Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PROTECTIVE LIFE CORP | a13-17528_18k.htm |

| EX-99.1 - EX-99.1 - PROTECTIVE LIFE CORP | a13-17528_1ex99d1.htm |

Exhibit 99.2

Draft 7/31/2013

Draft 7/31/2013

Quarterly Financial Highlights

|

(Dollars In Thousands) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

|

6 MOS |

| |||||||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

2012 |

|

2013 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Pre-tax Operating Income (Loss) (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Life Marketing |

|

$ |

30,348 |

|

$ |

28,673 |

|

$ |

15,642 |

|

$ |

23,707 |

|

$ |

24,673 |

|

$ |

60,717 |

|

$ |

48,380 |

|

|

Acquisitions |

|

43,615 |

|

46,155 |

|

42,191 |

|

34,377 |

|

29,435 |

|

82,714 |

|

63,812 |

| |||||||

|

Annuities |

|

28,553 |

|

9,408 |

|

45,348 |

|

43,398 |

|

36,382 |

|

64,336 |

|

79,780 |

| |||||||

|

Stable Value Products |

|

15,958 |

|

13,050 |

|

18,675 |

|

17,844 |

|

22,464 |

|

28,604 |

|

40,308 |

| |||||||

|

Asset Protection |

|

6,479 |

|

4,150 |

|

859 |

|

6,081 |

|

7,384 |

|

11,445 |

|

13,465 |

| |||||||

|

Corporate & Other |

|

(25,397 |

) |

(6,614 |

) |

928 |

|

(18,332 |

) |

(2,483 |

) |

2,483 |

|

(20,815 |

) | |||||||

|

Total Pre-tax Operating Income |

|

$ |

99,556 |

|

$ |

94,822 |

|

$ |

123,643 |

|

$ |

107,075 |

|

$ |

117,855 |

|

$ |

250,299 |

|

$ |

224,930 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Total Assets |

|

$ |

54,195,024 |

|

$ |

55,912,100 |

|

$ |

57,384,672 |

|

$ |

58,573,487 |

|

$ |

58,162,886 |

|

|

|

|

| ||

|

Total Protective Life Corporation’s Shareowners’ Equity |

|

$ |

4,147,234 |

|

$ |

4,565,855 |

|

$ |

4,615,183 |

|

$ |

4,541,292 |

|

$ |

3,837,991 |

|

|

|

|

| ||

|

Total Protective Life Corporation’s Shareowners’ Equity (excluding accumulated other comprehensive income (loss)) (2) |

|

$ |

2,828,898 |

|

$ |

2,849,089 |

|

$ |

2,878,461 |

|

$ |

2,941,969 |

|

$ |

3,036,797 |

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Stock Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Closing Price |

|

$ |

29.41 |

|

$ |

26.21 |

|

$ |

28.58 |

|

$ |

35.80 |

|

$ |

38.41 |

|

|

|

|

| ||

|

Average Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Basic |

|

81,639,756 |

|

80,662,745 |

|

79,652,495 |

|

79,139,392 |

|

79,404,770 |

|

81,985,649 |

|

79,272,814 |

| |||||||

|

Diluted |

|

83,243,703 |

|

82,406,103 |

|

81,339,803 |

|

80,706,744 |

|

81,087,238 |

|

83,583,025 |

|

80,898,042 |

| |||||||

(1) “Pre-tax Operating Income (Loss)” is a non-GAAP financial measure. “Income (loss) Before Income Tax” is a GAAP financial measure to which “Pre-tax Operating Income” may be compared.

See Page 6 for a reconciliation of “Pre-tax Operating Income” to “Income (loss) Before Income Tax”.

(2) “Total Protective Life Corporation’s Shareowners’ equity excluding accumulated other comprehensive income (loss)” is a non-GAAP financial measure. “Total Protective Life Corporation’s Shareowners’ equity” is a GAAP financial measure to which “Total Protective Life Corporation’s Shareowners’ equity excluding accumulated other comprehensive income (loss)” may be compared.

See Page 5 for a reconciliation of “Total Protective Life Corporation’s Shareowners’ equity excluding accumulated other comprehensive income (loss)” to “Total Protective Life Corporation’s Shareowners’ equity”.

Draft 7/31/2013

Financial Strength Ratings as of June 30, 2013

|

|

|

A.M. Best |

|

Fitch |

|

Standard & Poor’s |

|

Moody’s |

|

|

Legal Entity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance companies: |

|

|

|

|

|

|

|

|

|

|

Protective Life Insurance Company |

|

A+ |

|

A |

|

AA- |

|

A2 |

|

|

West Coast Life Insurance Company |

|

A+ |

|

A |

|

AA- |

|

A2 |

|

|

Protective Life and Annuity Insurance Company |

|

A+ |

|

A |

|

AA- |

|

— |

|

|

Lyndon Property Insurance Company |

|

A- |

|

— |

|

— |

|

— |

|

Draft 7/31/2013

Consolidated Statements of Income

|

(Dollars In Thousands) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

|

6 MOS |

| |||||||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

2012 |

|

2013 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Gross premiums and policy fees |

|

$ |

711,429 |

|

$ |

684,939 |

|

$ |

721,605 |

|

$ |

726,847 |

|

$ |

756,331 |

|

$ |

1,407,734 |

|

$ |

1,483,178 |

|

|

Reinsurance ceded |

|

(344,673 |

) |

(321,059 |

) |

(375,546 |

) |

(335,350 |

) |

(390,490 |

) |

(649,231 |

) |

(725,840 |

) | |||||||

|

Net premiums and policy fees |

|

366,756 |

|

363,880 |

|

346,059 |

|

391,497 |

|

365,841 |

|

758,503 |

|

757,338 |

| |||||||

|

Net investment income |

|

456,222 |

|

467,944 |

|

476,045 |

|

457,634 |

|

466,220 |

|

918,343 |

|

923,854 |

| |||||||

|

RIGL - derivatives |

|

(48,268 |

) |

(134,222 |

) |

(26,081 |

) |

7,385 |

|

143,881 |

|

(78,177 |

) |

151,266 |

| |||||||

|

RIGL - all other investments |

|

65,593 |

|

122,555 |

|

7,161 |

|

(4,145 |

) |

(109,978 |

) |

101,319 |

|

(114,123 |

) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

OTTI losses |

|

(13,670 |

) |

(1,676 |

) |

(16,422 |

) |

(1,340 |

) |

(1,789 |

) |

(48,090 |

) |

(3,129 |

) | |||||||

|

Portion recognized in OCI (before taxes) |

|

62 |

|

(6,880 |

) |

(1,536 |

) |

(3,244 |

) |

(2,211 |

) |

15,718 |

|

(5,455 |

) | |||||||

|

Net impairment losses recognized in earnings |

|

(13,608 |

) |

(8,556 |

) |

(17,958 |

) |

(4,584 |

) |

(4,000 |

) |

(32,372 |

) |

(8,584 |

) | |||||||

|

Other income |

|

81,480 |

|

81,190 |

|

84,633 |

|

85,027 |

|

94,392 |

|

192,740 |

|

179,419 |

| |||||||

|

Total revenues |

|

908,175 |

|

892,791 |

|

869,859 |

|

932,814 |

|

956,356 |

|

1,860,356 |

|

1,889,170 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

BENEFITS & EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Benefits and settlement expenses |

|

568,522 |

|

629,945 |

|

537,944 |

|

581,880 |

|

557,866 |

|

1,158,151 |

|

1,139,746 |

| |||||||

|

Amortization of deferred policy acquisition costs and value of business acquired |

|

67,188 |

|

14,011 |

|

65,530 |

|

52,239 |

|

74,946 |

|

124,024 |

|

127,185 |

| |||||||

|

Other operating expenses |

|

124,530 |

|

118,964 |

|

120,406 |

|

138,061 |

|

123,661 |

|

240,785 |

|

261,722 |

| |||||||

|

Interest expense - subsidiaries |

|

6,098 |

|

6,253 |

|

10,336 |

|

11,105 |

|

11,511 |

|

12,207 |

|

22,616 |

| |||||||

|

Interest expense - holding company - other debt |

|

23,298 |

|

23,731 |

|

23,481 |

|

23,434 |

|

22,891 |

|

46,670 |

|

46,325 |

| |||||||

|

Interest expense - holding company - subordinated debt |

|

10,852 |

|

8,901 |

|

8,443 |

|

8,468 |

|

8,468 |

|

20,253 |

|

16,936 |

| |||||||

|

Total benefits and expenses |

|

800,488 |

|

801,805 |

|

766,140 |

|

815,187 |

|

799,343 |

|

1,602,090 |

|

1,614,530 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

INCOME BEFORE INCOME TAX |

|

107,687 |

|

90,986 |

|

103,719 |

|

117,627 |

|

157,013 |

|

258,266 |

|

274,640 |

| |||||||

|

Income tax expense |

|

31,532 |

|

30,506 |

|

36,923 |

|

39,336 |

|

53,814 |

|

83,090 |

|

93,150 |

| |||||||

|

NET INCOME |

|

76,155 |

|

60,480 |

|

66,796 |

|

78,291 |

|

103,199 |

|

175,176 |

|

181,490 |

| |||||||

|

Less: Net income (loss) attributable to noncontrolling interests |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||||||

|

NET INCOME AVAILABLE TO PLC’S COMMON SHAREOWNERS |

|

$ |

76,155 |

|

$ |

60,480 |

|

$ |

66,796 |

|

$ |

78,291 |

|

$ |

103,199 |

|

$ |

175,176 |

|

$ |

181,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

PER SHARE DATA FOR QUARTER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Operating income - diluted (1) |

|

$ |

0.85 |

|

$ |

0.76 |

|

$ |

0.98 |

|

$ |

0.89 |

|

$ |

0.96 |

|

|

|

|

| ||

|

RIGL - derivatives |

|

(0.31 |

) |

(0.98 |

) |

(0.12 |

) |

0.16 |

|

1.27 |

|

|

|

|

| |||||||

|

RIGL - all other investments |

|

0.37 |

|

0.95 |

|

(0.04 |

) |

(0.08 |

) |

(0.96 |

) |

|

|

|

| |||||||

|

Net income available to PLC’s common shareowners-diluted |

|

$ |

0.91 |

|

$ |

0.73 |

|

$ |

0.82 |

|

$ |

0.97 |

|

$ |

1.27 |

|

|

|

|

| ||

|

Average shares outstanding-diluted |

|

83,243,703 |

|

82,406,103 |

|

81,339,803 |

|

80,706,744 |

|

81,087,238 |

|

|

|

|

| |||||||

|

Dividends paid |

|

$ |

0.18 |

|

$ |

0.18 |

|

$ |

0.18 |

|

$ |

0.18 |

|

$ |

0.20 |

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

PER SHARE DATA FOR YTD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Operating income - diluted (1) |

|

$ |

2.04 |

|

$ |

2.80 |

|

$ |

3.78 |

|

$ |

0.89 |

|

$ |

1.84 |

|

|

|

|

| ||

|

RIGL - derivatives |

|

(0.49 |

) |

(1.46 |

) |

(1.59 |

) |

0.16 |

|

1.44 |

|

|

|

|

| |||||||

|

RIGL - all other investments |

|

0.55 |

|

1.49 |

|

1.47 |

|

(0.08 |

) |

(1.04 |

) |

|

|

|

| |||||||

|

Net income available to PLC’s common shareowners - diluted |

|

$ |

2.10 |

|

$ |

2.83 |

|

$ |

3.66 |

|

$ |

0.97 |

|

$ |

2.24 |

|

|

|

|

| ||

|

Average shares outstanding - diluted |

|

83,583,025 |

|

83,187,854 |

|

82,723,016 |

|

80,706,744 |

|

80,898,042 |

|

|

|

|

| |||||||

|

Dividends paid |

|

$ |

0.34 |

|

$ |

0.52 |

|

$ |

0.70 |

|

$ |

0.18 |

|

$ |

0.38 |

|

|

|

|

| ||

(1) “Operating Income” is a non-GAAP financial measure. “Net income available to PLC’s common shareowners” is a GAAP financial measure to which “Operating Income” may be compared.

Draft 7/31/2013

Consolidated Balance Sheets

|

(Dollars In Thousands) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

| |||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

| |||||

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Fixed maturities, at fair value |

|

$ |

28,850,496 |

|

$ |

29,607,238 |

|

$ |

29,787,959 |

|

$ |

30,065,491 |

|

$ |

28,922,966 |

|

|

Fixed maturities, at amortized cost |

|

— |

|

— |

|

300,000 |

|

315,000 |

|

335,000 |

| |||||

|

Equity securities |

|

350,503 |

|

373,552 |

|

411,786 |

|

415,176 |

|

446,518 |

| |||||

|

Mortgage loans |

|

5,203,999 |

|

5,096,080 |

|

4,950,201 |

|

4,835,917 |

|

4,773,709 |

| |||||

|

Investment real estate |

|

20,582 |

|

19,858 |

|

19,816 |

|

18,952 |

|

16,178 |

| |||||

|

Policy loans |

|

870,775 |

|

869,607 |

|

865,391 |

|

862,202 |

|

855,780 |

| |||||

|

Other long-term investments |

|

333,358 |

|

347,065 |

|

361,837 |

|

348,394 |

|

429,987 |

| |||||

|

Long-term investments |

|

35,629,713 |

|

36,313,400 |

|

36,696,990 |

|

36,861,132 |

|

35,780,138 |

| |||||

|

Short-term investments |

|

89,495 |

|

110,684 |

|

217,812 |

|

161,506 |

|

172,011 |

| |||||

|

Total investments |

|

35,719,208 |

|

36,424,084 |

|

36,914,802 |

|

37,022,638 |

|

35,952,149 |

| |||||

|

Cash |

|

219,877 |

|

206,012 |

|

368,801 |

|

275,103 |

|

255,712 |

| |||||

|

Accrued investment income |

|

354,282 |

|

360,024 |

|

357,368 |

|

361,463 |

|

365,483 |

| |||||

|

Accounts and premiums receivable |

|

111,362 |

|

104,037 |

|

85,500 |

|

104,539 |

|

96,819 |

| |||||

|

Reinsurance receivable |

|

5,716,333 |

|

5,753,980 |

|

5,805,401 |

|

5,842,124 |

|

5,832,194 |

| |||||

|

Deferred policy acquisition costs and value of business acquired |

|

3,208,319 |

|

3,208,227 |

|

3,239,519 |

|

3,262,029 |

|

3,414,988 |

| |||||

|

Goodwill |

|

110,110 |

|

109,335 |

|

108,561 |

|

107,786 |

|

107,012 |

| |||||

|

Property and equipment, net |

|

48,307 |

|

48,321 |

|

47,607 |

|

48,590 |

|

49,492 |

| |||||

|

Other assets |

|

164,354 |

|

189,086 |

|

262,052 |

|

272,760 |

|

305,752 |

| |||||

|

Current/Deferred income tax |

|

62,316 |

|

55,518 |

|

30,827 |

|

— |

|

— |

| |||||

|

Assets related to separate accounts |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Variable annuity |

|

7,949,926 |

|

8,895,947 |

|

9,601,417 |

|

10,670,833 |

|

11,162,856 |

| |||||

|

Variable universal life |

|

530,630 |

|

557,529 |

|

562,817 |

|

605,622 |

|

620,429 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

TOTAL ASSETS |

|

$ |

54,195,024 |

|

$ |

55,912,100 |

|

$ |

57,384,672 |

|

$ |

58,573,487 |

|

$ |

58,162,886 |

|

Draft 7/31/2013

Consolidated Balance Sheets - Continued

|

(Dollars In Thousands) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

| |||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Policy liabilities and accruals |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Future policy benefits and claims |

|

$ |

21,165,796 |

|

$ |

21,400,351 |

|

$ |

21,626,386 |

|

$ |

21,793,320 |

|

$ |

21,932,062 |

|

|

Unearned premiums |

|

1,301,537 |

|

1,367,241 |

|

1,396,026 |

|

1,426,496 |

|

1,454,003 |

| |||||

|

Stable value product deposits |

|

2,676,312 |

|

2,328,237 |

|

2,510,559 |

|

2,544,609 |

|

2,579,172 |

| |||||

|

Annuity deposits |

|

10,774,666 |

|

10,751,652 |

|

10,658,463 |

|

10,524,393 |

|

10,509,829 |

| |||||

|

Other policyholders’ funds |

|

539,364 |

|

553,262 |

|

566,985 |

|

569,533 |

|

577,821 |

| |||||

|

Repurchase program borrowings |

|

200,000 |

|

280,000 |

|

150,000 |

|

300,000 |

|

340,000 |

| |||||

|

Other liabilities |

|

1,157,689 |

|

1,306,298 |

|

1,434,604 |

|

1,375,962 |

|

1,225,042 |

| |||||

|

Deferred income taxes |

|

1,430,027 |

|

1,668,885 |

|

1,736,389 |

|

1,690,052 |

|

1,318,175 |

| |||||

|

Income tax payable |

|

— |

|

— |

|

— |

|

4,782 |

|

13 |

| |||||

|

Non-recourse funding obligations |

|

297,000 |

|

297,000 |

|

586,000 |

|

596,000 |

|

604,900 |

| |||||

|

Debt |

|

1,510,000 |

|

1,400,000 |

|

1,400,000 |

|

1,390,000 |

|

1,460,000 |

| |||||

|

Subordinated debt securities |

|

515,593 |

|

540,593 |

|

540,593 |

|

540,593 |

|

540,593 |

| |||||

|

Liabilities related to separate accounts |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Variable annuity |

|

7,949,926 |

|

8,895,947 |

|

9,601,417 |

|

10,670,833 |

|

11,162,856 |

| |||||

|

Variable universal life |

|

530,630 |

|

557,529 |

|

562,817 |

|

605,622 |

|

620,429 |

| |||||

|

TOTAL LIABILITIES |

|

50,048,540 |

|

51,346,995 |

|

52,770,239 |

|

54,032,195 |

|

54,324,895 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

SHAREOWNERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Common stock |

|

44,388 |

|

44,388 |

|

44,388 |

|

44,388 |

|

44,388 |

| |||||

|

Additional paid-in-capital |

|

603,045 |

|

603,083 |

|

606,369 |

|

599,514 |

|

606,523 |

| |||||

|

Treasury stock |

|

(157,412 |

) |

(183,330 |

) |

(209,840 |

) |

(203,698 |

) |

(203,385 |

) | |||||

|

Retained earnings |

|

2,338,877 |

|

2,384,948 |

|

2,437,544 |

|

2,501,765 |

|

2,589,271 |

| |||||

|

Accumulated other comprehensive income (loss) |

|

1,318,336 |

|

1,716,766 |

|

1,736,722 |

|

1,599,323 |

|

801,194 |

| |||||

|

TOTAL PROTECTIVE LIFE CORPORATION’S SHAREOWNERS’ EQUITY |

|

4,147,234 |

|

4,565,855 |

|

4,615,183 |

|

4,541,292 |

|

3,837,991 |

| |||||

|

Noncontrolling interest |

|

(750 |

) |

(750 |

) |

(750 |

) |

— |

|

— |

| |||||

|

TOTAL EQUITY |

|

4,146,484 |

|

4,565,105 |

|

4,614,433 |

|

4,541,292 |

|

3,837,991 |

| |||||

|

TOTAL LIABILITIES AND SHAREOWNERS’ EQUITY |

|

$ |

54,195,024 |

|

$ |

55,912,100 |

|

$ |

57,384,672 |

|

$ |

58,573,487 |

|

$ |

58,162,886 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

PROTECTIVE LIFE CORPORATION’S SHAREOWNERS’ EQUITY PER SHARE |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Total Protective Life Corporation’s Shareowners’ Equity |

|

$ |

51.81 |

|

$ |

57.70 |

|

$ |

59.06 |

|

$ |

57.89 |

|

$ |

48.91 |

|

|

Less: Accumulated other comprehensive income (loss) |

|

16.47 |

|

21.70 |

|

22.22 |

|

20.39 |

|

10.21 |

| |||||

|

Excluding accumulated other comprehensive income (loss) (1) |

|

$ |

35.34 |

|

$ |

36.00 |

|

$ |

36.84 |

|

$ |

37.50 |

|

$ |

38.70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Total Protective Life Corporation’s Shareowners’ Equity |

|

$ |

4,147,234 |

|

$ |

4,565,855 |

|

$ |

4,615,183 |

|

$ |

4,541,292 |

|

$ |

3,837,991 |

|

|

Less: Accumulated other comprehensive income (loss) |

|

1,318,336 |

|

1,716,766 |

|

1,736,722 |

|

1,599,323 |

|

801,194 |

| |||||

|

Total Protective Life Corporation’s Shareowners’ Equity (excluding accumulated other comprehensive income (loss)) (1) |

|

$ |

2,828,898 |

|

$ |

2,849,089 |

|

$ |

2,878,461 |

|

$ |

2,941,969 |

|

$ |

3,036,797 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Common shares outstanding |

|

80,046,258 |

|

79,136,858 |

|

78,137,493 |

|

78,449,071 |

|

78,465,053 |

| |||||

|

Treasury Stock shares |

|

8,730,702 |

|

9,640,102 |

|

10,639,467 |

|

10,327,889 |

|

10,311,907 |

| |||||

(1) “Total Protective Life Corporation’s Shareowners’ equity excluding accumulated other comprehensive income (loss)” is a non-GAAP financial measure. “Total Protective Life Corporation’s Shareowners’ equity” is a GAAP financial measure to which “Total Protective Life Corporation’s Shareowners’ equity excluding accumulated other comprehensive income (loss)” may be compared.

Draft 7/31/2013

Calculation of Operating Earnings Per Share

|

(Dollars In Thousands) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

|

6 MOS |

| |||||||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

2012 |

|

2013 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

CALCULATION OF NET INCOME PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Net income available to PLC’s common shareowners |

|

$ |

76,155 |

|

$ |

60,480 |

|

$ |

66,796 |

|

$ |

78,291 |

|

$ |

103,199 |

|

$ |

175,176 |

|

$ |

181,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Average shares outstanding - basic |

|

81,639,756 |

|

80,662,745 |

|

79,652,495 |

|

79,139,392 |

|

79,404,770 |

|

81,985,649 |

|

79,272,814 |

| |||||||

|

Average shares outstanding - diluted |

|

83,243,703 |

|

82,406,103 |

|

81,339,803 |

|

80,706,744 |

|

81,087,238 |

|

83,583,025 |

|

80,898,042 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Net income available to PLC’s common shareowners per share-basic |

|

$ |

0.93 |

|

$ |

0.75 |

|

$ |

0.84 |

|

$ |

0.99 |

|

$ |

1.30 |

|

$ |

2.14 |

|

$ |

2.29 |

|

|

Net income available to PLC’s common shareowners per share-diluted |

|

$ |

0.91 |

|

$ |

0.73 |

|

$ |

0.82 |

|

$ |

0.97 |

|

$ |

1.27 |

|

$ |

2.10 |

|

$ |

2.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Income from continuing operations |

|

$ |

76,155 |

|

$ |

60,480 |

|

$ |

66,796 |

|

$ |

78,291 |

|

$ |

103,199 |

|

$ |

175,176 |

|

$ |

181,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS (basic) |

|

$ |

0.93 |

|

$ |

0.75 |

|

$ |

0.84 |

|

$ |

0.99 |

|

$ |

1.30 |

|

$ |

2.14 |

|

$ |

2.29 |

|

|

EPS (diluted) |

|

$ |

0.91 |

|

$ |

0.73 |

|

$ |

0.82 |

|

$ |

0.97 |

|

$ |

1.27 |

|

$ |

2.10 |

|

$ |

2.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

CALCULATION OF REALIZED INVESTMENT GAINS (LOSSES) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

RIGL - derivatives |

|

$ |

(48,268 |

) |

$ |

(134,222 |

) |

$ |

(26,081 |

) |

$ |

7,385 |

|

$ |

143,881 |

|

$ |

(78,177 |

) |

$ |

151,266 |

|

|

VA GMWB economic cost |

|

8,355 |

|

9,641 |

|

11,265 |

|

12,923 |

|

14,588 |

|

15,595 |

|

27,511 |

| |||||||

|

RIGL - all other investments |

|

51,985 |

|

113,999 |

|

(10,797 |

) |

(8,729 |

) |

(113,978 |

) |

68,947 |

|

(122,707 |

) | |||||||

|

Related amortization of DAC & VOBA |

|

(3,941 |

) |

6,746 |

|

5,689 |

|

(1,027 |

) |

(5,333 |

) |

1,602 |

|

(6,360 |

) | |||||||

|

|

|

8,131 |

|

(3,836 |

) |

(19,924 |

) |

10,552 |

|

39,158 |

|

7,967 |

|

49,710 |

| |||||||

|

Tax effect |

|

(2,845 |

) |

1,342 |

|

6,974 |

|

(3,693 |

) |

(13,706 |

) |

(2,787 |

) |

(17,399 |

) | |||||||

|

|

|

$ |

5,286 |

|

$ |

(2,494 |

) |

$ |

(12,950 |

) |

$ |

6,859 |

|

$ |

25,452 |

|

$ |

5,180 |

|

$ |

32,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

RIGL - derivatives per share-diluted |

|

$ |

(0.31 |

) |

$ |

(0.98 |

) |

$ |

(0.12 |

) |

$ |

0.16 |

|

$ |

1.27 |

|

$ |

(0.49 |

) |

$ |

1.44 |

|

|

RIGL - all other investments per share-diluted |

|

$ |

0.37 |

|

$ |

0.95 |

|

$ |

(0.04 |

) |

$ |

(0.08 |

) |

$ |

(0.96 |

) |

$ |

0.55 |

|

$ |

(1.04 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

OPERATING INCOME PER SHARE (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Net income available to PLC’s common shareowners per share-diluted |

|

$ |

0.91 |

|

$ |

0.73 |

|

$ |

0.82 |

|

$ |

0.97 |

|

$ |

1.27 |

|

$ |

2.10 |

|

$ |

2.24 |

|

|

Less: RIGL - derivatives per share-diluted |

|

(0.31 |

) |

(0.98 |

) |

(0.12 |

) |

0.16 |

|

1.27 |

|

(0.49 |

) |

1.44 |

| |||||||

|

Less: RIGL - all other investments per share-diluted |

|

0.37 |

|

0.95 |

|

(0.04 |

) |

(0.08 |

) |

(0.96 |

) |

0.55 |

|

(1.04 |

) | |||||||

|

Operating income per share-diluted |

|

$ |

0.85 |

|

$ |

0.76 |

|

$ |

0.98 |

|

$ |

0.89 |

|

$ |

0.96 |

|

$ |

2.04 |

|

$ |

1.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

NET OPERATING INCOME (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Net income available to PLC’s common shareowners |

|

$ |

76,155 |

|

$ |

60,480 |

|

$ |

66,796 |

|

$ |

78,291 |

|

$ |

103,199 |

|

$ |

175,176 |

|

$ |

181,490 |

|

|

Less: RIGL - derivatives net of tax |

|

(25,943 |

) |

(80,978 |

) |

(9,630 |

) |

13,200 |

|

103,004 |

|

(40,678 |

) |

116,204 |

| |||||||

|

Less: RIGL - all other investments net of tax and amortization |

|

31,229 |

|

78,484 |

|

(3,320 |

) |

(6,341 |

) |

(77,552 |

) |

45,858 |

|

(83,893 |

) | |||||||

|

Net operating income |

|

$ |

70,869 |

|

$ |

62,974 |

|

$ |

79,746 |

|

$ |

71,432 |

|

$ |

77,747 |

|

$ |

169,996 |

|

$ |

149,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

PRE-TAX OPERATING INCOME (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Income before income tax and discontinued operations |

|

$ |

107,687 |

|

$ |

90,986 |

|

$ |

103,719 |

|

$ |

117,627 |

|

$ |

157,013 |

|

$ |

258,266 |

|

$ |

274,640 |

|

|

Less: RIGL - derivatives |

|

(48,268 |

) |

(134,222 |

) |

(26,081 |

) |

7,385 |

|

143,881 |

|

(78,177 |

) |

151,266 |

| |||||||

|

Less: VA GMWB economic cost |

|

8,355 |

|

9,641 |

|

11,265 |

|

12,923 |

|

14,588 |

|

15,595 |

|

27,511 |

| |||||||

|

Less: RIGL - all other investments |

|

51,985 |

|

113,999 |

|

(10,797 |

) |

(8,729 |

) |

(113,978 |

) |

68,947 |

|

(122,707 |

) | |||||||

|

Less: Related amortization of DAC & VOBA |

|

(3,941 |

) |

6,746 |

|

5,689 |

|

(1,027 |

) |

(5,333 |

) |

1,602 |

|

(6,360 |

) | |||||||

|

Pre-tax operating income |

|

$ |

99,556 |

|

$ |

94,822 |

|

$ |

123,643 |

|

$ |

107,075 |

|

$ |

117,855 |

|

$ |

250,299 |

|

$ |

224,930 |

|

(1) “Net Operating Income” and “Operating Income Per Share” are non-GAAP financial measures. “Net Income available to PLC’s common shareowners” and “Net Income available to PLC’s common shareowners Per Share” are GAAP financial measures to which “Net Operating Income” and “Operating Income Per Share” may be compared.

(2) “Pre-tax Operating Income” is a non-GAAP financial measure. “Income Before Income Tax” is a GAAP financial measure to which “Pre-tax Operating Income” may be compared.

Draft 7/31/2013

Invested Asset Summary

|

(Dollars In Millions) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

|

|

| |||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Total Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

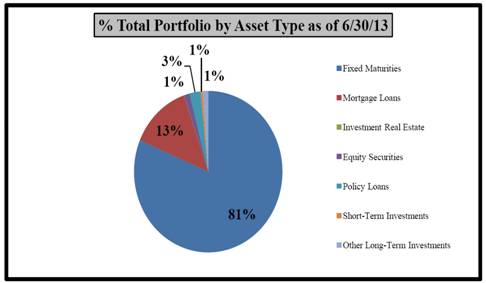

Fixed Maturities |

|

$ |

28,850.5 |

|

$ |

29,607.2 |

|

$ |

30,088.0 |

|

$ |

30,380.5 |

|

$ |

29,258.0 |

|

81 |

% |

|

Mortgage Loans |

|

5,204.0 |

|

5,096.1 |

|

4,950.2 |

|

4,835.9 |

|

4,773.7 |

|

13 |

% | |||||

|

Investment Real Estate |

|

20.6 |

|

19.8 |

|

19.8 |

|

18.9 |

|

16.2 |

|

0 |

% | |||||

|

Equity Securities |

|

350.5 |

|

373.6 |

|

411.8 |

|

415.2 |

|

446.5 |

|

1 |

% | |||||

|

Policy Loans |

|

870.8 |

|

869.6 |

|

865.4 |

|

862.2 |

|

855.8 |

|

3 |

% | |||||

|

Short-Term Investments |

|

89.5 |

|

110.7 |

|

217.8 |

|

161.5 |

|

172.0 |

|

1 |

% | |||||

|

Other Long-Term Investments |

|

333.3 |

|

347.1 |

|

361.8 |

|

348.4 |

|

430.0 |

|

1 |

% | |||||

|

Total Invested Assets |

|

$ |

35,719.2 |

|

$ |

36,424.1 |

|

$ |

36,914.8 |

|

$ |

37,022.6 |

|

$ |

35,952.2 |

|

100 |

% |

Draft 7/31/2013

Invested Asset Summary - Fixed Income

|

(Dollars In Millions) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

|

|

| |||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Fixed Income |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

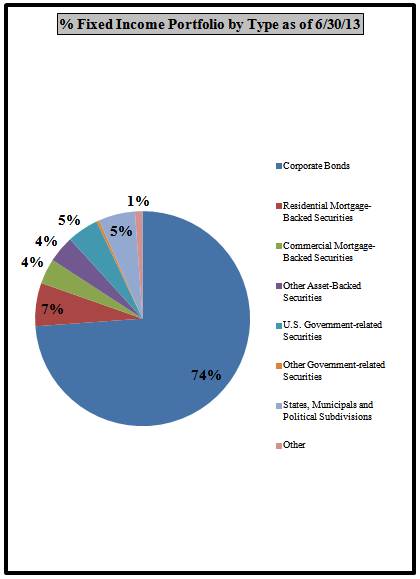

Corporate Bonds |

|

$ |

20,903.8 |

|

$ |

21,580.4 |

|

$ |

22,054.4 |

|

$ |

22,417.5 |

|

$ |

21,610.4 |

|

74 |

% |

|

Residential Mortgage-Backed Securities |

|

2,501.3 |

|

2,393.9 |

|

2,197.1 |

|

2,072.4 |

|

1,907.1 |

|

7 |

% | |||||

|

Commercial Mortgage-Backed Securities |

|

938.0 |

|

1,023.6 |

|

1,040.9 |

|

1,093.2 |

|

1,113.8 |

|

4 |

% | |||||

|

Other Asset-Backed Securities |

|

1,056.3 |

|

1,091.7 |

|

1,133.0 |

|

1,109.0 |

|

1,181.4 |

|

4 |

% | |||||

|

U.S. Government-related Securities |

|

1,629.2 |

|

1,659.9 |

|

1,475.8 |

|

1,503.8 |

|

1,382.5 |

|

5 |

% | |||||

|

Other Government-related Securities |

|

166.3 |

|

160.2 |

|

164.2 |

|

152.2 |

|

122.9 |

|

0 |

% | |||||

|

States, Municipals and Political Subdivisions |

|

1,655.6 |

|

1,697.5 |

|

1,722.6 |

|

1,717.4 |

|

1,604.9 |

|

5 |

% | |||||

|

Other |

|

— |

|

— |

|

300.0 |

|

315.0 |

|

335.0 |

|

1 |

% | |||||

|

Total Fixed Income Portfolio |

|

$ |

28,850.5 |

|

$ |

29,607.2 |

|

$ |

30,088.0 |

|

$ |

30,380.5 |

|

$ |

29,258.0 |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Fixed Income - Quality |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

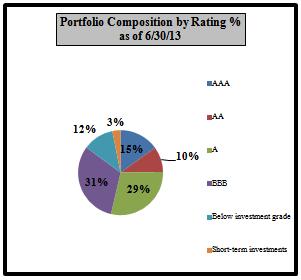

AAA |

|

16.2 |

% |

15.9 |

% |

14.6 |

% |

14.4 |

% |

14.4 |

% |

|

| |||||

|

AA |

|

7.1 |

% |

7.2 |

% |

7.2 |

% |

7.0 |

% |

6.9 |

% |

|

| |||||

|

A |

|

30.3 |

% |

30.8 |

% |

30.8 |

% |

31.5 |

% |

30.9 |

% |

|

| |||||

|

BBB |

|

39.2 |

% |

39.1 |

% |

39.7 |

% |

39.6 |

% |

40.6 |

% |

|

| |||||

|

Below investment grade |

|

7.2 |

% |

7.0 |

% |

6.7 |

% |

6.5 |

% |

6.1 |

% |

|

| |||||

|

Not rated |

|

0.0 |

% |

0.0 |

% |

1.0 |

% |

1.0 |

% |

1.1 |

% |

|

| |||||

|

|

|

100.0 |

% |

100.0 |

% |

100.0 |

% |

100.0 |

% |

100.0 |

% |

|

| |||||

Note: Prior period ratings and investment classifications have been restated to be consistent with current quarter presentation.

Draft 7/31/2013

Fixed Maturities by NAIC Rating

STAT Carry Value % of Total

|

|

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

|

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAIC Rating |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

56.44 |

% |

56.82 |

% |

56.77 |

% |

56.91 |

% |

56.17 |

% |

|

2 |

|

38.58 |

% |

38.16 |

% |

38.52 |

% |

38.74 |

% |

39.67 |

% |

|

3 |

|

3.21 |

% |

3.32 |

% |

3.23 |

% |

3.22 |

% |

3.04 |

% |

|

4 |

|

0.76 |

% |

0.70 |

% |

0.62 |

% |

0.58 |

% |

0.64 |

% |

|

5 |

|

0.94 |

% |

0.91 |

% |

0.70 |

% |

0.46 |

% |

0.39 |

% |

|

6 |

|

0.07 |

% |

0.09 |

% |

0.16 |

% |

0.09 |

% |

0.09 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100.00 |

% |

100.00 |

% |

100.00 |

% |

100.00 |

% |

100.00 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Below investment grade (using NAIC 3-6) |

|

4.98 |

% |

5.02 |

% |

4.71 |

% |

4.35 |

% |

4.16 |

% |

Note: NAIC Ratings reflect statutory carrying values

Draft 7/31/2013

Invested Asset Summary - Mortgages

|

(Dollars In Millions) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

| |||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Mortgage Loans - Type |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

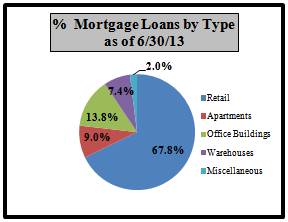

Retail |

|

66.4 |

% |

68.0 |

% |

67.3 |

% |

68.0 |

% |

67.8 |

% | |||||

|

Apartments |

|

10.7 |

% |

8.9 |

% |

9.5 |

% |

8.7 |

% |

9.0 |

% | |||||

|

Office Buildings |

|

13.6 |

% |

13.6 |

% |

13.7 |

% |

13.9 |

% |

13.8 |

% | |||||

|

Warehouses |

|

7.3 |

% |

7.3 |

% |

7.4 |

% |

7.3 |

% |

7.4 |

% | |||||

|

Miscellaneous |

|

2.0 |

% |

2.2 |

% |

2.1 |

% |

2.1 |

% |

2.0 |

% | |||||

|

|

|

100.0 |

% |

100.0 |

% |

100.0 |

% |

100.0 |

% |

100.0 |

% | |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Delinquent Loans & Foreclosed Properties |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

60 Days Past Due |

|

$ |

30.1 |

|

$ |

1.6 |

|

$ |

2.3 |

|

$ |

1.7 |

|

$ |

3.0 |

|

|

90 Days Past Due |

|

11.3 |

|

21.8 |

|

17.2 |

|

19.5 |

|

14.6 |

| |||||

|

Foreclosed Real Estate |

|

2.7 |

|

2.4 |

|

4.4 |

|

— |

|

— |

| |||||

|

|

|

$ |

44.1 |

|

$ |

25.8 |

|

$ |

23.9 |

|

$ |

21.2 |

|

$ |

17.6 |

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

% of Commercial Mortgage Loan Portfolio |

|

0.8 |

% |

0.5 |

% |

0.5 |

% |

0.4 |

% |

0.4 |

% | |||||

(1) Includes $2.2 million of nonperforming loans subject to a pooling and servicing agreement as of June 30, 2013.

Draft 7/31/2013

Invested Asset Summary - Trading Portfolios

|

(Dollars In Millions) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

| |||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Trading Portfolio Composition (excl. Modco Trading Portfolio) |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

| |||||

|

AAA |

|

$ |

1.3 |

|

$ |

0.9 |

|

$ |

0.5 |

|

$ |

0.1 |

|

$ |

— |

|

|

AA |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||||

|

A |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||||

|

BBB |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||||

|

Below investment grade |

|

17.2 |

|

15.4 |

|

14.1 |

|

12.8 |

|

11.0 |

| |||||

|

Total |

|

$ |

18.5 |

|

$ |

16.3 |

|

$ |

14.6 |

|

$ |

12.9 |

|

$ |

11.0 |

|

|

Modco Trading Portfolio |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

| |||||

|

AAA |

|

$ |

605.9 |

|

$ |

590.3 |

|

$ |

559.4 |

|

$ |

546.7 |

|

$ |

440.1 |

|

|

AA |

|

245.5 |

|

267.6 |

|

239.8 |

|

233.2 |

|

286.0 |

| |||||

|

A |

|

799.1 |

|

801.8 |

|

801.6 |

|

828.2 |

|

847.1 |

| |||||

|

BBB |

|

1,037.7 |

|

1,055.4 |

|

1,038.9 |

|

992.5 |

|

922.8 |

| |||||

|

Below investment grade |

|

316.9 |

|

364.5 |

|

353.1 |

|

354.7 |

|

345.5 |

| |||||

|

Short-term investments |

|

43.4 |

|

56.0 |

|

118.9 |

|

110.6 |

|

91.6 |

| |||||

|

Total |

|

$ |

3,048.5 |

|

$ |

3,135.6 |

|

$ |

3,111.7 |

|

$ |

3,065.9 |

|

$ |

2,933.1 |

|

Note: Prior period ratings have been restated to be consistent with current quarter presentation.

Draft 7/31/2013

Invested Asset Summary - MBS - Alt-A

Mortgage-backed Securities Collateralized by Alt-A Mortgage Loans as of June 30, 2013:

|

(Dollars In Millions) |

|

2009 and |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

(Unaudited) |

|

Prior |

|

2010 |

|

2011 |

|

2012 |

|

2013 |

|

Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Fair Value of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

A |

|

$ |

0.8 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

0.8 |

|

|

Below investment grade |

|

425.5 |

|

— |

|

— |

|

— |

|

— |

|

425.5 |

| ||||||

|

Total mortgage-backed securities collateralized by Alt-A mortgage loans |

|

$ |

426.3 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

426.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

A |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

Below investment grade |

|

31.0 |

|

— |

|

— |

|

— |

|

— |

|

31.0 |

| ||||||

|

Total mortgage-backed securities collateralized by Alt-A mortgage loans |

|

$ |

31.0 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

31.0 |

|

Draft 7/31/2013

Invested Asset Summary - MBS - Prime

Mortgage-backed Securities Collateralized by Prime Loans as of June 30, 2013:

|

(Dollars In Millions) |

|

2009 and |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

(Unaudited) |

|

Prior |

|

2010 |

|

2011 |

|

2012 |

|

2013 |

|

Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Fair Value of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

AAA |

|

$ |

389.7 |

|

$ |

318.2 |

|

$ |

328.7 |

|

$ |

5.3 |

|

$ |

46.9 |

|

$ |

1,088.8 |

|

|

AA |

|

0.3 |

|

— |

|

— |

|

— |

|

— |

|

0.3 |

| ||||||

|

A |

|

27.5 |

|

— |

|

— |

|

— |

|

— |

|

27.5 |

| ||||||

|

BBB |

|

6.5 |

|

— |

|

— |

|

— |

|

— |

|

6.5 |

| ||||||

|

Below investment grade |

|

355.3 |

|

— |

|

— |

|

— |

|

— |

|

355.3 |

| ||||||

|

Total mortgage-backed securities collateralized by prime loans |

|

$ |

779.3 |

|

$ |

318.2 |

|

$ |

328.7 |

|

$ |

5.3 |

|

$ |

46.9 |

|

$ |

1,478.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Includes $1.1 billion of agency mortgage backed securities. |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

AAA |

|

$ |

23.4 |

|

$ |

13.3 |

|

$ |

11.7 |

|

$ |

(0.3 |

) |

$ |

(1.0 |

) |

$ |

47.1 |

|

|

AA |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

| ||||||

|

A |

|

0.6 |

|

— |

|

— |

|

— |

|

— |

|

0.6 |

| ||||||

|

BBB |

|

0.7 |

|

— |

|

— |

|

— |

|

— |

|

0.7 |

| ||||||

|

Below investment grade |

|

9.9 |

|

— |

|

— |

|

— |

|

— |

|

9.9 |

| ||||||

|

Total mortgage-backed securities collateralized by prime loans |

|

$ |

34.6 |

|

$ |

13.3 |

|

$ |

11.7 |

|

$ |

(0.3 |

) |

$ |

(1.0 |

) |

$ |

58.3 |

|

Draft 7/31/2013

Invested Asset Summary - CMBS

Commercial Mortgage-backed Securities as of June 30, 2013:

|

(Dollars In Millions) |

|

2009 and |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

(Unaudited) |

|

Prior |

|

2010 |

|

2011 |

|

2012 |

|

2013 |

|

Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Fair Value of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

AAA |

|

$ |

77.6 |

|

$ |

80.7 |

|

$ |

213.6 |

|

$ |

288.5 |

|

$ |

102.5 |

|

$ |

762.9 |

|

|

AA |

|

— |

|

33.2 |

|

37.1 |

|

41.2 |

|

27.8 |

|

139.3 |

| ||||||

|

A |

|

44.4 |

|

33.8 |

|

83.6 |

|

13.6 |

|

19.0 |

|

194.4 |

| ||||||

|

BBB |

|

17.2 |

|

— |

|

— |

|

— |

|

— |

|

17.2 |

| ||||||

|

Total commercial mortgage-backed securities |

|

$ |

139.2 |

|

$ |

147.7 |

|

$ |

334.3 |

|

$ |

343.3 |

|

$ |

149.3 |

|

$ |

1,113.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

AAA |

|

$ |

1.8 |

|

$ |

6.0 |

|

$ |

14.1 |

|

$ |

(11.1 |

) |

$ |

(6.4 |

) |

$ |

4.4 |

|

|

AA |

|

— |

|

1.9 |

|

2.1 |

|

(2.9 |

) |

(2.4 |

) |

(1.3 |

) | ||||||

|

A |

|

1.1 |

|

1.2 |

|

0.1 |

|

(0.7 |

) |

(1.5 |

) |

0.2 |

| ||||||

|

BBB |

|

0.5 |

|

— |

|

— |

|

— |

|

— |

|

0.5 |

| ||||||

|

Total commercial mortgage-backed securities |

|

$ |

3.4 |

|

$ |

9.1 |

|

$ |

16.3 |

|

$ |

(14.7 |

) |

$ |

(10.3 |

) |

$ |

3.8 |

|

Draft 7/31/2013

Invested Asset Summary - ABS(1)

Other Asset-backed Securities(1) as of June 30, 2013:

|

(Dollars In Millions) |

|

2009 and |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

(Unaudited) |

|

Prior |

|

2010 |

|

2011 |

|

2012 |

|

2013 |

|

Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Fair Value of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

AAA |

|

$ |

518.8 |

|

$ |

7.1 |

|

$ |

26.0 |

|

$ |

33.7 |

|

$ |

2.2 |

|

$ |

587.8 |

|

|

AA |

|

169.2 |

|

— |

|

— |

|

63.7 |

|

— |

|

232.9 |

| ||||||

|

A |

|

49.1 |

|

— |

|

72.8 |

|

91.6 |

|

7.7 |

|

221.2 |

| ||||||

|

BBB |

|

3.4 |

|

— |

|

— |

|

— |

|

— |

|

3.4 |

| ||||||

|

Below investment grade |

|

136.1 |

|

— |

|

— |

|

— |

|

— |

|

136.1 |

| ||||||

|

Total other asset-backed securities |

|

$ |

876.6 |

|

$ |

7.1 |

|

$ |

98.8 |

|

$ |

189.0 |

|

$ |

9.9 |

|

$ |

1,181.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Rating |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

AAA |

|

$ |

(16.4 |

) |

$ |

0.1 |

|

$ |

0.9 |

|

$ |

(0.3 |

) |

$ |

(0.1 |

) |

$ |

(15.8 |

) |

|

AA |

|

(7.4 |

) |

— |

|

— |

|

(0.1 |

) |

— |

|

(7.5 |

) | ||||||

|

A |

|

5.2 |

|

— |

|

5.3 |

|

(0.5 |

) |

(0.1 |

) |

9.9 |

| ||||||

|

BBB |

|

(0.1 |

) |

— |

|

— |

|

— |

|

— |

|

(0.1 |

) | ||||||

|

Below investment grade |

|

12.3 |

|

— |

|

— |

|

— |

|

— |

|

12.3 |

| ||||||

|

Total other asset-backed securities |

|

$ |

(6.4 |

) |

$ |

0.1 |

|

$ |

6.2 |

|

$ |

(0.9 |

) |

$ |

(0.2 |

) |

$ |

(1.2 |

) |

(1) Excludes Residential and Commercial mortgage-backed securities

Draft 7/31/2013

Life Marketing Quarterly Trends

|

(Dollars In Thousands) |

|

2ND QTR |

|

3RD QTR |

|

4TH QTR |

|

1ST QTR |

|

2ND QTR |

|

6 MOS |

| |||||||||

|

(Unaudited) |

|

2012 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

2012 |

|

2013 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Gross premiums and policy fees |

|

$ |

397,645 |

|

$ |

379,207 |

|

$ |

410,105 |

|

$ |

418,705 |

|

$ |

442,338 |

|

$ |

785,762 |

|

$ |

861,043 |

|

|

Reinsurance ceded |

|

(209,803 |

) |

(190,099 |

) |

(239,056 |

) |

(207,662 |

) |

(255,180 |

) |

(402,558 |

) |

(462,842 |

) | |||||||

|

Net premiums and policy fees |

|

187,842 |

|

189,108 |

|

171,049 |

|

211,043 |

|

187,158 |

|

383,204 |

|

398,201 |

| |||||||

|

Net investment income |

|

121,283 |

|

123,647 |

|

122,507 |

|

127,248 |

|

130,054 |

|

240,309 |

|

257,302 |

| |||||||

|

Other income |

|

29,966 |

|

28,280 |

|

29,709 |

|

29,335 |

|

29,809 |

|

59,120 |

|

59,144 |

| |||||||

|