Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - dELiAs, Inc. | d580702d8k.htm |

| EX-99.2 - EX-99.2 - dELiAs, Inc. | d580702dex992.htm |

Exhibit 99.1

dELiA*s’

Safe Harbor and Other Information The slide presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Readers of this presentation should be aware of the speculative nature of “forward-looking statements.” Statements that are not historical in nature, including those that include the words “anticipate”, “estimate”, “plan”, “project”, “continuing”, “ongoing”, “target”, “aim” “expect”, “believe”, “intend”, “may”, “will”, “should”, “could”, or the negative of those words and other comparable words, are based on current expectations, estimates and projections about, among other things, the industry and the markets in which dELiA*s operates, and they are not guarantees of future performance. Whether actual results will conform to expectations and predictions is subject to known and unknown risks and uncertainties, including risks and uncertainties discussed in the reports that dELiA*s has filed with the Securities and Exchange Commission; general economic, market, or business conditions, including real estate market conditions; changes in dELiA*s’ competitive position or competitive actions by other companies; dELiA*s’ ability to maintain strong relationships with its customers; disruptions in dELiA*s’ supply chain; dELiA*s’ ability to retain key personnel; dELiA*s’ ability to achieve and/or manage growth and to meet target metrics associated with such growth; dELiA*s’ ability to successfully implement new products and strategies; dELiA*s’ ability to comply with government regulations; changes in laws or regulations or policies of federal and state regulators and agencies; and other circumstances beyond dELiA*s’ control. Consequently, all of the forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results anticipated will be realized or, if substantially realized, will have the expected consequences on dELiA*s’ business or operations. These and other risks are discussed in detail in the periodic reports that dELiA*s files with the Securities and Exchange Commission. Except as required by applicable laws, dELiA*s does not intend to publish updates or revisions of any forward-looking statements it makes to reflect new information, future events or otherwise. Readers should understand that it is not possible to predict or identify all risks and uncertainties to which dELiA*s may be subject. Consequently, readers should not consider such disclosures to be a complete discussion of all potential risks or uncertainties. Other Information On June 4, 2013, the Company divested Alloy Merchandise, LLC, a wholly-owned subsidiary, to HRSH Acquisitions LLC. As a result, financial results provided herein have been adjusted to reflect the operating results of the Company’s Alloy business as discontinued operations. Certain reclassifications have been made to prior year amounts to conform to current year presentation. The financial statements include the accounts of dELiA*s, Inc. and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation. 2

Company Overview • Iconic, authentic, “Girls Only” lifestyle brand • Established omni-channel platform • Enormous untapped opportunity within the teen market – girls ages 12 to 18 • Exceptionally loyal, digitally connected and highly engaged consumer following • Poised for meaningful growth 3

Our Brand DNA PRODUCT MARKETING OMNI-CHANNEL GIVE HER WHAT SHE LOVES! REACH HER WHERE SHE LIVES! GIVE HER ACCESS EVERYWHERE! BELOVED BRAND COLABORATIONS CATALOG WEB FOUND COOL VERTICAL PROPRIETERY RETAIL EMAIL SOCIAL MOBILE 4

Stabilizing the Business

New management talent with meaningful merchandise, marketing and turnaround expertise

Divested non core operating division

Bolstered liquidity profile with new revolving credit facility, proceeds from the divestiture and recent capital raise

Transitioning through underperforming legacy inventory

Optimizing SEO, affiliate and circulation spend to drive omni- channel sales

Our Near-term Areas of Strategic Focus • We intend to leverage the expertise of new talent to: • Amplify brand image and consistency across channels • Launch creative refresh for BTS • Sharpen focus on merchandise mix – vertical, found in market, branded and proprietary market driven product • Maximize return on invested capital • Marketing • Systems • Inventory turn 6

Why She Will Love Us More • We will lead with jeans and graphic tees – the most important pieces of her wardrobe • Diverse and balanced mix of apparel, jewelry, footwear and accessories • Use the catalog and the web to be “her” stylist • Vertical, found in market, branded and proprietary market driven products • Always new, always on trend—what she wants when she wants it! 7

Financial Overview 8

Statement of Operations

2012

Total Revenue increased 5.1% to $181.2 million

Retail revenues increased 1.9% full year comparable store sales increased 5.2%, offset by 8% reduction in store count

Direct revenues increased 13.2%

Total gross margin was 31.3% compared to 28.2% in 2011

Increase driven by occupancy leverage and improved product margins

SG&A decreased as a percent of revenues to 42.8% from 44.4% in 2011

Net loss from continuing ops of $22.9 million vs. $25.5 million in 2011

Statement of Operations

Q1 2013

Total Revenue decreased 14.6% to $35.2 million from $41.2 million in 2012

Retail revenues decreased 14.4% including a comparable store sales decrease of 7.1%, and an 8% reduction in store count

Direct revenues decreased 15.3%

Total gross margin was 23.8% compared to 31.6% in 2012

Decrease primarily resulted from increased inventory reserves

SG&A expenses decreased slightly in dollars, but increased as a percent of revenues to 49.7% from 42.9%

Net loss from continuing ops of $9.2 million vs. $4.3 million in 2012

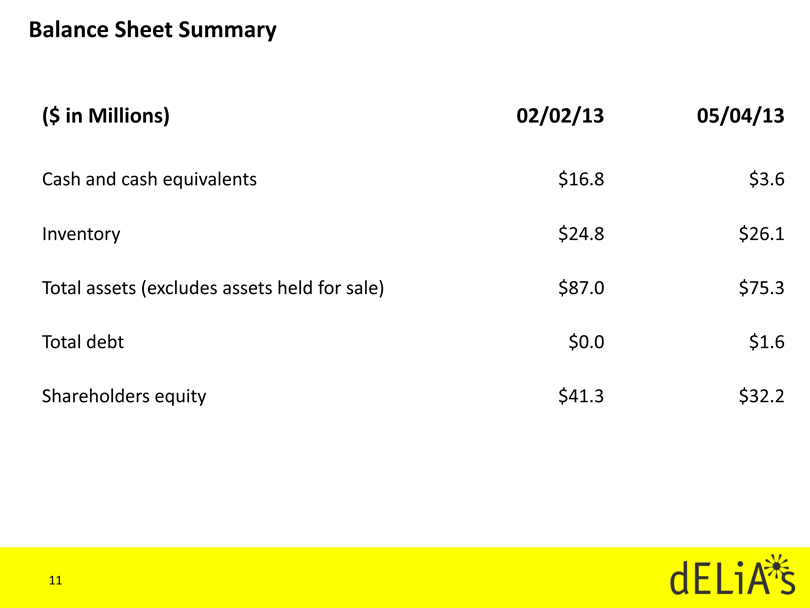

Balance Sheet Summary ($ in Millions) 02/02/13 05/04/13 Cash and cash equivalents $16.8 $3.6 Inventory $24.8 $26.1 Total assets (excludes assets held for sale) $87.0 $75.3 Total debt $0.0 $1.6 Shareholders equity $41.3 $32.2 11

Compelling Opportunity • New management talent with meaningful merchandise, marketing and turnaround expertise • Exceptionally loyal, digitally connected and highly engaged consumer following • Established, omni-channel platform • Positioned to capitalize on large addressable market with exceptional untapped opportunity 12