Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - VANTAGESOUTH BANCSHARES, INC. | q22013pressrelease.htm |

| 8-K - 8-K - VANTAGESOUTH BANCSHARES, INC. | form8-k.htm |

VantageSouth Bancshares 2013 Q2 Earnings Conference Call July 30, 2013

Forward-looking statements 2 Statements in this presentation relating to plans, strategies, economic performance and trends, projections of results of specific, acquisitions, activities or investments, expectations or beliefs about future events or results, and other statements that are not descriptions of historical facts, may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking information is inherently subject to risks and uncertainties, and actual results could differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, risk factors discussed in the Company’s Annual Report on Form 10-K, and in other documents filed by the Company with the Securities and Exchange Commission from time to time. Factors that could influence the accuracy of such forward-looking statements include, but are not limited to pressures on the earnings, capital and liquidity of financial institutions in general, resulting from current and future conditions in the credit and equity markets, the financial success or changing strategies of the Company’s customers, actions of government regulators, the level of market interest rates, changes in general economic conditions and the real estate values in our banking market (particularly changes that affect our loan portfolio, the abilities of our borrowers to repay their loans, and the values of loan collateral). In addition, in connection with the Company’s completed acquisitions, the Company may (i) incur greater than expected costs or difficulties related to the integration of acquired companies, (ii) not realize the expected cost savings or synergies, and/or (iii) experience deposit attrition, customer or revenue loss with respect to an acquired company. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. The Company has no obligation to, and does not intend to, update any forward-looking statements. Important Information about this Presentation Piedmont Community Bank Holdings, Inc. owns 70% of VantageSouth Bancshares, Inc. VantageSouth Bank is a wholly-owned subsidiary of VantageSouth Bancshares. VantageSouth Bancshares conducts business under the name VantageSouth Bank. All historical financial information combines VantageSouth Bancshares, Inc., VantageSouth Bank and Community Bank of Rowan results. Non‐GAAP Measures Statements included in this presentation include non‐GAAP measures and should be read along with the accompanying tables to the earnings release which provide a reconciliation of non‐GAAP measures to GAAP measures. Management believes that these non‐GAAP measures provide additional useful information. Non‐GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the company's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company. Non‐GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the company's results or financial condition as reported under GAAP.

2nd quarter 2013 highlights 3 Net income available to common shareholders of $3.0 million or $0.07 per diluted share • $6.0 million in core pre-tax pre-provision earnings Organic growth trajectory continues • Q2 organic loan growth totaled $75 million (24% annualized) Continued asset quality improvement • Nonperforming assets to total assets decreased from 1.48% to 1.32% • Adjusted allowance to total loans of 3.70% up from 2.54% at Q1 Capital levels optimized • Tangible common equity to tangible assets of 7.83% • Tier 1 leverage ratio of 8.26% Closed and integrated ECB • ECB acquisition closed on April 1; systems conversion completed the weekend of April 26th • Cost take outs on track with 7% FTE reduction primarily at the end of Q2 • Gain on acquisition of $8.2 million offset significant portion of $12.0 million of merger and conversion costs

Loan portfolio transformation 4 New Loan Originations ($mm) Targeting balanced loan portfolio between C&I, CRE, and consumer/other • Running off non-strategic CRE • Growing C&I Average Yield (%) New Loan Originations – Fixed vs. Floating Rate ($mm) Drivers of Loan Growth: “All-star” talent hired for strong client relationships Superior geographic markets with macro growth Capital and liquidity to deploy Agility/responsiveness – vs. “big bank” bureaucracy Horsepower – able to handle more complex credits Distraction/dislocation among competitors $26.4 $63.0 $83.6 $95.8 $85.6 $216.1 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Total CRE C&I Other Builder 6.13% 6.06% 5.95% 5.79% 5.54% 6.21% 4.55% 4.61% 4.43% 4.52% 4.26% 4.45% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 2 1 $9.3 $30.4 $38.5 $39.3 $39.9 $145.0 $17.1 $32.6 $45.0 $56.6 $45.7 $71.1 $0.0 $40.0 $80.0 $120.0 $160.0 $200.0 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Floating Fixed Total Portfolio New Originations Loan Portfolio Composition (Q2 2013) (ex. Builder) C&I 4% Owner- Occ. CRE 18% Investor CRE* 1% Other 27 Note: New loan originations represent total loan commitments originated in each respective period *Investor CRE is comprised of non-owner occupied CRE, multifamily and C&D Mandatory use of robust pricing model ensures pricing discipline

Allowance for loan losses 5 Q2 allowance primarily driven by strong Q2 loan growth Purchase impaired portfolio impacts remain lumpy as negative pool level cash flows are realized immediately while positive pool level cash flows are realized over the remaining life of the pool Effective reserve, including ALLL and loan marks, is 3.70% of outstanding principal balances ($ in thousands) Non-Acquired Portfolio Purchased Non-Impaired Purchased Impaired (SOP 03-3) Total Balance at 3/31/13 2,834$ 210$ 2,483$ 5,527$ Net charge-offs (28) (567) 0 (595) Provision for loan losses 1,533 357 (397) 1,493 ALLL balance at 6/30/13 4,339 - 2,086 6,425 Remaining credit mark - 12,769 21,919 34,688 Remaining non-credit mark - 7,846 - 7,846 Total effective reserve 4,339$ 20,615$ 24,005$ 48,959$ Loans 493,789$ 625,203$ 204,989$ 1,323,981$ Effective reserve percentage 0.88% 3.30% 11.71% 3.70%

Core Deposits* 44% Time Deposits 42% FHLB 16% Funding mix dramatically improved 6 *Core deposits defined as total deposits less all time deposits Funding Balances (Q2 2013) Stronger, core-deposit based funding • Building DDA deposits through commercial lending • Reduced reliance on time deposits and FHLB borrowings • Maturities replaced with lower cost funding Core Deposits* 58% Time Deposits 36% FHLB 6% Q3 2011 Funding Evolution Over Time Q2 2013 Balance Cost Core Dep. $455.6 Time Dep. 439.1 FHLB 150.0 Total $1,044.7 1.82 % Balance Cost Core Dep. $1,024.4 Time Dep. 630.3 FHLB 100.9 Total $1,755.6 0.40 % Balance % of Average Rate MRQ Cost Type ($000) Total Q1 Q2 Noninterest Demand $197,229 11.2% 0.00% 0.00% Interest Bearing Demand 344,515 19.6% 0.31% 0.22% Money Market & Savings 482,672 27.5% 0.53% 0.29% Retail Time 420,214 23.9% 0.85% 0.63% Wholesale Time 210,068 12.0% 1.02% 0.88% FHLB 100,902 5.7% 0.76% 0.43% Total $1,755,601 100.0 0.60% 0.40% ($ in millions) ($ in millions)

Earnings profile 7 ECB acquisition closed and converted in April Net income was $3.7mm on over $25mm of operating revenue Annualized net loan growth was approximately 24% (excluding acquired ECB loans) Net interest margin expanded 43 bps to 4.67% driven by accretion, deposit re- pricing and improved earning asset mix Provision for loan losses driven by organic loan growth Improved operating efficiency with realization of ECB cost saves starting late in the quarter, post conversion Three months ended, ($ in thousands) 2012Q2 2012Q3 2012Q4 2013Q1 2013Q2 Net interest income 10,033$ 10,265$ 10,175$ 9,944$ 20,428$ Provision for loan losses 2,046 1,077 1,167 1,940 1,492 Net int. inc. after provision 7,987 9,188 9,008 8,004 18,936 Noninterest income 2,390 3,332 4,133 3,462 4,855 Noninterest expense 10,292 10,593 12,240 11,066 19,179 Income before taxes & M&A costs 85 1,927 901 400 4,612 Gain on ECB acquisition - - - - 8,241 Merger & conversion costs 6 547 2,114 1,601 11,961 Income before taxes 79 1,380 (1,213) (1,201) 892 Tax expense (benefit) (259) 95 (3,326) (395) (2,808) Net income (loss) 338$ 1,285$ 2,113$ (806)$ 3,700$ Dividends & accretion on preferred stock 367 367 368 369 705 Net income (loss) to common (29)$ 918$ 1,745$ (1,175)$ 2,995$ Net income (loss) to common per share -$ 0.03$ 0.05$ (0.03)$ 0.07$ Weighted average diluted shares 35,723,442 35,749,168 35,806,191 35,758,033 45,935,330 Core pre-tax, pre-provision earnings 2,158$ 2,521$ 1,465$ 1,248$ 5,981$

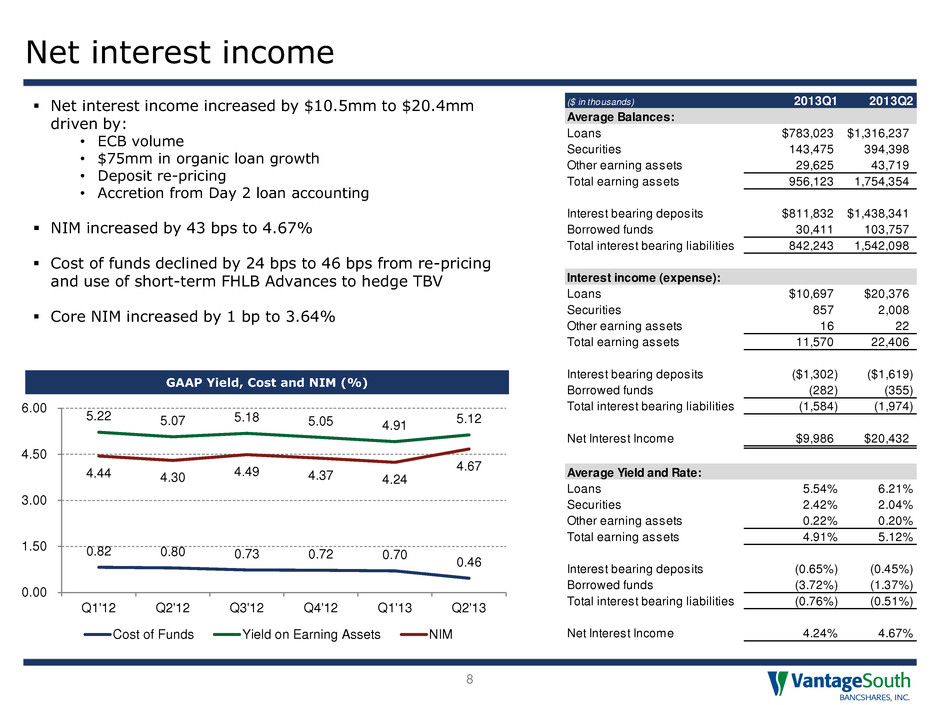

Net interest income 8 Net interest income increased by $10.5mm to $20.4mm driven by: • ECB volume • $75mm in organic loan growth • Deposit re-pricing • Accretion from Day 2 loan accounting NIM increased by 43 bps to 4.67% Cost of funds declined by 24 bps to 46 bps from re-pricing and use of short-term FHLB Advances to hedge TBV Core NIM increased by 1 bp to 3.64% GAAP Yield, Cost and NIM (%) 0.82 0.80 0.73 0.72 0.70 0.46 5.22 5.07 5.18 5.05 4.91 5.12 4.44 4.30 4.49 4.37 4.24 4.67 0.00 1.50 3.00 4.50 6.00 Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Cost of Funds Yield on Earning Assets NIM ($ in thousands) 2013Q1 2013Q2 Average Balances: Loans $783,023 $1,316,237 Securities 143,475 394,398 Other earning assets 29,625 43,719 Total earning assets 956,123 1,754,354 Interest bearing deposits $811,832 $1,438,341 Borrowed funds 30,411 103,757 Total interest bearing liabilities 842,243 1,542,098 Interest income (expense): Loans $10,697 $20,376 Securities 857 2,008 Other earning assets 16 22 Total earning assets 11,570 22,406 Interest bearing deposits ($1,302) ($1,619) Borrowed funds (282) (355) Total interest bearing liabilities (1,584) (1,974) Net Interest Income $9,986 $20,432 Average Yield and Rate: Loans 5.54% 6.21% Securities 2.42% 2.04% Other earning assets 0.22% 0.20% Total earning assets 4.91% 5.12% Interest bearing deposits (0.65%) (0.45%) Borrowed funds (3.72%) (1.37%) Total interest bearing liabilities (0.76%) (0.51%) Net Interest Income 4.24% 4.67%

Noninterest income 9 Record noninterest income driven by: • Increase in service charges and fees reflect ECB acquisition, lower fee waivers and seasonality of tourism markets • Mortgage production totaling $64.8mm, an increase of 34% from the first quarter Purchase volume increased to 36% for the quarter with trend improving • SBA loan production of $16.8mm with 97% in the saleable 7a product SBA loan sales were $8.0mm at an average gain of 12.6% • Other noninterest income increasing with ECB fee base coupled with the seasonality of the merchant business in the tourism markets Noninterest Income Composition* ($000) $518 $423 $533 $345 $1,052 $557 $523 $508 $515 $1,525 $770 $1,127 $771 $391 $1,096 $572 $776 $1,718 $1,119 $1,058 0 1,250 2,500 3,750 5,000 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Other Service Charges Mortgage Income SBA Lending *Excludes realized securities gains and losses $4,732 $2,370 $3,530 $2,849 $2,417

Noninterest expense 10 Total non-interest expense increased to $31.1mm driven by merger and conversion costs and the ECB acquisition which closed on April 1st Operating non-interest expense increased to $19.2mm driven by the acquisition of ECB which closed April 1st Merger and conversion costs include liquidated damages to terminate contracts, system conversion costs, severance and retention payments and rebranding / marketing costs • These costs were largely offset by the ECB acquisition gain Costs saves were estimated at 25% of the ECB expense base and were projected to be realized over 2 years • Cost reductions began late in the quarter, after the conversion, with FTE decreasing from 520 to 485 • The company believes it is tracking to meet its cost save target but on a faster timeline than was underwritten *Excludes merger and conversion costs Three months ended, ($ in thousands) 2012Q2 2012Q3 2012Q4 2013Q1 2013Q2 Sal ries an employee benefits $5,513 $5,648 $6,588 $5,991 $11,009 Occupancy and equipment 1,353 1,385 1,321 1,547 2,408 Data processing 594 644 698 644 1,075 FDIC insurance premiums 229 205 216 227 400 Professio al services 584 800 684 497 43 Foreclo d asset expenses 295 251 662 183 79 Other loan-related expense 335 419 352 461 792 Merger and conversion costs 6 547 2,114 1,601 11,961 Other 1,389 1,241 1,719 1,516 3,373 Total non-interest expense $10,298 $11,140 $14,354 $12,667 $31,140 Operating non-interest expense* $10,292 $10,593 $12,240 $11,066 $19,179

ECB acquisition: Scale at an excellent price 11 Creates the largest community bank in eastern North Carolina • Doubles North Carolina deposit market share • 92 year-old franchise represents strong core funding base • Ability to leverage VSB’s SBA and mortgage platforms and ECB’s merchant and agricultural lending platforms across larger footprint Immediately accretive to core EPS and tangible book value per share Integration and cost saves ahead of schedule Bargain purchase gain largely offset one-time costs Customer attrition well below industry standards and underwriting Planned loan sale strengthens portfolio without additional impairment • Reduces CRE concentrations Strategically & Financially Compelling Integration Ahead of Schedule

2013 priorities 12 Execute on ECB transaction • Including integrating, cost saves and revenue growth Continue ramp-up of SBA, mortgage and builder finance growth initiatives • Adding SBA Business Development Officers in three new markets Continue C&I/CRE organic growth trajectory • Including Jacksonville, NC and Charlotte de novos Redeem TARP Continue building IT infrastructure to support future growth • Including mobile banking and loan origination Pursue other strategic growth opportunities