Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PORTLAND GENERAL ELECTRIC CO /OR/ | form8-kfor20130630prandsli.htm |

| EX-99.1 - PRESS RELEASE - PORTLAND GENERAL ELECTRIC CO /OR/ | exhibit99120130630pressrel.htm |

Earnings Conference Call Second Quarter 2013 1 Exhibit 99.2

Cautionary Statement 2 Information Current as of August 2, 2013 Except as expressly noted, the information in this presentation is current as of August 2, 2013 — the date on which PGE filed its Quarterly Report on Form 10-Q for the quarter ended June 30, 2013 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update the presentation, except as may be required by law. Forward-Looking Statements Statements in this presentation that relate to future plans, objectives, expectations, performance, events and the like may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding earnings guidance, statements regarding future load, hydro conditions and operating and maintenance costs; statements concerning implementation of the Company’s Integrated Resource Plan and related future capital expenditures, statements concerning future compliance with regulations limiting emissions from generation facilities and the costs to achieve such compliance; statements regarding the outcome of any legal or regulatory proceeding; as well as other statements containing words such as “anticipates,” “believes,” “intends,” “estimates,” “promises,” “expects,” “should,” “conditioned upon,” and similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including the reductions in demand for electricity and the sale of excess energy during periods of low wholesale market prices; operational risks relating to the Company’s generation facilities, including hydro conditions, wind conditions, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy markets conditions, which could affect the availability and cost of purchased power and fuel; changes in capital market conditions, which could affect the availability and cost of capital and result in delay or cancellation of capital projects; failure to complete projects on schedule and within budget, or the abandonment of capital projects, which could result in the Company’s inability to recover project costs; the outcome of various legal and regulatory proceedings; and general economic and financial market conditions. As a result, actual results may differ materially from those projected in the forward-looking statements. All forward-looking statements included in this presentation are based on information available to the Company on the date hereof and such statements speak only as of the date hereof. The Company assumes no obligation to update any such forward-looking statement. Prospective investors should also review the risks and uncertainties listed in the Company’s most recent Annual Report on Form 10-K and the Company’s reports on Forms 8-K and 10-Q filed with the United States Securities and Exchange Commission, including Management’s Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time.

Leadership Presenting Today 3 Jim Lobdell Senior Vice President, Finance, CFO & Treasurer Jim Piro President & CEO

On Today’s Call 4 Strategic Initiatives General Rate Case Operational Update Economy and Customers Financial Update 2013 Outlook

Q2 2013 Earnings Results Q1 $0.65 Q1 $0.65 Q2 $0.34 Q2 ($0.29) Q3 $0.50 Q4 $0.38 2012 EPS 2013E EPS 5 NI in millions Q2 2012 Q2 2013 2012 Actuals 2013 Guidance Net Income (Loss) $26 $(22) $141 $96 - $108 EPS (Loss) $0.34 $(0.29) $1.87 $1.25 - $1.40 $1.87 $1.25-$1.40

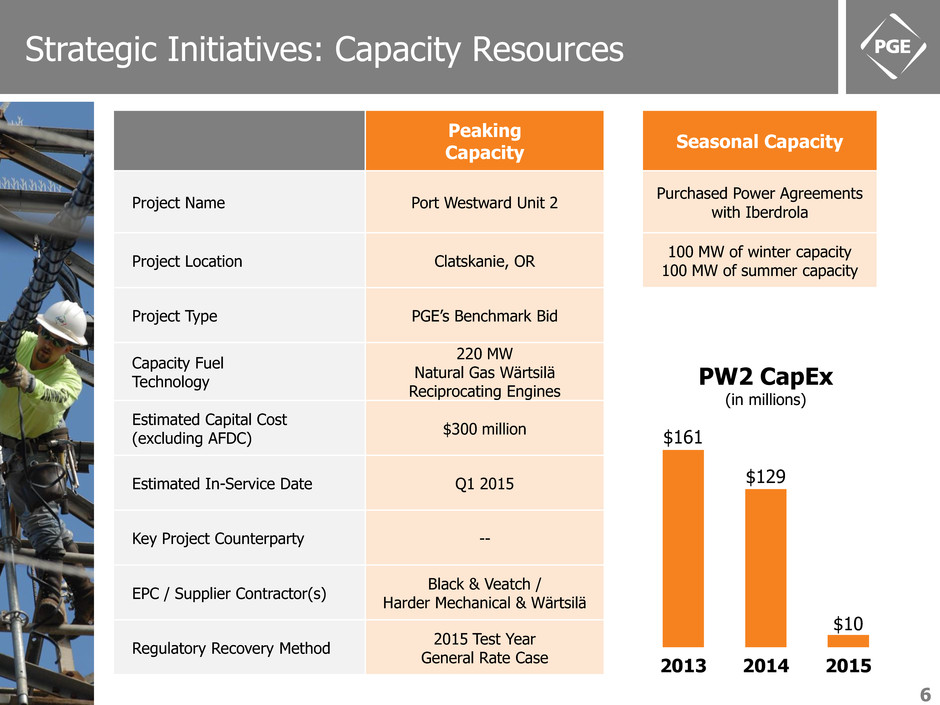

Strategic Initiatives: Capacity Resources 6 Peaking Capacity Seasonal Capacity Project Name Port Westward Unit 2 Purchased Power Agreements with Iberdrola Project Location Clatskanie, OR 100 MW of winter capacity 100 MW of summer capacity Project Type PGE’s Benchmark Bid Capacity Fuel Technology 220 MW Natural Gas Wärtsilä Reciprocating Engines Estimated Capital Cost (excluding AFDC) $300 million Estimated In-Service Date Q1 2015 Key Project Counterparty -- EPC / Supplier Contractor(s) Black & Veatch / Harder Mechanical & Wärtsilä Regulatory Recovery Method 2015 Test Year General Rate Case $161 $129 $10 2013 2014 2015 PW2 CapEx (in millions)

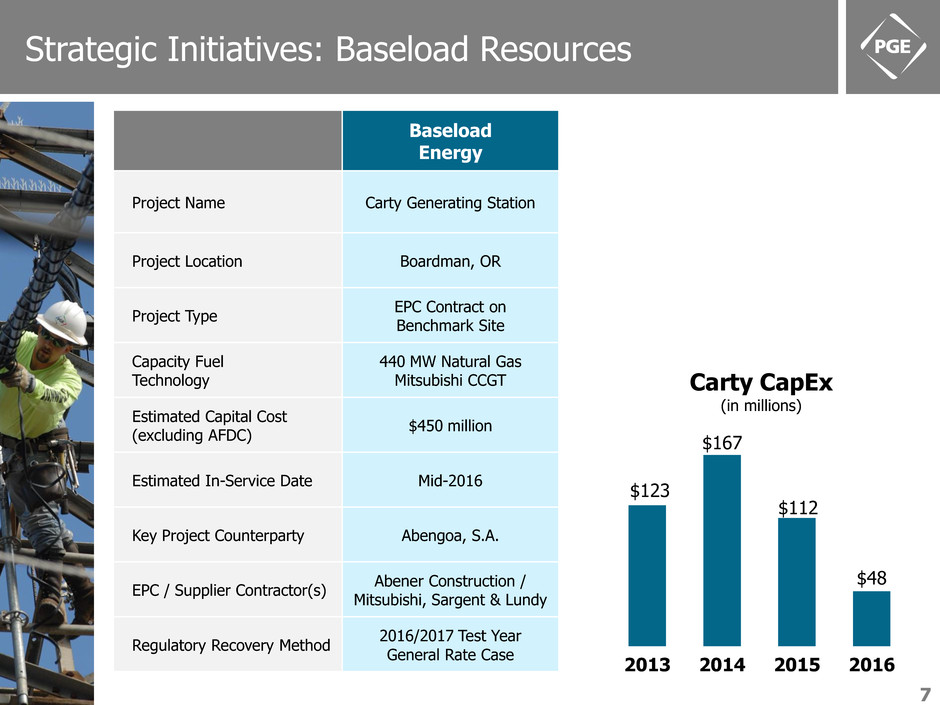

Strategic Initiatives: Baseload Resources 7 Baseload Energy Project Name Carty Generating Station Project Location Boardman, OR Project Type EPC Contract on Benchmark Site Capacity Fuel Technology 440 MW Natural Gas Mitsubishi CCGT Estimated Capital Cost (excluding AFDC) $450 million Estimated In-Service Date Mid-2016 Key Project Counterparty Abengoa, S.A. EPC / Supplier Contractor(s) Abener Construction / Mitsubishi, Sargent & Lundy Regulatory Recovery Method 2016/2017 Test Year General Rate Case $123 $167 $112 $48 2013 2014 2015 2016 Carty CapEx (in millions)

Strategic Initiatives: Renewable Resources 8 Renewable Energy Project Name Tucannon River Wind Farm Project Location Columbia County, WA Project Type EPC Contract on Third Party Site Capacity Fuel Technology 267 MW Wind Project Siemens Turbines Estimated Capital Cost (excluding AFDC) $500 million Estimated In-Service Date First half of 2015 Key Project Counterparty Puget Sound Energy EPC / Supplier Contractor(s) Renewable Energy Service (RES) / Siemens Regulatory Recovery Method Renewable Adjustment Clause Filing/GRC $105 $387 $8 2013 2014 2015 Tucannon River CapEx (in millions)

Expected Rate Base and Capital Expenditures 9 $1.4B of Expected Increase in Rate Base (in millions) 2013 2014 2015 2016 2017 TOTAL Base Capital Spending(1) $338 $354 $284 $262 $242 $1,480 Port Westward Unit 2 $161 $129 $10 $300 Carty Generating Station $123 $167 $112 $48 $450 Tucannon River Wind Farm $105 $387 $8 $500 TOTAL $727 $1,037 $414 $310 $242 $2,730 (1) Includes ongoing capex and hydro relicensing as disclosed in the Q2 10-Q filed on August 2, 2013 Note: Amounts exclude AFDC debt and equity $3.1B $4.5B 2012 20172012 2017 8% CAGR Expected Capital Expenditures

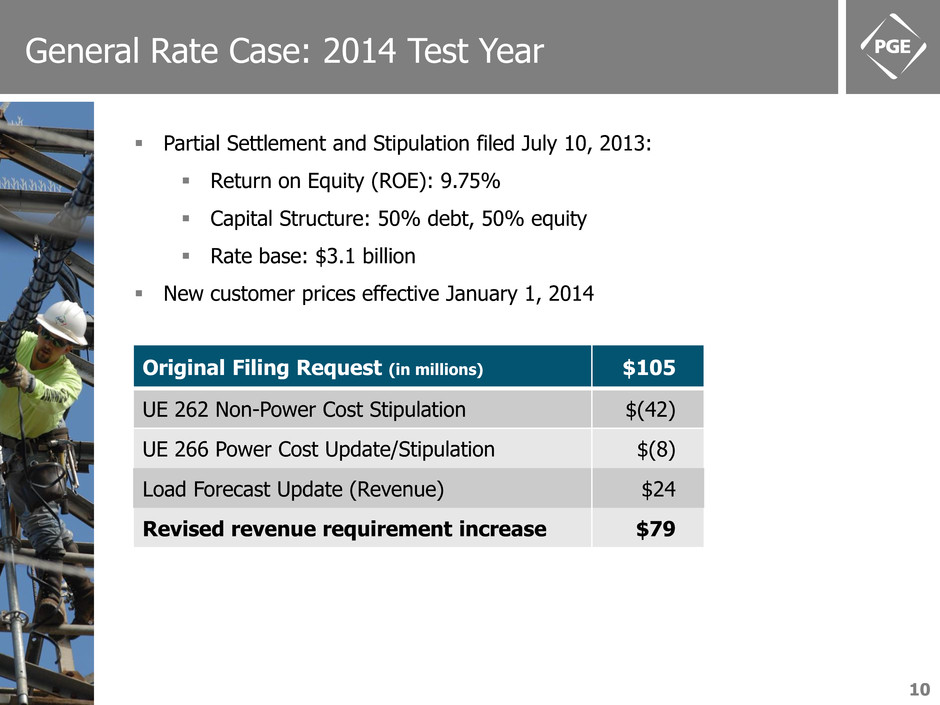

General Rate Case: 2014 Test Year Partial Settlement and Stipulation filed July 10, 2013: Return on Equity (ROE): 9.75% Capital Structure: 50% debt, 50% equity Rate base: $3.1 billion New customer prices effective January 1, 2014 10 Original Filing Request (in millions) $105 UE 262 Non-Power Cost Stipulation $(42) UE 266 Power Cost Update/Stipulation $(8) Load Forecast Update (Revenue) $24 Revised revenue requirement increase $79

Operational Update –Plant Outages 11 in millions Boardman Colstrip Unit 4 Replacement Power Costs (PGE share) $3-$4 $7-$8 Potential Repair Costs (Full Cost) $10 $30-$40 Insurance Deductible (Full Cost) $2.5 $2.5 While the split between O&M and capital has not been determined, we estimate that a majority of the repair costs will be capital.

Economic Outlook & Customer Satisfaction 12 Growth in Operating Area Unemployment rate of 6.8% in core operating area Improved housing market, increasing new connects Weather-adjusted load growth quarter over quarter

Second Quarter Financial Results Quarter over Quarter Drivers of Results 13 NI in millions Q2 2012 Q2 2013 Net Income (Loss) $26 $(22) EPS (Loss) $0.34 $(0.29) in millions, pre-tax Q2 over Q2 Cascade Crossing expense $(52) Customer billing matter $(9) Generation/delivery system expense $(12)

Retail Revenues and Power Costs 14 in millions Q2 2012 Q2 2013 YTD 2012 YTD 2013 Total Revenues $413 $403 $892 $876 Power Costs $156 $156 $351 $348 PCAM Results 2012 2013 Q1 $5 million below baseline $1 million below baseline Q2 $5 million below baseline $13 million below baseline YTD $10 million below baseline $14 million below baseline

Operating Expenses 15 Interest Expense $27 $25 $55 $50 in millions Q2 2012 Q2 2013 YTD 2012 YTD 2013 Production & Distribution $51 $64 $104 $115 Administrative & General $56 $55 $110 $109 Total O&M $107 $119 $214 $224 Cascade Crossing Expense -- $52 -- $52 Depreciation & Amortization $63 $62 $125 $124 Income Taxes $9 $(11) $24 $6

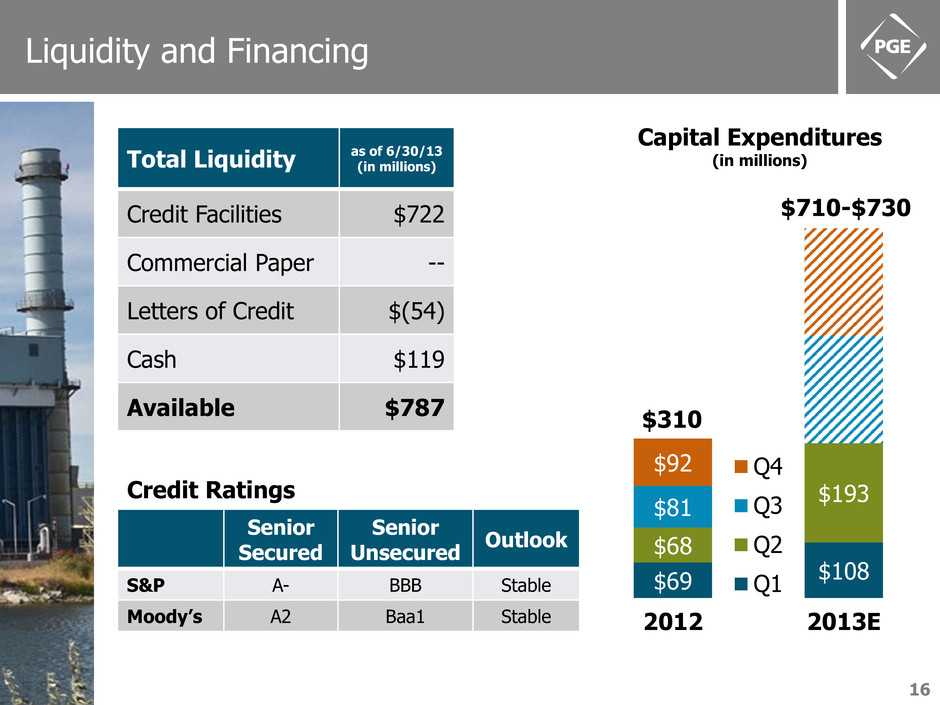

Liquidity and Financing Senior Secured Senior Unsecured Outlook S&P A- BBB Stable Moody’s A2 Baa1 Stable Credit Ratings Total Liquidity as of 6/30/13 (in millions) Credit Facilities $722 Commercial Paper -- Letters of Credit $(54) Cash $119 Available $787 16 $69 $108 $68 $193 $81 $92 2012 2013E Q4 Q3 Q2 Q1 Capital Expenditures (in millions) $710-$730 $310

2013 Earnings Guidance Progression 17 2/24/13 Original 2013 Earnings Guidance $1.85 - $2.00 5/1/13 Q1 2013 Earnings Call no change 6/3/13 Cascade Crossing project suspension Customer billing refund $(0.42) $(0.07) Guidance Revised Downward $1.35 - $1.50 8/2/13 Replacement power costs: $10 - $12 million $(0.10) Guidance Revised Downward(1) $1.25 - $1.40 (1) Excluding the negative impacts of the Cascade Crossing expense and customer billing matter, non-GAAP operating earnings would be roughly between $1.75 and $1.90. 2013 EPS Guidance: $1.25 - $1.40 per share

18 2013 Earnings Guidance Assumptions 2013 EPS Guidance: $1.25 - $1.40 per share Energy deliveries comparable to weather-adjusted 2012 O&M expense between $440 and $460 million D&A expense between $240 and $250 million Assumptions for FY 2013 Capital expenditures between $710 and $730 million Estimated replacement power costs of $10-12 million for plant outages Normal hydro conditions, expected wind conditions