Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERLING FINANCIAL CORP /WA/ | sfc8-kreq2investordeck.htm |

Management Update Second Quarter 2013 NASDAQ Ticker: STSA Spokane, Washington www.sterlingfinancialcorporation.com

Safe Harbor (1) The Reform Act defines the term "forward-looking statements" to include: statements of management plans and objectives, statements regarding the future economic performance, and projections of revenues and other financial data, among others. The Reform Act precludes liability for oral or written forward-looking statements if the statement is identified as such and accompanied by "meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those made in the forward-looking statements." In the course of our presentation, we may discuss matters that are deemed to be forward-looking statements, which are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995 (the “Reform Act”)(1). Forward-looking statements involve substantial risks and uncertainties, many of which are difficult to predict and are generally beyond our control. Actual results may differ materially and adversely from projected results. We assume no obligation to update any forward-looking statements (including any projections) to reflect any changes or events occurring after the date hereof. Additional information about risks of achieving results suggested by any forward-looking statements may be found in Sterling’s 10-K, 10-Q and other SEC filings, included under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” 2

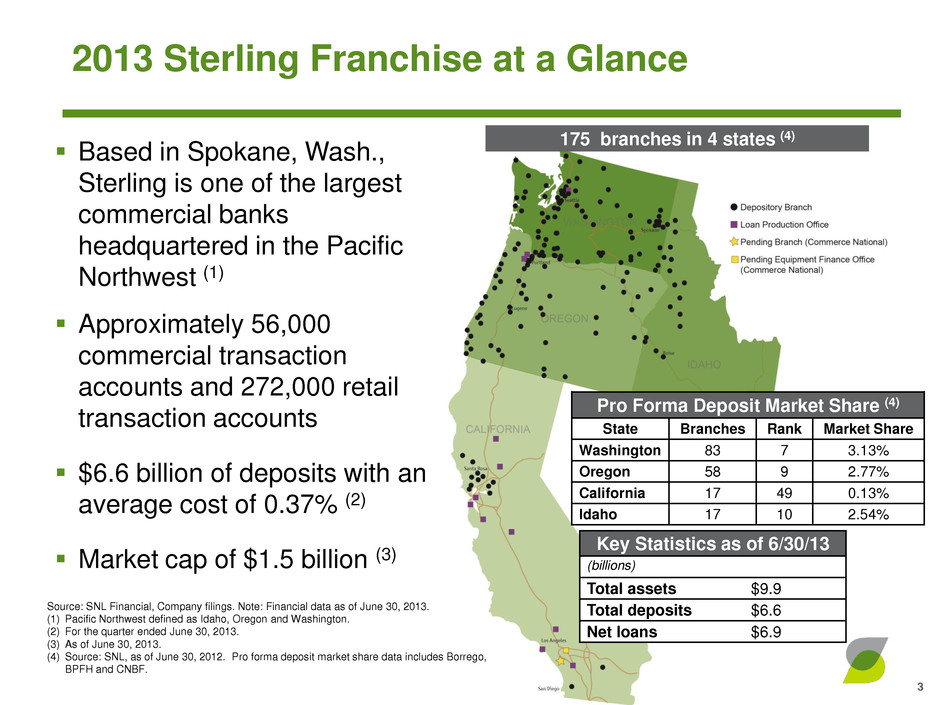

Key Statistics as of 6/30/13 (billions) Total assets $9.9 Total deposits $6.6 Net loans $6.9 2013 Sterling Franchise at a Glance 3 Based in Spokane, Wash., Sterling is one of the largest commercial banks headquartered in the Pacific Northwest (1) Approximately 56,000 commercial transaction accounts and 272,000 retail transaction accounts $6.6 billion of deposits with an average cost of 0.37% (2) Market cap of $1.5 billion (3) 175 branches in 4 states (4) Source: SNL Financial, Company filings. Note: Financial data as of June 30, 2013. (1) Pacific Northwest defined as Idaho, Oregon and Washington. (2) For the quarter ended June 30, 2013. (3) As of June 30, 2013. (4) Source: SNL, as of June 30, 2012. Pro forma deposit market share data includes Borrego, BPFH and CNBF. Pro Forma Deposit Market Share (4) State Branches Rank Market Share Washington 83 7 3.13% Oregon 58 9 2.77% California 17 49 0.13% Idaho 17 10 2.54%

Key Operating Objectives Performance Trends Cost of Deposits: 37 bps in Q2 ‘13, down 2 bps from Q1 ‘13 Net interest margin (FTE) of 3.70%, up 1 bp from Q1 ‘13 Transaction/Savings/MMDA balances 74% of total deposits at 6/30/13 Ratio of NPA/total assets: 1.70%, down from 2.29% at Q1 ‘13 Q2 ‘13 60+ day delinquencies: 0.92%, down from 1.61% at Q1 ‘13 Allowance to loans: 2.02%; Allowance to nonperforming loans: 99% Originated $687MM of new portfolio loans Q2 ‘13 Originations: 41% multifamily, 34% residential/consumer; 21% commercial Q2 ‘13 Annualized organic loan growth: 14% Q2 ‘13 Noninterest expenses/assets: 3.45% annualized, down from 3.61% for Q1 ‘13 Q2 ‘13 Efficiency ratio: 63%, down from 73% for Q1 ‘13 Reported net income of $27.8MM, or $0.44 per diluted share, compared to $22.7MM, or $0.36 per diluted share, for Q1 ’13 Pre-tax earnings of $40.7MM, highest in company history Declared special dividend of $0.35 and paid quarterly dividend of $0.20 Dividends declared YTD of $0.75 per share, represent 94% of earnings Announced acquisition of Commerce National Bank Completed acquisition of Puget Sound ops of Boston Private Bank & Trust Profitable growth Cost- effective funding Improved asset quality High quality relationship based asset generation Expense control Active capital mgmt + + + = + 4

(in millions) 6/30/2012 6/30/2013 Annual % change Retail deposits: Transaction $2,236 $2,455 10% Savings and MMDA 2,183 2,282 5% Time deposits 1,812 1,414 -22% Total retail 6,231 6,151 -1% Public: 269 174 -35% Brokered: 297 303 2% Total deposits $6,797 $6,628 -2% BPs Change Depost funding costs 0.58% 0.37% -21 Gross loans to deposits 90% 106% Non-interest bearing transaction: $1,702 / 26% Interest-bearing transaction: $753 / 11% Savings and money market demand: $2,282 / 34% Retail time deposits: $1,414 / 21% Public: $174 / 3% Brokered: $303 / 5% Balance of $6,628 million as of June 30, 2013 (in millions) 2.08% 0.37% 0.90% 0.23% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 2Q 2013 Y-o-Y Improvement (21 bps) STSA Peer Deposit Composition and Funding Source: SNL Financial and company filings. (1) Peers include: BANR, CATY, CYN, CVBF, GBCI, PACW, SIVB, UMPQ, and WABC. Figures based on median of peers. $556 million of CDs re-pricing by YE 2013 with a current average rate of 1.0% Structured repurchased agreement borrowings: o 6/30/13 structured repo balance $500MM, WAC 3.8%, WAM 4.0 years Deposit composition Deposit balances Reducing avg. cost of deposits (%) (1) 5

Washington: $2,729 / 39% Oregon: $1,354 / 19% N. California: $1,408 / 20% S. California: $881 / 13% Idaho: $254 / 4% Other: $376 / 5% (in millions) Residential RE: $965 / 14% Multifamily: $1,963 / 28% CRE, NOO: $1,172 / 17% CRE, OO: $1,412 / 20% C&I : $637 / 9% Construction: $70 / 1% Consumer: $783 / 11% (in millions) Loan Portfolio Summary Focusing on Relationship-Based Lending Gross loans were $7.0 billion at June 30, 2013 Q2 ‘13 portfolio loan originations increased $228 million, or 50% over Q2 ‘12 (1) Multifamily and C&I accounted for 56% of Q2 ‘13 portfolio originations Source: Company filings. (1) Excluding residential mortgage loans held for sale. Loan mix by geography Loan mix by category 6

WA 24% OR 9% N Cal 29% S Cal 38% 5 Yr Fixed Hybrid ARM 67% 7 Yr Fxd H- ARM 21% 3 Yr Fxd H- ARM 9% Other 3% Refi 70% Purchase 30% $28 $147 $365 $568 $748 $921 $1,156 $1,300 $1,561 $1,747 $2,028 $- $500 $1,000 $1,500 $2,000 $2,500 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Mi llio ns Quarterly Originations Cumulative Multifamily – Program to Date as of Q2 2013 7 MF loan programs MF geography MF loan purpose MF originations since program inception Wtd Avg LTV: 66.4%; Wtd Avg DSC: 1.34:1; Wtd Avg Yield: 4.2%; Average Loan: $1.9 million

Working to improve efficiency and effectiveness of operations o Branch rationalization substantially complete • Sold 4 branches YTD • Closed or consolidated 6 branches YTD o Leverage existing technology and operational infrastructure o Continued focus on vendor management and consolidation Expense Control and Operating Efficiency Drivers 8

0% 2% 4% 6% 8% 10% 12% Q2 08 Q3 08 Q4 08 Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 NPAs/Assets STSA Peer $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 Q2 08 Q3 08 Q4 08 Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Mil lion s Classified Assets Non-perfoming Assets Non-performing Loans 9 Asset Quality Metrics Comparable to Peers Source: SNL Financial and company filings. (1) Peers include: BANR, CATY, CYN, CVBF, GBCI, PACW, SIVB, UMPQ, and WABC. Figures based on median of peers. 12/31/09: $1,648 $161

Summary Executing on our strategic plan o Valuable, core-deposit franchise drives earnings power o Continued improvement in asset quality metrics o High-quality, relationship-based loan generation • Strategic acquisitions o Ongoing expense management YTD dividend payout ratio: 94% of earnings • Quarterly regular dividend rate of $0.20 (3% yield) • $0.35 special dividend paid in 2Q ‘13 o Significantly exceed regulatory levels required for “well-capitalized” status under Basel III o Additional capital in place to support organic growth o Will evaluate other capital management alternatives, including acquisitions that make strategic and financial sense, and share repurchase 10

NASDAQ Ticker: STSA Spokane, Washington www.sterlingfinancialcorporation.com Investor Contact Media Contact Patrick Rusnak Cara Coon Chief Financial Officer VP/Communications and Public Affairs Director (509) 227-0961 (509) 626-5348 patrick.rusnak@bankwithsterling.com cara.coon@bankwithsterling.com

Earnings Release Supplement For the Quarter and Quarter Ended June 30, 2013

($ in Millions) 6/30/2013 3/31/2013 Difference Originations and Sales Activity $20.1 $11.1 $9.0 Loan Servicing Fees 4.1 2.7 1.4 Porfolio Loan Fair Value Adjustment (1.0) - (1.0) Mortgage Banking Operations $23.2 $13.8 $9.4 Three Months Ended 3.07% 3.68% 3.60% 1.63% 2.35% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $- $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 M argin $ i n M illi on s HFS Loan Production MBO Activity Margin on Loan Sales Income From Mortgage Banking Operations 13 49% of Q2 ‘13 originations were purchase loans, 10% HARP refi, and 41% traditional refi Expect reduced Q3 ‘13 origination activity due to the lower refinance volume as a result of higher interest rates 0% 25% 50% 75% 100% Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Refi Purchase

($ in Thousands) Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Qtr Change Personnel Expense Salaries Expense $32,634 $32,463 $32,927 $31,197 $33,238 $2,041 Benefits Expense 8,523 7,444 7,239 9,534 8,958 (576) Bonus and Incentive Expense 10,465 13,537 17,341 11,795 15,506 3,711 Deferred Equity Comp Expense 1,945 1,421 1,329 1,360 1,375 15 Other Personnel Expense 919 1,329 1,647 1,743 1,766 23 Deferred Direct Orig Exp (8,001) (10,558) (10,960) (13,193) (15,040) (1,847) Total Personnel Expense $46,485 $45,636 $49,523 $42,436 $45,803 $3,367 FTE's 2,523 2,527 2,532 2,487 2,541 54 Headcount 2,615 2,596 2,561 2,600 2,634 34 Bonus and Incentive Expense Bonus Expense $647 $741 $2,332 $1,336 $1,608 $272 Commission Expense 6,595 8,881 10,199 7,158 9,587 2,429 Incentive Expense 2,998 3,712 4,774 3,032 4,137 1,105 Awards 225 203 36 269 174 (95) Total Bonus and Incentive Expense $10,465 $13,537 $17,341 $11,795 $15,506 $3,711 Commission Expense Home Loan Division $5,479 $8,097 $8,512 $6,374 $8,109 $1,735 Income Property Group 760 396 1,207 494 977 483 All Other Departments 356 388 480 290 501 211 Total Commission Expense $6,595 $8,881 $10,199 $7,158 $9,587 $2,429 Personnel • Salaries up due to one more working day in the quarter and addition of employees from Borrego (March) and Boston Private (May) • Deferred Direct Origination Expense up as # of closed loans increased over Q1 Bonus and Incentive Expense • Bonus for Q2 reflects additional accrual for discretionary plan based on performance • Commissions and Incentives increase related to production increase, primarily in the Home Loan Division 14 Employee Compensation and Benefits

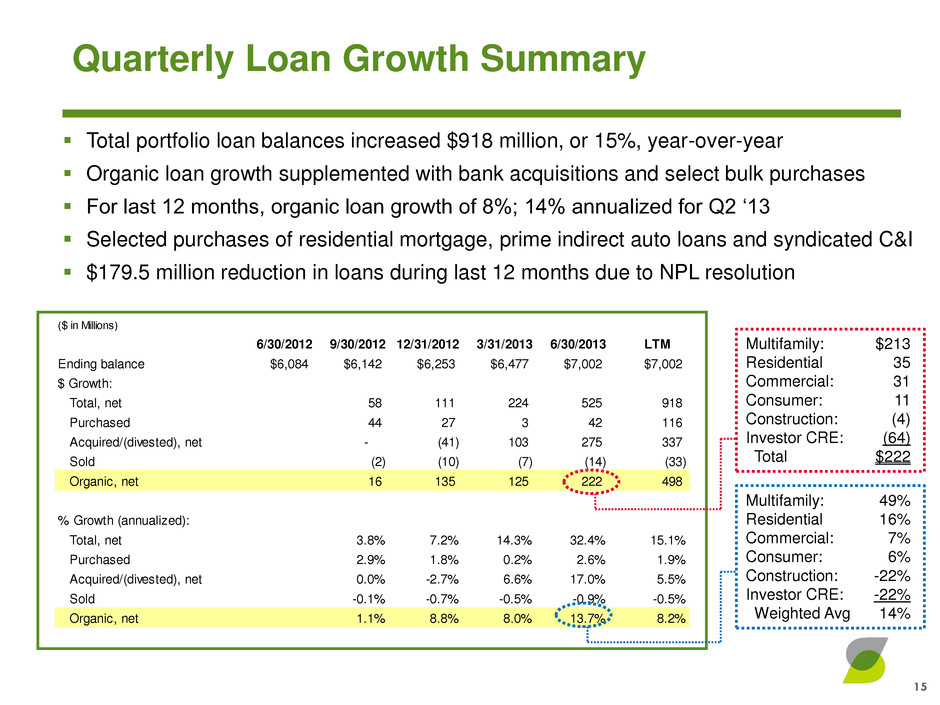

($ in Millions) 6/30/2012 9/30/2012 12/31/2012 3/31/2013 6/30/2013 LTM Ending balance $6,084 $6,142 $6,253 $6,477 $7,002 $7,002 $ Growth: Total, net 58 111 224 525 918 Purchased 44 27 3 42 116 Acquired/(divested), net - (41) 103 275 337 Sold (2) (10) (7) (14) (33) Organic, net 16 135 125 222 498 % Growth (annualized): Total, net 3.8% 7.2% 14.3% 32.4% 15.1% Purchased 2.9% 1.8% 0.2% 2.6% 1.9% Acquired/(divested), net 0.0% -2.7% 6.6% 17.0% 5.5% Sold -0.1% -0.7% -0.5% -0.9% -0.5% Organic, net 1.1% 8.8% 8.0% 13.7% 8.2% Quarterly Loan Growth Summary Total portfolio loan balances increased $918 million, or 15%, year-over-year Organic loan growth supplemented with bank acquisitions and select bulk purchases For last 12 months, organic loan growth of 8%; 14% annualized for Q2 ‘13 Selected purchases of residential mortgage, prime indirect auto loans and syndicated C&I $179.5 million reduction in loans during last 12 months due to NPL resolution 15 Multifamily: $213 Residential 35 Commercial: 31 Consumer: 11 Construction: (4) Investor CRE: (64) Total $222 Multifamily: 49% Residential 16% Commercial: 7% Consumer: 6% Construction: -22% Investor CRE: -22% Weighted Avg 14%

0 100 200 300 400 500 600 700 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Residential RE Multifamily CRE Construction Consumer Commercial 16 $348 $346 $348 $426 Source: Company filings. (1) Excluding residential mortgage loans held for sale. Loan Portfolio New Originations by Quarter (1) $512 $459 $ M illion s $457 $562 $687

Key Statistics as of 3/31/2013 (millions) Total assets $243 Total loans $146 Total deposits $211 Equity $ 30 Acquisition of Commerce National Bank 17 Established in 2003 Commercial banking platform o 54% CRE o 15% C&I o 15% Commercial leases $42.9MM total consideration o $15.10 per common share o Includes redemption of stock options and warrants All cash transaction Expected close: Q4 ‘13 1 Branch, 1 LPO STSA Branch: STSA LPO: CNBF Branch: CNBF Equipment Finance Office: Commerce National Bank

Acquisitions Target Market Number of Branches Announce Date Closed Date Assets ($M) Commerce National Bank S. California 1 5/2/2013 Pending 243 PNW Ops of Boston Private Financial Holdings Puget Sound 3 12/14/2012 5/10/2013 292 Borrego Springs Bank, NA S. California 3 10/21/2012 2/28/2013 142 First Independent Bank Vancouver, Portland 14 11/6/2011 2/29/2012 737 Divestitures Buyer Market Number of Branches Announce Date Closed Date Deposits ($M) Bank of the Pacific OR, WA Coast 3 1/28/2013 5/31/2013 48 Siuslaw Bank Central Oregon 1 12/5/2012 3/15/2013 9 American Federal Savings Bank Montana 7 6/26/2012 11/30/2012 181 Recent Acquisition and Divestiture Activity 18

APPENDIX

6/30/2013 Peer median (1) TCE/TA 11.7% 9.0% Tier 1 leverage 12.2% 9.3% Tier 1 risk-based capital 16.3% 13.8% Total risk-based capital 17.6% 15.3% Tier 1 common capital 12.9% 12.2% NPA/Tangible Capital + ALLL 13.1% 17.5% Capital Compared to Peers Source: SNL Financial and company filings. Sterling Financial data as of June 30, 2013. Peer group data as of most recent quarter available. (1) Peers include all public U.S. banking companies with between $7 billion and $25 billion in assets. 20

For the quarters ended (in millions) 6/30/2012 9/30/2012 12/31/2012 3/31/2013 6/30/2013 Balance Sheet Total assets $9,600 $9,472 $9,237 $9,256 $9,940 Net loans $5,927 $5,990 $6,102 $6,335 $6,869 Securities $2,121 $2,052 $1,513 $1,472 $1,539 Core deposits (1) $6,500 $6,515 $6,268 $6,384 $6,326 Gross loans/total deposits 90% 91% 97% 98% 106% Capital $1,221 $1,251 $1,218 $1,237 $1,206 TCE/TA 12.3% 12.8% 12.8% 13.0% 11.7% Tier 1 leverage 12.2% 12.7% 12.1% 12.8% 12.2% Operating Highlights Operating income (loss) before taxes $32.0 $30.6 $17.7 $32.5 $40.7 Provision for credit losses $4.0 $2.0 $0.0 $0.0 $0.0 FTE net interest margin 3.56% 3.43% 3.49% 3.69% 3.70% Asset Quality NPAs $321 $259 $210 $212 $169 Classified assets $327 $267 $222 $215 $161 Loan delinquency ratio (60+ days) 2.6% 2.0% 1.6% 1.6% 0.9% NPAs / assets 3.4% 2.7% 2.3% 2.3% 1.7% ALLLs / NPLs 60% 73% 83% 82% 99% ALLL / loans 2.6% 2.5% 2.5% 2.3% 2.0% Net (charge-offs) recoveries ($5) ($6) $1 ($5) ($5) NCOs / avg. loans (annualized) 0.3% 0.4% 0.0% 0.3% 0.3% Last Five Quarters Financial/Operating Highlights 21 (1) Core deposits defined as total deposits less brokered CDs.

$0.0 $0.5 $1.0 $1.5 $2.0 9/30/2012 12/31/2012 3/31/2013 6/30/2013 Bi llio ns 30-yr MBS 20-yr MBS 10- & 15-yr MBS CMO 3.6 3.3 3.8 4.9 2.2 2.4 3.3 4.0 0 1 2 3 4 5 6 09/30/12 12/31/12 03/31/13 06/30/13 Ye ar s WA Life-Base case Eff Dur - Base case MBS: $1,320 / 87% Muni bonds: $188 / 12% CMO: $18 / 1% $1.5 billion total portfolio (1) (in millions) Investment Portfolio Overview Three considerations in shaping investment portfolio composition are safety, liquidity and return Higher yields attributable to slight decrease in prepay speeds 87% Agency MBS pass-throughs Source: Company filings. (1) Does not include net unrealized gains. (2) Durations and average life measures are base case, under current market rates. (3) Yield at quarter end. Investment portfolio Weighted avg life and effective duration (2) 2.68% overall portfolio yield (3) MBS composition Yield (3) 2.44% 2.53% 2.32% 2.42% $1.76B 22 $1.26B $1.23B $1.34B

Washington: $929 / 30% N. California: $835 / 27% S. California: $756 / 24% Oregon: $451 / 14% Idaho: $33 / 1% Other: $131 / 4% (in millions) $1,963 $367 $216 $201 $151 $120 $117 $0 $500 $1,000 $1,500 $2,000 $2,500 (in millions) Loan Portfolio – CRE Non-Owner-Occupied Includes Multifamily Non-owner-occupied commercial real estate loans (including multifamily) totaled $3.1 billion as of 6/30/2013 Increased by $499 million, or 19% over a year ago Represented 45% of gross loans as of 6/30/2013 1.1% of non-owner-occupied CRE loans were non-performing as of 6/30/2013 Source: Company filings. CRE NOO loan mix by geography CRE NOO loan mix by property type 23

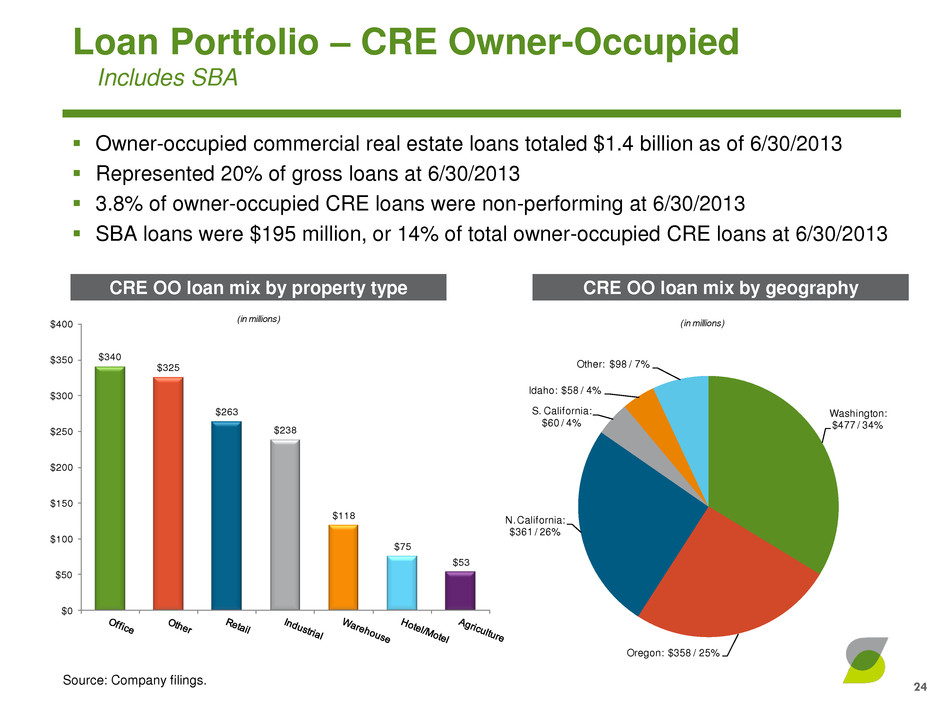

Washington: $477 / 34% Oregon: $358 / 25% N. California: $361 / 26% S. California: $60 / 4% Idaho: $58 / 4% Other: $98 / 7% (in millions)$340 $325 $263 $238 $118 $75 $53 $0 $50 $100 $150 $200 $250 $300 $350 $400 (in millions) Loan Portfolio – CRE Owner-Occupied Includes SBA Owner-occupied commercial real estate loans totaled $1.4 billion as of 6/30/2013 Represented 20% of gross loans at 6/30/2013 3.8% of owner-occupied CRE loans were non-performing at 6/30/2013 SBA loans were $195 million, or 14% of total owner-occupied CRE loans at 6/30/2013 Source: Company filings. CRE OO loan mix by geography CRE OO loan mix by property type 24

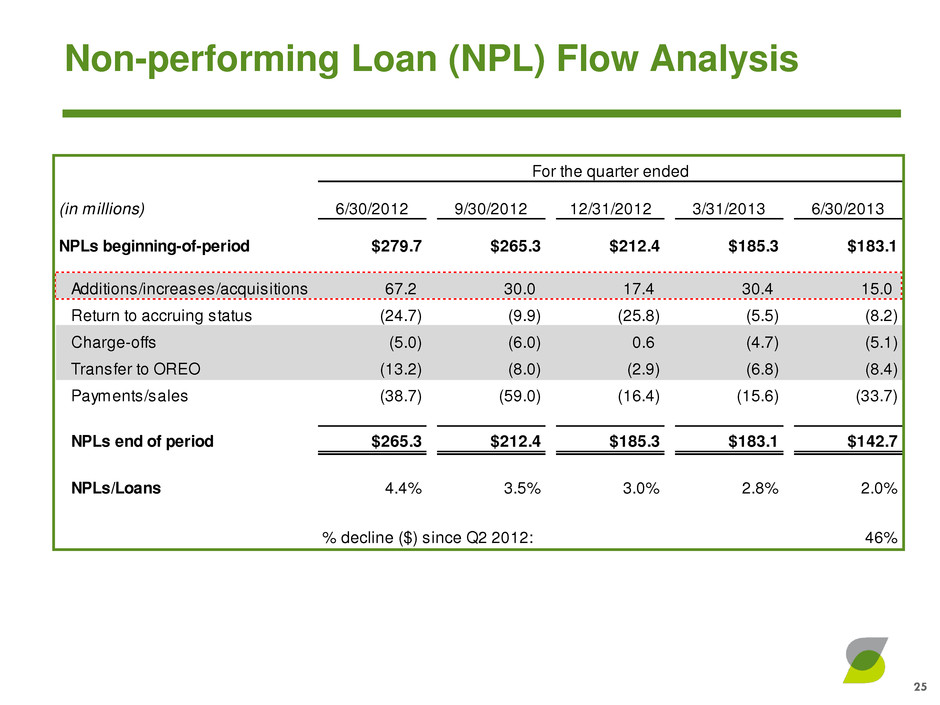

(in millions) 6/30/2012 9/30/2012 12/31/2012 3/31/2013 6/30/2013 NPLs beginning-of-period $279.7 $265.3 $212.4 $185.3 $183.1 Additions/increases/acquisitions 67.2 30.0 17.4 30.4 15.0 Return to accruing status (24.7) (9.9) (25.8) (5.5) (8.2) Charge-offs (5.0) (6.0) 0.6 (4.7) (5.1) Transfer to OREO (13.2) (8.0) (2.9) (6.8) (8.4) Payments/sales (38.7) (59.0) (16.4) (15.6) (33.7) NPLs end of period $265.3 $212.4 $185.3 $183.1 $142.7 NPLs/Loans 4.4% 3.5% 3.0% 2.8% 2.0% % decline ($) since Q2 2012: 46% For the quarter ended Non-performing Loan (NPL) Flow Analysis 25

(dollars in millions) Amount Properties Amount Properties OREO: Beginning balance $70 118 $29 55 Additions/acquisitions 13 26 8 22 Valuation adjustments (1) - (1) - Sales (27) (63) (10) (35) Other changes 1 - 1 - Ending balance $56 81 $27 42 2012 2013 For the quarter ended June 30, OREO Flow Analysis 26

NASDAQ Ticker: STSA Spokane, Washington www.sterlingfinancialcorporation.com Investor Contact Media Contact Patrick Rusnak Cara Coon Chief Financial Officer VP/Communications and Public Affairs Director (509) 227-0961 (509) 626-5348 patrick.rusnak@bankwithsterling.com cara.coon@bankwithsterling.com