Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NTELOS HOLDINGS CORP. | d575091d8k.htm |

| EX-99.1 - EX-99.1 - NTELOS HOLDINGS CORP. | d575091dex991.htm |

NASDAQ: NTLS

2Q 2013 Earnings Presentation

July 30, 2013

Exhibit 99.2 |

Presentation of Financial and Other Important Information

2

NASDAQ: NTLS

USE OF NON-GAAP FINANCIAL MEASURES

Included in this presentation are certain non-GAAP financial measures that are not determined in

accordance with US generally accepted accounting principles (“GAAP”). These financial

performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating,

capital and financing costs and may differ from comparable information provided by other companies,

and they should not be considered in isolation, as an alternative to, or more meaningful than

measures of financial performance determined in accordance with US generally accepted accounting principles. These

financial performance measures are commonly used in the industry and are presented because NTELOS

believes they provide relevant and useful information to investors. NTELOS utilizes these

financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur

indebtedness if necessary, and to fund continued growth. NTELOS also uses these financial

performance measures to evaluate the performance of its business, for budget planning purposes

and as factors in its employee compensation programs. Adjusted EBITDA is defined as net income attributable to NTELOS Holdings

Corp. before interest, income taxes, depreciation and amortization, accretion of asset retirement

obligations, gain/loss on derivatives, net income attributable to non-controlling

interests, other expenses/income, equity based compensation charges, acquisition related charges, gain/loss on sale of assets and net loss from

discontinued operations and costs related to the separation of the wireless and wireline companies.

Please review the reconciliations and other definitions of non- GAAP financial measures

contained in the press releases filed by the Company with the SEC, including those filed on Form 8-K on August 1, 2012, November 8,

2012, February 28, 2013, May 7, 2013 and July 30, 2013.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Any statements contained in this presentation that are not statements of historical fact, including

statements about our beliefs and expectations, are forward-looking statements and should be

evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “targets,” “projects,” “should,” “may,”

“will” and similar words and expressions are intended to identify forward-looking

statements. Such forward-looking statements reflect, among other things, our current

expectations, plans and strategies, and anticipated financial results, all of which are subject to known and unknown risks, uncertainties and factors that may

cause our actual results to differ materially from those expressed or implied by these

forward-looking statements. Many of these risks are beyond our ability to control or

predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Furthermore,

forward-looking statements speak only as of the date they are made. We do not undertake any

obligation to update or review any forward-looking information, whether as a result of new

information, future events or otherwise. Important factors with respect to any such forward-looking statements, including certain risks

and uncertainties that could cause actual results to differ from those contained in the

forward-looking statements, include, but are not limited to: our ability to attract

and retain retail subscribers to our services; our dependence on our strategic relationship and the

potential outcome of any disputes with Sprint Nextel (“Sprint”); a potential increase

in roaming rates and wireless handset subsidy costs; rapid development and intense competition in the telecommunications industry; our ability

to finance, design, construct and realize the benefits of any planned network technology upgrade; our

ability to acquire or gain access to additional spectrum; the potential to experience a high

rate of customer turnover; the potential for Sprint and others to build networks in our markets; cash and capital requirements;

operating and financial restrictions imposed by our senior credit facility; adverse economic

conditions; federal and state regulatory fees, requirements and developments; loss of ability

to use our current cell sites; our continued reliance on indirect channels of retail distribution; our reliance on certain suppliers and

vendors; and other unforeseen difficulties that may occur. These risks and uncertainties are not

intended to represent a complete list of all risks and uncertainties inherent in our business,

and should be read in conjunction with the more detailed cautionary statements and risk factors included in our SEC filings, including our

most recent Annual Report filed on Form 10-K.

|

Agenda

NASDAQ: NTLS

3

•

Jim Hyde, Chief Executive Officer

•

Steb Chandor, Chief Financial Officer

•

Conrad Hunter, Chief Operating Officer

Review Financial and Operational Highlights

Guidance Update

Q&A Session |

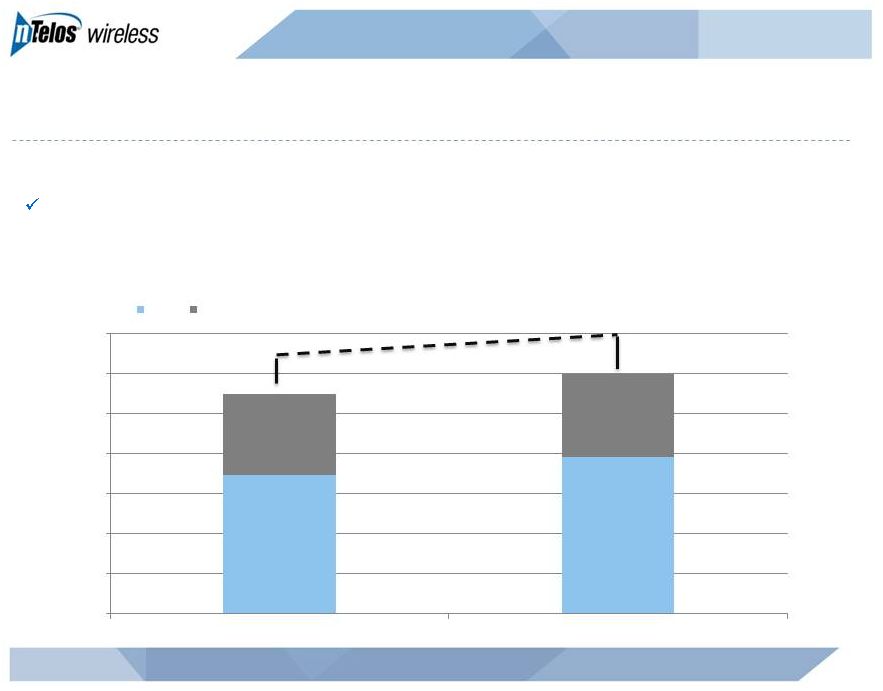

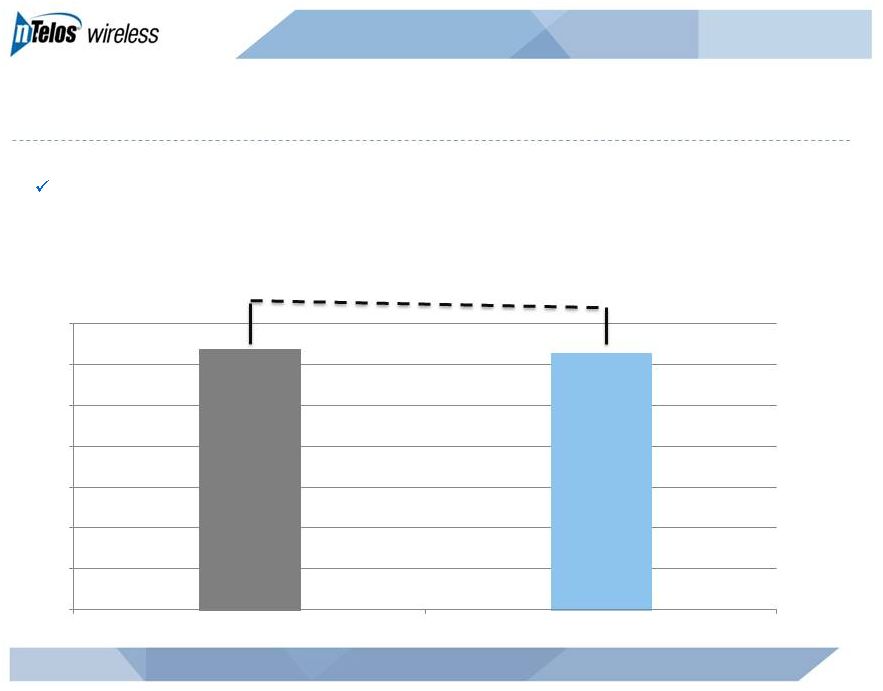

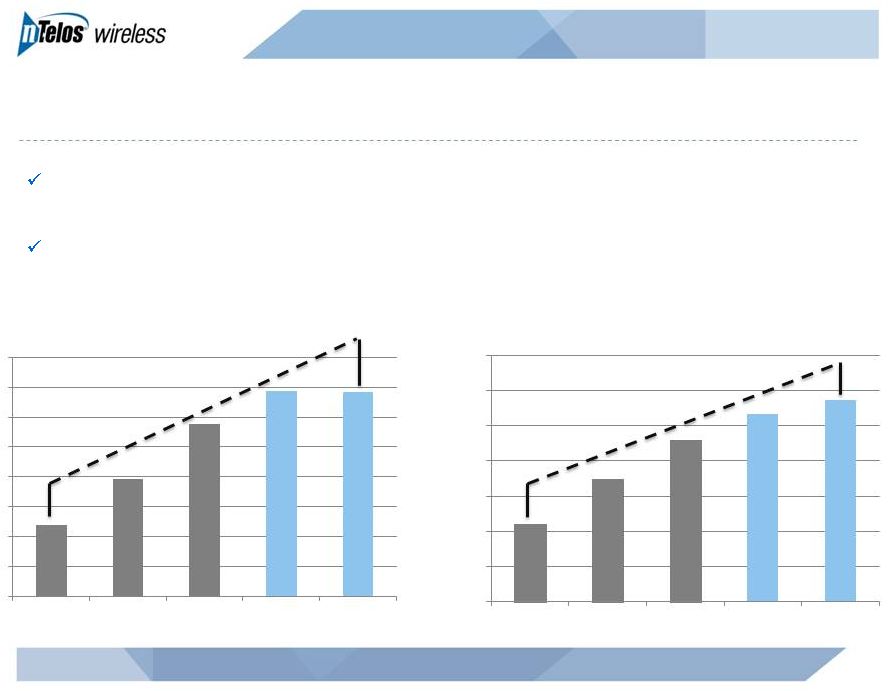

Continuing Growth in Operating Revenues

4

NASDAQ: NTLS

millions

+7%

2Q13 revenue increased 7% from 2Q12 to $119.9 million

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

2Q 2012

2Q 2013

Retail

Wholesale & Other |

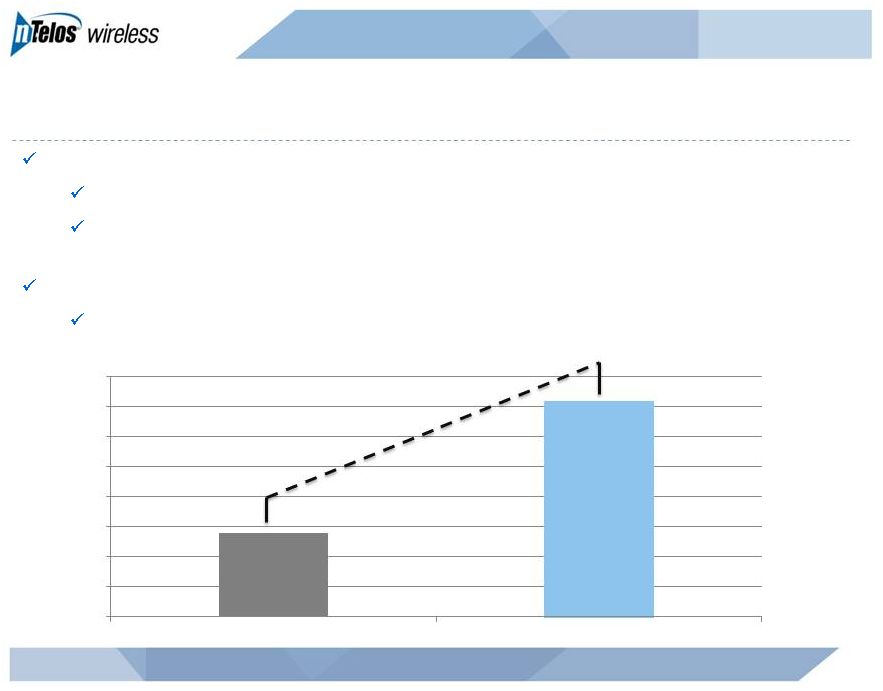

Retail Revenue Gains Continue

5

NASDAQ: NTLS

millions

Subscriber revenue growth continues to be driven by both:

ARPU growth

Subscriber growth

2Q13 retail revenue increased 1% sequentially and 13% from 2Q12 to $78.4

million Highest level in four years

+13%

$64.0

$66.0

$68.0

$70.0

$72.0

$74.0

$76.0

$78.0

$80.0

2Q 2012

2Q 2013 |

Wholesale/Other Revenue Remains Strong

6

NASDAQ: NTLS

millions

-1%

2Q13 wholesale/other revenue decreased 1% from 2Q12 to $41.4 million

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

2Q 2012

2Q 2013 |

Sprint Disputes Update

7

NASDAQ: NTLS

Data rate reset dispute

Still outstanding

Ranges updated to:

Sprint’s favor: $12.0 million

nTelos’s favor: $19.0 million

$4.2 million unrelated dispute raised during 3Q 2012, isolated to historical

billing issues $18.3 million accrual recorded for the disputes, included in

current liabilities |

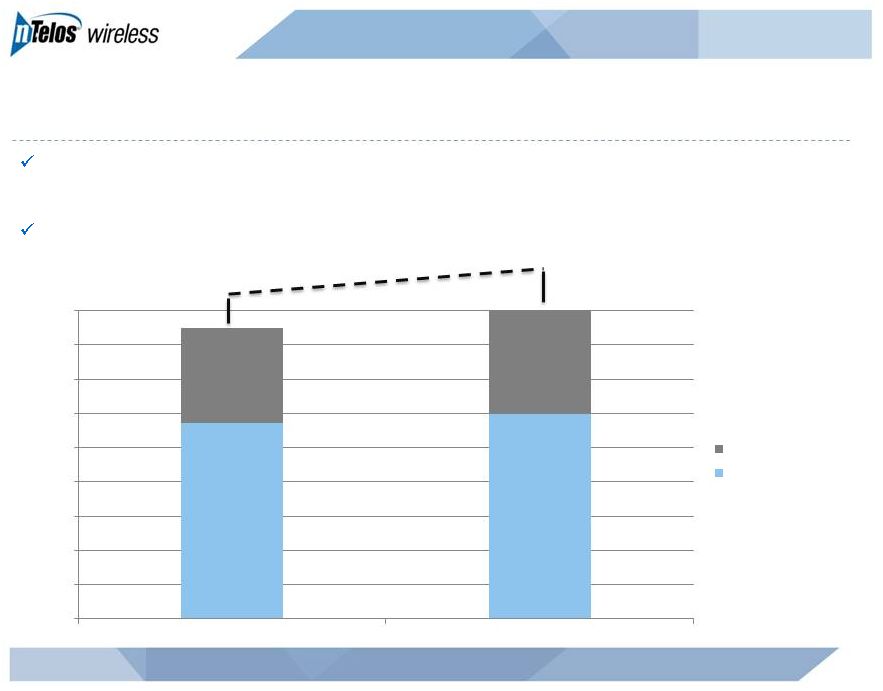

Subscribers –

Net Additions Trend

8

NASDAQ: NTLS

Subscribers up 7% year-over year to approximately 454,800

As of June 30, 2013, postpaid made up 66% of subscriber base

+7%

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

2Q 2012

2Q 2013

Prepaid Subscribers

Postpaid Subscribers |

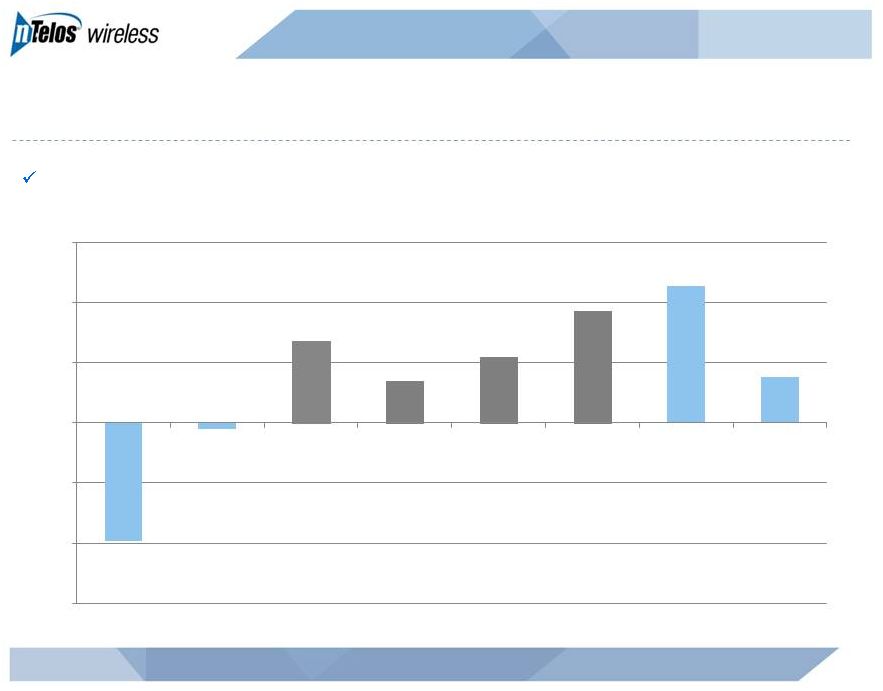

Subscribers –

Net Additions Trend (Continued)

9

NASDAQ: NTLS

Sixth consecutive quarter of positive net adds

(9,800)

(500)

6,800

3,500

5,500

9,300

11,400

3,800

(15,000)

(10,000)

(5,000)

0

5,000

10,000

15,000

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013 |

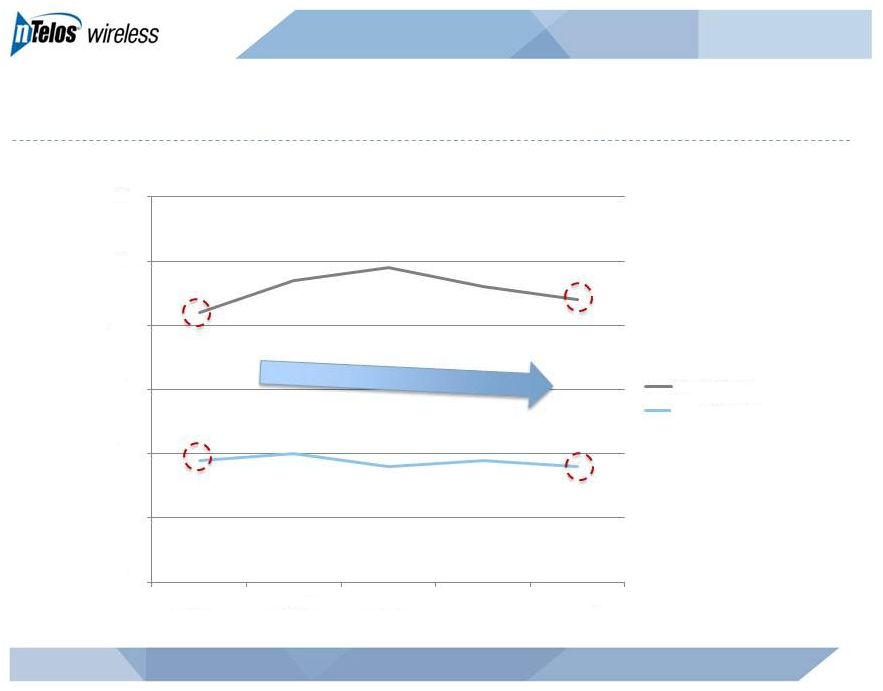

Average Revenue Per User (ARPU)

10

NASDAQ: NTLS

2Q13 Blended ARPU up 9% year-over-year to $53.82

2Q13 Postpaid ARPU up 13% year-over-year to $63.48

+9%

+13%

$47.00

$48.00

$49.00

$50.00

$51.00

$52.00

$53.00

$54.00

$55.00

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

Blended ARPU

$52.00

$54.00

$56.00

$58.00

$60.00

$62.00

$64.00

$66.00

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

Postpaid ARPU |

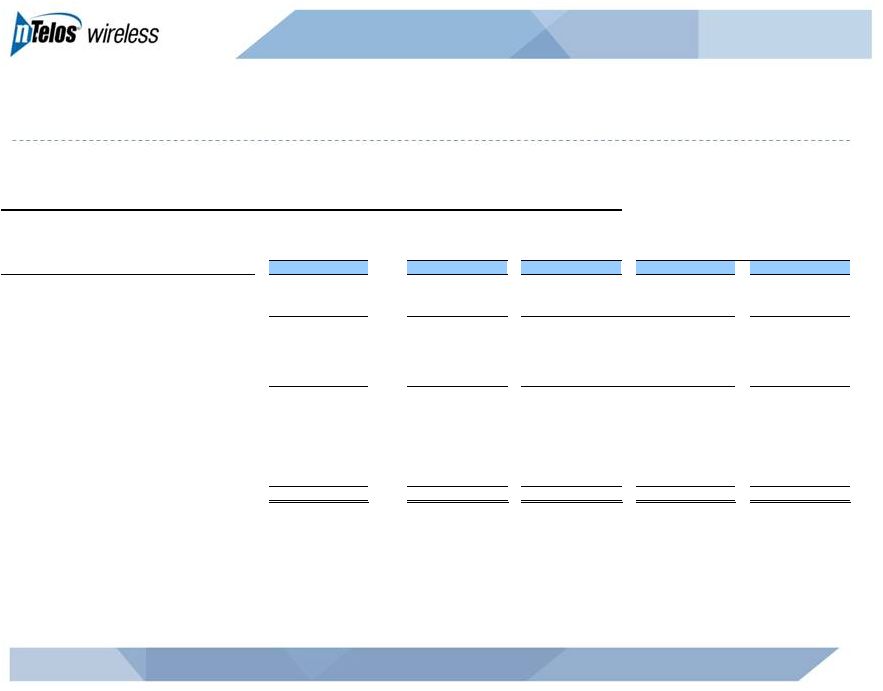

Operational Expenses

NASDAQ: NTLS

11

($ in millions)

2Q13

2Q12

Cost of sales and services

$42.6

$41.8

Customer operations

$30.0

$29.8

Corporate operations

$7.7

$8.3

Depreciation & Amortization

$20.4

$15.1

Gain on sale of intangible assets

($4.4)

-

$96.3

$95.0

Increase of 1% primarily driven by:

Increased depreciation tied to replacement of legacy network equipment

Increased expenses related to network access and cell sites

Offset by gain on sale of intangible assets |

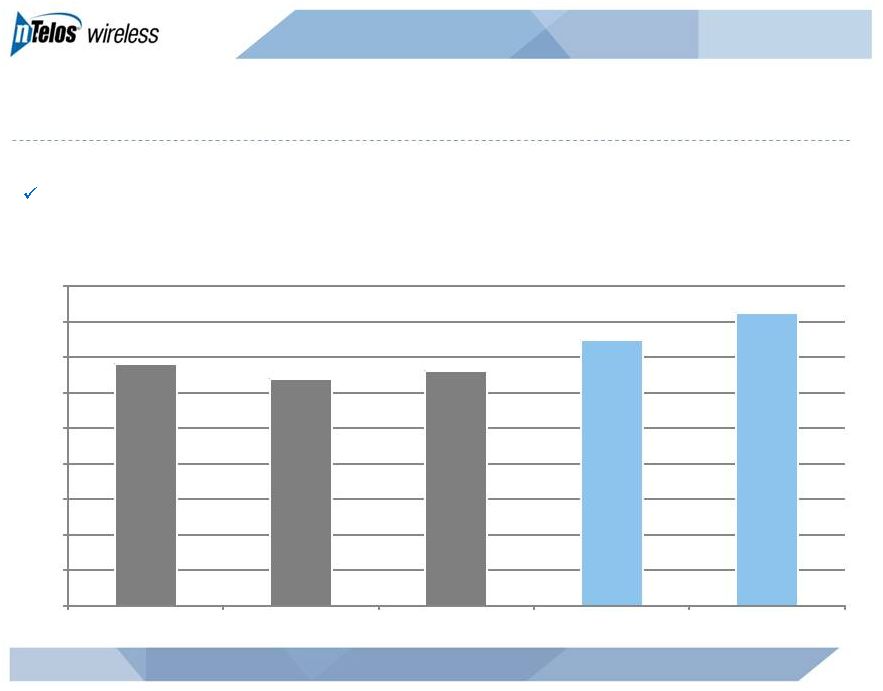

Adjusted EBITDA

12

NASDAQ: NTLS

millions

Continued investments in the business resulted in higher Adjusted EBITDA

$34

$32

$33

$37

$41

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013 |

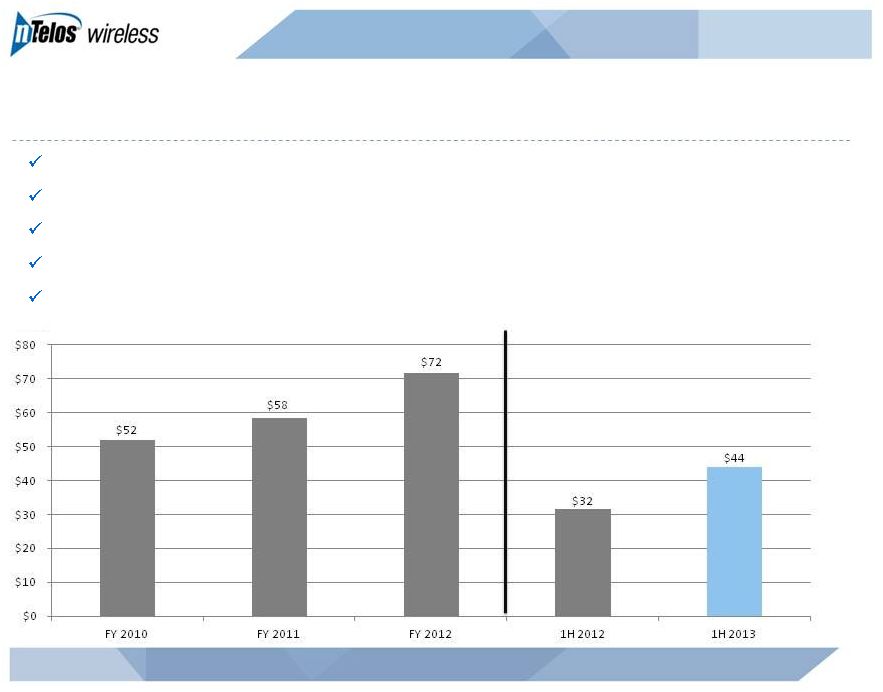

Capital Investment

13

NASDAQ: NTLS

Expands wholesale coverage

Controls roaming costs

Mitigates churn risk

As of June 30, 2013, 100% of cell sites support 3G EV-DO

1,432 cell sites as of June 30, 2013

millions |

Capitalization Overview

($ in millions)

June 30, 2013

Cash

$98.2

Total Debt

$492.5

Net Debt

$394.3

LTM Adjusted EBITDA

$143.5

Secured Term Loan

$491.5

Net Debt Leverage

2.7x

NASDAQ: NTLS

14 |

Competitively Differentiated Retail Model

SAVINGS

SIMPLICITY

SERVICE

Driving consideration for

“the best value in

wireless”

proposition

Making it “easy”

to switch

Creating “raving fans”

through superior

customer service

15

NASDAQ: NTLS |

2Q

2013 Net Adds 16

NASDAQ: NTLS

2Q13 prepaid net adds increased 800 year-over-year

2Q13 postpaid net adds decreased 500 year-over-year

2,800

700

3,500

3,600

200

3,800

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Prepaid Net Adds

Postpaid Net Adds

Total Net Adds

2Q12

2Q13 |

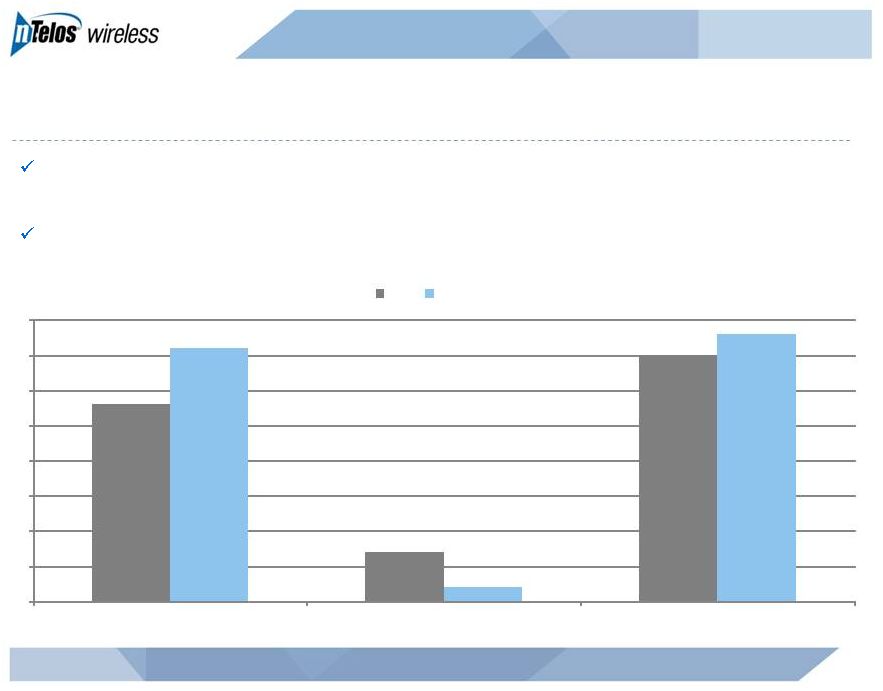

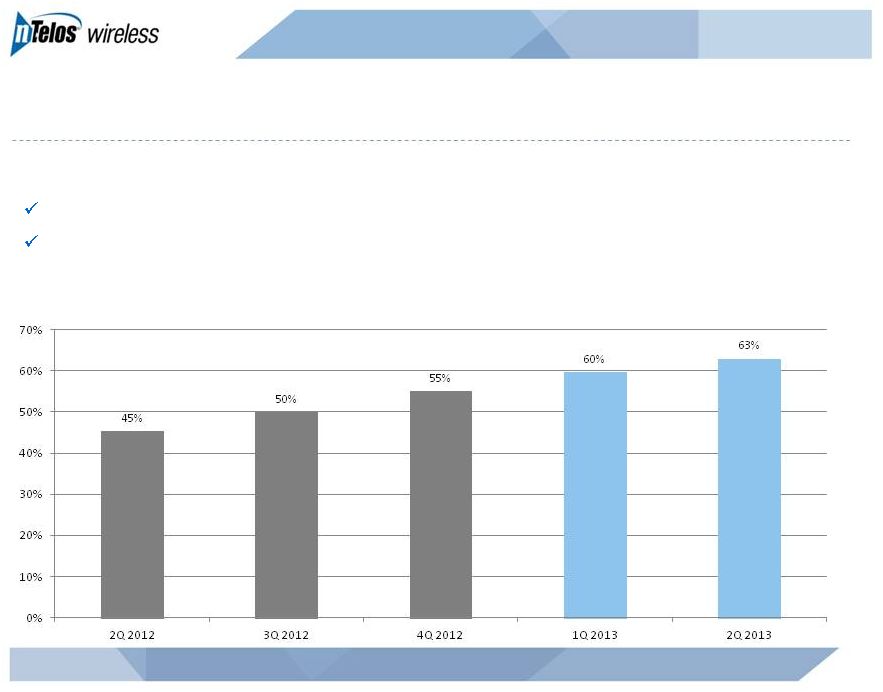

Smartphone Penetration

17

NASDAQ: NTLS

As of June 30, 2013:

66% of postpaid subscribers have a smartphone

56% of prepaid subscribers have a smartphone |

Churn Remains Stable

18

NASDAQ: NTLS

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

Prepaid Churn

Postpaid Churn |

Guidance (as of July 30, 2013)

NASDAQ: NTLS

19

For the year ended December 31, 2013

Adjusted

EBITDA

of

$140

million

-

$145

million

Previously $135 million -

$145 million

CapEx of $75 million -

$85 million

2013 net adds expected to be at or about 2012 net adds

|

Appendix |

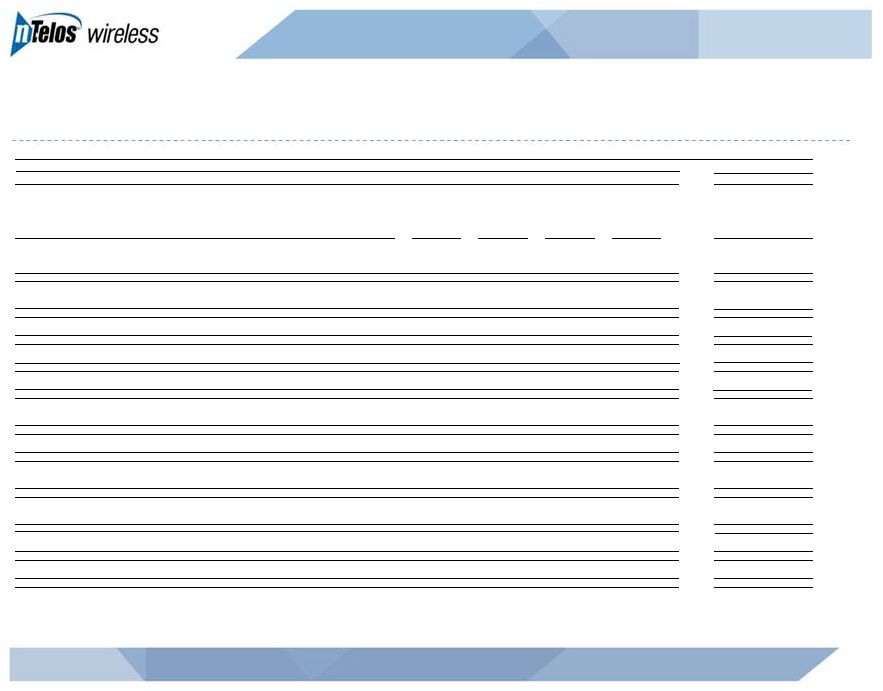

21

NASDAQ: NTLS

NTELOS Holdings Corp.

Reconciliation of Net Income Attributable to NTELOS Holdings Corp. to Adjusted EBITDA

(In thousands)

2Q13

1Q13

4Q12

3Q12

2Q12

9,386

$

5,493

$

321

$

4,608

$

5,606

$

Net income attributable to noncontrolling interests

541

529

443

488

881

Net Income

9,927

6,022

764

5,096

6,487

Interest expense

7,398

7,361

6,651

5,432

5,433

Income taxes

6,380

3,744

(454)

3,141

4,609

Other expense (income), net

(151)

369

7,038

50

44

Operating income

23,554

17,496

13,999

13,719

16,573

Depreciation and amortization

20,443

18,456

17,440

15,810

15,101

Gain on sale of intangible assets

(4,442)

-

-

-

-

Accretion of asset retirement obligations

173

143

174

163

151

Equity-based compensation

1,460

1,321

1,346

1,478

1,536

Business separation charges¹

-

-

56

684

635

Adjusted EBITDA

41,188

$

37,416

$

33,015

$

31,854

$

33,996

$

1

Charges for legal and consulting services costs in connection with the separation

of the wireless and wireline operations. Net Income Attributable to NTELOS

Holdings Corp. |

22

NASDAQ: NTLS

NTELOS Holdings Corp.

ARPU Reconciliation

Average Monthly Revenue per User (ARPU) ¹

2Q13

1Q13

4Q12

3Q12

2Q12

FY 2012

FY 2011

(In thousands, except for subscribers and ARPU)

Operating Revenues

119,859

$

119,345

$

117,398

$

114,466

$

111,585

$

453,989

$

422,629

$

Less: Equipment revenue from sales to new customers

(3,104)

(3,521)

(3,808)

(3,333)

(4,026)

(15,041)

(9,091)

Less: Equipment revenue from sales to existing customers

(2,395)

(3,117)

(3,315)

(3,416)

(3,903)

(15,037)

(17,793)

Less: Wholesale, other and adjustments

(41,179)

(40,918)

(41,488)

(42,380)

(41,061)

(165,765)

(143,477)

Gross subscriber revenue

73,181

71,789

68,787

65,337

62,595

258,146

252,268

Less: prepay subscriber revenue

(15,879)

(15,205)

(14,823)

(14,103)

(14,001)

(56,330)

(48,758)

Less: adjustments to prepay subscriber revenue

(303)

(479)

(237)

(434)

(382)

(1,706)

(1,175)

Gross postpay subscriber revenue

56,999

$

56,105

$

53,727

$

50,800

$

48,212

$

200,110

$

202,335

$

Prepay subscriber revenue

15,879

15,205

14,823

14,103

14,001

56,330

48,758

Plus: adjustments to prepay subscriber revenue

303

479

237

434

382

1,706

1,175

Gross prepay subscriber revenue

16,182

$

15,684

$

15,060

$

14,537

$

14,383

$

58,036

$

49,933

$

Average number of subscribers

453,262

444,244

434,457

427,610

422,247

425,377

422,256

Total ARPU

53.82

$

53.87

$

52.78

$

50.93

$

49.41

$

50.57

$

49.79

$

Average number of postpay subscribers

299,304

298,414

292,668

287,165

284,834

288,428

298,992

Postpay ARPU

63.48

$

62.67

$

61.19

$

58.97

$

56.42

$

57.82

$

56.39

$

Average number of prepay subscribers

153,958

145,831

141,789

140,446

137,413

136,949

123,264

Prepay ARPU

35.04

$

35.85

$

35.41

$

34.50

$

34.89

$

35.31

$

33.76

$

Gross subscriber revenue

73,181

71,789

68,787

65,337

62,595

258,146

252,268

Less: voice and other feature revenue

(43,078)

(42,658)

(41,379)

(39,366)

(37,708)

(156,032)

(171,882)

Data revenue

30,103

$

29,131

$

27,408

$

25,971

$

24,887

$

102,114

$

80,386

$

Average number of subscribers

453,262

444,244

434,457

427,610

422,247

425,377

422,256

Total Data ARPU

22.14

$

21.86

$

21.03

$

20.25

$

19.65

$

20.00

$

15.86

$

Gross postpay subscriber revenue

56,999

56,105

53,727

50,800

48,212

200,110

202,335

Less: postpay voice and other feature revenue

(36,170)

(35,952)

(34,651)

(33,028)

(31,490)

(130,601)

(144,114)

Postpay data revenue

20,829

$

20,153

$

19,076

$

17,772

$

16,722

$

69,509

$

58,221

$

Gross prepay subscriber revenue

16,182

15,684

15,060

14,537

14,383

58,036

49,933

Less: prepay voice and other feature revenue

(6,908)

(6,706)

(6,728)

(6,338)

(6,218)

(25,431)

(27,768)

Prepay data revenue

9,274

$

8,978

$

8,332

$

8,199

$

8,165

$

32,605

$

22,165

$

Average number of postpay subscribers

299,304

298,414

292,668

287,165

284,834

288,428

298,992

Postpay data ARPU

23.20

$

22.51

$

21.73

$

20.63

$

19.57

$

20.08

$

16.23

$

Average number of prepay subscribers

153,958

145,831

141,789

140,445

137,413

136,949

123,264

Prepay data ARPU

20.08

$

20.52

$

19.59

$

19.46

$

19.81

$

19.84

$

14.99

$

Average monthly revenue per user is(ARPU) computed by dividing service revenues per period by

the average number of subscribers during that period. ARPU as defined may not be similar to ARPU measures of other companies, is

not a measurement under GAAP and should be considered in addition to, but not as a substitute

for, the information contained in the Company’s consolidated statements of operations. The Company closely monitors the effects of new

rate plans and service offerings on ARPU in order to determine their effectiveness. ARPU

provides management useful information concerning the appeal of NTELOS rate plans and service offerings and the Company’s performance in

attracting and retaining high-value customers.

1 |

NASDAQ: NTLS

July 30, 2013

2Q 2013 Earnings Presentation |