Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ENCORE WIRE CORP | Financial_Report.xls |

| 10-Q - FORM 10-Q - ENCORE WIRE CORP | d551740d10q.htm |

| EX-32.1 - EX-32.1 - ENCORE WIRE CORP | d551740dex321.htm |

| EX-31.1 - EX-31.1 - ENCORE WIRE CORP | d551740dex311.htm |

| EX-32.2 - EX-32.2 - ENCORE WIRE CORP | d551740dex322.htm |

| EX-31.2 - EX-31.2 - ENCORE WIRE CORP | d551740dex312.htm |

|

EXHIBIT 10.1 |

NORTH TEXAS COMMERCIAL ASSOCIATION OF REALTORS®

COMMERCIAL CONTRACT OF SALE

[Check all boxes applicable to this Contract – Boxes not checked do not apply to this Contract]

In consideration of the agreements contained in this Commercial Contract of Sale (the “Contract”), Seller shall sell and convey to Purchaser, and Purchaser shall buy and pay for, the Property (defined below) pursuant to the provisions, and subject to the conditions, of this Contract.

1. PARTIES. The parties to this Contract are:

Seller: VTCR, LP, MADMT, LP, PRAIRIE FLIGHT, LP

Address: 3850 TPC Drive, Suite 104, McKinney, Texas 75070

| Phone: 972-529-1371 | Fax: 927-529-5709 | |||

| Email: dcraig@craigintl.com |

Purchaser: ENCORE WIRE CORPORATION, and/or its Assigns

Address: 1329 Millwood Road, McKinney, Texas 75069, Attn: Daniel L. Jones;

| Copy: Norman Medlen |

|

Phone: 972-562-9473, Ext. 315 |

Fax: 972-562-3644 |

Email: Daniel.jones@encorewire.com; n.medlen@encorewire.com

2. PROPERTY. The address of the Property is:

Approximate northeast corner of Industrial Blvd. and Airport Road in McKinney, Collin County, Texas.

The Property is located in Collin County, Texas, the land portion of which is further described as:

A 200.993 acre tract, more or less, with Industrial Blvd. on the south and Airport Road on the west, and generally described in the attached Exhibit “A” and “A-1”.

The Property includes, all and singular, all improvements and fixtures situated thereon, and all rights and appurtenances pertaining thereto, including any right, title and interest of Seller in and to adjacent streets, alleys, or rights-of-way (such land, improvements, fixtures, rights and appurtenances being collectively herein referred to as the “Property”).

1

3. PURCHASE PRICE.

A. Amount and Payable. The purchase price for the Property is Twenty Five Million Seven Hundred and Seven Thousand Three Hundred Fifty Dollars and no/100 ($25,707,350.00) (the “Purchase Price”), payable at the Closing as follows (with the Earnest Money to be applied to the Purchase Price) [Check only one]:

x (1) All in cash (meaning Good Funds, as defined in Section 4F below). If this Contract is subject to approval for Purchaser to obtain financing from a third party, then Addendum B-1, THIRD PARTY FINANCING is attached.

(2) Part in cash (Good Funds), in the following amount or percentage [Check only one]:

(a) $

(b) percent ( %) of the Purchase Price.

If only part of the Purchase Price is to be paid in cash, then the balance of the Purchase Price will be paid according to the provisions in Addendum B -2, SELLER FINANCING. If part of the Purchase Price is to be paid by Purchaser assuming an existing promissory note secured by the Property, or taking the Property subject to an existing promissory note secured by the Property, then Addendum B -3, EXISTING LOAN, is attached.

B. Adjustment. The Purchase Price will be adjusted up or down based upon the land area of the Property as determined by the Survey. The land area will be multiplied by the following amount per acre or square foot, as applicable , and the product will become the Purchase Price at the Closing [Check only one]: $ N/A per acre; or N/A per square foot. The land area for purposes of determining the Purchase Price will be the gross land area of the Property unless this box is checked, in which case the land area for purposes of determining the Purchase Price will be the Net Land Area [as defined in Section 5A (Survey)] of the Property. Notwithstanding the foregoing, the Purchase Price will not be reduced under this Section 3B to less than $ N/A

4. EARNEST MONEY AND TITLE COMPANY ESCROW.

A. Title Company. The Title Company to serve as escrow agent for this Contract is (the “Title Company”): Reunion Title Company, 1700 Redbud Blvd., Suite 300, McKinney, Texas 75069, Attn: Loretta Boddy.

B. Effective Date. The “Effective Date” is the date the Title Company acknowledges receipt of this fully executed Contract as indicated by the signature block for the Title Company.

C. Earnest Money. Within two (2) Business Days after the Effective Date, Purchaser shall deliver an earnest money deposit in the amount of $10,000.00 (the “Earnest Money”) payable to the Title Company, in its capacity as escrow agent, to be held in escrow pursuant to the terms of this Contract. Seller’s acceptance of this Contract is expressly conditioned upon Purchaser’s timely deposit of the Earnest Money with the Title Company. If Purchaser fails to timely deposit the Earnest Money with the Title Company, then Seller may, at Seller’s option, terminate this Contract by delivering a written termination notice to Purchaser at any time until Purchaser deposits the Earnest Money with the Title Company.

The Title Company shall deposit the Earnest Money in one or more fully insured accounts in one or more federally insured banking or savings institutions. Purchaser hereby instructs the Title Company to promptly deposit the check upon receipt (which instruction may not be retracted without Seller’s written consent). After receipt of necessary tax forms from Purchaser, the Title Company will deposit the Earnest Money in an interest bearing account unless this box is checked, in which case the

2

Title Company will not be required to deposit the Earnest Money in an interest bearing account. Any interest earned on the Earnest Money will become a part of the Earnest Money. At the Closing, the Earnest Money will be applied to the Purchase Price or, at Purchaser’s option, will be returned to Purchaser upon full payment of the Purchase Price.

D. Independent Consideration. Notwithstanding anything in this Contract to the contrary, a portion of the Earnest Money in the amount of $100.00 will be non-refundable and will be distributed to Seller upon any termination of this Contract as independent consideration for Seller’s performance under this Contract. If this Contract is properly terminated by Purchaser pursuant to a right of termination granted to Purchaser by any provision of this Contract, the Earnest Money will be promptly returned to Purchaser. Any provision of this Contract that states that the Earnest Money is to be returned to Purchaser means that the Earnest Money, less the non-refundable portion, is to be returned to Purchaser.

E. Escrow. The Earnest Money is deposited with the Title Company with the understanding that the Title Company is not: (1) responsible for the performance or non-performance of any party to this Contract; or (2) liable for interest on the funds except to the extent interest has been earned after the funds have been deposited in an interest bearing account.

F. Definition of Good Funds. “Good Funds” means currently available funds, in United States dollars, paid in the form of a certified check, cashier’s check, official bank check or wire transfer acceptable to the Title Company, such that the payment may not be stopped by the paying party. Any reference in this Contract to “cash” means Good Funds.

5. SURVEY AND TITLE.

| A. | Survey. Within twenty (20) days after the Effective Date [Check only one]: |

Seller shall deliver to Purchaser a new survey (the “Survey”) of the Property prepared at Seller’s expense.

Seller shall deliver to Purchaser a new survey (the “Survey”) of the Property prepared at Purchaser’s expense.

| x | Seller shall deliver to Purchaser a new survey (the “Survey”) of the Property prepared at Purchaser’s expense, and Seller will give a credit to Purchaser against the Purchase Price at the Closing for the cost of the Survey in an amount not to exceed $ |

| x | Seller shall deliver to Purchaser a copy of the most recent existing survey (the “Survey”) of the Property in Seller’s possession. Seller shall also deliver an Affidavit to the Title Company, in form and substance reasonably satisfactory to the Title Company, stating that none of the improvements on the Property and other matters shown by the existing Survey have changed since the existing Survey was prepared. If Purchaser, Purchaser’s lender or the Title Company requires a new survey for any reason, then Purchaser shall pay for the cost of the new Survey, and [check only one]: Seller will not be required to pay for any portion of the cost of the new Survey; or x Seller will give a credit to Purchaser against the Purchase Price at the Closing for the cost of the new Survey in an amount not to exceed $5,000.00. |

Any new Survey must:

3

| (1) | be prepared by a Registered Professional Land Surveyor; |

| (2) | be in a form reasonably acceptable to Purchaser and the Title Company; |

| (3) | set forth a legal description of the Property by metes and bounds or by reference to a platted lot or lots; |

| (4) | show that the Survey was made on the ground with corners marked with monuments either found or placed; |

| (5) | show any discrepancies or conflicts in boundaries, and any visible encroachments; |

| (6) | contain the surveyor’s certificate that the Survey is true and correct; and |

| (7) | show the location and size of all of the following on or immediately adjacent to the Property, if any, if recorded or visible and apparent: |

| (a) | buildings, |

| (b) | building set back lines (as shown on any recorded plat, but not as may be described in any restrictive covenants or zoning ordinances), |

| (c) | streets and roads, |

| (d) | 100-year flood plain (approximate location), |

| (e) | improvements, |

| (f) | encroachments, |

| (g) | easements, |

| (h) | recording information of recorded easements, |

| (i) | pavements, |

| (j) | protrusions, |

| (k) | fences, |

| (l) | rights-of-way, and |

| (m) | any markers or other visible evidence of utilities. |

Any area of the Property within the 100-year flood plain will be shown on the Survey as the approximate location of the 100-year flood plain as defined by the Federal Emergency Management Agency or other applicable governmental authority. If the area within any 100-year flood plain is to be deducted for the purpose of determining Net Land Area (defined below), then the Sur vey must show the area of the Property covered by the 100-year flood plain, and that area, as reasonably determined by the surveyor, will be conclusive for purposes of this Contract, even though the surveyor may qualify that determination as approximate.

After the delivery of the Survey, the legal description of the Property set forth in the Survey will be incorporated in this Contract as the legal description of the Property, and will be used in the deed and any other documents requiring a legal description of the Property.

The Survey must show the gross land area of the Property, and if the Purchase Price is based upon the Net Land Area then the Survey must also show the Net Land Area, expressed in both acres and square feet. The term “Net Land Area” means the gross land area of the Property less the area within any of the following (if recorded or visible and apparent, but excluding those within set back areas) [Check all that apply]:

| x | utility easements; |

| x | drainage easements; |

| x | access easements; |

| x | rights-of-way; |

| x | 100-year flood plain; and |

| x | any encroachments on the Property. |

4

B. Title Commitment. Within twenty (20) days after the Effective Date, Seller shall deliver or cause to be delivered to Purchaser:

| (1) | A title commitment (the “Title Commitment”) covering the Property binding the Title Company to issue a Texas Owner Policy of Title Insurance (the “Title Policy”) on the standard form prescribed by the Texas Department of Insurance at the Closing, in the full amount of the Purchase Price, insuring Purchaser’s fee simple title to the Property to be good and indefeasible, subject only to the Permitted Exceptions (defined below); and |

| (2) | the following (collectively, the “Title Documents”): |

| (a) | true and legible copies of all recorded instruments affecting the Property and recited as exceptions in the Title Commitment; |

| (b) | a current tax certificate; |

| (c) | any written notices required by applicable statutes, including those referenced in Section 17; and |

| (d) | if the Property includes any personal property, UCC search reports pertaining to the Seller. |

6. REVIEW OF SURVEY AND TITLE.

A. Title Review Period. Purchaser will have five (5) days (the “Title Review Period”) after receipt of the last of the Survey, Title Commitment and Title Documents to review them and to deliver a written notice to Seller stating any objections Purchaser may have to them or any item disclosed by them. Purchaser’s failure to object within the time provided will be a waiver of the right to object. Any item to which Purchaser does not object will be deemed a “Permitted Exception.” The items set forth on Schedule C of the Title Commitment, and any other items the Title Company identifies to be released upon the Closing, will be deemed objections by Purchaser. Zoning ordinances and the lien for current taxes are deemed to be Permitted Exceptions.

B. Cure Period. If Purchaser delivers any written objections to Seller within the Title Review Period, then Seller shall make a good faith attempt to cure the objections within ten (10) days (the “Cure Period”) after receipt of the objections. However, Seller is not required to incur any cost to do so. If Seller cannot cure the objections within the Cure Period, Seller may deliver a written notice to Purchaser, before expiration of the Cure Period, stating whether Seller is committed to cure the objections at or before the Closing. If Seller does not cure the objections within the Cure Period, or does not timely deliver the notice, or does not commit in the notice to fully cure all of the objections at or before the Closing, then Purchaser may terminate this Contract by delivering a written notice to Seller on or before the earlier to occur of: (1) the date that is seven (7) days after the expiration of the Cure Period; or (2) the scheduled Closing Date.

C. New Items. If any new items are disclosed by any updated Survey, updated Title Commitment, or any new Title Documents, that were not disclosed to Purchaser when the Survey, Title Commitment, and Title Documents were first delivered to Purchaser, then Purchaser will have fifteen (15) days to review the new items and to deliver a written notice to Seller stating any objections Purchaser may have to the new items. If Purchaser timely delivers any written objections as to the new items to Seller, then Seller shall make a good faith attempt to cure the objections to the new items within ten (10) days (the “Additional Cure Period”) after receipt of the objections as to the new items. However, Seller is not required to incur any cost to do so. If Seller does not cure the objections as to the new items within the Additional Cure Period, or does not deliver a written notice to Purchaser before the expiration of the Additional Cure Period stating whether Seller is committed to cure the objections as to the new items at

5

or before the Closing, then Purchaser may terminate this Contract by delivering a written notice to Seller on or before the earlier to occur of: (1) that date that is seven (7) days after the expiration of the Additional Cure Period; or (2) the scheduled Closing Date.

D. Return of Earnest Money or Waiver. If Purchaser properly and timely terminates this Contract, the Earnest Money will be returned to Purchaser. If Purchaser does not properly and timely terminate this Contract, then Purchaser will be deemed to have waived any uncured objections and must accept title at the Closing subject to the uncured objections and other Permitted Exceptions. Seller’s failure to cure Purchaser’s objections under this Section 6 does not constitute a default by Seller.

7. SELLER’S REPRESENTATIONS.

A. Statements. Seller represents to Purchaser, to the best of Seller’s knowledge, as follows:

(1) Title. At the Closing, Seller will convey to Purchaser good and indefeasible fee simple title to the Property free and clear of any and all liens, assessments, easements, security interests and other encumbrances except the Permitted Exceptions. Delivery of the Title Policy pursuant to Section 12 (the Closing) will be deemed to satisfy the obligation of Seller as to the sufficiency of title required under this Contract. However, delivery of the Title Policy will not release Seller from the warranties of title set forth in the warranty deed.

(2) Leases. There are no parties in possession of any portion of the Property as lessees, tenants at sufferance or trespassers except tenants under written leases delivered to Purchaser pursuant to this Contract.

(3) Liens and Debts. There are no mechanic’s liens, Uniform Commercial Code liens or unrecorded liens against the Property, and Seller shall not allow any such liens to attach to the Property before the Closing that will not be satisfied out of the Closing proceeds. All obligations of Seller arising from the ownership and operation of the Property and any business operated on the Property, including, but not limited to, taxes, leasing commissions, salaries, contracts, and similar agreements, have been paid or will be paid before the Closing. Except for obligations for which provisions are made in this Contract for prorating at the Closing and any indebtedness taken subject to or assumed, there will be no obligations of Seller with respect to the Property outstanding as of the Closing.

(4) Litigation. There is no pending or threatened litigation, condemnation, or assessment affecting the Property. Seller shall promptly advise Purchaser of any litigation, condemnation or assessment affecting the Property that is instituted after the Effective Date.

(5) Material Defects. Seller has disclosed to Purchaser any and all known conditions of a material nature with respect to the Property which may affect the health or safety of any occupant of the Property. Except as disclosed in writing by Seller to Purchaser, the Property has no known latent structural defects or construction defects of a material nature, and none of the improvements have been constructed with materials known to be a potential health hazard to occupants of the Property.

(6) Hazardous Materials. Except as otherwise disclosed in writing by Seller to Purchaser, the Property (including any improvements) does not contain any Hazardous Materials (defined below) other than lawful quantities properly stored in containers in compliance with applicable laws.

6

B. Remedies. If Purchaser discovers, before the Closing, that any of Seller’s representations has been misrepresented in a material respect, Purchaser may notify Seller of the misrepresentation in writing, and Seller shall attempt to correct the misrepresentation. If the misrepresentation is not corrected by Seller before the Closing, Purchaser may: (1) proceed to Closing, without waiving any claim for misrepresentation; or (2) terminate this Contract by delivering a written termination notice to Seller, in which case the Earnest Money will be returned to Purchaser.

C. Negative Covenants. After the Effective Date, Seller shall not, without Purchaser’s prior written approval: (1) further encumber the Property or allow an encumbrance upon the title to the Property, or modify the terms of any existing encumbrance, if the encumbrance would still be in effect after Closing; or (2) enter into any lease or contract affecting the Property, if the lease or contract would still be in effect after Closing. However, Seller may enter into a lease or contract with an independent third party, in the ordinary course of business, without Purchaser’s consent, if Purchaser will be entitled to terminate the lease or contract after Closing, without incurring any termination charge, by delivering a termination notice thirty (30) days in advance of the termination date. If Seller enters into any lease or contract affecting the Property after the Effective Date, then Seller shall immediately deliver a photocopy of the signed document to Purchaser.

8. NONCONFORMANCE. Purchaser has or will independently investigate and verify to Purchaser’s satisfaction the extent of any limitations of uses of the Property. Purchaser acknowledges that the current use of the Property or the improvements located on the Property (or both) may not conform to applicable Federal, State or municipal laws, ordinances, codes or regulations. Zoning, permitted uses, height limitations, setback requirements, minimum parking requirements, limitations on coverage of improvements to total area of land, Americans with Disabilities Act requirements, wetlands restrictions and other matters may have a significant economic impact upon the intended use of the Property by Purchaser. However, if Seller is aware of pending zoning changes and/or current nonconformance with any Federal, State or local laws, ordinances, codes or regulations, Seller shall disclose same to Purchaser.

9. INSPECTION. [Check only one]

| x |

A. Inspection Desired. Purchaser desires to inspect the Property and Seller grants to Purchaser the right to inspect the Property as described in Addendum C, INSPECTION. | |

| B. Inspection Not Necessary. Purchaser acknowledges that Purchaser has inspected the Property, including all buildings and improvements, and is thoroughly familiar with their condition. Purchaser accepts the Property in its present “AS IS” condition, and any changes caused by normal wear and tear before the Closing, but without waiving Purchaser’s rights by virtue of Seller’s representations expressed in this Contract. | ||

10. CASUALTY LOSS AND CONDEMNATION.

A. Damage or Destruction. All risk of loss to the Property will remain upon Seller before the Closing. If the Property is damaged or destroyed by fire or other casualty to a Material Extent (defined below), then Purchaser may terminate this Contract by delivering a written termination notice to Seller within ten (10) days after the date the casualty occurred (and in any event before the Closing), in which case the Earnest Money will be returned to Purchaser. If the Property is damaged by fire or other casualty to less than a Material Extent, the parties shall proceed to the Closing as provided in this Contract. If the transaction is to proceed to the Closing, despite any damage or destruction, there will be no reduction in the Purchase Price and Seller shall either: (1) fully repair the damage before the Closing, at Seller’s expense; or (2) give a credit to Purchaser at the Closing for the entire cost of repairing the Property. The term “Material Extent” means damage or destruction where the cost of repair exceeds ten percent (10%) of the Purchase Price. If the repairs cannot be completed before the Closing Date, or the cost of repairing the Property cannot be determined before the Closing Date, then either party may postpone the Closing Date by delivering a written notice to the other party specifying an extended Closing Date that is not more than thirty (30) days after the previously scheduled Closing Date.

7

B. Condemnation. If condemnation proceedings are commenced before the Closing against any portion of the Property, then Seller shall immediately notify Purchaser in writing of the condemnation proceedings, and Purchaser may terminate this Contract by delivering a written notice to Seller within ten (10) days after Purchaser receives the notice (and in any event before the Closing), in which case the Earnest Money will be returned to Purchaser. If this Contract is not terminated, then any condemnation award will (a) if known on the Closing Date, belong to Seller and the Purchase Price will be reduced by the same amount, or (b) if not known on the Closing Date, belong to Purchaser and the Purchase Price will not be reduced.

11. ASSIGNMENT. [Check only one]

| x |

A. Assignment Permitted. Purchaser may assign this Contract provided the assignee assumes in writing all obligations and liabilities of Purchaser under this Contract, in which event Purchaser will be relieved of any further liability under this Contract. | |

| B. Limited Assignment Permitted. Purchaser may assign this Contract only to a related party, defined as: (1) an entity in which Purchaser is an owner, partner or corporate officer; (2) an entity which is owned or controlled by the same person or persons that own or control Purchaser; or (3) a member or members of the immediate family of Purchaser, or a trust in which the beneficiary or beneficiaries is or are a member or members of the immediate family of Purchaser. Purchaser will remain liable under this Contract after any assignment. | ||

| C. Assignment Prohibited. Purchaser may not assign this Contract without Seller’s prior written consent. | ||

12. CLOSING.

A. Closing Date. The closing of the transaction described in this Contract (the “Closing”) will be held at the offices of the Tit le Company at its address stated below, on the date (the “Closing Date”) that is [complete only one]:

days after the expiration of the Inspection Period (defined in Addendum C); days

after the Effective Date; or June 28, 2013

However, if any objections that were timely made by Purchaser in writing pursuant to Section 6 (Review of Survey and Title ) have not been cured, then either party may postpone the Closing Date by delivering a written notice to the other party specifying an extended Closing Date that is not more than thirty (30) days after the previously scheduled Closing Date.

B. Seller’s Closing Obligations . At the Closing, Seller shall deliver to Purchaser, at Seller’s expense:

(1) A duly executed [check only one] General Warranty Deed x Special Warranty Deed (with vendor’s lien retained if financing is given by Seller or obtained from a third party) conveying the Property in fee simple according to the legal description prepared by the surveyor as shown on the Survey, subject only to the Permitted Exceptions;

8

(2) An updated Title Commitment committing the underwriter for the Title Company to issue promptly after the Closing, at Seller’s expense, the Title Policy pursuant to the Title Commitment, subject only to the Permitted Exceptions, in the full amount of the Purchase Price, dated as of the date of the Closing, and (at an additional premium cost) [check only one if applicable] with the survey exception modified at Seller’s expense to read “any shortages in area,” or x with the survey exception modified at Purchaser’s expense to read “any shortages in area;”

(3) A Bill of Sale conveying the personal property, if any, including, but not limited to, any described on Addendum A, IMPROVED PROPERTY, free and clear of liens, security interests and encumbrances, subject only to the Permitted Exceptions (to the extent applicable);

(4) Possession of the Property, subject to valid existing leases disclosed by Seller to Purchaser and other applicable Permitted Exceptions;

(5) An executed assignment of all leases, if there are any leases affecting the Property;

(6) A current rent roll certified by Seller to be complete and accurate, if there are any leases affecting the Property;

(7) Evidence of Seller’s authority and capacity to close this transaction; and

(8) All other documents reasonably required by the Title Company to close this transaction.

C. Purchaser’s Closing Obligations. At the Closing, Purchaser shall deliver to Seller, at Purchaser’s expense:

(1) The cash portion of the Purchase Price (with the Earnest Money being applied to the Purchase Price);

(2) The Note and the Deed of Trust, if Addendum B-2, SELLER FINANCING, is attached;

(3) An Assumption Agreement in recordable form agreeing to pay all commissions payable under any lease affecting the Property;

(4) Evidence of Purchaser’s authority and capacity to close this transaction; and

(5) All other documents reasonably required by the Title Company to close this transaction.

D. Closing Costs. Each party shall pay its share of the closing costs which are customarily paid by a seller or purchaser in a transaction of this character in the county where the Property is located, or as otherwise agreed.

E. Prorations. Rents, lease commissions, interest on any assumed loan, insurance premiums on any transferred insurance policies, maintenance expenses, operating expenses, standby fees, and ad valorem taxes for the year of the Closing will be prorated at the Closing effective as of the date of the Closing. Seller shall give a credit to Purchaser at the Closing in the aggregate amount of any security deposits deposited by tenants under leases affecting the Property. If the Closing occurs before the tax rate is fixed for the year of the Closing, the apportionment of the taxes will be upon the basis of the tax rate

9

for the preceding year applied to the latest assessed valuation, but any difference between actual and estimated taxes for the year of the Closing actually paid by Purchaser will be adjusted equitably between the parties upon receipt of a written statement of the actual amount of the taxes. This provision will survive the Closing.

F. Rollback Taxes. If any Rollback Taxes are due before the Closing due to a change in use of the Property by Seller or a denial of any special use valuation of the Property before the Closing, then Seller shall pay those Rollback Taxes (including any interest and penalties) at or before the Closing. If this sale or a change in use of the Property or denial of any special use valuation of the Property after the Closing would result in the assessment after the Closing of additional taxes and interest applicable to the period of time before the Closing (“Rollback Taxes”), then: (1) Purchaser shall pay the Rollback Taxes (including any interest and penalties) if and when they are assessed, without receiving any credit from Seller; unless (2) this box is checked, in which case Seller shall give a credit to Purchaser at the Closing for the amount of the Rollback Taxes (including interest and penalties) that may be assessed after the Closing as reasonably estimated by the Title Company, and Purchaser shall pay the Rollback Taxes (including any interest and penalties) if and when they are assessed after the Closing. If Seller gives a credit to Purchaser for the estimated amount of Rollback Taxes, and the actual Rollback Taxes assessed after the Closing are different from the estimate used at the Closing, then there will be no subsequent adjustment between Seller and Purchaser.

G. Loan Assumption. If Purchaser assumes an existing mortgage loan, or takes the Property subject to an existing lien, at the Closing, Purchaser shall pay: (1) to the lender, any assumption fee charged by the lender; (2) to the lender, reasonable attorney’s fees charged by the lenders’ attorney; and (3) to Seller, a sum equal to the amount of any reserve accounts held by the lender for the payment of taxes, insurance and any other expenses applicable to the Property for which reserve accounts are held by the lender, and Seller shall transfer the reserve accounts to Purchaser. Purchaser shall execute, at the option and expense of Seller, a Deed of Trust to Secure Assumption with a trustee named by Seller. If consent to the assumption is required by the lender, Seller shall obtain the lender’s consent in writing and deliver the consent to Purchaser at the Closing. If Seller does not obtain the lender’s written consent (if required) and deliver it to Purchaser at or before the Closing, Purchaser may terminate this Contract by delivering a written termination notice to Seller, and the Earnest Money will be returned to Purchaser.

H. Foreign Person Notification. If Seller is a Foreign Person, as defined by the Internal Revenue Code, or if Seller fails to deliver to Purchaser a non-foreign affidavit pursuant to §1445 of the Internal Revenue Code, then Purchaser may withhold from the sales proceeds an amount sufficient to comply with applicable tax law and deliver the withheld proceeds to the Internal Revenue Service, together with appropriate tax forms. A non-foreign affidavit from Seller must include: (1) a statement that Seller is not a foreign person; (2) the U. S. taxpayer identification number of Seller; and (3) any other information required by §1445 of the Internal Revenue Code.

13. DEFAULT.

A. Purchaser’s Remedies. If Seller fails to close this Contract for any reason except Purchaser’s default or the termination of this Contract pursuant to a right to terminate set forth in this Contract, Seller will be in default and Purchaser may elect to either: (1) enforce specific performance of this Contract (force Seller to sell the Property to Purchaser pursuant to this Contract); or (2) terminate this Contract by delivering a written notice to Seller. If Purchaser elects to terminate this Contract due to Seller’s default, then Purchaser will be deemed to have waived any other remedies available to Purchaser and the Earnest Money will be returned to Purchaser.

10

The foregoing will be Purchaser’s sole and exclusive remedies for Seller’s default unless this box is checked, in which case Purchaser may sue Seller for damages. If the box is checked to allow Purchaser to sue Seller for damages, then Purchaser must elect to pursue either specific performance or a claim for damages at the beginning of any legal action initiated by Purchaser.

B. Seller’s Remedies. If Purchaser fails to close this Contract for any reason except Seller’s default or the termination of this Contract pursuant to a right to terminate set forth in this Contract, Purchaser will be in default and Seller may terminate this Contract and receive the Earnest Money as liquidated damages for Purchaser’s breach of this Contract, thereby releasing Purchaser from this Contract. If Seller terminates this Contract due to Purchaser’s default, then the Earnest Money will be paid to Seller.

The right to receive the Earnest Money will be Seller’s sole and exclusive remedy for Purchaser’s default unless one of the following remedies is selected, in which case Seller may sue Purchaser: to enforce specific performance (force Purchaser to purchase the Property pursuant to this Contract); or for damages. If one or both of the boxes is checked to allow Seller to sue Purchaser to enforce specific performance or for damages, then Seller must elect to either receive the Earnest Money as liquidated damages or pursue one of the other selected remedies at the beginning of any legal action initiated by Seller.

14. AGENCY DISCLOSURE.

A. Agency Relationships. The term “Brokers” refers to the Principal Broker and the Cooperating Broker, if applicable, as set forth on the signature page. Each Broker has duties only to the party the Broker represents as identified below. If either Broker is acting as an intermediary, then that Broker will have only the duties of an intermediary, and the intermediary disclosure and consent provisions apply as set forth below. [Each broker check only one]

(1) The Principal Broker is: x agent for Seller only; or agent for Purchaser only; or an intermediary.

(2) The Cooperating Broker is: agent for Seller only; x agent for Purchaser only; or an intermediary.

B. Other Brokers. Seller and Purchaser each represent to the other that they have had no dealings with any person, firm, agent or finder in connection with the negotiation of this Contract or the consummation of the purchase and sale contemplated by this Contract, other than the Brokers named in this Contract, and no real estate broker, agent, attorney, person, firm or entity, other than the Brokers, is entitled to any commission or finder’s fee in connection with this transaction as the result of any dealings or acts of the representing party. Each party agrees to indemnify, defend, and hold the other party harmless from and against any costs, expenses or liability for any compensation, commission, fee, or charges that may be claimed by any agent, finder or other similar party, other than the Brokers, by reason of any dealings or acts of the indemnifying party.

C. Fee Sharing. Seller and Purchaser agree that the Brokers may share the Fee (defined below) among themselves, their sales associates, and any other licensed brokers involved in the sale of the Property. The parties authorize the Title Company to pay the Fee directly to the Principal Broker and, if applicable, the Cooperating Broker, in accordance with Section 15 (Professional Service Fee) or any other agreement pertaining to the Fee. Payment of the Fee will not alter the fiduciary relationships between the parties and the Brokers.

11

D. Intermediary Relationship. If either of the Brokers has indicated in Section 14A (Agency Relationships) that the Broker is acting as an intermediary in this transaction, then Purchaser and Seller hereby consent to the intermediary relationship, authorize such Broker or Brokers to act as an intermediary in this transaction, and acknowledge that the source of any expected compensation to the Brokers will be Seller, and the Brokers may also be paid a fee by Purchaser. A broker is required to treat each party honestly and fairly and to comply with the Texas Real Estate License Act. A broker who acts as an intermediary in a transaction:

(1) shall treat all parties honestly;

(2) may not disclose that the owner will accept a price less than the asking price unless authorized in writing to do so by the owner;

(3) may not disclose that the buyer will pay a price greater than the price submitted in a written offer unless authorized in writing to do so by the buyer; and

(4) may not disclose any confidential information or any information that a party specifically instructs the broker in writing not to disclose unless authorized in writing to disclose the information or required to do so by the Texas Real Estate License Act or a court order or if the information materially relates to the condition of the property.

Broker is authorized to appoint, by providing written notice to the parties, one or more licensees associated with Broker to communicate with and carry out instructions of one party, and one or more other licensees associated with Broker to communicate with and carry out instructions of the other party or parties. During negotiations, an appointed licensee may provide opinions and advice to the party to whom the licensee is appointed.

15. PROFESSIONAL SERVICE FEE.

A. Payment of Fee. Seller agrees to pay the Brokers a professional service fee (the “Fee”) for procuring the Purchaser and for assisting in the negotiation of this Contract as follows: Seller will pay Principal Broker at Closing a commission in accordance with a separate written agreement. Principal Broker will pay, or cause to be paid, a one percent (1%) commission of the Purchase Price to the Cooperating Broker at Closing.

The Fee will be earned upon the execution of this Contract and will be paid at the Closing of a sale of the Property by Seller pursuant to this Contract (as may be amended or assigned). The Fee will be paid by Seller to the Brokers in the county in which the Property is located. Seller shall pay any applicable sales taxes on the Fee. The Title Company or other escrow agent is authorized and directed to pay the Fee to the Brokers out of the Closing proceeds. A legal description of the Property, as set forth in this Contract and any Survey delivered pursuant to this Contract, is incorporated by reference in the agreement pertaining to the Fee set forth or referenced in this Section.

The Fee is earned notwithstanding: (1) any subsequent termination of this Contract (except a termination by Seller or Purchaser pursuant to a right of termination in this Contract); or (2) any default by Seller. If the Closing does not occur due to Purchaser’s default, and Seller does not elect to enforce specific performance, the Fee will not exceed one-half of the Earnest Money. If either party defaults under this Contract, then the Fee will be paid within ten (10) days after the scheduled Closing Date, and the Title Company is authorized to pay the fee out of the Earnest Money or any other escrow deposit made pursuant to this Contract. If Seller defaults, then Seller’s obligation to pay the Fee will not be affected if Purchaser chooses the remedy of terminating this Contract, and the amount of the Fee will not be limited to the amount of the Earnest Money or any other escrow deposit made pursuant to this Contract.

12

B. Consent Required. Purchaser, Seller and Title Company agree that the Brokers are third party beneficiaries of this Contract with respect to the Fee, and that no change may be made by Purchaser, Seller or Title Company as to the time of payment, amount of payment or the conditions for payment of the Fee without the written consent of the Brokers.

C. Right to Claim a Lien. Pursuant to Chapter 62 of the Texas Property Code, the Brokers hereby disclose their right to claim a lien based on the commission agreement set forth in this Section 15 and any other commission agreements referenced in this Contract or applicable to the transaction contemplated by this Contract. This disclosure is hereby incorporated in any such commission agreements.

16. MISCELLANEOUS PROVISIONS.

A. Definition of Hazardous Materials. “Hazardous Materials” means any pollutants, toxic substances, oils, hazardous wastes, hazardous materials or hazardous substances as defined in or pursuant to the Comprehensive Environmental Response, Compensation and Liability Act, as amended, the Clean Water Act, as amended, or any other Federal, State or local environmental law, ordinance, rule, or regulation, whether existing as of the Effective Date or subsequently enacted.

B. Notices. All notices and other communications required or permitted under this Contract must be in writing and will be deemed delivered on the earlier of: (1) actual receipt, if delivered in person or by courier, with evidence of delivery; (2) receipt of an electronic facsimile (“Fax”) transmission with confirmation of delivery to the Fax numbers specified in this Contract, if any; or (3) upon deposit with the United States Postal Service, certified mail, return receipt requested, postage prepaid, and properly addressed to the intended recipient at the address set forth in this Contract. Any party may change its address for notice purposes by delivering written notice of its new address to all other parties in the manner set forth above. Copies of all written notices should also be delivered to the Brokers and to the Title Company, but failure to notify the Brokers or the Title Company will not cause an otherwise properly delivered notice to be ineffective.

C. Termination. If this Contract is terminated for any reason, the parties will have no further rights or obligations under this Contract, except that: (1) Purchaser shall pay the costs to repair any damage to the Property caused by Purchaser or Purchaser’s agents; (2) Purchaser shall return to Seller any reports or documents delivered to Purchaser by Seller; and (3) each party shall perform any other obligations that, by the explicit provisions of this Contract, expressly survive the termination of this Contract. The obligations of this Section 16C will survive the termination of this Contract. The terms of any mutual termination agreement will supersede and control over the provisions of this Section 16C to the extent of any conflict.

D. Forms. In case of a dispute as to the form of any document required under this Contract, the most recent form prepared by the State Bar of Texas will be used, modified as necessary to conform to the terms of this Contract.

E. Attorneys ’ Fees. The prevailing party in any proceeding brought to enforce this Contract, or brought relating to the transaction contemplated by this Contract, will be entitled to recover, from the non-prevailing party, court costs, reasonable attorneys’ fees and all other reasonable related expenses.

F. Integration. This Contract contains the complete agreement between the parties with respect to the Property and cannot be varied except by written agreement. The parties agree that there are no oral agreements, understandings, representations or warranties made by the parties that are not

13

expressly set forth in this Contract. Any prior written agreements, understandings, representations or warranties between the parties will be deemed merged into and superceded by this Contract, unless it is clear from the written document that the intent of the parties is for the previous written agreement, understanding, representation or warranty to survive the execution of this Contract.

G. Survival. Any representation or covenant contained in this Contract not otherwise discharged at the Closing will survive the Closing.

H. Binding Effect. This Contract will inure to the benefit of, and will be binding upon, the parties to this Contract and their respective heirs, legal representatives, successors and assigns.

I. Time for Performance. Time is of the essence under each provision of this Contract. Strict compliance with the times for performance is required.

J. Business Day. If any date of performance under this Contract falls on a Saturday, Sunday or Texas legal holiday, such date of performance will be deferred to the next day that is not a Saturday, Sunday or Texas legal holiday.

K. Right of Entry. After reasonable advance notice and during normal business hours, Purchaser, Purchaser’s representatives and the Brokers have the right to enter upon the Property before the Closing for purposes of viewing, inspecting and conducting studies of the Property, so long as they do not unreasonably interfere with the use of the Property by Seller or any tenants, or cause damage to the Property.

L. Governing Law. This Contract will be construed under and governed by the laws of the State of Texas, and unless otherwise provided in this Contract, all obligations of the parties created under this Contract are to be performed in the county where the Property is located.

M. Severability. If any provision of this Contract is held to be invalid, illegal, or unenforceable by a court of competent jurisdiction, the invalid, illegal, or unenforceable provision will not affect any other provisions, and this Contract will be construed as if the invalid, illegal, or unenforceable provision is severed and deleted from this Contract.

N. Broker Disclaimer. The Brokers will disclose to Purchaser any material factual knowledge the Brokers may possess about the condition of the Property. Purchaser understands that a real estate broker is not an expert in matters of law, tax, financing, surveying, hazardous materials, engineering, construction, safety, zoning, land planning, architecture, or the Americans with Disabilities Act. Purchaser should seek expert assistance on such matters. The Brokers do not investigate a property’s compliance with building codes, governmental ordinances, statutes and laws that relate to the use or condition of the Property or its construction, or that relate to its acquisition. Purchaser is not relying upon any representations of the Brokers concerning permitted uses of the Property or with respect to any nonconformance of the Property. If the Brokers provide names of consultants or sources for advice or assistance, the Brokers do not warrant the services of the advisors or their products. The Brokers cannot warrant the suitability of property to be acquired. Purchaser acknowledges that current and future federal, state and local laws and regulations may require any Hazardous Materials to be removed at the expense of those persons who may have had or continue to have any interest in the Property. The expense of such removal may be substantial. Purchaser agrees to look solely to experts and professionals selected or approved by Purchaser to advise Purchaser with respect to the condition of the Property and will not hold the Brokers responsible for any condition relating to the Property. The Brokers do not warrant that Seller will disclose any or all property defects or other matters pertaining to the Property or its condition. Seller and Purchaser agree to hold the Brokers harmless from any damages, claims, costs and expenses including, but not limited to, reasonable attorneys’ fees and court costs, resulting from or related to any

14

person furnishing any false, incorrect or inaccurate information with respect to the Property, Seller’s concealing any material information with respect to the condition of the Property, or matters that should be analyzed by experts. To the extent permitted by applicable law, the Brokers’ liability for errors or omissions, negligence, or otherwise, is limited to the return of the Fee, if any, paid to the responsible Broker pursuant to this Contract. The parties agree that they are not relying upon any oral statements that the Brokers may have made. Purchaser is relying solely upon Purchaser’s own investigations and the representations of Seller, if any, and Purchaser acknowledges that the Brokers have not made any warranty or representation with respect to the condition of the Property or otherwise.

O. Counterparts. This Contract may be executed in a number of identical counterparts. Each counterpart is deemed an original and all counterparts will, collectively, constitute one agreement.

P. Patriot Act Representation. Seller and Purchaser each represent to the other that: (1) its property interests are not blocked by Executive Order No. 13224, 66 Fed. Reg. 49079; (2) it is not a person listed on the Specially Designated Nationals and Blocked Persons list of the Office of Foreign Assets Control of the United States Department of the Treasury; and (3) it is not acting for or on behalf of any person on that list.

Q. Exchange. Seller and Purchaser shall cooperate with each other in connection with any tax deferred exchange that either party may be initiating or completing in connection with Section 1031 of the Internal Revenue Code, so long as neither party will be required to pay any expenses related to the other party’s exchange and the Closing is not delayed. Notwithstanding any other provision that may prohibit the assignment of this Contract, either party may assign this Contract to a qualified intermediary or exchange accommodation title holder, if the assignment is required in connection with the exchange. The parties agree to cooperate with each other, and sign any reasonable documentation that may be required, to effectuate any such exchange.

17. STATUTORY NOTICES.

A. Abstract or Title Policy. At the time of the execution of this Contract, Purchaser acknowledges that the Brokers have advised and hereby advise Purchaser, by this writing, that Purchaser should have the abstract covering the Property examined by an attorney of Purchaser’s own selection or that Purchaser should be furnished with or obtain a policy of title insurance.

B. Notice Regarding Unimproved Property Located in a Certificated Service Area. If the Property is unimproved and is located in a certificated service area of a utility service, then Seller shall give to Purchaser a written notice in compliance with §13.257 of the Texas Water Code, and Purchaser agrees to acknowledge receipt of the notice in writing. The notice must set forth the correct name of utility service provider authorized by law to provide water or sewer service to the Property, and must comply with all other applicable requirements of the Texas Water Code.

C. Special Assessment Districts. If the Property is situated within a utility district or flood control district subject to the provisions of §49.452 of the Texas Water Code, then Seller shall give to Purchaser the required written notice and Purchaser agrees to acknowledge receipt of the notice in writing. The notice must set forth the current tax rate, the current bonded indebtedness and the authorized indebtedness of the district, and must comply with all other applicable requirements of the Texas Water Code.

D. Property Owners’ Association. If the Property is subject to mandatory membership in a property owners’ association, Seller shall notify Purchaser of the current annual budget of the property owners’ association, and the current authorized fees, dues and/or assessments relating to the Property. In addition, Seller shall give to Purchaser the written notice required under §5.012 of the Texas Property

15

Code, if applicable, and Purchaser agrees to acknowledge receipt of the notice in writing. Also, Seller shall give to Purchaser the resale certificate required under Chapter 207 of the Texas Property Code, if applicable, and Purchaser agrees to acknowledge receipt of the resale certificate in writing.

E. Notice Regarding Possible Annexation. If the Property that is the subject of this Contract is located outside the limits of a municipality, the Property may now or later be included in the extraterritorial jurisdiction of the municipality and may now or later be subject to annexation by the municipality. Each municipality maintains a map that depicts its boundaries and extraterritorial jurisdiction. To determine if the Property is located within a municipality’s extraterritorial jurisdiction or is likely to be located within a municipality’s extraterritorial jurisdiction, contact all municipalities located in the general proximity of the Property for further information.

F. Notice Regarding Coastal Area Property. If the Property adjoins or shares a common boundary with the tidally influenced submerged lands of the state, then Seller shall give to Purchaser a written notice regarding coastal area property, in compliance with §33.135 of the Texas Natural Resources Code, and Purchaser agrees to acknowledge receipt of the notice in writing.

G. Gulf Intracoastal Waterway Notice. If the Property is located seaward of the Gulf Intracoastal Waterway, then Seller shall give to Purchaser a written notice regarding the seaward location of the Property, in compliance with §61.025 of the Texas Natural Resources Code, and Purchaser agrees to acknowledge receipt of the notice in writing.

H. Notice for Property Located in an Agricultural Development District. If the Property is located in an agricultural development district, then in accordance with §60.063 of the Texas Agricultural Code: (1) Seller shall give to Purchaser a written notice that the Property is located in such a district; (2) Purchaser agrees to acknowledge receipt of the notice in writing; and (3) at the Closing, a separate copy of the notice with current information about the district will be executed by Seller and Purchaser and recorded in the deed records of the county in which the Property is located.

I. Disclosure of Dual Capacity as Broke r and Principal. [Complete if applicable].

is a licensed Texas real estate broker and is acting in a dual capacity as broker for the Purchaser and as a principal in this transaction, as he or she may be the Purchaser (or one of the owners of the Purchaser after any assignment of this Contract).

is a licensed Texas real estate broker and is acting in a dual capacity as broker for the Seller and as a principal in this transaction, as he or she may be the Seller (or one of the owners of the Seller).

18. DISPUTE RESOLUTION.

A. Mediation. If any dispute (the “Dispute”) arises between any of the parties to this Contract including, but not limited to, payment of the Fee, then any party (including any Broker) may give written notice to the other parties requiring all involved parties to attempt to resolve the Dispute by mediation. Except in those circumstances where a party reasonably believes that an applicable statute of limitations period is about to expire, or a party requires injunctive or equitable relief, the parties are obligated to use this mediation procedure before initiating arbitration or any other action. Within seven (7) days after receipt of the mediation notice, each party must deliver a written designation to all other parties stating the names of one or more individuals with authority to resolve the Dispute on such party’s behalf. Within fourteen (14) days after receipt of the mediation notice, the parties shall make a good faith effort to select a qualified mediator to mediate the Dispute. If the parties are unable to timely agree upon a mutually acceptable mediator, any party may request any state or federal judge to appoint a mediator.

16

In consultation with the mediator, the parties shall promptly designate a mutually convenient time and place for the mediation that is no later than thirty (30) days after the date the mediator is selected. In the mediation, each party must be represented by persons with authority and discretion to negotiate a resolution of the Dispute, and may be represented by counsel. The mediation will be governed by applicable provisions of Chapter 154 of the Texas Civil Practice and Remedies Code, and such other rules as the mediator may prescribe. The fees and expenses of the mediator will be shared equally by all parties included in the Dispute.

B. Arbitration. If the parties are unable to resolve any Dispute by mediation, then the parties (including the Brokers)

shall submit the Dispute to binding arbitration before a single arbitrator. The Dispute will be decided by arbitration in accordance with the applicable arbitration statute and any rules selected by the arbitrator. After an unsuccessful mediation,

any party may initiate the arbitration procedure by delivering a written notice of demand for arbitration to the other parties. Within fourteen (14) days after the receipt of the written notice of demand for arbitration, the parties shall make

a good faith effort to select a qualified arbitrator acceptable to all parties. If the parties are unable to agree upon the selection of an arbitrator, then any party may request any state or federal judge to appoint an arbitrator. This agreement to

arbitrate will be specifically enforceable under the prevailing arbitration law.

19. CONSULT AN ATTORNEY. This Contract is a legally binding agreement. The Brokers cannot give legal advice. The parties to this Contract acknowledge that they have been advised to have this Contract reviewed by legal counsel before signing this Contract.

| Purchaser’s | Seller’s | |||||

| attorney is: | Greg Curry |

attorney is: | Randy Hullett | |||

| Thompson & Knight LLP | Abernathy, Roeder, Boyd & Joplin, P.C. | |||||

| One Arts Plaza | 1700 Redbud Blvd., Suite 300 | |||||

| 1722 Routh Street, Suite 1500 | McKinney, Texas 75069 | |||||

| Dallas, Texas 75201-2533 | Phone: 214-544-4000 | |||||

| Phone: 214-969-1252 | Fax: 214-54404044 | |||||

| Fax: 214-880-3228 |

20. EXHIBITS AND ADDENDA. All Exhibits and Addenda attached to this Contract are incorporated herein by reference and made a part of this Contract for all purposes [check all that apply]:

| x |

Exhibit “A” | Legal Description | ||||

| x |

Exhibit “A-1” | Survey Plats | ||||

| Exhibit “B” | Site Plan | |||||

| Exhibit “C” |

|

|||||

| Addendum A | Improved Property | |||||

| Addendum B-1 | Third Party Financing | |||||

| Addendum B-2 | Seller Financing | |||||

| Addendum B-3 | Existing Loan | |||||

| x |

Addendum C | Inspection | ||||

| Addendum D | Disclosure Notice | |||||

| Addendum E | Lead Based Paint | |||||

| Addendum F | Information About Brokerage Services | |||||

| Addendum G | Additional Provisions | |||||

| x |

Addendum H | Special |

17

21. CONTRACT AS OFFER. The execution of this Contract by the first party to do so constitutes an offer to purchase or sell the Property. If the other party does not accept that offer by signing this Contract and delivering a fully executed copy to the first party within 5 days after the date this Contract is executed by the first party, then the first party may withdraw that offer by delivering a written notice to the other party at any time before the other party accepts that offer, in which case the Earnest Money, if any, will be returned to Purchaser.

22. ADDITIONAL PROVISIONS. [Additional provisions may be set forth below or on any attached Addendum].

Purchaser’s obligation to close is further contingent upon the approval of this purchase by its Board of Directors prior to the expiration of the Inspection Period. Purchaser shall request this approval following the Purchaser’s receipt and approval of the Survey, Title Commitment, inspection results and the hazardous materials survey; however, this condition shall not extend beyond the expiration of the Inspection Period, or cause the Inspection Period to be extended.

18

This Contract is executed to be effective as of the date the Title Company acknowledges receipt of this fully executed Contract as indicated by the signature block for the Title Company (the Effective Date).

| SELLER: | PURCHASER: | |||||

| VTCR, LP | ENCORE WIRE CORPORATION | |||||

| By: (Signature) | /s/ Robert J. Holcomb |

By: (Signature) | /s/ Daniel L. Jones | |||

| Name: | Robert J. Holcomb | Name: | Daniel L. Jones | |||

| Title: | Treasurer | Title: | President & CEO | |||

| Tax I.D. No.: | Tax I.D. No.: | 75-2274963 | ||||

| Date of Execution: | 5/15/13 | Date of Execution: | 6.18.2013 | |||

| MADMT, LP | ||||||

| By: (Signature) | /s/ Darrell McCutcheon |

|||||

| Name: | Darrell McCutcheon | |||||

| Title: | 5/15/13 | |||||

| Tax I.D. No.: | ||||||

| Date of Execution: | ||||||

| PRAIRIE FLIGHT, LP | ||||||

| By: (Signature) | /s/ David H. Craig |

|||||

| Name: | David H. Craig | |||||

| Title: | Owner | |||||

| Tax I.D. No.: | ||||||

| Date of Execution: | ||||||

19

| PRINCIPAL BROKER: | COOPERATING BROKER: | |||||

| By: (Signature) | /s/ Jones Lang LaSalle |

By: (Signature) | /s/ Norman R. Medlen | |||

| Name: | Jones Lang LaSalle | Name: | Norman R. Medlen | |||

| Title: | Broker-Tom McElroy | Title: | Broker | |||

| Address: | 8343 Douglas Avenue Dallas, Texas 75225 |

Address: | 2601 Graphic Place or 1329 Millwood Rd., #315 Plano, Texas 75075 or McKinney, Texas 75069 | |||

| Telephone: | 214-438-6189 Fax: | Telephone: | 214-801-4536 Fax: 972-562-3644 | |||

| Email: |

tom.mcelroy@am.jll.com | Email: | n.medlen@encorewire.com | |||

| TREC License No.: | TREC License No.: | 0385718 | ||||

TITLE COMPANY RECEIPT: The Title Company acknowledges receipt of this Contract on (the Effective Date).

Upon receipt of and the Earnest Money, the Title Company accepts the Earnest Money subject to the terms and conditions set forth in this Contract.

TITLE COMPANY:

REUNION TITLE COMPANY

| By: (Signature) |

/s/ Loretta Boddy |

|||||

| Name: |

Loretta Boddy | |||||

| Title: |

Escrow Officer | |||||

| Address: |

1700 Reunion Blvd. | |||||

| Suite 300 | ||||||

| McKinney, Texas 75069 | ||||||

| Telephone: |

214-544-4000 Fax: 214-544-4044 | |||||

| Email: |

lboddy@reuniontitle.com | |||||

PERMISSION TO USE: This form is provided for use by members of the North Texas Commercial Association of Realtors®, Inc. (“NTCAR”) and members of the North Texas Commercial Association of Real Estate Professionals, Inc. Permission is given to make limited copies of the current version of this form for use in a particular Texas real estate transaction. Please contact the NTCAR office to confirm you are using the current version of this form. Mass production, or reproduction for resale, is not allowed without express permission. Any changes to this form must be made in a manner that is obvious. If any words are deleted, they must be left in the form with a line drawn through them. If changes are made that are not obvious, they are not enforceable.

20

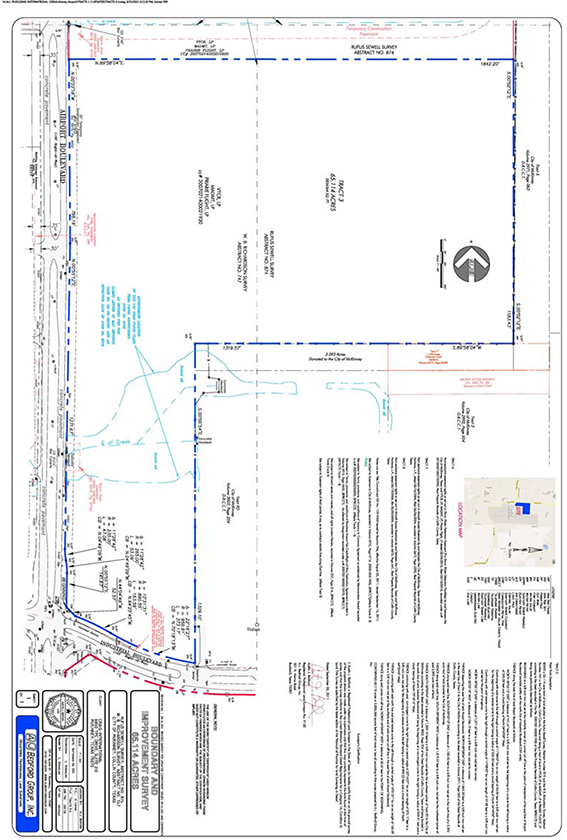

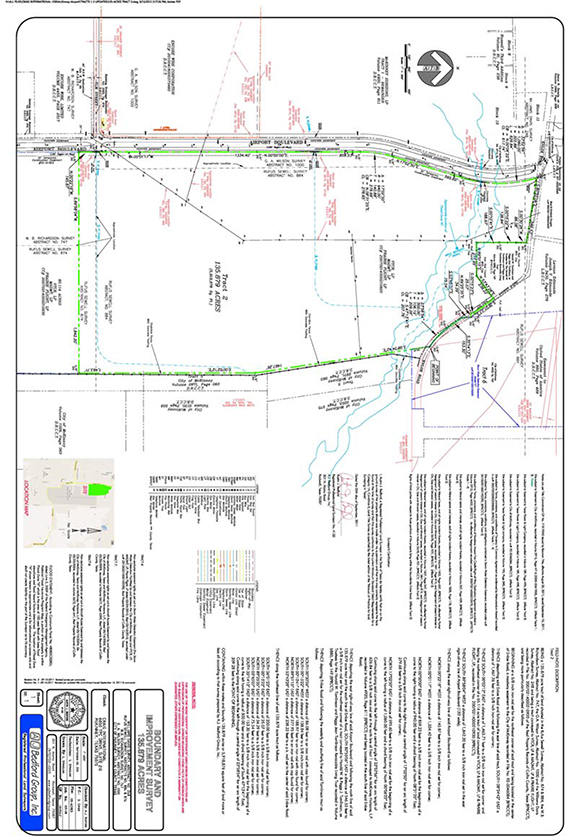

EXHIBIT A

Legal Description

The Property is a portion of two tracts of property containing 200.993 acres, more or less, as shown on the attached Exhibit A-1.

21

EXHIBIT A-1

Survey Plats

22

23

NORTH TEXAS COMMERCIAL ASSOCIATION OF REALTORS®

ADDENDUM C TO COMMERCIAL CONTRACT OF SALE

INSPECTION

Property address or description: Northeast corner of Industrial Blvd. and Airport Road in McKinney, Collin County, Texas

1. Inspection Period. Purchaser will have a period of ten (10) days after the Effective Date (the “Inspection Period”) to inspect the Property and conduct studies regarding the Property. Purchaser’s studies may include, without limitation: (1) permitted use and zoning of the Property; (2) core borings; (3) environmental and architectural tests and investigations; (4) physical inspections of improvements, fixtures, equipment, subsurface soils, structural members, and personal property; and (5) examination of agreements, manuals, plans, specifications and other documents relating to the construction and condition of the Property. Purchaser and Purchaser’s agents, employees, consultants and contractors will have the right of reasonable entry onto the Property during normal business hours, and upon reasonable advance notice to Seller and any tenants on the Property, for purposes of inspections, studies, tests and examinations deemed necessary by Purchaser. The inspections, studies, tests and examinations will be at Purchaser’s expense and risk. Purchaser shall defend and indemnify Seller against any claims that arise due to any actions by Purchaser or Purchaser’s agents, employees, consultants and contractors. Purchaser may also use the Inspection Period to perform feasibility studies, obtain equity funding, seek financing, and satisfy other conditions unrelated to the condition of the Property.

2. Reports.

¨ A. Within days after the Effective Date, Seller shall deliver to Purchaser a written “Phase I” report of an environmental assessment of the Property. The report will be prepared, at Seller’s expense, by an environmental consultant reasonably acceptable to Purchaser. The environmental assessment must include an investigation into the existence of Hazardous Materials (as defined in Section 16A of this Contract) in, on or around the Property. The environmental assessment must also include a land use history search, engineering inspections, research and studies that may be necessary to discover the existence of Hazardous Materials.

x B. Within five (5) days after the Effective Date, Seller shall deliver to Purchaser copies of all reports in Seller’s possession or control of engineering investigations, tests and environmental studies that have been made with respect to the Property within the three year period before the Effective Date.

x C. If Purchaser terminates this Contract, Purchaser shall deliver to Seller, at Purchaser’s expense and contemporaneously with the termination, copies of all written reports, inspections, plats, drawings and studies that relate to the condition of the Property made by Purchaser’s agents, consultants and contractors. This provision will survive the termination of this Contract.

3. Termination. If Purchaser determines, in Purchaser’s sole discretion, no matter how arbitrary, that Purchaser chooses not to purchase the Property for any reason, then Purchaser may terminate this Contract by delivering a written notice to Seller on or before the last day of the Inspection Period, in which case the Earnest Money will be returned to Purchaser. Purchaser’s reason for choosing to terminate this Contract does not need to be related to the condition of the Property, and Purchaser is not required to justify Purchaser’s decision to terminate this Contract.

24

4. Acceptance. If Purchaser does not properly and timely terminate this Contract before the expiration of the Inspection Period (or if Purchaser accepts the Property in writing) then Purchaser will be deemed to have waived all objections to the Property, except for any title objections that may be outstanding pursuant to Section 6 (Review of Survey and Title) of this Contract. In that event, except as may be expressly stated otherwise in this Contract, Purchaser agrees to purchase the Property in its current “AS IS” condition without any further representations of Seller, this Contract will continue in full force and effect, and the parties shall proceed to the Closing. This provision does not, however, limit or invalidate any express representations Seller has made in this Contract.

5. Reimbursement. If Seller defaults and Purchaser does not elect to enforce specific performance of this Contract, then Seller shall reimburse Purchaser for Purchaser’s actual, out-of-pocket expenses paid by Purchaser to independent third parties in connection with this Contract including, but not limited to, reasonable fees and expenses for engineering assessments, environmental assessments, architectural plans, surveys and legal work (but excluding any indirect, punitive or consequential damages, such as a claim for lost profits) in an amount not to exceed $ 0.00 .

6. Restoration. If the transaction described in this Contract does not close through no fault of Seller, and the condition of the Property was altered due to inspections, studies, tests or examinations performed by Purchaser or on Purchaser’s behalf, then Purchaser must restore the Property to its original condition at Purchaser’s expense.

25

ADDENDUM H TO NORTH TEXAS COMMERCIAL ASSOCIATION OF REALTORS COMMERCIAL CONTRACT OF SALE

This Addendum H to North Texas Commercial Association of Realtors Commercial Contract of Sale (“Addendum”) is incorporated into and shall amend and supplement the North Texas Commercial Association of Realtors Commercial Contract of Sale to which it is attached (the “Contract”), between the Seller and the Purchaser concerning the Property. The Seller and Purchaser agree that the following provisions are made a part of the Contract and that if anything contained in this Addendum conflicts with or contradicts any of the terms in the Contract or any other addendum thereto, this Addendum shall control:

1. Defined Terms. All capitalized terms that are defined in the Contract shall have the same meanings in this Addendum that are given to them in the Contract.

2. Rollback Taxes. Seller shall pay when due

all Additional Taxes (defined below) assessed for those years prior to the year in which the Closing is held; Seller and Purchaser shall each pay when due their prorata share of Additional Taxes assessed for the year in which the Closing is held

(the “Closing Year”); and Purchaser shall pay when due all Additional Taxes assessed for those years following the Closing Year. Each party hereto shall indemnify and save the other party harmless from and against all claims,

liabilities, losses, costs and expenses (including attorney’s fees) relating to those Additional Taxes for which it is responsible to pay hereunder. Purchaser shall cause KE Andrews (the “Tax Consultant”) to estimate the amount

of unpaid Additional Taxes attributable to the Property for the five calendar years preceding the Closing Year that would be due and payable on or before January 31 of the year following the Closing if a change in the usage of the Property

occurred after the Closing and prior to the Rollback Date (the “Estimated Rollback Taxes”), and such amount shall be retained from the proceeds paid by Purchaser at the Closing and held in escrow by the Title Company subject to the

terms hereof and pursuant to an escrow agreement reasonably acceptable to Title Company, Purchaser and Seller. Further, Purchaser shall cause the Tax Consultant to estimate the amount of unpaid Additional Taxes attributable to the Property for the

Closing Year that would be due and payable if a change in the usage of the Property occurred after the Closing and prior to the Rollback Date (the “Estimated Market Value Taxes”). Seller’s prorata share of the Estimated Market

Value Taxes shall also be retained from the proceeds paid by Purchaser at the Closing and held in escrow by the Title Company subject to the terms hereof in the same account as the account and pursuant to the same escrow agreement established

hereunder for Estimated Rollback Taxes. At such time or times as the actual liability of Seller is determined with respect to such Additional Taxes and the same are due and payable, the Title Company shall promptly apply the escrowed funds to the

payment of such Additional Taxes, and, after Seller’s liability is finally determined or it is determined that Seller has no liability, any excess funds remaining in such escrow account, plus accrued interest thereon, shall be promptly

withdrawn from escrow and paid to Seller. If additional funds are required to cover Seller’s obligation, Seller shall be obligated to pay such amount to the Title Company on demand by either the Title Company or Purchaser, in which event the

Title Company shall promptly apply such funds to the payment of such Additional Taxes. If a change in use of the Property occurs prior to the Closing, Seller shall provide Purchaser with written notice thereof promptly upon receipt of notice or

rendition thereof from the applicable taxing authority, together with a copy of the applicable assessment or statement from such taxing authority. If a change in use of the Property occurs after the Closing Date, Purchaser shall provide Seller with

written notice thereof promptly upon receipt of notice or rendition thereof from the applicable taxing authority, together with a copy of the applicable assessment or statement from such taxing authority. As used herein, (i) the term

“Additional Taxes” shall mean any ad valorem taxes and personal property taxes, which for the purposes hereof include penalties and interest, becoming due upon Closing or thereafter because of a change in ownership or land usage of

the Property (or any portion thereof) or the loss of a tax exemption, including without limitation rollback taxes, and (ii) the term “Rollback Date” shall mean January 1 of the year following the Closing

3. Impact Fees. At Closing, Seller shall assign to Purchaser any and all Impact Fees (defined below). As used herein,

“Impact Fees” means any amounts due and payable , if any, under that certain Roadway Impact Fee Credit/Right-of-Way Dedication Agreement recorded in Volume 5915, Page 4652, Real Property Records Collin County, Texas (as such

document was affected by Assignment recorded under cc# 20070214000210970, Real Property Records Collin County, Texas), to the extent the same apply to the Property. Such assignment shall be incorporated into the deed executed by Seller at

Closing.

4. Arbitration. Section 18B is hereby deleted from the Contract.

5. Closing. Closing shall occur on or before June 28, 2013 provided Purchaser has had five (5) days prior thereto to review the Title Commitment.

6. Counterparts. This addendum may be executed in one or more counterparts, each of which shall be deemed an original, but all of which, together, shall constitute one and the same instrument.

[signature page follows]

| SELLER: | ||

| VTCR, LP | ||

| By: | /s/ Robert J. Holcomb | |

| Name: | Robert J. Holcomb | |

| Title: | Treasurer | |

| MADMT, LP | ||

| By: | /s/ Darrell McCutcheon | |

| Name: | Darrell McCutcheon | |

| Title: | ||

| PRAIRIE FLIGHT, LP | ||

| By: | /s/ David H. Craig | |

| Name: | David H. Craig | |

| Title: | Owner | |

| PURCHASER: | ||

| ENCORE WIRE CORPORATION | ||

| By: | /s/ Daniel L. Jones | |

| Name: | Daniel L. Jones | |

| Title: | President & CEO 6.18.13 | |