Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDEAVOUR INTERNATIONAL CORP | d580729d8k.htm |

| EX-99.1 - EX-99.1 - ENDEAVOUR INTERNATIONAL CORP | d580729dex991.htm |

Second Quarter 2013

Earnings Review

August 6, 2013

Exhibit 99.2 |

2

This presentation contains certain forward-looking statements regarding

various oil and gas discoveries, oil and gas exploration, development and

production activities, anticipated and potential production and flow rates;

anticipated revenues; the economic potential of properties and estimated exploration costs.

Accuracy of the projections depends on assumptions about events that change over

time and is thus susceptible to periodic change based on actual experience

and new developments. Endeavour cautions readers that it assumes no

obligation to update or publicly release any revisions to the projections in this

presentation and, except to the extent required by applicable law, does not intend

to update or otherwise revise the projections. Important factors that might

cause future results to differ from these projections include: variations

in the market prices of oil and natural gas; drilling results; access to

equipment and oilfield services; unanticipated fluctuations in flow rates

of producing wells related to mechanical, reservoir or facilities

performance; oil and natural gas reserves expectations; the ability to satisfy future cash

obligations

and

environmental

costs;

and

general

exploration

and

development

risks

and

hazards.

The Securities and Exchange Commission permits oil and gas companies in their

filings with the SEC to disclose only proved reserves that a company has

demonstrated by actual production or conclusive

formation tests to be economically and legally producible under existing economic

and operating conditions. SEC guidelines prohibit the use in filings of

terms such as “probable,” “possible,”

P2 or P3 and

“non-proved”

reserves, reserves “potential”

or “upside”

or other descriptions of volumes of reserves

potentially recoverable through additional drilling or recovery techniques.

These estimates are by their nature more speculative than estimates of

proved reserves and accordingly are subject to greater risk of being

actually realized by the company. Certain statements should be regarded as “forward-looking”

statements within the meaning of the securities laws. These statements speak only

as of the date made. Such statements are subject to assumptions, risk and

uncertainty. Actual results or events may vary materially. The

estimates of recoverable resources per well and completed well costs included herein are

based upon other typical results in these shale plays and may not be indicative of

actual results. |

3

2013 Second Quarter –

Financial/Operational Results

Sales Volumes and Physical Production

•

Q2 sales volumes averaged 14,497 barrels of oil equivalent per day

(“boepd”) •

Volumes for the quarter were impacted by two liftings at the Alba field during the

period •

Physical production for Q2 averaged 9,498 boepd compared to 9,385 boepd during

Q1 •

The well flowed at 9,600 barrels of oil per day (“bopd”) gross and the

performance from all three wells was 17,600 bopd gross

•

The well was completed ahead of schedule and under cost estimates

•

The total MPP outstanding is $125 million

The West Rochelle well (W-1) has been completed and is expected on-line in

September 2013 following routine maintenance work on the Scott Platform

The E-2 well at East Rochelle commenced drilling on July 25

th

and is expected on-

line in Q4 2013

At Bacchus, the third production well (B-1) was completed and is

on-line The Forward Sale commitment was fulfilled during the quarter

In May, the Company completed the sale of an additional $17.5 million expansion to

the Monetary Production Payment (MPP) |

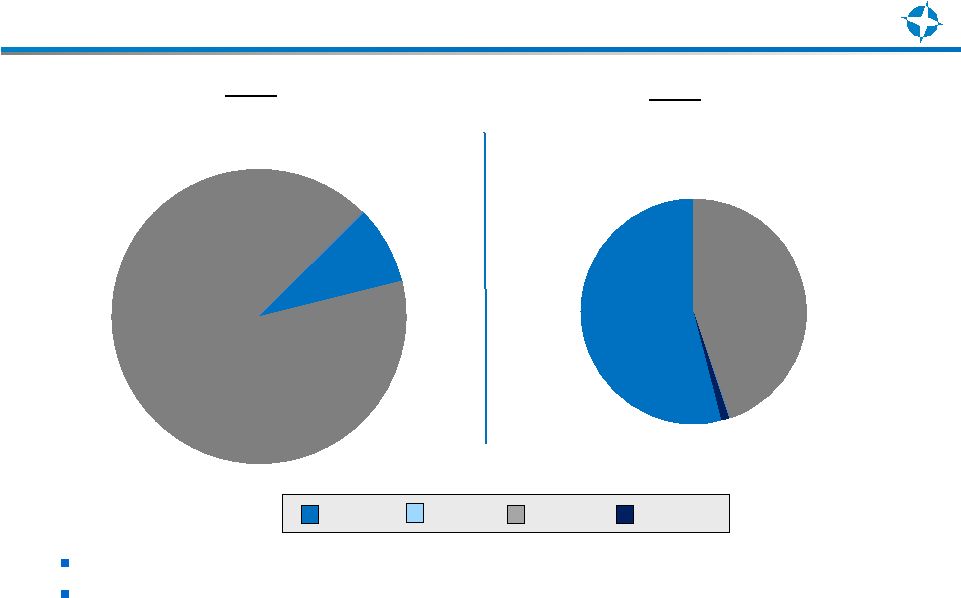

45%

54%

91%

9%

4

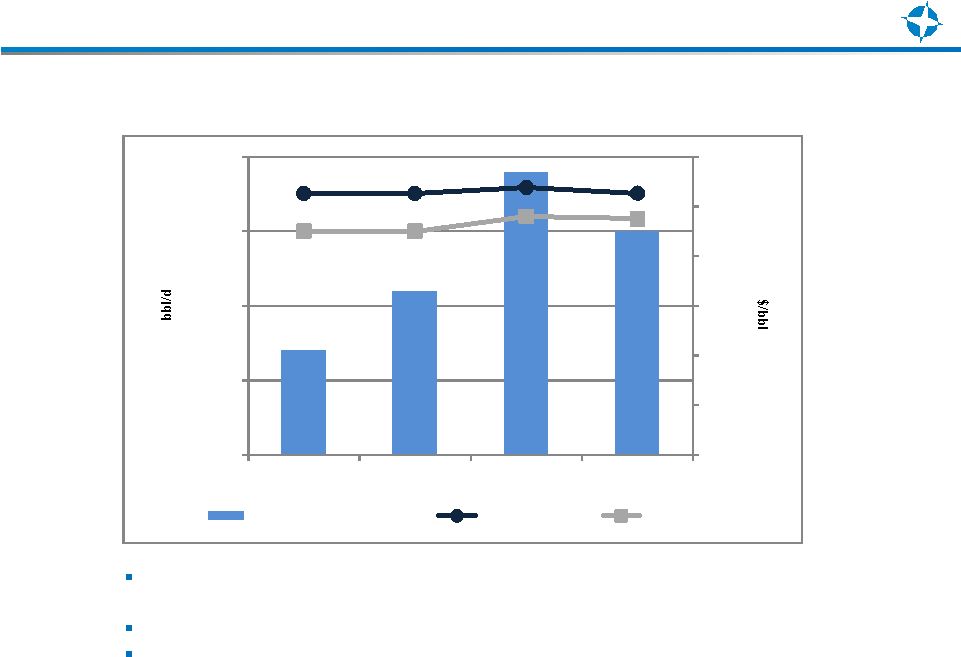

Production Volumes (BOE per day)

2013

Q2 Sales = 14,497

Physical

production

volume

for

the

second

quarter

averaged

9,498

boepd

vs.

9,385

boepd

for

Q1

Second quarter realized prices

•

Oil and condensate price = $102.67 per barrel

•

Gas price = $3.50 per Mcf

2012

Q2 Sales = 4,677

US Gas

US Oil UK Oil

UK Gas |

5

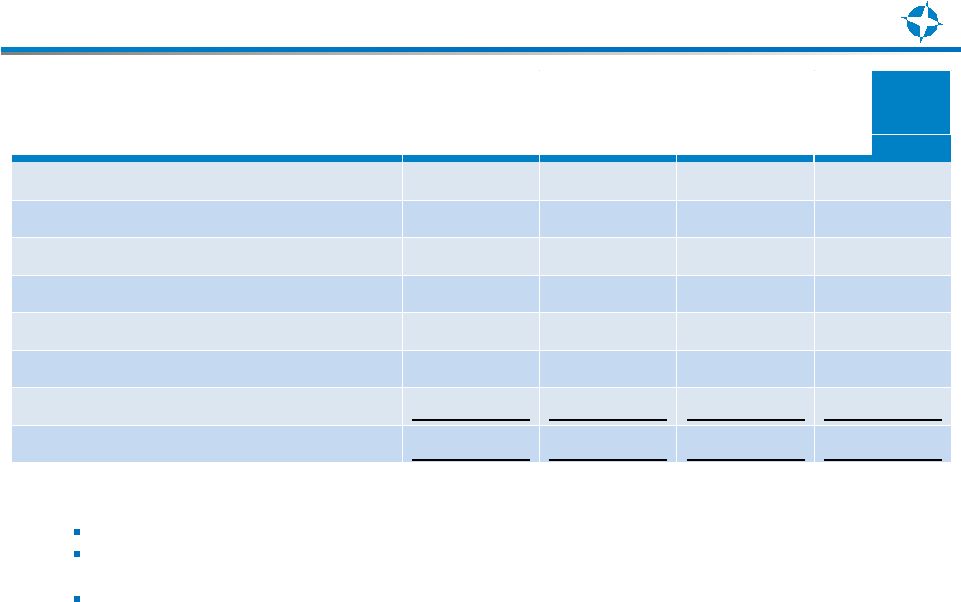

Summary Financial Results

Revenues increased year-over-year due to the increased working interest at

Alba and two wells on production at the Bacchus development

Quarter-over-quarter revenues (Q1 $57.7 million)

were up due to two liftings during the quarter compared to one lifting in

the first quarter Measure

($ in millions, except per share data)

2013

2012

2013

2012

Oil and Gas Revenues

126.2

$

23.0

$

183.8

$

38.2

$

Operating Expenses

38.1

$

5.7

$

55.6

$

10.6

$

Adjusted cash flow from Operations

88.1

$

17.3

$

128.2

$

27.6

$

Second Quarter Ending

June 30,

Six Months Ending

June 30, |

6

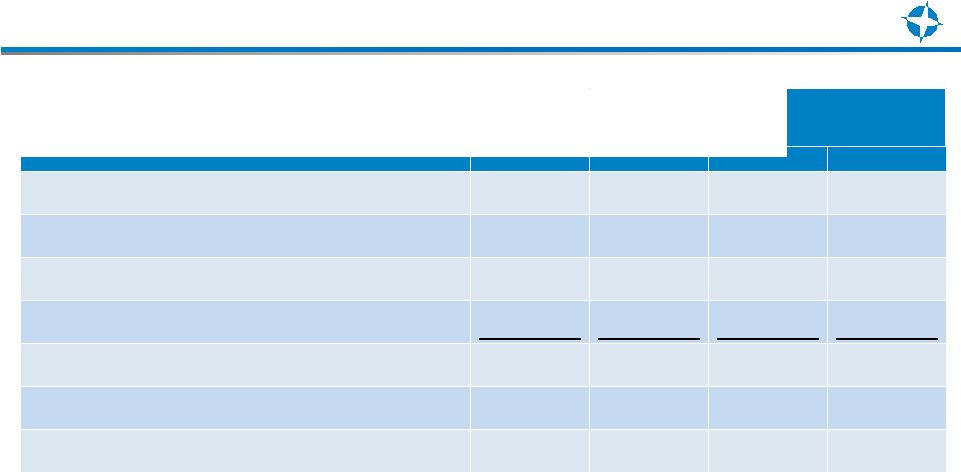

Key Business Metrics

OpEx expense during the quarter continues to be impacted by on-going

maintenance work at the Alba field to resolve processing issues. In the

U.S., well work over costs continued into the second quarter

The increase in DD&A is due to increased volumes from the U.K. and increased

accretion expense on asset retirement obligations

Interest expense is down year-over-year due to the repayment of the senior

term loan and notes payable

during

Q2

2012.

Quarter-over-quarter,

cash

and

non-cash

(Q1

2013

-

$24.31

cash/$8.83

non-

cash)

interest expense declined due to an increase in the barrels produced in Q2

Measure ($ expense per BOE)

2013

2012

2013

2012

Operating Expenses (OpEx)

Consolidated

$28.88

$13.49

$28.28

$13.21

U.K.

$30.03

$21.15

$29.20

$25.08

U.S.

$16.50

$6.97

$21.94

$6.34

Depreciation, depletion and amortization (DD&A)

Consolidated

$39.36

$24.97

$38.08

$23.01

U.K.

$42.17

$41.67

$42.35

$42.84

U.S.

$9.01

$10.76

$8.62

$11.54

General and Administrative Expense (G&A)

$3.70

$11.82

$5.27

$12.85

Interest Expenses

Cash

$13.65

$46.96

$17.16

$40.35

Non-cash

$4.88

$12.38

$6.18

$15.47

Second Quarter Ending

June 30,

Six Months Ending

June 30, |

7

Adjusted EBITDA

Measure ($ in millions, except per share data)

2013

2012

2013

2012

Net Income (loss)

(13.9)

$

(50.8)

$

(27.9)

$

(86.1)

$

Unrealized (gain) loss on derivatives

1.3

(3.8)

(0.3)

1.0

Net Interest Expense

24.5

46.7

45.8

66.4

Letter of Credit Fees

7.1

3.1

18.5

3.1

Depreciation, depletion and amortization

51.9

10.6

74.9

18.5

Impairment of U.S. oil and gas properties

-

20.0

3.5

35.7

Income tax expense (benefit)

11.3

(14.3)

12.2

(24.9)

Adjusted EBITDA

82.2

$

11.5

$

126.7

$

13.7

$

Second Quarter Ending

June 30,

Six Months Ending

June 30,

Income tax expense is primarily PRT related to the Alba field

Adjusted EBITDA increased seven-fold over 2012, driven by the increase

in production at Alba and Bacchus

EBITDA increased significantly year-over-year, however the increases were

offset by higher interest expense, Letter of Credit fees, DD&A and

taxes |

8

Adjusted Net Income (Loss)

Measure

($ in millions, except per share data)

2013

2012

2013

2012

Net Income (loss)

(13.9)

$

(50.8)

$

(27.9)

$

(86.1)

$

Impairment of U.S. oil and gas properties

-

20.0

3.5

35.7

Unrealized (gain) loss on derivatives (net of tax)

1.3

(4.4)

(0.3)

(0.2)

Loss on early extinguishment of debt (next of tax)

-

17.8

-

17.8

Net Income (loss) as Adjusted

(12.6)

$

(17.4)

$

(24.7)

$

(32.8)

$

Weighted-average basic

shares

outstanding (in millions)

47.1

39.0

47.1

38.4

Adjusted earning (loss) per basic share

(0.27)

$

(0.45)

$

(0.52)

$

(0.85)

$

Second Quarter Ending

June 30,

Six Months Ending

June 30, |

9

Capex Update

Capex spend for the quarter was impacted by drilling and development activities at

all the major U.K. projects -

Bacchus, Rochelle and Alba

In Q2 2012, Total Capital Expenditures included the purchase costs for the

additional working interest in the Alba field

Measure

($ in millions)

2013

2012

2013

2012

Direct Oil & Gas Capex

U.K.

64.4

$

40.8

$

97.5

$

84.5

$

U.S.

1.3

2.2

1.3

13.9

Total Direct Oil & Gas Capex

65.7

43.0

98.8

98.4

Acquisitions

0.7

190.1

1.5

191.6

66.4

233.1

100.3

290.0

Capitalized Interest

7.6

6.3

13.8

11.9

Capitalized G&A

1.8

5.3

6.8

9.8

Asset Retirement Obligations (AROs)

(7.7)

-

(3.5)

-

Total Capital Expenditures

68.1

$

244.7

$

117.4

$

311.7

$

Second Quarter Ending

June 30,

Six Months Ending

June 30, |

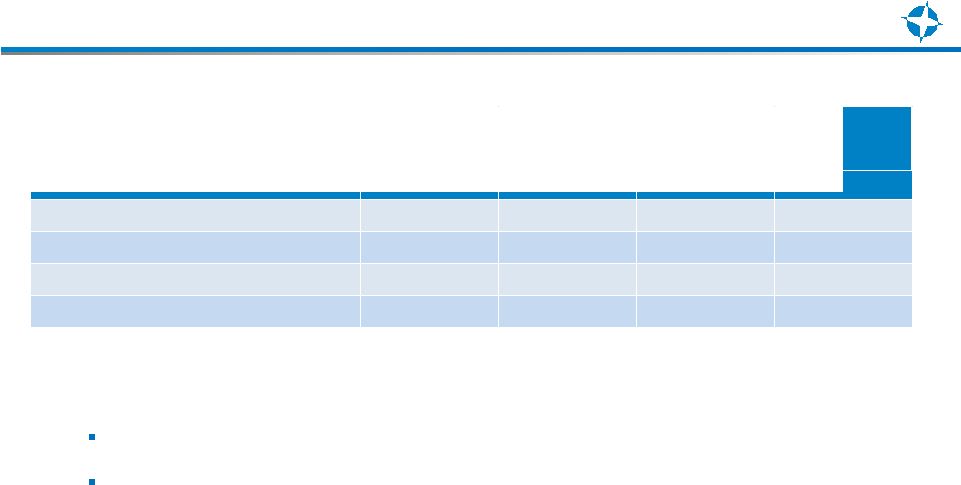

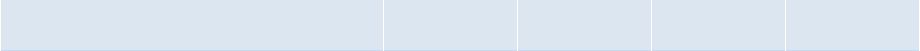

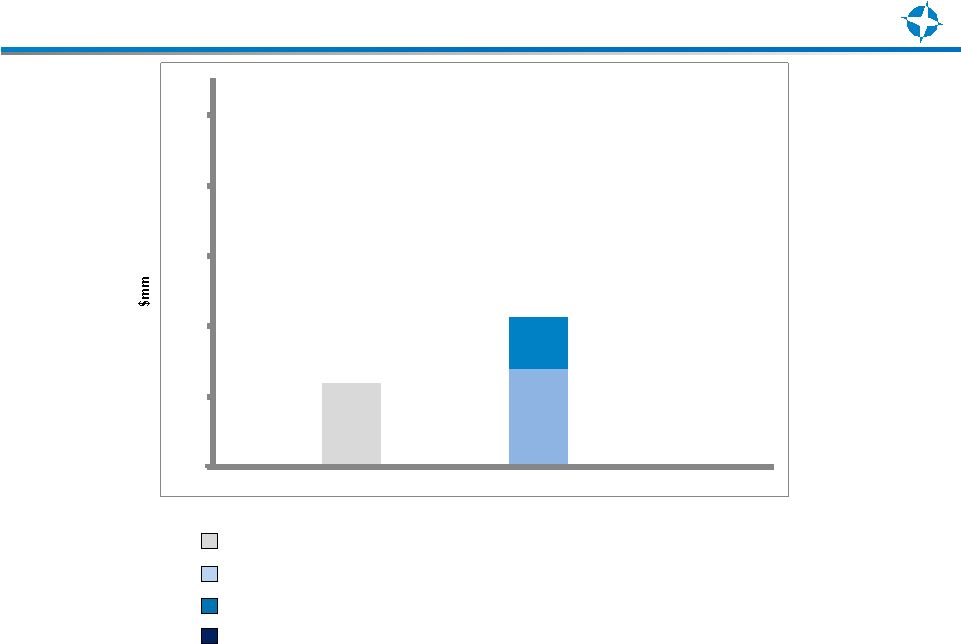

2013

Direct Capital Expenditures 10

Direct capital expenditures in the U.K. increased ~$30 million to reflect cost

overruns at Rochelle, due to extended drilling on the West Well (W-1)

and drilling of the new E-2 well at East Rochelle

Rochelle

Bacchus

Alba

U.S.

U.K. Other

Centurion

South

U.K. = $170 million -

$180 million

U.S. = $ 10 million -

$ 30 million |

U.K.

Hedged Oil Position 11

The current hedging program involves embedding collars within existing

production marketing contracts

Pricing for the Forward Sale falls within the average ceiling and floor

Production for the Forward Sale is included in the barrels-per-day

$0

$20

$40

$60

$80

$100

$120

-

1,000

2,000

3,000

4,000

1Q2013

2Q2013

3Q2013

4Q2013

Hedged Production

Ave Ceiling

Ave Floor |

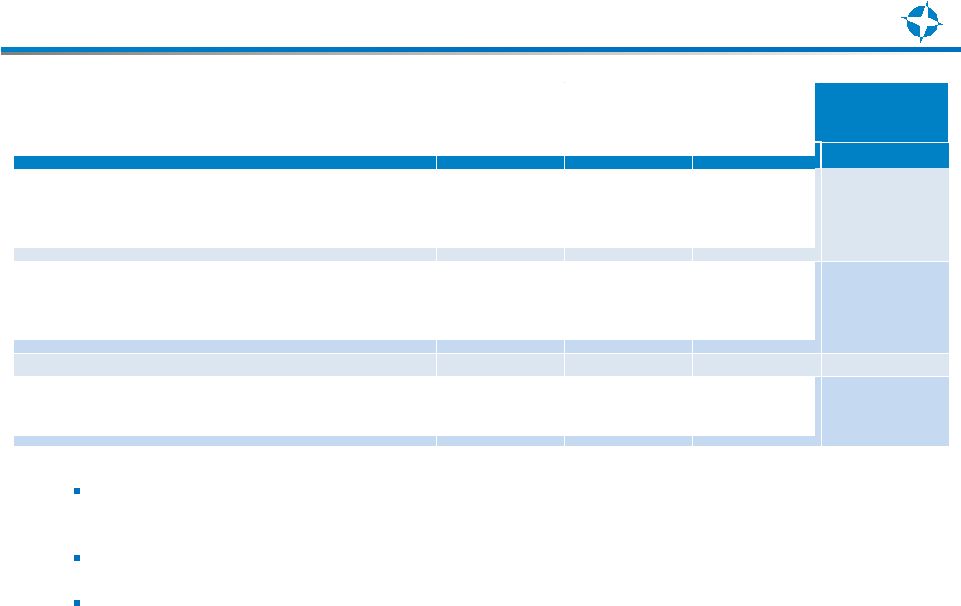

12

Debt Maturity Schedule

Convertible Notes due 2016 ($18.51 per share conversion price)

Convertible Bonds due 2016 ($16.52 per share conversion price)

Senior Notes due 2018

Revolving Credit Facility due 2014

$115

$135

$554

$74

$0

$100

$200

$300

$400

$500

2013

2014

2015

2016

2017

2018 |

LSE:ENDV

NYSE:END

www.endeavourcorp.com

Darcey Matthews

Director of Investor Relations

(713) 307-8711

darcey.matthews@endeavourcorp.com

INVESTOR CONTACTS: |