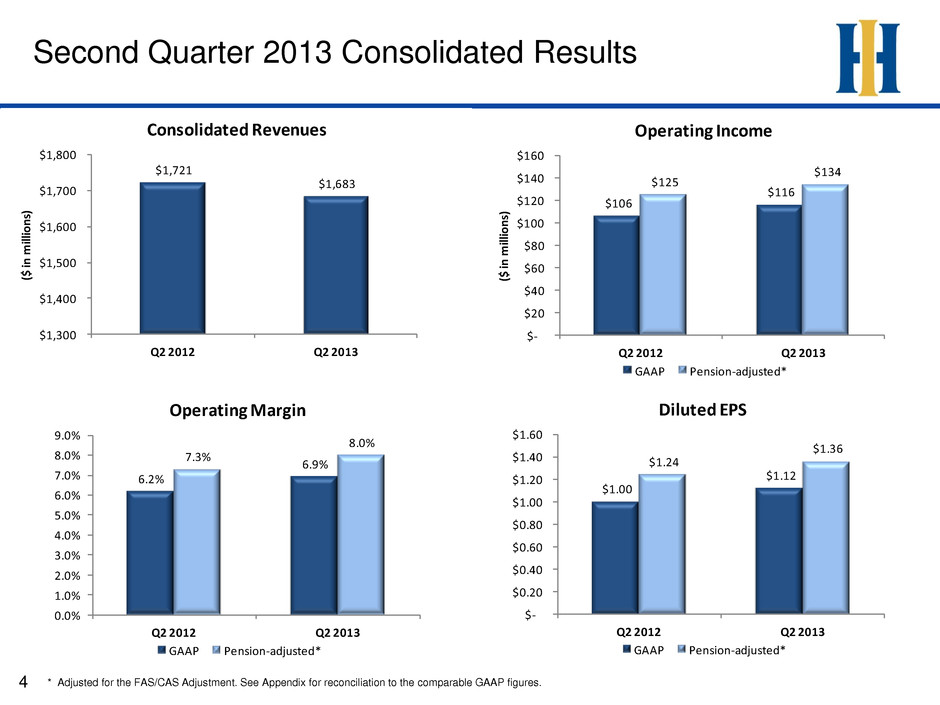

* Adjusted for the FAS/CAS Adjustment. See Appendix for reconciliation to the comparable GAAP figures. Highlights from the Second Quarter 3 Revenues were $1.7 billion for the quarter Total operating margin was 6.9%, up 73 bps over prior year Pension-adjusted operating margin* was 8.0%, up from 7.3% last year Diluted EPS of $1.12 for the quarter Pension-adjusted Diluted EPS* of $1.36 for the quarter, up 9.7% over prior year Segment operating margin increased to 8.1%, from 7.4% last year, driving operating margin and EPS growth Ingalls operating margin was 5.2% for the quarter, up from 5.0% last year Newport News operating margin was 9.8% for the quarter, up from 9.1% last year Announced $5.3 billion of new contract awards in Q2 2013 with a $20.7 billion backlog at the end of the quarter $3.3 billion contract for the construction of five DDG-51 Arleigh Burke-class destroyers $745 million contract for the inactivation of CVN-65 USS Enterprise $487 million contract for the construction of NSC-6 Munro

$1.00 $1.12 $1.24 $1.36 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 Q2 2012 Q2 2013 Diluted EPS GAAP Pension-adjusted* 6.2% 6.9% 7.3% 8.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Q2 2012 Q2 2013 Operating Margin GAAP Pension-adjusted* $106 $116 $125 $134 $- $2 $4 $6 $8 $100 $120 $140 $160 Q2 2012 Q2 2013 ($ in m illi on s) Operating Income GAAP Pension-adjusted* $1,721 $1,683 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 Q2 2012 Q2 2013 ($ in m illi on s) Consolidated Rev nues Second Quarter 2013 Consolidated Results 4 * Adjusted for the FAS/CAS Adjustment. See Appendix for reconciliation to the comparable GAAP figures.

5.0% 5.2% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Q2 2012 Q2 2013 Operating Margin $38 $35 $10 $15 $20 $25 $30 $35 $40 Q2 2012 Q2 2013 ($ in m illi on s) Operating Income $756 $ 672 $- $10 $200 $300 $400 $500 $600 $700 $800 Q2 2012 Q2 2013 ($ in m illi on s) Segment Revenues Ingalls Shipbuilding 5 Ingalls Q2 revenues were down YoY due to lower sales on amphibious assault ships, partially offset by higher sales on the NSC program and surface combatants Q2 segment margin was up YoY due to risk retirement on amphibious assault ships and the NSC program offset by the receipt of $7 million for resolution of a contract dispute in Q2 2012

9.1% 9.8% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% Q2 2012 Q2 2013 Operating Margin $89 $101 $50 $60 $70 $80 $90 $100 $110 Q2 2012 Q2 2013 ($ in m illi on s) Operating Income $979 $ 1,031 $500 $600 $700 $800 $900 $1,000 $1,100 Q2 2012 Q2 2013 ($ in m illi on s) Segment Revenues Newport News Shipbuilding 6 Newport News Q2 revenues were up YoY due to higher sales on fleet support, submarines and aircraft carriers Q2 segment operating income and margin increased YoY primarily due to VCS program risk retirement and performance improvements

U n sa ve d Docum e n t / 1 2 /2 9 /1 0 / 1 0 :0 2 Appendix

Reconciliations 8 We make reference to “segment operating income,” “segment operating margin,” “pension-adjusted operating income,” “pension- adjusted operating margin,” “pension-adjusted net earnings,” and “pension-adjusted diluted earnings per share.” Segment operating income is operating income before the FAS/CAS Adjustment and deferred state income taxes. Segment operating margin is segment operating income as a percentage of total sales and service revenues. Pension-adjusted operating income is total operating income adjusted for the FAS/CAS Adjustment. Pension-adjusted operating margin is pension-adjusted operating income as a percentage of total sales and service revenues. Pension-adjusted net earnings is net income adjusted for the tax effected FAS/CAS Adjustment. Pension-adjusted diluted earnings per share is pension-adjusted net earnings divided by the weighted-average diluted common shares outstanding. Segment operating income and segment operating margin are two of the key metrics we use to evaluate operating performance because they exclude items that do not affect segment performance. We believe pension-adjusted operating income, pension- adjusted operating margin, pension-adjusted net earnings and pension-adjusted diluted earnings per share are also useful metrics because they exclude non-operating items that we do not consider indicative of our core operating performance. Therefore, we believe it is appropriate to disclose these measures to help investors analyze our operating performance. However, these measures are not measures of financial performance under GAAP and may not be defined or calculated by other companies in the same manner.

Reconciliation of Non-GAAP Measures – Segment Operating Income and Segment Operating Margin 9 Three Months Ended June 30 ($ in millions) 2013 2012 Sales and Service Revenues Ingalls 672$ 756$ Newport News 1,031 979 Intersegment eliminations (20) (14) Total Sales and Service Revenues 1,683 1,721 Segment Operating Income Ingalls 35 38 As a percentage of revenues 5.2% 5.0% Newport News 101 89 As a percentage of revenues 9.8% 9.1% Total Segment Operating Income 136 127 As a percentage of revenues 8.1% 7.4% Non-segment factors affecting operating income FAS/CAS Adjustment (18) (19) Deferred state income taxes (2) (2) Total Operating Income 116 106 Interest expense (29) (29) Federal income taxes (30) (27) Total Net Earnings 57$ 50$

Reconciliation of Non-GAAP Measures – Pension Adjusted Figures 10 Three Months Ended June 30 ($ in millions, except per share amounts) 2013 2012 $ Change % Change Revenues 1,683$ 1,721$ (38)$ (2.2% ) Segment operating income1 136 127 9 7.1% Segment operating margin % 1 8.1% 7.4% 70 bps Total operating income 116 106 10 9.4% Operating margin % 6.9% 6.2% 73 bps Net earnings 57 50 7 14.0% Diluted earnings per share 1.12$ 1.00$ 0.12$ 12.0% Weighted-average diluted shares outstanding 50.7 50.1 Pension-adjusted Operating Highlights Total operating income 116 106 FAS/CAS Adjustment 18 19 Pension-adjusted operating income2 134 125 9 7.2% Pension-adjusted operating margin % 2 8.0% 7.3% 70 bps Pension-adjusted Net Earnings Net earnings 57 50 After-tax FAS/CAS Adjustment3 12 12 Pension-adjusted net earnings2 69 62 Weighted-average diluted shares outstanding 50.7 50.1 Pension-adjusted diluted earnings per share2 1.36$ 1.24$ 0.12$ 9.7% 1 Non-GAAP metrics that ex clude non-segment factors affecting operating income. See page 8 for definition and page 9 for reconciliation. 2 Non-GAAP metrics - see page 8 for definition. 3 Tax effected at 35% federal statutory tax rate.