Attached files

| file | filename |

|---|---|

| EX-2.1 - Guar Global Ltd. | ex2-1.htm |

| EX-10.3 - Guar Global Ltd. | ex10-3.htm |

| EX-10.4 - Guar Global Ltd. | ex10-4.htm |

| EX-10.1 - Guar Global Ltd. | ex10-1.htm |

| EX-10.6 - Guar Global Ltd. | ex10-6.htm |

| EX-99.1 - Guar Global Ltd. | ex99-1.htm |

| EX-99.2 - Guar Global Ltd. | ex99-2.htm |

| EX-10.5 - Guar Global Ltd. | ex10-5.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

July 31, 2013

Date of Report (Date of earliest event reported)

Guar Global Ltd.

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

000-52929

|

98-0540833

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

407 E. Louisiana Street, McKinney, Texas 75069-4233 USA

(Address of Principal Executive Offices)

(214) 380-9677

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Cautionary Notice Regarding Forward-Looking Statements

This Current Report on Form 8-K (“Form 8-K”) and other reports filed by the Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Registrant’s management as well as estimates and assumptions made by the Registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to the Registrant or the Registrant’s management identify forward-looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward-looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Registrant’s financial statements and pro forma financial statements and the related notes filed with this Form 8-K.

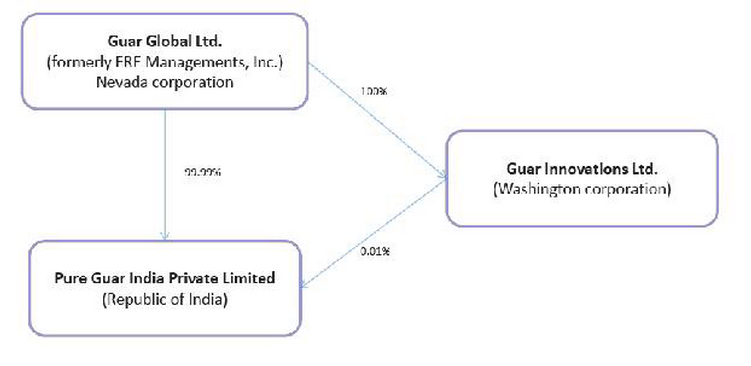

Unless otherwise indicated, in this Form 8-K, references to “we,” “our,” “us,” “GGBL,” the “Company” or the “Registrant” refer to Guar Global Ltd., a Nevada corporation and its wholly owned subsidiaries, Guar Innovations, Ltd., a Washington corporation and Pure Guar India Private Limited, a company organized under the laws of the Republic of India.

Section 1 – Registrant’s Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

Reference is made to the information set forth below in Item 2.01 which is incorporated herein by reference.

Section 2 - Financial Information

Item 2.01. Completion of Acquisition or Disposition of Assets.

On July 31, 2013 (the “Closing Date”), Guar Global Ltd., a Nevada corporation (the “Registrant,” “Company” or “GGBL”), acquired Ninety Nine 99/100 percent (99.99%) of the capital stock of Pure Guar India Private Limited, a company organized under the laws of the Republic of India (“Pure Guar”) pursuant to a Stock Purchase Agreement dated July 31, 2013 (the “Stock Purchase Agreement”) by and among the Company, Pure Guar, and the shareholders of Pure Guar (the “Selling Shareholder”). The Company paid $1,692.43 to the Selling Shareholder.

As a result of the closing of the transactions contemplated by the Stock Purchase Agreement (the “Stock Purchase”), we hold Ninety Nine 99/100 percent (99.99%) of the ownership interest in Pure Guar. The remaining 0.01% ownership in Pure Guar is held by Guar Innovations Ltd., a Washington corporation, which is a wholly owned subsidiary of the Company.

Pure Guar was established in 2012 to produce guar gum in northwest India for export internationally to the oil and gas sector. Pure Guar aims to use new technology and specialized research to increase yields of guar seed and produce hydroxypropyl guar gum, a gelling agent used in hydraulic fracturing for natural gas extraction.

2

Prior to the Stock Purchase, we were a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (“Exchange Act”). Accordingly, pursuant to the requirements of Item 2.01(f) of Form 8-K, set forth below is the information that would be required if the Registrant were filing a general form for registration of securities on Form 10 under the Exchange Act, for the Registrant’s common stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Stock Purchase.

The following description of the terms and conditions of the Stock Purchase Agreement and the transactions contemplated thereunder that are material to the Registrant does not purport to be complete and is qualified in its entirety by reference to the full text of the Stock Purchase Agreement, a copy of which is filed as Exhibit 2.1 hereto and incorporated by reference into this Item 2.01.

From and after the Closing Date, our primary operations consist of the business and operations of Pure Guar. In the Stock Purchase, or reverse acquisition, the Registrant is the accounting acquiree and Pure Guar is the accounting acquirer. Accordingly, we are presenting the financial statements of Pure Guar as set forth in Exhibit 99.1 and certain pro forma financial information as set forth in Exhibit 99.2 of this report. Further, we disclose information about the business, financial condition, and management of Pure Guar in this Form 8-K.

DESCRIPTION OF BUSINESS

Except as otherwise indicated by context, references to “we,” “us” or “our” hereinafter in this Form 8-K are to the business of Pure Guar, except that references to “our common stock,” “our shares of common stock” or “our capital stock” or similar terms shall refer to the common stock of the Registrant.

Overview

Pure Guar was incorporated under the laws of the Republic of India on February 19, 2013 Pure Guar is a research-driven development stage company aiming to implement new, modern strategies that will increase yields of guar crops and produce a high quality product for the oil and gas sector. To date, Pure Guar has not generated any revenue and Pure Guar’s business is subject to several significant risks, any of which could materially adversely affect its business, operating results, financial condition and the actual outcome of matters as to which it makes forward-looking statements (See “Risk Factors”).

Background

The Registrant was organized under the laws of the State of Nevada on May 29, 2007 under the name ERE Management, Inc. to develop a software product that enables real estate agents with no technical knowledge to build a website to showcase their listings. The Registrant has not generated any revenue from its business operations to date, and to date, the Registrant has been unable to raise additional funds to implement its operations. As a result, the Registrant consummated the Stock Purchase with Pure Guar.

3

As a result of the Stock Purchase, the organizational structure of the Registrant is as follows:

Summary

Pure Guar was established on February 19, 2013 under the laws of the Republic of India to produce guar gum in northwest India for export internationally to the oil and gas sector. Pure Guar will use new technology and targeted research to increase yields of guar seed and produce hydroxypropyl guar gum, a gelling agent used in hydraulic fracturing for natural gas extraction.

Pure Guar intends to lease approximately 50 hectares of farmland in in Rajasthan, a state in northwest India (see Figure 1 below) which it believes has ideal guar growing conditions and proximity to processors and ports. Our office and storage facilities will be near our farm location. We have established contacts in the Ministry of Agriculture in India as well as in the oil and gas industry in the United State of America (“U.S.”), Russia, Africa, China and Canada. To date, however, we have not entered into any material contracts for the production and sale of guar seed or hydroxypropyl guar gum, and we have not generated any revenue since inception.

4

Figure 1

Historically, local farmers in several Indian states have grown and processed guar for food and various industrial uses, including textiles, paper, food and more recently, oil and gas extraction. In the last two years, guar gum demand has tripled worldwide mainly because of its use in hydraulic fracturing activity, especially in the U.S. Hydraulic fracturing is a process used in natural gas wells where millions of gallons of water, sand and chemicals are pumped underground to break apart the rock and release the gas.

With no viable alternative to guar gum on the horizon and demand remaining high, we believe that India will continue to be at the forefront of guar production. Farming practices in India remain low tech and often lead to productivity issues. In addition, we believe there is a lack of supportive policy that makes it cumbersome for customers to deal with the complex supply chain of farmers, traders, processors and shippers. Thus, we believe the present guar industry has significant potential and that by combining the knowledge and experience of local farmers with new agricultural technologies and a comprehensive business model, there are significant opportunities for Pure Guar to enter into the guar production industry.

Objectives & Strategy

The following is a summary of the initial objectives and strategy for Pure Guar:

Acquisition of Farmland – We have secured 50 hectares of farmland in Rajasthan by leasing it for no more than five years.

Research and Target Facility Locations – We intend to analyze recent industry and cultivation research and work with agri-business consultants and the Ministry of Agriculture in India to find land and set up a location for our business. We will use our President’s established connections with experts in the agriculture ministry to fund research and development projects in the guar industry. We have identified and entered into discussions with two consultants who we believe can provide valuable information and insight into India’s guar market, however, to date, we have not entered into any consulting agreements.

5

Hire Personnel – We will hire local managers with knowledge and experience in guar agriculture. We also plan to bring in a team of laborers to plant, tend and harvest the crop. We believe local managers will ensure that these workers are reliable and knowledgeable. Once harvested, the seeds will be transported to a local processor so the endosperm can be ground into guar gum, and the residual sold/used as fodder for the next crop. To date, we have hired one general manager in India, Ganesh Prajapat, who works with our current Chief Executive Officer, Michael C. Shores. Further, we plan on researching and acquiring guar processors and storage/transportation suppliers.

Acquire Machine and Transportation Services – After visiting and observing various processing plants, we will select what we believe to be the most reliable, cost-effective processor for the harvest. The cost of processing varies depending on the season. When demand is high for the harvest after the monsoon, the processors charge a premium. We believe that our plan to use the latest irrigation technology to harvest two crops a year means there will be considerable savings (half the price) to process the harvest during the off season; however, there is no guarantee that such an approach will be successful.

Begin Production in Six Months – By connecting with existing management contacts in India’s agriculture ministry, we believe we will be able to set up and start growing guar in the next six months, engage in government research projects and expand to other guar-growing locations, particularly the development of a guar industry in the U.S. While we anticipate production within six months, there is no guarantee that we will be able to meet such timeframe.

Products

Pure Guar will grow guar, also known as Clusterbean or Cyamopsistetragonoloba (L.) Taubert, which historically has been used for human consumption and cattle feed. The guar plant is extremely drought resistant and flourishes in semiarid regions where most plants perish. It grows best in sandy soils. When limited moisture is available the plant will stop growing, but it does not die. Figure 2 below is a high yield guar plant.

Figure 2

6

Guar seed is a legume that has three parts including the coat, the endosperm and the germ. The endosperm of the seed contains galactomannan gum. During processing, the seeds are dehusked, milled and screened into a free-flowing, pale powder that forms a viscous gel in cold water. Figure 3 below depicts guar gum powder. Figure 4 below depicts green guar pods and seeds.

Figure 3

Figure 4

The powder’s ability to suspend solids, bind water by hydrogen bonding, control the viscosity of aqueous solutions, and form strong tough films have accounted for its rapid growth and use in various industries. Guar gum has several industrial uses:

FOOD PRODUCTS

Ice Cream/Dairy Products

|

·

|

Provides smooth and creamier texture.

|

|

·

|

Prevents formation of ice crystals.

|

|

·

|

Prevents quick meltdown.

|

7

Bakery Products

|

·

|

Improves texture.

|

|

·

|

Increases shelf life.

|

|

·

|

Improves moisture retention.

|

Pet Food

|

·

|

As a viscosifier.

|

|

·

|

Soups & Gravies.

|

|

·

|

As a viscosifier.

|

Noodles

|

·

|

Better sheet formation.

|

|

·

|

Improves moisture retention.

|

|

·

|

Improves texture.

|

|

·

|

Improves machine runnability, thereby increasing production.

|

COSMETICS & PHARMACEUTICALS

|

·

|

Cosmetics - As conditioner cum viscosifier.

|

|

·

|

Pharmaceuticals - As water binding agent & rheology modifier.

|

EXPLOSIVES

|

·

|

Water binding agent for aqueous slurry explosives.

|

TEXTILE

|

·

|

As thickener for direct as well as discharge printing.

|

|

·

|

As flocculating agent for purification.

|

|

·

|

Wide range of tailor-made products based on printing styles, types of fabrics and dyes, as well as types of printing machines.

|

MINING

|

·

|

As flocculating agent for purification.

|

OIL WELL DRILLING

|

·

|

As fluid-loss controlling agent.

|

|

·

|

As additives in fracturing fluids.

|

PAPER

|

·

|

As wet-end additive.

|

|

·

|

As sizing agent.

|

|

·

|

As retention aid.

|

We have researched the various categories of guar seed and will purchase the RGC 936 variety. We believe the RGC 936 variety is the highest quality guar seed and this hybrid seed is most popular among experienced farmers due to its 70-90 day maturation time, which is shorter than other seeds.

Pure Guar will focus on producing hydroxypropyl guar gum for the oil and gas industry where it is valued for its unique gelling properties, making it ideal for resource extraction in drilling and hydraulic fracturing projects. At this time, we believe there is no real, inexpensive substitute for guar in hydraulic fracturing, an increasingly popular method for natural gas extraction, particularly in the U.S. We intend to use or sell the residual products of guar processing including green fodder, green manure and grains.

Present guar production depends on how many Indian farmers who own small to medium size farms (5 to 250 acres) decide to grow guar as their main crop. These farmers rely on the monsoon season and traditional farming practices, and they receive little help from the Indian government. These challenges often result in low productivity.

8

We intend to use research, technology and irrigation to produce high-yield guar harvests two times a year. We will work with processors and nearby ports to ensure our product is delivered in as timely and efficient a manner possible. If the market price of guar is in flux, it is our intent to store the product until the price has improved. We will closely monitor the market and sell at a strong market price or store our product if there is too much instability or uncertainty.

Mr. Ganesh Prajapat, our Indian general manager, has developed relationships within the Indian Ministry of Agriculture. Professionals within the ministry will advise Pure Guar on land selection and growing methods. When possible, we will fund relevant research and development projects to help further the guar growing industry in India. These relationships will facilitate our adherence to the various government acts, rules and regulations, allowing us to grow and export guar in accordance with applicable law.

We believe that our government connections are valuable and will also allow us to expand internationally by providing the opportunity to export guar seed to grow in other locations, furthering our plan to find suitable land and cultivate guar in the U.S. We intend to seek assistance from the agriculture ministry to help the company take soil samples and track weather conditions and to analyze guar growing potential in the U.S. with Arkansas, Florida, Oklahoma, South Dakota and Texas at the forefront of possible locations. To date, we have not conducted any soil samples and tested any locations in the U.S. for possible guar growing.

Industry

India produces 600,000 tons of guar on an annual basis, approximately 80% of the world’s total. The vast majority (97%) of this guar is cultivated and processed in three western states with, what we believe is, an ideal arid climate: Rajasthan, Haryana and Gujarat. Approximately 80% of the country’s total is concentrated in Rajasthan, where there are more than 120 guar gum processing plants.

Two major seaports comprise the export points for guar gum – JNPT near Mumbai and Mundra in Gujarat, which is home to three smaller ports from which guar is also shipped. Ports in India are under strain as container traffic has been increasing at an average annual rate of 15% for the last several years. Congestion, equipment breakdowns and delays are symptoms of a stressed port system but government and private companies are now working to improve the situation. The ports handling guar gum are undergoing upgrades and expansion that we believe will ease the problems.

In 2012, there were more than 8 million acres of guar crops in India, with an estimated harvest of 515,000 tons of guar gum for export. This number is lower than the 2011/2012 harvest due to a late arrival of the monsoon season, which has raised concerns about productivity. However, the guar growing areas did eventually receive enough rainfall and the government, researchers, processors and farmers are working together to keep the crop viable.

With farmers making significant profits from last year’s crop thanks to increased prices, we believe there is heightened interest among farmers in guar growing states this year. Even farmers in states where guar has never been cultivated for commercial use are looking into growing the crop this year.

While farmers in this area of India have been growing guar for decades, increased demand from the oil and gas sector has increased farmers’ interest in the crop. They have experience in growing, selling and transporting guar worldwide, they have available seed and they have the processing capacity. However, there are challenges and complexities in the industry including an uncertain market, lack of government regulations and incentives, low-tech farming practices, reliance on the monsoon season, and manipulation by traders that have led to fragmentation and underdevelopment.

Analysts and observers in India indicate that internationally, the guar industry is still running in a disorganized way and is ripe for investment. Farmers have had concerns about productivity from some seeds and most of the crop is grown in rain-fed condition so the risk is very high. The uncertain return and considerable risk have not attracted investors or researchers but these agricultural experts emphasize that proper research and development into seed varieties and growing conditions would be significant for investors and farmers.

9

Further, the lack of stringent government policy in the guar industry has made it vulnerable and unstable, particularly recently. We believe that stronger support and a transparent, cohesive framework of rules and regulations could lead to better price protection, better irrigation, higher quality seed and more research investment.

Market Trends

The guar market has been fluctuating since early 2011, when some traders and market sellers took advantage of the increasing demand for guar and the lack of government oversight to manipulate supply by hoarding the product. This exploitation led to an apparent shortage of guar seeds, resulting in a 229% price increase from the end of 2010 to the end of 2011. From December 2011 to May 2012, the price increased another 374%, hitting a record high of $1,761 per 100 kg.

The price increase drew the attention of the Indian government’s regulators, the Forward Markets Commission (“FMC”). All future trades in guar were halted and an investigation into the market hoarders was started. Since then, the price has dropped substantially to $464 per 100 kg on Sept.7, 2012. To prevent traders from manipulating the market again, the FMC is carefully monitoring the guar trade and has indicated that it is prepared to prevent future manipulation if necessary.

We believe that contract farming is a potential market trend that could lead to the eradication of traders from the supply chain. This trend would see more farmers and processors entering into agreements that include an established buying price for cultivated guar. In some cases, processors even provide farmers with free seeds. However, the lack of legal binding means this could be a risky endeavor for many farmers as processors could back out and not buy their harvest.

The recent market fluctuations led customers, particularly in the U.S. oil and gas sector, to stockpile supplies of guar gum in early 2012 to protect against uncertainty. Analysts expect the price to stay lower until the harvest season in November through December. After that, we believe that the new crop will come to market and demand is expected to escalate again as continued hydraulic fracturing activity leads to a decrease in the oil and gas industry’s inventory.

Customers

Pure Guar will target the United States, which is one of the largest importers of Indian grown guar, at 60% of the total guar market. We also plan to sell to China (presently at about 7% of the market) and Canada. The other large importers of guar from India include Germany at 6%, Russia at 4% and Italy at 3%.

The U.S. oil and gas sector’s rapidly increasing demand for guar gum, most recently at 45 per cent of production, has attracted many of India’s producers. Despite the expanding supply, many analysts believe that guar prices will remain high because there are no easy or cheap alternatives and it is an essential component of fracturing fluids.

Also, we believe that the oil and gas industry’s increase in demand for guar gum has attracted suppliers away from other sectors such as food and beverages, paper, and textiles that are now facing a constrained supply as well.

We will focus on selling to the natural gas sector and taking advantage of present supply uncertainties by using research and technology to produce two high-yield harvests of guar a year. Our CEO, Michael Shores has relationships in the North American oil and gas industry, as well as contacts in both the China and Russia oil and gas sector. To date, however, we have not entered into any contracts or agreements with any companies in the oil and gas sector.

Marketing and Sales Strategy

We believe that the guar market is growing and demand for the product is expected to continue. Our marketing strategy is to focus on the natural gas sector in the U.S., Canada and China, positioning Pure Guar as a modern, reliable and research-driven provider of quality guar gum for hydraulic fracturing. We will include the following actions in our strategy.

10

|

·

|

Generate media attention to create interest after the first harvest by using established contacts in the television and Internet media throughout Southeast Asia.

|

|

·

|

Contract a well-respected international public relations firm to issue press releases to maintain attention.

|

|

·

|

Develop an informative website that attracts and educates potential buyers, and allows them to contact us immediately. We believe the press releases will create traffic to the site.

|

|

·

|

Establish sales by using existing contacts in the natural gas industry in the U.S., Canada and China.

|

|

·

|

Contact online agricultural blogs, social media and magazines to generate attention on what we believe is our innovative approach to guar production.

|

|

·

|

Showcase Pure Guar as a company that is bringing technology and innovation to a traditionally low-tech, fragmented industry.

|

Farmland

We will work with our local manager and use satellite technology to locate and lease 50 hectares of land. We have already narrowed down the location to the Ganganagar and Hanumangarh areas in Rajasthan state, a major guar growing area in the world. Here, we believe the sandy soil allows the aeration necessary for guar plants’ root development. The areas are also home to a canal irrigation facility that is available year-round, which will result in less dependency on the weather. Local labor, processing facilities and a reliable road connection to the transportation network for shipping the product are readily available at this location. To date, however, we have not entered into any lease agreements for the farmland.

The information retrieved from satellite observation will assist us in planning and prioritizing cultivating activities, monitoring progress, and assessing impacts of various land use practices. We believe the use of satellite technology will greatly increase our efficiency, saving time and money as it will eliminate much of the guesswork in guar farming. For example, it will show where open fields were brought under tree cover to intercept rainfall, reduce soil erosion, and bind the topsoil. We will be able to identify field bunds, contoured trenches, and check where dams were built to prevent monsoon rainwater from carrying away fertile topsoil. At these locations, the water percolates into the ground to recharge tanks and wells. We are currently negotiating with the Indian Space Research Organization to provide Pure Guar with ongoing technical monitoring and evaluation services. To date, we have not entered into any agreements with the Indian Space Research Organization.

Research and Development

With the support of carefully selected guar agriculture experts from several universities, we will focus on constantly monitoring the soil, the irrigation and the crop from seed to harvest, using all the information retrieved to improve and to increase yield as much as possible. These two research and development consultants will work on techniques to increase quality and quantity of our guar gum product. We will also be open to research and development proposals from any innovators in the guar growing industry, and will fund ideas we believe are promising. To date, we have engaged in discussions with several universities, but we have not yet established any relationships or entered into any agreements with any universities or agricultural experts.

Areas of planned research could include the following:

|

·

|

Crop production in different climatic conditions

|

|

·

|

Crop production in different water availability

|

|

·

|

High yield varieties

|

|

·

|

High gum percentage variety

|

|

·

|

Short duration crops

|

|

·

|

Resistance to pest and disease

|

|

·

|

Improvement in the size and boldness of seed

|

|

·

|

Mechanization of the guar cultivation

|

|

·

|

Storage facility for guar

|

|

·

|

Efficient gum extraction technology

|

|

·

|

Increase in scope of application of guar seeds and gum

|

|

·

|

Marketing and processing infrastructure

|

11

We are currently negotiating with two American universities, University of Arkansas and Texas A&M, to develop a research project that will further the guar growing business. To date, we have not hired any agricultural experts, engaged any consultants or begun any research projects with any universities.

Competition

In general, the markets in which Pure Guar will compete include many companies focusing on certain geographic regions. The market for guar production and farming is highly fragmented. These service providers tend to focus either on a limited geographic region or a smaller subset of products and services. The remainder of the market is comprised of local competitors.

Pure Guar’s main competitors are Vikas WSP Limited, Abdullabhai Abdul Kader, Hindustan Gum, Dinesh Enterprises and Rama Industries. Many of these companies will compete directly with Pure Guar. In addition, many of these companies already have an established market in the guar industry, have significantly greater financial and other resources than Pure Guar and have been developing their farmland and production facilities longer than Pure Guar has been in operation. While Pure Guar is a development stage company with limited operating history, Pure Guar believes it will compete on the basis of its comprehensive business strategy, industry connections, and technological innovation.

Government Regulation

General

A significant portion of our initial business operations will occur in India. We will be generally subject to laws and regulations applicable to foreign investment in India. The legal system in India is based on common law and statute. Similarly, as we expand into other markets, we will be subject to the laws and regulations of such jurisdictions.

The conduct of our business, and the production, distribution, sale, advertising, labeling, safety, transportation and use of our products, may be subject to various laws and regulations administered by federal, state and local governmental agencies in the United States, as well as to foreign laws and regulations administered by government entities and agencies in markets where we operate and sell our products. It is our policy to abide by the laws and regulations that apply to our business.

In the United States, we are or may be required to comply with certain federal health and safety laws, laws governing equal employment opportunity, customs and foreign trade laws and regulations, and various other federal statutes and regulations. We may also be subject to various state and local statutes and regulations. We will rely on legal and operational compliance programs, as well as local counsel, to guide our businesses in complying with applicable laws and regulations of the jurisdictions in which we do business.

We do not anticipate at this time that the cost of compliance with U.S. and foreign laws will have a material financial impact on our operations, business or financial condition, but there are no guarantees that new regulatory and tariff legislation may not have a material negative effect on our business in the future.

Environmental Regulation

The main environmental laws governing our anticipated operations in India include: the Water (Prevention and Control of Pollution) Act 1974 (“Water Act”), which also sets out the powers, functions and hierarchy of the environmental agencies, including the Central Pollution Control Board (“CPCB”) and the state pollution control boards (“SPCBs”); the Air (Prevention and Control of Pollution) Act 1981 (“Air Act”); and the Environment (Protection) Act 1986 (“EP Act”), an umbrella law that enables the central government to take all measures it deems necessary to protect and improve the quality of the environment and to prevent, control and reduce environmental pollution. The main environmental enforcement agencies are the CPCB and the SPCBs. They were set up under the Water Act initially. However, the scope of their authority now includes the enforcement of the Air Act and various rules adopted under the EP Act, unless a specific authority has been set up under the rules. The record of enforcement by the SPCBs varies across states. Environmental agencies are more active and rigorous in states with a higher business/industrial presence, such as Maharashtra, Gujarat, Karnataka, Delhi and Chennai.

12

We currently comply in all material respects with applicable international, federal, state and local environmental laws, permits, orders and regulations that are applicable to our business. In addition, we attempt to anticipate future regulatory requirements and plan in advance as necessary to comply with them. We do not presently anticipate incurring any material costs to bring our operations into environmental compliance with existing or expected future regulatory requirements, although we can give no assurance that this will not change in the future.

Foreign Currency Exchange Rate

We expect that international revenues will account for a majority of our total revenues. Our international operations expose Pure Guar to foreign currency fluctuations. Revenues and related expenses generated from our international operations will generally be denominated in the functional currencies of the local countries. For example, revenues derived from the Republic of India will be denominated in rupees. The Reserve Bank of India (“RBI”) imposes exchange control restrictions on foreign currency transactions. The Indian currency is not fully convertible. Generally, current accounts are fully convertible while capital accounts are only partially convertible, and only certain types of capital account transactions are permitted. There is usually a requirement to obtain prior consent from RBI, or to subsequently notify RBI of a transaction. In addition, there are restrictions on the amount of Indian currency notes, coins and foreign exchange that can be brought into or taken out of the country.

Our statements of income of our international operations are translated into United States dollars at the average exchange rates in each applicable period. To the extent the United States dollar strengthens against foreign currencies, the translation of foreign currency denominated transactions will result in reduced revenues, operating expenses and net income for our business. Similarly, our revenues, operating expenses and net income will increase if the United States dollar weakens against foreign currencies.

We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries and our investments in equity interests into United States dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into United States dollars will lead to a translation gain or loss which is recorded as a component of accumulated other comprehensive income which is part of stockholders’ equity. In addition, we may have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss.

Intellectual Property

Currently, Pure Guar does not hold any intellectual property, such as trademarks or trade secrets. To date, we do not have any patents nor have we submitted any patent applications; however, it is our policy to seek patent protection for significant inventions that may be patented, though we may elect, in appropriate cases, not to seek patent protection even for significant inventions if other protection, such as maintaining the invention as a trade secret, is considered more advantageous. There can be no assurance that any patent will be issued on pending applications or that any patent issued will provide substantive protection for the technology or product covered by it.

In the future, we will rely upon our intellectual property to develop and maintain our competitive position. There can be no assurance that others will not develop or patent similar technology or reverse engineer our products or that the confidentiality agreements with employees, consultants, and other suppliers and vendors will be adequate to protect our interests.

Employees

Pure Guar currently has 3 employees, a general manager, farm manager and office coordinator.

Seasonality

Our business is subject to seasonality. Guar is planted twice a year, in the early spring and fall. There is no summer crop of guar. In the winter season, a wheat crop is grown that has a lower value than guar.

13

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Form 8-K before making an investment decision with regard to our securities. The statements contained in or incorporated into this Form 8-K that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and Industry

We are a development stage company with a limited operating history on which to evaluate our business or base an investment decision.

Our business prospects are difficult to predict because of our limited operating history, early stage of development and unproven business strategy. We are a development stage company that has not generated any revenue. Use of guar seed and hydroxypropyl guar gum are limited in the natural gas hydraulic fracturing industry. Both the continued use of the guar gum in fracturing and the hydraulic fracturing industry in general, and our ability to introduce and develop new technology to increase yields of guar seed, face numerous risks and uncertainties. In particular, we have not proven that we can increase yields of guar seed in a manner that enables us to be profitable and meet industry requirements, develop intellectual property to increase guar seed production, develop and maintain relationships with key growers and strategic partners to extract value from our intellectual property, raise sufficient capital in the public and/or private markets, or respond effectively to competitive pressures. If we are unable to accomplish these goals, our business is unlikely to succeed and you should consider our prospects in light of these risks, challenges and uncertainties.

We have not generated revenue and have incurred losses.

Our auditors have expressed uncertainty as to our ability to continue as a going concern as at the period ended May 31, 2013. Furthermore, since inception we have not generated any revenue. We have an accumulated deficit of $20,469 since inception. We anticipate that our existing cash and cash equivalents will not be sufficient to fund our longer term business needs and we will need to generate revenue or receive additional investment in the Company to continue operations. Such financing may not be available in sufficient amounts, or on terms acceptable to us and may dilute existing stockholders.

If we fail to raise additional capital, our ability to implement our business model and strategy could be compromised.

We have limited capital resources and operations. To date, our operations have been funded entirely from the proceeds from debt and equity financings. We expect to require substantial additional capital in the near future to develop our technology, research and farming practices. We may not be able to obtain additional financing on terms acceptable to us, or at all. Even if we obtain financing for our near term operations, we expect that we will require additional capital beyond the near term. If we are unable to raise capital when needed, our business, financial condition and results of operations would be materially adversely affected, and we could be forced to reduce or discontinue our operations.

We face intense competition which could prohibit us from developing a customer base and generating revenue.

The industry within which we compete, including the guar gum farming and production industry, are highly competitive with companies that have greater capital resources, facilities and established history of production and processing. Additionally, if demand for guar gum hydroxypropyl continues to grow as a result of increased natural gas hydraulic fracturing, we expect many new competitors to enter the market as there are no significant barriers to guar gum production. More established agricultural companies with much greater financial resources which do not currently compete with us may be able to easily adapt their existing

14

operations to the growth and production of guar seed and guar gum. Due to this competition, there is no assurance that we will not encounter difficulties in obtaining revenues and market share or in the positioning of our services or that competition in the industry will not lead to reduced prices for guar gum based products. Our competitors may also introduce new alternatives to guar gum seeds and hydroxypropyl guar gum or be successful in developing other alternative production methods which could also increase competition and decrease demand for guar seed based products.

Inability to protect our proprietary rights could damage our competitive position.

Our business will be dependent upon the intellectual property we develop or acquire. Any infringement or misappropriation of our intellectual property could damage its value and limit our ability to compete. We may rely on patents, copyrights, trademarks, trade secrets, confidentiality provisions and licensing arrangements to establish and protect our intellectual property. We may have to engage in litigation to protect the rights to our intellectual property, which could result in significant litigation costs and require a significant amount of our time. In addition, our ability to enforce and protect our intellectual property rights may be limited in certain countries outside the United States, which could make it easier for competitors to capture market position in such countries by utilizing technologies that are similar to those developed or licensed by us.

Competitors may also harm our sales by designing products that mirror the capabilities of our products or technology without infringing our intellectual property rights. If we do not obtain sufficient protection for our intellectual property, or if we are unable to effectively enforce our intellectual property rights, our competitiveness could be impaired, which would limit our growth and future revenue.

A successful claim of infringement against us could result in a substantial damage award and materially harm our financial condition. Even if a claim against us is unsuccessful, we would likely have to devote significant time and resources to defending against it.

We may also find it necessary to bring infringement or other actions against third parties to seek to protect our intellectual property rights. Litigation of this nature, even if successful, is often expensive and disruptive of a company’s management’s attention, and in any event may not lead to a successful result relative to the resources dedicated to any such litigation.

We may be unable to effectively develop an intellectual property portfolio or may fail to keep pace with advances in technology.

We have a limited operating history in the agriculture industry and there is no certainty that we will be able to effectively develop a viable portfolio of intellectual property. The success of our guar farming and processing depends upon our ability to create such intellectual property.

Even if we are able to obtain any regulatory approvals and clearances necessary for our technologies and methods, the success of such services will depend upon market acceptance. Levels of market acceptance for our products and services could be affected by several factors, including:

|

·

|

the availability of alternative services from our competitors;

|

|

·

|

the price, quality and reliability of the our products relative to that of our competitors; and

|

|

·

|

the timing of our market entry.

|

Additionally, our intellectual property must keep pace with advances by our competitors. Failure to do so could cause our position in the industry to erode rapidly.

Confidentiality agreements with employees and others may not adequately prevent disclosure of our trade secrets and other proprietary information.

Our success depends upon the skills, knowledge and experience of our technical personnel, our consultants and advisors as well as our licensors and contractors. Because we operate in a highly competitive field, we will rely significantly on trade secrets to protect our proprietary technology and processes. However, trade secrets are difficult to protect. We will enter into confidentiality and intellectual property assignment agreements with our corporate partners, employees, consultants, outside scientific collaborators, developers and other advisors. These agreements generally require that the receiving party keep confidential and not disclose to third parties confidential information developed by us during the course of the receiving party’s relationship with us. These agreements also generally provide that inventions conceived by the receiving party in the course of rendering services to us will be our exclusive property. However, these agreements

15

may be breached and may not effectively assign intellectual property rights to us. Our trade secrets also could be independently discovered by competitors, in which case we would not be able to prevent use of such trade secrets by our competitors. The enforcement of a claim alleging that a party illegally obtained and was using our trade secrets could be difficult, expensive and time consuming and the outcome would be unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets. The failure to obtain or maintain meaningful trade secret protection could adversely affect our competitive position.

If we are unable to deliver consistent, high quality guar gum at sufficient volumes, our relationship with our customers may suffer and our operating results will be adversely affected.

Customers will expect us to be able to consistently deliver guar at sufficient volumes, while meeting their established quality standards. If we are unable to consistently deliver such volumes either from our own farms, or those of our grower partners, if any, our relationship with these customers could be adversely affected which could have a negative impact on our operating results.

Failure to effectively manage growth of internal operations and business may strain our financial resources.

We intend to significantly expand the scope of our farming operations and our research and development activities in the near term. Our growth rate may place a significant strain on our financial resources for a number of reasons, including, but not limited to, the following:

|

·

|

The need for continued development of our financial and information management systems;

|

|

·

|

The need to manage strategic relationships and agreements with government agencies, oil and gas companies, growers and partners; and

|

|

·

|

Difficulties in hiring and retaining skilled management, technical and other personnel necessary to support and manage our business.

|

Additionally, our strategy envisions a period of rapid growth that may impose a significant burden on our administrative and operational resources. Our ability to effectively manage growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract, train, manage and retain qualified management and other personnel. Our failure to successfully manage growth could result in our sales not increasing commensurately with capital investments. Our inability to successfully manage growth could materially adversely affect our business.

Adverse weather conditions, natural disasters, crop disease, pests and other natural conditions can impose significant costs and losses on our business.

Weather-related events could significantly affect our results of operations. We do not currently maintain insurance to cover weather-related losses and if we do obtain such insurance it likely will not cover all weather-related events and, even when an event is covered, our retention or deductible may be significant. Cooler temperatures in the regions where we operate could negatively affect us, while not affecting our competitors in other regions.

Our crops could also be affected by drought, temperature extremes, windstorms and floods. For example, guar production in north western India is dependent on the performance of the monsoon. Below average monsoon rainfall in 2000, 2002, 2004, 2007 and 2009 led to significant reductions in guar production and sharp price rises. Currently, there are concerns over the delayed onset of monsoon rains in Rajasthan, which could reduce guar production from the current season. Furthermore, severe weather events linked to seasonal weather patterns, such as droughts or flooding are common and can inflict severe harm through key supply chain components.

16

In addition, such crops could be vulnerable to crop disease and to pests, which may vary in severity and effect, depending on the stage of agricultural production at the time of infection or infestation, the type of treatment applied and climatic conditions. Unfavorable growing conditions caused by these factors can reduce both crop size and crop quality. In extreme cases, entire harvests may be lost. These factors may result in lower production and, in the case of farms we own or manage, increased costs due to expenditures for additional agricultural techniques or agrichemicals, the repair of infrastructure, and the replanting of damaged or destroyed crops. We may also experience shipping interruptions, port damage and changes in shipping routes as a result of weather-related disruptions.

Competitors and industry participants may be affected differently by weather-related events based on the location of their production and supply. If adverse conditions are widespread in the industry, it may restrict supplies and lead to an increase in prices for guar seed, but in the event we enter into fixed-price supply contracts, this may prevent us from recovering these higher costs.

A change in government policy, a downturn in the global economy or a natural disaster could adversely affect our business, financial condition, results of operations and future prospects.

Our business depends on the growth and expansion of natural gas exploration in the U.S. as well as other parts of the world. However, a global recession that causes a slowdown of natural gas exploration could reduce the demand for guar-based products adversely affecting our business, financial condition and results of operations and future prospects.

If we are unable to continually innovate and increase efficiencies, our ability to attract new customers may be adversely affected.

In the area of innovation, we must be able to locate arable land, develop new processes, seed strains, and other technologies that appeal to guar farmers. This depends, in part, on the technological and creative skills of our personnel and on our ability to protect our intellectual property rights. We may not be successful in the development, introduction, marketing and sourcing of new technologies or innovations, that satisfy customer needs, achieve market acceptance or generate satisfactory financial returns.

Global economic conditions may adversely affect our industry, business and result of operations.

Disruptions in the global credit and financial market could result in diminished liquidity and credit availability, a decline in consumer confidence, a decline in economic growth, an increased unemployment rate, and uncertainty about economic stability. These economic uncertainties can affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. Such conditions can lead consumers to reduce power consumption, which can cause producers to cancel, decrease or delay orders with us. We are unable to predict the likelihood of the occurrence, duration or severity of such disruptions in the credit and financial markets and adverse global economic conditions and such economic conditions could materially and adversely affect our business and results of operations.

Our business depends substantially on the continuing efforts of our key executive officer and our business may be severely disrupted if we lose his services.

Our future success depends substantially on the continued services of our key executive officer, Mr. Shores. We do not maintain key man life insurance on any of our executive officers and directors. If one or more of our current of future executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. In addition, if any of our current or future executives joins a competitor or forms a competing company, we may lose some of our customers.

Our insurance coverage may be inadequate to cover all significant risk exposures.

We will be exposed to liabilities that are unique to the products and services we provide. While we intend to maintain insurance for certain risks, the amount of our insurance coverage may not be adequate to cover all claims or liabilities, and we may be forced to bear substantial costs resulting from risks and uncertainties of our business. It is also not possible to obtain insurance to protect against all operational risks and liabilities. The failure to obtain adequate insurance coverage on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations.

17

Litigation may adversely affect our business, financial condition and results of operations.

From time to time in the normal course of our business operations, we may become subject to litigation that may result in liability material to our financial statements as a whole or may negatively affect our operating results if changes to our business operation are required. The cost to defend such litigation may be significant and may require a diversion of our resources. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid or whether we are ultimately found liable. As a result, litigation may adversely affect our business, financial condition and results of operations.

We may be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with our Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities. As of July 31, 2012, the management of the Company assessed the effectiveness of the Company’s internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) and SEC guidance on conducting such assessments. Management concluded, as of July 31, 2012, that its internal controls and procedures were not effective to detect the inappropriate application of U.S. GAAP rules. Management realized there were deficiencies in the design or operation of our internal control that adversely affected our internal controls which management considers to be material weaknesses including those described below:

|

·

|

Lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures;

|

|

·

|

Inadequate segregation of duties consistent with control objectives; and

|

|

·

|

Ineffective controls over period end financial disclosure and reporting processes

|

Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. No assurance can be given that we will be able to fully comply with Section 404 or that we and our independent registered public accounting firm would be able to conclude that our internal control over financial reporting is effective at fiscal year end. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties. In addition, our independent registered public accounting firm may not agree with our management’s assessment or conclude that our internal control over financial reporting is operating effectively.

Risks Related to Doing Business in India and Internationally

Returns on investment in Indian companies may be decreased by withholding and other taxes.

Our operations and investment in India may incur tax risk unique to investment in India and in developing economies in general. Income that might otherwise not be subject to withholding of local income tax under normal international conventions may be subject to withholding of Indian income tax. Under treaties with India and under local Indian income tax law, income is generally sourced in India and subject to Indian tax if paid from India. This is true whether or not the services or the earning of the income would normally be considered as being from sources outside India in other contexts. Additionally, proof of payment of

18

withholding taxes may be required as part of the remittance procedure. Any withholding taxes paid by us on income from our operations in India may or may not be creditable on our income tax returns. We may also incur taxes in India on any profits that we may choose to distribute as dividends to our shareholders. We intend to avail ourselves of transfer pricing rules and minimize any Indian withholding tax or local taxes. However, there is no assurance that the Indian tax authorities will always recognize such rules in its applications.

Our industry depends on the stability of policies and the political situation in India and a change in policy could adversely affect our business.

The role of the Indian central and state governments in the Indian economy on producers, consumers and regulators has remained significant over the years. Since 1991, the Government of India has pursued policies of economic liberalization, including significantly relaxing restrictions on the private sector. We cannot assure you that these liberalization policies will continue under the present or under newly elected governments. Protests against privatization could slow down the pace of liberalization and deregulation. The rate of economic liberalization could change, and specific laws and policies affecting companies in the agricultural and production sectors in India, foreign investment, currency exchange rates and other matters affecting our business could change as well. A significant change in India’s economic liberalization and deregulation policies could disrupt business and economic conditions in India and thereby affect our business.

The lack of guar-specific regulation in India may negatively impact the production and pricing of guar products and could adversely affect our business.

Effective regulation across the guar supply chain is currently lacking in India and may dissuade international buyers from seeking guar product from India, due to lack of regulation and oversight, its impact on the ultimate cost of guar products and the timing of their arrival to the market. India’s near absence of guar-specific regulation at the production and processing end of the supply chain, increases the unpredictability in quantity, quality, and price of the product. Further, incoming legislation in India looks likely to open the commodities markets to foreign participation and halt the speculative trading that compounded price volatility through early 2012, but on-going restrictions, such as the prohibition of foreign direct investment in the agriculture sector, complicate and restrict supply chain options, and may adversely affect our business and operations.

Failure to comply with the U.S. Foreign Corrupt Practices Act could subject the Company to, among other things, penalties and legal expenses that could harm our reputation and have a material adverse effect on our business, financial condition and results of operations.

Any violation of the Foreign Corrupt Practices Act (the “FCPA”), or similar laws and regulations could result in significant expenses, divert management attention, and otherwise have a negative impact on us. The FCPA generally prohibits U.S. companies and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or retaining business, and the anti-bribery laws of other jurisdictions. Reputational risks for shale gas and food companies are compounded by pervasive corruption at all levels of government in India which is classified at ‘extreme risk’ in Maplecroft’s Corruption Risk Index. According to Maplecroft’s report, the guar suppliers will likely be exposed to routine demands for bribes for issuing export licenses, vehicle permits, tax receipts, and customs and excise clearances. Complicity with bribery payments pose direct risks to companies from legal repercussions under foreign legislation, such as the FCPA. In Rajasthan, India’s main guar-producing state, levels of corruption are far higher than national averages. Any accusations or allegations, even if proven false, could negatively affect our business reputation, and we may incur substantial fees defending any allegations and enacting internal compliance and training programs to conform to international standards.

Terrorist attacks and other acts of violence or war within India or involving India and other countries could adversely affect the financial markets and our business.

19

Terrorist attacks and other acts of violence could have the direct effect of destroying our plants and property causing a loss and interruption of business. According to the CIA 2011 World Factbook, religious and border disputes persist in India and remain pressing problems. For example, India has from time to time experienced civil unrest and hostilities with Pakistan and other neighboring countries. The longstanding dispute with Pakistan over the border Indian states of Jammu and Kashmir, a majority of whose populations are Muslim, remains unresolved. While India and Pakistan resumed formal peace talks, there are no guarantees that these will be successful. In addition, India continues to struggle with insurgent attacks from Maoist- Naxalite groups. If the Indian government is unable to control the violence and disruption associated with these insurgencies, then the result could be the destabilization of the economy, and, consequently, an adverse effect on our business. Since early 2003, there have also been military hostilities and civil unrest in Afghanistan, in Iraq, and more recently in Pakistan and other Asian countries. These events could adversely affect the Indian economy, and, as a result, negatively affect our business.

While we may obtain insurance to cover some of these risks and can file claims against the Indian contracting agencies, there can be no guarantee that we will be able to collect in a timely manner. Further, India has a fairly active insurgency and a fairly active communist following. Any serious uprising from these groups could delay our work and disrupt our business. Terrorist attacks, insurgencies, or other threats of violence could slow down our farming activity and the production of guar seed, thereby adversely affecting our business.

Exchange controls that exist in India may limit our ability to utilize our cash flow effectively following a business combination.

We are subject to India’s rules and regulations on currency conversion. In India, the Foreign Exchange Management Act, FEMA, regulates the conversion of the Indian rupee into foreign currencies. However, as according to the Reserve Bank of India, comprehensive amendments have been made to FEMA to support the government’s policy for economic liberalization. Companies are now permitted to operate in India without any special restrictions, effectively placing them on a par with wholly-owned Indian companies. In addition, foreign exchange controls have been substantially relaxed. Notwithstanding these changes, the Indian foreign exchange market is not yet fully developed and we cannot assure that the Indian authorities will not revert back to regulating companies and imposing new restrictions on the convertibility of the Indian rupee. Any future restrictions on currency exchange may limit our ability to use our cash flow to fund operations outside of India.

Changes in the exchange rate of the Indian rupee may negatively influence our revenues and expenses.

Our operations will primarily be located in India. We will receive payment in Indian rupees for work in India. We report our financial statements in U.S. dollars. To the extent that there is a decrease in the exchange rate of Indian rupees relative to U.S. dollars, such a decrease could have a material impact on our operating results or financial condition.

It will be extremely difficult to acquire jurisdiction and enforce liabilities against our officers, directors and assets outside the United States.

Substantially all of our assets are currently located outside of the United States and two of our directors reside outside of the United States as well. As a result, it may not be possible for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under Federal securities laws. Moreover, we have been advised that India in particular does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States as the United States has not been declared a reciprocating territory by the Republic of India. Judgments from “non-reciprocating territories,” such as the United States, can be enforced only by filing a law suit in an Indian Court for a judgment based on the foreign judgment. Indian courts are overburdened and therefore slow. Enforcing a foreign judgment in India could take years in some instances, depending upon the complexity of the issues involved in the dispute between the parties. Further, it is unclear if extradition treaties now in effect between the United States and India would permit effective enforcement of criminal penalties of the Federal securities laws.

20

Risks Related to an Investment in Our Securities

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience and is generally unfamiliar with the requirements of the United States securities laws and U.S. Generally Accepted Accounting Principles, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. The individuals who now constitute our senior management team have never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately responds to such increased legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is categorized as a “penny stock”. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $4.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We expect to experience volatility in our stock price, which could negatively affect stockholders’ investments.

Although our common stock is quoted on the OTCQB under the symbol “GGBL”, there is a limited public market for our common stock. No assurance can be given that an active market will develop or that a stockholder will ever be able to liquidate its shares of common stock without considerable delay, if at all. Many brokerage firms may not be willing to effect transactions in the securities. Even if a purchaser finds a broker willing to effect a transaction in these securities, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Furthermore, our

21

stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price and liquidity of our common stock.

In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. Due to the volatility of our common stock price, we may be the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and resources.