Attached files

EXHIBIT 99.1

[CNL Growth Properties, Inc. Letterhead]

August 1, 2013

Dear Shareholder:

Thank you for your investment in our Company, CNL Growth Properties, Inc., a non-traded real estate investment trust aimed at creating growth through the development of multifamily properties.

To date, we have deployed a majority of our capital to build new Class A multifamily development communities in the Southeastern and Sunbelt regions of the United States. Our geographic footprint has expanded due to the June 2013 land acquisitions in connection with the development of two additional multifamily communities — REALM Patterson Place in Durham, North Carolina and Crescent Cool Springs in Nashville, Tennessee. As a result of these acquisitions, we have now invested in eight multifamily communities in markets that have been carefully chosen for their growth potential. The approximate cost of our multifamily projects is $276 million, consisting of $58 million in capitalized costs on our two completed projects and $218 million as the budgeted costs on our six projects that are currently under development.

Valuation & Follow-On Offering

In the second quarter of 2013, we closed our initial public offering and currently plan to commence a follow-on offering for shares of our common stock in the third quarter of 2013. In order to establish an offering price for our follow-on offering, and to assist broker-dealers and stockholders in their evaluation of the Company, we initiated a process designed to follow recommendations of the Investment Program Association, a trade association for non-listed direct investment vehicles, to estimate our net asset value (NAV) per share. A valuation committee was created and our board of directors engaged an independent valuation firm, CBRE Capital Advisors, Inc. (“CBRE Cap”), to provide the valuation committee and our board with property level and aggregate valuation analysis of the Company and a range for the estimated NAV per share of our common stock.

Based on the results of the valuation, discussed below, the board of directors determined an offering price of $10.84 per share for the purchase of shares in our follow-on offering. The new public offering price is based on the estimated NAV per share of common stock as of June 30, 2013, plus selling commissions and marketing support fees. The board of directors also ratified the continuation of our stock distribution at the same annualized rate of 8 percent of a share used since July 2010.

After taking into consideration the valuation analyses performed by CBRE Cap and certain other factors, our board of directors unanimously determined $9.76* as the estimated NAV per share of our common stock as of June 30, 2013. For a description of the methodology considered by our valuation committee and our board of directors, please refer to our current report on Form 8-K filed July 19, 2013, with the Securities and Exchange Commission at www.sec.gov. Please keep in mind that this estimated NAV is simply a snapshot in time and is not necessarily indicative of the value we expect when we pursue strategies for a future liquidity event.

Redemption Plan & Distribution Reinvestment Plan

In connection with preparing for our contemplated follow-on offering and the recent determination of our estimated NAV, we have made certain changes to our Redemption Plan and Distribution Reinvestment Plan, effective August 16, 2013. Subject to the terms of the Amended Redemption Plan and the maximum amount available for redemption per quarter, shareholders that have held their shares for at least one year may submit their shares for redemption and, if approved, would be redeemed at an amount equal to our last estimated NAV per share as of the redemption date.

The Amended Distribution Reinvestment Plan was modified to clarify that for any period in which we do not have an on-going public offering, the purchase price of any shares under the plan will not be less than 95 percent of the estimated NAV of the shares, as of the reinvestment date. To date, we have only issued stock distributions and have not issued any shares under our Amended Distribution Reinvestment Plan; therefore, the plan will remain inoperative until such time, if any, that we declare cash distributions.

Portfolio Update

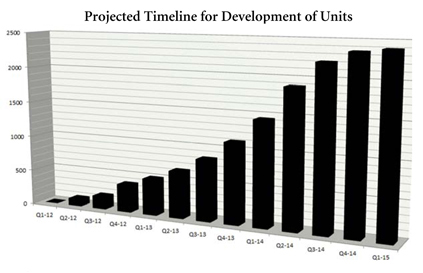

Our portfolio comprises nine properties, of which eight are Class A multifamily apartment communities and one is a multi-tenant, three-building office complex. Two of the communities, Woodfield Long Point in South Carolina and Whitehall in North Carolina are operational. As of June 30, 2013, our Woodfield Long Point community was 99 percent leased, while Whitehall was 85 percent leased. Construction on our six other multifamily communities is scheduled for completion between year-end 2013 and the first quarter of 2015. Total completed units are expected to increase from approximately 700 units to date to approximately 2,400 units, once our current projects are completed.

Looking Ahead

We are pleased with the performance of our completed development projects and the progress with the projects under development, as well as potential future development opportunities we have identified. With the successful launch of our upcoming follow-on offering, we expect to continue to diversify our holdings. Our potential sale of the multi-tenant, three-building office complex later this year or next year, would provide additional capital to be redeployed into additional multifamily projects. We believe our strategy to focus on multifamily development is instrumental in helping the Company achieve its desired investment objectives. Thank you for the confidence you have placed in CNL Growth Properties as we manage our portfolio to drive performance and value. Should you have questions, please contact CNL Client Services at 866-650-0650, option 3.

Sincerely,

| /s/ James M. Seneff, Jr. |

/s/ Andrew A. Hyltin | |||

| James M. Seneff, Jr. Chairman of the Board |

Andrew A. Hyltin Chief Executive Officer & President |

| cc: | Financial Advisor |

| * | This valuation represents the estimated value per share at a snapshot in time and will likely change over the Company’s lifecycle. The estimated NAV per share does not necessarily represent the amount an investor could expect to receive if the Company were to list its shares or liquidate its assets, now or in the future. The estimated NAV per share is only an estimate and is based on a number of assumptions and estimates which may not be complete. CBRE Capital Advisors, Inc. (“CBRE Cap”) the independent valuation firm, made numerous assumptions with respect to industry, business, economic and regulatory conditions, all of which are subject to changes beyond the control of CBRE Cap or the Company. Throughout the valuation process, the valuation committee and our advisor and senior members of management reviewed, confirmed and approved the processes and methodologies and their consistency with real estate industry standards and best practices. |

Cautionary Note Regarding Forward-Looking Statements

Statements above that are not statements of historical fact, including statements about the purported value of the Company’s common stock, constitute “forward-looking statements” within the meaning of the Federal Private Securities Litigation Reform Act of 1995. CBRE Cap relied on forward-looking information, some of which was provided by the Company, in preparing its valuation materials. The Company and CBRE Cap intend that such forward-looking statements be subject to the safe harbors created by Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements that do not relate strictly to historical or current facts, but reflect our current understandings, intentions, beliefs, plans, expectations, assumptions and/or predictions regarding the future of the Company’s business and its performance, statements of future economic performance, and other future conditions and forecasts of future events and circumstances. Forward-looking statements are typically identified by words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “estimated,” “plans,” “continues,” “pro forma,” “may,” “will,” “seeks,” “should” and “could,” and words and terms of similar substance in connection with discussions of future operating or financial performance, business strategy and portfolios, projected growth prospects, cash flows, costs and financing needs, legal proceedings, amount and timing of anticipated future distributions, estimated per share value of the Company’s common stock, and other matters. The Company’s forward-looking statements are not guarantees of future performance. While we believe our forward-looking statements are reasonable, such statements are inherently susceptible to uncertainty and changes in circumstances. As with any projection or forecast, forward-looking statements are necessarily dependent on assumptions, data and/or methods that may be incorrect or imprecise, and may not be realized. The Company’s forward-looking statements are based on our current expectations and a variety of risks, uncertainties and other factors, many of which are beyond our ability to control or accurately predict. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, the Company’s actual results could differ materially from those set forth in the forward-looking statements due to a variety of risks, uncertainties and other factors. Given these uncertainties, the Company cautions you not to place undue reliance on such statements. For further information regarding risks and uncertainties associated with the Company’s business, and important factors that could cause the Company’s actual results to vary materially from those expressed or implied in its forward-looking statements, please refer to the factors listed and described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the “Risk Factors” sections of the Company’s documents filed from time to time with the U.S. Securities and Exchange Commission, copies of which may be obtained from the Company’s website at http://www.cnlgrowthproperties.com. All written and oral forward-looking statements attributable to the Company or persons acting on its behalf are qualified in their entirety by these cautionary statements. Forward-looking statements speak only as of the date on which they are made; the Company undertakes no obligation to, and expressly disclaims any obligation to, update or revise its forward-looking statements to reflect new information, changed assumptions, the occurrence of subsequent events, or changes to future operating results over time unless otherwise required by law.