Attached files

| file | filename |

|---|---|

| EX-2.1 - SHARE EXCHANGE AGREEMENT - GASE ENERGY, INC. | epsilon_ex21.htm |

| EX-10.5 - INDEPENDENT CONSULTANT AGREEMENT - GASE ENERGY, INC. | epsilon_ex105.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - GASE ENERGY, INC. | epsilon_ex211.htm |

| EX-10.3 - AFFILIATE STOCK PURCHASE AGREEMENT - GASE ENERGY, INC. | epsilon_ex103.htm |

| EX-10.2 - FORM OF SUBSCRIPTION AGREEMENT - GASE ENERGY, INC. | epsilon_ex102.htm |

| EX-10.4 - AMENDMENT TO AFFILIATE STOCK PURCHASE AGREEMENT - GASE ENERGY, INC. | epsilon_ex104.htm |

| EX-10.1 - FORM OF OPTION AGREEMENT - GASE ENERGY, INC. | epsilon_ex101.htm |

| EX-10.6 - INDEPENDENT CONSULTANT AGREEMENT - GASE ENERGY, INC. | epsilon_ex106.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2013

Commission File Number: 333-179321

EPSILON CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

46-0525801

|

|

(State or other jurisdiction of incorporation)

|

|

(IRS Employer Identification Number)

|

173 Keith St., Suite 300

Warrenton, VA 20186

(Address of principal executive offices)

Tel: 540-347-2212

Fax: 540-347-2291

(Registrant’s telephone number, including area code)

7950 NW 53rd St., Suite 337

Miami, FL 33166

(Former name or former address if changed since the last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

TABLE OF CONTENTS

|

Item No.

|

Description of Item

|

Page No.

|

||

|

|

|

|||

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

3 | ||

|

|

|

|||

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

5 | ||

|

|

|

|||

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

16 | ||

|

|

|

|||

|

Item 5.01

|

Changes in Control of Registrant

|

16 | ||

|

|

|

|||

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

16 | ||

|

|

|

|||

|

Item 5.06

|

Change in Shell Company Status

|

16 | ||

|

|

|

|||

|

Item 9.01

|

Financial Statements and Exhibits

|

17 | ||

2

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed by Epsilon Corp. We are reporting the acquisition of a new business and providing a description of this business and its audited financials below.

USE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to:

|

·

|

“Epsilon,” “the Company,” “we,” “us,” or “our,” are references to the combined business of Epsilon Corp., and its subsidiary, Great East Energy, Inc.

|

|

·

|

“GEEI” refers to Great East Energy, Inc., a Nevada corporation, and a wholly-owned subsidiary of the Company;

|

|

·

|

“BHL” refers to Bezerius Holdings Limited, a corporation organized under the laws of the Republic of Cyprus;

|

|

·

|

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States;

|

|

·

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

·

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

|

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Share Exchange Agreement

On July 25, 2013, we consummated transactions pursuant to a Share Exchange Agreement (the “Share Exchange Agreement”) dated July 25, 2013 by and among the Company and the stockholders of GEEI (the “GEEI Stockholders”) whereby GEEI Stockholders transferred 100% of the outstanding shares of common stock of GEEI held by them, in exchange for an aggregate of 5,893 newly issued shares of the Company’s common stock, par value $.001 per share (“Common Stock”).

Stock Purchase Option Agreement

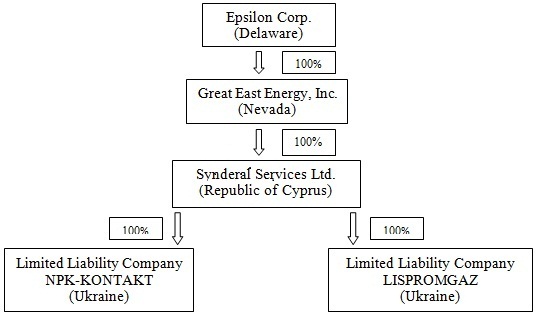

On July 25, 2013, GEEI entered into a Stock Purchase Option Agreement (the “Option Agreement”) with Bezerius Holdings Limited, a corporation organized under the laws of the Republic of Cyprus (“BHL”), whereby BHL granted to GEEI an option to purchase 1,000 shares of equity capital of Synderal Services LTD, a corporation organized under the laws of the Republic of Cyprus ("SSL"), representing all issued and outstanding shares of SSL, for $1,250,000. SSL is engaged in the gas exploration and production business in Ukraine through its two wholly-owned subsidiaries, Limited Liability Company NPK-KONTAKT and Limited Liability Company LISPROMGAZ, each a legal entity formed under the laws of Ukraine.

3

Under the Option Agreement, GEEI is required to pay to BHL $412,500 as an advance payment to be credited towards the purchase price of the SSL’s shares. The Company made the advance payment out of the proceeds of the Private Placement. The balance of the purchase price in the amount of $837,500 shall be paid by GEEI upon exercise of the option to be completed on or before September 30, 2013. If GEEI elects not to exercise the option to purchase SSL’s shares, BHL is required to return to GEEI the advance payment. This obligation by BHL is secured by the pledge of all the issued and outstanding shares of BHL by its shareholder.

On July 25, 2013, the Company issued 460,714 shares of Common Stock to BHL in connection with the option grant closing under the Option Agreement. Such Common Stock was issued in accordance with an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), under Section 4(2) of the Securities Act by virtue of compliance with the provisions of Regulation S under the Securities Act.

In connection with the issuance of 460,714 shares of Common Stock, BHL entered into a Stock Escrow Agreement and a Lock-Up Agreement with Epsilon. Pursuant to the Stock Escrow Agreement, BHL delivered to the escrow agent the shares of Common Stock issued to it to be held by the escrow agent pending the closing of the option exercise to purchase shares of SSL by GEEI under the Option Agreement in which case such 460,714 shares of Common Stock will be released by the escrow agent to BHL. Shall the parties to the Option Agreement fail to consummate the purchase of SSL shares by GEEI, the escrowed shares will be cancelled. BHL has no right to vote the escrowed shares until such time as they are eligible for release to BHL.

Under such Lockup Agreement, BHL agreed not to offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, sell short, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of any shares of Common Stock, or enter into any swap or other arrangement that transfers any economic consequences of ownership of Common Stock until 12 months after the date therein.

Private Placement of Common Stock

On July 25, 2013, the Company entered into and consummated transactions pursuant to the Subscription Agreement (the “Subscription Agreement”) with certain accredited investors whereby the Company issued and sold to the investors for $56 per share an aggregate of 10,982 shares of the Company’s Common Stock for an aggregate purchase price of $615,000 (the “Private Placement”). Such Common Stock was issued in accordance with an exemption from the registration requirements of the Securities Act under Section 4(2) of the Securities Act by virtue of compliance with the provisions of Regulation D and/or Regulation S under the Securities Act.

The Subscription Agreement contains representations and warranties by the Company and the investors which are customary for transactions of this type such as, with respect to the Company: organization, good standing and qualification to do business; capitalization; subsidiaries, authorization and enforceability of the transaction and transaction documents; valid issuance of stock, consents being obtained or not required to consummate the transaction; litigation; compliance with securities laws; and no brokers used, and with respect to the investors: authorization, accredited investor status and investment intent.

The foregoing description of the terms of the Share Exchange Agreement, Option Agreement and Subscription Agreement is qualified in its entirety by reference to the provisions of the forms of the Share Exchange Agreement, Option Agreement and Subscription Agreement which are filed as Exhibits 2.1, 10.1 and 10.2 to this Current Report, respectively, and are incorporated by reference herein.

4

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On July 25, 2013, we completed the acquisition of GEEI as a result of the share exchange. The acquisition was accounted for as a recapitalization effected by a merger. GEEI is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

As a result of this transaction, the Company ceased being a “shell company” as that term is defined in Rule 12b-2 under the Exchange Act.

Our Corporate Structure

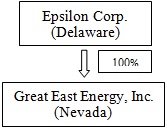

As set forth in the following diagram, following our acquisition of GEEI, GEEI became and currently is our direct, wholly-owned subsidiary.

Organizational History of Epsilon Corp.

Epsilon Corp was incorporated on October 17, 2011, under the laws of the State of Delaware. The business plan of the Company was originally to launch and maintain an on-line social network for start-ups in high-tech industry, where entrepreneurs and investors and industry experts meet. Immediately after the completion of the Share Exchange, the Company discontinued its on-line social network business and changed its business plan to acquisition and development of natural gas properties located in Ukraine.

Organizational History of Great East Energy, Inc.

Great East Energy, Inc. was incorporated in the State of Nevada on April 5, 2013 and is a development-stage natural gas company. The Company's current business plan is to complete the transactions contemplated by the Option Agreement and as a result to engage in the business of developing and operating currently producing natural gas properties located in Ukraine.

DESCRIPTION OF BUSINESS

The Company’s purpose is to complete the transactions contemplated by the Option Agreement and to engage in the business of developing and operating currently producing natural gas properties located in Ukraine upon such completion through its two indirect Ukrainian subsidiaries, Limited Liability Company NPK-KONTAKT and Limited Liability Company LISPROMGAZ, to be acquired upon exercise of the option.

5

Below is the corporate structure of the Company following a successful completion of the transactions contemplated by the Option Agreement:

The Company has currently no employees. It plans to hire employees upon a successful completion of the transactions contemplated by the Option Agreement. From time to time, the Company also plans to employ independent contractors to support its operations.

DESCRIPTION OF PROPERTY

We do not own any real property. Our corporate headquarters are at c/o Escrow, LLC, 173 Keith St., Suite 300, Warrenton, VA 20186. The office space is provided to us free of charge by Escrow LLC, a company controlled by our Chairman.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

THE DISCUSSION IN THIS SECTION CONTAINS CERTAIN STATEMENTS OF A FORWARD-LOOKING NATURE RELATING TO FUTURE EVENTS OR OUR FUTURE PERFORMANCE. WORDS SUCH AS "ANTICIPATES," "BELIEVES," "EXPECTS," "INTENDS," "FUTURE," "MAY" AND SIMILAR EXPRESSIONS OR VARIATIONS OF SUCH WORDS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, BUT ARE NOT THE ONLY MEANS OF IDENTIFYING FORWARD-LOOKING STATEMENTS. SUCH STATEMENTS ARE ONLY PREDICTIONS AND ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS, WE URGE YOU TO CAREFULLY CONSIDER VARIOUS FACTORS IDENTIFIED IN THIS REPORT, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING STATEMENTS.

Epsilon Corp. (the “Company”) is a Delaware corporation organized on October 17, 2011.

Recent Developments

On June 1, 2013, our then President and CEO Mr. David Schwartz and GEEI entered into an Affiliate Stock Purchase Agreement, which was amended on July 15, 2013, pursuant to which on July 25, 2013 Mr. Schwartz sold to GEEI 3,000,000 shares of the Company’s common stock representing approximately 89.3% of the then issued and outstanding shares of common stock.

6

On July 25, 2013, the Company entered into and consummated the transactions contemplated by the Share Exchange Agreement with GEEI and its shareholders whereby the Company purchased from the shareholders of GEEI all issued and outstanding shares of GEEI’s common stock in consideration of the issuance of 5,893 shares of common stock of the Company.

The Share Exchange resulted in (i) a change in control of Epsilon with GEEI and the shareholders of GEEI owning approximately 89.3% of the then issued and outstanding shares of common stock of Epsilon, and (ii) appointment of certain nominees of the shareholders of GEEI as directors and officers of Epsilon and resignation of David Schwartz as director, chief executive officer, chief financial officer, secretary and treasurer of Epsilon.

GEEI is deemed to be the accounting acquirer and Epsilon to be the accounting acquiree. The financial statements before the date of the Share Exchange are those of GEEI with the results of Epsilon being consolidated from the date of the Share Exchange. The equity section and earnings per share have been retroactively restated to reflect the reverse acquisition. The share exchange of a private operating company with a non-operating public shell corporation with nominal net assets is considered to be a capital transaction, in substance, rather than a business combination, for accounting purposes. Accordingly, GEEI treated this transaction as a capital transaction without recording goodwill or adjusting any of its other assets or liabilities.

On July 25, 2013, the Company issued 460,714 shares of its common stock to BHL in connection with the option grant closing under the Option Agreement.

GEEI cancelled 3,000,000 shares of common stock acquired from Mr. Schwartz effective immediately after the issuance of the shares to BHL. This resulted in a change of control of the Company with BHL owning approximately 51.2% of the issued and outstanding shares of common stock of Epsilon.

On July 25, 2013, the Company entered into and consummated transactions pursuant to the Subscription Agreement whereby the Company issued and sold to the investors for $56 per share an aggregate of 10,982 shares of the Company’s Common Stock for an aggregate purchase price of $615,000. The Company used $412,500 out of the gross proceeds of the closing to make a payment to BHL under the Option Agreement in connection with the option grant closing. The balance of $837,500 under the Option Agreement is due upon our exercise of the option to occur on or before September 30, 2013.

Plan of Operations

At this time, the Company’s purpose is to complete the transactions contemplated by the Option Agreement and to engage in the business of developing and operating currently producing natural gas properties located in Ukraine upon such completion through its two indirect Ukrainian subsidiaries, Limited Liability Company NPK-KONTAKT and Limited Liability Company LISPROMGAZ, to be acquired upon exercise of the option.

Results of Operations

We did not have any revenues since inception. We incurred operating expenses of $487,972, and realized a net loss of $487,972 for the six months ended June 30, 2013.

7

Liquidity and Capital Resources

The Company does not currently have sufficient resources to cover ongoing expenses and expansion. On July 25, 2013, we consummated a private placement of our securities which resulted in net proceeds to us of $615,000. We used $412,500 out of the gross proceeds of the closing to make a payment to BHL under the Option Agreement in connection with the option grant closing. The balance of $837,500 under the Option Agreement is due upon our exercise of the option to occur on or before September 30, 2013. We plan on raising additional funds from investors to implement our business model. In the event we are unsuccessful, this will have a negative impact on our operations.

If the Company cannot find sources of additional financing to fund its working capital needs, the Company will be unable to obtain sufficient capital resources to operate our business. We cannot assure you that we will be able to access any financing in sufficient amounts or at all when needed. Our inability to obtain sufficient working capital funding will have an immediate material adverse effect upon our financial condition and our business.

Critical Accounting Policies

Development stage entity

The Company is considered a development stage entity, as defined in FASB ASC 915, because since inception it has not commenced operations that have resulted in significant revenue and the Company’s efforts have been devoted primarily to activities related to raising capital.

Going concern

The Company's financial statements are prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of obligations in the normal course of business. However, it has no cash, has losses and an accumulated deficit, and a working capital deficiency. The Company does not currently have any revenue generating operations. These conditions, among others, raise substantial doubt about the ability of the Company to continue as a going concern.

In view of these matters, continuation as a going concern is dependent upon continued operations of the Company, which in turn is dependent upon the Company's ability to, meets its financial requirements, raise additional capital, and the success of its future operations. The financial statements do not include any adjustments to the amount and classification of assets and liabilities that may be necessary should the Company not continue as a going concern.

Management believes they can raise the appropriate funds needed to support their business plan and acquire an operating company with positive cash flow. Management intends to seek new capital from owners and related parties to provide needed funds.

Off-Balance Sheet Arrangements

We do not have off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as "special purpose entities" (SPEs).

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our voting securities following the completion of the transactions described in Item 1.01 of this report by (i) persons who beneficially own more than 5% of our Common Stock; (ii) our directors; (iii) our executive officers; and (iv) all of our executive officers and directors as a group. The address for each officer and director is c/o Escrow, LLC, 173 Keith St., Suite 300, Warrenton, VA 20186.

|

Name

|

Office

|

Shares Beneficially Owned(1)(2)

|

Percent of

Class(3)

|

|||||||

|

|

|

|||||||||

|

Officers and Directors

|

|

|||||||||

|

Michael Doron

|

Director, CEO, CFO and Treasurer

|

5,357

|

*

|

|||||||

|

|

|

|||||||||

|

Johnnie Zarecor

|

Chairman, Director and Secretary

|

536

|

*

|

|||||||

|

|

|

|||||||||

|

All officers and directors as a group (2 persons named above)

|

|

5,893

|

*

|

|||||||

|

|

|

|||||||||

|

5% Securities Holders

|

|

|||||||||

|

Bezerius Holdings Limited(4)

Boumpoulimas, 11, 3rd Floor

Nicosia, Republic of Cyprus 1060

|

|

460,714

|

51.2

|

%

|

||||||

___________________

|

*

|

Less than 1%.

|

|

|

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities.

|

|

|

|

|

(2)

|

Represent shares of the Company’s common stock issuable upon conversion of Series B preferred stock of the Company.

|

|

(3)

|

Based on 899,160 shares of the Company’s common stock outstanding after the Closing and after giving effect to the Share Exchange and cancellation of 3,000,000 of common stock held by GEEI. The Company currently intends to effect a 56-for-1 forward stock split.

|

|

(4)

|

ASK Management Ltd has sole voting and dispositive power over the shares held by Bezerius Holdings Limited.

|

Changes in Control

Except as described herein, there are currently no arrangements which may result in a change in control of the Company.

9

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors and Executive Officers

The following table sets forth certain information as of July 25, 2013 concerning our directors and executive officers:

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Michael Doron

|

|

52

|

|

Director, Chief Executive Officer, Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

|

Johnnie Zarecor

|

|

70

|

|

Chairman, Director and Secretary

|

Michael Doron, age 52, is an accomplished corporate leader with executive level experience in the financing of small to mid-cap private and public companies. Currently based in Stockholm, Sweden, he is also Managing Partner at DDR & Associates, a business development firm specializing in pre-IPO companies. Previously Mr. Doron was Co-Founder and a Partner in Evolution Capital, a private firm working in conjunction with DDR, and specializing in providing capital to publicly held companies using various debt instruments. He serves on the Board of Directors of MusclePharm Corp (NASDAQ: MSLP). We believe that Mr. Doron’s qualifications and his extensive experience with emerging public companies provide a unique perspective for our board.

Johnnie Zarecor, age 70, is also President of the Virginia, USA based full service securities escrow firm Escrow, LLC (“EL”) since 2008. EL offers services including escrowing of funds and collateral escrow for stock transactions, private placements, reverse mergers, and holdback escrows. She created the escrow division for Tri-State Title & Escrow LLC in 2005, and has lived and traveled in Europe for many years, including time spent in Vienna, Austria, the Netherlands, and England. We believe that Ms. Zarecor is well suited to sit on our board based on her extensive securities and international experience.

All of our directors hold their positions on the board until our next annual meeting of the shareholders, and until their successors have been qualified after being elected or appointed. Officers serve at the discretion of the board of directors.

There are no family relationships among our directors and executive officers. There is no arrangement or understanding between or among our executive officers and directors pursuant to which any director or officer was or is to be selected as a director or officer, and there is no arrangement, plan or understanding as to whether non-management shareholders will exercise their voting rights to continue to elect the current board of directors.

Our directors and executive officers have not, during the past ten years:

|

|

·

|

had any bankruptcy petition filed by or against any business of which was a general partner or executive officer, either at the time of the bankruptcy or within two years prior to that time,

|

|

|

·

|

been convicted in a criminal proceeding and is not subject to a pending criminal proceeding,

|

|

|

·

|

been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities, futures, commodities or banking activities; or

|

|

|

·

|

been found by a court of competent jurisdiction (in a civil action), the Securities Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacate

|

10

Board Committees

We currently do not have standing audit, nominating or compensation committees. Currently, our entire board of directors is responsible for the functions that would otherwise be handled by these committees. We intend, however, to establish an audit committee, a nominating committee and a compensation committee of the board of directors as soon as practicable. We envision that the audit committee will be primarily responsible for reviewing the services performed by our independent auditors, evaluating our accounting policies and our system of internal controls. The nominating committee would be primarily responsible for nominating directors and setting policies and procedures for the nomination of directors. The nominating committee would also be responsible for overseeing the creation and implementation of our corporate governance policies and procedures. The compensation committee will be primarily responsible for reviewing and approving our salary and benefit policies (including stock options), including compensation of executive officers.

Audit Committee Financial Expert

The Board of Directors does not currently have Audit Committee financial expert, as defined under Item 407(d)(5)(i) of Regulation S-K.

Code of Ethics

We do not have a code of ethics but intend to adopt one in the near future.

Board Leadership Structure

Michael Doron is our Chief Executive Officer. Johnnie Zarecor is the Chairperson of our Board of Directors. We believe a board leadership structure involving one person serving as chairman and another as chief executive officer is best for our company and our stockholders. Further, we believe this separation improves the Board’s oversight of management, provides greater accountability of management to stockholders, and allows the chief executive officer to focus on managing our business operations, while allowing the chairman to focus on more effectively leading the Board and overseeing our general strategic direction and extraordinary transactions.

Potential Conflict of Interest

Since we do not have an audit or compensation committee comprised of independent Directors, the functions that would have been performed by such committees are performed by our Board of Directors. Thus, there is a potential conflict of interest in that our Directors have the authority to determine issues concerning management compensation, in essence their own, and audit issues that may affect management decisions. We are not aware of any other conflicts of interest with any of our executives or Directors.

Board’s Role in Risk Oversight

The Board assesses on an ongoing basis the risks faced by the Company. These risks include financial, technological, competitive, and operational risks. The Board dedicates time at each of its meetings to review and consider the relevant risks faced by the Company at that time. In addition, since the Company does not have an Audit Committee, the Board is also responsible for the assessment and oversight of the Company’s financial risk exposures.

11

EXECUTIVE COMPENSATION

We have not paid, nor do we owe, any compensation to our executive officers for the year ending December 31, 2012. From inception through December 31, 2012, we have not paid any compensation to our officers.

Employment Agreements

On April 15, 2013, GEEI and Mr. Michael Doron entered into an independent consultant agreement for his service as GEEI’s Chief Executive Officer, Chief Financial Officer, Director and Treasurer for a term of six months. The agreement is automatically renewable for additional six months unless either party notifies the other at least 30 days prior to the end of the term of an intention to terminate. Under the agreement, Mr. Doron is compensated with a monthly cash compensation of US$3,000, payable in arrears. He also received 5,357 shares of GEEI’s common stock which are not subject to any vesting conditions or subject to forfeiture.

Director Compensation

For the year ended December 31, 2012, none of the members of our Board of Directors received compensation for his service as a director.

On April 15, 2013, GEEI and Escrow, LLC entered into an independent consultant agreement for the service of Johnnie Zarecor, the principal of Escrow, LLC, as GEEI’s Chairperson and Secretary for a term of six months. The agreement is automatically renewable for additional six months unless either party notifies the other at least 30 days prior to the end of the term of an intention to terminate. Under the agreement, Ms. Zarecor is compensated with a six-month cash stipend of US$5,000, payable upon closing of the private placement of June 2013 described above. She also received 536 shares of GEEI’s common stock which are not subject to any vesting conditions or subject to forfeiture.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Transactions with related persons

On November 14, 2011, we issued a total of 3,000,000 shares of common stock to Mr. David Schwartz, the then Company’s sole Officer and Director, for total cash consideration of $30,000 which was received in January 2012.

On June 1, 2013, Mr. Schwartz and GEEI entered into an Affiliate Stock Purchase Agreement, which was amended on July 15, 2013, pursuant to which on July 25, 2013 Mr. Schwartz sold to GEEI 3,000,000 shares of the Company’s common stock representing approximately 89.3% of the then issued and outstanding shares of common stock.

On July 25, 2013, the Company issued 460,714 shares of its common stock to BHL in connection with the option grant under the Option Agreement. GEEI cancelled 3,000,000 shares of common stock acquired from Mr. Schwartz effective immediately after the issuance of such shares to BHL.

Other than the above transactions or as otherwise set forth in this report or in any reports filed by the Company with the SEC, there have been no related party transactions, or any other transactions or relationships required to be disclosed pursuant to Item 404 of Regulation S-K. The Company is currently not a subsidiary of any company.

12

The Company’s Board conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict of interest situations where appropriate. The Board has not adopted formal standards to apply when it reviews, approves or ratifies any related party transaction. However, the Board believes that the related party transactions are fair and reasonable to the Company and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services at the time they are authorized by the Board.

Director Independence

We are not subject to listing requirements of any national securities exchange and, as a result, we are not at this time required to have our board comprised of a majority of “independent Directors.” We do not believe that any of our directors currently meets the definition of “independent” as promulgated by the rules and regulations of NASDAQ.

LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our Common Stock, $.001 par value, is quoted on the OTC Bulletin Board under the symbol “EPSO.” There were no reported quotations for our common stock during the fiscal years 2011 and 2012.

As of July 31, 2013, we had approximately 58 shareholders of record. The holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of the common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to the common stock

Dividends

Since our inception, we have not declared nor paid any cash dividends on our capital stock and we do not anticipate paying any cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance our operations. Our Board of Directors will determine future declarations and payments of dividends, if any, in light of the then-current conditions it deems relevant and in accordance with applicable corporate law.

Securities Authorized for Issuance under Equity Compensation Plans

We have no existing equity compensation plan.

RECENT SALES OF UNREGISTERED SECURITIES;

USE OF PROCEEDS FROM REGISTERED SECURITIES

Reference is made to the disclosure set forth under Item 3.02 of this report, which disclosure is incorporated herein by reference.

13

DESCRIPTION OF SECURITIES

General

Our authorized capital stock consists of 100,000,000 shares of common stock, with a par value of $0.001 per share. As of July 31, 2013, there were 899,160 shares of our common stock issued and outstanding held by 58 holders of record of our common stock.

Voting Rights

Each share of common stock entitles the holder to one vote on all matters submitted to a vote of the stockholders including the election of directors. Except as otherwise required by law the holders of our common stock possess all voting power. Our articles of incorporation and bylaws do not provide for cumulative voting in the election of directors. Because the holders of our common stock do not have cumulative voting rights and directors are generally to be elected by a majority of the votes casts with respect to the directors at any meeting of our stockholders for the election of directors, holders of more than fifty percent, and in some cases less than 50%, of the issued and outstanding shares of our common stock can elect all of our directors.

Dividends

The holders of our common stock are entitled to receive the dividends as may be declared by our board of directors out of funds legally available for dividends. Our board of directors is not obligated to declare a dividend. Any future dividends will be subject to the discretion of our board of directors and will depend upon, among other things, future earnings, the operating and financial condition of our company, its capital requirements, general business conditions and other pertinent factors. We do not anticipate that dividends will be paid in the foreseeable future.

As of the date of this prospectus, we have not paid any dividends to shareholders. The declaration of any future dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Miscellaneous Rights and Provisions

In the event of our liquidation or dissolution, whether voluntary or involuntary, each share of our common stock is entitled to share ratably in any assets available for distribution to holders of our common stock after satisfaction of all liabilities.

Our common stock is not convertible or redeemable and has no pre-emptive, subscription or conversion rights. There are no conversions, redemption, sinking fund or similar provisions regarding our common stock. Our common stock, after the fixed consideration thereof has been paid or performed, are not subject to assessment, and the holders of our common stock are not individually liable for the debts and liabilities of our company.

Our bylaws provide that our board of directors may amend our bylaws by a majority vote of our board of directors including any bylaws adopted by our stockholders, but our stockholders may from time to time specify particular provisions of these bylaws, which must not be amended by our board of directors. Our current bylaws were adopted by our board of directors. Therefore, our board of directors can amend our bylaws to make changes to the provisions relating to the quorum requirement and votes requirements to the extent permitted by the Delaware Revised Statutes.

14

Stock Transfer Agent

Globex Transfer, LLC of 780 Deltona Blvd., Suite 202, Deltona, FL 32725 is the registrar and transfer agent for our common stock. Their website is http://www.globextransfer.com/, their phone number is (813) 344-4490 and their fax number is (386) 267-3124.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our by-laws provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such persons promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us, which it may be unable to recoup.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore unenforceable.

At the present time, there is no pending litigation or proceeding involving a director, officer, employee or other agent of ours in which indemnification would be required or permitted. We are not aware of any threatened litigation or proceeding which may result in a claim for such indemnification.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Please see Item 9.01 - “Financial Statements and Exhibits” of this Current Report.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Commission, located on 100 F Street NE, Washington, D.C. 20549, Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and other reports, statements and information as required under the Securities Exchange Act of 1934, as amended.

The reports, statements and other information that we have filed with the Commission may be read and copied at the Commission's Public Reference Room at 100 F Street NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

The Commission maintains a web site (http://www.sec.gov.) that contains the registration statements, reports, proxy and information statements and other information regarding registrants that file electronically with the Commission such as us. You may access our Commission filings electronically at this Commission website. These Commission filings are also available to the public from commercial document retrieval services.

15

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES

Please refer to Item 1.01 - “Entry into a Material Definitive Agreement” for a description of the unregistered sales of equity securities as a result of the Merger, which is incorporated in its entirety into this Item 3.02.

The issuances of the shares of Common Stock under the Share Exchange Agreement, the Subscription Agreement and the Option Agreement were exempt from registration under the Securities Act pursuant to Section 4(2) of the Securities Act, Regulation D and Regulation S promulgated thereunder.

ITEM 5.01 CHANGES IN CONTROL OF REGISTRANT

On June 1, 2013, Mr. Schwartz and GEEI entered into an Affiliate Stock Purchase Agreement, pursuant to which on July 25, 2013 Mr. Schwartz sold to GEEI 3,000,000 shares of the Company’s common stock representing approximately 89.3% of the then issued and outstanding shares of common stock.

On July 25, 2013, the Company entered into and consummated the transactions contemplated by the Share Exchange Agreement with GEEI and its shareholders whereby the Company purchased from the shareholders of GEEI all issued and outstanding shares of GEEI’s common stock in consideration of the issuance of 5,893 shares of common stock of the Company.

The Share Exchange resulted in (i) a change in control of Epsilon with GEEI and the shareholders of GEEI owning approximately 89.3% of the then issued and outstanding shares of common stock of Epsilon, and (ii) appointment of certain nominees of the shareholders of GEEI as directors and officers of Epsilon and resignation of David Schwartz as director, chief executive officer, chief financial officer, secretary and treasurer of Epsilon.

On July 25, 2013, the Company issued 460,714 shares of its common stock to BHL in connection with the option grant closing under the Option Agreement.

GEEI cancelled 3,000,000 shares of common stock acquired from Mr. Schwartz effective immediately after the issuance of the shares to BHL. This resulted in a change of control of the Company with BHL owning approximately 51.2% of the issued and outstanding shares of common stock of Epsilon.

As a result of these transactions, the Company is controlled by BHL.

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

Please refer to Item 2.01 - “Completion of Acquisition or Disposition of Assets “- “Our Directors and Executive Officers,” which description is in its entirety incorporated by reference to this Item 5.02 of this report.

ITEM 5.06 CHANGE IN SHELL COMPANY STATUS

As a result of the Shares Exchange as described in Items 1.01 and 2.01, which description is incorporated by reference in this Item 5.06 of this report, we ceased being a shell company as such term is defined in Rule 12b-2 under the Exchange Act.

16

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(a) The financial statements of GEII are appended to this report beginning on page F-1, and unaudited proforma financial statements of Epsilon are appended to this report beginning on page F-12.

(d) The following exhibits are filed with this report:

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

2.1

|

|

Share Exchange Agreement.

|

|

|

|

|

|

10.1

|

|

Form of Option Agreement.

|

|

|

|

|

|

10.2

|

|

Form of Subscription Agreement.

|

|

10.3

|

Affiliate Stock Purchase Agreement.

|

|

|

10.4

|

Amendment to Affiliate Stock Purchase Agreement

|

|

|

10.5

|

Independent Consultant Agreement dated April 15, 2013 by and between GEEI and Michael Doron.

|

|

|

10.6

|

Independent Consultant Agreement dated April 15, 2013 by and between GEEI and Escrow, LLC.

|

|

|

|

|

|

|

21.1

|

|

List of subsidiaries.

|

17

GREAT EAST ENERGY, INC.

(A DEVELOPMENT STAGE COMPANY)

Index to Financial Statements

|

Page

|

||||

|

Independent Auditors’ Report

|

F-2 | |||

|

Balance Sheet as of June 30, 2013

|

F-3 | |||

|

Statement of Operations From April 5, 2013 (Inception) To June 30, 2013

|

F-4 | |||

|

Statement of Stockholders’ Deficit From April 5, 2013 (Inception) To June 30, 2013

|

F-5 | |||

|

Statement of Cash Flows From April 5, 2013 (Inception) To June 30, 2013

|

F-6 | |||

|

Notes to Financial Statements

|

F-7 | |||

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To Stockholders of Great East Energy, Inc.

We have audited the accompanying balance sheet of Great East Energy, Inc. as of June 30, 2013, and the related statements of operations, stockholders’ equity, and cash flows for the period of April 5 (inception) through June 30, 2013. Great East Energy, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Great East Energy, Inc. as of June 30, 2013, and the results of its operations and its cash flows for the period from April 5 (inception) through June 30, 2013 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 9 to the financial statements, the Company has incurred approximately $481,425 in operating deficit since its inception and has generated no operating revenue, which could raise substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 10. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/S/ JPDH & Company

Irvine, California

July 31, 2013

F-2

GREAT EAST ENERGY, INC.

(A DEVELOPMENT STAGE COMPANY)

BALANCE SHEET

JUNE 30, 2013

|

ASSETS

|

||||

|

Current asset:

|

||||

|

Cash

|

$ | 50,000 | ||

|

Total current asset

|

50,000 | |||

|

Long-term asset:

|

||||

|

Deposits

|

40,000 | |||

|

Total long-term asset

|

40,000 | |||

|

Total assets

|

$ | 90,000 | ||

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

||||

|

Current liabilities:

|

||||

|

Accounts payable

|

$ | 118,719 | ||

|

Accrued liabilities

|

309,312 | |||

|

Advance subscriptions from investors

|

90,000 | |||

|

Related party payables

|

13,479 | |||

|

Total current liabilities

|

531,510 | |||

|

Total liabilities

|

531,510 | |||

|

Stockholders’ equity (deficit):

|

||||

|

Common stock - $.001 par value; 1,000,000 shares

|

||||

|

authorized; 5,893 shares outstanding

|

6 | |||

|

Additional paid-in capital

|

39,909 | |||

|

Accumulated deficit

|

(481,425 | ) | ||

|

Total stockholders' deficit

|

(441,510 | ) | ||

|

Total liabilities and stockholders' deficit

|

$ | 90,000 | ||

The accompanying notes are an integral part of these financial statements.

F-3

GREAT EAST ENERGY, INC.

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF OPERATIONS

FROM APRIL 5, 2013 (INCEPTION) TO JUNE 30, 2013

|

INCOME

|

$ | - | ||

|

OPERATING EXPENSES

|

||||

|

Organizational expenses

|

902 | |||

|

General and administrative expenses

|

4,000 | |||

|

Professional fees

|

476,523 | |||

|

Total Operating Expenses

|

481,425 | |||

|

NET LOSS APPLICABLE TO COMMON SHARES

|

$ | (481,425 | ) | |

|

NET LOSS PER BASIC AND DILUTED SHARES

|

$ | (81.69 | ) | |

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING

|

5,893 |

The accompanying notes are an integral part of these financial statements.

F-4

GREAT EAST ENERGY, INC.

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF CHANGES IN STOCKHOLDERS' DEFICIT

FROM APRIL 5, 2013 (INCEPTION) TO JUNE 30, 2013

|

Additional

|

Total

|

|||||||||||||||||||

|

Common Stock

|

Paid-in

|

Accumulated

|

Stockholders'

|

|||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit

|

Deficit

|

||||||||||||||||

|

Balances at April 5, 2013 (Inception)

|

- | $ | - | $ | - | $ | - | $ | - | |||||||||||

|

Common shares issued for services

|

5,893 | 6 | 39,909 | - | 39,915 | |||||||||||||||

|

Net loss for the period ended June 30, 2013

|

- | - | - | (481,425 | ) | (481,425 | ) | |||||||||||||

|

Balances at June 30, 2013

|

5,893 | $ | 6 | $ | 39,909 | $ | (481,425 | ) | $ | (441,510 | ) | |||||||||

The accompanying notes are an integral part of these financial statements.

F-5

GREAT EAST ENERGY, INC.

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF CASH FLOWS

FROM APRIL 5, 2013 (INCEPTION) TO JUNE 30, 2013

|

Cash Flows from Operating Activities:

|

||||

|

Net loss

|

$ | (481,425 | ) | |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||

|

Common shares issued for services

|

39,915 | |||

|

Changes in assets and liabilities:

|

||||

|

Accounts payable and accrued liabilities

|

428,031 | |||

|

Related party payable

|

13,479 | |||

|

Net Cash Used in Operating Activities

|

- | |||

|

Cash Flows from Investing Activities:

|

||||

|

Deposits for investments

|

(40,000 | ) | ||

|

Net Cash Used in Investing Activities

|

(40,000 | ) | ||

|

Cash Flows from Financing Activities:

|

||||

|

Proceeds from advance subscription from investors

|

90,000 | |||

|

Net Cash Provided by Financing Activities

|

90,000 | |||

|

Net Increase in Cash

|

50,000 | |||

|

Cash, Beginning of Year

|

- | |||

|

Cash, End of Year

|

$ | 50,000 | ||

|

Supplemental Disclosures of Cash flow information:

|

||||

|

Cash paid for interest

|

$ | - | ||

|

Cash paid for taxes

|

$ | - | ||

|

Non Cash Financing Activities

|

||||

|

Common shares issued for services

|

$ | 39,915 | ||

The accompanying notes are an integral part of these financial statements.

F-6

GREAT EAST ENERGY, INC.

(A DEVELOPMENTAL STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2013

NOTE 1 - ORGANIZATION AND BASIS OF PRESENTATION

Great East Energy, Inc. was incorporated in Nevada on April 5, 2013 and is a development-stage entity. The Company's current business plan is to complete the acquisition transaction contemplated by the Option Agreement and as a result to engage in the business of developing natural gas properties located in Ukraine.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Development Stage Company

The Company is considered to be in the development stage as defined in ASC 915-10-05, “Development Stage Entity.” The Company is devoting substantially all of its efforts to the execution of its business plan.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents consists principally of currency on hand, demand deposits at commercial banks, and liquid investment funds having a maturity of three months or less at the time of purchase. The Company had $50,000 in cash and cash equivalents as of June 30, 2013.

Start-up Costs

In accordance with ASC 720-15-20, “Start-up Activities,” the Company expenses all costs incurred in connection with the start-up and organization of the Company.

Common Stock Issued For Other Than Cash

Services purchased and other transactions settled in the Company's common stock are recorded at the estimated fair value of the stock issued if that value is more readily determinable than the fair value of the consideration received.

F-7

GREAT EAST ENERGY, INC.

(A DEVELOPMENTAL STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2013

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recently Enacted Accounting Standards

We do not expect the adoption of recently issued accounting pronouncement to have a significant impact on our results of operations, financial position or cash flow.

NOTE 3 - PROVISION FOR INCOME TAXES

The Company recognizes the tax effects of transactions in the year in which such transactions enter into the determination of net income regardless of when reported for tax purposes. Deferred taxes are provided in the financial statements under FASC 740-10-65-1 to give effect to the temporary differences which may arise from differences in the bases of fixed assets, depreciation methods and allowances based on the income taxes expected to be payable in future years. Minimal development stage deferred tax assets arising as a result of net operating loss carry-forwards have been offset completely by a valuation allowance due to the uncertainty of their utilization in future periods. Operating loss carry-forwards generated during the period from April 5, 2013 (date of inception) through June 30, 2013 of approximately $441,510will begin to expire in 2033.

Accordingly, deferred tax assets related to the net operating loss of approximately $150,113 were fully reserved as of June 30, 2013.

The Company recognizes interest accrued relative to unrecognized tax benefits in interest expense and penalties in operating expense. During the period from April 5, 2013 (inception) to June 30, 2013 the Company recognized no income tax related interest and penalties. The Company had no accruals for income tax related interest and penalties at June 30, 2013.

NOTE 4 - STOCKHOLDERS’ EQUITY

As of June 30, 2013 the Company has 1,000,000 shares of common stock authorized with a par value of $.001 per share. 5,893 shares have been issued to the President and director as part of their consulting agreements, further discussed in note 7. The shares were valued based on an hourly rate of $150 that is compatible to the market rate for the similar positions and applied to their average of a combined 30 hours per week. The Company valued their services, excluding the cash payments totaled $39,915.

NOTE 5 - ACCOUNTS PAYABLE

As of June 30, 2013, the Company’s accounts payable totaled $118,719. The following table shows the content of the account as of June 30, 2013:

|

Professional Fees

|

$ | 117,817 | ||

|

Incorporation Fees

|

902 | |||

|

Total Accounts Payable

|

$ | 118,719 |

F-8

GREAT EAST ENERGY, INC.

(A DEVELOPMENTAL STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2013

NOTE 6 - ACCRUED LIABLIES

As of June 30, 2013, the Company’s accrued liabilities totaled $309,312. The following table shows the content of the account as of June 30, 2013:

|

Accrued stock payable

|

$ | 255,162 | ||

|

Professional Fees

|

54,150 | |||

|

Total Accounts Payable

|

$ | 309,312 |

Under the stock option agreement discussed further in note 10, the Company also accrued $20,000 for professional fees to prepay the Seller (BHL) for professional services incurred by BHL.

Accrued liabilities also consist of $205,995 of accrued compensation for consulting services for the period of May and June 2013. It includes $6,000 cash payment and approximately $199,995 of stock payment. Under the agreement the consultant is to receive monthly cash payment of $3,000 in addition to a total of 5,357 common shares of Epsilon Corp, a shell company upon the closing of the Private Placement Financing (PPF) simultaneous with the Company going-public through a reverse merger with Epsilon Corp. Both PPF and reverse merger transactions were completed on July 25, 2013. The stock compensation for the period was calculated using the private placement financing per share price of $56 deemed fair value, and prorated for the month of May and June. See note 10 for additional information.

The Company also entered into a legal retainer agreement on May 6, 2013. Under the agreement, the Company is required to make a flat fee payment, including cash payment of $50,000 and 200,000 post-split common shares of Epsilon Corp. The stock payment to the law firm is valued under the assumption of a post-split PPS of $1 per share after 56:1 forward split. Since the completion (closing) date is July 25, 2013, and the services cover approximately three months, and the Company accrued professional fees related to the legal service for the month of May and June 2013 totaled $166,667, including the cash payment. The Company also accrued approximately $4,150 for the accounting and auditing fees for the period ended June 30, 2013.

NOTE 7 - RELATED PARTY PAYABLES

The related party payables consist reimbursement of expenses and compensations to the Company’s acting Chairman and acting CEO for their services at fair value. Each of them is to receive monthly cash payment in addition to the Company’s common shares for the period of April 15 through June 30, 2013. The fair value compensation was calculated based on their average hours worked per week applied to an hourly rate that is compatible to the average market hourly compensation rate of similar positions. The total of compensation and payables to these related party for the period ended June 30, 2013 totaled $13,479.

F-9

GREAT EAST ENERGY, INC.

(A DEVELOPMENTAL STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2013

NOTE 8 - ADVANCE SUBSCRIPTION FROM INVESTORS

In connection with the Private Placement Financing discussed in note 10, the Company has received $90,000 in advances for subscriptions prior to June 30, 2013 from investors to purchase the Epsilon Corp’s common stock as of June 30, 2013.

NOTE 9 - GOING CONCERN

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, which contemplates continuation of the Company as a going concern. The Company has incurred approximately $481,425 in operating deficit since its inception, and has generated no operating revenue, which could raise substantial doubt about the Company’s ability to continue as a going concern.

In view of these matters, realization of the assets of the Company is dependent upon the Company’s ability to meet its financial requirements through equity financing and the success of future operations. These financial statements do not include adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence.

NOTE 10 -SUBSEQUENT EVENTS

The Company has evaluated events from June 30, 2013 through the date the financial statements were issued.

Share Exchange Agreement

On July 25, 2013, the Company consummated transactions pursuant to a Share Exchange Agreement (the “Share Exchange Agreement”) with Epsilon Corp. dated July 25, 2013 by and among the Company and the stockholders of the Company whereby the Company’s Stockholders transferred 100% of the outstanding shares of common stock of the Company held by them, in exchange for an aggregate of 5,893 newly issued shares of the Epsilon Corp.’s common stock with a par value $.001 per share (“Common Stock”).

Stock Purchase Option Agreement

On July 25, 2013, the Company entered into a Stock Purchase Option Agreement (the “Option Agreement”) with Bezerius Holdings Limited, a corporation organized under the laws of the Republic of Cyprus (“BHL”), whereby BHL granted to the Company an option to purchase 1,000 shares of equity capital of Synderal Services LTD, a corporation organized under the laws of the Republic of Cyprus ("SSL"), representing all issued and outstanding shares of SSL for $1,250,000. SSL is engaged in the gas exploration and production business in Ukraine through its two wholly-owned subsidiaries, Limited Liability Company NPK-KONTAKT and Limited Liability Company LISPROMGAZ, each a legal entity formed under the laws of Ukraine.

F-10

GREAT EAST ENERGY, INC.

(A DEVELOPMENTAL STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2013

Under the Option Agreement, the Company is required to pay to BHL $412,500 as an advance payment to be credited towards the purchase price of the SSL’s shares. The balance of the purchase price in the amount of $837,500 shall be paid by the Company upon exercise of the option to be completed on or before September 30, 2013. If the Company elects not to exercise the option to purchase the SSL’s shares, BHL is required to return to the Company the advance payment. This obligation by BHL is secured by the pledge of all the issued and outstanding shares of BHL by its shareholder.

On July 25, 2013, the Company issued 460,714 shares of Common Stock to BHL in connection with the option grant closing under the Option Agreement. Such Common Stock was issued in accordance with an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), under Section 4(2) of the Securities Act by virtue of compliance with the provisions of Regulation S under the Securities Act.

In connection with the issuance of 460,714 shares of Common Stock, BHL entered into a Stock Escrow Agreement and a Lock-Up Agreement with Epsilon. Pursuant to the Stock Escrow Agreement, BHL delivered to the escrow agent the shares of Common Stock issued to it to be held by the escrow agent pending the closing of the option exercise to purchase shares of SSL by the Company under the Option Agreement in which case such shares will be released by the escrow agent to BHL. Shall the parties to the Option Agreement fail to consummate the purchase of SSL shares by the Company; the escrowed shares will be cancelled. BHL has no right to vote the escrowed shares until such time as they are eligible for release to BHL.

Under such Lockup Agreement, BHL agreed not to offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, sell short, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of any shares of Common Stock, or enter into any swap or other arrangement that transfers any economic consequences of ownership of Common Stock until 12 months after the date therein.

Under the Option Agreement, the Company is required to reimburse BHK for professional service expenses up to $50,000 whether or not the Company exercise the purchase Option. However, the Company estimated approximately $20,000 legal expense has been occurred by BHK by June 30, 2013, and thus accrued this amount accordingly.

Private Placement of Common Stock

On July 25, 2013, the Company entered into and consummated transactions pursuant to the Subscription Agreement (the “Subscription Agreement”) with certain accredited investors whereby the Company issued and sold to the investors for $56.00 per share an aggregate of 10,982 shares of the Company’s Common Stock for an aggregate purchase price of $615,000 (the “Private Placement”). Such Common Stock was issued in accordance with an exemption from the registration requirements of the Securities Act under Section 4(2) of the Securities Act by virtue of compliance with the provisions of Regulation D and/or Regulation S under the Securities Act.

F-11

EPSILON CORP.

Unaudited Proforma Consolidated Balance Sheet

|

Great East

Energy, Inc.

|

Epsilon Corp.

|

|||||||||||||||||

|

June 30, 2013

|

June 30, 2013

|

Adjustments

|

Consolidated

|

|||||||||||||||

|

ASSETS

|

||||||||||||||||||

|

Current assets:

|

||||||||||||||||||

|

Cash

|

$ | 50,000 | $ | 255 | $ | 50,255 | ||||||||||||

|

Total current assets

|

50,000 | 255 | 50,255 | |||||||||||||||

|

Current assets:

|

||||||||||||||||||

|

Deposits

|

40,000 | - | 40,000 | |||||||||||||||

|

Total current assets

|

40,000 | - | 40,000 | |||||||||||||||

|

Total assets

|

$ | 90,000 | $ | 255 | $ | 90,255 | ||||||||||||

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

||||||||||||||||||

|

Current liabilities:

|

||||||||||||||||||

|

Accounts payable

|

$ | 118,719 | $ | 11,650 | $ | 130,369 | ||||||||||||

|

Accrued liabilities

|

309,312 | - | 309,312 | |||||||||||||||

|

Advance subscriptions from investors

|

90,000 | - | 90,000 | |||||||||||||||

|

Related party payables

|

13,479 | 25 | 13,504 | |||||||||||||||

|

Total current liabilities

|

531,510 | 11,675 | 543,185 | |||||||||||||||

|

Total liabilities

|

531,510 | 11,675 | 543,185 | |||||||||||||||

|

Stockholders’ equity (deficit):

|

||||||||||||||||||

|

Common stock - $.001 par value; 1,000,000 shares

|

||||||||||||||||||

|

authorized; 5,893 shares outstanding

|

6 | 336 | a | (6 | ) | 336 | ||||||||||||

|

Additional paid-in capital

|

39,909 | 67,864 | b | (481,425 | ) | (373,646 | ) | |||||||||||

| a | 6 | |||||||||||||||||

|

Accumulated deficit

|

(481,425 | ) | (79,620 | ) | b | 481,425 | (79,620 | ) | ||||||||||

|

Total stockholders' deficit

|

(441,510 | ) | (11,420 | ) |

a

|

(452,930 | ) | |||||||||||

|

Total liabilities and stockholders' deficit

|

$ | 90,000 | $ | 255 | $ | 90,255 | ||||||||||||

F-12

EPSILON CORP.

Unaudited Proforma Consolidated Statement of Operations

For the Period form Inception [April 5, 2013] to June 30, 3013 for Great East Eneregy, Inc.

For the Six Months Ended June 30, 2013 Epsilon Corp.

FROM APRIL 5, 2013 (INCEPTION) TO JUNE 30, 2013

|

Great East

Energy, Inc.

From Inception [April 5, 2013] to June 30, 2013 |

Epsilon Corp.

For the Six

Months Ended

June 30, 2013

|

Adjustments

|

Consolidated

|

||||||||||

|

INCOME

|

$ | - | $ | - | $ | - | |||||||

|

OPERATING EXPENSES

|

|||||||||||||

|

Organizational expenses

|

902 | - | 902 | ||||||||||

|

General and administrative expenses

|

4,000 | 1,643 | 5,643 | ||||||||||

|

Professional fees

|

476,523 | 4,904 | 481,427 | ||||||||||

|

Total Operating Expenses

|

481,425 | 6,547 | 487,972 | ||||||||||

|

NET LOSS APPLICABLE TO COMMON SHARES

|

$ | (481,425 | ) | $ | (6,547 | ) | $ | (487,972 | ) | ||||

|

NET LOSS PER BASIC AND DILUTED SHARES

|

$ | (81.69 | ) | $ | (0.00 | ) | $ | (0.15 | ) | ||||

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING

|

5,893 | 3,360,000 | 3,360,000 | ||||||||||

Pro Forma adjustments:

|

(a)

|

5,893 shares cancelled in respect to the share exchange agreement

|

|

(b)

|

Transfer of the accumulated deficit during the exploration stage to additional paid in capital.

|

F-13

PROFORMA FINANCIAL STATEMENTS

The unaudited pro forma consolidated balance sheet and statement of operations reflects amounts as if the transaction, which concluded on July 25, 2013, had occurred on June 30, 2013 by and between Epsilon Corp (the “Company”) and Great East Energy, Inc. (“GEEI”), a corporation incorporated under the laws of the State of Nevada.

The information presented in the unaudited pro forma combined financial statements does not purport to represent what the financial position or results of operations would have been had the acquisition occurred as of June 30, 2013, nor is it indicative of future financial position or results of operations. You should not rely on this information as being indicative of the historical results that would have been achieved had the companies always been combined, or the future result that the combined company will experience after the Exchange Transaction is consummated.

The pro forma adjustments are based upon available information and certain assumptions that the Company believes are reasonable under the circumstances. The unaudited pro forma financial statements should be read in conjunction with the accompanying notes and assumptions and the historical financial statements of the Company and Epsilon.

On July 25, 2013, the Company consummated transactions pursuant to a Share Exchange Agreement (the “Share Exchange Agreement”) with GEEI, dated July 25, 2013 by and among the Company and the stockholders of the Company whereby the Company’s Stockholders transferred 100% of the outstanding shares of common stock of the Company held by them, in exchange for an aggregate of 5,893 newly issued shares of GEEI’s common stock with a par value $.001 per share (“Common Stock”).

F-14

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Epsilon Corp.

|

|

|

|

|

|

|

|

|

Dated: July 31, 2013

|

By:

|

/s/ Michael Doron

|

|

|

|

|

Michael Doron

|

|

|

|

|

Chief Executive Officer

|

|

18