Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No.1 To

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

Commission File No. 000-54024

ONE2ONE LIVING CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-4281128

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

3585 North Courtenay Parkway, Suite 5

Merritt Island, Florida 32953

(Address of principal executive offices, zip code)

(877) 407-9797

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year,

if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|

(Do not check if a smaller

|

|||

|

reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

At June 30, 2012, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $7,980,000. At April 15, 2013, there were 212,500,100 shares of the Registrant’s common stock, par value $0.001 per share, outstanding. At December 31, 2012, the end of the Registrant’s most recently completed fiscal year, there were 212,500,100 shares of the Registrant’s common stock, par value $0.001 per share, outstanding.

Explanatory Note: The purpose of this Amendment No. 1 to the Annual Report on Form 10-K of One2One Living Corporation, a Nevada corporation (the “Company”), is to indicate on the facing sheet hereof that the Company is required to file reports pursuant to Section 13 or 15(d) of the Act.

ONE2ONE LIVING CORPORATION

TABLE OF CONTENTS

|

Page No.

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

17

|

|

Item 1B.

|

Unresolved Staff Comments

|

17

|

|

Item 2.

|

Properties

|

17

|

|

Item 3.

|

Legal Proceedings

|

17

|

|

Item 4.

|

Mine Safety Disclosures

|

17

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

18

|

|

Item 6.

|

Selected Financial Data

|

18

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

19

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

26

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

27

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

28

|

|

Item 9A.

|

Controls and Procedures

|

28

|

|

Item 9B.

|

Other Information

|

29

|

|

Part III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

29

|

|

Item 11.

|

Executive Compensation

|

31

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

32

|

|

Certain Relationships and Related Transactions, and Director Independence

|

33

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

33

|

|

Part IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

33

|

|

Signatures

|

34

|

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of One2One Living Corporation, a Nevada corporation, contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results.

Our management has included projections and estimates in this Form 10-K, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

All references in this Form 10-K to the “Company”, “One2One Living Corporation”, “One2One Living,” “One2One,” “we”, “us,” or “our” are to One2One Living Corporation.

PART I

|

ITEM 1.

|

BUSINESS

|

Our Corporate History and Background

We were incorporated as Jinmimi Network Inc. on November 13, 2008 in the State of Nevada. From inception until we completed our reverse acquisition of One2One Florida, the principal business of the Company was to provide online financial and listed company data and information mainly through online forums. With a network of localized web sites targeting China and overseas Chinese persons, the Company provided forum-based products and services such as blogs and discussion board through an on-line forum titled, “Jinmimi Financial Forum.”

Reverse Acquisition of One2One Florida

On December 31, 2012, we completed a reverse acquisition transaction through a reverse-triangular merger with One2One Florida whereby issued 100 shares of Series A Preferred Stock and 34,000,000 shares of Series B Preferred Stock of the Company and in consideration for all the issued and outstanding shares in One2One Florida. Each share of Series A Preferred Stock is convertible into one share of common stock of the Company and requires the consent of the majority of the holders of Series A Preferred Stock to change the composition of the board of directors or President and Chief Executive Officer of the Company, change the Articles of Incorporation or Bylaws of the Company, or engage in merger, sale of assets, share exchange or other reorganization of the Company. Each share of Series B Preferred Stock is convertible into 5 shares of common stock and equal to 100 votes of common stock of the Company. The effect of the issuance is that One2One Florida shareholders now hold approximately 80.0% of the issued and outstanding shares of common stock of the Company. As a result of the transactions contemplated by the Agreement and Plan of Merger, One2One Florida became a wholly-owned subsidiary of the Company.

The merger transaction with One2One Florida was treated as a reverse acquisition, with One2One Florida as the acquiror and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this Form 8-K to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of One2One Florida.

3

In connection with the merger, Mary Spio has agreed pursuant to a Lockup and Shareholder Agreement dated December 12, 2012, by and between the Company and Ms. Spio, not to sell, assign, transfer, pledge, hypothecate or otherwise dispose of or transfer any of the Series A Preferred Stock or Series B Preferred Stock, or their respective underlying shares of common stock, Ms. Spio received from the Company until June 12, 2013.

The Lockup and Shareholder Agreement also provides that so long as any shares of common stock of the Company issued and outstanding on December 12, 2012, are held by such holder of common stock prior to June 12, 2013, the Company or One2One Florida shall not, without first obtaining the approval (by vote or written consent, as provided by law) of such of common stock of Parent on December 12, 2012:

|

(a)

|

amend the Articles of Incorporation or Bylaws of the Company or One2One Florida;

|

|

(b)

|

change or modify the rights, preferences or other terms of the any securities of the Company or One2One Florida, or increase or decrease the number of authorized shares or other securities of the Company or One2One Florida;

|

|

(c)

|

effect any forward or reverse split of any issued or outstanding securities of the Company or One2One Florida or otherwise reclassify or recapitalize any outstanding equity securities;

|

|

(d)

|

authorize or issue, or undertake an obligation to authorize or issue, any equity securities (or any debt securities convertible into or exercisable for any equity securities), except that the Company may issue that number of shares of common stock equal to seven percent (7%) of the issued and outstanding number of shares of common stock of the parent immediately after consummation of the Merger and issuance of the Merger Shares pursuant to the Merger;

|

|

(e)

|

authorize or effect any transaction constituting a Liquidation Event (as defined in this subparagraph) under the Articles, or any other merger or consolidation of the Company or One2One Florida. For purposes of the Lockup and Shareholder Agreement, a “Liquidation Event” shall mean: (1) the closing of the sale, transfer or other disposition of all or substantially all of the Company’s or One2One Florida’s assets (including an irrevocable or exclusive license with respect to all or substantially all of the Company’s or One2One Florida’s intellectual property); (2) the consummation of a merger, share exchange or consolidation with or into any other corporation, limited liability company or other entity, (3) authorize or effect any transaction liquidation, dissolution or winding up of the Company or One2One Florida, either voluntary or involuntary, provided, however, that none of the following shall be considered a Deemed Liquidation: (i) a merger effected exclusively for the purpose of changing the domicile of the Company or One2One Florida, or (ii) the Merger itself;

|

|

(f)

|

declare or pay any dividends or make any other distribution with respect to any class or series of capital stock;

|

|

(g)

|

redeem, repurchase or otherwise acquire (or pay into or set aside for a sinking fund for such purpose) any outstanding shares of capital stock (other than the repurchase of shares of common stock from employees, consultants or other service providers pursuant to agreements approved by the Board of Directors under which the Company or One2One Florida has the option to repurchase such shares at no greater than original cost upon the occurrence of certain events, such as the termination of employment);

|

|

(h)

|

amend any stock option plan of the Company or One2One Florida, if any (other than amendments that do not require approval of the stockholders under the terms of the plan or applicable law) or approve any new equity incentive plan; or

|

|

(i)

|

transfer assets to any subsidiary or other affiliated entity.

|

Organization & Subsidiaries

We have one operating subsidiary, One2One Florida.

4

Overview of One2One Florida

Through our wholly owned subsidiary, we are an online and mobile social community that provides single men and women what we believe is an easy and efficient way to meet people, connect and find lifestyle resources such as local events, singles-friendly venues and travel. Our mission is to connect single men and women through shared interests and the things they like to do. The One2One software provides a lifestyle optimized search engine designed to easily discover or find people, places, events, activities and things to do for singles. One2One Florida was established on July 13, 2011 and currently operating in Merritt Island, Florida.

One2One Florida had no revenues for the period from July 13, 2011 (Inception) to the fiscal year ended December 31, 2011, no revenues for the nine months ended December 31, 2012. One2One Florida’s net loss was $1,257,465 for the period from July 13, 2011 (Inception) to the period ended December 31, 2012.

One2One connects singles to each other and the things that they care about. It is a dynamic environment for single men and women to discover, create, and share experiences, events and activities. One2One addresses the frustration of finding people to do the things they hate to do alone.

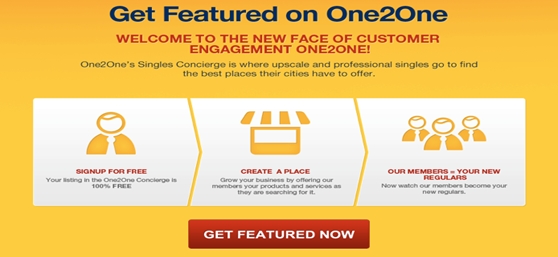

One2One strives to be a central destination for finding many of the things single men and women care about and meeting people at the same time. It addresses the frustration of having to sift through millions of websites in an effort to find an event, activity and for that matter people to do those things with. One2One’s featured listings allows venue owners and event promoters to highlight their venue or event on a local or national level, thereby gain exposure within their target audience.

One2One is redefining the singles lifestyle with an entirely new and current way to enjoy the journey to finding love with various fun, appealing, and interactive features.

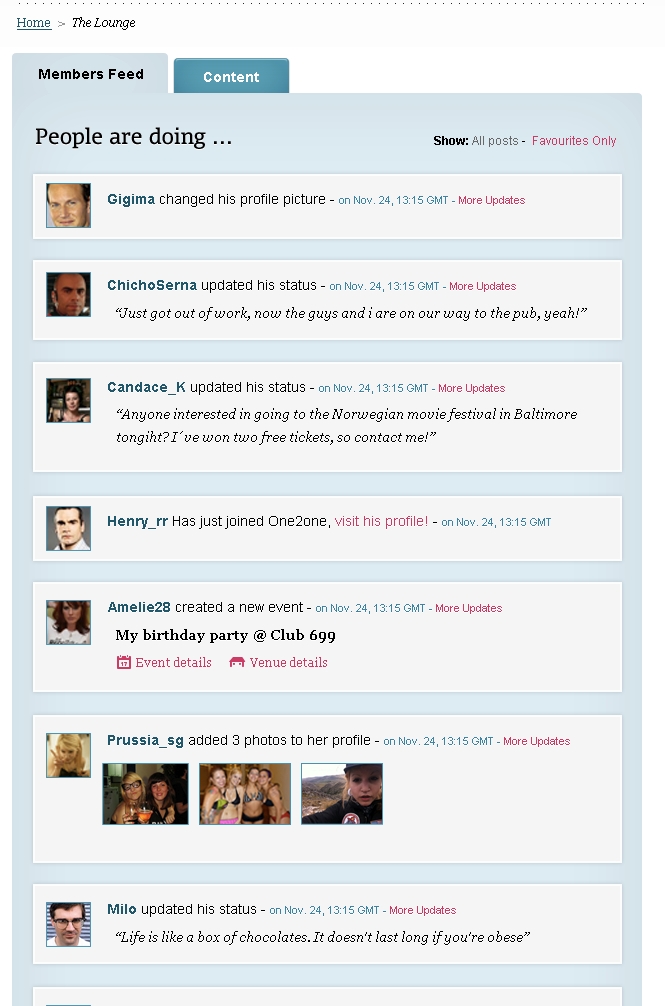

One2One’s Lounge is a fun virtual hangout unlike any other. It’s the place to share what’s on one’s mind, join in the conversation, people watch and spontaneous interactions.

The One2One proprietary find-match algorithm, and social optimization engine is overlaid with Facebook, thus takes one’s social interactions into account in finding them the best possible compatible matches and helping them meet people that they have a lot in common with.

In keeping with One2One’s commitment to make life as enjoyable as possible, One2One is launching a Single Friendly Venue (SFV) campaign to find venues that are singles friendly to include in its recommendation engine. Venues with the One2One SFV decal will be reviewed, rated, and recommended by One2One editors.

The Problem

One2One believes that there has been a massive cultural shift in consumer behavior and expectations due to social media. Consumers today expect more from businesses. In a social media economy consumers pay for experiences and today’s dater craves a dynamic dating service and community that sparks ‘spontaneous and natural interactions’ not a static product that’s more like a fulltime job. Dating websites today are a collection of millions of profiles that users have to search through to find the ‘one’. Even matchmaking sites like eHarmony require users to complete long questionnaires and then users are sent candidates that the matchmaking site considers suitable. Online daters tend to be busy professionals who find this approach to be impersonal, frustrating and time consuming.

Singles are active and require their social lives be as well. By applying social media functionality and mobile phone convenience One2One is humanizing the online dating experience. Mobile phones offer a personal, convenient way for singles to meet prospective dates while naturally interacting with their environment, it also serves as a fun tool for quickly browsing through millions of profiles. Mobile dating presents a massive opportunity to engage and market to daters in an entirely new way.

A major problem with online dating is “truth in dating”. Many singles misrepresent who they are online. Outdated and manipulated images seem to be a major culprit. With One2One’s mobile app, daters can easily upload images and videos via their mobile phones to their web and mobile profiles.

5

Online daters often can’t gauge chemistry through images and email exchanges alone. Investing energy and time into someone only to discover when they meet in real life that there is no chemistry. By enabling video profiles, being events/activities-driven and incorporating instantaneous interactions through dynamic updates, One2One creates a more natural environment that’s less susceptible to time-wasting.

Currently there is no software that offers singles dating, socializing and lifestyle resources in one community. Singles are not only looking for the tools to find a mate, they also seek the ability to lead fulfilling lives by attending events, travelling and doing so much more but they do not want to do these things alone.

Top 10 Things Singles Hate to Do Alone

|

1.

|

Dinning Out

|

|

|

2.

|

Travelling

|

|

|

3.

|

Movies

|

|

|

4.

|

Concerts / Live Events/Sporting Event

|

|

|

5.

|

Museums

|

|

|

6.

|

Playing Sports (Golfing)

|

|

|

7.

|

Bar

|

|

|

8.

|

Hiking

|

|

|

9.

|

Exercising

|

|

|

10.

|

Hanging Out

|

Businesses can generate additional streams of revenue from this untapped market by reaching out to Singles via One2One. A Win- Win for both – Singles can discover fun things to spend money that they otherwise wouldn’t if they have to do these things alone.

The Solution

One2One is a social mobile application and web community that provides singles an effective and easy way to connect, date and find lifestyle resources such as local events and travel.

One2One offers a dynamic environment for singles to find a potential mate along with the relevant tools and information that singles are seeking. One2One’s social community and discovery tools combine interactivity and the convenience of mobile phones to create a dynamic real-time experience that leads to natural, spontaneous interactions and conversations for daters.

One2One is creating a cultural shift with the Single Friendly Venue Certification.

6

|

|

The Opportunity

America has gone from being ‘Married with Children’ to being ‘Home Alone.’ According to the 2010 Census married couples have dropped below half of all American households for the first time. This is a drastic departure from the 1950’s when 78 percent of households were occupied by married couples. Today online dating is ‘mainstream’ with many singles having at least one online dating account. The Economist (Dec 29th 2010) estimates the online dating industry is now valued at $3 - $4 billion dollars worldwide. Online Personals Watch puts the North American Market at $1.3 Billion. The Average Subscription Cost (ASC) is $35 monthly, with the average dater spending $239 a year. Singles go online more often than the general public, and they are in constant search for resources that will enrich their lives. According to online dating industry leader Match.com 64% of online daters say common interests are the most important factor in finding a potential partner online.

According to mobile research group Ground Truth, mobile dating saw a 92% increase in users in 2010. The average user of a mobile phone spends 12 minutes and 44 seconds on mobile dating sites per week. Juniper Media Metrix estimates that the overall mobile dating sector will grow to $1.4 billion worldwide by 2013. One2One combines the reach of online dating with the ease and convenience of mobile apps to give singles an easy way to enjoy life while searching for their perfect mate.

7

Competition and Competitive Advantage

The Online dating and personals industry is a highly competitive industry. More recently there is competition from social media sites where people can connect for free. While these sites infringe on the periphery, most daters value their privacy and do not feel comfortable scouting for candidates openly or with unverified candidates. Secondly most social network only allow you to connect to people you already know.

Mobile & Social dating however currently has few contenders. Match.com, eHarmony, Yahoo! Personals and Spark Network (Parent of JDate.com) dominate the online dating market. Some of these sites have created mobile versions of their website, but none of them offer the functionality and enhanced experience that One2One provides. We believe that at some point our application and content could be extended for licensing to other dating sites and even search engines.

The One2One Application is also deeply integrated with Facebook, making it extremely easy for people to join and have a completed profile with a simple click.

Zoosk, MeetMoi, OkCupid Mobile and Grindr/Blendr are location based mobile dating applications. Grindr is for gay men. MeetMoi is a mobile dating application, and Zoosk is the fastest growing online and mobile application for that targets a younger 18 – 24 demographic. Many of these apps have developed racy reputations because of highly limited features, they only show a user’s profile picture, location and blip. One2One avoids this problem by having enhanced features including longer profile descriptions, events, content cross platform functionality and security filters that allows users to chose to disclose or obscure their location. Combined this will create an optimal user experience and mainstream appeal.

We believe that there currently there is no clear mobile dating leader. No portable application exists today that offers the features and functionality that One2One Offers. One2One is the first clearly definable social web and mobile community for singles. One2One is quickly emerging as a market leader for singles resources; already ranking #1 in Google, Yahoo and Bing for terms such as “magazine for single women”, “ things to do for Singles” and much more.

“One2One Living provides the perfect venue to help singles navigate the often difficult world of dating.” –Dr. John Gray, Author of Men are From Mars.

Competitive Advantage

Key factors for competing in this environment include gaining member loyalty, ease-of-use and convenience, security and reaching critical mass. Being first to prominently establish leadership in the minds of the user for social singles community and mobile dating will allow us to acquire members at a fraction of the cost as our competitors. Our entry approach is capitalizing on our celebrity relationships, which provides One2One a reach to over 100 fans on Facebook.

Offering a Facebook App that allows people to find friends of friends and co-workers to date and do fun things with; promotes social sharing and ultimately an exponential/viral and organic growth of the One2One Application

One2One’s easy fun enjoyable approach will create high acceptance and trust even within groups who are wary of online dating. These groups are less limited by geography and more focused on shared experiences and ideals, which will enable us to reach critical mass faster than serving the general market.

One2One has the following competitive advantages:

|

●

|

Teaming up with celebrities and other personalities with large fan base f more than 100 Million, this is as good as word of mouth from a trusted friend - offers credibility that most new sites don’t have. This is a new untapped channel that will create multiplication of value for every $1 spent.

|

|

●

|

Not just another dating website – One2One offers real value and convenience by offering users a means to find highly customized events and activities that fills an unmet need for singles to find others to do fun things they enjoy.

|

8

|

●

|

Social Commerce Platform for easy and well integrated virtual and real goods

|

|

●

|

Authoring tools for generating dynamic user and professional content - well positioned for rapid growth to capture market share and drive advertising sales.

|

|

●

|

Team with high domain expertise and success track record. One2One draws from industry professionals who with experience and strong execution credentials.

|

|

●

|

A business model that has proven successful in the industry.

|

|

●

|

Content Management System and Proprietary Matching Engine which leverages Search Engine Optimization to drive traffic while giving user optimized experience.

|

The combination of the Company’s products and services gives it a competitive advantage over other providers because it is a “one stop shop” for singles.

The Model

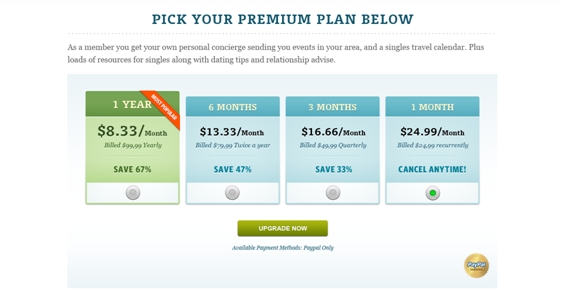

One2One’s communities are free to join; members have to pay monthly subscription fees in order to initiate any form of communication with other members. For example only premium paying members can see event attendees. All Site visitors have to register in order to access the site.

|

●

|

One2One’s online dating subscription costs $24.99 monthly with special discounts for signing up for various plans. One2One will also generate revenue from advertising sales, featured business listing and sales of virtual and real goods.

|

|

●

|

Users can also purchase and share virtual gifts such as music, flowers, jewelry and much more.

|

|

●

|

Mobile advertising and sponsorship opportunities are available. Businesses can pay premium monthly fees for their venues or events to be featured in the offline push to members.

|

9

History and Background

One2One started as a publication with resources for singles. The database grew to 98,000 subscribers (mainly free subs) in a very short period of time with sites like Match.com, WebDates and JDate offering the magazine’s content on a licensing basis to their members.

One2One is a culmination of the founder’s vision for what dater’s want from their dating service. She has worked with both traditional and nontraditional dating services helping them increase customer engagement and sales. One2One Magazine’s intimate understanding of consumer-specific behaviors made it the “go-to” source and purveyor of information on the singles market with commentary and features on Oprah, USA Today, Washington Post, MSNBC, Los Angeles Times, Miami Herald, Women’s Wall Street, Guardian UK, The O’Reilly Factor, The Fine Living Network and much more. In 2004, One2One Magazine partnered with ABC’s The Bachelor in helping the series find contestants for the show as well increasing viewership with the singles demographic. One2One’s mobile application will leverage these relationships. One2One’s personalized targeted experience and offering is based on user feedback from thousands of singles.

10

The Market

We believe that the United States has more single adults than any other nation in the world except for China and India. Our research indicates that the total number of singles in the U.S. surpasses that of the total national population of all except 11 of the world’s 192 nations. There are over 112 million single Americans, 41% of all adults are single. Single adults head up about 48.3 percent of the nation’s households, and make up 42 percent of the nation’s full-time workforce.

Delaying age of marriage, increased incidence of cohabitation and high divorce rates have created a cultural shift that is shaping new and emerging markets; requiring that marketers rethink their processes and approach. The social influence, distinctive characteristics and wallet full of discretionary income, make it necessary that businesses find means of reaching singles uniquely.

The singles lifestyle is not limited to nightclubs and online dating. Singles are looking for resources and information to help them live happier healthier lives. They desire satisfying relationships, personal growth, success, group activities, and ways to cultivate meaningful relationships. Currently there is no central place to find deals and events specifically for singles. Singles are often apprehensive of going to places alone, with One2One’s application and website not only can singles find local events on their phones, they can also see profiles of other event attendees; this motivates them to do the things they love to do without the fear of doing it alone.

The increasing popularity of dating services should come as no surprise. They’re a result of sweeping demographic change in our society. Career demands, hectic lifestyles and the changing role of women in the workplace have created a need for different ways to find and select a mate. Dating is not a trend or a fad, it’s an evergreen necessity. Chadwick Martin Bailey Research indicates that in 2010, 17% of couples who married met on a dating site, online dating has become an integral part of everyday life.

Our Products

One2One’s application is a cross platform tool that allows singles to find each other. Interested users can easily register on via web or mobile phones. The app provides search through individual search terms, matching. In addition location-based criteria enables highly targeted search results. Results are displayed in list views, which show relevant single data at a glance and can be sorted per distance, matching or online status.

11

The powerful instant messenger lets users anonymously chat with each other. The chat bundles are a revenue source for One2One, as users have to purchase packages in order to use the anonymous chat feature.

One2One offers various unique features such as a flirtwall, photowall, events, video newsfeed, conversation feed and virtual gift shop where users can buy and send others virtual or real gifts such as music.

The Flirtwall allows members to quickly get in touch and show others their interest. The Photowall displays all recently posted photos from all members or can be filtered to show only photos of those meeting specific criteria. The events feed features events, activities and deals from local businesses, who can pay for featured positions and the offline push.

12

Events are shown in list, map and event detail views. Users can RSVP to attend events, buy event tickets (Where applicable) see who else is attending, as well share the information on their Facebook or Twitter and forward it via mail to friends. Our video store feature free and premium content including relationship advice, dating tips and much more.

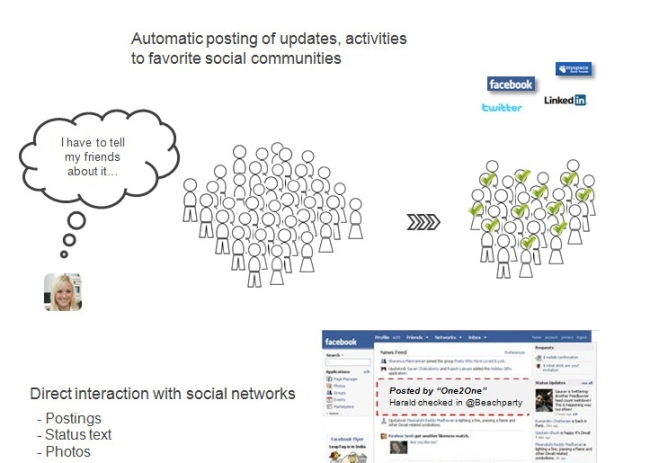

13

All aspects of our application from signing up with FB Connect to flirts and voting are easily shared. It’s all done by the application with simple user clicks. Interactions like comments, votes, event attendances, posts, status texts updates etc. can be broadcasted to user’s Facebook and Twitter walls. Each activity promotes the application and website with a logo, title and direct download link to the application.

14

One2One features an advertising module for serving and monitoring ads online and on the mobile app. eCommerce is via in-app payments offered by the respective app stores or mobile platform operators. One2One provides an overall great user experience with interactive map views and offline push notification enabling users to always be “in” the application if when the application is off.

Our simple and clean design is based on providing an optimal and enjoyable personal experience. Features such as Photo and Flirt Walls will increase our member interactions and ultimately result in greater conversion rates.

One2One’s technology comprises of a cloud-based content management and matchmaking software. We have a network structure that is designed to ensure reliable performance, high security and scalability in a cost-effective manner. The architecture is based on a robust SEO framework that makes our content easily discoverable by the search engines. We believe this new architecture will enable us to grow our site traffic rapidly.

Use of open technology for fast feature addition to capitalize on trends faster than competitors. Engagement Based Optimization, collaborative features, social syndication, activity & newsfeeds keep members engaged.

Market Size and Market Need

In 2010 17% of couples who married met on a dating site (Chadwick Martin Bailey). In a digital age online and mobile dating are a necessity for most singles. The online dating industry is now valued at $4 billion worldwide. According to mobile research group Ground Truth, mobile dating saw a 92% increase in users in 2010. Juniper Media Metrix estimates that the overall mobile dating sector will grow to $1.4 billion worldwide by 2013.

We believe the consumer demand for accessing content and daters on and offline easily will drive our network to grow quickly. This demand is expected to create demand for the Company’s offering.

Business Strategy

Business Model

One2One has 3 primary planned areas of revenue

|

●

|

Customer Subscription

|

|

●

|

Advertising, Featured Business & Events Listings

|

|

●

|

Social Commerce

|

15

Marketing and Advertising

Marketing Plan

Content Strategies: Organic Community Growth through Search Engine Optimized Content and Social Media

One2One’s authoring tools for generating dynamic user and professional content, Just In Time Content generated by our staff writers based on high KEI (Keyword Effectiveness Index) i.e. keywords with high volume and low competition will drive targeted traffic to One2One.

One2One’s Dating Service Professionals Directory – Directory of service providers such as Dating Coaches, Book Authors, Nightclubs, Gyms, Restaurants etc that offer their services to the singles demographic. This content will provide value, drive traffic as well as drive sponsorship and advertising revenue.

One2One plans on creating a massive evergreen video and text library which can be syndicated socially and to other portals such as radio and TV Station affiliate sites. Content companies are in very high demand and One2One has an untapped high demand niche.

Gaining new members through content will be extremely effective since it targets our audience when they are most attentive to our messaging. These are people who have taken the time to perform searches for specific terms, an organic match for One2One. One2One starting to get ranked highly for relevant keywords.

Through discussions and social media pushes, One2One members will be provided with the tools needed to evangelize our message.

SMS and In- App Marketing

SMS and In-App Marketing is a great way to promoteOne2One to millions of iPhone, Android and iPod touch users. Using this unique, cost-effective advertising program, One2One can reach the right audience to drive more targeted download.

Marketing to Niche Groups or Tribes

We believe that singles are more likely gravitate towards those with common values, beliefs and cultural influences. Targeted communities enjoy greater member loyalty.

Targeted Remnant Media

Remnant Advertising TV & Radio

Public Relations

Public Relations will be utilized to create public awareness for One2One. One2One has relationships with various media outlets for such purpose.

Event Marketing

Aerial Advertising will be used to target large crowds at large outdoor events and outings. We can reach crowds of 100,000 plus and more at sporting events, concerts, fairs and on the beach. This is a cost effective means reach a captive audience when they’re outside and relaxed. Our messaging will provoke curiosity and interactivity.

Affiliate Programs

One2One plans to create an affiliate program to access tens of thousands of publishers who promote dating products on a pay for performance basis.

16

Intellectual Property

We rely on a combination of trademark laws, trade secrets, confidentiality provisions and other contractual provisions to protect our proprietary rights, which are primarily our brand names, product designs and marks. We do not own patents.

Government Regulation and Approvals

We are not aware of any governmental regulations or approvals for any of our products.

Employees

As of the date hereof, we have 1 employee, Mary Spio, who works full-time.

DESCRIPTION OF PROPERTIES

We do not own any real estate or other physical properties material to our operations. We operate from leased space. Our executive offices are located at 3585 North Courtenay Parkway, Suite 5, Merritt Island, Florida 32953.

LEGAL PROCEEDINGS

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or stockholder is a party adverse to the Company or has a material interest adverse to the Company.

|

ITEM 1A.

|

RISK FACTORS

|

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

|

ITEM 2.

|

PROPERTIES

|

Our current business address is 3585 North Courtenay Parkway, Suite 5, Merritt Island, Florida 32953.

We are not currently involved in any legal proceedings and we are not aware of any pending or potential legal actions.

|

ITEM 4.

|

MINE SAFETY DISCLOSURES.

|

17

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS MARKET INFORMATION

|

Since June 4, 2012, our shares of common stock have been quoted on the OTC Bulletin Board and the OTCQB tier of the OTC Markets Group, Inc., under the stock symbol “LOVI.” From June 17, 2009 until June 4, 20012, our shares of common stock were quoted under the ticker symbol “JINM.” The following table shows the reported high and low closing bid prices per share for our common stock based on information provided by the OTCQB. The over-the-counter market quotations set forth for our common stock reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

BID PRICE PER SHARE

|

||||||||

|

HIGH

|

LOW

|

|||||||

|

Three Months Ended December 31, 2012

|

$ | 0.20 | $ | 0.18 | ||||

|

Three Months Ended September 30, 2012

|

$ | 0.00 | $ | 0.00 | ||||

|

Three Months Ended June 30, 2012

|

$ | 0.00 | $ | 0.00 | ||||

|

Three Months Ended March 31, 2012

|

$ | 0.00 | $ | 0.00 | ||||

|

Three Months Ended December 31, 2011

|

$ | 0.00 | $ | 0.00 | ||||

|

Three Months Ended September 30, 2011

|

$ | 0.00 | $ | 0.00 | ||||

|

Three Months Ended June 30, 2011

|

$ | 0.00 | $ | 0.00 | ||||

|

Three Months Ended March 31, 2011

|

$ | 0.00 | $ | 0.00 | ||||

TRANSFER AGENT

The Transfer Agent for our common stock is Guardian Registrar & Transfer, Inc. at 7951 SW 6th St Ste 216, Plantation, Florida 33324, and their telephone number is (877) 797-3632.

HOLDERS

As of December 31, 2012, the Company had 212,500,100 shares of our common stock issued and outstanding held by approximately 74 holders of record.

Historically, we have not paid any dividends to the holders of our common stock and we do not expect to pay any such dividends in the foreseeable future as we expect to retain our future earnings for use in the operation and expansion of our business.

RECENT SALES OF UNREGISTERED SECURITIES

None.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

We have not established any compensation plans under which equity securities are authorized for issuance.

PURCHASES OF EQUITY SECURITIES BY THE REGISTRANT AND AFFILIATED PURCHASERS

Pursuant to a Stock Redemption Agreement dated December 31, 2012, Brain Cohen, who served as President and Chief Executive Officer, Secretary, Treasurer and Director from November 3, 2011 until December 31, 2012, the Company redeemed from Mr. Cohen 45,150,000 shares of common stock of the Company for an aggregate redemption price of $45.15 and a mutual release of claims with the Company, the effect of which is that Mr. Cohen holds no shares of common stock or any other securities of the Company immediately following the redemption.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

18

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

OVERVIEW

One2One Living Corporation (the “Company” or “we”) was incorporated in the State of Nevada on November 13, 2008 and has a fiscal year end of December 31. We are a development stage Company. Implementing our planned business operation is dependent on our ability to raise approximately $2,135,700.

Going Concern

To date the Company has little operations and little revenues and consequently has incurred recurring losses from operations. No revenues are anticipated until we complete the financing described in our Registration Statement and implement our initial business plan. The ability of the Company to continue as a going concern is dependent on raising capital to fund our business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern.

Our activities have been financed primarily from the proceeds of share subscriptions. From our inception to December 31, 2012, we raised a total of $1,087,060, consisting of $444,906 from public and private offerings of our common stock, $210,500 from the private offerings of promissory notes, $145,877 of related party loans, $22,377 of credit card financing, and $3,400 from the sale of preferred stock.

The Company plans to raise additional funds through debt or equity offerings. There is no guarantee that the Company will be able to raise any capital through this or any other offerings.

PLAN OF OPERATION

We are a development stage corporation which operates a social networking website and have not yet generated or realized any revenues from our business. The next 12 months will be focused on continuing development of the One2One online and mobile application, marketing activities, adding additional staff for customer support, sales and marketing/partnerships, administrative and operations.

We estimate that we need to raise not less than $2,135,700 to complete our plan of operation, using such funds as follows:

|

Item

|

Cost

|

|||

|

Content - Video

|

$

|

60,000

|

||

|

Content Non-Video

|

$

|

52,500

|

||

|

CEO/CTO

|

$

|

90,000

|

||

|

Development Team

|

$

|

120,000

|

||

|

CMO

|

$

|

65,100

|

||

|

Business Development

|

$

|

42,000

|

||

|

CFO

|

$

|

42,000

|

||

|

COO

|

$

|

54,000

|

||

|

Customer Service

|

$

|

42,000

|

||

|

Content Manager/Publisher

|

$

|

54,000

|

||

|

Salaries

|

$

|

509,100

|

||

|

Rent/Hosting/Comm

|

$

|

75,000

|

||

|

Total Cost Content

|

$

|

165,000

|

||

|

Marketing

|

$

|

720,000

|

||

|

Legal and Accounting

|

$

|

45,000

|

||

|

TOTAL

|

$

|

2,135,700

|

||

We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our 12-month plan of operation and ongoing operational expenses. In the absence of such financing, our business will likely fail. There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our 12-month plan of operation and our business will fail.

19

The Company believes it cannot presently satisfy its cash requirements from its cash reserves of $453 and plans on continuing asking for related-party loans to fund its immediate cash needs. No related-party or other person has promised to make any loan or otherwise to provide funding to the Company.

We have generated nominal revenues since inception and have incurred $1,257,465 in expenses from inception through December 31, 2012. These expenses were comprised of operating expenses of $840,958, which included general and administrative expenses of $401,439, consulting fees of $201,723, web development expenses of $42,647, marketing expense of $156,960, professional fees of $37,135, net investment income of $5,287, other expenses of $98,465, interest income of $4,618, interest expense of $26,241 and loss on deconsolidation of $301,706.

We incurred operating expenses of $389,044 and 75,088 for the years ended December 31, 2012 and 2011, respectively. With respect to operating expenses, at December 31, 2012 we had $55,707 in general and administrative expenses (as compared to $75,088 at December 31, 2011), and $135,115 in consulting fees, $36,975 in web development expenses, $126,172 in marketing expense, and $35,075 in professional fees. By comparison, or sole operating expenses at December 31, 2011 were $75,088 in general and administrative expenses. With respect to other income and expenses, at December 31, 2012, we had other expense of $16, 352, interest income of $672 and interest expense of $26,241. By comparison, or sole other income and expenses at December 31, 2011 was a $14,223 loss on deconsolidation.

Our net loss since inception (November 27, 2006) through December 31, 2012 was $1,257,465. Our comprehensive loss since inception (November 27, 2006) through December 31, 2012 was $1,253,900. The following table provides selected financial data about our company for the years ended December 31, 2012 and 2011.

|

December 31, 2012

|

December 31, 2011

|

|||||||

|

Cash and Cash Equivalents

|

$

|

453

|

$

|

163

|

||||

|

Total Assets

|

$

|

320,813

|

$

|

16,515

|

||||

|

Total Liabilities

|

$

|

22,377

|

$

|

-0-

|

||||

|

Shareholders’ Equity (Deficit)

|

$

|

41,949

|

)

|

$

|

(20,985)

|

|||

GOING CONCERN

Although we have recognized some nominal amount of revenues since inception, we are still devoting substantially all of our efforts on establishing the business and, therefore, still qualify as a development stage company. From inception to December 31, 2012, the Company had accumulated losses of $1,257,465. Our independent public accounting firm included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent public accounting firm. Our financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

LIQUIDITY AND CAPITAL RESOURCES

At December 31, 2012, we had a cash balance of $453. Our expenditures over the next 12 months to solely maintain our reporting obligations and our website are expected to be approximately $75,000.

At December 31, 2012 our cash position increased to $453 from $163 to fund operations.

We must raise approximately $2,135,700, to complete our plan of operation for the next 12 months. Additionally, we anticipate spending an additional $75,000 on general and administration expenses including fees payable in connection with complying with reporting obligations, and general administrative costs. Additional funding will likely come from equity financing from the sale of our common stock, if we are able to sell such stock. If we are successful in completing an equity financing, existing stockholders will experience dilution of their interest in our Company. We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our plan of operation. In the absence of such financing, our business will fail.

20

There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our business and our business will fail.

OFF BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements including arrangements that would affect our liquidity, capital resources, market risk support and credit risk support or other benefits.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Method of accounting

The Company maintains its general ledger and journals with the accrual method of accounting for financial reporting purposes. The consolidated financial statements and notes are representations of management. Accounting policies adopted by the Company conform to generally accepted accounting principles in the United States of America (“US GAAP”) and have been consistently applied in the presentation of consolidated financial statements.

The preparation of consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. This basis of accounting differs in certain material respects from that used for the preparation of the books of account of the Company’s principal subsidiaries, which are prepared in accordance with the accounting principles and the relevant financial regulations applicable to enterprises with limited liabilities established in the PRC and Hong Kong, the accounting standards used in the places of their domicile. The accompanying consolidated financial statements reflect necessary adjustments not recorded in the books of account of the Company's subsidiaries to present them in conformity with US GAAP.

Principles of consolidation

The Company consolidates its subsidiaries and the entities it controls through a majority voting interest or otherwise, including entities that are variable interest entities (“VIEs”) for which the Company is the primary beneficiary pursuant to Accounting Standards Codification (“ASC”) No. 810, “Consolidation” (“ACS 810”). The provisions of ASC 810 have been applied respectively to all periods presented in the consolidated financial statements.

21

Subsidiary

The Company consolidates its wholly owned subsidiaries, Active Choice Limited, Chuangding Investment Consultant (Shenzhen) Co., Ltd as of December 31, 2010. The management determined to write-off these two subsidiaries and closed down their business as of December 31, 2011. The deemed variable interest entity was deconsolidated on September 16, 2010 in accordance with termination agreement. The following sets forth information about the wholly owned subsidiaries:

|

Name of Subsidiary

|

Place & Date

of Incorporation

|

Equity Interest

Attributable to the

Company (%)

|

Registered

Capital ($)

|

Issued

Capital (HKD)

|

Registered

Capital

(RMB)

|

|||||

|

#Active Choice Limited (“HKAC”)

|

Hong Kong/

September 26, 2008

|

100

|

$1,290

|

HKD10,000

|

-

|

|||||

|

#Chuangding Investment Consultant

(Shenzhen) Co., Ltd (“Chuangding”)

|

PRC/

December 4, 2008

|

100

|

$146,056

|

-

|

RMB1,000,000

|

|||||

|

*Shenzhen Jinmimi Network Technology

Limited Company (“Shenzhen Jinmimi”)

|

PRC/August 4, 2008

|

Deemed control

|

$291,864

|

-

|

RMB 2,000,000

|

|

*Note : Deemed variable interest entity was deconsolidated on September 16, 2010

|

|||||||||||

|

#Note: The management decides to write off the investment of subsidiaries on November 3, 2011

|

|||||||||||

Use of estimates

The preparation of the consolidated financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made; however actual results could differ materially from those estimates.

Property, plant and equipment

Plant and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimateduseful lives, using the straight-line method. Estimated useful lives of the plant and equipment are as follows:

|

Office equipment

|

5 years

|

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income.

Goodwill

Goodwill represents the excess of the cost of an acquisition over the fair value of the net acquired identifiable assets at the date of acquisition. Goodwill is included in intangible assets and no amortization is provided.

Goodwill is tested annually for impairment.

Accounting for the impairment of long-lived assets

The Company periodically evaluates the carrying value of long-lived assets to be held and used, including intangible assets subject to amortization, when events and circumstances warrant such a review, pursuant to the guidelines established in ASC No. 360, “Property, Plant and Equipment”. The carrying value of a long-lived asset is considered impaired when the anticipated undiscounted cash flow from such asset is separately identifiable and is less than its carrying value. In that event, a loss is recognized based on the amount by which the carrying value exceeds the fair market value of the long-lived asset. Fair market value is determined primarily using the anticipated cash flows discounted at a rate commensurate with the risk involved. Losses on long-lived assets to be disposed of are determined in a similar manner, except that fair market values are reduced for the cost to dispose. During the reporting periods, there was no impairment loss.

22

Foreign currency translation

The accompanying consolidated financial statements are presented in United States dollars. The functional currencies of the Company are Hong Kong dollars (HKD) and the Renminbi (RMB). The consolidated financial statements are translated into United States dollars from HKD and RMB at year-end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. The exchange rates used to translate amounts in HKD and RMB into USD for the purposes of preparing the consolidated financial statements were as follows:

|

DECEMBER 31, 2011

|

DECEMBER 31, 2010

|

|||||||

|

Twelve months ended

|

|

|

||||||

|

USD : RMB exchange rate

|

6.3555 | 6.5918 | ||||||

|

Average twelve months ended

|

||||||||

|

USD : RMB exchange rate

|

6.4554 | 6.7605 | ||||||

|

Twelve months ended

|

||||||||

|

USD : HKD exchange rate

|

7.7711 | 7.7822 | ||||||

|

Average twelve months ended

|

||||||||

|

USD : HKD exchange rate

|

7.7839 | 7.7682 | ||||||

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into USD at the rates used in translation. In addition, the current foreign exchange control policies applicable in PRC also restrict the transfer of assets or dividends outside the PRC. There were no foreign currency translation costs for the year ended December 31, 2012.

Cash and cash equivalents

The Company considers all highly liquid investments purchased with original maturities of twelve months or less to be cash equivalents. The Company maintains bank accounts in Hong Kong and the PRC. Since the management closed down the subsidiaries in Hong Kong and the PRC, the cash balance of the subsidiaries has been written off as a loss.

Leases

The Company did not have a lease that met the criteria of a capital lease. Leases that do not qualify as a capital lease are classified as an operating lease. Operating lease rental payments included in general and administrative expenses for the twelve months end December 31, 2012 and 2011 were $4,917 and nil respectively.

Marketing and Advertising

The Company expensed all advertising costs as incurred. Advertising expenses included in the marketing expense for the twelve months ended December 31, 2012 and 2011 were $126,172 and nil respectively.

Income taxes

The Company follows the liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment.

The Company income tax rate for the twelve months ended December 31, 2012 and 2011 are 35%.

23

Comprehensive income

Comprehensive income is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, all items that are required to be recognized under current accounting standards as components of comprehensive income are required to be reported in a financial statement that is presented with the same prominence as other consolidated financial statements. The Company’s current component of other comprehensive income is the foreign currency translation adjustment.

Stock dividends and stock splits

Stock dividends represent neither an actual distribution of the assets of the Company nor a promise to distribute those assets. Stock dividend is not considered a legal liability or a taxable transaction. The stock dividends have been processed by Financial Industry Regulatory Authority (“FINRA”) as a stock split of one-for-10.5 shares and therefore the Company will record this as stock split. The record date for this transaction was September 26, 2011 and the payable date was October 5, 2011. The Company will round-up fractional shares and the additional shares will be mailed out to shareholders of record. On October 5, 2011, the common stock was increased from 8,300,000 shares to 87,150,000 shares. On December 31, 2012 the Company redeemed from the former President of the Company 42,150,000 shares of common stock of the Company for an aggregate redemption price of $45.15 and a mutual release of claims with the Company, the effect of which is that the former President holds no shares of common stock or any other securities of the Company immediately following the redemption.

Earnings per share

Basic earnings per share, which includes no dilution, is computed by dividing income available to common stockholders by the weighted-average number of shares outstanding for the period. In contrast, diluted earnings per share consider the potential dilution that could occur from other financial increase the total number of outstanding shares of common stock.

Website Development Costs

The Company accounts for its Development Costs in accordance with ASC-350-50, “Accounting for Website Development Costs.” The Company’s website comprises multiple features and offerings that are currently developed with on-going refinements. In connection with the development of its products, the Company has incurred external costs for hardware, software, and consulting services, and internal costs for payroll and related expenses of its technology directly involved in the development. All hardware costs are capitalized as fixed assets. Purchased software will be capitalized in accordance with ASC codification 350-50-25 related to accounting for the costs of computer software developed or obtained for internal use. All other costs are reviewed to determine whether they should be capitalized or expensed.

Recently implemented standards

In January 2011, the FASB issued ASU 2011-01, “Receivables (Topic 310): Deferral of the Effective Date of Disclosures about Troubled Debt Restructurings in Update No. 2010-20”, which temporarily delay the effective date of the disclosures about troubled debt restructurings in ASU No. 2010-20, Receivables (Topic 310): Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses, for public entities. The delay is intended to allow the FASB time to complete its deliberations on what constitutes a troubled debt restructuring. The effective date of the new disclosures about troubled debt restructurings for public entities and the guidance for determining what constitutes a troubled debt restructuring will then be coordinated. Currently, that guidance is anticipated to be effective for interim and annual periods ending after June 15, 2011.

The deferral in ASU 2011-01 is effective January 19, 2011 (date of issuance).

In April 2011, the FASB issued ASU 2011-02, “A Creditor’s Determination of Whether a Restructuring is a Troubled Debt Restructuring”, which clarifies when creditors should classify loan modifications as troubled debt restructurings. The guidance is effective for interim and annual periods beginning on or after June 15, 2011, and applies retrospectively to restructurings occurring on or after the beginning of the year. The guidance on measuring the impairment of a receivable restructured in a troubled debt restructuring is effective on a prospective basis. A provision in ASU 2011-02 also ends the FASB’s deferral of the additional disclosures about troubled debt restructurings as required by ASU 2010-20. The adoption of ASU 2011-02 is not expected to have a material impact on the Company’s financial condition or results of operations.

24

In April 2011, the FASB issued ASU 2011-03, Consideration of Effective Control on Repurchase Agreements, which deals with the accounting for repurchase agreements and other agreements that both entitle and obligate a transferor to repurchase or redeem financial assets before their maturity. ASU 2011-03 changes the rules for determining when these transactions should be accounted for as financings, as opposed to sales. The guidance in ASU 2011-03 is effective for the first interim or annual period beginning on or after December 15, 2011. The guidance should be applied prospectively to transactions or modifications of existing transactions that occur on or after the effective date. Early adoption is not permitted. The adoption of ASU 2011-03 is not expected to have a material impact on the Company’s financial condition or results of operation.

In May 2011, the FASB issued ASU 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve CommonFair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (“IFRS”). ASU 2011-04 clarifies some existing concepts, eliminates wording differences between U.S. GAAP and IFRS, and in some limited cases, changes some principles to achieve convergence between U.S. GAAP and IFRS. ASU 2011-04 results in a consistent definition of fair value and common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU 2011-04 also expands the disclosures for fair value measurements that are estimated using significant unobservable (Level 3) inputs. ASU 2011-04 will be effective for the Company beginning after December 15, 2011. The Company does not expect the adoption of ASU 2011-04 to have a material effect on its operating results or financial position.

In June 2011, the Financial Accounting Standard Board (“FASB”) issued Accounting Standard Update (“ASU”) 2011-05, Presentation of Comprehensive Income, which requires an entity to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income, or in two separate but consecutive statements. ASU 2011-05 eliminates the option to present components of other comprehensive income as part of the statement of equity. ASU 2011-05 will be effective for the Company beginning after December 15, 2011. The Company does not expect the adoption of ASU 2011-05 to have a material effect on its operating results or financial position. However, it will impact the presentation of comprehensive income.

In September 2011, the FASB has issued Accounting Standards Update (ASU) No. 2011-08, Intangibles—Goodwill and Other (Topic 350): Testing Goodwill for Impairment. ASU 2011-08 is intended to simplify how entities, both public and non-public, test goodwill for impairment. ASU 2011-08 permits an entity to first assess qualitative factors to determine whether it is "more likely than not" that the fair value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform the two-step goodwill impairment test described in Topic 350, Intangibles-Goodwill and Other. The more-likely-than-not threshold is defined as having a likelihood of more than 50%. ASU 2011-08 is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. Early adoption is permitted, including for annual and interim goodwill impairment tests performed as of a date before September 15, 2011, if an entity’s financial statements for the most recent annual or interim period have not yet been issued or, for non-public entities, have not yet been made available for issuance.

In December 2011, the FASB has issued Accounting Standards Update (ASU) No. 2011-10, Property, Plant, and Equipment (Topic 360): Derecognition of in Substance Real Estate-a Scope Clarification. ASU No. 2011-10 is intended to resolve the diversity in practice about whether the guidance in Subtopic 360-20, Property, Plant, and Equipment—Real Estate Sales, applies to a parent that ceases to have a controlling financial interest (as described in Subtopic 810-10, Consolidation—Overall) in a subsidiary that is in substance real estate as a result of default on the subsidiary’s nonrecourse debt. This Update does not address whether the guidance in Subtopic 360-20 would apply to other circumstances when a parent ceases to have a controlling financial interest in a subsidiary that is in substance real estate. ASU 2011-10 should be applied on a prospective basis to deconsolidation events occurring after the effective date; with prior periods not adjusted even if the reporting entity has continuing involvement with previously derecognized in substance real estate entities. For public entities, ASU 2011-10 is effective for fiscal years, and interim periods within those years, beginning on or after June 15, 2012. For non-public entities, ASU 2011-10 is effective for fiscal years ending after December 15, 2013, and interim and annual periods thereafter. Early adoption is permitted.

In December 2011, the FASB has issued Accounting Standards Update (ASU) No. 2011-11, Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities. ASU No. 2011-11 is intended to provide enhanced disclosures that will enable users of its financial statements to evaluate the effect or potential effect of netting arrangements on an entity’s financial position. This includes the effect or potential effect of rights of setoff associated with an entity’s recognized assets and recognized liabilities within the scope of this Update. The amendments require enhanced disclosures by requiring improved information about financial instruments and derivative instruments that are either (1) offset in accordance with either Section 210-20-45 or Section 815-10-45 or (2) subject to an enforceable master netting arrangement or similar agreement, irrespective of whether they are offset in accordance with either Section 210-20-45 or Section 815-10-45. An entity is required to apply the amendments for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. An entity should provide the disclosures required by those amendments retrospectively for all comparative periods presented.

25

In December 2011, the FASB has issued Accounting Standards Update (ASU) No. 2011-12, Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items out of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05. ASU No. 2011-11 is intended to supersede certain pending paragraphs in Accounting Standards Update No. 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income, to effectively defer only those changes in Update 2011-05 that relate to the presentation of reclassification adjustments out of accumulated other comprehensive income. The amendments will be temporary to allow the Board time to redeliberate the presentation requirements for reclassifications out of accumulated other comprehensive income for annual and interim financial statements for public, private, and non-profit entities. All other requirements in ASU No. 2011-05 are not affected by ASU No. 2011-12, including the requirement to report comprehensive income either in a single continuous consolidated financial statement or in two separate but consecutive consolidated financial statements. Public entities should apply these requirements for fiscal years, and interim periods within those years, beginning after December 15, 2011. Non-public entities should begin applying these requirements for fiscal years ending after December 15, 2012, and interim and annual periods thereafter.

Other Recently Issued, but Not Yet Effective Accounting Pronouncements

Management does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the accompanying consolidated financial statements.

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

26

|

ITEM 8.

|

FINANCIAL STATEMENTS

|

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

One2One Living Corporation

(Formerly Jinmimi Network Inc.)

(A Development Stage Company)

We have audited the accompanying consolidated balance sheet of One2One Living Corporation (fka Jinmimi Network Inc.) (A development stage company) as of December 31, 2012, and the related statements of operations, stockholders' equity and cash flows for the year then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements of One2One Living Corporation (fka Jinmimi Network Inc.) (A development stage company) as of December 31, 2011, were audited by other auditors whose report dated April 16, 2012, included an explanatory paragraph that described the going concern issue discussed in Note 2 to the financial statements.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the 2012 consolidated financial statements referred to above present fairly, in all material respects, the financial position of One2One Living Corporation as of December 31, 2012, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.